Space Technology (SpaceTech) Market size was valued at USD 433.25 Bn. in 2023 and the total Space Technology industry revenue is expected to grow by 7.1% from 2023 to 2030, reaching nearly USD 700.28 Bn.Space Technology (SpaceTech) Market Overview:

Space Technology is a technology that supports travel to space or activities conducted in space. Beyond exploration, space tech enables commercial and governmental endeavors conducted in space, from communications to scientific experiments. The advancements in hardware and software technologies driving the Space Technology (SpaceTech) Market. To explore and utilize the vast resources available beyond Earth’s boundaries, adoption of Space Technology. The need for advanced technologies to support a wide range of applications, including telecommunications, earth observation, and scientific research boosts the market growth. For Instance, as per the MMR study report Microsoft and the Indian Space Research Organization signed a memorandum of Understanding to boost the growth of space –Tech Startups in India the MoU seeks to empower space tech startups across the country with technology tools and platforms.To know about the Research Methodology :- Request Free Sample Report

Space Technology (SpaceTech) Market Trend:

Space technologies are evolving continuously. The industry witnessed significant growth toward commercialization and privatization. It was private companies such as SpaceX, Blue Origin, and Virgin Galactic that drove innovation and reduced space technology costs. Small satellites and CubeSats are becoming increasingly popular. Various applications, such as communications, Earth observation, and scientific research, achieved through the miniaturization of satellites.The increasing accessibility of space to smaller organizations and universities has contributed to the rise of this trend. The emergence of space tourism is another notable trend. There are companies like Virgin Galactic and Blue Origin that are developing suborbital vehicles that can carry tourists into space for long periods of time. Due to advancing technology and declining costs, this sector holds growth potential.

Space Technology (SpaceTech) Market Dynamics:

Drivers Increasing demand for satellite-based services Drives Market Growth. SpaceTech is on the rise due to higher demand for satellite services like telecommunications, broadcasting, navigation and remote sensing. Satellites are vital in providing global telecoms in areas with limited terrestrial infrastructure. Companies like Inmarsat and Iridium provide services such as phone calls, internet access, video conferencing, and broadcasting. Furthermore, these satellites are also equipped with advanced sensors that can take high-resolution pictures of the Earth's surface and atmosphere. These images are then analysed to observe the environment, predict weather conditions, and handle emergency situations. For Instance, NASA's Landsat satellites, provide continuous Earth observation data, and the European Space Agency's Sentinel satellites, which monitor various aspects of the Earth's environment so, the increasing demand for SpaceTech solutions to meet global communication, navigation, monitoring, and connectivity needs accelerates the Space Technology (SpaceTech) Market growth. Commercialization of space Boosts market growth. The companies are now providing launch services for satellites, challenging the supremacy of government-operated launch providers SpaceX and United Launch Alliance, LLC are developing more affordable launch technologies, which has resulted in a surge of satellites being launched for various applications. Although, Private companies are developing and operating satellite systems to provide a wide range of services. These include telecommunications, Earth observation, remote sensing, weather monitoring, and navigation. For example, SpaceX's Starlink aims to provide global broadband internet coverage using a large constellation of satellites. The commercialization of satellite services is driving competition, innovation, and new business models in the Space Technology (SpaceTech) industry.Restrains High Development and Operational Costs Hamper the Market Growth Developing and deploying space technologies is extremely expensive. Designing and propelling satellites and other space equipment are very pricey for certain organizations, especially for smaller start-ups or companies with restricted funds. Besides, the cost of running them, such as maintenance, ground equipment, and communication networks, quite large, which makes it difficult for businesses to enter the market or extend their reach. It is important to be realistic when determining business start-up costs, which include office space, legal fees, payroll, business credit cards, and other organizational expenses developing space technologies involves extensive research, engineering, and testing processes. Also, the construction of satellites, launch vehicles, and associated components requires specialized facilities, equipment, and skilled labor. The production costs involve procurement of materials, assembly, integration, quality assurance, and testing. The complexity of space systems often leads to higher manufacturing expenses compared to terrestrial technologies. This Factor significantly limits the Space Technology (SpaceTech) Market growth.

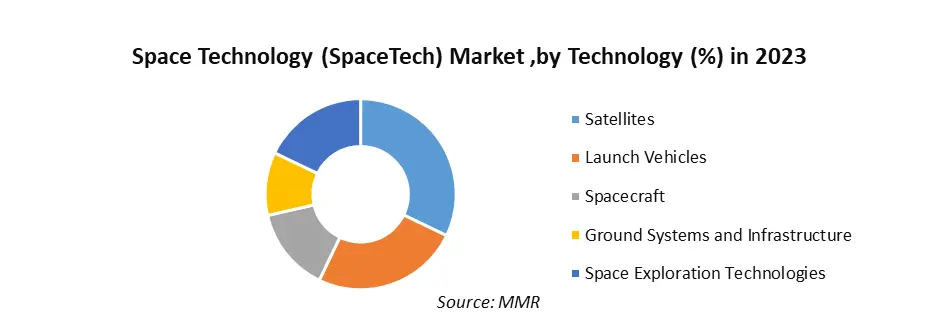

Opportunity Satellite Internet and Connectivity creates lucrative growth opportunities for Market Growth Earth's observation satellites give important data for environmental monitoring, climatic studies, disaster administration and urban planning. The growing need for rigorous and updated information creates opportunities for organizations to develop and operate land observation satellites, offer data study services and interpretation services, and serve different industries, such as agriculture, silviculture and development of infrastructure. Satellite Internet allows connectivity on remote and unattended surfaces where terrestrial infrastructure is reduced. Satellite Internet enables connectivity in remote and underserved areas where terrestrial infrastructure is limited or absent. This helps to close digital separation by giving the Internet connection to societies and areas that were previously neglected. So, those all factors creates ample growth opportunities for the Space Technology (SpaceTech) Market growth Recent Developments in Space Technology (SpaceTech) Market 1.) 25 December 2023, NASA launched the James Webb Space Telescope, the most powerful telescope. The telescope is designed to study the universe in infrared light, which allow to see objects that are too faint or distant to be seen by other telescopes. 2.) 24 January 2023, SpaceX most spacecraft launched into space on a single mission, with 143 satellites. 3.) 2023, SpaceX raised about USD2 billion with an ambitious plan for 2023 which includes 87 rocket launches, a sustained moon exploration project, and expansion of Starlink internet service. 4.) 20 April 2023, SpaceX Starship was launched on its first orbital test flight, which the company dubbed the Starship Integrated Flight Test. The vehicle exploded without reaching orbit less than four minutes after liftoff from the SpaceX Starbase in Boca Chica, Texas. The vehicle became the tallest and most powerful rocket ever flown; breaking the record which had previously been held by the Soviet N1 rocket for over 50 years. Based on Technology, The Satellites sub segment dominates the global Space Technology (SpaceTech) Market in year 2023. The increasing demand for satellite-based services such as broadcasting, communication, and Earth observation, the satellite segment has a high growth potential. Advancements in satellite miniaturization, increased efficiency in launch services, and the emergence of reusable launch vehicles contribute to the technological advancements in this segment. Satellites offer universal coverage, so it is a preferred alternative for communication services in remote and unattended areas where the terrestrial infrastructure is reduced or absent. The satellites have the possibility of providing connectivity even to the most remote surfaces, which enables the communication and transmission of data at universal scale. These advancements enhance the capacity, efficiency, and performance of satellite communication systems.

Regional Insights

North America Dominates the Global Space Technology (SpaceTech) Market in year 2023. North America, especially the USA, was a dominant player in the space tech market throughout a decade. NASA, the US Space Agency, was necessary to promote innovation and technological advances in spatial analysis and satellite technologies in addition, private companies such as SpaceX, Blue Origin, and several others actively participate in the development and launch of satellites, provide launch services, and explore commercial space opportunities. Canada has contributed to different world space missions and has experience on surfaces such as satellite communications, earth, and robotics observation. Due to all these factors and the high level of technological advancement the North American region is expected to dominate the global Space Technology (SpaceTech) Market during the forecast period.Global Space Technology (SpaceTech) Market Scope: Inquire before buying

Global Space Technology (SpaceTech) Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 433.25 Bn. Forecast Period 2024 to 2030 CAGR: 7.3% Market Size in 2030: US $ 700.28 Bn. Segments Covered: by Technology Satellites Launch Vehicles Spacecraft Ground Systems and Infrastructure Space Exploration Technologies Others by Application Commercial Defense and Military Scientific Research Navigation and Positioning Others by End User Government Commercial Enterprises Research and Educational Institutions Others Space Technology (SpaceTech) Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Space Technology (SpaceTech) Market Key Players

1.) NASA 2.) SpaceX 3.) Blue Origin 4.) MDA 5.) Telesat 6.) Northrop Grumman 7.) Lockheed Martin 8.) Thales Alenia Space 9.) ISRO 10.) China Aerospace Science and Technology Corporation 11.) Boing 12.) SES S.A. 13.) Viasat, Inc. 14.)Safran 15.) Leonardo SpA 16.) General Electric 17.) NEC Corporation FAQs 1] What segments are covered in the Global Space Technology (SpaceTech) Market report? Ans. The segments covered in the Space Technology (SpaceTech) Market report are based on Technology, Application, End User, and Regions. 2] Which region is expected to hold the highest share in the Global Space Technology (SpaceTech) Market? Ans. The North America region is expected to hold the highest share of the Space Technology (SpaceTech) Market. 3] What is the market size of the Global Space Technology (SpaceTech) Market by 2030? Ans. The market size of the Space Technology (SpaceTech) Market by 2030 is expected to reach USD 700.28 Bn. 4] What is the forecast period for the Global Space Technology (SpaceTech) Market? Ans. The forecast period for the Space Technology (SpaceTech) Market is 2023-2030. 5] What was the market size of the Global Space Technology (SpaceTech) Market in 2023? Ans. The market size of the Space Technology (SpaceTech) Market in 2023 was valued at USD 433.25 Bn.

1. Space Technology (SpaceTech) Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Space Technology (SpaceTech) Market: Dynamics 2.1. Space Technology (SpaceTech) Market Trends by Region 2.1.1. North America Space Technology (SpaceTech) Market Trends 2.1.2. Europe Space Technology (SpaceTech) Market Trends 2.1.3. Asia Pacific Space Technology (SpaceTech) Market Trends 2.1.4. Middle East and Africa Space Technology (SpaceTech) Market Trends 2.1.5. South America Space Technology (SpaceTech) Market Trends 2.2. Space Technology (SpaceTech) Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Space Technology (SpaceTech) Market Drivers 2.2.1.2. North America Space Technology (SpaceTech) Market Restraints 2.2.1.3. North America Space Technology (SpaceTech) Market Opportunities 2.2.1.4. North America Space Technology (SpaceTech) Market Challenges 2.2.2. Europe 2.2.2.1. Europe Space Technology (SpaceTech) Market Drivers 2.2.2.2. Europe Space Technology (SpaceTech) Market Restraints 2.2.2.3. Europe Space Technology (SpaceTech) Market Opportunities 2.2.2.4. Europe Space Technology (SpaceTech) Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Space Technology (SpaceTech) Market Drivers 2.2.3.2. Asia Pacific Space Technology (SpaceTech) Market Restraints 2.2.3.3. Asia Pacific Space Technology (SpaceTech) Market Opportunities 2.2.3.4. Asia Pacific Space Technology (SpaceTech) Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Space Technology (SpaceTech) Market Drivers 2.2.4.2. Middle East and Africa Space Technology (SpaceTech) Market Restraints 2.2.4.3. Middle East and Africa Space Technology (SpaceTech) Market Opportunities 2.2.4.4. Middle East and Africa Space Technology (SpaceTech) Market Challenges 2.2.5. South America 2.2.5.1. South America Space Technology (SpaceTech) Market Drivers 2.2.5.2. South America Space Technology (SpaceTech) Market Restraints 2.2.5.3. South America Space Technology (SpaceTech) Market Opportunities 2.2.5.4. South America Space Technology (SpaceTech) Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Space Technology (SpaceTech) Industry 2.8. Analysis of Government Schemes and Initiatives For Space Technology (SpaceTech) Industry 2.9. Space Technology (SpaceTech) Market Trade Analysis 2.10. The Global Pandemic Impact on Space Technology (SpaceTech) Market 3. Space Technology (SpaceTech) Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 3.1.1. Satellites 3.1.2. Launch Vehicles 3.1.3. Spacecraft 3.1.4. Ground Systems and Infrastructure 3.1.5. Space Exploration Technologies 3.1.6. Others 3.2. Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 3.2.1. Commercial 3.2.2. Defense and Military 3.2.3. Scientific Research 3.2.4. Navigation and Positioning 3.2.5. Others 3.3. Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 3.3.1. Government 3.3.2. Commercial Enterprises 3.3.3. Research and Educational Institutions 3.3.4. Others 3.4. Space Technology (SpaceTech) Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Space Technology (SpaceTech) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 4.1.1. Satellites 4.1.2. Launch Vehicles 4.1.3. Spacecraft 4.1.4. Ground Systems and Infrastructure 4.1.5. Space Exploration Technologies 4.1.6. Others 4.2. North America Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 4.2.1. Commercial 4.2.2. Defense and Military 4.2.3. Scientific Research 4.2.4. Navigation and Positioning 4.2.5. Others 4.3. North America Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 4.3.1. Government 4.3.2. Commercial Enterprises 4.3.3. Research and Educational Institutions 4.3.4. Others 4.4. North America Space Technology (SpaceTech) Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 4.4.1.1.1. Satellites 4.4.1.1.2. Launch Vehicles 4.4.1.1.3. Spacecraft 4.4.1.1.4. Ground Systems and Infrastructure 4.4.1.1.5. Space Exploration Technologies 4.4.1.1.6. Others 4.4.1.2. United States Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 4.4.1.2.1. Commercial 4.4.1.2.2. Defense and Military 4.4.1.2.3. Scientific Research 4.4.1.2.4. Navigation and Positioning 4.4.1.2.5. Others 4.4.1.3. United States Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 4.4.1.3.1. Government 4.4.1.3.2. Commercial Enterprises 4.4.1.3.3. Research and Educational Institutions 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 4.4.2.1.1. Satellites 4.4.2.1.2. Launch Vehicles 4.4.2.1.3. Spacecraft 4.4.2.1.4. Ground Systems and Infrastructure 4.4.2.1.5. Space Exploration Technologies 4.4.2.1.6. Others 4.4.2.2. Canada Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 4.4.2.2.1. Commercial 4.4.2.2.2. Defense and Military 4.4.2.2.3. Scientific Research 4.4.2.2.4. Navigation and Positioning 4.4.2.2.5. Others 4.4.2.3. Canada Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 4.4.2.3.1. Government 4.4.2.3.2. Commercial Enterprises 4.4.2.3.3. Research and Educational Institutions 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 4.4.3.1.1. Satellites 4.4.3.1.2. Launch Vehicles 4.4.3.1.3. Spacecraft 4.4.3.1.4. Ground Systems and Infrastructure 4.4.3.1.5. Space Exploration Technologies 4.4.3.1.6. Others 4.4.3.2. Mexico Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 4.4.3.2.1. Commercial 4.4.3.2.2. Defense and Military 4.4.3.2.3. Scientific Research 4.4.3.2.4. Navigation and Positioning 4.4.3.2.5. Others 4.4.3.3. Mexico Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 4.4.3.3.1. Government 4.4.3.3.2. Commercial Enterprises 4.4.3.3.3. Research and Educational Institutions 4.4.3.3.4. Others 5. Europe Space Technology (SpaceTech) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 5.2. Europe Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 5.3. Europe Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 5.4. Europe Space Technology (SpaceTech) Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 5.4.1.2. United Kingdom Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 5.4.1.3. United Kingdom Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 5.4.2. France 5.4.2.1. France Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 5.4.2.2. France Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 5.4.2.3. France Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 5.4.3.2. Germany Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 5.4.3.3. Germany Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 5.4.4.2. Italy Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 5.4.4.3. Italy Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 5.4.5.2. Spain Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 5.4.5.3. Spain Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 5.4.6.2. Sweden Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 5.4.6.3. Sweden Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 5.4.7.2. Austria Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 5.4.7.3. Austria Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 5.4.8.2. Rest of Europe Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 5.4.8.3. Rest of Europe Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Space Technology (SpaceTech) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 6.2. Asia Pacific Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 6.4. Asia Pacific Space Technology (SpaceTech) Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 6.4.1.2. China Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 6.4.1.3. China Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 6.4.2.2. S Korea Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 6.4.2.3. S Korea Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 6.4.3.2. Japan Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 6.4.3.3. Japan Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 6.4.4. India 6.4.4.1. India Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 6.4.4.2. India Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 6.4.4.3. India Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 6.4.5.2. Australia Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 6.4.5.3. Australia Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 6.4.6.2. Indonesia Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 6.4.6.3. Indonesia Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 6.4.7.2. Malaysia Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 6.4.7.3. Malaysia Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 6.4.8.2. Vietnam Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 6.4.8.3. Vietnam Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 6.4.9.2. Taiwan Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 6.4.9.3. Taiwan Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 6.4.10.2. Rest of Asia Pacific Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 6.4.10.3. Rest of Asia Pacific Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Space Technology (SpaceTech) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 7.2. Middle East and Africa Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 7.4. Middle East and Africa Space Technology (SpaceTech) Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 7.4.1.2. South Africa Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 7.4.1.3. South Africa Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 7.4.2.2. GCC Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 7.4.2.3. GCC Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 7.4.3.2. Nigeria Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 7.4.3.3. Nigeria Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 7.4.4.2. Rest of ME&A Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 7.4.4.3. Rest of ME&A Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 8. South America Space Technology (SpaceTech) Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 8.2. South America Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 8.3. South America Space Technology (SpaceTech) Market Size and Forecast, by End User(2023-2030) 8.4. South America Space Technology (SpaceTech) Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 8.4.1.2. Brazil Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 8.4.1.3. Brazil Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 8.4.2.2. Argentina Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 8.4.2.3. Argentina Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Space Technology (SpaceTech) Market Size and Forecast, by Technology (2023-2030) 8.4.3.2. Rest Of South America Space Technology (SpaceTech) Market Size and Forecast, by Application (2023-2030) 8.4.3.3. Rest Of South America Space Technology (SpaceTech) Market Size and Forecast, by End User (2023-2030) 9. Global Space Technology (SpaceTech) Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Space Technology (SpaceTech) Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. NASA 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. SpaceX 10.3. Blue Origin 10.4. MDA 10.5. Telesat 10.6. Northrop Grumman 10.7. Lockheed Martin 10.8. Thales Alenia Space 10.9. ISRO 10.10. China Aerospace Science and Technology Corporation 10.11. Boing 10.12. SES S.A. 10.13. Viasat, Inc. 10.14. Safran 10.15. Leonardo SpA 10.16. General Electric 10.17. NEC Corporation 11. Key Findings 12. Industry Recommendations 13. Space Technology (SpaceTech) Market: Research Methodology 14. Terms and Glossary