Global Social Security Insurance Market size was valued at USD 3.4 Bn in 2022 and is expected to reach USD 4.63 Bn by 2029, at a CAGR of 4.5 %.Social Security Insurance Market Overview

Social Security is a government-run program that offers income support and financial benefits to eligible individuals and families. It primarily provides retirement, disability and survivor benefits. Social security is the protection that society provides to individuals and households to ensure access to health care and to guarantee income security, particularly in cases of old age, unemployment, sickness, invalidity, work injury, maternity, or loss of a breadwinner. The financial protection against specific risks in exchange for regular premium payments. Insurance policies are designed to cover several risks including health expenses, disability, life events, property damage and liability. Insurance plays a complementary role in the context of Social Security. While Social Security offers a basic level of financial security through its retirement, survivors, and disability benefits, insurance products have been used to supplement or enhance that coverage. The bottom-up approach was used to estimate the Social Security Insurance market size. The market revenue is determined by the primary and secondary data collection methods. The Social Security Insurance market report focuses on the drivers, challenges and major restraints of the Social Security Insurance industry.To know about the Research Methodology :- Request Free Sample Report

Social Security Insurance Market Dynamics

Drivers Growing Ageing Population to Boosts the Social Security Insurance Market Growth As the population ages, a large number of individuals are approaching retirement or have already retired. This creates an increasing demand for retirement planning and financial security during the post-employment phase. Social Security Insurance products including annuities or retirement income policies, offer individuals with additional income streams to supplement their Social Security benefits, ensuring a more comfortable retirement. With an aging population, there is an increase in the individual’s likelihood of requiring long-term care services such as nursing home care and assisted living. These services have been expensive and traditional health insurance has barriers in covering long-term care expenses. Social Security Insurance products, such as long-term care insurance, address this requirement by offering coverage for these specific care needs and ease the financial burden on individuals and their families. As increasing age of people age, generally, they experience a higher prevalence of health issues and medical expenses. The cost of healthcare continues to grow, and government-provided social security benefits have not fully cover all medical expenses. Social Security Insurance has been including health insurance policies that provide comprehensive coverage for medical expenses, ensuring that individuals have access to quality healthcare without facing significant financial strain. As a result, the growing Ageing Population drives the Social Security Insurance Market growth. Government Initiatives to Fuel the Social Security Insurance Market Growth The governments perceive the importance of retirement planning and the need for individuals to save for their future. They implement several initiatives including tax incentives, employer-sponsored retirement plans and public awareness campaigns to boost citizens to take an active role in planning for their retirement. These initiatives has been create a favorable environment for the Social Security Insurance products growth that complement current social security programs. Governments aim to minimize the strain on their social security systems by promoting private insurance solutions. By encouraging individuals to supplement their social security benefits with private insurance, governments has been alleviate the burden on the public sector. This proactive approach