Tappet Market was valued at USD 8.8 Billion in 2022, and is expected to reach USD 11.20 Billion by 2029, exhibiting a CAGR of 3.5% during the forecast period.Tappet Market Overview

Tappet also known as a cam follower or lifter, is a part of the engine gear train that converts cam lift into up and down movement, which it transmits to the valve. The manufacturers supply tappets to the automotive OEMs such as General Motors (US), Nissan (Japan), Daimler AG(Germany) and others. The report includes a detailed analysis of dynamics in each region, which helps to understand why the demand for tappets is increasing and what factors are expected to hamper the growth of the market.To know about the Research Methodology :- Request Free Sample Report

Tappet Market Dynamics

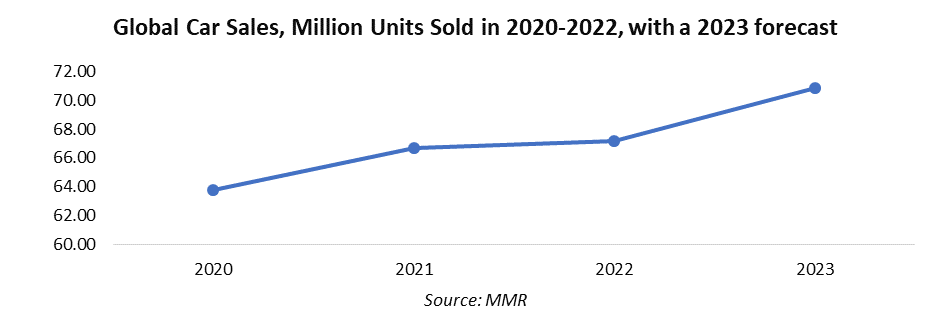

The global increase in the production and demand for automobiles is mainly driving market growth. In 2021, the global automotive manufacturing market was worth around USD 2.86 trillion and is expected to grow at a high rate during the forecast period. The demand for tappets is increasing because of the increase in consumer demand for enhanced efficiency and output power of the vehicle. Technological developments are creating various opportunities for the tappet market growth. The rising environmental awareness has led to the need for improved fuel efficiency in automobiles. This has in turn increased the demand for diesel engines as they have high thermal efficiency and low CO2 emissions, which is resulting in the advancements in tappets. The high demand for high-performance vehicles is boosting the growth of the tappet market. The global sales of vehicles are increasing highly, which is driving the growth of the market. Around 23.24 million heavy buses, light commercial vehicles and trucks were produced across the world in 2021. Automotive technology is expected to change considerably during the forecast period resulting in an increase in demand for advanced tappets. Automotive manufacturers across the world are highly investing in electric and hybrid vehicles while many governments are promoting electric mobility with the aim to reduce CO2 emissions. Electric and Hybrid Vehicles do not require tappets to improve engine performance. Some 24 percent of global new car sales are expected to be of electric vehicles by the end of the forecast period. This is expected to hamper the tappet market growth in the future. The main restraining factor for the growth of the market is the tappet noises, labor costs required for the replacement of tappets and the high cost of oil that provides the necessary oil cushion between the tappets and camshaft to withstand high contact pressure. The tappet clearance also known as valve clearance, is a small gap between the top of the valve stem and the rocker arm. Many common engine issues are been by having the knowledge of it. Hence, engineers have important skills are required that majorly help to troubleshoot problems. The lack of these skilled experts in the tappet industry is also the main restraining factor for the market growth.Tappet Market Regional Insights

The Asia Pacific Tappet Market held the largest market share in 2022 and is expected to grow at a high rate during the forecast period. In the region, the Japanese Tappet Market is growing majorly because of increasing demand for commercial and passenger vehicles. India and China are also significant markets because of the high demand for automobiles. The regional market is majorly growing due to the growing population, which increases the demand for effective mobility. Asia Pacific accounts for 60 percent of the world’s population and is home to major vehicle manufacturers. The huge number of sales of commercial vehicles and passenger cars in the region with high levels of production makes the region a major market for Tappet. Hence, the demand for tappets in the region is expected to increase during the forecast period. The infrastructural development in the region is also resulting in the high demand for vehicles, which in turn increases the demand for tappets. Europe held the major Tappet market share in 2022 and is expected to grow steadily during the forecast period. The region is one of the biggest producers of motor vehicles and the sector also represents the largest private investor in R&D. Hence, the demand for tappets is high in Europe. The European Commission provides funding for research and development to strengthen the competitiveness of the EU automotive industry which is creating growth opportunities for the market. During the forecast period, the Tappet market in North America is expected to grow at a high CAGR. The region is one of the largest producers of commercial vehicles. The US holds the largest share of the market, which is mainly attributed to the increasing vehicle production in the country. The vehicle production in the US exceeded 13.1 units, reaching 69 percent of the total vehicle production in the US, in 2021.Tappet Market Segmentation

Based on Type: The segment is divided into Flat Tappet, Roller Tappet and Hydraulic Tappet. During the forecast period, the Roller Tappet segment is expected to grow at a high rate. The biggest reason for the growth of the segment even after the high cost associated with it is that the roller camshaft allows for a more aggressive profile with more civilized street manners. The market has been driven by the rising trend of engine downsizing without compromising the engine's performance. The developments of tappets are also driving the market growth for e.g. – the replacement of old solid tappets with modern roller tappets in shiny new bronze guides. Recently, the roller tappets and rocker arms with roller tappet ends have made a resurgence due to the lower friction reducing drag and providing greater efficiency. Based on Engine Capacity: The segment is divided into <4 Cylinders Engine, 4-6 Cylinders Engine and >6 Cylinders Engine. The 4-6 Cylinders Engine segment held the largest share of the market in 2022 due to stringent restrictions on emissions in many countries. The increasing demand for mid-sized vehicles majorly in developing countries is expected to drive the <4 Cylinders Engine segment growth. Based on Distribution Channel: The segment is divided into OEMs and Aftermarket. The OEMs segment held the share of the market and is expected to grow steadily during the forecast period. this is mainly attributed to the increasing rate of OEM production for automobiles. Based on End-User: The segment is divided into Heavy Duty Commercial Vehicles, Light Duty Commercial Vehicles and Cars. The Cars segment is further sub-segmented into Economic Passenger Car, Luxury Passenger Car and Mid-Priced Passenger Car. During the forecast period, the Cars segment is expected to hold the major Tappet Market share due to the high demand for cars for easy and comfortable traveling. The heavy duty commercial vehicles and light duty commercial vehicles segments are also expected to grow because of increasing trade activities across the world.

Tappet Market Competitive Landscape

This section of the Tappet Market report provides a detailed analysis of the competitors and information provided by the competitors. A secondary research method was used to provide detailed information on tappet key competitors while the primary research method included interviews of the market players. The investments by key players in research and development, revenue, sales, production capacities and company overview are all included in the report. SWOT analysis was used to provide the strengths and weaknesses of the tappet key players.Tappet Market Scope: Inquire before buying

Tappet Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 8.8 Bn Forecast Period 2023 to 2029 CAGR: 3.5% Market Size in 2029: USD 11.20 Bn Segments Covered: by Type 1. Flat Tappet 2. Roller Tappet 3. Hydraulic Tappets by Engine Capacity 1. <4 Cylinders Engine 2. 4-6 Cylinders Engine 3. >6 Cylinder Engine by Distribution Channel 1. OEMs 2. Aftermarket by End-User 1. Heavy Duty Commercial vehicles 2. Light Duty Commercial Vehicles 3. Cars 3.1 Economic Passenger Car 3.2 Luxury Passenger Car 3.3 Mid-Priced Passenger Car Tappet Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Tappet Market, Key Players are

1. Yuhuan Huiyu Tappets Co. Ltd 2. Competition Cams Inc. 3. Wuxi Xizhou Machinery Co. Ltd. 4.NSK 5. Rane Engine Valve Ltd 6. Lunati Power 7. SM Motor Parts GmbH 8. Crower Cams Equipment Company Inc. 9. Garuda Impex 10. GT Technologies 11. Kibblewhite Precision Machining 12. Sac Engine Components Private Limited 13. Taj Industries Frequently Asked Questions 1] What is the expected CAGR of the Global Tappet Market during the forecast period? Ans. During the forecast period, the Global Tappet Market is expected to grow at a CAGR of 3.5 percent. 2] What was the Tappet Market size in 2022? Ans. USD 8.8 Bn was the Tappet Market size in 2022. 3] What is the expected Tappet Market size by 2029? Ans. USD 11.20 Bn is the expected Tappet Market size by 2029. 4] What are the Tappet Market segments? Ans. The market is divided by Type, Engine Capacity, Distribution Channel and End-User. 5] Which region’s Tappet Market share is expected to increase at a high rate during the forecast period? Ans. The Tappet Market share of Asia Pacific is expected to increase at a high rate during the forecast period. 6] Who are the key players in the Tappet Industry? Ans. Yuhuan Huiyu Tappets Co. Ltd, Competition Cams Inc., Wuxi Xizhou Machinery Co. Ltd., NSK, Rane Engine Valve Ltd, Lunati Power, SM Motor Parts GmbH, Crower Cams Equipment Company Inc., Garuda Impex, GT Technologies, Kibblewhite Precision Machining, Sac Engine Components Private Limited, Taj Industries.

1. Tappet Market: Research Methodology 2. Tappet Market: Executive Summary 3. Tappet Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Tappet Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Tappet Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Tappet Market Size and Forecast, by Type (2022-2029) 5.1.1. Flat Tappet 5.1.2. Roller Tappet 5.1.3. Hydraulic Tappet 5.2. Tappet Market Size and Forecast, by Engine Capacity (2022-2029) 5.2.1. <4 Cylinders Engine 5.2.2. 4-6 Cylinders Engine 5.2.3. >6 Cylinders Engine 5.3. Tappet Market Size and Forecast, by Distribution Channel (2022-2029) 5.3.1. OEMs 5.3.2. Aftermarket 5.4. Tappet Market Size and Forecast, by End-User (2022-2029) 5.4.1. Heavy Duty Commercial vehicles 5.4.2. Light Duty Commercial vehicles 5.4.3. Cars 5.4.3.1. Economic Passenger Car 5.4.3.2. Luxury Passenger Car 5.4.3.3. Mid-Priced Passenger Car 5.5. Tappet Market Size and Forecast, by Region (2022-2029) 5.5.1. North America 5.5.2. Europe 5.5.3. Asia Pacific 5.5.4. Middle East and Africa 5.5.5. South America 6. North America Tappet Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Tappet Market Size and Forecast, by Type (2022-2029) 6.1.1. Flat Tappet 6.1.2. Roller Tappet 6.1.3. Hydraulic Tappet 6.2. North America Tappet Market Size and Forecast, by Engine Capacity (2022-2029) 6.2.1. <4 Cylinders Engine 6.2.2. 4-6 Cylinders Engine 6.2.3. > 6 Cylinders Engine 6.3. North America Tappet Market Size and Forecast, by Distribution Channel (2022-2029) 6.3.1. OEMs 6.3.2. Aftermarket 6.4. North America Tappet Market Size and Forecast, by End-User (2022-2029) 6.4.1. Heavy Duty Commercial vehicles 6.4.2. Light Duty Commercial vehicles 6.4.3. Cars 6.4.3.1. Economic Passenger Car 6.4.3.2. Luxury Passenger Car 6.4.3.3. Mid-Priced Passenger Car 6.5. North America Tappet Market Size and Forecast, by Country (2022-2029) 6.5.1. United States 6.5.2. Canada 6.5.3. Mexico 7. Europe Tappet Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Tappet Market Size and Forecast, by Type (2022-2029) 7.1.1. Flat Tappet 7.1.2. Roller Tappet 7.1.3. Hydraulic Tappet 7.2. Europe Tappet Market Size and Forecast, by Engine Capacity (2022-2029) 7.2.1. <4 Cylinders Engine 7.2.2. 4-6 Cylinders Engine 7.2.3. >6 Cylinders Engine 7.3. Europe Tappet Market Size and Forecast, by Distribution Channel (2022-2029) 7.3.1. OEMs 7.3.2. Aftermarket 7.4. Europe Tappet Market Size and Forecast, by End-User (2022-2029) 7.4.1. Heavy Duty Commercial vehicles 7.4.2. Light Duty Commercial vehicles 7.4.3. Cars 7.4.3.1. Economic Passenger Car 7.4.3.2. Luxury Passenger Car 7.4.3.3. Mid-Priced Passenger Car 7.5. Europe Tappet Market Size and Forecast, by Country (2022-2029) 7.5.1. UK 7.5.2. France 7.5.3. Germany 7.5.4. Italy 7.5.5. Spain 7.5.6. Sweden 7.5.7. Austria 7.5.8. Rest of Europe 8. Asia Pacific Tappet Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Tappet Market Size and Forecast, by Type (2022-2029) 8.1.1. Flat Tappet 8.1.2. Roller Tappet 8.1.3. Hydraulic Tappet 8.2. Asia Pacific Tappet Market Size and Forecast, by Engine Capacity (2022-2029) 8.2.1. <4 Cylinders Engine 8.2.2. 4-6 Cylinders Engine 8.2.3. >6 Cylinders Engine 8.3. Asia Pacific Tappet Market Size and Forecast, by Distribution Channel (2022-2029) 8.3.1. OEMs 8.3.2. Aftermarket 8.4. Asia Pacific Tappet Market Size and Forecast, by End-User (2022-2029) 8.4.1. Heavy Duty Commercial vehicles 8.4.2. Light Duty Commercial vehicles 8.4.3. Cars 8.4.3.1. Economic Passenger Car 8.4.3.2. Luxury Passenger Car 8.4.3.3. Mid-Priced Passenger Car 8.5. Asia Pacific Tappet Market Size and Forecast, by Country (2022-2029) 8.5.1. China 8.5.2. S Korea 8.5.3. Japan 8.5.4. India 8.5.5. Australia 8.5.6. Indonesia 8.5.7. Malaysia 8.5.8. Vietnam 8.5.9. Taiwan 8.5.10. Bangladesh 8.5.11. Pakistan 8.5.12. Rest of Asia Pacific 9. Middle East and Africa Tappet Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Tappet Market Size and Forecast, by Type (2022-2029) 9.1.1. Flat Tappet 9.1.2. Roller Tappet 9.1.3. Hydraulic Tappet 9.2. Middle East and Africa Tappet Market Size and Forecast, by Engine Capacity (2022-2029) 9.2.1. <4 Cylinders Engine 9.2.2. 4-6 Cylinders Engine 9.2.3. >6 Cylinders Engine 9.3. Middle East and Africa Tappet Market Size and Forecast, by Distribution Channel (2022-2029) 9.3.1. OEMs 9.3.2. Aftermarket 9.4. Middle East and Africa Tappet Market Size and Forecast, by End-User (2022-2029) 9.4.1. Heavy Duty Commercial Vehicles 9.4.2. Light Duty Commercial Vehicles 9.4.3. Cars 9.4.3.1. Economic Passenger Car 9.4.3.2. Luxury Passenger Car 9.4.3.3. Mid-Priced Passenger Car 9.5. Middle East and Africa Tappet Market Size and Forecast, by Country (2022-2029) 9.5.1. South Africa 9.5.2. GCC 9.5.3. Egypt 9.5.4. Nigeria 9.5.5. Rest of ME&A 10. South America Tappet Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Tappet Market Size and Forecast, by Type (2022-2029) 10.1.1. Flat Tappet 10.1.2. Roller Tappet 10.1.3. Hydraulic Tappet 10.2. South America Tappet Market Size and Forecast, by Engine Capacity (2022-2029) 10.2.1. <4 Cylinders Engine 10.2.2. 4-6 Cylinders Engine 10.2.3. >6 Cylinders Engine 10.3. South America Tappet Market Size and Forecast, by Distribution Channel (2022-2029) 10.3.1. OEMs 10.3.2. Aftermarket 10.4. South America Tappet Market Size and Forecast, by End-User (2022-2029) 10.4.1. Heavy Duty Commercial vehicles 10.4.2. Light Duty Commercial vehicles 10.4.3. Cars 10.4.3.1. Economic Passenger Car 10.4.3.2. Luxury Passenger Car 10.4.3.3. Mid-Priced Passenger Car 10.5. South America Tappet Market Size and Forecast, by Country (2022-2029) 10.5.1. Brazil 10.5.2. Argentina 10.5.3. Rest of South America 11. Company Profile: Key players 11.1. Yuhuan Huiyu Tappets Co. Ltd 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Competition Cams Inc. 11.3. Wuxi Xizhou Machinery Co. Ltd. 11.4. NSK 11.5. Rane Engine Valve Ltd 11.6. Lunati Power 11.7. SM Motor Parts GmbH 11.8. Crower Cams Equipment Company Inc. 11.9. Garuda Impex 11.10. GT Technologies 11.11. Kibblewhite Precision Machining 11.12. Sac Engine Components Private Limited 11.13. Taj Industries 12. Key Findings 13. Industry Recommendation