Soft Touch Lamination Film Market size was valued at US$ 2.87 Bn. in 2022 and the total revenue is expected to grow at 6.55% through 2023 to 2029, reaching nearly US$ 4.48 Bn.Soft Touch Lamination Film Market Overview:

The soft touch lamination film market is expected to grow significantly with a CAGR of 6.55% during the forecast period. Soft touch lamination film Market report examines the market's growth drivers as well as its segments. Report includes market participants, and regional insights. This market study takes an in-depth look at all of the significant advancements that are currently occurring across all industry sectors. To provide key data analysis for the historical period (2018-2022), statistics, infographics, & presentations are used. The report examines the markets, Drivers, Restraints, Opportunities, & Challenges. This MMR report includes investor recommendations based on a detailed analysis of the current competitive landscape of the Soft touch lamination film market.To know about the Research Methodology :- Request Free Sample Report

Soft Touch Lamination Film Market Dynamics:

Soft touch lamination films provide a velvet-like and soft texture, as well as a protective finish and matte impression. Due to their appealing surface, these films' special properties persuade people to use them. Soft Touch Lamination Film Market size was valued at US$ 2.7 Bn. in 2022 and the total revenue is expected to grow at 6.55% through 2022 to 2029, reaching nearly US$ 4.48 Bn. These are ideally suited for use on business cards, high-end brochures, and luxury packaging to give them a premium top class look. This superior finish aids in making a lasting impact on individuals who come into contact with printed items with soft touch lamination performed on them. Soft touch lamination films are extremely long-lasting. Their polish leaves the final product fingerprint-free, which is an important feature for promoting costly and premium items. In comparison to normal varieties of lamination, such as matt, these are naturally more scuff resistant. As they are non-yellowing, their finish lasts longer. They work with a wide range of high-speed coating finishes, gloss varnishes, and foil blocking. The printing industry's increasing use of double-sided laminated films is likely to boost demand for soft touch lamination films in the near future. Another important aspect that is expected to boost the global market is the rising demand for one-sided lamination films in packaging applications. During the offset lithography process, some printers require soft touch lamination films. The ink-receptive layer of the film acts as a barrier between the proof sheet and the printing plate in this case. These sheets also serve as a prototype for checking the printed roofs from various perspectives before the actual production run. The global market is projected to be driven by these factors. These also aid in the preservation of food and the prevention of moisture-related harm. These also make it easier to hold items like hand soap bottles and cereal cartons. The soft touch lamination process gives every printed object a luxurious appearance, but it has significant drawbacks. The matt quality of soft touch films can sometimes degrade the color of the printed piece. If the printed component has a lot of color, the lamination will dull it down. Furthermore, because these films are not cost-effective, very few enterprises in emerging economies can afford to use them on a regular basis. These are scratch-prone and necessitate design expertise on the part of the employees. Sales of soft touch lamination films may be affected in the next years as a result of the aforementioned causes.Soft Touch Lamination Film Market Segment Analysis:

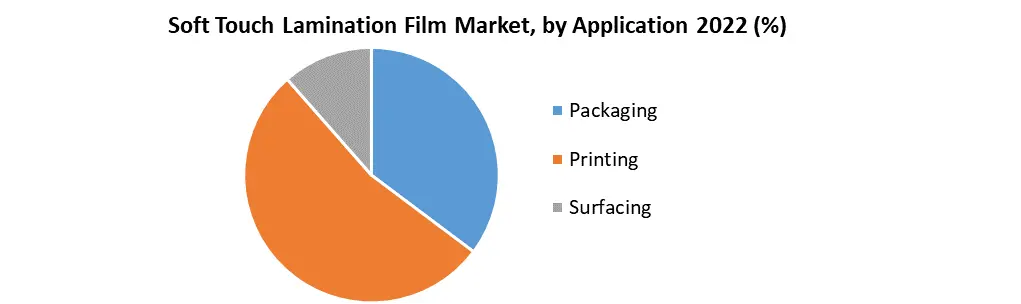

On the basis of type, the soft touch lamination film market is segmented into one side lamination film type and double side lamination film type. Double side lamination types segment is projected to grow at CAGR of xx% during the forecast period, due to it is mostly used for magazines and important official documents like passports and immigration forms that require protection from photocopying and forgery. As the number of international travellers is projected to increase so is the requirement of double-sided soft touch lamination films. Furthermore, on the basis of application the soft touch lamination market is sub-segmented into packaging, printing and surfacing. The packaging segment is projected to hold largest market share of xx% by 2029, owing to the increased e-commerce activities. All the products sold on e-commerce require packaging and additionally as the global trade has increased with every country focussing on increased cross nation partnership the share of packaging segment is projected to go higher.