helps ensure the long-term sustainability of social security programs while permitting individuals to enhance their financial security which drives the Social Security Insurance Market growth. For Instance, the Indian Government Sponsored Socially Oriented Insurance Schemes such as Pradhan Mantri Jeevan Jyoti Bima Yojana(PMJJBY), Pradhan Mantri Suraksha Bima Yojana(PMSBY) and Atal Pension Yojana APY, etc. Pradhan Mantri Suraksha Bima Yojana (PMSBY): The risk coverage under the scheme is Rs. 2 lakh for accidental death and full disability and Rs. 1 lakh for partial disability. The scheme is being offered by Public Sector General Insurance Companies or any other General Insurance Company that is offering the product on similar terms with necessary approvals and tie up with Banks and Post Offices for this purpose. On the 8th anniversary of the Jan Suraksha Schemes, Smt. Sitharaman said that 16.2 crores, 34.2 crore and 5.2 crore enrolments have been done under PMJJBY, PMSBY & APY respectively till 26th April 2023. On the PMJJBY scheme, the Finance Minister said that it has provided crucial support to 6.64 lakh families who have received claims for Rs. 13,290 crores. Social Security Insurance Market Trend Technological Advancements Technology has been streamlining administrative processes and automating repetitive tasks resulting in increased efficiency in managing Social Security insurance programs. This has been leading to faster processing of claims, reduced paperwork and more accurate benefit calculations. By leveraging technology, governments and insurance providers have optimized their operations and delivered services more effectively. Fraud detection and prevention are crucial in the social security insurance market. Advances in data analytics and machine learning algorithms enable the identification of patterns and anomalies that indicate potential fraud or abuse. These technologies have been supporting detect fraudulent claims, improper use of benefits, and identity theft, thereby protecting the integrity of social security programs and preserving resources for those in genuine need. Technology enables the digitization of services, allowing individuals to access and manage their social security advantages online. Online portals, mobile applications, and self-service platforms has been provide convenient and user-friendly interfaces for beneficiaries to apply for benefits, check their eligibility, monitor their contributions, and receive updates. Digital service delivery has to improve accessibility, minimize administrative costs, and enhance the overall user experience. This trend resulted in boosts in the Social Security Insurance Market growth. Social Security Insurance Market Restraints Financial Sustainability to Restraints the Market Growth One of the primary factors contributing to financial sustainability concerns is the changing demographics, particularly the aging population. As the proportion of elderly individuals rises and life expectancies rise, there is an increasing demand for retirement benefits and healthcare services. This demographic shift has been a strain on social security insurance systems as the number of retirees drawing benefits exceeds the number of active contributors paying into the system. This imbalance increases pressure on the financial resources of these programs. In many countries, declining birth rates contribute to the financial sustainability challenge. A lower birth rate means there are lower future contributors to the social security system, minimizing the revenue base required to fund benefits. This has resulted in a shrinking contributor-to-beneficiary ratio and created funding gaps that require to be addressed to ensure the long-term viability of social security insurance programs. The increasing longevity, economic fluctuations, inadequate contribution rates and future economic uncertainty are also the hampering factors for the Social Security Insurance Market growth.Social Security Insurance Market Segment Analysis

