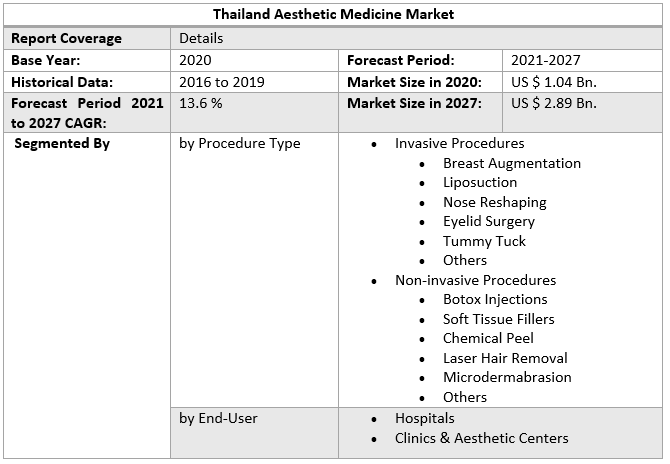

By 2027, the Thailand Aesthetic Medicine Market is expected to reach US $2.89 billion, thanks to growth in the industrial processes segment. The report analyzes Thailand's Aesthetic Medicine market dynamics by region and end-user industries.Thailand Aesthetic Medicine Market Overview:

Scars, skin laxity, wrinkles, moles, liver spots, excess fat, cellulite, undesirable hair, skin discoloration, and spider veins are all disorders that can be treated with aesthetic medicine. Dermatology, dental and maxillofacial surgery, reconstructive surgery, and plastic surgery are all traditionally included. Liposuction, facelifts, breast implants, and High-frequency ablation are surgical procedures, while non-surgical procedures (high-frequency skin tightening, non-surgical liposuction, chemical peels, high-intensity focused electromagnetic field, and radiofrequency fat removal) are non-surgical procedures.To know about the Research Methodology :- Request Free Sample Report The report has covered the market trends from 2015 to forecast the market through 2027. 2020 is considered a base year however 2020's numbers are on the real output of the companies in the market. Special attention is given to 2020 and the effect of lockdown on the demand and supply, and also the impact of lockdown for the next two years on the market. Some companies have done good in lockdown also and specific strategic analysis of those companies is done in the report

Thailand Aesthetic Medicine Market Dynamics:

One of the major elements driving the use of aesthetic procedures is the changing trend toward preserving an ideal aesthetic appearance. Furthermore, the rise in medical tourism and the growing senior population is predicted to propel the country's market forward. The arrival of Covid-19 in 2020, on the other hand, had an impact on the country's total aesthetics market. Week-long lockdowns were enacted in cities like Bangkok, which are significant cosmetic hubs in the country. Travel restrictions have hampered medical tourism in the country. However, movement limitations have been removed, and the country's economy is predicted to improve gradually by the second half of 2021. Aesthetic operations are becoming more popular, yet reimbursements for traditional insurance-based medicine are decreasing. Medical aesthetic practices, such as providing cosmetic operations in their offices or working in medical spas, are becoming increasingly popular among doctors, regardless of their expertise. Injectables, laser hair removal, chemical peels, laser skin resurfacing, and non-invasive fat reduction are all popular minimally invasive procedures in the country. Botulinum toxin filler treatments, for example, increased by 13% in 2019 compared to 2018. This implies that the country's need for non-invasive therapies is increasing. Thailand's economy is largely based on tourism. Thailand is one of the top five locations in the world for inbound medical tourism spending, according to the World Travel & Tourism Council (WTTC). In 2019, tourism accounted for almost 20% of the country's GDP, with 60% of medical tourists coming to the country for cosmetic operations. Medical healthcare services account for roughly 13.3% of the Thai government's total healthcare budget. In the early and second half of 2020, the start of Covid-19 had an impact on the country's cosmetic treatment as well as the medical tourism business. Bangkok and Phuket, the country's two largest cities, are heavily reliant on tourism and home to the majority of the country's aesthetic treatment facilities. According to the Asia Foundation, more than 62 percent of these regions' enterprises were totally shut down during rigorous lockdown hours in 2020. This also means that elective cosmetic procedures in hospitals and clinics have been delayed, harming the country's aesthetic medicine business.Thailand Aesthetic Medicine Market Segment Analysis:

The invasive procedure segment is dominating the Procedure Type segment of the Thailand Aesthetic Medicine Market:

Invasive procedures accounted for 74.6 % of the market in 2020. Breast augmentation, liposuction, nose reshaping, eyelid surgery, stomach tuck, and other invasive operations are divided into this category. According to the International Society of Aesthetic Plastic Surgery (ISAPS), roughly 92,597 invasive aesthetic operations were performed in the country in 2019, with eyelid surgery, rhinoplasty, and breast augmentation being the most popular. Because the country's currency is lower than that of Europe and North America, invasive operations are cheaper in the country than in other Western countries, and patients can save 20% to 65 % of their costs. Further, In 2020, eyelid surgery had a sizable market share. Since the majority of Thais lack wrinkled eyelids, they choose eyelid surgery to achieve a more defined eye shape and reduce drooping. The clinics and aesthetic centers segment is considered to supplement the growth of the Thailand Aesthetic Medicine Market. In 2020, the clinics and aesthetic centers sector had the biggest market share of 69.3 %, and it is expected to continue to develop profitably over the projected period. Aesthetic operations such as skin rejuvenation, body contouring and reshaping, wrinkle reduction, and scar treatment are often performed in clinics. Dermatology and beauty clinics are progressively implementing technologically advanced aesthetic systems that can treat a variety of skin disorders, resulting in increased patient traffic. The Sanatorium and Art of Healing Bureau of the Health Service Support Department is the regulating agency in charge of the country's private clinics and hospitals. Aesthetic clinics make up 1,458 of Thailand's total medical clinics, accounting for 13% of the country's total. However, the clinic's sector is poorly regulated, and many complaints about aesthetic surgery have been submitted with the Office of the Consumer Protection Board over the years. This could stifle market expansion.The objective of the report is to present a comprehensive analysis of the Thailand Aesthetic Medicine Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Thailand Aesthetic Medicine Market dynamics, structure by analyzing the market segments and projecting the Thailand Aesthetic Medicine Market size. Clear representation of competitive analysis of key players by Grade, price, financial position, Grade portfolio, growth strategies, and regional presence in the Thailand Aesthetic Medicine Market make the report investor’s guide.

Thailand Aesthetic Medicine Market Scope: Inquire before buying

Thailand Aesthetic Medicine Market, by Region

• ThailandThailand Aesthetic Medicine Market Key Player

• Dermaster Co., Ltd. • BSL Clinic • Thai Medical Vacation • Bumrungrad International Hospital • Dr. Orawan Holistic Dermatology & Anti-Aging Institute • Nirunda International Aesthetic Clinic • Alma Lasers, Ltd. • Anika Therapeutics. • ACI Pharma Company Limited • Khaolaor Company LimitedFAQs:

1. What is the Thailand Aesthetic Medicine market value in 2020? Ans: Thailand Aesthetic Medicine market value in 2020 was estimated as 1.04 Billion USD. 2. What is the Thailand Aesthetic Medicine market growth? Ans: The Thailand Aesthetic Medicine market is anticipated to grow with a CAGR of 13.6 % in the forecast period and is likely to reach USD 2.89 Billion by the end of 2027. 3. Which segment is expected to dominate the Thailand Aesthetic Medicine market during the forecast period? Ans: The invasive procedure segment dominated the Thailand aesthetic medicine market with a share of 75.0% o in 2020. Since invasive procedures are cheaper in the country as compared to other Western countries, as its currency is weaker than that of European and North American countries 4. Who are the key players in the Thailand Aesthetic Medicine market? Ans: Some key players operating in the Thailand aesthetic medicine market include Dermaster Co, Ltd, BSL Clinic, Thai Medical Vacation, Bumrungrad International Hospital, Dr. Orawan Holistic Dermatology & Anti-Aging Institute, and Nirunda International Aesthetic Clinic 5. What is the key driving factor for the growth of the Thailand Aesthetic Medicine market? Ans: Key factors that are driving the Thailand aesthetic medicine market growth include shifting trend towards maintaining optimal aesthetic beauty, the rise in medical tourism, high popularity of minimally invasive procedures, and the growing geriatric population prone to different skin conditions

1. Thailand Aesthetic Medicine Market: Research Methodology 2. Thailand Aesthetic Medicine Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Thailand Aesthetic Medicine Market 2.2. Summary 2.1.1. Key Findings 2.1.2. Recommendations for Investors 2.1.3. Recommendations for Market Leaders 2.1.4. Recommendations for New Market Entry 3. Thailand Aesthetic Medicine Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • Thailand 3.12 COVID-19 Impact 4. Thailand Aesthetic Medicine Market Segmentation 4.1 Thailand Aesthetic Medicine Market, by Procedure Type (2020-2027) • Invasive Procedures o Breast Augmentation o Liposuction o Nose Reshaping o Eyelid Surgery o Tummy Tuck o Others • Non-invasive Procedures o Botox Injections o Soft Tissue Fillers o Chemical Peel o Laser Hair Removal o Microdermabrasion o Others 4.2 Thailand Aesthetic Medicine Market, by End-User (2020-2027) • Hospitals • Clinics & Aesthetic Centers 5. Company Profile: Key players 5.1 Cutera 5.1.1 Company Overview 5.1.2. Financial Overview 5.1.3. Global Presence 5.1.4. Procedure Type Portfolio 5.1.5. Business Strategy 5.1.6. Recent Developments 5.2 Dermaster Co., Ltd. 5.3 BSL Clinic 5.4 Thai Medical Vacation 5.5 Bumrungrad International Hospital 5.6 Dr. Orawan Holistic Dermatology & Anti-Aging Institute 5.7 Nirunda International Aesthetic Clinic 5.8 Allergan-AbbVi 5.9 Alma Lasers, Ltd. 5.10 Anika Therapeutics