Regional Insights:

North America is projected to hold the greatest market share of xx% by 2029. This market dominance is due to the increase in the use of these films in surface coatings to prevent photocopying. This is mostly practiced in Canada and the United States. Many companies in North America currently use them as a security printing medium on top of official papers like passports and driver's licenses, as well as on currency. These aid in the prevention of forgery and duplication. This is a significant aspect that will bolster North American economy. After North America, Asia Pacific is projected to continue in second place in terms of market share. The existence of a high number of small and large-scale manufacturing enterprises in developing nations like India and China is expected to boost the regional market. Furthermore, the Asia Pacific market is estimated to grow with high rate due to the constant expansion of the packaging industry in these nations. These films are commonly used to produce flexible packaging for food pouches and bags. The objective of the report is to present a comprehensive analysis of the market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the market dynamics, structure by analyzing the market segments and project the market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the market make the report investor’s guide.Soft Touch Lamination Film Market Scope: Inquire before buying

Global Soft Touch Lamination Film Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 2.87 Bn. Forecast Period 2023 to 2029 CAGR: 6.55% Market Size in 2029: US $ 4.48 Bn. Segments Covered: by lamination Type One side lamination film Double side lamination film by Application Packaging Printing Surfacing by Material Type Plastic Bi-Axially Oriented Polyethylene Terephthalate (BOPET) Extrusion-Coated Ethylene vinyl Acetate(EVA) Polypropylene (PP) Paper by Film Thickness Below 15 Micrones 15-25 Microns 25-35 Microns Above 35 Microns by Coating Type Water-based Soft Touch Lamination Film Solvent-based Soft Touch Lamination Film by End Use Ducket Jackets Pocket Folders Postcard Gift Bags Corporate Brochurs Electronic Packaging Others By Region

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) North America (United States, Canada and Mexico) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Soft Touch Lamination Film Market, Key Players

1. Monotech Systems Ltd. (India) 2. Avery Dennison Corporation (US) 3. Dunmore Corporation (US) 4. Ampacet Corporation (US) 5. Pragati Corporation (India) 6. Jet Technologies (India) 7. Taghleef Industries SLU (Spain) 8. Flexfilm Limited (India) 9. Cosmo Films Ltd. (India) 10. Spiral Binding (US) 11. Polyplex Ltd (India) 12. Flexia Films (Spain) 13. UFlex Ltd (India) 14. Jindal Poly Films (India) Frequently Asked Questions: 1. What is the forecast period considered for the Soft Touch Lamination Film market report? Ans. The forecast period for the Soft Touch Lamination Film market is 2023-2029. 2. Which key factors are hindering the growth of the Soft Touch Lamination Film market? Ans. The key factor hindering the growth of soft touch lamination film market is that the it dulls the colour of the printed piece. Additionally, the lamination is very costly and not every prospective customer can afford it. 3. What is the compound annual growth rate (CAGR) of the Soft Touch Lamination Film market for the forecast period? Ans. The compound annual growth rate (CAGR) of the market for the forecast period is 6.55% 4. What are the key factors driving the growth of the soft touch lamination film market? Ans. The key factors driving the growth of market is its extensive usage in offset lithography process. 5. Which are the worldwide major key players covered for the Soft Touch Lamination Film market report? Ans. Some of the worldwide key players in the Soft Touch Lamination Film market are Doro Tape (UK) Ltd. (UK), Monotech Systems Ltd. (India), Avery Dennison Corporation (US), Dunmore Corporation (US), Ampacet Corporation (US), Pragati Corporation (India), Jet Technologies (India), Taghleef Industries SLU (Spain)

1. Global Soft Touch Lamination Film Market: Research Methodology 2. Global Soft Touch Lamination Film Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Soft Touch Lamination Film Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Soft Touch Lamination Film Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 . COVID-19 Impact 4. Global Soft Touch Lamination Film Market Segmentation 4.1 Global Soft Touch Lamination Film Market, lamination Type (2022-2029) • One side lamination film • Double side lamination film 4.2 Global Soft Touch Lamination Film Market, Application (2022-2029) • Packaging • Printing • Surfacing 4.3 Global Soft Touch Lamination Film Market, Material Type (2022-2029) • Plastic • Bi-Axially Oriented Polyethylene Terephthalate (BOPET) • Extrusion-Coated Ethylene vinyl Acetate(EVA) • Polypropylene (PP) • Paper 4.4 Global Soft Touch Lamination Film Market, Film Thickness (2022-2029) • Below 15 Micrones • 15-25 Microns • 25-35 Microns • Above 35 Microns 4.5 Global Soft Touch Lamination Film Market, Coating Type (2022-2029) • Water-based Soft Touch Lamination Film • Solvent-based Soft Touch Lamination Film 4.6 Global Soft Touch Lamination Film Market, End Use (2022-2029) • Ducket Jackets • Pocket Folders • Postcard • Gift Bags • Corporate Brochurs • Electronic Packaging • Others 4.7 Global Soft Touch Lamination Film Market, by Region (2022-2029) • North America • Europe • Asia Pacific • The Middle East and Africa • South America 5. North America Soft Touch Lamination Film Market(2022-2029) 5.1 North America Soft Touch Lamination Film Market, lamination Type (2022-2029) • One side lamination film • Double side lamination film 5.2 North America Soft Touch Lamination Film Market, Application (2022-2029) • Packaging • Printing • Surfacing 5.3 North America Soft Touch Lamination Film Market, Material Type (2022-2029) • Plastic • Bi-Axially Oriented Polyethylene Terephthalate (BOPET) • Extrusion-Coated Ethylene vinyl Acetate(EVA) • Polypropylene (PP) • Paper 5.4 North America Soft Touch Lamination Film Market, Film Thickness (2022-2029) • Below 15 Micrones • 15-25 Microns • 25-35 Microns • Above 35 Microns 5.5 North America Soft Touch Lamination Film Market, Coating Type (2022-2029) • Water-based Soft Touch Lamination Film • Solvent-based Soft Touch Lamination Film 5.6 North America Soft Touch Lamination Film Market, End Use (2022-2029) • Ducket Jackets • Pocket Folders • Postcard • Gift Bags • Corporate Brochurs • Electronic Packaging • Others 5.7 North America Soft Touch Lamination Film Market, by Country (2022-2029) • United States • Canada • Mexico 6. Europe Soft Touch Lamination Film Market (2022-2029) 6.1. European Soft Touch Lamination Film Market, lamination Type (2022-2029) 6.2. European Soft Touch Lamination Film Market, Application (2022-2029) 6.3. European Soft Touch Lamination Film Market, Material Type (2022-2029) 6.4. European Soft Touch Lamination Film Market, Film Thickness (2022-2029) 6.5. European Soft Touch Lamination Film Market, Coating Type (2022-2029) 6.6. European Soft Touch Lamination Film Market, End Use (2022-2029) 6.7. European Soft Touch Lamination Film Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Soft Touch Lamination Film Market (2022-2029) 7.1. Asia Pacific Soft Touch Lamination Film Market, lamination Type (2022-2029) 7.2. Asia Pacific Soft Touch Lamination Film Market, Application (2022-2029) 7.3. Asia Pacific Soft Touch Lamination Film Market, Material Type (2022-2029) 7.4. Asia Pacific Soft Touch Lamination Film Market, Film Thickness (2022-2029) 7.5. Asia Pacific Soft Touch Lamination Film Market, Coating Type (2022-2029) 7.6. Asia Pacific Soft Touch Lamination Film Market, End Use (2022-2029) 7.7. Asia Pacific Soft Touch Lamination Film Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Soft Touch Lamination Film Market (2022-2029) 8.1 Middle East and Africa Soft Touch Lamination Film Market, lamination Type (2022-2029) 8.2. Middle East and Africa Soft Touch Lamination Film Market, Application (2022-2029) 8.3. Middle East and Africa Soft Touch Lamination Film Market, Material Type (2022-2029) 8.4. Middle East and Africa Soft Touch Lamination Film Market, Film Thickness (2022-2029) 8.5. Middle East and Africa Soft Touch Lamination Film Market, Coating Type (2022-2029) 8.6. Middle East and Africa Soft Touch Lamination Film Market, End Use (2022-2029) 8.7. Middle East and Africa Soft Touch Lamination Film Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Soft Touch Lamination Film Market (2022-2029) 9.1. South America Soft Touch Lamination Film Market, lamination Type (2022-2029) 9.2. South America Soft Touch Lamination Film Market, Application (2022-2029) 9.3. South America Soft Touch Lamination Film Market, Material Type (2022-2029) 9.4. South America Soft Touch Lamination Film Market, Film Thickness (2022-2029) 9.5. South America Soft Touch Lamination Film Market, Coating Type (2022-2029) 9.6. South America Soft Touch Lamination Film Market, End Use (2022-2029) 9.7. South America Soft Touch Lamination Film Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 Doro Tape (UK) Ltd. (UK) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Monotech Systems Ltd. (India) 10.3 Avery Dennison Corporation (US) 10.4 Dunmore Corporation (US) 10.5 Ampacet Corporation (US) 10.6 Pragati Corporation (India) 10.7 Jet Technologies (India) 10.8 Taghleef Industries SLU (Spain) 10.9 Flexfilm Limited (India) 10.10 Cosmo Films Ltd. (India) 10.11 Spiral Binding (US) 10.12 Polyplex Ltd (India) 10.13 Flexia Films (Spain) 10.14 UFlex Ltd (India) 10.15 Jindal Poly Films (India)