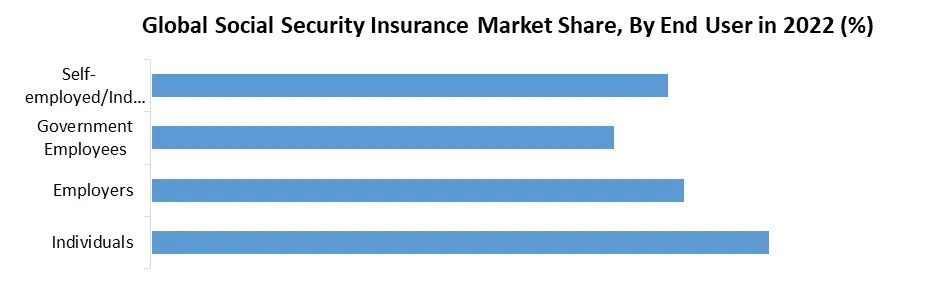

Based on Insurance Type: the market is segmented into Retirement Insurance, Disability Insurance, Survivor Insurance, Healthcare Insurance and Unemployment Insurance. Retirement Insurance held the Social Security Insurance Market in 2022 and is expected to have a significant CAGR for Social Security Insurance Market. Retirement insurance is designed to offer individuals with income support and financial security during their retirement years when they are no longer actively earning income from employment. Retirement insurance includes contributions made by individuals and their employers during their working years. These contributions are invested to build up a retirement fund, which is then used to provide regular pension payments to the individual upon retirement. Retirement insurance programs vary across several countries and regions, with variations in eligibility criteria, contribution levels, benefit calculations, and retirement ages. Some countries operate public pension systems funded by mandatory contributions from employees and employers, while provides have a mix of public and private pension schemes.It plays a vital role in ensuring individuals have a reliable income stream in their post-employment years. It supports retirees maintain their standard of living, meet basic needs, and enjoy a comfortable retirement. With the increasing aging population and the rising importance of retirement planning, retirement insurance has become a dominant insurance type within the Social Security Insurance Market.Based on End User On the basis of End User, the market is categorized into Individuals, Employers, Government Employees and Self-employed/Independent Workers. Individuals held the largest Social Security Insurance Market share in 2022. Social Security insurance programs typically aim to offer coverage and support to a broad population base. Individuals make them the primary target for social security benefits and services. The coverage extends to employees, self-employed individuals and other working professionals, ensuring that a significant part of the population is involved. Social security insurance is designed to offer individuals with financial security and protection during several life stages including retirement, disability, unemployment or healthcare requirements. Individuals are directly impacted by these events and have a personal interest in accessing the benefits provided by social security programs. They contribute to the programs through payroll deductions and expect to receive the corresponding benefits when they required them. Individuals are executive for their own financial well-being such as planning for retirement and managing healthcare costs. Social Security insurance programs act as a safety net, assuring that individuals have a lower level of income and aid when facing challenges. The responsibility for participating in and utilizing social security insurance lies with the individuals themselves which drives the Social Security Insurance Market growth.

Social Security Insurance Market Regional Insights

North America dominates the Social Security Insurance Market North America held the largest Social Security Insurance Market share. The aging population in the region particularly in the United States is a significant driver of Social Security Insurance Market growth. As the baby boomer generation reaches retirement age, there is an increasing demand for retirement benefits and healthcare services. This demographic trend requires the expansion and sustainability of social security programs to hold the growing number of retirees. Government support and regulation play a vital role in the Social Security Insurance industry growth. The governments have implemented social security programs to offer a safety net for their citizens. These programs are designed to offer retirement benefits, disability insurance, and healthcare coverage. Governments also regulate the insurance industry to assure compliance, consumer protection, and financial stability, thereby fostering Social Security Insurance industry growth. Growing awareness among individuals regarding the importance of social security benefits and retirement planning contributes drive the market growth. As people recognize the requirement for financial security in retirement, there is an increased interest in participating in social security insurance programs and exploring options to supplement their retirement income. This awareness boosts the market growth as more individuals are actively busy with social security systems. Asia Pacific is expected to have significant growth for the Social Security Insurance Market over the forecast period. The region has a large and rapidly increasing population, which creates a substantial social security insurance market. As more individuals enter the workforce and contribute to social security systems, there is an expansion of the revenue base programs. The increasing middle class in drives the demand for social security benefits such as retirement plans, healthcare coverage, etc. The increasing urbanization, government initiatives and reforms, rising awareness of social security, economic growth and increasing disposable income and technological advancements are also the driving factors for the regional market growth.Global Social Security Insurance Market Scope : Inquire Before Buying

Global Social Security Insurance Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 3.4 Bn. Forecast Period 2023 to 2029 CAGR: 4.5% Market Size in 2029: US $ 4.63 Bn. Segments Covered: by Insurance Type Retirement Insurance Disability Insurance Survivor Insurance Healthcare Insurance Unemployment Insurance by End User Individuals Employers Government Employees Self-employed/Independent Workers by Distribution Channel Insurance Agents/Brokers Direct Sales Online Channels Bancassurance Social Security Insurance Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Social Security Insurance Market, Key Players are

1. Allianz 2. Aetna Inc., 3. AXA 4. Cigna 5. Bupa Global 6. Expacare Limited 7. Foyer Group 8. GeoBlue 9. Berkshire Hathaway 10. Ping An Insurance 11. AIA Group 12. China Life Insurance 13. Humana 14. Munich 15. CSA Travel Protection DBA Generali Global Assistance & Insurance ServicesFrequently Asked Questions:

1] What is the growth rate of the Global Social Security Insurance Market? Ans. The Global Social Security Insurance Market is growing at a significant rate of 4.5 % during the forecast period. 2] Which region is expected to dominate the Global Social Security Insurance Market? Ans. North America is expected to dominate the Social Security Insurance Market during the forecast period. 3] What is the expected Global Social Security Insurance Market size by 2029? Ans. The Social Security Insurance Market size is expected to reach USD 4.63 Bn by 2029. 4] Which are the top players in the Global Social Security Insurance Market? Ans. The major top players in the Global Social Security Insurance Market are Allianz , Aetna Inc., AXA, Cigna, Bupa Global, Expacare Limited, Foyer Group, GeoBlue, Berkshire Hathaway, Ping An Insurance and others. 5] What are the factors driving the Global Market growth? Ans. The rowing Ageing Population and government initiatives are expected to drive market growth during the forecast period.

1. Social Security Insurance Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Social Security Insurance Market: Dynamics 2.1. Social Security Insurance Market Trends by Region 2.1.1. North America Social Security Insurance Market Trends 2.1.2. Europe Social Security Insurance Market Trends 2.1.3. Asia Pacific Social Security Insurance Market Trends 2.1.4. Middle East and Africa Social Security Insurance Market Trends 2.1.5. South America Social Security Insurance Market Trends 2.2. Social Security Insurance Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Social Security Insurance Market Drivers 2.2.1.2. North America Social Security Insurance Market Restraints 2.2.1.3. North America Social Security Insurance Market Opportunities 2.2.1.4. North America Social Security Insurance Market Challenges 2.2.2. Europe 2.2.2.1. Europe Social Security Insurance Market Drivers 2.2.2.2. Europe Social Security Insurance Market Restraints 2.2.2.3. Europe Social Security Insurance Market Opportunities 2.2.2.4. Europe Social Security Insurance Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Social Security Insurance Market Drivers 2.2.3.2. Asia Pacific Social Security Insurance Market Restraints 2.2.3.3. Asia Pacific Social Security Insurance Market Opportunities 2.2.3.4. Asia Pacific Social Security Insurance Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Social Security Insurance Market Drivers 2.2.4.2. Middle East and Africa Social Security Insurance Market Restraints 2.2.4.3. Middle East and Africa Social Security Insurance Market Opportunities 2.2.4.4. Middle East and Africa Social Security Insurance Market Challenges 2.2.5. South America 2.2.5.1. South America Social Security Insurance Market Drivers 2.2.5.2. South America Social Security Insurance Market Restraints 2.2.5.3. South America Social Security Insurance Market Opportunities 2.2.5.4. South America Social Security Insurance Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Social Security Insurance Industry 2.8. Analysis of Government Schemes and Initiatives For Social Security Insurance Industry 2.9. Social Security Insurance Market Trade Analysis 2.10. The Global Pandemic Impact on Social Security Insurance Market 3. Social Security Insurance Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 3.1.1. Retirement Insurance 3.1.2. Disability Insurance 3.1.3. Survivor Insurance 3.1.4. Healthcare Insurance 3.1.5. Unemployment Insurance 3.2. Social Security Insurance Market Size and Forecast, by End User (2022-2029) 3.2.1. Individuals 3.2.2. Employers 3.2.3. Government Employees 3.2.4. Self-employed/Independent Workers 3.3. Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 3.3.1. Insurance Agents/Brokers 3.3.2. Direct Sales 3.3.3. Online Channels 3.3.4. Bancassurance 3.4. Social Security Insurance Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Social Security Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 4.1.1. Retirement Insurance 4.1.2. Disability Insurance 4.1.3. Survivor Insurance 4.1.4. Healthcare Insurance 4.1.5. Unemployment Insurance 4.2. North America Social Security Insurance Market Size and Forecast, by End User (2022-2029) 4.2.1. Individuals 4.2.2. Employers 4.2.3. Government Employees 4.2.4. Self-employed/Independent Workers 4.3. North America Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.1. Insurance Agents/Brokers 4.3.2. Direct Sales 4.3.3. Online Channels 4.3.4. Bancassurance 4.4. North America Social Security Insurance Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 4.4.1.1.1. Retirement Insurance 4.4.1.1.2. Disability Insurance 4.4.1.1.3. Survivor Insurance 4.4.1.1.4. Healthcare Insurance 4.4.1.1.5. Unemployment Insurance 4.4.1.2. United States Social Security Insurance Market Size and Forecast, by End User (2022-2029) 4.4.1.2.1. Individuals 4.4.1.2.2. Employers 4.4.1.2.3. Government Employees 4.4.1.2.4. Self-employed/Independent Workers 4.4.1.3. United States Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1.3.1. Insurance Agents/Brokers 4.4.1.3.2. Direct Sales 4.4.1.3.3. Online Channels 4.4.1.3.4. Bancassurance 4.4.2. Canada 4.4.2.1. Canada Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 4.4.2.1.1. Retirement Insurance 4.4.2.1.2. Disability Insurance 4.4.2.1.3. Survivor Insurance 4.4.2.1.4. Healthcare Insurance 4.4.2.1.5. Unemployment Insurance 4.4.2.2. Canada Social Security Insurance Market Size and Forecast, by End User (2022-2029) 4.4.2.2.1. Individuals 4.4.2.2.2. Employers 4.4.2.2.3. Government Employees 4.4.2.2.4. Self-employed/Independent Workers 4.4.2.3. Canada Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.2.3.1. Insurance Agents/Brokers 4.4.2.3.2. Direct Sales 4.4.2.3.3. Online Channels 4.4.2.3.4. Bancassurance 4.4.3. Mexico 4.4.3.1. Mexico Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 4.4.3.1.1. Retirement Insurance 4.4.3.1.2. Disability Insurance 4.4.3.1.3. Survivor Insurance 4.4.3.1.4. Healthcare Insurance 4.4.3.1.5. Unemployment Insurance 4.4.3.2. Mexico Social Security Insurance Market Size and Forecast, by End User (2022-2029) 4.4.3.2.1. Individuals 4.4.3.2.2. Employers 4.4.3.2.3. Government Employees 4.4.3.2.4. Self-employed/Independent Workers 4.4.3.3. Mexico Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.3.3.1. Insurance Agents/Brokers 4.4.3.3.2. Direct Sales 4.4.3.3.3. Online Channels 4.4.3.3.4. Bancassurance 5. Europe Social Security Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 5.1. Europe Social Security Insurance Market Size and Forecast, by End User (2022-2029) 5.1. Europe Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.4. Europe Social Security Insurance Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 5.4.1.2. United Kingdom Social Security Insurance Market Size and Forecast, by End User (2022-2029) 5.4.1.3. United Kingdom Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.2. France 5.4.2.1. France Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 5.4.2.2. France Social Security Insurance Market Size and Forecast, by End User (2022-2029) 5.4.2.3. France Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 5.4.3.2. Germany Social Security Insurance Market Size and Forecast, by End User (2022-2029) 5.4.3.3. Germany Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 5.4.4.2. Italy Social Security Insurance Market Size and Forecast, by End User (2022-2029) 5.4.4.3. Italy Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.5. Spain 5.4.5.1. Spain Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 5.4.5.2. Spain Social Security Insurance Market Size and Forecast, by End User (2022-2029) 5.4.5.3. Spain Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 5.4.6.2. Sweden Social Security Insurance Market Size and Forecast, by End User (2022-2029) 5.4.6.3. Sweden Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 5.4.7.2. Austria Social Security Insurance Market Size and Forecast, by End User (2022-2029) 5.4.7.3. Austria Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 5.4.8.2. Rest of Europe Social Security Insurance Market Size and Forecast, by End User (2022-2029) 5.4.8.3. Rest of Europe Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Social Security Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 6.2. Asia Pacific Social Security Insurance Market Size and Forecast, by End User (2022-2029) 6.3. Asia Pacific Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4. Asia Pacific Social Security Insurance Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 6.4.1.2. China Social Security Insurance Market Size and Forecast, by End User (2022-2029) 6.4.1.3. China Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 6.4.2.2. S Korea Social Security Insurance Market Size and Forecast, by End User (2022-2029) 6.4.2.3. S Korea Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 6.4.3.2. Japan Social Security Insurance Market Size and Forecast, by End User (2022-2029) 6.4.3.3. Japan Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.4. India 6.4.4.1. India Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 6.4.4.2. India Social Security Insurance Market Size and Forecast, by End User (2022-2029) 6.4.4.3. India Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 6.4.5.2. Australia Social Security Insurance Market Size and Forecast, by End User (2022-2029) 6.4.5.3. Australia Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 6.4.6.2. Indonesia Social Security Insurance Market Size and Forecast, by End User (2022-2029) 6.4.6.3. Indonesia Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 6.4.7.2. Malaysia Social Security Insurance Market Size and Forecast, by End User (2022-2029) 6.4.7.3. Malaysia Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 6.4.8.2. Vietnam Social Security Insurance Market Size and Forecast, by End User (2022-2029) 6.4.8.3. Vietnam Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 6.4.9.2. Taiwan Social Security Insurance Market Size and Forecast, by End User (2022-2029) 6.4.9.3. Taiwan Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Social Security Insurance Market Size and Forecast, by End User (2022-2029) 6.4.10.3. Rest of Asia Pacific Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Social Security Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 7.2. Middle East and Africa Social Security Insurance Market Size and Forecast, by End User (2022-2029) 7.3. Middle East and Africa Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 7.4. Middle East and Africa Social Security Insurance Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 7.4.1.2. South Africa Social Security Insurance Market Size and Forecast, by End User (2022-2029) 7.4.1.3. South Africa Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 7.4.2.2. GCC Social Security Insurance Market Size and Forecast, by End User (2022-2029) 7.4.2.3. GCC Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 7.4.3.2. Nigeria Social Security Insurance Market Size and Forecast, by End User (2022-2029) 7.4.3.3. Nigeria Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 7.4.4.2. Rest of ME&A Social Security Insurance Market Size and Forecast, by End User (2022-2029) 7.4.4.3. Rest of ME&A Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Social Security Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 8.2. South America Social Security Insurance Market Size and Forecast, by End User (2022-2029) 8.3. South America Social Security Insurance Market Size and Forecast, by Distribution Channel(2022-2029) 8.4. South America Social Security Insurance Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 8.4.1.2. Brazil Social Security Insurance Market Size and Forecast, by End User (2022-2029) 8.4.1.3. Brazil Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 8.4.2.2. Argentina Social Security Insurance Market Size and Forecast, by End User (2022-2029) 8.4.2.3. Argentina Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Social Security Insurance Market Size and Forecast, by Insurance Type (2022-2029) 8.4.3.2. Rest Of South America Social Security Insurance Market Size and Forecast, by End User (2022-2029) 8.4.3.3. Rest Of South America Social Security Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Social Security Insurance Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Social Security Insurance Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Allianz 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Aetna Inc., 10.3. AXA 10.4. Cigna 10.5. Bupa Global 10.6. Expacare Limited 10.7. Foyer Group 10.8. GeoBlue 10.9. Berkshire Hathaway 10.10. Ping An Insurance 10.11. AIA Group 10.12. China Life Insurance 10.13. Humana 10.14. Munich 10.15. CSA Travel Protection DBA Generali Global Assistance & Insurance Services 11. Key Findings 12. Industry Recommendations 13. Social Security Insurance Market: Research Methodology 14. Terms and Glossary