Temperature Sensor Market was worth US$ 7.53 Bn in 2022 and total revenue is expected to grow at a rate of 4.5% CAGR from 2023 to 2029, reaching almost US$ 10.25 Bn in 2029.Temperature Sensor Market Overview:

A Temperature sensor is device that measure the temperature and convert the analog output into its digital output. The market is being driven by the increasing adoption of HVAC modules in the automotive industry and the growing demand for temperature sensors across a variety of industrial end users. Rising global focus on security and surveillance, as well as government measures toward safety requirements, aid market growth. The market's expansion is aided by strong demand for consumer electrical devices. The advent of IoT and IIoT as a result of the shift toward digitalization in electronics has spurred the expansion of temperature sensors. The sensing industry's digital revolution has aided manufacturers in designing and developing new temperature sensors that use a digital interface with a low interface. The increasing use of temperature sensors in the industrial market is expected to propel the Temperature sensors market forward throughout the forecast period. New technical breakthroughs in the Petrochemical Industry are important growth factors for the Temperature Sensors market.To know about the Research Methodology :- Request Free Sample Report

Temperature Sensor Market Dynamics:

The temperature sensor market is being driven by the growing need for innovative and portable healthcare equipment. The demand for temperature sensors is increasing as new technologies emerge, such as improved patient monitoring systems and portable health monitoring systems. The demand for portable healthcare devices is excepted to rise further as the ageing population grows, lifestyles deteriorate, and viral illnesses spread. In wearable healthcare devices, temperature sensors are utilised to provide continuous monitoring of patients' health. The growing use of portable and wearable healthcare gadgets is a primary factor driving the temperature sensor market. The market for temperature sensors has expanded in tandem with the increased need for reliability, comfort, and other innovative features in automobiles. In the automotive industry, for example, accurate temperature sensors are in high demand for applications like engine coolant temperature management, outside air temperature management, active in-vehicle temperature management, steering wheel and seat heat temperature control, exhaust gas temperature management, battery temperature management, e-motor temperature management, and cylinder heat temperature management Raw materials used by temperature sensor manufacturers include cobalt, nickel, manganese, iron alloy, and copper. To get these resources, many manufacturers rely on third-party vendors. The price volatility of such materials, as well as the availability of supplies, have a significant impact on the profitability of producers. Continuing global economic expansion in many emerging economies, trade tariffs, increased worldwide demand, natural disasters, wars and other political events, and volatility in foreign currency exchange rates are all factors that affect raw material costs. Materials science and engineering advancements have paved the path for the creation of new and more sophisticated sensors. Manufacturing has been in the forefront of incorporating modern sensor technologies to a large extent. Advanced sensor technology, for example, has enabled the present revolution in computer-integrated manufacturing. The rising expense of quality inspection is reflected in an increasingly competitive global marketplace. As a result, quality must be an intrinsic part of the production process, which necessitates process control, either by continuous monitoring with appropriate sensors or by pulling the product for inspection at intermediate manufacturing stages.Temperature Sensor Market Segment Analysis:

