The Space Mining Market size was valued at USD 2.54 Billion in 2023 and the total Space Mining revenue is expected to grow at a CAGR of 15.1 % from 2024 to 2030, reaching nearly USD 6.80 Billion in 2030. Space mining is the process of extracting valuable resources from celestial bodies such as asteroids, moons, and planets for use on Earth or in space exploration. Earth's resources are finite, and space mining offers access to potentially vast quantities of valuable metals.To know about the Research Methodology :- Request Free Sample Report The government's initiatives and growing private investments in the industry are expected to drive the space mining market's development in the coming decades. Governmental and private organizations are making significant investments in resource and space exploration, which is accelerating technological development and commercial development. In-situ resource Utilization (ISRU) technology allows the use of resources found in space for space missions, reducing reliance on Earth-sourced materials. 1. According to MMR, Type C asteroids are the most common, accounting for over 75% of known asteroids. Technological developments in mining, robotics, and spacecraft propulsion has been opening up new possibilities for space mining. The major key Players in the Space Mining Market are NASA, Moon Express, I Space, Deltion Innovations, Transastra, and Asteroid Mining Corporation Ltd. Asia-Pacific region is the fastest-growing region with a market share of over 28.5% in 2023. The region is expected to grow at a CAGR of 15.3% during the forecast period and maintain its dominance by 2030. Asia-Pacific is expected to have significant growth in the space mining market during the forecast period. Growing investments in the space mining industry and falling space launch costs are expected to boost the market in China. China is also prioritizing space resource development as well as Japan and India also have their space mining plans. China's state-owned and commercial aerospace companies continued to grow rapidly in 2021, a sign of the nation's rising goals for military and economic dominance in space.

Space Mining Market Dynamics:

Space Mission Surge Drives Growth in Space Mining Market Space missions increasingly focus on exploring celestial bodies such as asteroids, the Moon, and other planets to understand their structure and potential resources. Space missions involve sending probes, rovers, and satellites to scan celestial bodies for valuable minerals, water, and elements like platinum and rare earth metals. The data collected from these missions provides valuable insights into potential mining targets, driving investment in the space mining Market. The technological advancement has made it easier and more cost-effective to conduct missions like the contraction of spacecraft machineries, and advancements in robotics and these developments in technology also make it simpler to create mining methods and equipment. Governments and international organizations are regulating the extraction and utilization of space resources. Artemis Accords and U.S. Space Resources Policy provide guidelines for commercial space mining in compliance with international law. Regulatory frameworks reduce doubts for investors and boost private sector participation. Increasing investments by private stakeholders in space mining companies are driving market developments. The growth of private Space Companies such as Space X, Planetary Resources, and Blue Origin has catalyzed investments and innovation in the space industry. These companies see space mining as a lucrative opportunity in the forecast period.Restraint of Space Mining Market: The expense involved in developing technologies, launching spacecraft, and conducting mining operations in space is a significant restraint for the space mining market. This high-cost factor poses a challenge to the growth of the industry. The technology needed for mining space profitably and efficiently is still in its early stages. Before space mining becomes financially viable, several technological obstacles must be cleared. These include gathering resources in a zero-gravity environment, turning them into useful commodities, and returning the minerals to Earth. The complicated procedures included in space mining initiatives, like the requirement for advanced machinery and protocols analogous to those employed on Earth, enhance the expenses and hamper the growth of the market.

Space Mining Market Segment Analysis:

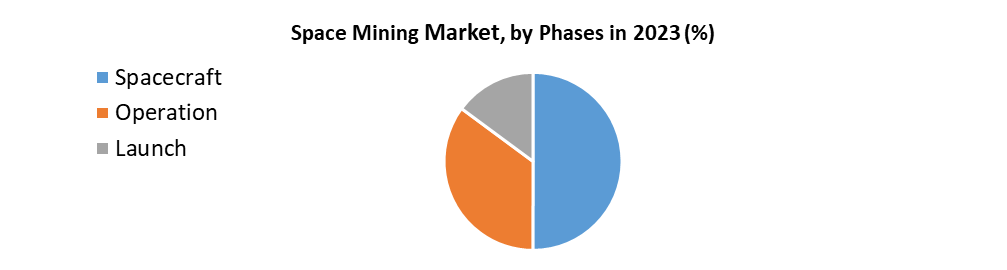

Based on Asteroid Type, the Type C segment held the largest market share of about 54.03% in the Space Mining Market in 2023. According to the MMR analysis, the segment is expected to grow at a CAGR of 15.1 % during the forecast period and maintain its dominance till 2030. C-type asteroids are the most common they have a composition like the sun without hydrogen, helium, and other volatiles. When water ice be turned into rocket propellant, it used in space instead of launching water from Earth, which is very expensive. Some C-type asteroids are found in near-Earth orbits, making them more accessible for potential mining missions compared to others. 1. NASA’s OSIRIS-Rex mission – successfully obtained a sample from the C-type asteroid Bennu, with a September 2023 return to Earth date planned. 2. Japan’s Hayabusa2 mission collected samples from the C-type asteroid Ryugu and returned to Earth in December 2020.Based on Phase, the Spacecraft segment held the largest market share of about 45.87% in the Space Mining Market in 2023 and is expected to maintain its dominance till 2030. A Spacecraft is a vehicle machine designed to fly in outer space. It is used in communications, earth observation, navigation, space colonization, and transportation of humans and cargo. Spacecraft designed for mining purposes are often complex and require significant upfront investment.

Regional Analysis of Space Mining Market:

North America dominates the Space Mining Market with the largest market share accounting for 52.04% in 2023, the region is expected to grow during the forecast period and maintain its dominance by 2030. North American countries like the US possess strong scientific and technological capabilities, which is crucial for the development of sophisticated technologies required for resource extraction and space investigation. It includes Robotics spacecraft design, economical transportation to and from possible mining locations, also resources processing and refining. NASA's ARM is expected to recover an asteroid sample, while Psyche's mission is to study a metal-rich asteroid to advance space resource utilization research. The growing number of space mining missions conducted by NASA- National Aeronautics and Space Administration is contributing to space mining market growth. The US government also provides funding and incentives for private companies involved in space mining activities. Europe, the fastest-growing region in the Space Mining Market held a market share of 23.8% and is significantly growing during its forecast period. Latin America represents a smaller but growing market for space mining, with the support of Brazil, Mexico, Argentina, and Chile are key markets in this region. Middle East and Africa are emerging markets for the Space Mining Market. Competitive Landscape for Space Mining Market: The competitive landscape of the Space Mining market is constantly evolving, with new players emerging and established players adapting their strategies.Building Partnerships and collaboration with established players, research institutions, and investors to leverage expertise and resources. In October 2021, a 500-ton thrust solid rocket engine was investigated by the Academy of Aerospace Solid Propulsion Technology (AASPT), a division of the China Aerospace Science and Technology Corporation (CASC). The rocket is intended to power China's upcoming heavy-lift rocket generation, which satisfy a range of requirements for space missions such as crewed lunar landings, deep space surveying, and the mining of resources far from Earth. In June 2021, Japan became the fourth country to draft a dedicated law for exploring and exploiting space resources. The law allows Japanese private businesses to explore and develop space resources, such as water, minerals, and non-living resources on the Moon and other celestial bodies. On 27 April 2021, China launched a commercial satellite and small space mining test spacecraft into orbit. The satellite test near-Earth Asteroid observation and prototype technology verification for space mining in LEO (Low Earth orbit). The goal of the launch is to verify functions like simulated small celestial body capture, spacecraft orbital plots, and intelligent spacecraft identification.Space Mining Market Scope: Inquiry Before Buying

Global Space Mining Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.54 Bn. Forecast Period 2024 to 2030 CAGR: 15.1% Market Size in 2030: US $ 6.80 Bn. Segments Covered: by Phase Spacecraft Design Launch Operation by Asteroid Type Type C Type S Type M by Application 3D Printing Construction Resource Harvesting Space Mining Market, by Region:

North America (United States, Canwpada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Space Mining Market Key Players:

North America: 1. National Aeronautics and Space Administration (NASA), 2. Deep Space Industries (DSI) 3. Bradford Space 4. ConsenSys 5. Planetary Resources, 6. Moon Express, 7. Trans Astronautica Corporation 8. Ispace 9. OffWorld 10. Shackleton Energy Company 11. SpaceFab.US 12. Virgin galactic (California) 13. Boeing (Arlington) 14. SpaceX (California) 15. Ad astra rocket company (U.S.) 16. Sierra Nevada Corporation Europe: 1. Asteroid Mining Corporation (AMC), (Luxembourg) 2. Russian Federal Space Agency (Russia) 3. Deltion Innovations Asia-Pacific Region: 1. China National Space Administration (CNSA) (China) 2. Japan Aerospace Exploration Agency (JAXA) (Japan) Frequently Asked Questions: 1] What is the growth rate of the Space Mining Market? Ans. The Space Mining market is expected to grow at a CAGR of 15.1 % during the forecast period of 2024 to 2030. 2] Which region is expected to hold the highest share in the Market? Ans. North America is expected to hold the highest share of the Market. 3] What is the market size of the Space Mining Market? Ans. The Space Mining Market size was valued at USD 2.54 Billion in 2023 reaching nearly USD 6.80 Billion in 2030. 4] What is the forecast period for the Space Mining Market? Ans. The forecast period for the Space Mining Market is 2024-2030. 5] What segments are covered in the Space Mining Market report? Ans. The segments covered in the Space Mining Market report are based on Phase, Asteroid Type, and Application.

1. Space Mining Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Space Mining Market: Dynamics 2.1. Space Mining Market Trends by Region 2.1.1. North America Space Mining Market Trends 2.1.2. Europe Space Mining Market Trends 2.1.3. Asia Pacific Space Mining Market Trends 2.1.4. Middle East and Africa Space Mining Market Trends 2.1.5. South America Space Mining Market Trends 2.2. Space Mining Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Space Mining Market Drivers 2.2.1.2. North America Space Mining Market Restraints 2.2.1.3. North America Space Mining Market Opportunities 2.2.1.4. North America Space Mining Market Challenges 2.2.2. Europe 2.2.2.1. Europe Space Mining Market Drivers 2.2.2.2. Europe Space Mining Market Restraints 2.2.2.3. Europe Space Mining Market Opportunities 2.2.2.4. Europe Space Mining Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Space Mining Market Drivers 2.2.3.2. Asia Pacific Space Mining Market Restraints 2.2.3.3. Asia Pacific Space Mining Market Opportunities 2.2.3.4. Asia Pacific Space Mining Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Space Mining Market Drivers 2.2.4.2. Middle East and Africa Space Mining Market Restraints 2.2.4.3. Middle East and Africa Space Mining Market Opportunities 2.2.4.4. Middle East and Africa Space Mining Market Challenges 2.2.5. South America 2.2.5.1. South America Space Mining Market Drivers 2.2.5.2. South America Space Mining Market Restraints 2.2.5.3. South America Space Mining Market Opportunities 2.2.5.4. South America Space Mining Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Space Mining Industry 2.8. Analysis of Government Schemes and Initiatives For Space Mining Industry 2.9. Space Mining Market Trade Analysis 2.10. The Global Pandemic Impact on Space Mining Market 3. Space Mining Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Space Mining Market Size and Forecast, by Phase (2023-2030) 3.1.1. Spacecraft Design 3.1.2. Launch 3.1.3. Operation 3.2. Space Mining Market Size and Forecast, by Form (2023-2030) 3.2.1. Type C 3.2.2. Type S 3.2.3. Type M 3.3. Space Mining Market Size and Forecast, by Application (2023-2030) 3.3.1. 3D Printing 3.3.2. Construction 3.3.3. Resource Harvesting 3.4. Space Mining Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Space Mining Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Space Mining Market Size and Forecast, by Phase (2023-2030) 4.1.1. Spacecraft Design 4.1.2. Launch 4.1.3. Operation 4.2. North America Space Mining Market Size and Forecast, by Form (2023-2030) 4.2.1. Type C 4.2.2. Type S 4.2.3. Type M 4.3. North America Space Mining Market Size and Forecast, by Application (2023-2030) 4.3.1. 3D Printing 4.3.2. Construction 4.3.3. Resource Harvesting 4.4. North America Space Mining Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Space Mining Market Size and Forecast, by Phase (2023-2030) 4.4.1.1.1. Spacecraft Design 4.4.1.1.2. Launch 4.4.1.1.3. Operation 4.4.1.2. United States Space Mining Market Size and Forecast, by Form (2023-2030) 4.4.1.2.1. Type C 4.4.1.2.2. Type S 4.4.1.2.3. Type M 4.4.1.3. United States Space Mining Market Size and Forecast, by Application (2023-2030) 4.4.1.3.1. 3D Printing 4.4.1.3.2. Construction 4.4.1.3.3. Resource Harvesting 4.4.2. Canada 4.4.2.1. Canada Space Mining Market Size and Forecast, by Phase (2023-2030) 4.4.2.1.1. Spacecraft Design 4.4.2.1.2. Launch 4.4.2.1.3. Operation 4.4.2.2. Canada Space Mining Market Size and Forecast, by Form (2023-2030) 4.4.2.2.1. Type C 4.4.2.2.2. Type S 4.4.2.2.3. Type M 4.4.2.3. Canada Space Mining Market Size and Forecast, by Application (2023-2030) 4.4.2.3.1. 3D Printing 4.4.2.3.2. Construction 4.4.2.3.3. Resource Harvesting 4.4.3. Mexico 4.4.3.1. Mexico Space Mining Market Size and Forecast, by Phase (2023-2030) 4.4.3.1.1. Spacecraft Design 4.4.3.1.2. Launch 4.4.3.1.3. Operation 4.4.3.2. Mexico Space Mining Market Size and Forecast, by Form (2023-2030) 4.4.3.2.1. Type C 4.4.3.2.2. Type S 4.4.3.2.3. Type M 4.4.3.3. Mexico Space Mining Market Size and Forecast, by Application (2023-2030) 4.4.3.3.1. 3D Printing 4.4.3.3.2. Construction 4.4.3.3.3. Resource Harvesting 5. Europe Space Mining Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Space Mining Market Size and Forecast, by Phase (2023-2030) 5.2. Europe Space Mining Market Size and Forecast, by Form (2023-2030) 5.3. Europe Space Mining Market Size and Forecast, by Application (2023-2030) 5.4. Europe Space Mining Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Space Mining Market Size and Forecast, by Phase (2023-2030) 5.4.1.2. United Kingdom Space Mining Market Size and Forecast, by Form (2023-2030) 5.4.1.3. United Kingdom Space Mining Market Size and Forecast, by Application (2023-2030) 5.4.2. France 5.4.2.1. France Space Mining Market Size and Forecast, by Phase (2023-2030) 5.4.2.2. France Space Mining Market Size and Forecast, by Form (2023-2030) 5.4.2.3. France Space Mining Market Size and Forecast, by Application (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Space Mining Market Size and Forecast, by Phase (2023-2030) 5.4.3.2. Germany Space Mining Market Size and Forecast, by Form (2023-2030) 5.4.3.3. Germany Space Mining Market Size and Forecast, by Application (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Space Mining Market Size and Forecast, by Phase (2023-2030) 5.4.4.2. Italy Space Mining Market Size and Forecast, by Form (2023-2030) 5.4.4.3. Italy Space Mining Market Size and Forecast, by Application (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Space Mining Market Size and Forecast, by Phase (2023-2030) 5.4.5.2. Spain Space Mining Market Size and Forecast, by Form (2023-2030) 5.4.5.3. Spain Space Mining Market Size and Forecast, by Application (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Space Mining Market Size and Forecast, by Phase (2023-2030) 5.4.6.2. Sweden Space Mining Market Size and Forecast, by Form (2023-2030) 5.4.6.3. Sweden Space Mining Market Size and Forecast, by Application (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Space Mining Market Size and Forecast, by Phase (2023-2030) 5.4.7.2. Austria Space Mining Market Size and Forecast, by Form (2023-2030) 5.4.7.3. Austria Space Mining Market Size and Forecast, by Application (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Space Mining Market Size and Forecast, by Phase (2023-2030) 5.4.8.2. Rest of Europe Space Mining Market Size and Forecast, by Form (2023-2030) 5.4.8.3. Rest of Europe Space Mining Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Space Mining Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Space Mining Market Size and Forecast, by Phase (2023-2030) 6.2. Asia Pacific Space Mining Market Size and Forecast, by Form (2023-2030) 6.3. Asia Pacific Space Mining Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Space Mining Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Space Mining Market Size and Forecast, by Phase (2023-2030) 6.4.1.2. China Space Mining Market Size and Forecast, by Form (2023-2030) 6.4.1.3. China Space Mining Market Size and Forecast, by Application (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Space Mining Market Size and Forecast, by Phase (2023-2030) 6.4.2.2. S Korea Space Mining Market Size and Forecast, by Form (2023-2030) 6.4.2.3. S Korea Space Mining Market Size and Forecast, by Application (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Space Mining Market Size and Forecast, by Phase (2023-2030) 6.4.3.2. Japan Space Mining Market Size and Forecast, by Form (2023-2030) 6.4.3.3. Japan Space Mining Market Size and Forecast, by Application (2023-2030) 6.4.4. India 6.4.4.1. India Space Mining Market Size and Forecast, by Phase (2023-2030) 6.4.4.2. India Space Mining Market Size and Forecast, by Form (2023-2030) 6.4.4.3. India Space Mining Market Size and Forecast, by Application (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Space Mining Market Size and Forecast, by Phase (2023-2030) 6.4.5.2. Australia Space Mining Market Size and Forecast, by Form (2023-2030) 6.4.5.3. Australia Space Mining Market Size and Forecast, by Application (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Space Mining Market Size and Forecast, by Phase (2023-2030) 6.4.6.2. Indonesia Space Mining Market Size and Forecast, by Form (2023-2030) 6.4.6.3. Indonesia Space Mining Market Size and Forecast, by Application (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Space Mining Market Size and Forecast, by Phase (2023-2030) 6.4.7.2. Malaysia Space Mining Market Size and Forecast, by Form (2023-2030) 6.4.7.3. Malaysia Space Mining Market Size and Forecast, by Application (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Space Mining Market Size and Forecast, by Phase (2023-2030) 6.4.8.2. Vietnam Space Mining Market Size and Forecast, by Form (2023-2030) 6.4.8.3. Vietnam Space Mining Market Size and Forecast, by Application (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Space Mining Market Size and Forecast, by Phase (2023-2030) 6.4.9.2. Taiwan Space Mining Market Size and Forecast, by Form (2023-2030) 6.4.9.3. Taiwan Space Mining Market Size and Forecast, by Application (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Space Mining Market Size and Forecast, by Phase (2023-2030) 6.4.10.2. Rest of Asia Pacific Space Mining Market Size and Forecast, by Form (2023-2030) 6.4.10.3. Rest of Asia Pacific Space Mining Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Space Mining Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Space Mining Market Size and Forecast, by Phase (2023-2030) 7.2. Middle East and Africa Space Mining Market Size and Forecast, by Form (2023-2030) 7.3. Middle East and Africa Space Mining Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Space Mining Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Space Mining Market Size and Forecast, by Phase (2023-2030) 7.4.1.2. South Africa Space Mining Market Size and Forecast, by Form (2023-2030) 7.4.1.3. South Africa Space Mining Market Size and Forecast, by Application (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Space Mining Market Size and Forecast, by Phase (2023-2030) 7.4.2.2. GCC Space Mining Market Size and Forecast, by Form (2023-2030) 7.4.2.3. GCC Space Mining Market Size and Forecast, by Application (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Space Mining Market Size and Forecast, by Phase (2023-2030) 7.4.3.2. Nigeria Space Mining Market Size and Forecast, by Form (2023-2030) 7.4.3.3. Nigeria Space Mining Market Size and Forecast, by Application (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Space Mining Market Size and Forecast, by Phase (2023-2030) 7.4.4.2. Rest of ME&A Space Mining Market Size and Forecast, by Form (2023-2030) 7.4.4.3. Rest of ME&A Space Mining Market Size and Forecast, by Application (2023-2030) 8. South America Space Mining Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Space Mining Market Size and Forecast, by Phase (2023-2030) 8.2. South America Space Mining Market Size and Forecast, by Form (2023-2030) 8.3. South America Space Mining Market Size and Forecast, by Application(2023-2030) 8.4. South America Space Mining Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Space Mining Market Size and Forecast, by Phase (2023-2030) 8.4.1.2. Brazil Space Mining Market Size and Forecast, by Form (2023-2030) 8.4.1.3. Brazil Space Mining Market Size and Forecast, by Application (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Space Mining Market Size and Forecast, by Phase (2023-2030) 8.4.2.2. Argentina Space Mining Market Size and Forecast, by Form (2023-2030) 8.4.2.3. Argentina Space Mining Market Size and Forecast, by Application (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Space Mining Market Size and Forecast, by Phase (2023-2030) 8.4.3.2. Rest Of South America Space Mining Market Size and Forecast, by Form (2023-2030) 8.4.3.3. Rest Of South America Space Mining Market Size and Forecast, by Application (2023-2030) 9. Global Space Mining Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Space Mining Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. National Aeronautics and Space Administration (NASA), 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Deep Space Industries (DSI) 10.3. Bradford Space 10.4. ConsenSys 10.5. Planetary Resources, 10.6. Moon Express, 10.7. Trans Astronautica Corporation 10.8. Ispace 10.9. OffWorld 10.10. Shackleton Energy Company 10.11. SpaceFab.US 10.12. Virgin galactic (California) 10.13. Boeing (Arlington) 10.14. SpaceX (California) 10.15. Ad astra rocket company (U.S.) 10.16. Sierra Nevada Corporation 10.17. Asteroid Mining Corporation (AMC), (Luxembourg) 10.18. Russian Federal Space Agency (Russia) 10.19. Deltion Innovations 10.20. China National Space Administration (CNSA) (China) 10.21. Japan Aerospace Exploration Agency (JAXA) (Japan) 11. Key Findings 12. Industry Recommendations 13. Space Mining Market: Research Methodology 14. Terms and Glossary