Global Stud Welding Machine Market size was valued at USD 1.37 Billion in 2022, and is expected to reach USD 1.93 Billion by 2029, exhibiting a CAGR of 5% during the forecast period (2023-2029)Stud Welding Machine Market Overview

Stud welding machine is used for welding where a fastener or a specially formed nut is welded onto another metal part, typically a substrate or base metal. The machine consists of a direct current power supply, a controller, a weld gun and cables to tie the system components and the base metal together. All types of metals are suitable for stud welding and the most common metals used are Aluminium, Brass, Steel and Copper. The major benefit of using this machine is that it precisely controls and monitors the amount of energy used. It can weld up to 30 times in a minute and with an automatic machine around 1800 studs are fastened. The report includes a detailed analysis of the Stud Welding Machine Market including dynamics, regional insights, competitive landscape, market size, market segmentation, sales, production, etc.To know about the Research Methodology :- Request Free Sample Report

Stud Welding Machine Market Dynamics

Stud welding machines are almost used in every industry. The market is majorly growing due to the increasing demand because of the benefits of using stud welding machines such as a reduction in labor costs and error, cost-effectiveness, energy efficiency, clean welding, easy operation and light weight of the machine, which makes it easy to carry. The use of these machines helps companies save money and time, which is increasing the adoption rate of machines. The stud welding process is advantageous for many industries because of the strength provided by a full fusion weld point. These operations completely fuse stud materials to surface materials, which can be done with a variety of materials such as aluminium, steel and copper. Stud welding machine manufacturers have most of their business with the industrial market including customers manufacturing parts and assemblies of all types. They mostly supply to electronics, automotive, agricultural equipment, robotics and furniture industries. The growth of the metro area has been slowed and there is a large increase in industrial demand, shifting the stud welding machines market supply slightly from construction to industrial. Factory equipment is also largely built with stud welding systems. Therefore, the growing industries are resulting in an increase in the use of stud welding machines. Hence, the demand for stud welding machine market is increasing globally but the high stud welding machine price is expected to hamper the market’s growth in the future.Stud Welding Machine Market Regional Insights

During the forecast period, the Asia Pacific Stud Welding Machine Market is expected to hold the largest market share. This is attributed to the high investments in research and development for technological developments and innovations. The Stud Welding Research Institute of China IKING Group is the only professional research institute that integrates research, designs and manufactures various stud welding machines and stud welding processes. It is the first stud welding machine manufacturer that independently designed and produced the first Chinese stud welding machine. It has also overcome many technical problems in the field of stud welding and obtained a number of utility model patents and invention patents.Stud Welding Machine Market Segment Analysis

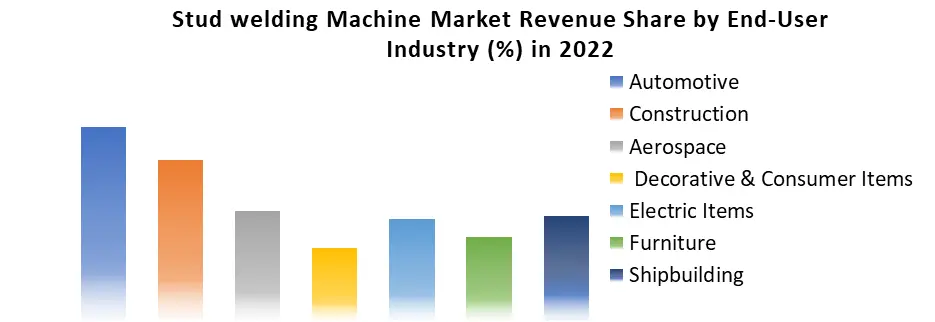

Based on Material Suitability: The market has been divided into Steel, Copper, Brass and Aluminium. The Steel segment is expected to hold the largest market share and the aluminum segment is expected to grow at a high CAGR during the forecast period.Based on Power Source: The market has been divided into Transformers, Generators and Inverters. Transformers are less costly compared to other power supplies and they can be used within a facility because of their large size. A generator is the best choice for power conversion for job site welding with portable welders. The most significant feature of inverters is that they are adjusted with software systems due to their use of semiconductor chips. During the forecast period, the inverters segment is expected to hold the largest stud welding machine market share because of the advanced features of inverters. Based on Distribution Channel: The market is divided into Online and Offline. Among these, the Offline segment held the largest share of the market in 2022. The Online segment is expected to grow at a high rate during the forecast period due to the increasing technological developments and the rising trend of online shopping. Based on End-User: The market has been divided into Automotive, Construction, Decorative and construction items, Electric Items, Furniture and shipbuilding. Among these, the automotive and construction segments hold the largest Stud Welding Machine Market share. The construction industry is one of the largest industries and includes large number of applications for stud welding machines such as door, window, and facade construction, thermal Insulation, vending machines, etc. The large number of infrastructure projects in developing countries is contributing to the growth of segments.

Stud Welding Machine Market Competitive Landscape

As per the research, there are a large number of manufacturers present across the globe, which makes the market competitive. The Market report includes a detailed analysis of innovative trends, advancements, mergers, acquisitions, joint ventures, new products, product portfolio intensification and geographical expansion along with information on market leaders, new entrants and followers. The IKING Group is a leading enterprise in the Stud Welding Machine Industry that researched and solved the problem of stud welding technology and created twelve “Chinese No.1”. Their products have been sold in more than 50 countries and all regions across the world. Stud Welding Products, Inc presented its products in ISA 2023 such as LYNX4 Modular Stud Welding System and StudPro 2500XI Stud Welding System. The company also offered huge discounts on its products.Stud Welding Machine Market Scope: Inquire before buying

Stud Welding Machine Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 1.37 Bn. Forecast Period 2023 to 2029 CAGR: 5% Market Size in 2029: US $ 1.93 Bn. Segments Covered: by Operation Mode Automatic Semi-Automatic by Type Capacitor Discharge Stud Welder Short Cycle Stud Welder Drawn - Arc Stud Welder by Stud Range Below 3 mm 3-12 mm 12-18 mm 18 mm & Above by Material Suitability Steel Copper Brass Aluminium by Power Source Transformers Generators Inverters by Distribution Channel Online Offline by End-User Automotive Construction Aerospace Decorative & Consumer Items Electric Items Furniture Shipbuilding by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Stud Welding Machine Key Players

1. Bolte GmbH 2. ChangZhou Jinda Welding Co., Ltd 3. Heinz Soyer Bolzenschweisstechnik GmbH 4. HBS Bolzenschweiss-Systeme 5. NIPPON STUD WELDING Co., Ltd 6. Cruxweld Industrial Equipments Private Limited 7. Tru-Weld (TFP Corporation) 8. Shenzhen Hongbai Technology Industrial Co., Ltd 9. STANLEY Engineered Fastening, Image Industries Inc 10.Midwest Fasteners Inc. 11.International Welding Technologies 12.Sunbelt Stud Welding, Inc. 13.KÖSTER & CO 14.Taylor Studwelding Systems Limited 15.Artech Welders Private Limited 16.Thomas Welding Systems 17.CEBORA Welding and Cutting 18.C2G-SOUDAGE INNOVATION 19.Akshay Fasteners 20.IKING GROUP 21.NORTHLAND FASTENING SYSTEMS Frequently Asked Questions 1] What was the Stud Welding Machine Market size in 2022? Ans. USD 1.37 Bn was the Market size in 2022. 2] What is the expected Stud Welding Machine Market size by 2029? Ans. USD 1.93 Bn is the expected Market size by 2029. 3] What is the expected CAGR of the Global Stud Welding Machine Market during the forecast period? Ans. During the forecast period, the Global Market is expected to grow at a CAGR of 5 percent. 4] What are the major Stud Welding Machine Market segments? Ans. The market is divided by Operation Mode, Type, Stud Range, Material Suitability, Distribution Channel and End-User. 5] Which region is expected to hold the largest Stud Welding Machine Market share during the forecast period? Ans. The Market share of Asia Pacific is expected to hold the largest share of the global market during the forecast period. 6] Who are the key players in the Stud Welding Machine Market? Ans. Bolte GmbH, ChangZhou Jinda Welding Co., Ltd, Heinz Soyer Bolzenschweisstechnik GmbH, HBS Bolzenschweiss-Systeme, NIPPON STUD WELDING Co., Ltd, Cruxweld Industrial Equipments Private Limited, Tru-Weld (TFP Corporation).

1. Stud Welding Machine Market: Research Methodology 2. Stud Welding Machine Market: Executive Summary 3. Stud Welding Machine Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Stud Welding Machine Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Stud Welding Machine Market: Segmentation (by Value and Volume USD) 5.1. Stud Welding Machine Market, by Operation Mode (2022-2029) 5.1.1. Automatic 5.1.2. Semi-Automatic 5.2. Stud Welding Machine Market, by Type (2022-2029) 5.2.1. Capacitor Discharge Stud Welder 5.2.2. Short Cycle Stud Welder 5.2.3. Drawn - Arc Stud Welder 5.3. Stud Welding Machine Market, by Stud Range (2022-2029) 5.3.1. Below 3 mm 5.3.2. 3-12 mm 5.3.3. 12-18 mm 5.3.4. 18 mm & Above 5.4. Stud Welding Machine Market, by Material Suitability (2022-2029) 5.4.1. Steel 5.4.2. Copper 5.4.3. Brass 5.4.4. Aluminium 5.5. Stud Welding Machine Market, by Power Source (2022-2029) 5.5.1. Transformers 5.5.2. Generators 5.5.3. Inverters 5.6. Stud Welding Machine Market, by Distribution Channel (2022-2029) 5.6.1. Online 5.6.2. Offline 5.7. Stud Welding Machine Market, by End-User (2022-2029) 5.7.1. Automotive 5.7.2. Construction 5.7.3. Decorative and Consumer Items 5.7.4. Electric Items 5.7.5. Furniture 5.7.6. Shipbuilding 5.8. Stud Welding Machine Market, by Region (2022-2029) 5.8.1. North America 5.8.2. Europe 5.8.3. Asia Pacific 5.8.4. Middle East and Africa 5.8.5. South America 6. North America Stud Welding Machine Market (by Value and Volume USD) 6.1. North America Stud Welding Machine Market, by Operation Mode (2022-2029) 6.1.1. Automatic 6.1.2. Semi-Automatic 6.2. North America Stud Welding Machine Market, by Type (2022-2029) 6.2.1. Capacitor Discharge Stud Welder 6.2.2. Short Cycle Welder 6.2.3. Drawn - Arc Stud Welder 6.3. North America Stud Welding Machine Market, by Stud Range (2022-2029) 6.3.1. Below 3 mm 6.3.2. 3-12 mm 6.3.3. 12-18 mm 6.3.4. 18 mm & Above 6.4. North America Stud Welding Machine Market, by Material Suitability (2022-2029) 6.4.1. Steel 6.4.2. Copper 6.4.3. Brass 6.4.4. Aluminium 6.5. North America Stud Welding Machine Market, by Power Source (2022-2029) 6.5.1. Transformers 6.5.2. Generators 6.5.3. Inverters 6.6. North America Stud Welding Machine Market, by Distribution Channel (2022-2029) 6.6.1. Online 6.6.2. Offline 6.7. North America Stud Welding Machine Market, by End-User (2022-2029) 6.7.1. Automotive 6.7.2. Construction 6.7.3. Decorative & Consumer Items 6.7.4. Electric Items 6.7.5. Furniture 6.7.6. Shipbuilding 6.8. North America Stud Welding Machine Market, by Country (2022-2029) 6.8.1. United States 6.8.2. Canada 6.8.3. Mexico 7. Europe Stud Welding Machine Market (by Value and Volume USD) 7.1. Europe Stud Welding Machine Market, by Operation Mode (2022-2029) 7.2. Europe Stud Welding Machine Market, by Type (2022-2029) 7.3. Europe Stud Welding Machine Market, by Stud Range (2022-2029) 7.4. Europe Stud Welding Machine Market, by Material Suitability (2022-2029) 7.5. Europe Stud Welding Machine Market, by Power Source (2022-2029) 7.6. Europe Stud Welding Machine Market, by Distribution Channel (2022-2029) 7.7. Europe Stud Welding Machine Market, by End-User (2022-2029) 7.8. Europe Stud Welding Machine Market, by Country (2022-2029) 7.8.1. UK 7.8.2. France 7.8.3. Germany 7.8.4. Italy 7.8.5. Spain 7.8.6. Sweden 7.8.7. Austria 7.8.8. Rest of Europe 8. Asia Pacific Stud Welding Machine Market (by Value and Volume USD) 8.1. Asia Pacific Stud Welding Machine Market, by Operation Mode (2022-2029) 8.2. Asia Pacific Stud Welding Machine Market, by Type (2022-2029) 8.3. Asia Pacific Stud Welding Machine Market, by Stud Range (2022-2029) 8.4. Asia Pacific Stud Welding Machine Market, by Material Suitability (2022-2029) 8.5. Asia Pacific Stud Welding Machine Market, by Power Source (2022-2029) 8.6. Asia Pacific Stud Welding Machine Market, by Distribution Channel (2022-2029) 8.7. Asia Pacific Stud Welding Machine Market, by End-User (2022-2029) 8.8. Asia Pacific Stud Welding Machine Market, by Country (2022-2029) 8.8.1. China 8.8.2. S Korea 8.8.3. Japan 8.8.4. India 8.8.5. Australia 8.8.6. Indonesia 8.8.7. Malaysia 8.8.8. Vietnam 8.8.9. Taiwan 8.8.10. Bangladesh 8.8.11. Pakistan 8.8.12. Rest of Asia Pacific 9. Middle East and Africa Stud Welding Machine Market (by Value and Volume USD) 9.1. Middle East and Africa Stud Welding Machine Market, by Operation Mode (2022-2029) 9.2. Middle East and Africa Stud Welding Machine Market, by Type (2022-2029) 9.3. Middle East and Africa Stud Welding Machine Market, by Stud Range (2022-2029) 9.4. Middle East and Africa Stud Welding Machine Market, by Material Suitability (2022-2029) 9.5. Middle East and Africa Stud Welding Machine Market, by Power Source (2022-2029) 9.6. Middle East and Africa Stud Welding Machine Market, by Distribution Channel (2022-2029) 9.7. Middle East and Africa Stud Welding Machine Market, by End-User (2022-2029) 9.8. Middle East and Africa Stud Welding Machine Market, by Country (2022-2029) 9.8.1. South Africa 9.8.2. GCC 9.8.3. Egypt 9.8.4. Nigeria 9.8.5. Rest of ME&A 10. South America Stud Welding Machine Market (by Value and Volume USD) 10.1. South America Stud Welding Machine Market, by Operation Mode (2022-2029) 10.2. South America Stud Welding Machine Market, by Type (2022-2029) 10.3. South America Stud Welding Machine Market, by Stud Range (2022-2029) 10.4. South America Stud Welding Machine Market, by Material Suitability (2022-2029) 10.5. South America Stud Welding Machine Market, by Power Source (2022-2029) 10.6. South America Stud Welding Machine Market, by Distribution Channel (2022-2029) 10.7. South America Stud Welding Machine Market, by End-User (2022-2029) 10.8. South America Stud Welding Machine Market, by Country (2022-2029) 10.8.1. Brazil 10.8.2. Argentina 10.8.3. Rest of South America 11. Company Profile: Key players 11.1. Bolte GmbH 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. ChangZhou Jinda Welding Co., Ltd 11.3. Heinz Soyer Bolzenschweisstechnik GmbH 11.4. HBS Bolzenschweiss-Systeme 11.5. NIPPON STUD WELDING Co., Ltd 11.6. Cruxweld Industrial Equipments Private Limited 11.7. Tru-Weld (TFP Corporation) 11.8. Shenzhen Hongbai Technology Industrial Co., Ltd 11.9. STANLEY Engineered Fastening 11.10. Image Industries Inc. 11.11. Midwest Fasteners Inc. 11.12. International Welding Technologies 11.13. Sunbelt Stud Welding, Inc. 11.14. KÖSTER & CO 11.15. Taylor Studwelding Systems Limited 11.16. Artech Welders Private Limited 11.17. Thomas Welding Systems 11.18. CEBORA Welding and Cutting 11.19. C2G-SOUDAGE INNOVATION 11.20. Akshay Fasteners 11.21. IKING GROUP 11.22. NORTHLAND FASTENING SYSTEMS 12. Key Findings 13. Industry Recommendation