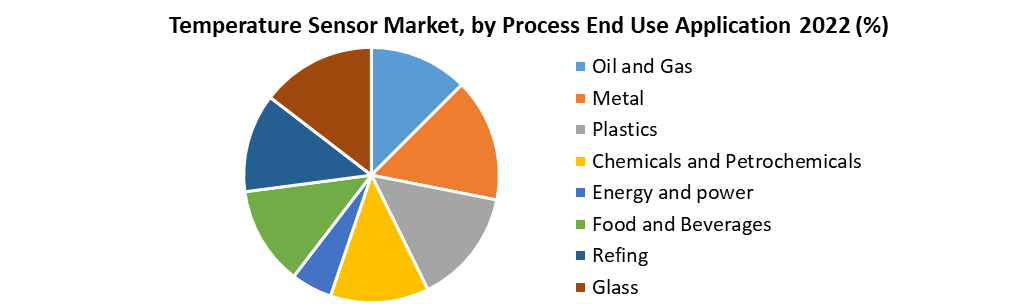

Temperature Sensor Market is segmented into Product type, Process end use application, Non process end use application. Based on Product Type, the market is sub–segmented into Thermistor, Thermocouple, Temperature Sensor IC, Resistive Temperature Detector (RTD), Bimetallic Temperature Sensor, Fiber Optic Temperature Sensor and Infrared Temperature Sensor. The IR temperature sensor held the largest market share of xx% in 2022. IR temperature sensors have traditionally been used in a range of defense applications, including optical target sighting and changeable emissivity measures, which are typically useful in tracking activities. All of these applications, are quite advanced and will continue to be in high demand due to rising military spending around the world. Infrared temperature sensors, like all other sensors on the market, have seen a growth in demand from the manufacturing sector in recent years, owing in large part to the global adoption of Industry 4.0 policies. In the field of predictive maintenance, infrared temperature sensors are obtaining a significant portion of the market. There is a considerable demand for temperature monitoring of moving parts, which is rarely met by the efficiency of infrared temperature sensors. Based on Process End use application, the market is sub-segmented into Oil and Gas, Metal, Plastics, Chemical and Petrochemical, Energy and Power, Food and Beverages and Refining Glass. Food and beverages dominating in the market to attain improved quality and consistency, food and beverage businesses are increasingly depending on automated controls. As a result, the need for sensors has increased. The increased use of sensors has resulted from the necessity for instruments and controllers that properly measure, regulate, or record pressure, temperature, or other parameters. Sensor companies must offer a diverse range of products to meet consumer preferences in the competitive food and beverage market. Consumers care about achieving the highest levels of quality in a consistent and cost-effective manner.

Temperature Sensor Market Regional Insights:

APAC accounted for the highest proportion 46 % of the temperature sensor market in 2022. China, India, South Korea, and Japan are the primary contributors to the growth of the temperature sensor market in APAC. The developing automotive, medical, and industrial manufacturing industries, as well as increased demand for temperature sensors from foreign countries such as North America and Europe, are projected to drive the temperature sensor market in APAC. Because of the presence of renowned system integrators, North America is one of the most technologically advanced markets for temperature sensors. Multiple established manufacturers in the region investing heavily in the development and improvement of current temperature sensors, North America held the biggest market share. Automakers and their suppliers are America's largest manufacturing sector, accounting for 3% of GDP, according to the American Automotive Policy Council. Furthermore, in the last five years, FCA US, Ford, and GM have announced approximately USD 35 billion in investments in their U.S. assembly, engine, and transmission factories, R&D labs, headquarters, and administrative offices, as well as other infrastructure that connects and supports them. The objective of the report is to present a comprehensive analysis of the global Temperature Sensor Market to the stakeholders in the Equipment. The past and current status of the analysis of complicated data in simple language. The report covers all the aspects of the Equipment with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market has Been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the Equipment to the decision-makers. The report also helps in understanding the global Temperature Sensor Market dynamics, structure by analyzing the market segments and projects the global Temperature Sensor Market size. Clear representation of competitive analysis of key players by Power supply, price, and financial position, Power supply portfolio, growth strategies, and Regional presence in the global Temperature Sensor Market make the report investor’s guide.Temperature Sensor Market Scope: Inquire before buying

Temperature Sensor Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 7.53 Bn. Forecast Period 2023 to 2029 CAGR: 4.5% Market Size in 2029: US $ 10.25 Bn. Segments Covered: by Product Type Thermistor Thermocouple Temperature Sensor IC Resistive Temperature Detector (RTD) Bimetallic Temperature Sensor Infrared Temperature Sensor by Process End Use Application Oil and Gas Metal Plastics Chemicals and Petrochemicals Energy and power Food and Beverages Refing Glass by Non Process End use application Healthcare Automotive Electrical and Electronics Aerospace and Defense HVAC Temperature Sensor Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Temperature Sensor Market Key Players are:

1. ABB 2. Analog Devices, Inc. 3. Amphenol Corporation 4. Honeywell International Inc. 5. Global Mixed Mode Technology, Inc. 6. Kongsberg Gruppen 7. Integrated Device Technology Inc. 8. Microchip Technology Inc 9. Maxim Integrated Products Inc 10.NXP Semiconductors N.V. 11.Siemens 12.TE Connectivity Ltd 13.On Semiconductor Corporation 14.STMicroelectronics N.V 15.Texas Instruments Inc. 16.Omega EngineeringFrequently Asked Questions:

1) What was the market size of Global Temperature Sensor Market in 2022? Ans - Global Temperature Sensor Market was worth US$ 7.53 Bn in 2022. 2) What is the market segment of Global Temperature Sensor Market? Ans -The market segments are based on Product type, Process end use application, Non process end use application 3) What is forecast period consider for Global Temperature Sensor Market? Ans -The forecast period for Global Temperature Sensor Market is 2023 to 2029. 4) What is the market size of Global Temperature Sensor markets in 2029? Ans – Global Temperature Sensor Market is estimated as worth US$ 10.25 Bn in 2029. 5) Which region is dominated in Global Temperature Sensor Market? Ans -In 2022, Asia pacific region dominated the Global Temperature Sensor Market

Temperature Sensor Market

1. EXECUTIVE SUMMARY 2. RESEARCH METHODOLOGY 2.1. Market Definition 2.2. Market Scope 2.3. Data Sources 3. MARKET DYNAMICS 3.1. Market Drivers 3.2. Market Restraints 3.3. Market Opportunities 4. END-USER OVERVIEW 4.1. Value Chain Analysis 4.2. Key Trends 5. TEMPERATURE SENSOR MARKET, BY PRODUCT TYPE (2022-2029) 5.1. Introduction 5.2. Thermistor 5.2.1. Thermistor Market Overview 5.2.2. Thermistor Market Size & Forecast 5.3. Thermocouple 5.3.1. Thermocouple Market Overview 5.3.2. Thermocouple Market Size & Forecast 5.4. Temperature Sensor IC 5.4.1. Temperature Sensor IC Market Overview 5.4.2. Temperature Sensor IC Market Size & Forecast 5.5. Resistive Temperature Detector (RTD) 5.5.1. Resistive Temperature Detector (RTD) Market Overview 5.5.2. Resistive Temperature Detector (RTD) Market Size & Forecast 5.6. Bimetallic Temperature Sensor 5.6.1. Bimetallic Temperature Sensor Market Overview 5.6.2. Bimetallic Temperature Sensor Market Size & Forecast 5.7. Fiber Optic Temperature Sensor 5.7.1. Fiber Optic Temperature Sensor Market Overview 5.7.2. Fiber Optic Temperature Sensor Market Size & Forecast 5.8. Infrared Temperature Sensor 5.8.1. Infrared Temperature Sensor Market Overview 5.8.2. Infrared Temperature Sensor Market Size & Forecast 6. TEMPERATURE SENSOR MARKET, BY PROCESS END-USE APPLICATION (2022-2029) 6.1. Introduction 6.2. Temperature Sensor Oil and Gas 6.2.1. Temperature Sensor Oil and Gas Market Overview 6.2.2. Temperature Sensor Oil and Gas Market Size & Forecast 6.3. Temperature Sensor Metal 6.3.1. Temperature Sensor Metal Market Overview 6.3.2. Temperature Sensor Metal Market Size & Forecast 6.4. Temperature Sensor Plastics 6.4.1 Temperature Sensor Plastics Market Overview 6.4.2. Temperature Sensor Plastics Market Size & Forecast 6.5. Temperature Sensor Chemical and Petrochemical 6.5.1. Temperature Sensor Chemical and Petrochemical Market Overview 6.5.2. Temperature Sensor Chemical and Petrochemical Market Size & Forecast 6.6. Temperature Sensor Energy and Power 6.6.1. Temperature Sensor Energy and Power Market Overview 6.6.2. Temperature Sensor Energy and Power Market Size & Forecast 6.7. Temperature Sensor Food and Beverages 6.7.1. Temperature Sensor Food and Beverages Market Overview 6.7.2. Temperature Sensor Food and Beverages Market Size & Forecast 6.8. Temperature Sensor Refining 6.8.1. Temperature Sensor Refining Market Overview 6.8.2. Temperature Sensor Refining Market Size & Forecast 6.9. Temperature Sensor Glass 6.9.1. Temperature Sensor Glass Market Overview 6.9.2. Temperature Sensor Glass Market Size & Forecast 7. TEMPERATURE SENSOR MARKET, BY NON-PROCESS END-USE APPLICATION (2022-2029) 7.1. Introduction 7.2. Temperature Sensor Healthcare 7.2.1. Temperature Sensor Healthcare Market Overview 7.2.2. Temperature Sensor Healthcare Market Size & Forecast 7.3. Temperature Sensor Automotive 7.3.1. Temperature Sensor Automotive Market Overview 7.3.2. Temperature Sensor Automotive Market Size & Forecast 7.4. Temperature Sensor Electrical and Electronics 7.4.1. Temperature Sensor Electrical and Electronics Market Overview 7.4.2. Temperature Sensor Electrical and Electronics Market Size & Forecast 7.5. Temperature Sensor Aerospace & Defense 7.5.1. Temperature Sensor Aerospace & Defense Market Overview 7.5.2. Temperature Sensor Aerospace & Defense Market Size & Forecast 7.6. Temperature Sensor HVAC 7.6.1. Temperature Sensor HVAC Market Overview 7.6.2. Temperature Sensor HVAC Market Size & Forecast 8. TEMPERATURE SENSOR MARKET, BY GEOGRAPHY (2019-2026) 8.1. North America Temperature Sensor Market 8.1.1. North America Temperature Sensor Market, by Product Type 8.1.2. North America Temperature