The Tin Snips Tool Market size was valued at USD 501.84 Million in 2024 and the total Tin Snips Tool revenue is expected to grow at a CAGR of 4.7% from 2025 to 2032, reaching nearly USD 724.67 Million. Tin snips are hand tools designed for cutting and shaping thin sheets of metal, including materials like aluminum, tin, and steel. The tin snips tool market is a vital segment within the broader hand tool industry, primarily catering to professionals and DIY enthusiasts involved in metalworking and sheet metal fabrication. Tin snips, also known as aviation snips, are specialized cutting tools designed to cut and shape thin sheets of metal, including aluminum, tin, steel, and other materials. This market has witnessed consistent growth due to the increasing demand for metalworking activities across various sectors, including construction, automotive, aerospace, and manufacturing. Key market drivers include a surge in construction and infrastructure development projects, leading to a heightened demand for sheet metal and metalworking tools. Additionally, advancements in technology have led to the development of ergonomically designed, high-precision tin snips, enhancing efficiency and reducing user fatigue. Furthermore, the emphasis on sustainability and eco-friendly practices has propelled the demand for tin snips made from recycled materials, appealing to environmentally conscious consumers. In electrical installations for infrastructure projects, tin snips are utilized to cut and shape metal sheets for enclosures, panels, and other electrical components. These components house and protect electrical equipment. Tin snips are valuable tools for maintenance and repair activities in infrastructure projects. They are used to cut and replace damaged or worn-out metal components, ensuring the longevity and safety of the infrastructure.To know about the Research Methodology :- Request Free Sample Report

Tin Snips Tool Market Dynamics

The Increasing Construction Sectors across the Globe Fuel the Demand For Tin Snips in the Global Market The construction industry is a major consumer of sheet metal, which is widely used in various construction components, structures, HVAC systems, roofing, and more. As urbanization and infrastructure development continue to rise globally, the demand for tin snips to cut and shape these materials also increases. Metalworking is an integral part of construction processes. Sheet metal needs to be precisely cut, bent, and shaped to fit specific designs and dimensions. Tin snips provide the necessary precision and versatility for these tasks. Large-scale infrastructure projects like bridges, airports, roads, and commercial buildings often involve substantial usage of sheet metal. The demand for tin snips in such projects is high due to the need for accurate metal cutting to meet project specifications. The construction of residential buildings, including houses and apartments, also requires sheet metal for various purposes such as roofing, ductwork, and fittings. The construction industry grew to a spending value of approximately 12 trillion U.S. dollars before the coronavirus pandemic and is expected to grow by three percent per annum. This includes building projects in real estate either residential or commercial but also in infrastructure or industrial structures tin snips are essential tools these construction projects. Renovation and remodeling projects in both residential and commercial sectors frequently involve working with existing metal structures or incorporating new sheet metal. Tin snips are indispensable tools for customizing and fitting these metal components.Fluctuation in the Cost of Raw Material The production of tin snips requires steel and other metals, which are essential raw materials. Steel prices, in particular, are susceptible to changes in global supply chains, trade tariffs, mining operations, and geopolitical issues. Sudden spikes or declines in the prices of these raw materials can significantly impact the overall production cost of tin snips. Higher production costs due to fluctuating raw material prices can translate into higher prices for tin snips. If prices rise significantly, it can lead to decreased affordability for consumers, potentially affecting the demand for these tools. Sharp fluctuations in raw material prices can disrupt the supply chain. Manufacturers may struggle to procure raw materials at stable prices and within expected timeframes. This can disrupt production schedules, leading to delays in product availability in the market. Delays in product availability can impact customer satisfaction and trust in the brand. This is somehow restraining the growth of the global tin snips tools market.

Tin Snips Tool Market Opportunity

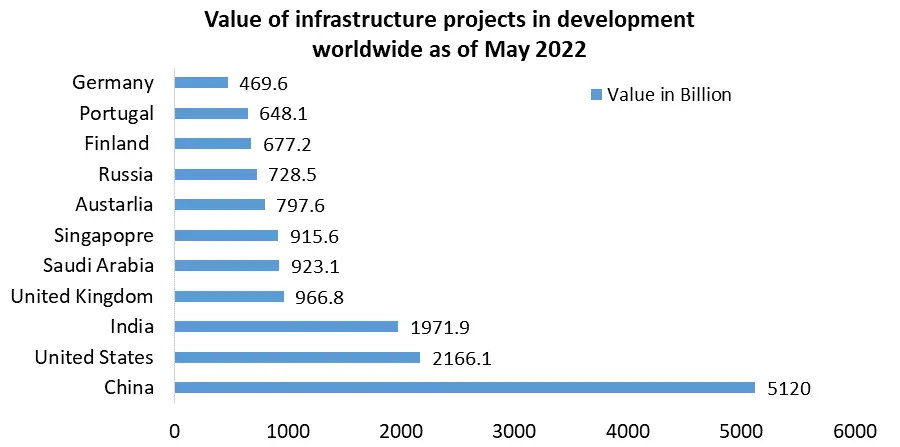

Ongoing Infrastructure Development Projects Provide The Opportunity For The Growth Of The Global Tin Snips Tool Market. Global infrastructure comprises the physical networks and facilities fundamental to the functioning of a modern industrial nation. This includes transportation infrastructures, such as roads, bridges, railroads, and ports; energy infrastructures, such as energy transmission lines and pipelines; or telecommunication infrastructures, which include cellular base stations. In 2020, China was the country with the highest spending on infrastructure worldwide. However, as of May 2022, the three most expensive infrastructure projects currently under development were in Europe and the United States. Infrastructure spending is spending on transportation, power, and water facilities are public goods that benefit everyone in the economy. Government provision of these goods is critical to the economy, and this type of spending does have a stimulatory effect on gross domestic product (GDP). The government has initiated the National Infrastructure Pipeline (NIP) in conjunction with other efforts like Make in India and the production-linked incentives (PLI) scheme to enhance the growth of the infrastructure sector. A significant portion, exceeding 80%, of the country's infrastructure investment has been allocated to support transportation, electricity, water, and irrigation. As of May 2022, India leads globally in the number of ongoing or underway infrastructure projects valued at over 25 million U.S. dollars. In comparison to India's 1,944 construction projects, the United States had 1,866 projects, while China had 1,175. As a result, the increasing number of infrastructure projects in several countries drives the demand for the tin snips tool.

Tin Snips Tool Market Regional Insights

Asia Pacific, dominates the global tin snips tool market, with the highest revenue share in 2024. The Asia-Pacific region is the largest construction market, driven by rapid urbanization and infrastructure development in countries like China and India. Infrastructure is a key enabler in helping India become a US$26 trillion economy. Investments in building and upgrading physical infrastructure, especially in synergy with the ease of doing business initiatives, remain pivotal to increasing efficiency and costs. Infrastructure projects often involve the installation of heating, ventilation, and air conditioning (HVAC) systems. Tin snips are used to cut and shape sheet metal for HVAC ductwork, allowing for efficient air distribution within buildings. This versatility of the tin snip tool increases the growth of the global market.Tin Snips Tool Market Segment Analysis

By application, the construction segment has witnessed significant growth in recent years. In recent years, the construction sector has experienced significant expansion. This growth is propelled by various factors such as population surges, urbanization, infrastructure advancements, and heightened investments in real estate. Within construction, sheet metal finds extensive utility for diverse applications including roofing, cladding, ductwork, and structural components. Tin snip tools play an indispensable role in precisely cutting and shaping these metal sheets to suit the particular needs of construction projects. The construction industry stands as a pivotal sector exerting substantial influence on a nation's economic landscape. In the United States, the construction industry has demonstrated robust growth after the last economic downturn. According to MMR analysts, the real output of the construction market is projected to approach nearly US$1.2 trillion by 2020. Recent data from a survey revealed that construction enterprises generated approximately $375 billion in contract revenue in 2017 alone, reflecting a 2.1% improvement from the preceding year. The increase in the construction industry is attributed to significant modernizations of the aging infrastructure across the United States.Tin Snips Tool Market Scope: Inquiry Before Buying

Tin Snips Tool Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 501.84 Million. Forecast Period 2025 to 2032 CAGR: 4.7% Market Size in 2032: USD 724.67 Million. Segments Covered: by Type Straight-cut tin snips Curved tin snips Jewelers tin snips Universal tin snips Straight pattern tin snips Spring-loaded tin snips by Application Construction Automotive Aerospace Manufacturing Tin Snips Tool Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Tin Snips Tool Market Key Players

North America 1. Stanley Black & Decker (USA) 2. Apex Tool Group, LLC (USA) 3. Klein Tools, Inc. (USA) 4. Irwin Industrial Tools (USA) 5. Malco Products, SBC (USA) 6. Midwest Tool and Cutlery Company (USA) 7. RIDGID (Emerson Electric Co.) (USA) Europe 8. SNA Europe (Bahco) (France) 9. Facom S.A.S. (France) 10. BESSEY Tool GmbH & Co. KG (Germany) 11. Stubai KSHB GmbH (Austria) 12. KNIPEX-Werk C. Gustav Putsch KG (Germany) 13. Fein GmbH (Germany) 14. NWS Tool Group GmbH (Germany) 15. GEDORE Werkzeugfabrik GmbH & Co. KG (Germany) Asia-Pacific 16. Rudani Enterprises Pvt. Ltd. (India) 17. Skyline Technology (India) 18. Device International (India) 19. Hebei Sinotools Industrial Co., Ltd. (China) MEA (Middle East & Africa) 20. Tolsen Tools FZCO (UAE) 21. L&G Tools (Pty) Ltd. (South Africa) 22. Fragram Tools (L&G Tools Pty Ltd.) (South Africa) 23. South America 24. Tramontina S.A. Cutelaria (Brazil) 25. IRWIN do Brasil Ltda. (Brazil)Frequently Asked Questions:

1] What segments are covered in the Global Tin Snips Tool Market report? Ans. The segments covered in the Tin Snips Tool market report are based on type and application. 2] Which region is expected to hold the highest share of the Global Tin Snips Tool Market? Ans. The Asia Pacific region is expected to hold the highest share of the Tin Snips Tool Market. 3] What is the market size of the Global Tin Snips Tool Market by 2032? Ans. The market size of the Tin Snips Tool Market by 2032 is expected to reach USD 724.67 Million. 4] What is the forecast period for the Global Tin Snips Tool Market? Ans. The forecast period for the Tin Snips Tool Market is 2025-2032. 5] What was the Global Tin Snips Tool Market size in 2024? Ans. The Global Tin Snips Tool Market size was USD 501.84 Million in 2024. 6] What Are The Driving Factor In The Global Tin Snips Tool Market? Ans. The increasing construction sectors across the globe fuel the demand for tin snips in the global market.

