Global Takaful Insurance Market size was valued at USD 33.50 Bn. in 2023 and the total Takaful Insurance Market revenue is expected to grow by 15.1% from 2024 to 2030, reaching nearly USD 120.2 Bn.Takaful Insurance Market Overview:

Takaful insurance market also called Islamic insurance, is growing and developing steadily around the world. In this type of insurance, members contribute money into a pool system to guarantee each other against loss or damage which explains the responsibilities of individuals to cooperate with each other. The takaful policies cover life, health, and general insurance needs, like education funding, savings, and retirement planning. The Agents & Brokers is expected to dominate the market during the forecast period. Hence, the demand for the Takaful Insurance Market is increasing especially, in Muslim countries.To know about the Research Methodology :- Request Free Sample Report

Takaful Insurance Market Dynamics

Market Growth and Awareness and Lack of Conventional Alternatives drive the market The takaful insurance market has increased the demand for Islamic financial products and services. Due to an increase in awareness of takaful insurance, more individuals and businesses are becoming familiar with its principles and benefits. Muslim-majority countries as well as regions with Muslim populations, such as Southeast Asia and the Middle East have witnessed increased market penetration. The market expansion is driven by growing awareness of Islamic finance principles. Innovation and product divergence of insurance head toward market growth. In some regions, there might be limited access to conventional insurance for Sharia-compliant financial products. Takaful insurance products and operations are reviewed and certified by Shariah scholars to confirm that they obey Islamic principles. Takaful fills this gap by offering solutions that provide the specific needs of the Muslim Population. As a result, the demand for the Takaful Insurance Market is increasing. Lack of Awareness and Understanding and Limited Product Offerings can hamper the market The concept and the benefits of a takaful insurance policy might not understand fully by the customers even within Muslim-majority countries. The potential participants may not comprehend the value and importance of takaful insurance compared to conventional insurance. Conventional insurance offers a broader range of product offerings compared to takaful insurance as takaful insurance needs to adhere to Shariah principles. These are the limitations that can hamper the market as it makes it challenging to cater to the diverse and evolving needs of customers. Hence, the lack of awareness and fewer product offerings can hinder the Takaful Insurance Market Growth. Ethical and Social Responsibility and Innovative Product Development create opportunity The demand for takaful insurance is increasing as people are becoming more conscious of their financial choices and pursuing ways to align their actions with values. Takaful insurance appeals to businesses and individuals to seek ethical and socially responsible financial solutions. Muslim countries have a higher penetration of takaful insurance as compared to conventional insurance, as conventional insurance is unethical in Islamic law. The innovation of product development is a possible chance in the takaful market. Customized Takaful products can be designed to address according to the specific needs of various customer segments, such as micro-Takaful for low-income individuals, specialized coverage for specific industries, and hybrid Takaful products which combine the elements of both insurance and investment. As a result, there is an opportunity for New entrants and businesses in the Takaful Insurance Market.Takaful Insurance Market Segment Analysis

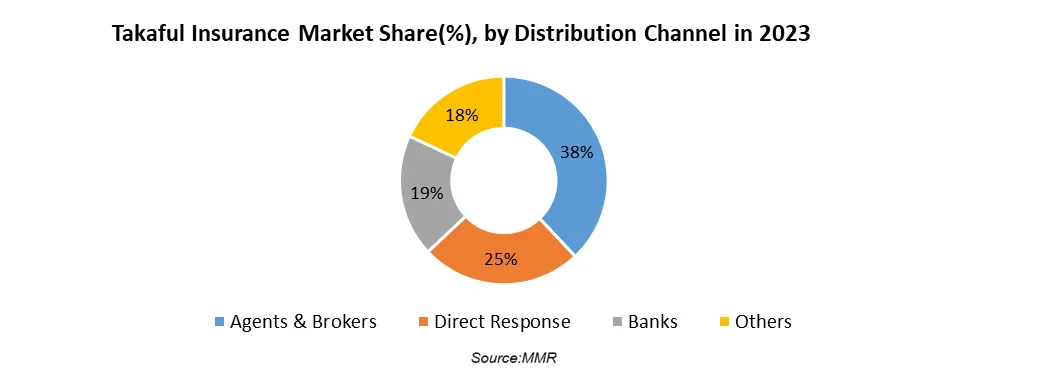

Based on the Type, The family takaful segment has dominated the market in the year 2023 and is expected to dominate the market during the forecast period. Family takaful insurance is also called Life takaful insurance. The products of family takaful provide Long-term financial goals including education funding, savings, and retirement planning. These products are intended to address the growing needs of policyholders throughout their lives. Other products are also included in family takaful insurance like Tax Benefits and Incentives, Estate Planning & Inheritance, and Cultural & Religious Considerations. On the other hand, General Takaful provides protection against many types of risks such as motor insurance, liability, travel insurance, property damage, and other non-life-related coverages.Based on the Distribution Channel, Agents & Brokers has dominated the market in the year 2023 and is expected to dominate the market during the forecast period. Takaful operators have a relationship with the agents & brokers as they played a major role in distributing Takaful products. The demand for tailored and personalized takaful insurance coverage is growing the independent Brokers & Agents leveraging numerous websites and online selling platforms, which has become a prominent trend in the market. The direct response segment is growing significantly as the digitalization of the insurance industry is increasing. Online platforms and Phone sales have gained importance and customer can compare and purchase takaful insurance policies directly through digital channels without any intermediaries.

Takaful Insurance Market Regional Insights:

The Middle East & Africa region dominated the market in the year 2023 and is expected to dominate the market during the forecast period, especially in Gulf Cooperation Council (GCC). Middle East countries which include the UAE, Qatar, Saudi Arabia, Kuwait, and Bahrain have important companies in the market. The growth of the industry depends on countries that have established supportive environments for Islamic finance, including Takaful. The strong financial infrastructure of the Middle East region contributed to the prominence of Takaful in the region. Whereas Asia-Pacific is a growing region and is expected to expand during the forecast period, especially in Southeast Asian countries. Malaysia and Indonesia are the countries that leading the expansion of Islamic finance and Takaful. The adoption of advanced technology in Asian countries by Takaful Insurance service providers increases sales and market value, boosting the market in this region forward.The objective of the report is to present a comprehensive analysis of the Takaful Insurance Market including all the stakeholders of the Application. The past and current status of the Application with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the Application with a dedicated study of key players that includes market leaders, followers, and new entrants by region. PORTER, SVOR, and PESTEL analysis with the potential impact of micro-economic factors by region on the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the Application to the decision-makers. The report also helps in understanding Takaful Insurance Market dynamics, and structure by analyzing the market segments and projecting the Takaful Insurance Market size. Clear representation of competitive analysis of key players by type, price, financial position, product portfolio, growth strategies, and regional presence in the Takaful Insurance Market makes the report investor’s guide.

Takaful Insurance Market Scope: Inquire Before Buying

Global Takaful Insurance Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 33.50 Bn. Forecast Period 2024 to 2030CAGR: 15.1% Market Size in 2030: US $ 120.2 Bn. Segments Covered: by Type Family General by Distribution Channel Agents & Brokers Direct Response Banks Others by Application Personal Commercial Takaful Insurance Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Takaful Insurance Market Key Players

1. Abu Dhabi National Takaful Co. [Abu Dhabi, United Arab Emirates] 2. Allianz 3. AMAN Insurance 4. Islamic Insurance 5. Prudential BSN Takaful Berhad 6. Qatar Islamic Insurance [Doha, Qatar] 7. SALAMA Islamic Arab Insurance Company 8. Syarikat Takaful Brunei Darussalam 9. Takaful International 10. Zurich Malaysia 11. HSBC Insurance 12. AIG Prudential 13. Tokio Marine Frequently Asked Questions: 1] What segments are covered in the Global Market report? Ans. The segments covered in the Takaful Insurance Market report are based on Type, Distribution Channel, Application, and Region. 2] Which region is expected to hold the highest share of the Global Takaful Insurance Market? Ans. The Middle East & Africa region is expected to hold the highest share of the Takaful Insurance Market. 3] What is the market size of the Global Takaful Insurance Market by 2030? Ans. The market size of the Takaful Insurance Market by 2030 is expected to reach USD 120.2 Bn. 4] What is the forecast period for the Global Takaful Insurance Market? Ans. The forecast period for the Takaful Insurance Market is 2023-2030. 5] What was the market size of the Global Takaful Insurance Market in 2023? Ans. The market size of the Takaful Insurance Market in 2023 was valued at USD 33.50 Bn.

1. Takaful Insurance Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Takaful Insurance Market: Dynamics 2.1. Takaful Insurance Market Trends by Region 2.1.1. North America Takaful Insurance Market Trends 2.1.2. Europe Takaful Insurance Market Trends 2.1.3. Asia Pacific Takaful Insurance Market Trends 2.1.4. Middle East and Africa Takaful Insurance Market Trends 2.1.5. South America Takaful Insurance Market Trends 2.2. Takaful Insurance Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Takaful Insurance Market Drivers 2.2.1.2. North America Takaful Insurance Market Restraints 2.2.1.3. North America Takaful Insurance Market Opportunities 2.2.1.4. North America Takaful Insurance Market Challenges 2.2.2. Europe 2.2.2.1. Europe Takaful Insurance Market Drivers 2.2.2.2. Europe Takaful Insurance Market Restraints 2.2.2.3. Europe Takaful Insurance Market Opportunities 2.2.2.4. Europe Takaful Insurance Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Takaful Insurance Market Drivers 2.2.3.2. Asia Pacific Takaful Insurance Market Restraints 2.2.3.3. Asia Pacific Takaful Insurance Market Opportunities 2.2.3.4. Asia Pacific Takaful Insurance Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Takaful Insurance Market Drivers 2.2.4.2. Middle East and Africa Takaful Insurance Market Restraints 2.2.4.3. Middle East and Africa Takaful Insurance Market Opportunities 2.2.4.4. Middle East and Africa Takaful Insurance Market Challenges 2.2.5. South America 2.2.5.1. South America Takaful Insurance Market Drivers 2.2.5.2. South America Takaful Insurance Market Restraints 2.2.5.3. South America Takaful Insurance Market Opportunities 2.2.5.4. South America Takaful Insurance Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Takaful Insurance Industry 2.8. Analysis of Government Schemes and Initiatives For Takaful Insurance Industry 2.9. Takaful Insurance Market Trade Analysis 2.10. The Global Pandemic Impact on Takaful Insurance Market 3. Takaful Insurance Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Takaful Insurance Market Size and Forecast, by Type (2023-2030) 3.1.1. Family 3.1.2. General 3.2. Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 3.2.1. Agents & Brokers 3.2.2. Direct Response 3.2.3. Banks 3.2.4. Others 3.3. Takaful Insurance Market Size and Forecast, by Application (2023-2030) 3.3.1. Personal 3.3.2. Commercial 3.4. Takaful Insurance Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Takaful Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Takaful Insurance Market Size and Forecast, by Type (2023-2030) 4.1.1. Family 4.1.2. General 4.2. North America Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 4.2.1. Agents & Brokers 4.2.2. Direct Response 4.2.3. Banks 4.2.4. Others 4.3. North America Takaful Insurance Market Size and Forecast, by Application (2023-2030) 4.3.1. Personal 4.3.2. Commercial 4.4. North America Takaful Insurance Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Takaful Insurance Market Size and Forecast, by Type (2023-2030) 4.4.1.1.1. Family 4.4.1.1.2. General 4.4.1.2. United States Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.1.2.1. Agents & Brokers 4.4.1.2.2. Direct Response 4.4.1.2.3. Banks 4.4.1.2.4. Others 4.4.1.3. United States Takaful Insurance Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. Personal 4.4.1.3.2. Commercial 4.4.2. Canada 4.4.2.1. Canada Takaful Insurance Market Size and Forecast, by Type (2023-2030) 4.4.2.1.1. Family 4.4.2.1.2. General 4.4.2.2. Canada Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.2.2.1. Agents & Brokers 4.4.2.2.2. Direct Response 4.4.2.2.3. Banks 4.4.2.2.4. Others 4.4.2.3. Canada Takaful Insurance Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. Personal 4.4.2.3.2. Commercial 4.4.3. Mexico 4.4.3.1. Mexico Takaful Insurance Market Size and Forecast, by Type (2023-2030) 4.4.3.1.1. Family 4.4.3.1.2. General 4.4.3.2. Mexico Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 4.4.3.2.1. Agents & Brokers 4.4.3.2.2. Direct Response 4.4.3.2.3. Banks 4.4.3.2.4. Others 4.4.3.3. Mexico Takaful Insurance Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. Personal 4.4.3.3.2. Commercial 5. Europe Takaful Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Takaful Insurance Market Size and Forecast, by Type (2023-2030) 5.2. Europe Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 5.3. Europe Takaful Insurance Market Size and Forecast, by Application (2023-2030) 5.4. Europe Takaful Insurance Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Takaful Insurance Market Size and Forecast, by Type (2023-2030) 5.4.1.2. United Kingdom Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.1.3. United Kingdom Takaful Insurance Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Takaful Insurance Market Size and Forecast, by Type (2023-2030) 5.4.2.2. France Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.2.3. France Takaful Insurance Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Takaful Insurance Market Size and Forecast, by Type (2023-2030) 5.4.3.2. Germany Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.3.3. Germany Takaful Insurance Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Takaful Insurance Market Size and Forecast, by Type (2023-2030) 5.4.4.2. Italy Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.4.3. Italy Takaful Insurance Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Takaful Insurance Market Size and Forecast, by Type (2023-2030) 5.4.5.2. Spain Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.5.3. Spain Takaful Insurance Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Takaful Insurance Market Size and Forecast, by Type (2023-2030) 5.4.6.2. Sweden Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.6.3. Sweden Takaful Insurance Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Takaful Insurance Market Size and Forecast, by Type (2023-2030) 5.4.7.2. Austria Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.7.3. Austria Takaful Insurance Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Takaful Insurance Market Size and Forecast, by Type (2023-2030) 5.4.8.2. Rest of Europe Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 5.4.8.3. Rest of Europe Takaful Insurance Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Takaful Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Takaful Insurance Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 6.3. Asia Pacific Takaful Insurance Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Takaful Insurance Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Takaful Insurance Market Size and Forecast, by Type (2023-2030) 6.4.1.2. China Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.1.3. China Takaful Insurance Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Takaful Insurance Market Size and Forecast, by Type (2023-2030) 6.4.2.2. S Korea Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.2.3. S Korea Takaful Insurance Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Takaful Insurance Market Size and Forecast, by Type (2023-2030) 6.4.3.2. Japan Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.3.3. Japan Takaful Insurance Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Takaful Insurance Market Size and Forecast, by Type (2023-2030) 6.4.4.2. India Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.4.3. India Takaful Insurance Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Takaful Insurance Market Size and Forecast, by Type (2023-2030) 6.4.5.2. Australia Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.5.3. Australia Takaful Insurance Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Takaful Insurance Market Size and Forecast, by Type (2023-2030) 6.4.6.2. Indonesia Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.6.3. Indonesia Takaful Insurance Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Takaful Insurance Market Size and Forecast, by Type (2023-2030) 6.4.7.2. Malaysia Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.7.3. Malaysia Takaful Insurance Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Takaful Insurance Market Size and Forecast, by Type (2023-2030) 6.4.8.2. Vietnam Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.8.3. Vietnam Takaful Insurance Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Takaful Insurance Market Size and Forecast, by Type (2023-2030) 6.4.9.2. Taiwan Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.9.3. Taiwan Takaful Insurance Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Takaful Insurance Market Size and Forecast, by Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 6.4.10.3. Rest of Asia Pacific Takaful Insurance Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Takaful Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Takaful Insurance Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 7.3. Middle East and Africa Takaful Insurance Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Takaful Insurance Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Takaful Insurance Market Size and Forecast, by Type (2023-2030) 7.4.1.2. South Africa Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.1.3. South Africa Takaful Insurance Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Takaful Insurance Market Size and Forecast, by Type (2023-2030) 7.4.2.2. GCC Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.2.3. GCC Takaful Insurance Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Takaful Insurance Market Size and Forecast, by Type (2023-2030) 7.4.3.2. Nigeria Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.3.3. Nigeria Takaful Insurance Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Takaful Insurance Market Size and Forecast, by Type (2023-2030) 7.4.4.2. Rest of ME&A Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 7.4.4.3. Rest of ME&A Takaful Insurance Market Size and Forecast, by Application (2023-2030) 8. South America Takaful Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Takaful Insurance Market Size and Forecast, by Type (2023-2030) 8.2. South America Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 8.3. South America Takaful Insurance Market Size and Forecast, by Application(2023-2030) 8.4. South America Takaful Insurance Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Takaful Insurance Market Size and Forecast, by Type (2023-2030) 8.4.1.2. Brazil Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.1.3. Brazil Takaful Insurance Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Takaful Insurance Market Size and Forecast, by Type (2023-2030) 8.4.2.2. Argentina Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.2.3. Argentina Takaful Insurance Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Takaful Insurance Market Size and Forecast, by Type (2023-2030) 8.4.3.2. Rest Of South America Takaful Insurance Market Size and Forecast, by Distribution Channel (2023-2030) 8.4.3.3. Rest Of South America Takaful Insurance Market Size and Forecast, by Application (2023-2030) 9. Global Takaful Insurance Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Takaful Insurance Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Abu Dhabi National Takaful Co. [Abu Dhabi, United Arab Emirates] 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Allianz 10.3. AMAN Insurance 10.4. Islamic Insurance 10.5. Prudential BSN Takaful Berhad 10.6. Qatar Islamic Insurance [Doha, Qatar] 10.7. SALAMA Islamic Arab Insurance Company 10.8. Syarikat Takaful Brunei Darussalam 10.9. Takaful International 10.10. Zurich Malaysia 10.11. HSBC Insurance 10.12. AIG Prudential 10.13. Tokio Marine 11. Key Findings 12. Industry Recommendations 13. Takaful Insurance Market: Research Methodology 14. Terms and Glossary