The Tobacco Market reached a value of USD 941.0 billion in 2023. Forecasts indicate a 2.55 % revenue growth in the Tobacco Market from 2024 to 2030. The Market is expected to achieve a total revenue of nearly USD 1122.38 billion by 2030.Overview of the Tobacco Market

The Tobacco market is transforming thanks to increasing awareness of health risks associated with tobacco consumption. This awareness has prompted a shift in consumer preferences toward alternatives such as smokeless tobacco, e-cigarettes, and heated tobacco. The global use of tobacco products exceeds 1.3 billion people. The global tobacco market is significantly driven by a few key countries. China leads, contributing over 38% of the world's total tobacco production. Brazil, India, and the US, in a strategic alliance, add another 25%. Turkey, Zimbabwe, Indonesia, Italy, Greece, Malawi, and Argentina collectively contribute 15%. These 11 nations jointly produce almost 80% of the world's tobacco, underscoring their significant influence in the industry. Regulatory pressures and anti-smoking efforts impact traditional cigarette sales, in major markets. Yet, the industry responds with innovation and partnerships to address challenges, offering opportunities in reduced-risk products and technological advancements. Future growth hinges on adaptability, diversification, and meeting evolving consumer expectations and health concerns. Tobacco Market Report Scope and Methodology The report provides a quantitative analysis of the current Tobacco market drivers, restraints, trends, estimations, and opportunities of the market to identify the prevailing opportunities in the market during the forecast period. PORTER's five forces analysis shows the ability of buyers and suppliers to make profit-oriented strategic decisions and build their supplier-buyer network. In-depth analysis as well as the market size and segmentation assist in determining the current Tobacco Market potential. Some factors that are supposed to affect the business positively or negatively have been analysed in this report which will give a clear futuristic view of the industry to the decision-makers. The report presents a comprehensive analysis of the global Tobacco Market to the stakeholders who want to invest in this market. The report includes past and current scenarios of the market with the forecasted market size. The report covers all the aspects of the market with a thorough study of key players that include market leaders, followers, and new entrants. The report contains strategic profiling of top key players in the market, a wide-ranging analysis of their core competencies, and their strategies like new product launches, growths, agreements, joint ventures, partnerships, and acquisitions that apply to the businesses.To Know About The Research Methodology :- Request Free Sample Report

Market Dynamics

Consumer Preferences Boost the market growth The Tobacco Market is undergoing significant changes driven by shifting consumer preferences and heightened health awareness. People are becoming more aware of the harmful effects of tobacco, leading them to opt for healthier choices. Tobacco companies are responding to this trend by diversifying their products to include options like e-cigarettes and smokeless tobacco, which are perceived as less risky. This change in strategy aligns with the broader societal movement toward wellness and a preference for products that are considered safer. Government initiatives and public health campaigns have further intensified efforts to disseminate information about smoking-related health risks. According to MMR Study Report in 2021, 4.5% of adults aged 18 and over were current e-cigarette users, with the highest usage observed among those aged 18–24 (11.0%). Usage patterns varied by race and Hispanic origin, with White non-Hispanic adults showing higher rates (5.2%) compared to Asian non-Hispanic (2.9%), Black or African American non-Hispanic (2.4%), and Hispanic or Latino (3.3%) adults. E-cigarette use also correlated with income, generally declining with increasing family income. Additionally, a demographic analysis revealed that adults aged 18–24 and 25–44 were more likely to be dual users of e-cigarettes and traditional cigarettes compared to those aged 45 and over. This multifaceted landscape underscores the dynamic interplay between consumer behaviors, health awareness, and market trends in the evolving Tobacco Market.Restrain Regulatory restrictions and taxation restrain market growth Governments across the globe implement strict regulations on various aspects of the tobacco industry. These regulations cover advertising, packaging, labeling, and public smoking. For example, limitations on tobacco advertising aim to reduce the visibility and appeal of tobacco products, especially to younger demographics. Plain packaging requirements, graphic health warnings, and restrictions on marketing practices are common regulatory measures aimed at curbing tobacco use. This factor significantly hampers the growth of the Tobacco market. In the United States, the tobacco market is subject to taxation at federal, state, and local levels, employing a unit tax model based on the quantity or weight of tobacco products. Federal law strictly regulates tobacco advertising, prohibiting free samples, displays, and sponsorships. The marketing of new tobacco products necessitates FDA authorization. At the state level, regulations encompass limitations on point-of-sale advertising, stipulations on package sizes, and the implementation of policies like elevating the minimum legal sale age. The American Lung Association actively supports a federal hike in cigarette taxes, proposing that the generated revenue be directed toward programs benefiting both children and adults. This includes support for initiatives like the Children's Health Insurance Program (CHIP). Internationally, tobacco taxation poses challenges, with higher taxes potentially stimulating significant tax evasion. To counter this, some countries establish tobacco excise departments to monitor production, maintain control over distribution, and collaborate with customs and tax authorities regionally and globally. Diversification into Reduced-Risk Products creates lucrative growth opportunities for the Tobacco market growth Changing consumer preferences and addressing health concerns. This approach involves expanding product portfolios to include alternatives with potentially lower health risks than traditional cigarettes. Reduced-risk products include e-cigarettes, smokeless tobacco, and other innovations designed to provide nicotine without the harmful effects associated with combustible tobacco. The growing global trend toward health consciousness and the decline in traditional cigarette consumption make reduced-risk products a promising avenue for growth. Investing in research and development to enhance the safety and appeal of these alternatives allows companies to position themselves as leaders in harm reduction within the Tobacco Market. Effective marketing and transparent communication about the reduced health risks associated with these products are crucial in gaining consumer trust. Companies leverage technological advancements, such as advanced delivery systems and innovative formulations, to create products that satisfy consumer cravings for nicotine while minimizing exposure to harmful substances found in traditional cigarettes.

Tobacco Market Segment Analysis

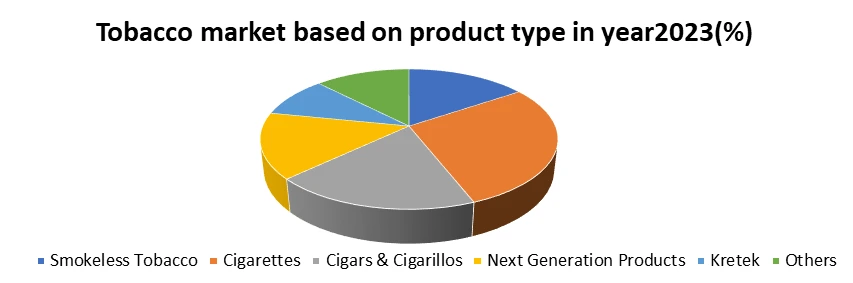

Based On Product, the cigarette segment dominates the global tobacco market in the year 2023. due to widespread social acceptance, the addictive nature of nicotine, and strong marketing strategies by major tobacco companies significantly boost the demand of cigarettes. Cultural habits, ease of use, and established distribution networks contribute to the enduring popularity of cigarettes. Also, with increasing regulations and anti-smoking campaigns, cigarettes often face less stringent restrictions compared to other tobacco products. For example, according to the MMR study Report In 2021, 11.5% of U.S. adults that is 28.3 million people smoked cigarettes. In the UK population in 2022, 12.9% of people aged 18 years and over, or around 6.4 million people, smoked cigarettes; E-cigarette use was highest among those aged 16 to 24 years in Great Britain; the percentage of people in this age group who were daily or occasional vapers in 2022 has increased to 15.5% compared with 11.1% in 2021.

Regional Insights of the Tobacco Market

The Asia Pacific region dominated the tobacco market in the year 2023. A High population density, particularly in countries such as China and India, contributes to a substantial consumer base. Additionally, culturally ingrained smoking habits and relatively lax tobacco regulations in certain areas further fuel market growth. The region's economic development has led to increased disposable income, allowing for higher tobacco consumption. Aggressive marketing strategies by multinational tobacco companies, coupled with a diverse range of tobacco products, provide to varied preferences. Collectively, these elements create a robust demand for tobacco in the Asia Pacific, solidifying its dominance in the global tobacco market. Tobacco In the Indian Economy India, a significant player in the global tobacco landscape, contributes to 10% of the world's tobacco production. Cultivating diverse types, including Flue-cured Virginia (FCV), Burley, and Oriental varieties across 15 states, India has become the second-largest producer and exporter after China and Brazil. With a mere 0.27% of the cultivated area, India's tobacco industry provides livelihood security to 36 million people, including farmers, laborers, and those involved in processing and manufacturing. The nation's competitive edge stems from low production costs and favorable export prices, positioning Indian tobacco as 'value for money.' With annual contributions of ₹4,400 crores in foreign exchange earnings and ₹14,000 crores in excise revenue, the sector significantly impacts the country's economy. Despite holding only 1% of the world's cigarette exports, India exhibits potential for growth in niche products like scented Bidis, Hookah tobacco paste, and others. Over the past five years, tobacco exports have surged by 76% in quantity and 209% in value, solidifying India's position in the global market. Major importers include the UK, Germany, Belgium, South Korea, and South Africa, while Brazil, Zimbabwe, Turkey, China, and Indonesia pose as key competitors.Competitive Landscape of the Tobacco Market

The Tobacco Market is Highly Competitive. The number of small as well as big key players dominates the Tobacco market growth. the key players mainly focus on mergers acquisitions, innovation of new products as well as partnerships. For example, industry leaders, such as British American Tobacco, are leveraging flavors such as menthol to provide a refreshing smoking experience, targeting a broad consumer base. Fruity alternatives like apple, cherry, mango, blueberry, and strawberry appeal to younger audiences, diversifying options beyond traditional tobacco tastes.The introduction of chocolate and honey-flavored cigarettes adds a sweet and soothing dimension, capturing the interest of consumers seeking a distinctive smoking experience. Citrusy options like orange contribute to the market's dynamism. As tobacco companies innovate with these flavors, competition intensifies to capture market share among the burgeoning demographic of flavored tobacco enthusiasts. The strategic development of these diverse flavor profiles reflects a concerted effort by the industry to attract and retain a broad spectrum of consumers, especially younger demographics, thereby shaping the competitive landscape of the Tobacco Market.

Tobacco Market Scope: Inquire Before Buying

Global Tobacco Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 941.0 Bn Forecast Period 2024 to 2030 CAGR: 2.55% Market Size in 2030: US $ 1122.38 Bn. Segments Covered: by Product Type Smokeless Tobacco Cigarettes Cigars & Cigarillos Next Generation Products Kretek Others by Distribution Channel Convenience Stores Tobacco Shops Online Others Tobacco Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Tobacco Market Key Players

1. Philip Morris International 2. British American Tobacco 3. Japan Tobacco International 4. Imperial Brands 5. China National Tobacco Corporation 6. ITC Limited 7. Korea Tobacco & Ginseng Corporation (KT&G) 8. Scandinavian Tobacco Group 9. Eastern Company 10. Universal Corporation 11. Alliance One International 12. Godfrey Phillips India Ltd. 13. Donskoy Tabak 14. Vector Group Ltd. 15. 22nd Century Group 16. Turning Point Brands 17. Swedish Match AB Frequently Asked Questions: 1] What segments are covered in the Global Tobacco Market report? Ans. The segments covered in the Tobacco Market report are based on product Type, Distribution Channel, and Region. 2] Which region is expected to hold the highest share in the Global Tobacco Market? Ans. The Asia Pacific region is expected to hold the highest share of the Tobacco Market. 3] What is the market size of the Global Tobacco Market by 2030? Ans. The market size of the Tobacco Market by 2030 is expected to reach US$ 1122.38 Bn. 4] What is the forecast period for the Global Tobacco Market? Ans. The forecast period for the Tobacco Market is 2024-2030. 5] What was the market size of the Global Tobacco Market in 2023? Ans. The market size of the Tobacco Market in 2023 was valued at US$ 941.0Bn.

1. Tobacco Market: Research Methodology 2. Tobacco Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Tobacco Market: Dynamics 3.1. Tobacco Market Trends by Region 3.1.1. North America Tobacco Market Trends 3.1.2. Europe Tobacco Market Trends 3.1.3. Asia Pacific Tobacco Market Trends 3.1.4. Middle East and Africa Tobacco Market Trends 3.1.5. South America Tobacco Market Trends 3.2. Tobacco Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Tobacco Market Drivers 3.2.1.2. North America Tobacco Market Restraints 3.2.1.3. North America Tobacco Market Opportunities 3.2.1.4. North America Tobacco Market Challenges 3.2.2. Europe 3.2.2.1. Europe Tobacco Market Drivers 3.2.2.2. Europe Tobacco Market Restraints 3.2.2.3. Europe Tobacco Market Opportunities 3.2.2.4. Europe Tobacco Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Tobacco Market Drivers 3.2.3.2. Asia Pacific Tobacco Market Restraints 3.2.3.3. Asia Pacific Tobacco Market Opportunities 3.2.3.4. Asia Pacific Tobacco Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Tobacco Market Drivers 3.2.4.2. Middle East and Africa Tobacco Market Restraints 3.2.4.3. Middle East and Africa Tobacco Market Opportunities 3.2.4.4. Middle East and Africa Tobacco Market Challenges 3.2.5. South America 3.2.5.1. South America Tobacco Market Drivers 3.2.5.2. South America Tobacco Market Restraints 3.2.5.3. South America Tobacco Market Opportunities 3.2.5.4. South America Tobacco Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Tobacco Market 3.8. Analysis of Government Schemes and Initiatives For the Tobacco Market 3.9. The Global Pandemic Impact on the Tobacco Market 4. Tobacco Market: Global Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 4.1. Tobacco Market Size and Forecast, By Product (2023-2030) 4.1.1. Smokeless Tobacco 4.1.2. Cigarettes 4.1.3. Cigars & Cigarillos 4.1.4. Next Generation Products 4.1.5. Kretek 4.1.6. Others 4.2. Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 4.2.1. Convenience Stores 4.2.2. Tobacco Shops 4.2.3. Online 4.2.4. Others 4.3. Tobacco Market Size and Forecast, by Region (2023-2030) 4.3.1. North America 4.3.2. Europe 4.3.3. Asia Pacific 4.3.4. Middle East and Africa 4.3.5. South America 5. North America Tobacco Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 5.1. North America Tobacco Market Size and Forecast, By Product (2023-2030) 5.1.1. Smokeless Tobacco 5.1.2. Cigarettes 5.1.3. Cigars & Cigarillos 5.1.4. Next Generation Products 5.1.5. Kretek 5.1.6. Others 5.2. North America Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 5.2.1. Convenience Stores 5.2.2. Tobacco Shops 5.2.3. Online 5.2.4. Others 5.3. North America Tobacco Market Size and Forecast, by Country (2023-2030) 5.3.1. United States 5.3.1.1. United States Tobacco Market Size and Forecast, By Product (2023-2030) 5.3.1.1.1. Smokeless Tobacco 5.3.1.1.2. Cigarettes 5.3.1.1.3. Cigars & Cigarillos 5.3.1.1.4. Next Generation Products 5.3.1.1.5. Kretek 5.3.1.1.6. Others 5.3.1.2. United States Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 5.3.1.2.1. Convenience Stores 5.3.1.2.2. Tobacco Shops 5.3.1.2.3. Online 5.3.1.2.4. Others 5.3.2. Canada 5.3.2.1. Canada Tobacco Market Size and Forecast, By Product (2023-2030) 5.3.2.1.1. Smokeless Tobacco 5.3.2.1.2. Cigarettes 5.3.2.1.3. Cigars & Cigarillos 5.3.2.1.4. Next Generation Products 5.3.2.1.5. Kretek 5.3.2.1.6. Others 5.3.2.2. Canada Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 5.3.2.2.1. Convenience Stores 5.3.2.2.2. Tobacco Shops 5.3.2.2.3. Online 5.3.2.2.4. Others 5.3.3. Mexico 5.3.3.1. Mexico Tobacco Market Size and Forecast, By Product (2023-2030) 5.3.3.1.1. Smokeless Tobacco 5.3.3.1.2. Cigarettes 5.3.3.1.3. Cigars & Cigarillos 5.3.3.1.4. Next Generation Products 5.3.3.1.5. Kretek 5.3.3.1.6. Others 5.3.3.2. Mexico Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 5.3.3.2.1. Convenience Stores 5.3.3.2.2. Tobacco Shops 5.3.3.2.3. Online 5.3.3.2.4. Others 6. Europe Tobacco Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 6.1. Europe Tobacco Market Size and Forecast, By Product (2023-2030) 6.2. Europe Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 6.3. Europe Tobacco Market Size and Forecast, by Country (2023-2030) 6.3.1. United Kingdom 6.3.1.1. United Kingdom Tobacco Market Size and Forecast, By Product (2023-2030) 6.3.1.2. United Kingdom Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 6.3.2. France 6.3.2.1. France Tobacco Market Size and Forecast, By Product (2023-2030) 6.3.2.2. France Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 6.3.3. Germany 6.3.3.1. Germany Tobacco Market Size and Forecast, By Product (2023-2030) 6.3.3.2. Germany Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 6.3.4. Italy 6.3.4.1. Italy Tobacco Market Size and Forecast, By Product (2023-2030) 6.3.4.2. Italy Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 6.3.5. Spain 6.3.5.1. Spain Tobacco Market Size and Forecast, By Product (2023-2030) 6.3.5.2. Spain Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 6.3.6. Sweden 6.3.6.1. Sweden Tobacco Market Size and Forecast, By Product (2023-2030) 6.3.6.2. Sweden Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 6.3.7. Austria 6.3.7.1. Austria Tobacco Market Size and Forecast, By Product (2023-2030) 6.3.7.2. Austria Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 6.3.8. Rest of Europe 6.3.8.1. Rest of Europe Tobacco Market Size and Forecast, By Product (2023-2030) 6.3.8.2. Rest of Europe Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 7. Asia Pacific Tobacco Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 7.1. Asia Pacific Tobacco Market Size and Forecast, By Product (2023-2030) 7.2. Asia Pacific Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 7.3. Asia Pacific Tobacco Market Size and Forecast, by Country (2023-2030) 7.3.1. China 7.3.1.1. China Tobacco Market Size and Forecast, By Product (2023-2030) 7.3.1.2. China Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 7.3.2. S Korea 7.3.2.1. S Korea Tobacco Market Size and Forecast, By Product (2023-2030) 7.3.2.2. S Korea Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 7.3.3. Japan 7.3.3.1. Japan Tobacco Market Size and Forecast, By Product (2023-2030) 7.3.3.2. Japan Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 7.3.4. India 7.3.4.1. India Tobacco Market Size and Forecast, By Product (2023-2030) 7.3.4.2. India Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 7.3.5. Australia 7.3.5.1. Australia Tobacco Market Size and Forecast, By Product (2023-2030) 7.3.5.2. Australia Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 7.3.6. Indonesia 7.3.6.1. Indonesia Tobacco Market Size and Forecast, By Product (2023-2030) 7.3.6.2. Indonesia Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 7.3.7. Malaysia 7.3.7.1. Malaysia Tobacco Market Size and Forecast, By Product (2023-2030) 7.3.7.2. Malaysia Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 7.3.8. Vietnam 7.3.8.1. Vietnam Tobacco Market Size and Forecast, By Product (2023-2030) 7.3.8.2. Vietnam Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 7.3.9. Taiwan 7.3.9.1. Taiwan Tobacco Market Size and Forecast, By Product (2023-2030) 7.3.9.2. Taiwan Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 7.3.10. Rest of Asia Pacific 7.3.10.1. Rest of Asia Pacific Tobacco Market Size and Forecast, By Product (2023-2030) 7.3.10.2. Rest of Asia Pacific Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 8. Middle East and Africa Tobacco Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 8.1. Middle East and Africa Tobacco Market Size and Forecast, By Product (2023-2030) 8.2. Middle East and Africa Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 8.3. Middle East and Africa Tobacco Market Size and Forecast, by Country (2023-2030) 8.3.1. South Africa 8.3.1.1. South Africa Tobacco Market Size and Forecast, By Product (2023-2030) 8.3.1.2. South Africa Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 8.3.2. GCC 8.3.2.1. GCC Tobacco Market Size and Forecast, By Product (2023-2030) 8.3.2.2. GCC Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 8.3.3. Nigeria 8.3.3.1. Nigeria Tobacco Market Size and Forecast, By Product (2023-2030) 8.3.3.2. Nigeria Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 8.3.4. Rest of ME&A 8.3.4.1. Rest of ME&A Tobacco Market Size and Forecast, By Product (2023-2030) 8.3.4.2. Rest of ME&A Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 9. South America Tobacco Market Size and Forecast by Segmentation (by Value in USD Million and Volume in Units) (2023-2030) 9.1. South America Tobacco Market Size and Forecast, By Product (2023-2030) 9.2. South America Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 9.3. South America Tobacco Market Size and Forecast, by Country (2023-2030) 9.3.1. Brazil 9.3.1.1. Brazil Tobacco Market Size and Forecast, By Product (2023-2030) 9.3.1.2. Brazil Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 9.3.2. Argentina 9.3.2.1. Argentina Tobacco Market Size and Forecast, By Product (2023-2030) 9.3.2.2. Argentina Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 9.3.3. Rest Of South America 9.3.3.1. Rest Of South America Tobacco Market Size and Forecast, By Product (2023-2030) 9.3.3.2. Rest Of South America Tobacco Market Size and Forecast, By Distribution Channel (2023-2030) 10. Global Tobacco Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Tobacco Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Philip Morris International 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. British American Tobacco 11.3. Japan Tobacco International 11.4. Imperial Brands 11.5. China National Tobacco Corporation 11.6. ITC Limited 11.7. Korea Tobacco & Ginseng Corporation (KT&G) 11.8. Scandinavian Tobacco Group 11.9. Eastern Company 11.10. Universal Corporation 11.11. Alliance One International 11.12. Godfrey Phillips India Ltd. 11.13. Donskoy Tabak 11.14. Vector Group Ltd. 11.15. 22nd Century Group 11.16. Turning Point Brands 11.17. Swedish Match AB 12. Key Findings 13. Industry Recommendations