1. Tin Snips Tool Market: Research Methodology 2. Tin Snips Tool Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Tin Snips Tool Market: Dynamics 3.1 Tin Snips Tool Market Trends 3.2 Tin Snips Tool Market Dynamics 3.2.1 Market Drivers 3.2.2 Market Restraints 3.2.3 Market Opportunities 3.2.4 Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 North America 3.6.2 Europe 3.6.3 Asia Pacific 3.6.4 Middle East and Africa 3.6.5 South America 3.7 Analysis of Government Schemes and Initiatives for the Tin Snips Tool Industry 3.8 The Global Pandemic and Redefining of The Tin Snips Tool Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 4. Global Tin Snips Tool Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2024-2032) 4.1 Global Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 4.1.1 Straight-cut tin snips 4.1.2 Curved tin snips 4.1.3 Jewellers tin snips 4.1.4 Universal tin snips 4.1.5 Straight pattern tin snips 4.1.6 Spring-loaded tin snips 4.2 Global Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 4.2.1 Construction 4.2.2 Automotive 4.2.3 Aerospace 4.2.4 Manufacturing 4.3 Global Tin Snips Tool Market Size and Forecast, by Region (2024-2032) 4.3.1 North America 4.3.2 Europe 4.3.3 Asia Pacific 4.3.4 Middle East and Africa 4.3.5 South America 5. North America Tin Snips Tool Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2024-2032) 5.1 North America Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 5.1.1 Straight-cut tin snips 5.1.2 Curved tin snips 5.1.3 Jewelers tin snips 5.1.4 Universal tin snips 5.1.5 Straight pattern tin snips 5.1.6 Spring-loaded tin snips 5.2 North America Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 5.2.1 Construction 5.2.2 Automotive 5.2.3 Aerospace 5.2.4 Manufacturing 5.3 North America Tin Snips Tool Market Size and Forecast, by Country (2024-2032) 5.3.1 United States 5.3.1.1 United States Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 5.3.1.1.1 Single Balloon 5.3.1.1.2 Dual Balloon 5.3.1.2 United States Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 5.3.1.2.1 Construction 5.3.1.2.2 Automotive 5.3.1.2.3 Aerospace 5.3.1.2.4 Manufacturing 5.3.2 Canada 5.3.2.1 Canada Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 5.3.2.1.1 Straight-cut tin snips 5.3.2.1.2 Curved tin snips 5.3.2.1.3 Jewelers tin snips 5.3.2.1.4 Universal tin snips 5.3.2.1.5 Straight pattern tin snips 5.3.2.1.6 Spring-loaded tin snips 5.3.2.2 Canada Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 5.3.2.2.1 Construction 5.3.2.2.2 Automotive 5.3.2.2.3 Aerospace 5.3.2.2.4 Manufacturing 5.3.3 Mexico 5.3.3.1 Mexico Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 5.3.3.1.1 Straight-cut tin snips 5.3.3.1.2 Curved tin snips 5.3.3.1.3 Jewelers tin snips 5.3.3.1.4 Universal tin snips 5.3.3.1.5 Straight pattern tin snips 5.3.3.1.6 Spring-loaded tin snips 5.3.3.2 Mexico Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 5.3.3.2.1 Construction 5.3.3.2.2 Automotive 5.3.3.2.3 Aerospace 5.3.3.2.4 Manufacturing 6. Europe Tin Snips Tool Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2024-2032) 6.1 Europe Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 6.2 Europe Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 6.3 Europe Tin Snips Tool Market Size and Forecast, by Country (2024-2032) 6.3.1 United Kingdom 6.3.1.1 United Kingdom Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 6.3.1.2 United Kingdom Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 6.3.2 France 6.3.2.1 France Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 6.3.2.2 France Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 6.3.3 Germany 6.3.3.1 Germany Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 6.3.3.2 Germany Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 6.3.4 Italy 6.3.4.1 Italy Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 6.3.4.2 Italy Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 6.3.5 Spain 6.3.5.1 Spain Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 6.3.5.2 Spain Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 6.3.6 Sweden 6.3.6.1 Sweden Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 6.3.6.2 Sweden Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 6.3.7 Austria 6.3.7.1 Austria Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 6.3.7.2 Austria Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 6.3.8 Rest of Europe 6.3.8.1 Rest of Europe Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 6.3.8.2 Rest of Europe Tin Snips Tool Market Size and Forecast, By Application (2024-2032). 7. Asia Pacific Tin Snips Tool Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2024-2032) 7.1 Asia Pacific Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 7.2 Asia Pacific Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 7.3 Asia Pacific Tin Snips Tool Market Size and Forecast, by Country (2024-2032) 7.3.1 China 7.3.1.1 China Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 7.3.1.2 China Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 7.3.2 South Korea 7.3.2.1 S Korea Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 7.3.2.2 S Korea Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 7.3.3 Japan 7.3.3.1 Japan Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 7.3.3.2 Japan Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 7.3.4 India 7.3.4.1 India Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 7.3.4.2 India Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 7.3.5 Australia 7.3.5.1 Australia Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 7.3.5.2 Australia Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 7.3.6 Indonesia 7.3.6.1 Indonesia Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 7.3.6.2 Indonesia Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 7.3.7 Malaysia 7.3.7.1 Malaysia Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 7.3.7.2 Malaysia Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 7.3.8 Vietnam 7.3.8.1 Vietnam Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 7.3.8.2 Vietnam Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 7.3.9 Taiwan 7.3.9.1 Taiwan Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 7.3.9.2 Taiwan Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 7.3.10 Bangladesh 7.3.10.1 Bangladesh Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 7.3.10.2 Bangladesh Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 7.3.11 Pakistan 7.3.11.1 Pakistan Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 7.3.11.2 Pakistan Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 7.3.12 Rest of Asia Pacific 7.3.12.1 Rest of Asia Pacific Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 7.3.12.2 Rest of Asia Pacific Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 8. Middle East and Africa Tin Snips Tool Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2024-2032) 8.1 Middle East and Africa Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 8.2 Middle East and Africa Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 8.3 Middle East and Africa Tin Snips Tool Market Size and Forecast, by Country (2024-2032) 8.3.1 South Africa 8.3.1.1 South Africa Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 8.3.1.2 South Africa Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 8.3.2 GCC 8.3.2.1 GCC Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 8.3.2.2 GCC Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 8.3.3 Egypt 8.3.3.1 Egypt Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 8.3.3.2 Egypt Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 8.3.4 Nigeria 8.3.4.1 Nigeria Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 8.3.4.2 Nigeria Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 8.3.5 Rest of ME&A 8.3.5.1 Rest of ME&A Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 8.3.5.2 Rest of ME&A Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 9. South America Tin Snips Tool Market Size and Forecast by Segmentation for Demand and Supply Side (Value) (2024-2032) 9.1 South America Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 9.2 South America Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 9.3 South America Tin Snips Tool Market Size and Forecast, by Country (2024-2032) 9.3.1 Brazil 9.3.1.1 Brazil Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 9.3.1.2 Brazil Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 9.3.2 Argentina 9.3.2.1 Argentina Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 9.3.2.2 Argentina Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 9.3.3 Rest Of South America 9.3.3.1 Rest Of South America Tin Snips Tool Market Size and Forecast, By Type (2024-2032) 9.3.3.2 Rest Of South America Tin Snips Tool Market Size and Forecast, By Application (2024-2032) 10. Global Tin Snips Tool Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Tin Snips Tool Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Stanley Black & Decker, Inc. (USA) 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2. Apex Tool Group, LLC (USA) 11.3. Klein Tools, Inc. (USA) 11.4. Irwin Industrial Tools (USA) 11.5. Malco Products, SBC (USA) 11.6. Midwest Tool and Cutlery Company (USA) 11.7. RIDGID (Emerson Electric Co.) (USA) 11.8. SNA Europe (Bahco) (France) 11.9. Facom S.A.S. (France) 11.10. BESSEY Tool GmbH & Co. KG (Germany) 11.11. Stubai KSHB GmbH (Austria) 11.12. KNIPEX-Werk C. Gustav Putsch KG (Germany) 11.13. Fein GmbH (Germany) 11.14. NWS Tool Group GmbH (Germany) 11.15. GEDORE Werkzeugfabrik GmbH & Co. KG (Germany) 11.16. Rudani Enterprises Pvt. Ltd. (India) 11.17. Skyline Technology (India) 11.18. Device International (India) 11.19. Hebei Sinotools Industrial Co., Ltd. (China) 11.20. Tolsen Tools FZCO (UAE) 11.21. L&G Tools (Pty) Ltd. (South Africa) 11.22. Fragram Tools (L&G Tools Pty Ltd.) (South Africa) 11.23. South America 11.24. Tramontina S.A. Cutelaria (Brazil) 11.25. IRWIN do Brasil Ltda. (Brazil) 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary