Global Tool Steel Market size was valued at USD 6.18 Bn in 2023 and Tool Steel market revenue is expected to reach USD 9.70 Bn by 2030, at a CAGR of 6.64 % over the forecast period.Tool Steel Market Overview

Tool steel, as a carbon alloy steel type, is well-suited for tool manufacturing, including the production of hand tools or machine dies. The key properties of this material include its hardness, resistance to abrasion, and its capacity to maintain shape at elevated temperatures. Typically, tool steel is employed in a heat-treated condition to achieve enhanced hardness. Increasing demand for high-performance tools in precision machining, metalworking, and other industries contributes to the growth of the Tool Steel market. Innovations in metallurgy and alloy development are driving advancements in tool steel quality and performance. The tool steel market dynamics vary regionally based on industrialization levels, manufacturing activities, and infrastructure development. The market for tool steel is global, with Global tool steel manufacturers and suppliers catering to the demands of industries across different regions. Regional variations exist based on industrialization levels, economic conditions, and specific sector demands. Compliance with Tool steel industry standards and regulations related to tool steel production and usage is a crucial aspect.To know about the Research Methodology :- Request Free Sample Report Innovative Industrialization and Manufacturing Practices to boost the Tool Steel Market growth The global surge in industrialization is intricately tied to heightened manufacturing activities. Tool steel, as a foundational material for tool production, witnesses increased demand owing to the need for avant-garde tools in cutting-edge manufacturing processes. The proliferation of Tool Steel manufacturing hubs in regions like Asia, particularly China and India, significantly fuels the market's innovative growth. The Tool Steel industry thrives on technological breakthroughs in manufacturing processes, driving the demand for state-of-the-art tools. Tool steel's exceptional hardness, abrasion resistance, and heat retention properties are instrumental in crafting tools that meet the rigors of modern manufacturing technologies. The adoption of precision machining and advanced metalworking techniques further amplifies the call for innovative, high-quality tool steel. Modern Tool steel manufacturing pivots on precision machining, demanding tools that excel in intricate and accurate operations. Tool steel's unique ability to maintain sharpness and form under challenging conditions positions it as the preferred material for precision tools. This innovation-driven demand extends across sectors such as aerospace, automotive, and electronics, where precision is paramount is expected to boost the Tool Steel Market growth. Precision engineering and high-performance standards in the automotive and aerospace industries fuel substantial consumption of innovative tool steel. The quest for lightweight materials, coupled with stringent quality requirements, mandates the use of advanced and durable tools. Tool steel, renowned for its hardness and wear resistance, assumes a critical role in innovatively producing molds, dies, and cutting tools for these high-performance industries. The continuous evolution of tool steel is marked by innovations in high-speed tool steels, engineered to endure elevated cutting speeds and temperatures. This forward-looking innovation directly addresses the growing demand for enhanced efficiency and productivity in machining processes. High-speed tool steels, representing a specialized subset of the Tool Steel market, find innovative applications in critical cutting and machining operations. The construction industry, experiencing a global upswing, leans heavily on robust and durable tools for diverse tasks, from concrete cutting to metal fabrication. Tool steel, recognized for its outstanding hardness and wear resistance, assumes an indispensable role in innovative construction applications, thereby contributing to the expansion of the market. Raw Material Price Volatility to limit the Tool Steel Market growth Tool Steel market is the inherent volatility in the prices of raw materials. Tool steel production relies on specific alloying elements, and fluctuations in the prices of these elements can significantly impact manufacturing costs. The industry must grapple with the challenge of mitigating the effects of unpredictable raw material costs, which influence pricing strategies and profit margins. In response, the market is showing adaptability by exploring alternative sourcing strategies and adopting agile pricing models. The Tool Steel market is susceptible to shifts in the global economic landscape. Economic uncertainties, such as recessions or geopolitical tensions, can result in reduced industrial activities and capital expenditures. This, in turn, affects the demand for tools and, consequently, tool steel. The Tool Production industry faces the challenge of navigating these macroeconomic uncertainties, which impact market dynamics and investment decisions. Tool Steel market segmentation shifts are observed as manufacturers strategically diversify their offerings to cater to different sectors, showcasing resilience in the face of economic uncertainties. Tool steel manufacturing processes are energy-intensive, requiring significant amounts of power for heating and processing. The rising costs of energy, coupled with the increasing focus on sustainable practices, pose a unique challenge. Manufacturers in the Tool Steel market must address the dual challenge of optimizing energy efficiency while exploring environmentally friendly alternatives to mitigate the impact of intensive energy consumption on production costs and environmental sustainability. This drive towards energy efficiency demonstrates the industry's resilience and commitment to sustainable practices. Tool Steel market contends with the challenge of rising competition from alternative materials, including high-performance ceramics and advanced polymers. These materials may offer specific advantages in certain applications, challenging the traditional dominance of tool steel. Manufacturers must innovate and differentiate their products to maintain a competitive edge in the face of evolving material preferences in the market. This adaptation to market dynamics showcases the Tool Steel industry's commitment to continuous improvement and staying at the forefront of technological advancements.

Tool Steel Market Segment Analysis

Based on Material Composition, the market is segmented into Carbon Tool Steel and Alloy Tool Steel. Alloy tool steel segment dominated the market in 2023 and is expected to hold the largest Tool Steel Market share over the forecast period. The Alloy Tool Steel segment within the market represents a category of tool steels that are enhanced with alloying elements beyond the basic composition of carbon and iron. These alloying elements are strategically added to impart specific properties, making Alloy Tool Steel well-suited for various applications that demand a combination of strength, toughness, and other specialized characteristics, which significantly contribute for the Tool Steel Market growth. Alloy Tool Steel is widely used in the production of molds and dies for various manufacturing processes. The enhanced hardness and wear resistance make it ideal for shaping and forming materials, such as in injection molding or stamping operations.Based on Product Types, the market is segmented into cold work tool steel, Hot Work Tool Steel, and High-Speed Tool Steel. Cold Work Tool Steel segment is expected to dominate the market over the forecast period. The cold work tool steel segment in tool steel market is specifically designed to perform in applications involving cold working processes. Cold work refers to the deformation of materials at temperatures below their recrystallization point, often involving cutting, shearing, stamping, and forming operations. Cold work tool steel is engineered to withstand these processes while maintaining essential properties such as hardness, wear resistance, and durability. Cold work tool steel is utilized in the production of cutting tools for cold machining operations, including milling, drilling, and turning processes where the material remains at or near room temperature.

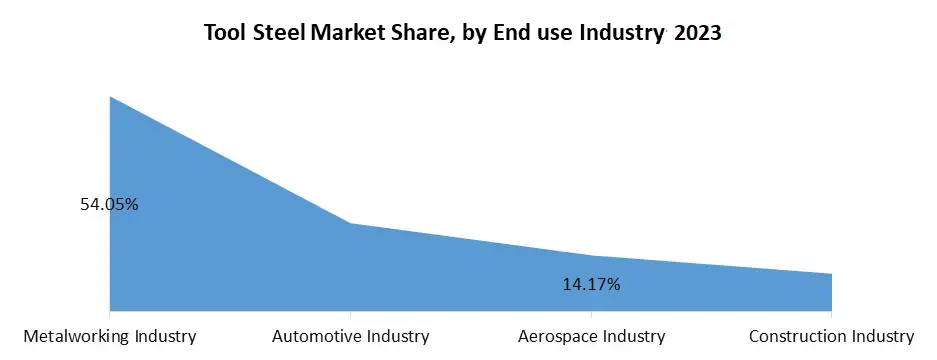

Based on End-User Applications, the market segmented into Metalworking Industry, Automotive, Aerospace, and Construction. Metalworking Industry dominated the market in 2023 and is expected to continue the dominance over the forecast period with largest Tool Steel Market share. The Metalworking Industry segment is a pivotal category that caters to the specific needs of metalworking processes. Tool steels used in this segment are carefully engineered to withstand the challenges posed by machining, cutting, shaping, and forming various metal materials. The Metalworking Industry relies heavily on tool steels to produce high-quality components with precision and efficiency, which is expected to boost the segment share in the tool steel market. High-Speed Steel is widely used in metalworking applications that involve high cutting speeds, such as milling, drilling, and turning. It is valued for its ability to maintain hardness at elevated temperatures. Advancements in metallurgy and manufacturing technologies continue to drive innovations in the Metalworking Industry segment of the Tool Steel market. This includes the development of high-performance coatings, surface treatments, and advanced alloys to enhance tool life, reduce friction, and improve overall performance in metalworking applications.

Tool Steel Market Regional Insight

Robust Manufacturing Activities in Asia Pacific to boost the Tool Steel Market Growth The Asia-Pacific region stands as a powerhouse in the market, driven by rapid industrialization, robust manufacturing activities, and a burgeoning demand for high-performance tools. Countries such as China and India are at the forefront of this growth, boasting extensive manufacturing hubs and a thriving construction sector. The region's expanding industrial base, particularly in sectors like automotive, construction, and electronics, fuels the demand for Tool Steel in the production of molds, dies, and cutting tools. Asia-Pacific embraces cutting-edge manufacturing technologies, propelling the demand for high-speed and precision tools, thus boosting the market. Ongoing construction activities across the region in India and China Market contribute to the demand for durable and robust tools, driving the market's growth.North America is a significant player in the market, characterized by advanced Tool Steel manufacturing capabilities, a focus on innovation, and a diverse range of industries. The region's emphasis on high-quality and precision manufacturing contributes to the demand for specialized tool steels. North America leads in the adoption of advanced manufacturing technologies, driving the demand for high-performance tool steels in precision machining and metalworking applications. The aerospace and automotive sectors, known for their stringent quality standards, are major consumers of Tool Steel in the production of critical components, molds, and dies. Ongoing research and development activities in metallurgy contribute to the creation of innovative tool steel grades, supporting the region's competitive edge in the global market. Europe has a longstanding tradition of precision engineering and manufacturing excellence, making it a key player in the global Tool Steel market. The region's focus on quality and sustainability further influences the demand for advanced tool steels. Europe's emphasis on precision engineering in industries such as automotive, aerospace, and machinery drives the demand for high-quality and specialized Tool Steel. The market in Europe aligns with the region's commitment to sustainable manufacturing practices, leading to the development of eco-friendly tool steel production processes. Tool Steel Market Competitive Landscape Tool steel manufacturers differentiate their products based on factors such as hardness, wear resistance, toughness, and heat resistance. The ability to offer specialized grades tailored to specific applications enhances competitiveness. Tool Steel companies invest in research and development to stay at the forefront of technological advancements. Continuous innovation in metallurgy, alloy development, and manufacturing processes allows manufacturers to offer high-performance tool steels. Global Tool steel key players have an extensive geographical presence, catering to diverse industries and markets. Regional and local manufacturers focus on strengthening their presence in specific markets to address regional demands effectively. The ability to customize tool steel formulations to meet specific end-user requirements is a key factor in the competitive landscape. Manufacturers offering a range of specialized and customizable grades gain a competitive advantage. Tool steel manufacturing companies focus on specific market segments, such as automotive, aerospace, or construction, tailoring their products to the unique requirements of these industries and gaining a competitive edge in specialized applications.

Tool Steel Market Report Scope : Inquire Before Buying

Global Tool Steel Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 6.18 Bn. Forecast Period 2024 to 2030 CAGR: 6.64% Market Size in 2030: US $ 9.70 Bn. Segments Covered: by Material Composition Carbon Tool Steel Alloy Tool Steel by Product Type Cold Work Tool Steel Hot Work Tool Steel High-Speed Tool Steel by End User Application Metalworking Industry Automotive Aerospace Construction Tool Steel Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Tool Steel Manufacturer

1. Swiss Steel Group 2. Proterial, Ltd. 3. Daido Steel Co., Ltd. 4. Samuel, Son & Co. 5. Vested Metals 6. Remblay Tool Steels, LLC 7. GMH Gruppe 8. Saarschmiede GmbH 9. Voestalpine High Performance Metals LLC 10. Nachi-Fujikoshi Corp. 11. CRS Holdings, LLC. 12. Diehl Tool Steel, Inc 13. Uddeholm USA 14. Kind & Co. Edelstahlwerk, GmbH & Co. KG 15. Ellwood Specialty Steel 16. Buderus Edelstahl GmbH 17. Ningshing Special-Steel Group Co., Ltd. 18. Sanyo Special Steel Co., Ltd. Frequently Asked Questions: 1. How does the demand for high-performance tools impact the Tool Steel market? Ans: Increasing demand for high-performance tools in precision machining and metalworking drives growth in the Tool Steel market. 2. What factors contribute to regional variations in the Tool Steel market? Ans: Regional variations are influenced by industrialization levels, economic conditions, and specific sector demands. 3. How does the Tool Steel industry address the challenge of raw material price volatility? Ans: The industry explores alternative sourcing strategies and adopts agile pricing models to mitigate the impact of fluctuating raw material costs. 4. Asia-Pacific: How does rapid industrialization contribute to the Tool Steel market in countries like China and India? Ans: Rapid industrialization in China and India creates extensive manufacturing hubs, driving the demand for high-performance tools and boosting the Tool Steel market. 5. North America: How does the emphasis on innovation contribute to the demand for specialized tool steels in the North American market? Ans: North America's focus on innovation, particularly in advanced manufacturing technologies, contributes to the demand for specialized tool steels in precision machining and metalworking applications, meeting stringent quality standards in industries like aerospace and automotive.

1. Tool Steel Market: Research Methodology 2. Tool Steel Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Tool Steel Market: Dynamics 3.1 Tool Steel Market Trends by Region 3.1.1 Global Tool Steel Market Trends 3.1.2 North America Tool Steel Market Trends 3.1.3 Europe Tool Steel Market Trends 3.1.4 Asia Pacific Tool Steel Market Trends 3.1.5 Middle East and Africa Tool Steel Market Trends 3.1.6 South America Tool Steel Market Trends 3.2 Tool Steel Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Tool Steel Market Drivers 3.2.1.2 North America Tool Steel Market Restraints 3.2.1.3 North America Tool Steel Market Opportunities 3.2.1.4 North America Tool Steel Market Challenges 3.2.2 Europe 3.2.2.1 Europe Tool Steel Market Drivers 3.2.2.2 Europe Tool Steel Market Restraints 3.2.2.3 Europe Tool Steel Market Opportunities 3.2.2.4 Europe Tool Steel Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Tool Steel Market Market Drivers 3.2.3.2 Asia Pacific Tool Steel Market Restraints 3.2.3.3 Asia Pacific Tool Steel Market Opportunities 3.2.3.4 Asia Pacific Tool Steel Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Tool Steel Market Drivers 3.2.4.2 Middle East and Africa Tool Steel Market Restraints 3.2.4.3 Middle East and Africa Tool Steel Market Opportunities 3.2.4.4 Middle East and Africa Tool Steel Market Challenges 3.2.5 South America 3.2.5.1 South America Tool Steel Market Drivers 3.2.5.2 South America Tool Steel Market Restraints 3.2.5.3 South America Tool Steel Market Opportunities 3.2.5.4 South America Tool Steel Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives For the Tool Steel Industry 3.8 The Global Pandemic and Redefining of The Tool Steel Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 4. Global Tool Steel Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 4.1 Global Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 4.1.1 Carbon Tool Steel 4.1.2 Alloy Tool Steel 4.2 Global Tool Steel Market Size and Forecast, by Product Type (2023-2030) 4.2.1 Cold Work Tool Steel 4.2.2 Hot Work Tool Steel 4.2.3 High-Speed Tool Steel 4.3 Global Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 4.3.1 Metalworking Industry 4.3.2 Automotive 4.3.3 Aerospace 4.3.4 Construction 4.4 Global Tool Steel Market Size and Forecast, by Region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Tool Steel Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 5.1 North America Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 5.1.1 Carbon Tool Steel 5.1.2 Alloy Tool Steel 5.2 North America Tool Steel Market Size and Forecast, by Product Type (2023-2030) 5.2.1 Cold Work Tool Steel 5.2.2 Hot Work Tool Steel 5.2.3 High-Speed Tool Steel 5.3 North America Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 5.3.1 Metalworking Industry 5.3.2 Automotive 5.3.3 Aerospace 5.3.4 Construction 5.4 North America Tool Steel Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 5.4.1.1.1 Carbon Tool Steel 5.4.1.1.2 Alloy Tool Steel 5.4.1.2 United States Tool Steel Market Size and Forecast, by Product Type (2023-2030) 5.4.1.2.1 Cold Work Tool Steel 5.4.1.2.2 Hot Work Tool Steel 5.4.1.2.3 High-Speed Tool Steel 5.4.1.3 United States Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 5.4.1.3.1 Metalworking Industry 5.4.1.3.2 Automotive 5.4.1.3.3 Aerospace 5.4.1.3.4 Construction 5.4.2 Canada 5.4.2.1 Canada Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 5.4.2.1.1 Carbon Tool Steel 5.4.2.1.2 Alloy Tool Steel 5.4.2.2 Canada Tool Steel Market Size and Forecast, by Product Type (2023-2030) 5.4.2.2.1 Cold Work Tool Steel 5.4.2.2.2 Hot Work Tool Steel 5.4.2.2.3 High-Speed Tool Steel 5.4.2.3 Canada Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 5.4.2.3.1 Metalworking Industry 5.4.2.3.2 Automotive 5.4.2.3.3 Aerospace 5.4.2.3.4 Construction 5.4.3 Mexico 5.4.3.1 Mexico Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 5.4.3.1.1 Carbon Tool Steel 5.4.3.1.2 Alloy Tool Steel 5.4.3.2 Mexico Tool Steel Market Size and Forecast, by Product Type (2023-2030) 5.4.3.2.1 Cold Work Tool Steel 5.4.3.2.2 Hot Work Tool Steel 5.4.3.2.3 High-Speed Tool Steel 5.4.3.3 Mexico Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 5.4.3.3.1 Metalworking Industry 5.4.3.3.2 Automotive 5.4.3.3.3 Aerospace 5.4.3.3.4 Construction 6. Europe Tool Steel Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 6.1 Europe Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 6.2 Europe Tool Steel Market Size and Forecast, by Product Type (2023-2030) 6.3 Europe Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 6.4 Europe Tool Steel Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 6.4.1.2 United Kingdom Tool Steel Market Size and Forecast, by Product Type (2023-2030) 6.4.1.3 United Kingdom Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 6.4.2 France 6.4.2.1 France Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 6.4.2.2 France Tool Steel Market Size and Forecast, by Product Type (2023-2030) 6.4.2.3 France Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 6.4.3.2 Germany Tool Steel Market Size and Forecast, by Product Type (2023-2030) 6.4.3.3 Germany Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 6.4.4.2 Italy Tool Steel Market Size and Forecast, by Product Type (2023-2030) 6.4.4.3 Italy Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 6.4.5.2 Spain Tool Steel Market Size and Forecast, by Product Type (2023-2030) 6.4.5.3 Spain Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 6.4.6.2 Sweden Tool Steel Market Size and Forecast, by Product Type (2023-2030) 6.4.6.3 Sweden Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 6.4.7.2 Austria Tool Steel Market Size and Forecast, by Product Type (2023-2030) 6.4.7.3 Austria Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 6.4.8.2 Rest of Europe Tool Steel Market Size and Forecast, by Product Type (2023-2030). 6.4.8.3 Rest of Europe Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 7. Asia Pacific Tool Steel Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 7.1 Asia Pacific Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 7.2 Asia Pacific Tool Steel Market Size and Forecast, by Product Type (2023-2030) 7.3 Asia Pacific Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 7.4 Asia Pacific Tool Steel Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 7.4.1.2 China Tool Steel Market Size and Forecast, by Product Type (2023-2030) 7.4.1.3 China Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 7.4.2.2 S Korea Tool Steel Market Size and Forecast, by Product Type (2023-2030) 7.4.2.3 S Korea Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 7.4.3.2 Japan Tool Steel Market Size and Forecast, by Product Type (2023-2030) 7.4.3.3 Japan Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 7.4.4 India 7.4.4.1 India Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 7.4.4.2 India Tool Steel Market Size and Forecast, by Product Type (2023-2030) 7.4.4.3 India Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 7.4.5.2 Australia Tool Steel Market Size and Forecast, by Product Type (2023-2030) 7.4.5.3 Australia Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 7.4.6.2 Indonesia Tool Steel Market Size and Forecast, by Product Type (2023-2030) 7.4.6.3 Indonesia Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 7.4.7.2 Malaysia Tool Steel Market Size and Forecast, by Product Type (2023-2030) 7.4.7.3 Malaysia Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 7.4.8.2 Vietnam Tool Steel Market Size and Forecast, by Product Type (2023-2030) 7.4.8.3 Vietnam Tool Steel Market Size and Forecast, by Type (2023-2030) 7.4.8.4 Vietnam Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 7.4.9.2 Taiwan Tool Steel Market Size and Forecast, by Product Type (2023-2030) 7.4.9.3 Taiwan Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 7.4.10.2 Bangladesh Tool Steel Market Size and Forecast, by Product Type (2023-2030) 7.4.10.3 Bangladesh Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 7.4.11.2 Pakistan Tool Steel Market Size and Forecast, by Product Type (2023-2030) 7.4.11.3 Pakistan Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 7.4.12.2 Rest of Asia PacificTool Steel Market Size and Forecast, by Product Type (2023-2030) 7.4.12.3 Rest of Asia Pacific Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 8. Middle East and Africa Tool Steel Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 8.1 Middle East and Africa Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 8.2 Middle East and Africa Tool Steel Market Size and Forecast, by Product Type (2023-2030) 8.3 Middle East and Africa Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 8.4 Middle East and Africa Tool Steel Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 8.4.1.2 South Africa Tool Steel Market Size and Forecast, by Product Type (2023-2030) 8.4.1.3 South Africa Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 8.4.2.2 GCC Tool Steel Market Size and Forecast, by Product Type (2023-2030) 8.4.2.3 GCC Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 8.4.3.2 Egypt Tool Steel Market Size and Forecast, by Product Type (2023-2030) 8.4.3.3 Egypt Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 8.4.4.2 Nigeria Tool Steel Market Size and Forecast, by Product Type (2023-2030) 8.4.4.3 Nigeria Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 8.4.5.2 Rest of ME&A Tool Steel Market Size and Forecast, by Product Type (2023-2030) 8.4.5.3 Rest of ME&A Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 9. South America Tool Steel Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2023-2030) 9.1 South America Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 9.2 South America Tool Steel Market Size and Forecast, by Product Type (2023-2030) 9.3 South America Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 9.4 South America Tool Steel Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 9.4.1.2 Brazil Tool Steel Market Size and Forecast, by Product Type (2023-2030) 9.4.1.3 Brazil Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 9.4.2.2 Argentina Tool Steel Market Size and Forecast, by Product Type (2023-2030) 9.4.2.3 Argentina Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Tool Steel Market Size and Forecast, by Material Composition (2023-2030) 9.4.3.2 Rest Of South America Tool Steel Market Size and Forecast, by Product Type (2023-2030) 9.4.3.3 Rest Of South America Tool Steel Market Size and Forecast, by End-User Applications (2023-2030) 10. Global Tool Steel Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Tool Steel Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Swiss Steel Group 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Recent Developments 11.2 Proterial, Ltd. 11.3 Daido Steel Co., Ltd. 11.4 Samuel, Son & Co. 11.5 Vested Metals 11.6 Remblay Tool Steels, LLC 11.7 GMH Gruppe 11.8 Saarschmiede GmbH 11.9 Voestalpine High Performance Metals LLC 11.10 Nachi-Fujikoshi Corp. 11.11 CRS Holdings, LLC. 11.12 Diehl Tool Steel, Inc 11.13 Uddeholm USA 11.14 Kind & Co. Edelstahlwerk, GmbH & Co. KG 11.15 Ellwood Specialty Steel 11.16 Buderus Edelstahl GmbH 11.17 Ningshing Special-Steel Group Co., Ltd. 11.18 Sanyo Special Steel Co., Ltd. 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary