The Space Tourism Market size was valued at USD 698.3 Million in 2022 and the total Global Space Tourism Market revenue is expected to grow at a CAGR of 41.2%from 2023 to 2029, reaching nearly USD 11033.66 Million. Space tourism is human space travel that tends to provide tourists with the ability to become astronauts and experience space travel. There are several kinds of space tourism including orbital tourism, suborbital tourism, and lunar tourism. Space tourism is considered expensive so now only the people with high expenditure capacity can afford it. In September 2022 axiom space announce a trip of 55 million, also blue origin announces ticket prices of 200,000 to 250,000. Commercial space tourism operators are offering sub-orbital tourism to tourists as a means of delivering the experience of weightlessness to tourists who are willing to pay premium fees. The ability to see the earth from outer space and to satisfy the curiosity of the consumer is influencing the demand for the market. The experience of travelling at high speed and having unusual experiences is the driving factor for the growth of the market in the next five years. The major players operating in the global space tourism market are Blue Origin, Virgin Galactic, SpaceX, Space Adventures Inc., EADS Astrium, Armadillo Aerospace, Excalibur Almaz, Space Island Group, Boeing, Zero 2 Infinity, and Starchaser Industries, among others. Major companies are developing advanced technologies and launching new services to stay competitive in the market. Other competitive strategies include mergers & acquisitions and new service developments. Investors have recently focused on space ventures in low earth orbit, but there is more interest is growing in lunar and beyond orbital regimes. A wide range of market space tourism market players is pursuing the mission in lunar and beyond orbits. They are highly focused and increasing investments in R&D for in-space transportation, robotics, infrastructure, communication and advanced technologies. The space tourism report covered the detailed analysis of space investments, R&D for space, the future of air mobility, and price trend analysis.To know about the Research Methodology :- Request Free Sample Report

Space Tourism Market Dynamics:

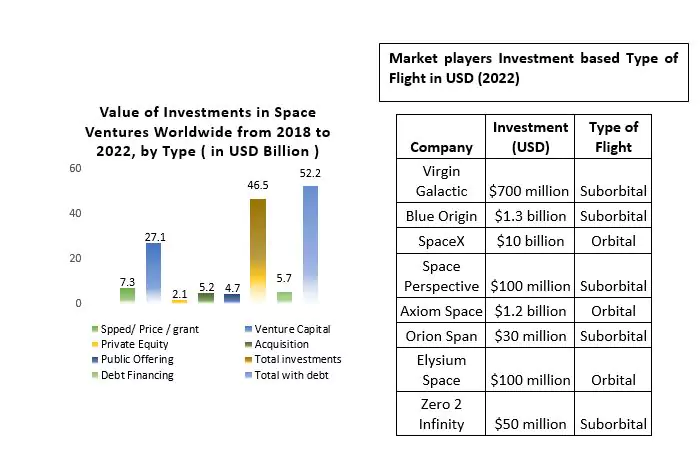

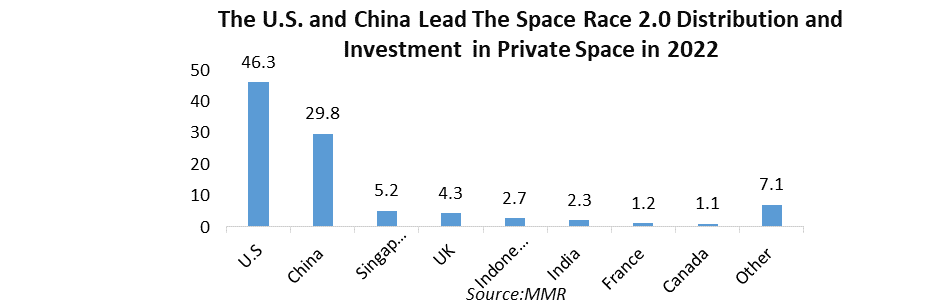

The Future of Space Tourism Prices Coming Down, Demand Going Up Many consumers dream of going to space and have travelled to space as astronauts. The government’s initiatives and funding agencies such as NASA, the European Space Agency and more are driving the demand for space truism during the forecast period. Increasing the popularity of space tourism the cost of spending something into space averaged between $6,000 to over $25,000 per kg of weight. NASA spent $28 billion to land astronauts on the moon up to $288 billion. Some factors will affect the cost of space spending like the size of the rocket, the cost of fuel and the amount of fuel needed. In addition, private companies have drastically changed the game. The increasing number of private space companies creates opportunities for civilians to book space trips. Price analysis of market players based on the type of flight in 2022The ticket price of space tourism is depending on the company that offers the type of flights in which the suborbital flight are less expensive compared to orbital flights. This is due to suborbital flight do not reach the same altitude same like orbital flight. These prices are not fixed as the space tourism industry grows, and as the cost of space travel decreases the price of the space tourism market is expected to come down during the forecast period. The space tourism price is still high, but is come down in the upcoming year this is a great advantage for space tourists, which drives the space tourism market. The industry is finding a way to reduce the cost of space travel in order to make space tours more affordable for a wide range of people, which is challenging for the pace tourism industry. Space Tourism Startups Rake in Billions of Dollars in Investment The space tourism market is rapidly growing due to the new start-ups’ leading the way. The start-ups have invested billions of dollars to develop new space tourism technology and services. Some of the most well-invested space tourism start-ups include Space Perspective, Blue Origin, Virgin Galactic, and SpaceX. These companies are developing orbital and suborbital space tourism flights as well as growing demand for space hotels and space tourism simulators. The space industry has experienced an increasing popularity of interest and investments as an emerging player entered the market. According to the MMR research for space capital, over USD 273.3 billion has been invested by different space tourism companies within the space industry indicating massive growth potential. In 2023, there are many interesting developments with many innovative NewSpace market players at the forefront of these advancements. The state of space companies is rapidly evolving in recent years, we have seen a surge in private investment in NewSpace companies driven by technological advancement and the growing commercial potential of space. This has increased the ecosystem of innovative space companies ranging from start-ups to established players contributing to the space industry in different ways. Space enterprises are focusing on the development of systems for satellite communication, earth observation and global positioning. The industry is expected to experience significant growth, expected to reach USD 1 trillion by 2040. The space tourism market has the potential to revolutionize the way team travel and explore the world. It could also open up new opportunities for scientific research and commercial development in the space industry.

Company Type of Flight Price (USD Mn) Virgin Galactic Suborbital $450,000 Blue Origin Suborbital $250,000 Space Perspective Suborbital $125,000 SpaceX Orbital $550,000

Space Tourism Market Segment Analysis

By Type Outlook: Based on type the market is segmented into orbital and suborbital type. Suborbital is expected to dominate the space tourism market during the forecast period. Suborbital space tourism offers short-time zero gravity and the earth view from space to its customers and the interesting packages that can offer the longest duration of zero gravity and the most attractive view from space to its tourist can be considered a better one than others. Most of the proposed operations of suborbital space tourism transportation involve a flight to above 80 km and less than 120 km and then taking off and landing at the same location. This operational location of the suborbital vehicle clearly determines the view of Earth from space that will be available to its passengers, which drives the space tourism market demand during the forecast period. The future operational locations or spaceports usually are current airports such as the airport at Curacao Island in the Caribbean or spaceport specially built at locations with financial interests such as Spaceport America in New Mexico or an airport that is going to be built, such as SpaceportSEA in Selangor, Malaysia. VTOL suborbital space tourism vehicle may not operate from a remote inefficient location even though the location is near an exotic viewing target, but such vehicles may operate from a luxury super yacht that can navigate to interesting locations around the world, and during the journey, the passengers can be qualified and prepared for the flight of their life. Such is an advantage and potential of VTOL suborbital space tourism vehicles, to drive the market demand.Suborbital tours are a stepping stone to orbital space tourism. As the technology for suborbital flights advances, it will become possible to offer extended and cheaper suborbital flights. This will make orbital space tourism easier to get to a wider range of people. Suborbital flights can be used to motivate people to learn more about space. The experience of seeing the Earth from space can be a life-changing event, and it can motivate people to pursue careers in science, engineering, and technology.

Space Tourism Market Regional Insights:

North America is expected to dominate the space tourism market during the forecast period. The market is growing due to the US government releasing a set of proposed rules for space tourism. These included screening techniques and training for extra situations, but not health requirements. Under current US law, any market player offering to launch paying passengers from American soil on a suborbital rocket must receive a license from the Federal Aviation Administration's Office of Commercial Space Transportation (FAA/AST). The licensing process focuses on public safety and the safety of property, and the details can be found in the Code of Federal Regulations, this regulation drives the market demand. The space tourism market is growing due to the International Space Station (ISS) being the largest modular space station in low Earth orbit. The development involves five space agencies: the United States' NASA, Russia's Roscosmos, Japan's JAXA, Europe's ESA, and Canada's CSA. Some market players in the U.S based space offer commercial futures in space beyond NASA contracts and satellite launches. This market player offers customers the opportunity to orbit Earth and experience the views and weightlessness of space travel. The Russian Orbital Segment (ROS) is operated by Russia, while the United States Orbital Segment (USOS) is run by the United States as well as other countries. The Russian segment includes six comfortable modules. The US segment includes seven habitable modules, whose support services are distributed 76.6% for NASA, 12.8% for JAXA, 8.3% for ESA and 2.3% for CSA. The length along the major axis of the pressurized sections is 218 ft (66 m), and the total habitable volume of these sections is 13,696 cu ft (387.8 m3).

Space Tourism Market Scope: Inquire before buying

Space Tourism Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 698.3 Million Forecast Period 2023 to 2029 CAGR: 41.2 % Market Size in 2029: USD 11033.66 Million Segments Covered: by Outlook Orbital Sub-Orbital Others by End-User Government Commercial Other Space Tourism Market by Region:

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Space Tourism Companies Analysis

1. SpaceX (United States) 2. Blue Origin (United States) 3. Virgin Galactic (United States) 4. Boeing (United States) 5. Axiom Space (United States) 6. Orbital Sciences Corporation (United States) 7. Space Adventures (United States) 8. Zero Gravity Corporation (United States) 9. XCOR Aerospace (United States) 10. Masten Space Systems (United States) 11. Rocket Lab (United States) 12. Stratolaunch Systems (United States) 13. Sierra Nevada Corporation (United States) 14. NanoRacks (United States 15. Bigelow Aerospace (United States) 16. Firefly Aerospace (United States) 17. Reaction Engines Ltd. (United Kingdom) 18. Ispace Inc. (Japan) 19. Spaceport America (United States) 20. Rocket Crafters Inc. (United States) FAQs: 1. What are the growth drivers for the Space Tourism Market? Ans. The growing popularity of sub orbital travel is to be the major driver for the Space Tourism Market. 2. What is the major restraint for the Space Tourism Market growth? Ans. Growing environmental negative impact are expected to be the major restraining factor for the Space Tourism Market growth. 3. Which Region is expected to lead the global Space Tourism Market during the forecast period? Ans. North America is expected to lead the global Space Tourism Market during the forecast period. 4. What is the projected Europe Space Tourism Market size & growth rate of the Space Tourism Market? Ans. The Space Tourism Market size was valued at USD 698.3 Million in 2022 and the total revenue is expected to grow at a CAGR of 41.2% from 2023 to 2029, reaching nearly USD 11033.66 Million. 5. What segments are covered in the Space Tourism Market report? Ans. The segments covered in the Space Tourism Market report are Type Outlook, End-User type, and Region.

1. Space Tourism Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Space Tourism Market: Dynamics 2.1. Space Tourism Market Trends by Region 2.1.1. North America Space Tourism Market Trends 2.1.2. Europe Space Tourism Market Trends 2.1.3. Asia Pacific Space Tourism Market Trends 2.1.4. Middle East and Africa Space Tourism Market Trends 2.1.5. South America Space Tourism Market Trends 2.2. Space Tourism Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Space Tourism Market Drivers 2.2.1.2. North America Space Tourism Market Restraints 2.2.1.3. North America Space Tourism Market Opportunities 2.2.1.4. North America Space Tourism Market Challenges 2.2.2. Europe 2.2.2.1. Europe Space Tourism Market Drivers 2.2.2.2. Europe Space Tourism Market Restraints 2.2.2.3. Europe Space Tourism Market Opportunities 2.2.2.4. Europe Space Tourism Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Space Tourism Market Drivers 2.2.3.2. Asia Pacific Space Tourism Market Restraints 2.2.3.3. Asia Pacific Space Tourism Market Opportunities 2.2.3.4. Asia Pacific Space Tourism Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Space Tourism Market Drivers 2.2.4.2. Middle East and Africa Space Tourism Market Restraints 2.2.4.3. Middle East and Africa Space Tourism Market Opportunities 2.2.4.4. Middle East and Africa Space Tourism Market Challenges 2.2.5. South America 2.2.5.1. South America Space Tourism Market Drivers 2.2.5.2. South America Space Tourism Market Restraints 2.2.5.3. South America Space Tourism Market Opportunities 2.2.5.4. South America Space Tourism Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Space Tourism Industry 2.8. Analysis of Government Schemes and Initiatives For Space Tourism Industry 2.9. Space Tourism Market Trade Analysis 2.10. The Global Pandemic Impact on Space Tourism Market 3. Space Tourism Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Space Tourism Market Size and Forecast, by Outlook (2022-2029) 3.1.1. Orbital 3.1.2. Sub-Orbital 3.1.3. Others 3.2. Space Tourism Market Size and Forecast, by End-User (2022-2029) 3.2.1. Government 3.2.2. Commercial 3.2.3. Other 3.3. Space Tourism Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Space Tourism Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Space Tourism Market Size and Forecast, by Outlook (2022-2029) 4.1.1. Orbital 4.1.2. Sub-Orbital 4.1.3. Others 4.2. North America Space Tourism Market Size and Forecast, by End-User (2022-2029) 4.2.1. Government 4.2.2. Commercial 4.2.3. Other 4.3. North America Space Tourism Market Size and Forecast, by Country (2022-2029) 4.3.1. United States 4.3.1.1. United States Space Tourism Market Size and Forecast, by Outlook (2022-2029) 4.3.1.1.1. Orbital 4.3.1.1.2. Sub-Orbital 4.3.1.1.3. Others 4.3.1.2. United States Space Tourism Market Size and Forecast, by End-User (2022-2029) 4.3.1.2.1. Government 4.3.1.2.2. Commercial 4.3.1.2.3. Other 4.3.2. Canada 4.3.2.1. Canada Space Tourism Market Size and Forecast, by Outlook (2022-2029) 4.3.2.1.1. Orbital 4.3.2.1.2. Sub-Orbital 4.3.2.1.3. Others 4.3.2.2. Canada Space Tourism Market Size and Forecast, by End-User (2022-2029) 4.3.2.2.1. Government 4.3.2.2.2. Commercial 4.3.2.2.3. Other 4.3.3. Mexico 4.3.3.1. Mexico Space Tourism Market Size and Forecast, by Outlook (2022-2029) 4.3.3.1.1. Orbital 4.3.3.1.2. Sub-Orbital 4.3.3.1.3. Others 4.3.3.2. Mexico Space Tourism Market Size and Forecast, by End-User (2022-2029) 4.3.3.2.1. Government 4.3.3.2.2. Commercial 4.3.3.2.3. Other 5. Europe Space Tourism Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Space Tourism Market Size and Forecast, by Outlook (2022-2029) 5.1. Europe Space Tourism Market Size and Forecast, by End-User (2022-2029) 5.3. Europe Space Tourism Market Size and Forecast, by Country (2022-2029) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Space Tourism Market Size and Forecast, by Outlook (2022-2029) 5.3.1.2. United Kingdom Space Tourism Market Size and Forecast, by End-User (2022-2029) 5.3.2. France 5.3.2.1. France Space Tourism Market Size and Forecast, by Outlook (2022-2029) 5.3.2.2. France Space Tourism Market Size and Forecast, by End-User (2022-2029) 5.3.3. Germany 5.3.3.1. Germany Space Tourism Market Size and Forecast, by Outlook (2022-2029) 5.3.3.2. Germany Space Tourism Market Size and Forecast, by End-User (2022-2029) 5.3.4. Italy 5.3.4.1. Italy Space Tourism Market Size and Forecast, by Outlook (2022-2029) 5.3.4.2. Italy Space Tourism Market Size and Forecast, by End-User (2022-2029) 5.3.5. Spain 5.3.5.1. Spain Space Tourism Market Size and Forecast, by Outlook (2022-2029) 5.3.5.2. Spain Space Tourism Market Size and Forecast, by End-User (2022-2029) 5.3.6. Sweden 5.3.6.1. Sweden Space Tourism Market Size and Forecast, by Outlook (2022-2029) 5.3.6.2. Sweden Space Tourism Market Size and Forecast, by End-User (2022-2029) 5.3.7. Austria 5.3.7.1. Austria Space Tourism Market Size and Forecast, by Outlook (2022-2029) 5.3.7.2. Austria Space Tourism Market Size and Forecast, by End-User (2022-2029) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Space Tourism Market Size and Forecast, by Outlook (2022-2029) 5.3.8.2. Rest of Europe Space Tourism Market Size and Forecast, by End-User (2022-2029) 6. Asia Pacific Space Tourism Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Space Tourism Market Size and Forecast, by Outlook (2022-2029) 6.2. Asia Pacific Space Tourism Market Size and Forecast, by End-User (2022-2029) 6.3. Asia Pacific Space Tourism Market Size and Forecast, by Country (2022-2029) 6.3.1. China 6.3.1.1. China Space Tourism Market Size and Forecast, by Outlook (2022-2029) 6.3.1.2. China Space Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.2. S Korea 6.3.2.1. S Korea Space Tourism Market Size and Forecast, by Outlook (2022-2029) 6.3.2.2. S Korea Space Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.3. Japan 6.3.3.1. Japan Space Tourism Market Size and Forecast, by Outlook (2022-2029) 6.3.3.2. Japan Space Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.4. India 6.3.4.1. India Space Tourism Market Size and Forecast, by Outlook (2022-2029) 6.3.4.2. India Space Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.5. Australia 6.3.5.1. Australia Space Tourism Market Size and Forecast, by Outlook (2022-2029) 6.3.5.2. Australia Space Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.6. Indonesia 6.3.6.1. Indonesia Space Tourism Market Size and Forecast, by Outlook (2022-2029) 6.3.6.2. Indonesia Space Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.7. Malaysia 6.3.7.1. Malaysia Space Tourism Market Size and Forecast, by Outlook (2022-2029) 6.3.7.2. Malaysia Space Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.8. Vietnam 6.3.8.1. Vietnam Space Tourism Market Size and Forecast, by Outlook (2022-2029) 6.3.8.2. Vietnam Space Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.9. Taiwan 6.3.9.1. Taiwan Space Tourism Market Size and Forecast, by Outlook (2022-2029) 6.3.9.2. Taiwan Space Tourism Market Size and Forecast, by End-User (2022-2029) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Space Tourism Market Size and Forecast, by Outlook (2022-2029) 6.3.10.2. Rest of Asia Pacific Space Tourism Market Size and Forecast, by End-User (2022-2029) 7. Middle East and Africa Space Tourism Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Space Tourism Market Size and Forecast, by Outlook (2022-2029) 7.2. Middle East and Africa Space Tourism Market Size and Forecast, by End-User (2022-2029) 7.3. Middle East and Africa Space Tourism Market Size and Forecast, by Country (2022-2029) 7.3.1. South Africa 7.3.1.1. South Africa Space Tourism Market Size and Forecast, by Outlook (2022-2029) 7.3.1.2. South Africa Space Tourism Market Size and Forecast, by End-User (2022-2029) 7.3.2. GCC 7.3.2.1. GCC Space Tourism Market Size and Forecast, by Outlook (2022-2029) 7.3.2.2. GCC Space Tourism Market Size and Forecast, by End-User (2022-2029) 7.3.3. Nigeria 7.3.3.1. Nigeria Space Tourism Market Size and Forecast, by Outlook (2022-2029) 7.3.3.2. Nigeria Space Tourism Market Size and Forecast, by End-User (2022-2029) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Space Tourism Market Size and Forecast, by Outlook (2022-2029) 7.3.4.2. Rest of ME&A Space Tourism Market Size and Forecast, by End-User (2022-2029) 8. South America Space Tourism Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Space Tourism Market Size and Forecast, by Outlook (2022-2029) 8.2. South America Space Tourism Market Size and Forecast, by End-User (2022-2029) 8.3. South America Space Tourism Market Size and Forecast, by Country (2022-2029) 8.3.1. Brazil 8.3.1.1. Brazil Space Tourism Market Size and Forecast, by Outlook (2022-2029) 8.3.1.2. Brazil Space Tourism Market Size and Forecast, by End-User (2022-2029) 8.3.2. Argentina 8.3.2.1. Argentina Space Tourism Market Size and Forecast, by Outlook (2022-2029) 8.3.2.2. Argentina Space Tourism Market Size and Forecast, by End-User (2022-2029) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Space Tourism Market Size and Forecast, by Outlook (2022-2029) 8.3.3.2. Rest Of South America Space Tourism Market Size and Forecast, by End-User (2022-2029) 9. Global Space Tourism Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Space Tourism Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. SpaceX (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Blue Origin (United States) 10.3. Virgin Galactic (United States) 10.4. Boeing (United States) 10.5. Axiom Space (United States) 10.6. Orbital Sciences Corporation (United States) 10.7. Space Adventures (United States) 10.8. Zero Gravity Corporation (United States) 10.9. XCOR Aerospace (United States) 10.10. Masten Space Systems (United States) 10.11. Rocket Lab (United States) 10.12. Stratolaunch Systems (United States) 10.13. Sierra Nevada Corporation (United States) 10.14. NanoRacks (United States 10.15. Bigelow Aerospace (United States) 10.16. Firefly Aerospace (United States) 10.17. Reaction Engines Ltd. (United Kingdom) 10.18. Ispace Inc. (Japan) 10.19. Spaceport America (United States) 10.20. Rocket Crafters Inc. (United States) 11. Key Findings 12. Industry Recommendations 13. Space Tourism Market: Research Methodology 14. Terms and Glossary