Global storage tank Market size was valued at USD 15.32 Bn in 2022 and is expected to reach USD 24.76 Bn by 2029, at a CAGR of 7.1 %.Storage Tank Market Overview:

A storage tank is a big container or tank that is particularly made to store different things including liquids, gases, or granular materials. Many industries use these tanks, such as the oil and gas industry, chemical manufacturing, water treatment, agriculture, etc. The main reason for having storage tanks is to keep a large number of materials safe and in good condition until they are needed in the future or when they need to be moved to another place. The market report focuses on the drivers, challenges and major restraints of the Storage Tank industry. The bottom-up approach was used in the report for the estimation of the Storage Tank market size. The qualitative and quantitative methods are included in the report for the analysis of the data of the Storage Tank market.To know about the Research Methodology :- Request Free Sample Report

Storage Tank Market Dynamics

Drivers Increasing demand for energy to boost the Storage Tank Market growth Storage tanks are largely used in the oil and gas industry due to they allow to store crude oil, refined petroleum products such as gasoline and diesel, and natural gas. Thus increasing demand for energy increases and the people need storage tanks to assure that they have sufficient reserves of these resources. Storage tanks support them to keep operations running smoothly by providing a way to store large amounts of energy products, ensuring a steady supply and distribution to meet the increasing energy needs. The countries have been required to ensure that they have a secure and reliable energy supply with the growing population and rapid industrialization. Energy security is an important priority for governments and storage tanks play a vital role to achieve the main part of Energy security. To store large quantities of energy resources such as crude oil and natural gas, the storage tanks provide benefits by allowing countries and energy companies. To meet the energy needs of their populations and industries, this ensures that they have sufficient reserves even during times of increasing demandand disruptions of supply. As a result, increasing demand drives the Storage Tank Market growth. Technological advancements to fuel the Storage Tank Market growth Technological advancements in storage tank design, materials, and construction techniques contribute to improving efficiency. The new advanced insulation materials minimize the loss of energy and support the maintenance of stored substances at optimal temperatures. The enhancements in tank designs increase storage capacity and optimize the utilization of space. These efficiency improvements have been playing a crucial role in cost savings, and increasing productivity. Technological advancements have resulted in the development of advanced safety features and monitoring systems for storage tanks. These involve advanced leak detection systems, automated fire suppression systems, and real-time monitoring of pressure and temperature. These advancements has been help to minimize the risk of accidents, spills, and leaks, assuring the safety of personnel, surrounding environments, and stored substances. The advancements in technology have led to the development of corrosion-resistant materials and storage tank coatings. Advanced materials including fiberglass, epoxy-coated steel, and reinforced concrete help to provide superior resistance to corrosion and extend the lifespan of storage tanks. As a result, Technological advancements drive the Storage Tank Market growth. Storage Tank Market Trends Sustainability and Environmental Considerations The increasing environmental concerns and stricter regulation led to an increase in the emphasis on storage tank systems that meet environmental standards. Many companies have been adopting sustainable practices to reduce the impact of storage tank operations on the environment. This involves implementing measures to prevent leaks and spills, reduce emissions and handle the disposal of hazardous materials. The integration of renewable energy technologies with storage tanks incentives. For the excess storing of energy generated from renewable sources such as solar and wind, the Energy storage systems including batteries have been combined with storage tanks. This integration facilitates the efficient utilization of renewable energy and promotes a greener energy mix. The use of sustainable materials in storage tanks has been more prevalent. This involves the use of corrosion-resistant materials that have a longer lifespan. Additionally, Eco-friendly coatings, paints, and insulation materials are used to reduce environmental impact.Sustainability and Environmental Considerations are the upcoming trends for the Storage Tank Market growth. Storage Tank Market Restraints High Initial Investment The installation and construction of storage tanks need significant capital investment. The costs associated with engineering, procurement, construction, and commissioning (EPCC) have been substantial, particularly for large-scale storage tank projects. This high initial investment hinders potential buyers and limits market growth, especially for smaller businesses. Volatile Raw Material Prices The cost of raw materials including steel, concrete, and coatings has significantly impacted storage tank manufacturing costs. Fluctuations in raw material prices has been create uncertainty for manufacturers and potentially affect project feasibility and profitability. The unexpected price increases have led to cost overruns, making storage tank projects less economically viable.Segmentation

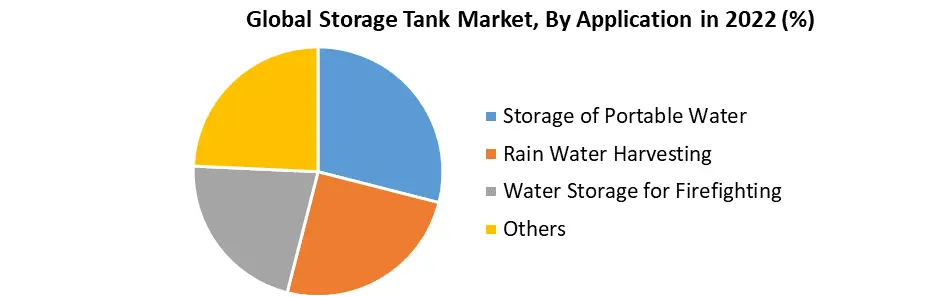

Based on Material Type: On the basis of the material type, the market is categorized into Steel Storage Tanks, Concrete Storage Tanks, Fiberglass Reinforced Plastic (FRP) Storage Tanks, Polyethylene Storage Tanks and Others. Steel Storage Tanks held the largest Storage Tank Market share in 2022 and are expected to continue their dominance over the forecast period. Steel storage tanks are usedin several industries such as oil and gas, water and wastewater, chemicals, and others. Steel is a material that offersattractive structural durability and integrity. Steel tanks have been combating severe environmental conditions and extreme temperatures ensuring long-term reliability and efficient safety. Steel tanks have been manufactured with corrosion-resistant coatings. These coatings help to prevent tank degradation and maintain the integrity of stored substances. Steel tanks have been fabricated in several sizes and capacities, ranging from small tanks for residential or commercial use to large-scale industrial storage tanks. This versatility makes them suitable for various applications. They are relatively easy to maintain and repair. Routine inspections, maintenance activities, and repairs have been carried out efficiently, ensuring the tank's optimal performance. Compared to some other material types, Steel tanks provide a cost-effective storage solution. They have competitive pricing, considering their durability and long lifespan. As a result, the effective benefits of Steel Storage Tanks among the several industries drive the Storage Tank industry growth.Based on Application: Storage of Portable Water is expected to dominate the storage tank market over the forecast period. The storage of potable water is used to store clean and potable water in storage tanks. These tanks are used in commercial as well as residential settings. They are largely used to manage the water supply by storing water during periods of high availability such as off-peak periods or during rainfall. This support to balance water supply, ensuring a reliable source of potable water. Portable water storage tanks have been required for emergency preparedness enabling communities to store water for critical needs during a natural disaster. These tanks offer a reserve of safe drinking water and minimize reliance on external sources during crises.In agricultural settings, Storage tanks are used for irrigation purposes, enabling farmers to store water for crop irrigation during dry periods. This supports agricultural activities and increases crop yield. In construction sites where access to a reliable water supply infrastructure has been limited, storage tanks provide a practical solution for storing and distributing portable water. They offer a self-sufficient water source, ensuring the availability of water for drinking and construction activities.

Storage Tank Market Regional Insights

North America dominated the Storage Tank Market with the largest share during the forecast period. The increasing demand for storage tanks from several industries including oil and gas and chemicals is the major driver of regionalStorage Tank industry growth. With an increasing demand for storage tanks in the oil and gas industry, Canada and the United States are key contributors to the Storage Tank market. This is due to shale gas exploration as well as production. The rising investments in the development of infrastructure, expansion of refineries, and increasing demand for petroleum products are boosting factors for the regional Storage Tank market growth. The environmental regulations and concerns about leakages have resulted to increase the demand for advanced storage tank technologies. This is another driver for the market growth. Asia Pacific is a rapidly growing region for the Storage Tank Market. The rapid growthin the oil and gas industry, expansion of refining capacity, rising investments in the petrochemical industry and increasing demand for energy are also driving factors for the regional Storage Tank market growth. The growing population, rapid urbanization, industrialization and infrastructure development are also the fuelling factors for the regional market growth. The increasing consumption of energy in developing economies such as China and India has resulted in high investments in the infrastructure of storage tanks.Storage Tank Market Scope: Inquire before buying

Global Storage Tank Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 15.32 Bn. Forecast Period 2023 to 2029 CAGR: 7.1 % Market Size in 2029: US $ 24.76 Bn. Segments Covered: by Material Type Steel Storage Tanks Concrete Storage Tanks Fiberglass Reinforced Plastic (FRP) Storage Tanks Polyethylene Storage Tanks Others by Product Type Aboveground Storage Tanks Underground Storage Tanks by Application Storage of Portable Water Rain Water Harvesting Water Storage for Firefighting Others by Storage Capacity Less than 5000 cubic meters 5000-15000 cubic meters 15000-30000 cubic meters Above 30000 cubic meters by End-User Oil and Gas Water and Wastewater Food and Beverage Pharmaceuticals Agriculture Others Storage Tank Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Storage Tank Key Player

1. Balmoral Tanks Ltd, DN Tanks 2. CST Industries, Inc. 3. Emiliana Serbatoi S.r.l. 4. Caldwell Tanks 5. Sintex Industries Ltd 6. McDermott International Inc. 7. Containment Solutions, Inc. 8. Carbery Plastics Limited 9. Nova Plastic Industries L.L.C 10. Fox Tank Company 11. Highland Tank and Manufacturing Company Inc 12. Ishii Iron Works Co. Ltd. 13. MERKRO Sp. z o.o 14. Pfaudler 15. Toyo Knetsu k.K. 16. Snyder Industries iNc 17. Caldwell tanks 18. Tank Connection 19. DN tank 20. Fiber Technology Corporation Ins. Frequently Asked Questions: 1] What is the growth rate of the Global Storage Tank Market? Ans. The Global Storage Tank Market is growing at a significant rate of 7.1 % during the forecast period. 2] Which region is expected to dominate the Global Storage Tank Market? Ans. North America is expected to dominate the Storage Tank Market during the forecast period. 3] What is the expected Global Storage Tank Market size by 2029? Ans. The Storage Tank Market size is expected to reach USD 24.76 Bn by 2029. 4] Which are the top players in the Global Storage Tank Market? Ans. The major top players in the Global Storage Tank Market are CST Industries, Inc., Emiliana Serbatoi S.r.l., Caldwell Tanks, Sintex Industries Ltd, Containment Solutions, Inc., Carbery Plastics Limited, Nova Plastic Industries L.L.C, Fox Tank Company, Ishii Iron Works Co. Ltd. and others. 5] What are the factors driving the Global Storage Tank Market growth? Ans. Increasing demand for energy and technological advancements in storage tansksare expected to drive market growth during the forecast period.

TOC 1. Storage Tank Market: Research Methodology 2. Storage Tank Market: Executive Summary 3. Storage Tank Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Storage Tank Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Storage Tank Market Size and Forecast by Segments (by Value USD and Volume Units ) 5.1. Storage Tank Market Size and Forecast, by Material Type (2022-2029) 5.1.1. Steel Storage Tanks 5.1.2. Concrete Storage Tanks 5.1.3. Fiberglass Reinforced Plastic (FRP) Storage Tanks 5.1.4. Polyethylene Storage Tanks 5.1.5. Others 5.2. Storage Tank Market Size and Forecast, by Product Type (2022-2029) 5.2.1. Aboveground Storage Tanks 5.2.2. Underground Storage Tanks 5.3. Storage Tank Market Size and Forecast, by Storage Capacity (2022-2029) 5.3.1. Less than 5000 cubic meters 5.3.2. 5000-15000 cubic meters 5.3.3. 15000-30000 cubic meters 5.3.4. Above 30000 cubic meters 5.4. Storage Tank Market Size and Forecast, by Application (2022-2029) 5.4.1. Storage of Portable Water 5.4.2. Rain Water Harvesting 5.4.3. Water Storage for Firefighting 5.4.4. Others 5.5. Storage Tank Market Size and Forecast, by End-User (2022-2029) 5.5.1. Oil and Gas 5.5.2. Water and Wastewater 5.5.3. Food and Beverage 5.5.4. Pharmaceuticals 5.5.5. Agriculture 5.5.6. Others 5.6. Storage Tank Market Size and Forecast, by Region (2022-2029) 5.6.1. North America 5.6.2. Europe 5.6.3. Asia Pacific 5.6.4. Middle East and Africa 5.6.5. South America 6. North America Storage Tank Market Size and Forecast by Segments (by Value USD and Volume Units ) 6.1. North America Storage Tank Market Size and Forecast, by Material Type (2022-2029) 6.1.1. Steel Storage Tanks 6.1.2. Concrete Storage Tanks 6.1.3. Fiberglass Reinforced Plastic (FRP) Storage Tanks 6.1.4. Polyethylene Storage Tanks 6.1.5. Others 6.2. North America Storage Tank Market Size and Forecast, by Product Type (2022-2029) 6.2.1. Aboveground Storage Tanks 6.2.2. Underground Storage Tanks 6.3. North America Storage Tank Market Size and Forecast, by Storage Capacity (2022-2029) 6.3.1. Less than 5000 cubic meters 6.3.2. 5000-15000 cubic meters 6.3.3. 15000-30000 cubic meters 6.3.4. Above 30000 cubic meters 6.4. North America Storage Tank Market Size and Forecast, by Application (2022-2029) 6.4.1. Storage of Portable Water 6.4.2. Rain Water Harvesting 6.4.3. Water Storage for Firefighting 6.4.4. Others 6.5. North America Storage Tank Market Size and Forecast, by End-User (2022-2029) 6.5.1. Oil and Gas 6.5.2. Water and Wastewater 6.5.3. Food and Beverage 6.5.4. Pharmaceuticals 6.5.5. Agriculture 6.5.6. Others 6.6. North America Storage Tank Market Size and Forecast, by Country (2022-2029) 6.6.1. United States 6.6.2. Canada 6.6.3. Mexico 7. Europe Storage Tank Market Size and Forecast by Segments (by Value USD and Volume Units ) 7.1. Europe Storage Tank Market Size and Forecast, by Material Type (2022-2029) 7.1.1. Steel Storage Tanks 7.1.2. Concrete Storage Tanks 7.1.3. Fiberglass Reinforced Plastic (FRP) Storage Tanks 7.1.4. Polyethylene Storage Tanks 7.1.5. Others 7.2. Europe Storage Tank Market Size and Forecast, by Product Type (2022-2029) 7.2.1. Aboveground Storage Tanks 7.2.2. Underground Storage Tanks 7.3. Europe Storage Tank Market Size and Forecast, by Storage Capacity (2022-2029) 7.3.1. Less than 5000 cubic meters 7.3.2. 5000-15000 cubic meters 7.3.3. 15000-30000 cubic meters 7.3.4. Above 30000 cubic meters 7.4. Europe Storage Tank Market Size and Forecast, by Application (2022-2029) 7.4.1. Storage of Portable Water 7.4.2. Rain Water Harvesting 7.4.3. Water Storage for Firefighting 7.4.4. Others 7.5. Europe Storage Tank Market Size and Forecast, by End-User (2022-2029) 7.5.1. Oil and Gas 7.5.2. Water and Wastewater 7.5.3. Food and Beverage 7.5.4. Pharmaceuticals 7.5.5. Agriculture 7.5.6. Others 7.6. Europe Storage Tank Market Size and Forecast, by Country (2022-2029) 7.6.1. UK 7.6.2. France 7.6.3. Germany 7.6.4. Italy 7.6.5. Spain 7.6.6. Sweden 7.6.7. Austria 7.6.8. Rest of Europe 8. Asia Pacific Storage Tank Market Size and Forecast by Segments (by Value USD and Volume Units ) 8.1. Asia Pacific Storage Tank Market Size and Forecast, by Material Type (2022-2029) 8.1.1. Steel Storage Tanks 8.1.2. Concrete Storage Tanks 8.1.3. Fiberglass Reinforced Plastic (FRP) Storage Tanks 8.1.4. Polyethylene Storage Tanks 8.1.5. Others 8.2. Asia Pacific Storage Tank Market Size and Forecast, by Product Type (2022-2029) 8.2.1. Aboveground Storage Tanks 8.2.2. Underground Storage Tanks 8.3. Asia Pacific Storage Tank Market Size and Forecast, by Storage Capacity (2022-2029) 8.3.1. Less than 5000 cubic meters 8.3.2. 5000-15000 cubic meters 8.3.3. 15000-30000 cubic meters 8.3.4. Above 30000 cubic meters 8.4. Asia Pacific Storage Tank Market Size and Forecast, by Application (2022-2029) 8.4.1. Storage of Portable Water 8.4.2. Rain Water Harvesting 8.4.3. Water Storage for Firefighting 8.4.4. Others 8.5. Asia Pacific Storage Tank Market Size and Forecast, by End-User (2022-2029) 8.5.1. Oil and Gas 8.5.2. Water and Wastewater 8.5.3. Food and Beverage 8.5.4. Pharmaceuticals 8.5.5. Agriculture 8.5.6. Others 8.6. Asia Pacific Storage Tank Market Size and Forecast, by Country (2022-2029) 8.6.1. China 8.6.2. S Korea 8.6.3. Japan 8.6.4. India 8.6.5. Australia 8.6.6. Indonesia 8.6.7. Malaysia 8.6.8. Vietnam 8.6.9. Taiwan 8.6.10. Bangladesh 8.6.11. Pakistan 8.6.12. Rest of Asia Pacific 9. Middle East and Africa Storage Tank Market Size and Forecast by Segments (by Value USD and Volume Units ) 9.1. Middle East and Africa Storage Tank Market Size and Forecast, by Material Type (2022-2029) 9.1.1. Steel Storage Tanks 9.1.2. Concrete Storage Tanks 9.1.3. Fiberglass Reinforced Plastic (FRP) Storage Tanks 9.1.4. Polyethylene Storage Tanks 9.1.5. Others 9.2. Middle East and Africa Storage Tank Market Size and Forecast, by Product Type (2022-2029) 9.2.1. Aboveground Storage Tanks 9.2.2. Underground Storage Tanks 9.3. Middle East and Africa Storage Tank Market Size and Forecast, by Storage Capacity (2022-2029) 9.3.1. Less than 5000 cubic meters 9.3.2. 5000-15000 cubic meters 9.3.3. 15000-30000 cubic meters 9.3.4. Above 30000 cubic meters 9.4. Middle East and Africa Storage Tank Market Size and Forecast, by Application (2022-2029) 9.4.1. Storage of Portable Water 9.4.2. Rain Water Harvesting 9.4.3. Water Storage for Firefighting 9.4.4. Others 9.5. Middle East and Africa Storage Tank Market Size and Forecast, by End-User (2022-2029) 9.5.1. Oil and Gas 9.5.2. Water and Wastewater 9.5.3. Food and Beverage 9.5.4. Pharmaceuticals 9.5.5. Agriculture 9.5.6. Others 9.6. Middle East and Africa Storage Tank Market Size and Forecast, by Country (2022-2029) 9.6.1. South Africa 9.6.2. GCC 9.6.3. Egypt 9.6.4. Nigeria 9.6.5. Rest of ME&A 10. South America Storage Tank Market Size and Forecast by Segments (by Value USD and Volume Units ) 10.1. South America Storage Tank Market Size and Forecast, by Material Type (2022-2029) 10.1.1. Steel Storage Tanks 10.1.2. Concrete Storage Tanks 10.1.3. Fiberglass Reinforced Plastic (FRP) Storage Tanks 10.1.4. Polyethylene Storage Tanks 10.1.5. Others 10.2. South America Storage Tank Market Size and Forecast, by Product Type (2022-2029) 10.2.1. Aboveground Storage Tanks 10.2.2. Underground Storage Tanks 10.3. South America Storage Tank Market Size and Forecast, by Storage Capacity (2022-2029) 10.3.1. Less than 5000 cubic meters 10.3.2. 5000-15000 cubic meters 10.3.3. 15000-30000 cubic meters 10.3.4. Above 30000 cubic meters 10.4. South America Storage Tank Market Size and Forecast, by Application (2022-2029) 10.4.1. Storage of Portable Water 10.4.2. Rain Water Harvesting 10.4.3. Water Storage for Firefighting 10.4.4. Others 10.5. South America Storage Tank Market Size and Forecast, by End-User (2022-2029) 10.5.1. Oil and Gas 10.5.2. Water and Wastewater 10.5.3. Food and Beverage 10.5.4. Pharmaceuticals 10.5.5. Agriculture 10.5.6. Others 10.6. South America Storage Tank Market Size and Forecast, by Country (2022-2029) 10.6.1. Brazil 10.6.2. Argentina 10.6.3. Rest of South America 11. Company Profile: Key players 11.1. Sintex Industries Ltd 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Balmoral Tanks Ltd, DN Tanks 11.3. CST Industries, Inc. 11.4. Emiliana Serbatoi S.r.l. 11.5. Caldwell Tanks 11.6. Sintex Industries Ltd 11.7. McDermott International Inc. 11.8. Containment Solutions, Inc. 11.9. Carbery Plastics Limited 11.10. Nova Plastic Industries L.L.C 11.11. Fox Tank Company 11.12. Highland Tank and Manufacturing Company Inc 11.13. Ishii Iron Works Co. Ltd. 11.14. MERKRO Sp. z o.o 11.15. Pfaudler 11.16. Toyo Knetsu k.K. 11.17. Snyder Industries iNc 11.18. Caldwell tanks 11.19. Tank Connection 11.20. DN tank 11.21. Fiber Technology Corporation Ins. 12. Key Findings 13. Industry Recommendation