Global Staple Gun Market size was valued at USD 1.54 Billion in 2024 and the total Staple Gun Market revenue is expected to grow at a CAGR of 3.13% from 2025 to 2032, reaching nearly USD 1.97 Billion.Staple Gun Market Overview:

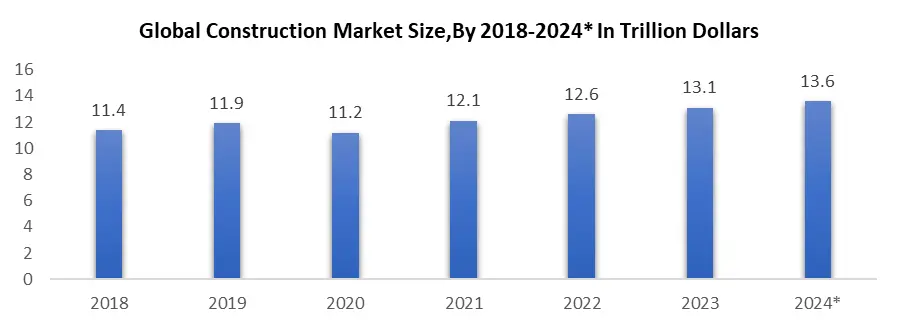

The staple gun market is projected to experience substantial growth in the coming years. Packaging has become increasingly integral to a product's lifecycle, serving to safeguard it from various risks such as leaks, contamination, and damage during transportation, usage, and storage. Manufacturers of sensitive products now prioritize packaging as it ensures the utmost safety and protection throughout the entire lifecycle of their goods. Sensitive products require sturdy packaging materials such as wood and plastic. Stapling these materials has posed significant challenges for the packaging industry over the past few decades. The development of staple guns has greatly simplified packaging operations. Staple guns are primarily used to drive robust metal staples into wood, plastic, or other hard surfaces. They are also known as trigger trackers and find applications in insulation, carpeting, wiring, roofing, house wrap, upholstery, and crafting. These tools are efficient and contribute to extending the shelf life of packaged goods. The increasing demand from the packaging sector is expected to drive staple gun market growth in the coming years. The increasing need for robust corrugated packaging is expected to bolster staple gun market growth, aligning with the expansion of the packaging industry. Furthermore, staple guns are gaining popularity among moving and packing companies due to their ease of use and efficiency, which is likely to further propel market growth in the foreseeable future. Recently, there has been a noticeable shift in customer preference from traditional hand tools to power tools due to factors such as enhanced durability, precision, performance, and convenience. Staple guns are gaining traction in construction applications because of their ease of use and portable nature. The rise in popularity of DIY projects has also driven demand from Furniture users staple gun market is responding to customer needs by incorporating additional safety features into staple guns to cater to non-professional users. Technological advancements are also playing a crucial role in market growth, with companies introducing improved products to enhance manufacturing efficiency. Staple guns have some limitations which cause constraints in staple gun market growth. Staple guns are unsuitable for soft and thin surfaces such as paper cartoons, which could impede market growth in the coming years. The staple gun market is highly fragmented with numerous regional and local players. These manufacturers typically offer staple guns at lower prices compared to global players, leading to intense price competition in recent years. It is anticipated that major multinational companies will acquire smaller regional and local players during the forecast period.To know about the Research Methodology :- Request Free Sample Report

Staple Gun Market Dynamics:

Drivers: Growing emphasis on sustainability

The staple gun market is increasingly focusing on sustainability in response to global environmental priorities. Manufacturers are adopting eco-friendly practices by using materials like recycled plastics in staple gun production, thereby reducing their environmental footprint. Efforts to minimize packaging waste and promote the use of sustainable packaging materials further highlight the industry's commitment to sustainability. These initiatives resonate well with consumers who prioritize environmentally friendly products. As sustainability becomes a critical factor in consumer choices, staple gun manufacturers are innovating not only in terms of functionality but also in reducing the ecological impact of their products. This shift towards sustainability demonstrates the industry's proactive response to environmental concerns and enhances its position in a market where responsible consumption is becoming increasingly important. Advancements in Ergonomics and Technology Development: The staple gun market is experiencing significant evolution propelled by innovations in ergonomic design and technology. Manufacturers are prioritizing user experience by integrating ergonomic features that minimize fatigue during prolonged use. Innovations such as ergonomically designed handles, adjustable depth settings, and improved weight distribution enhance comfort and precision for users. Furthermore, advancements in technology have resulted in staple guns with smoother and more efficient mechanisms, boosting productivity and achieving superior outcomes. These advancements address the diverse demands of professionals in sectors like construction, woodworking, and packaging, where precision and ease of operation are critical, and thereby stimulating market expansion. Rise of E-commerce Leading To Growth in Staple Gun Market: The growth of B2B e-commerce marketplaces is significantly influencing how buyers and sellers engage with third-party websites to purchase and sell staple gun tools. Factors such as bulk discounts, transparent pricing, and the ability to compare products easily across various parameters are expected to drive market expansion in the coming years. These e-commerce platforms play a crucial role in facilitating connections between buyers and sellers across the B2B value chain, offering new sales channels to accommodate a wider range of products that meet evolving buyer needs. The increasing presence of sellers on major platforms like Amazon.com and IndiaMART further supports staple gun market growth. E-commerce channels are poised to meet the rising demand for staple guns, leveraging benefits such as discounts on bulk orders to attract buyers seeking power tools. Traditionally, staple gun tools have been sold through distributors, direct sales representatives, and physical stores. Many B2B customers maintain long-standing relationships with manufacturers' sales representatives, preferring these direct channels. This strong preference for conventional sales methods could pose challenges to the growth of B2B e-commerce marketplaces in the staple gun market. Any reluctance among buyers to adopt alternative procurement channels may impede the anticipated growth of these e-commerce platforms in the forecast period. Emergence of DIY Culture: The staple gun market is experiencing significant growth due to the increasing popularity of DIY projects and home improvement endeavors. More Furnitures are taking on various projects to enhance their living spaces or pursue creative activities, driving up the demand for versatile tools like staple guns. These tools are essential for securely fastening materials such as fabrics, wood, and wires, making them indispensable for tasks ranging from upholstery to crafts. The availability of online tutorials and guides has empowered people to tackle projects that were once considered challenging. This trend has not only expanded the staple gun market but also broadened its user base beyond professional craftsmen to include enthusiasts and amateurs seeking efficient solutions for their projects. With the continued thriving of the DIY culture, the staple gun market is expected to continue growing.Challenges:

Market fragmentation and unsuitability with paper and cardboard: Staple guns are made in a way such that they can penetrate hard surfaces such as thin metal sheets, wood, metal frames, etc. The use of staple guns on thin paper and cardboard damages the material and overall packaging of the products. This may hamper the growth of the staple gun market and will prevent it from getting into a huge revenue market of paper and cardboard packaging. Market fragmentation is a huge challenge to mitigate for larger players in the market. Local players provide the staple guns at a cheaper price which creates intense price sensitivity in the market hampering the market share of major players. This causes a risk of accidents due to cheap quality materials used by local players. Shortly major players are expected to acquire the smaller players to retain their market share.Staple Gun Market Segment Analysis:

By Product Type: Based on their power supply, the global staple gun market can be subcategorized further into Manual staple Guns, Electric Staple Guns, and Pneumatic Staple Guns. Manual staple guns dominate the market with over 60 % of the market share. This shear dominance can be linked to Cost-Effectiveness, Ease of Use, and Versatility. Electric staple guns hold the second position.it is easy to use, faster and reduces worker fatigue. Pneumatic staple guns have limited use as it is being used for heavy-duty industrial work. By Distribution Channel: The staple gun market is heavily dependent on Hypermarkets & Supermarkets with over half of the distribution channel relying on it. These stores offer a variety of staple guns, catering to both DIY enthusiasts and professionals. Customers can see and handle the products before purchasing, which is advantageous for tools like staple guns. Often attract bulk buyers or those looking for competitive pricing on staple guns. Specialty Stores have another major chunk of the staple gun market.Specialty stores provide knowledgeable staff who can offer advice and guidance on selecting the right staple gun. They may carry specialized or higher-end models that appeal to professional users. Some customers prefer the personalized service and after-sales support offered by specialty stores. Online stores are gaining traction and growing at the highest pace. Online stores are expected to gain major market share in upcoming years. By Application: The market share distribution for staple guns across different applications typically merged into Construction, Furniture, and Upholstery Projects. The construction sector dominates the market due to Heavy-Duty Usage. Construction sites often require staple guns that can handle tough materials like wood, insulation, and fabrics. Guns can be used for a variety of tasks such as attaching insulation, securing roofing materials, and general construction purposes. Further furniture and upholstery projects have major usage of staple guns due to fine detailing, secure usage, and efficiency of work.

Staple Gun Market by Regional Analysis:

Regionally, the market is divided into North America, Europe, Asia Pacific, Latin America, and the Middle East and Africa. Asia Pacific is leading the market with almost 30-35% of total staple Gun market share. This growth in recent years is linked with massive infrastructure development in courtiers like China and India. Makita, Stanley, and Hitachi dominate the market. North America holds the second position with 20-25% of the staple gun market. Mature market with a strong emphasis on quality and safety standards. High demand in residential remodeling, commercial construction, and DIY sectors, etc. are characteristics of the market.Europe is a unique market with a focus on sustainable construction practices and historical renovations, Strong demand for residential refurbishments, infrastructure projects, industrial applications, etc. The Middle East region is showing high growth in heavy construction work in regions such as UAE and Qatar. This has led to an increase in demand for staple guns. Although it contributes up to 5% of the total market share, it is expected to increase in the future.

Staple Gun Market Scope: Inquiry Before Buying

Staple Gun Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: US $ 1.54 Bn. Forecast Period 2025 to 2032 CAGR: 3.13% Market Size in 2032: US $ 1.97 Bn. Segments Covered: by Product Type Manual staple Guns Electric Staple Guns Pneumatic Staple Guns by Distribution Channel Hypermarkets & Supermarkets Specialty Store Online Others by Application Construction Furniture Upholstery Projects Other by End-User Professional Individual Staple Gun Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Staple Gun Market, Key Players are:

1. Miles 2. Acme 3. Staplex 4. Makita 5. Rapid 6. Stanley 7. Bostitch 8. Rexel 9. RS Pro 10. Arrow 11. Steinel 12. Tac Wise 13. Heavy Duty 14. Dorking 15. Dewalt 16. Senco 17. Spotnails 18. Black & Decker 19. Hitachi 20. Tolsen 21. Kyocera Senco Industrial ToolsFAQs:

1. What are the growth drivers for the Staple Gun Market? Ans. Growing emphasis on sustainability, Advancements in Ergonomics and Technology Development, Rise of E-commerce Leading To Growth in the Staple Gun Market, and the Emergence of DIY Culture are expected to be the major drivers for the market. 2. What is the major restraint for the Staple Gun Market growth? Ans. Regulatory Changes, market fragmentation, and unsuitability with paper and cardboard are expected to be the major restraining factors for the Staple Gun market growth. 3. Which Region is expected to lead the global Staple Gun Market during the forecast period? Ans. Asia Pacific is expected to lead the global Staple Gun Market during the forecast period. 4. What is the projected Global Staple Gun Market size and growth rate of the Staple Gun Market? Ans. The Staple Gun Market size was valued at USD 1.54 Billion in 2024 and the total Annual revenue is expected to grow at a CAGR of 3.13% from 2025 to 2032, reaching nearly USD 1.97 Billion. 5. Who are the key players in the market ? Ans. Miles, Acme, Staples, Makita, Rapid, Stanley, Bostitch, Rexel, RS Pro, Arrow etc are major players in the market.

1. Staple Gun Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Staple Gun Market: Dynamics 2.1. Staple Gun Market Trends by Region 2.1.1. North America Staple Gun Market Trends 2.1.2. Europe Staple Gun Market Trends 2.1.3. Asia Pacific Staple Gun Market Trends 2.1.4. Middle East and Africa Staple Gun Market Trends 2.1.5. South America Staple Gun Market Trends 2.2. Staple Gun Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Staple Gun Market Drivers 2.2.1.2. North America Staple Gun Market Restraints 2.2.1.3. North America Staple Gun Market Opportunities 2.2.1.4. North America Staple Gun Market Challenges 2.2.2. Europe 2.2.2.1. Europe Staple Gun Market Drivers 2.2.2.2. Europe Staple Gun Market Restraints 2.2.2.3. Europe Staple Gun Market Opportunities 2.2.2.4. Europe Staple Gun Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Staple Gun Market Drivers 2.2.3.2. Asia Pacific Staple Gun Market Restraints 2.2.3.3. Asia Pacific Staple Gun Market Opportunities 2.2.3.4. Asia Pacific Staple Gun Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Staple Gun Market Drivers 2.2.4.2. Middle East and Africa Staple Gun Market Restraints 2.2.4.3. Middle East and Africa Staple Gun Market Opportunities 2.2.4.4. Middle East and Africa Staple Gun Market Challenges 2.2.5. South America 2.2.5.1. South America Staple Gun Market Drivers 2.2.5.2. South America Staple Gun Market Restraints 2.2.5.3. South America Staple Gun Market Opportunities 2.2.5.4. South America Staple Gun Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Staple Gun Industry 2.8. Analysis of Government Schemes and Initiatives For Staple Gun Industry 2.9. Staple Gun Market Trade Analysis 2.10. The Global Pandemic Impact on Staple Gun Market 3. Staple Gun Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2024-2032 3.1. Staple Gun Market Size and Forecast, by Product Type (2024-2032) 3.1.1. Manual staple Guns 3.1.2. Electric Staple Guns 3.1.3. Pneumatic Staple Guns 3.2. Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 3.2.1. Hypermarkets & Supermarkets 3.2.2. Specialty Store 3.2.3. Online 3.2.4. Others 3.3. Staple Gun Market Size and Forecast, by Application (2024-2032) 3.3.1. Construction 3.3.2. Furniture 3.3.3. Upholstery Projects 3.3.4. Other 3.4. Staple Gun Market Size and Forecast, by End User (2024-2032) 3.4.1. Professional 3.4.2. Individual 3.5. Staple Gun Market Size and Forecast, by Region (2024-2032) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Staple Gun Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 4.1. North America Staple Gun Market Size and Forecast, by Product Type (2024-2032) 4.1.1. Manual staple Guns 4.1.2. Electric Staple Guns 4.1.3. Pneumatic Staple Guns 4.2. North America Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 4.2.1. Hypermarkets & Supermarkets 4.2.2. Specialty Store 4.2.3. Online 4.2.4. Others 4.3. North America Staple Gun Market Size and Forecast, by Application (2024-2032) 4.3.1. Construction 4.3.2. Furniture 4.3.3. Upholstery Projects 4.3.4. Other 4.4. North America Staple Gun Market Size and Forecast, by End User (2024-2032) 4.4.1. Professional 4.4.2. Individual 4.5. North America Staple Gun Market Size and Forecast, by Country (2024-2032) 4.5.1. United States 4.5.1.1. United States Staple Gun Market Size and Forecast, by Product Type (2024-2032) 4.5.1.1.1. Manual staple Guns 4.5.1.1.2. Electric Staple Guns 4.5.1.1.3. Pneumatic Staple Guns 4.5.1.2. United States Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 4.5.1.2.1. Hypermarkets & Supermarkets 4.5.1.2.2. Specialty Store 4.5.1.2.3. Online 4.5.1.2.4. Others 4.5.1.3. United States Staple Gun Market Size and Forecast, by Application (2024-2032) 4.5.1.3.1. Construction 4.5.1.3.2. Furniture 4.5.1.3.3. Upholstery Projects 4.5.1.3.4. Other 4.5.1.4. United States Staple Gun Market Size and Forecast, by End User (2024-2032) 4.5.1.4.1. Professional 4.5.1.4.2. Individual 4.5.2. Canada 4.5.2.1. Canada Staple Gun Market Size and Forecast, by Product Type (2024-2032) 4.5.2.1.1. Manual staple Guns 4.5.2.1.2. Electric Staple Guns 4.5.2.1.3. Pneumatic Staple Guns 4.5.2.2. Canada Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 4.5.2.2.1. Hypermarkets & Supermarkets 4.5.2.2.2. Specialty Store 4.5.2.2.3. Online 4.5.2.2.4. Others 4.5.2.3. Canada Staple Gun Market Size and Forecast, by Application (2024-2032) 4.5.2.3.1. Construction 4.5.2.3.2. Furniture 4.5.2.3.3. Upholstery Projects 4.5.2.3.4. Other 4.5.2.4. Canada Staple Gun Market Size and Forecast, by End User (2024-2032) 4.5.2.4.1. Professional 4.5.2.4.2. Individual 4.5.3. Mexico 4.5.3.1. Mexico Staple Gun Market Size and Forecast, by Product Type (2024-2032) 4.5.3.1.1. Manual staple Guns 4.5.3.1.2. Electric Staple Guns 4.5.3.1.3. Pneumatic Staple Guns 4.5.3.2. Mexico Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 4.5.3.2.1. Hypermarkets & Supermarkets 4.5.3.2.2. Specialty Store 4.5.3.2.3. Online 4.5.3.2.4. Others 4.5.3.3. Mexico Staple Gun Market Size and Forecast, by Application (2024-2032) 4.5.3.3.1. Construction 4.5.3.3.2. Furniture 4.5.3.3.3. Upholstery Projects 4.5.3.3.4. Other 4.5.3.4. Mexico Staple Gun Market Size and Forecast, by End User (2024-2032) 4.5.3.4.1. Professional 4.5.3.4.2. Individual 5. Europe Staple Gun Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 5.1. Europe Staple Gun Market Size and Forecast, by Product Type (2024-2032) 5.2. Europe Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 5.3. Europe Staple Gun Market Size and Forecast, by Application (2024-2032) 5.4. Europe Staple Gun Market Size and Forecast, by End User (2024-2032) 5.5. Europe Staple Gun Market Size and Forecast, by Country (2024-2032) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Staple Gun Market Size and Forecast, by Product Type (2024-2032) 5.5.1.2. United Kingdom Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.1.3. United Kingdom Staple Gun Market Size and Forecast, by Application (2024-2032) 5.5.1.4. United Kingdom Staple Gun Market Size and Forecast, by End User (2024-2032) 5.5.2. France 5.5.2.1. France Staple Gun Market Size and Forecast, by Product Type (2024-2032) 5.5.2.2. France Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.2.3. France Staple Gun Market Size and Forecast, by Application (2024-2032) 5.5.2.4. France Staple Gun Market Size and Forecast, by End User (2024-2032) 5.5.3. Germany 5.5.3.1. Germany Staple Gun Market Size and Forecast, by Product Type (2024-2032) 5.5.3.2. Germany Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.3.3. Germany Staple Gun Market Size and Forecast, by Application (2024-2032) 5.5.3.4. Germany Staple Gun Market Size and Forecast, by End User (2024-2032) 5.5.4. Italy 5.5.4.1. Italy Staple Gun Market Size and Forecast, by Product Type (2024-2032) 5.5.4.2. Italy Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.4.3. Italy Staple Gun Market Size and Forecast, by Application (2024-2032) 5.5.4.4. Italy Staple Gun Market Size and Forecast, by End User (2024-2032) 5.5.5. Spain 5.5.5.1. Spain Staple Gun Market Size and Forecast, by Product Type (2024-2032) 5.5.5.2. Spain Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.5.3. Spain Staple Gun Market Size and Forecast, by Application (2024-2032) 5.5.5.4. Spain Staple Gun Market Size and Forecast, by End User (2024-2032) 5.5.6. Sweden 5.5.6.1. Sweden Staple Gun Market Size and Forecast, by Product Type (2024-2032) 5.5.6.2. Sweden Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.6.3. Sweden Staple Gun Market Size and Forecast, by Application (2024-2032) 5.5.6.4. Sweden Staple Gun Market Size and Forecast, by End User (2024-2032) 5.5.7. Austria 5.5.7.1. Austria Staple Gun Market Size and Forecast, by Product Type (2024-2032) 5.5.7.2. Austria Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.7.3. Austria Staple Gun Market Size and Forecast, by Application (2024-2032) 5.5.7.4. Austria Staple Gun Market Size and Forecast, by End User (2024-2032) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Staple Gun Market Size and Forecast, by Product Type (2024-2032) 5.5.8.2. Rest of Europe Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 5.5.8.3. Rest of Europe Staple Gun Market Size and Forecast, by Application (2024-2032) 5.5.8.4. Rest of Europe Staple Gun Market Size and Forecast, by End User (2024-2032) 6. Asia Pacific Staple Gun Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 6.1. Asia Pacific Staple Gun Market Size and Forecast, by Product Type (2024-2032) 6.2. Asia Pacific Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 6.3. Asia Pacific Staple Gun Market Size and Forecast, by Application (2024-2032) 6.4. Asia Pacific Staple Gun Market Size and Forecast, by End User (2024-2032) 6.5. Asia Pacific Staple Gun Market Size and Forecast, by Country (2024-2032) 6.5.1. China 6.5.1.1. China Staple Gun Market Size and Forecast, by Product Type (2024-2032) 6.5.1.2. China Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.1.3. China Staple Gun Market Size and Forecast, by Application (2024-2032) 6.5.1.4. China Staple Gun Market Size and Forecast, by End User (2024-2032) 6.5.2. S Korea 6.5.2.1. S Korea Staple Gun Market Size and Forecast, by Product Type (2024-2032) 6.5.2.2. S Korea Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.2.3. S Korea Staple Gun Market Size and Forecast, by Application (2024-2032) 6.5.2.4. S Korea Staple Gun Market Size and Forecast, by End User (2024-2032) 6.5.3. Japan 6.5.3.1. Japan Staple Gun Market Size and Forecast, by Product Type (2024-2032) 6.5.3.2. Japan Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.3.3. Japan Staple Gun Market Size and Forecast, by Application (2024-2032) 6.5.3.4. Japan Staple Gun Market Size and Forecast, by End User (2024-2032) 6.5.4. India 6.5.4.1. India Staple Gun Market Size and Forecast, by Product Type (2024-2032) 6.5.4.2. India Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.4.3. India Staple Gun Market Size and Forecast, by Application (2024-2032) 6.5.4.4. India Staple Gun Market Size and Forecast, by End User (2024-2032) 6.5.5. Australia 6.5.5.1. Australia Staple Gun Market Size and Forecast, by Product Type (2024-2032) 6.5.5.2. Australia Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.5.3. Australia Staple Gun Market Size and Forecast, by Application (2024-2032) 6.5.5.4. Australia Staple Gun Market Size and Forecast, by End User (2024-2032) 6.5.6. Indonesia 6.5.6.1. Indonesia Staple Gun Market Size and Forecast, by Product Type (2024-2032) 6.5.6.2. Indonesia Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.6.3. Indonesia Staple Gun Market Size and Forecast, by Application (2024-2032) 6.5.6.4. Indonesia Staple Gun Market Size and Forecast, by End User (2024-2032) 6.5.7. Malaysia 6.5.7.1. Malaysia Staple Gun Market Size and Forecast, by Product Type (2024-2032) 6.5.7.2. Malaysia Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.7.3. Malaysia Staple Gun Market Size and Forecast, by Application (2024-2032) 6.5.7.4. Malaysia Staple Gun Market Size and Forecast, by End User (2024-2032) 6.5.8. Vietnam 6.5.8.1. Vietnam Staple Gun Market Size and Forecast, by Product Type (2024-2032) 6.5.8.2. Vietnam Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.8.3. Vietnam Staple Gun Market Size and Forecast, by Application (2024-2032) 6.5.8.4. Vietnam Staple Gun Market Size and Forecast, by End User (2024-2032) 6.5.9. Taiwan 6.5.9.1. Taiwan Staple Gun Market Size and Forecast, by Product Type (2024-2032) 6.5.9.2. Taiwan Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.9.3. Taiwan Staple Gun Market Size and Forecast, by Application (2024-2032) 6.5.9.4. Taiwan Staple Gun Market Size and Forecast, by End User (2024-2032) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Staple Gun Market Size and Forecast, by Product Type (2024-2032) 6.5.10.2. Rest of Asia Pacific Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 6.5.10.3. Rest of Asia Pacific Staple Gun Market Size and Forecast, by Application (2024-2032) 6.5.10.4. Rest of Asia Pacific Staple Gun Market Size and Forecast, by End User (2024-2032) 7. Middle East and Africa Staple Gun Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 7.1. Middle East and Africa Staple Gun Market Size and Forecast, by Product Type (2024-2032) 7.2. Middle East and Africa Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 7.3. Middle East and Africa Staple Gun Market Size and Forecast, by Application (2024-2032) 7.4. Middle East and Africa Staple Gun Market Size and Forecast, by End User (2024-2032) 7.5. Middle East and Africa Staple Gun Market Size and Forecast, by Country (2024-2032) 7.5.1. South Africa 7.5.1.1. South Africa Staple Gun Market Size and Forecast, by Product Type (2024-2032) 7.5.1.2. South Africa Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.1.3. South Africa Staple Gun Market Size and Forecast, by Application (2024-2032) 7.5.1.4. South Africa Staple Gun Market Size and Forecast, by End User (2024-2032) 7.5.2. GCC 7.5.2.1. GCC Staple Gun Market Size and Forecast, by Product Type (2024-2032) 7.5.2.2. GCC Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.2.3. GCC Staple Gun Market Size and Forecast, by Application (2024-2032) 7.5.2.4. GCC Staple Gun Market Size and Forecast, by End User (2024-2032) 7.5.3. Nigeria 7.5.3.1. Nigeria Staple Gun Market Size and Forecast, by Product Type (2024-2032) 7.5.3.2. Nigeria Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.3.3. Nigeria Staple Gun Market Size and Forecast, by Application (2024-2032) 7.5.3.4. Nigeria Staple Gun Market Size and Forecast, by End User (2024-2032) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Staple Gun Market Size and Forecast, by Product Type (2024-2032) 7.5.4.2. Rest of ME&A Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 7.5.4.3. Rest of ME&A Staple Gun Market Size and Forecast, by Application (2024-2032) 7.5.4.4. Rest of ME&A Staple Gun Market Size and Forecast, by End User (2024-2032) 8. South America Staple Gun Market Size and Forecast by Segmentation (by Value in USD Million) 2024-2032 8.1. South America Staple Gun Market Size and Forecast, by Product Type (2024-2032) 8.2. South America Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 8.3. South America Staple Gun Market Size and Forecast, by Application(2024-2032) 8.4. South America Staple Gun Market Size and Forecast, by End User (2024-2032) 8.5. South America Staple Gun Market Size and Forecast, by Country (2024-2032) 8.5.1. Brazil 8.5.1.1. Brazil Staple Gun Market Size and Forecast, by Product Type (2024-2032) 8.5.1.2. Brazil Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 8.5.1.3. Brazil Staple Gun Market Size and Forecast, by Application (2024-2032) 8.5.1.4. Brazil Staple Gun Market Size and Forecast, by End User (2024-2032) 8.5.2. Argentina 8.5.2.1. Argentina Staple Gun Market Size and Forecast, by Product Type (2024-2032) 8.5.2.2. Argentina Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 8.5.2.3. Argentina Staple Gun Market Size and Forecast, by Application (2024-2032) 8.5.2.4. Argentina Staple Gun Market Size and Forecast, by End User (2024-2032) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Staple Gun Market Size and Forecast, by Product Type (2024-2032) 8.5.3.2. Rest Of South America Staple Gun Market Size and Forecast, by Distribution Channel (2024-2032) 8.5.3.3. Rest Of South America Staple Gun Market Size and Forecast, by Application (2024-2032) 8.5.3.4. Rest Of South America Staple Gun Market Size and Forecast, by End User (2024-2032) 9. Global Staple Gun Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2024) 9.3.5. Company Locations 9.4. Leading Staple Gun Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Miles 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Acme 10.3. Staplex 10.4. Makita 10.5. Rapid 10.6. Stanley 10.7. Bostitch 10.8. Rexel 10.9. RS Pro 10.10. Arrow 10.11. Steinel 10.12. Tac Wise 10.13. Heavy Duty 10.14. Dorking 10.15. Dewalt 10.16. Senco 10.17. Spotnails 10.18. Black & Decker 10.19. Hitachi 10.20. Tolsen 10.21. Kyocera Senco Industrial Tools 11. Key Findings 12. Industry Recommendations 13. Staple Gun Market: Research Methodology 14. Terms and Glossary