Sensor Market, by Process End-Use Application 8.1.3. North America Temperature Sensor Market, by Non-Process End-Use Application 8.1.4. North America Temperature Sensor Market, by Region 8.1.4.1. U.S. Temperature Sensor Market 8.1.4.2. Canada Temperature Sensor Market 8.2. Europe Temperature Sensor Market 8.2.1. Europe Temperature Sensor Market, by Product Type 8.2.2. Europe Temperature Sensor Market, by Process End-Use Application 8.2.3. Europe Temperature Sensor Market, by Non-Process End-Use Application 8.2.4. Europe Temperature Sensor Market, by Region 8.2.4.1. France Temperature Sensor Market 8.2.4.2. Germany Temperature Sensor Market 8.2.4.3. U.K .Temperature Sensor Market 8.2.4.4. Rest of Europe Temperature Sensor Market 8.3. Asia Pacific Temperature Sensor Market 8.3.1. Asia-Pacific Temperature Sensor Market, by Product Type 8.3.2. Asia-Pacific Temperature Sensor Market, by Process End-Use Application 8.3.3. Asia-Pacific Temperature Sensor Market, by Non-Process End-Use Application 8.3.4. Asia-Pacific Temperature Sensor Market, by Region 8.3.4.1. China Temperature Sensor Market 8.3.4.2. Japan Temperature Sensor Market 8.3.4.3. India Temperature Sensor Market 8.3.4.4. Australia Temperature Sensor Market 8.3.4.5. South Korea Temperature Sensor Market 8.3.4.6. Rest of Asia Pacific Temperature Sensor Market 8.4. Middle East & Africa Temperature Sensor Market 8.4.1. Middle East & Africa Temperature Sensor Market, by Product Type 8.4.2. Middle East & Africa Temperature Sensor Market, by Process End-Use Application 8.4.3. Middle East & Africa Temperature Sensor Market, by Non-Process End-Use Application 8.4.4. Middle East & Africa Temperature Sensor Market, by Region 8.4.4.1. South Africa Temperature Sensor Market 8.4.4.2. Egypt Temperature Sensor Market 8.4.4.3. Nigeria Temperature Sensor Market 8.4.4.4. Rest of Middle East & Africa Temperature Sensor Market 8.5. Latin America Temperature Sensor Market 8.5.1. Latin America Temperature Sensor Market, by Product Type 8.5.2. Latin America Temperature Sensor Market, by Process End-Use Application 8.5.3. Latin America Temperature Sensor Market, by Non-Process End-Use Application 8.5.4. Latin America Temperature Sensor Market, by Region 8.5.4.1. Brazil Temperature Sensor Market 8.5.4.2. Argentina Temperature Sensor Market 8.5.4.3. Columbia Temperature Sensor Market 8.5.4.4. Mexico Temperature Sensor Market 8.5.4.5. Rest of Latin America Temperature Sensor Market 9. TEMPERATURE SENSOR MARKET COMPETITION ANALYSIS 9.1 Temperature Sensor Market Share/Positioning Analysis 9.2 Temperature Sensor Key Innovators 9.3 Temperature Sensor Company Profiles 9.3.1 ABB 9.3.1.1 Overview 9.3.1.2 Products/ End-User 9.3.1.3 Strategy 9.3.1.4 Key Developments 9.3.2 Analog Devices, Inc. 9.3.2.1 Overview 9.3.2.2 Products/ End-User 9.3.2.3 Strategy 9.3.2.4 Key Developments 9.3.3 Amphenol Corporation 9.3.3.1 Overview 9.3.3.2 Products/ End-User 9.3.3.3 Strategy 9.3.3.4 Key Developments 9.3.4 Honeywell International Inc. 9.3.4.1 Overview 9.3.4.2 Products/ End-User 9.3.4.3 Strategy 9.3.4.4 Key Developments 9.3.5 Global Mixed Mode Technology, Inc. 9.3.5.1 Overview 9.3.5.2 Products/ End-User 9.3.5.3 Strategy 9.3.5.4 Key Developments 9.3.6 Kongsberg Gruppen 9.3.6.1 Overview 9.3.6.2 Products/ End-User 9.3.6.3 Strategy 9.3.6.4 Key Developments 9.3.7 Integrated Device Technology Inc. 9.3.7.1 Overview 9.3.7.2 Products/ End-User 9.3.7.3 Strategy 9.3.7.4 Key Developments 9.3.8 Microchip Technology Inc. 9.3.8.1 Overview 9.3.8.2 Products/ End-User 9.3.8.3 Strategy 9.3.8.4 Key Developments 9.3.9 Maxim Integrated Products Inc. 9.3.9.1 Overview 9.3.9.2 Products/ End-User 9.3.9.3 Strategy 9.3.9.4 Key Developments