Solid Sulfur Market: Global Industry Forecast (2023-2029) by Manufacturing Process, Application, and Region. Solid Sulfur Market was valued at US$ 3.57 Bn. in 2022 and the total Solid Sulfur revenue is expected to grow at 4.1% from 2023 to 2029, reaching nearly US$ 4.73 Bn. Solid Sulfur Market stood at 49.16 million tons in 2022 and the total Solid Sulfur volume is expected to grow by 3.24% from 2023 to 2029, reaching nearly 61.45 million tons.Solid Sulfur Market Overview:

Sulfur is a naturally occurring element and is the thirteenth most prevalent element in the earth's crust. It is mined in its elemental form, however, the sulfur production in this form has dwindled in recent years. Sulfur is a valuable commodity and an essential element of the global economy used to produce a variety of products such as fertilizers and other chemicals. Elemental solid Sulfur is produced all over the world. The highest output occurs where sour (sulfur-rich) gas and oil are treated and refined. International trade accounts for more than half of elemental sulfur production. The sulfur industry differs from a variety of prominent modern mineral industries in that the management of surplus sulfur reserves is becoming a more pressing concern than how to maintain long-term production. Unlike other companies that are looking for cost-effective ways to produce a marketable product from diminishing reserves and lower-grade ore, sulfur producers are seeking to discover novel uses for the continuously growing sulfur supply. As environmental concerns grow, the aim is to reduce the environmental impact of mining by recycling mineral resources or adopting more ecologically friendly products. Higher environmental perception leads to increased sulfur supply and lower growth in sulfur demand in many industrial processes.Solid Sulfur Market Report Scope:

The Solid Sulfur market is segmented based on Manufacturing Process, Application, and Region. The growth of various segments helps report users in acquiring knowledge of the many growth factors expected to be prevalent throughout the market and develop different strategies to help identify core application areas and the gap in the target market. The report provides an in-depth analysis of the market and contains meaningful insights, facts, historical data, and statistically supported and industry-validated market statistics. It also includes estimates based on an appropriate set of assumptions and methodologies. A bottom-up approach has been used to estimate the market size. Key Players in the Solid Sulfur market are identified through secondary research and their market revenues are determined through primary and secondary research. Secondary research included a review of annual and financial reports of leading manufacturers, while primary research included interviews with important opinion leaders and industry experts such as skilled front-line personnel, entrepreneurs, and marketing professionals. Some of the leading key players in the global Solid Sulfur market include Chemtrade, Citis SAS, Gazprom, and Jordan Sulfur. The report is not only a representation of global players but also covers the market holding of local players in each country. Market structure by country with market holding by market leaders, market followers, and local players make this report a comprehensive and insightful industry outlook. The report has covered the mergers and acquisitions, strategic alliances, joint ventures, and partnerships happening in the market by region, by investment, and their strategic intent.To know about the Research Methodology :- Request Free Sample Report

Solid Sulfur Market Dynamics:

A leap towards the eradication of world hunger: The growing global population and calorie consumption will more than double food demand by 2050. To attain and sustain the level of food supply required to satisfy this demand, global agriculture would need to significantly improve crop yields. Although experts are aware of the nutrients nitrogen (N), phosphorus (P), and potassium (K), few are aware of the importance and significance of sulfur as an agricultural resource. Treatment of sulfur-deficient soils is a cost-effective strategy to increase food and feed production. The Sulphur Institute conducted field trials in India, where rice is an important food staple for over one billion people. According to research, the introduction of sulfur fertilizer has the potential to improve the per capita food supply by more than 10%. For example, in the North American Corn Belt Sulphur fertilization maximizes maize yields by at least 11%. Role of sulfur in eco-friendly concrete production: Concrete is the most commonly used building material in the world, accounting for double the volume of all other building materials combined. A sulfur-based concrete binder is an environmentally friendly alternative to traditional Portland cement for paving stones, walkways, and building foundations. A sulfur binder is created with no water and less heat than Portland cement, leading to net energy savings, lower greenhouse gas emissions, and a diminished environmental footprint. Sulfur innovation may replace up to 30% of asphalt binder in road construction, which is a particularly labor-demanding input in blacktop roadways. Roads and parking lots that are sulfur-enhanced have a longer life cycle. Negligible and colossal losses from production and processing respectively: There are attempts in any industrial endeavor to reduce losses during manufacturing and processing to maximize the economic advantage of the operations. This is true in the sulfur mining industry, as companies attempt to maximize sulfur extraction. Sulfur mining varies from more traditional mining processes in ways that minimize losses throughout the Frasch mining process. Since ores are not mechanically treated to get the elemental sulfur product, almost no product is lost during handling. Sulfur leaks may occur in various Frasch plants, although in extremely small amounts that are negligible in comparison to overall sulfur output and environmental implications at particular locations. With the extinction of the Frasch industry in the United States and its severe decline in other nations, these losses to the sulfur industry are insignificant. Recovery of sulfur can be an economic burden rather than an asset in petroleum refining and natural gas processing. The expense of sulfur recovery equipment and operations greatly increases the cost of oil and gas processing. Costs vary greatly depending on location, size of operations, and type of equipment used. For example, a very small petroleum refinery in the United States paid an engineering company $22 million to increase its sulfur recovery capacity. Environmental concerns about sulfur and SO2 emissions, on the other hand, prevent practically all losses to the atmosphere, necessitating these types of installations. Although recovered sulfur sales might be beneficial for certain producers, others suffer the costs to have sulfur removed from their premises. However, stopping sulfur recovery activities while still processing oil and gas is never an option. If a refinery or natural gas business cannot collect sulfur for whatever reason, it must close, at least temporarily, until the issue is remedied and sulfur recovery is feasible again.Solid Sulfur Market Segment Analysis:

By Application, the fertilizers segment is expected to grow at a CAGR of 8.1% during the forecast period. Sulfur has long been an important raw ingredient in the fertilizer and chemical industries. It is the main source of sulfuric acid, the world's most frequently used chemical, which is utilized in a variety of manufacturing operations. The fertilizer industry uses sulfuric acid to make phosphates or phosphoric acid, as well as other fertilizers such as ammonium sulfate. The sulfur industry has evolved dramatically during the last decade. The sector has grown from being primarily a mining enterprise to a non-voluntary output of the petroleum and non-ferrous metals industries. Sulfur usage has also changed significantly. Although sulfur is an increasingly essential plant nutrient in its own right, its primary usage in the fertilizer industry is as an ingredient in the production of phosphate fertilizer. The transition from low to high-concentration phosphate compounds resulted in a significant rise in sulfur consumption. Non-fertilizer sulfur use has lately garnered prominence as a result of growing use in hydrometallurgical applications. Sulfur fertilizers are classified into three types: sulfate fertilizers, elemental sulfur fertilizers, and liquid sulfur fertilizers. The most concentrated sulfur carrier is elemental sulfur-based fertilizers. Modern technologies have enhanced their qualities and boosted their usage in direct applications or as fertilizer additions. Thiosulphates are expected to gain popularity in fluid fertilizer applications. Sulfur-modified or enhanced compound fertilizers based on sulfate or elemental sulfur has various advantages, including better chemical and physical qualities and the release of multi-nutrients in appropriate ratios for plant nutrition for direct application.

Solid Sulfur Market Regional Insights:

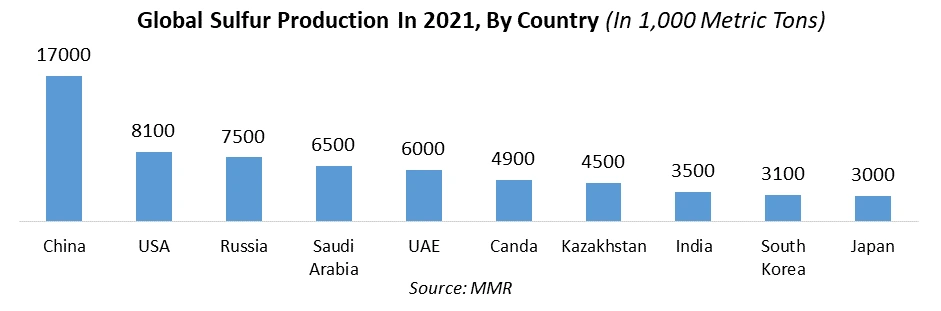

The North America solid sulfur market is expected to grow at a CAGR of 8.2% during the forecast period. In 2022, 95 facilities in 27 states produced recovered elemental sulfur and by-product sulfuric acid. The total value of the shipments was over $740 million. The output of elemental sulfur reached 7.5 million tons, with Louisiana and Texas accounting for around 55% of domestic production. Elemental sulfur was retrieved by 35 corporations at 90 plants in 26 states, in descending order of tonnage, at petroleum refineries, natural-gas processing plants, and coking plants. By-product sulfuric acid, accounting for roughly 7% of total sulfur output, was recovered by four enterprises at five nonferrous-metal smelters in four states. Local elemental sulfur accounted for 59% of domestic consumption, with by-product sulfuric acid accounting for 5%. Imported sulfur and sulfuric acid supplied the remaining 36% of sulfur consumed.The India solid sulfur market is expected to grow at a CAGR of 7.6% during the forecast period. Sulfur recovered as a by-product from fertilizer plants and oil refineries totaled 890 thousand tonnes in 2018-19, up from 825 thousand tonnes the previous year. As per the sulfur output reported by public sector oil refineries during the fiscal year 2018-19, Indian Oil Corp. Ltd contributed around 69% of total production. Odisha accounted for 26.88% of total sulfur output, followed by Kerala (25.36%), Haryana (19.85%), Gujarat (10.33%), Uttar Pradesh (5.81%), Maharashtra (5.27%), West Bengal (4.90%), while Assam and Bihar supplied the rest of the production. Also, Hindustan Petroleum Corp. Ltd., RIL, and Essar Oil have reported recovering by-product sulfur, which is then utilized as feedstock in the production of fertilizers and medicines. Essar Oil Ltd's Vadinar refinery is also reported to manufacture the by-product sulfur.

Solid Sulfur Market Scope: Inquiry Before Buying

Solid Sulfur Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 3.57 Bn. Forecast Period 2023 to 2029 CAGR: 4.1 % Market Size in 2029: US $ 4.73 Bn. Segments Covered: by Manufacturing Process 1. Frasch Process 2. Claus Process by Application 1. Fertilizers 2. Chemical Processing 3. Metal Manufacturing 4. Petroleum Refining 5. Others Solid Sulfur Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Solid Sulfur Market, Key Players are

1. Abu Dhabi National Oil Company 2. Chemtrade 3. Citis SAS 4. Gazprom 5. Jordan Sulphur 6. Lianyungang Yosoo Industrial Technique Co.,Ltd 7. Montana Sulphur & Chemical Co. 8. Motiva Enterprises 9. National Est. for Agricultural and Industrial Sulfur 10. Oxbow Corporation 11. Royal Dutch Shell PLC 12. Saudi Aramco 13. Singhasini Engineering Systems 14. Suncor Energy Inc. 15. Tengizchevroil LLP 16. Valero Energy Corporation FAQs: 1. Which region is expected to dominate the sulfur Market at the end of the forecast period? Ans. North America is expected to dominate the sulfur market at the end of the forecast period. 2. What is the growth rate of the North America sulfur Market? Ans. North America sulfur Market is expected to grow at a CAGR of 8.2% during the forecast period. 3. What is expected to drive the growth of the sulfur Market in the forecast period? Ans. Role of sulfur in eco-friendly concrete production. 4. What is the projected market size & growth rate of the sulfur Market? Ans. Solid Sulfur Market was valued at US$ 3.57 Bn. in 2022 and the total Solid Sulfur revenue is expected to grow at 4.1% from 2023 to 2029, reaching nearly US$ 4.73 Bn. 5. What segments are covered in the sulfur Market report? Ans. The segments covered are Manufacturing Process, Application, and Region.

1. Solid Sulfur Market: Research Methodology 2. Solid Sulfur Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Solid Sulfur Market: Dynamics 3.1 Solid Sulfur Market Trends by Region 3.1.1 Global Solid Sulfur Market Trends 3.1.2 North America Solid Sulfur Market Trends 3.1.3 Europe Solid Sulfur Market Trends 3.1.4 Asia Pacific Solid Sulfur Market Trends 3.1.5 Middle East and Africa Solid Sulfur Market Trends 3.1.6 South America Solid Sulfur Market Trends 3.2 Solid Sulfur Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Solid Sulfur Market Drivers 3.2.1.2 North America Solid Sulfur Market Restraints 3.2.1.3 North America Solid Sulfur Market Opportunities 3.2.1.4 North America Solid Sulfur Market Challenges 3.2.2 Europe 3.2.2.1 Europe Solid Sulfur Market Drivers 3.2.2.2 Europe Solid Sulfur Market Restraints 3.2.2.3 Europe Solid Sulfur Market Opportunities 3.2.2.4 Europe Solid Sulfur Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Solid Sulfur Market Market Drivers 3.2.3.2 Asia Pacific Solid Sulfur Market Restraints 3.2.3.3 Asia Pacific Solid Sulfur Market Opportunities 3.2.3.4 Asia Pacific Solid Sulfur Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Solid Sulfur Market Drivers 3.2.4.2 Middle East and Africa Solid Sulfur Market Restraints 3.2.4.3 Middle East and Africa Solid Sulfur Market Opportunities 3.2.4.4 Middle East and Africa Solid Sulfur Market Challenges 3.2.5 South America 3.2.5.1 South America Solid Sulfur Market Drivers 3.2.5.2 South America Solid Sulfur Market Restraints 3.2.5.3 South America Solid Sulfur Market Opportunities 3.2.5.4 South America Solid Sulfur Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives For the Solid Sulfur Industry 3.8 The Global Pandemic and Redefining of The Solid Sulfur Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 Global Solid Sulfur Trade Analysis (2017-2022) 3.11.1 Global Import of Solid Sulfur 3.11.2 Global Export of Solid Sulfur 3.12 Global Solid Sulfur Production Capacity Analysis 3.12.1 Chapter Overview 3.12.2 Key Assumptions and Methodology 3.12.3 Solid Sulfur Manufacturers: Global Installed Capacity 3.12.4 Analysis by Size of Manufacturer 4. Global Solid Sulfur Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 4.1 Global Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 4.1.1 Frasch Process 4.1.2 Claus Process 4.2 Global Solid Sulfur Market Size and Forecast, By Application (2022-2029) 4.2.1 Fertilizers 4.2.2 Chemical Processing 4.2.3 Metal Manufacturing 4.2.4 Petroleum Refining 4.2.5 Others 4.3 Global Solid Sulfur Market Size and Forecast, by Region (2022-2029) 4.3.1 North America 4.3.2 Europe 4.3.3 Asia Pacific 4.3.4 Middle East and Africa 4.3.5 South America 5. North America Solid Sulfur Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 5.1 North America Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 5.1.1 Frasch Process 5.1.2 Claus Process 5.2 North America Solid Sulfur Market Size and Forecast, By Application (2022-2029) 5.2.1 Fertilizers 5.2.2 Chemical Processing 5.2.3 Metal Manufacturing 5.2.4 Petroleum Refining 5.2.5 Others 5.3 North America Solid Sulfur Market Size and Forecast, by Country (2022-2029) 5.3.1 United States 5.3.1.1 United States Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 5.3.1.1.1 Frasch Process 5.3.1.1.2 Claus Process 5.3.1.2 United States Solid Sulfur Market Size and Forecast, By Application (2022-2029) 5.3.1.2.1 Fertilizers 5.3.1.2.2 Chemical Processing 5.3.1.2.3 Metal Manufacturing 5.3.1.2.4 Petroleum Refining 5.3.1.2.5 Others 5.3.2 Canada 5.3.2.1 Canada Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 5.3.2.1.1 Frasch Process 5.3.2.1.2 Claus Process 5.3.2.2 Canada Solid Sulfur Market Size and Forecast, By Application (2022-2029) 5.3.2.2.1 Fertilizers 5.3.2.2.2 Chemical Processing 5.3.2.2.3 Metal Manufacturing 5.3.2.2.4 Petroleum Refining 5.3.2.2.5 Others 5.3.3 Mexico 5.3.3.1 Mexico Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 5.3.3.1.1 Frasch Process 5.3.3.1.2 Claus Process 5.3.3.2 Mexico Solid Sulfur Market Size and Forecast, By Application (2022-2029) 5.3.3.2.1 Fertilizers 5.3.3.2.2 Chemical Processing 5.3.3.2.3 Metal Manufacturing 5.3.3.2.4 Petroleum Refining 5.3.3.2.5 Others 6. Europe Solid Sulfur Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 6.1 Europe Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 6.2 Europe Solid Sulfur Market Size and Forecast, By Application (2022-2029) 6.3 Europe Solid Sulfur Market Size and Forecast, by Country (2022-2029) 6.3.1 United Kingdom 6.3.1.1 United Kingdom Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 6.3.1.2 United Kingdom Solid Sulfur Market Size and Forecast, By Application (2022-2029) 6.3.2 France 6.3.2.1 France Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 6.3.2.2 France Solid Sulfur Market Size and Forecast, By Application (2022-2029) 6.3.3 Germany 6.3.3.1 Germany Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 6.3.3.2 Germany Solid Sulfur Market Size and Forecast, By Application (2022-2029) 6.3.4 Italy 6.3.4.1 Italy Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 6.3.4.2 Italy Solid Sulfur Market Size and Forecast, By Application (2022-2029) 6.3.5 Spain 6.3.5.1 Spain Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 6.3.5.2 Spain Solid Sulfur Market Size and Forecast, By Application (2022-2029) 6.3.6 Sweden 6.3.6.1 Sweden Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 6.3.6.2 Sweden Solid Sulfur Market Size and Forecast, By Application (2022-2029) 6.3.7 Austria 6.3.7.1 Austria Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 6.3.7.2 Austria Solid Sulfur Market Size and Forecast, By Application (2022-2029) 6.3.8 Rest of Europe 6.3.8.1 Rest of Europe Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 6.3.8.2 Rest of Europe Solid Sulfur Market Size and Forecast, By Application (2022-2029). 7. Asia Pacific Solid Sulfur Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 7.1 Asia Pacific Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 7.2 Asia Pacific Solid Sulfur Market Size and Forecast, By Application (2022-2029) 7.3 Asia Pacific Solid Sulfur Market Size and Forecast, by Country (2022-2029) 7.3.1 China 7.3.1.1 China Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 7.3.1.2 China Solid Sulfur Market Size and Forecast, By Application (2022-2029) 7.3.2 South Korea 7.3.2.1 S Korea Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 7.3.2.2 S Korea Solid Sulfur Market Size and Forecast, By Application (2022-2029) 7.3.3 Japan 7.3.3.1 Japan Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 7.3.3.2 Japan Solid Sulfur Market Size and Forecast, By Application (2022-2029) 7.3.4 India 7.3.4.1 India Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 7.3.4.2 India Solid Sulfur Market Size and Forecast, By Application (2022-2029) 7.3.5 Australia 7.3.5.1 Australia Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 7.3.5.2 Australia Solid Sulfur Market Size and Forecast, By Application (2022-2029) 7.3.6 Indonesia 7.3.6.1 Indonesia Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 7.3.6.2 Indonesia Solid Sulfur Market Size and Forecast, By Application (2022-2029) 7.3.7 Malaysia 7.3.7.1 Malaysia Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 7.3.7.2 Malaysia Solid Sulfur Market Size and Forecast, By Application (2022-2029) 7.3.8 Vietnam 7.3.8.1 Vietnam Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 7.3.8.2 Vietnam Solid Sulfur Market Size and Forecast, By Application (2022-2029) 7.3.9 Taiwan 7.3.9.1 Taiwan Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 7.3.9.2 Taiwan Solid Sulfur Market Size and Forecast, By Application (2022-2029) 7.3.10 Bangladesh 7.3.10.1 Bangladesh Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 7.3.10.2 Bangladesh Solid Sulfur Market Size and Forecast, By Application (2022-2029) 7.3.11 Pakistan 7.3.11.1 Pakistan Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 7.3.11.2 Pakistan Solid Sulfur Market Size and Forecast, By Application (2022-2029) 7.3.12 Rest of Asia Pacific 7.3.12.1 Rest of Asia Pacific Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 7.3.12.2 Rest of Asia PacificSolid Sulfur Market Size and Forecast, By Application (2022-2029) 8. Middle East and Africa Solid Sulfur Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 8.1 Middle East and Africa Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 8.2 Middle East and Africa Solid Sulfur Market Size and Forecast, By Application (2022-2029) 8.3 Middle East and Africa Solid Sulfur Market Size and Forecast, by Country (2022-2029) 8.3.1 South Africa 8.3.1.1 South Africa Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 8.3.1.2 South Africa Solid Sulfur Market Size and Forecast, By Application (2022-2029) 8.3.2 GCC 8.3.2.1 GCC Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 8.3.2.2 GCC Solid Sulfur Market Size and Forecast, By Application (2022-2029) 8.3.3 Egypt 8.3.3.1 Egypt Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 8.3.3.2 Egypt Solid Sulfur Market Size and Forecast, By Application (2022-2029) 8.3.4 Nigeria 8.3.4.1 Nigeria Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 8.3.4.2 Nigeria Solid Sulfur Market Size and Forecast, By Application (2022-2029) 8.3.5 Rest of ME&A 8.3.5.1 Rest of ME&A Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 8.3.5.2 Rest of ME&A Solid Sulfur Market Size and Forecast, By Application (2022-2029) 9. South America Solid Sulfur Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 9.1 South America Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 9.2 South America Solid Sulfur Market Size and Forecast, By Application (2022-2029) 9.3 South America Solid Sulfur Market Size and Forecast, by Country (2022-2029) 9.3.1 Brazil 9.3.1.1 Brazil Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 9.3.1.2 Brazil Solid Sulfur Market Size and Forecast, By Application (2022-2029) 9.3.2 Argentina 9.3.2.1 Argentina Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 9.3.2.2 Argentina Solid Sulfur Market Size and Forecast, By Application (2022-2029) 9.3.3 Rest Of South America 9.3.3.1 Rest Of South America Solid Sulfur Market Size and Forecast, By Manufacturing Process (2022-2029) 9.3.3.2 Rest Of South America Solid Sulfur Market Size and Forecast, By Application (2022-2029) 10. Global Solid Sulfur Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2022 10.3.9 No. of Stores 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading Solid Sulfur Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Abu Dhabi National Oil Company 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Chemtrade 11.3 Citis SAS 11.4 Gazprom 11.5 Jordan Sulphur 11.6 Lianyungang Yosoo Industrial Technique Co.,Ltd 11.7 Montana Sulphur & Chemical Co. 11.8 Motiva Enterprises 11.9 National Est. for Agricultural and Industrial Sulfur 11.10 Oxbow Corporation 11.11 Royal Dutch Shell PLC 11.12 Saudi Aramco 11.13 Singhasini Engineering Systems 11.14 Suncor Energy Inc. 11.15 Tengizchevroil LLP 11.16 Valero Energy Corporation 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary