Smart Clothing Market size was valued at USD 2.79 Billion in 2023 and the total Smart Clothing Market Size is expected to grow at a CAGR of 27.4 % from 2024 to 2030, reaching nearly USD 15.20 Billion in 2030.Smart Clothing Market Overview

Smart clothing is a type of wearable device. A wearable device is defined as an electronic device having a sensor that receives data on a wearer or its surroundings. The devices operate wirelessly or through other devices, such as smartphones or tablets, and wearable devices are broken down by use or form. Smart garments are intelligent products that provide platforms for the development of new innovative applications. Clothing acts as a communication medium, an information content platform, or an interface for future ubiquitous computing devices. Smart clothing promotes safety with the help of different alarms, positioning, and sensor systems. Clothing also functions as a working aid; e.g. smart clothes perform physiological measurement and data collection tasks for doctors or offer communication help for maintenance workers.To know about the Research Methodology :- Request Free Sample Report 1. The Samsung Group launched a smart clothing care service named ‘Air Dresser’ in the U.K. The service provides a smart cloth dry cleaning and washing service for people across the country. 2. The University of Helsinki has developed a smart jumpsuit to track infants’ movements, enabling accurate and continuous monitoring of their development. By recording spontaneous and voluntary movements, the jumpsuit offers insights comparable to those obtained through video recordings by health professionals. Athos company using EMG to move into the athletic wearables market. Athos has produced a gym clothing line and free iOS app that together provide real-time feedback on muscle engagement. Athos systems are currently being used by the professional basketball team ‘The Golden State Warriors. The Golden State Warriors coach monitors his players’ workouts and uses the data to determine physical readiness for upcoming games. In the professional sports industry, the cost of preventable injuries jeopardizes a team’s success. Thus, there is a market opportunity for EMG sensor-equipped smart clothing to provide injury-preventing insights.

Smart Clothing Market Dynamics

The Surge of Smart Clothing in Fitness and HealthcareRising adoption of smart wearable devices such as clothes, glasses, body sensors, and others is expected to drive the Smart Clothing Market growth. The emergence of IoT-connected medical clothing also growing sports and leisure activity trends among the global population have added impetus to the demand for such products. Smart Clothing is highly valuable to athletes and sports teams, and increasing demand for the product drives Smart Clothing Market growth. Smart clothing products have the potential to reduce or even eliminate the majority of preventable injuries. It Is another factor that makes smart clothing very advantageous for the healthcare industry. It helps to record running distance, breathing rates, and heart rates with the aid of sensors, the demand for smart clothing is quickly rising for fitness-related purposes. Smart Clothing Innovations to Enhancing Safety, Health, and Performance The suit consists of a two-piece set of underwear, a supporting structure, and the actual snowmobile jacket and trousers. The garment is capable of giving information about the wearer’s health, location, and movements. With several integrated sensors it is possible to monitor a user’s condition and position. If the user meets with an accident or other abnormal situation, the suit informs an emergency office or activates another preselected phone number via the Short Message Service (SMS) of the Global System for Mobile (GSM) communication. The user also sends an emergency message. The message contains the current coordinates of the user’s position and an emergency reason code, which in case refers to an injury situation or a technical failure of a snowmobile. After the emergency message has been sent, it is also possible to request additional information from the suit. To the request, the suit responds by sending data on the user and environmental measurements. The coordinates are acquired using the Global Positioning System (GPS). Another sensor that a smart clothing manufacturer includes in their product is an electromyography (EMG) or ‘muscle sensor’. It is particularly useful in smart athletic wear. Users put on their smart suits before heading to the gym, then use a mobile app to track muscle activity, optimize their workout, and prevent injury. EMG sensors use electrodes to measure the electrical potential of muscle tissue resulting from a nerve’s stimulation of that muscle. Nadi X is one of the most futuristic smart wear, designed by Wearable X, a leading fashion tech company fusing tech and design to create an improved quality of life. Nadi X yoga pants feature built-in haptic vibrations that pulse gently at the hips, ankles, and knees, encouraging you to hold or move positions. The pants sync to your phone via Bluetooth through its associated app that provides you valuable feedback. Nadi X pants come in different colors and sizes to accommodate different needs. Komodo Technologies launched a compression sleeve that utilizes electrocardiogram (ECG) tech to monitor heart rate activity. The sleeve also monitors sleep and workout intensity. In addition, the sleeve's module features sensors that monitor body temperature, UV rays, and air quality. Addressing Hurdles in the Adoption and Comfort of Smart Fitness Clothing The high cost of smart fitness clothing products is expected to hamper the market. Adoption of smart wearables for fitness tracking across the globe is anticipated to take time, owing to cost factors and lack of awareness. Rising concerns for data privacy are anticipated to restrain the market. Smart clothing is all about comfort. There are lots of wires inside the clothing attached to monitors. It is not comfortable for the user if the individual is working or resting. The wires and monitors irritate the wearer and cause rashes on the skin. It is one big concern to solve in front of smart textile companies.

Smart Clothing Market Segmentation:

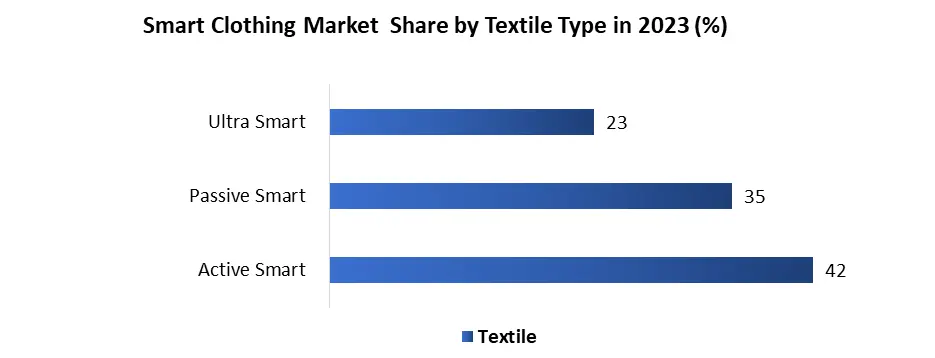

By Textile Type, Advancement in smart textile material has significantly revolutionized the textile industry, enabling them to penetrate the field of high-tech applications and cover markets beyond the scope of the traditional textile industry. Smart textiles are fabrics integrated with computing power that provide additional functionalities, such as monitoring, communication, and stimulation. Additionally, the advent of nanotechnology, RFID, and sensor technology in textiles provides an impetus to the market growth. Smart textiles pack powerful sensors and electronics in the weave of a material. The components are stretchable, breathable, even washable – and they are invisible to the eye. Passive textiles are largely used in outdoor apparel and medical wearables. Increasing spending power, the rising standard of living, and surging awareness regarding health and fitness drive the segment growth. Passive smart fabrics and textiles are the ones that sense the movement of the human body through magnetic, electrochemical, or electronic means. 1. Smart textiles incorporate LEDs or other lighting elements, creating garments that light up in response to movement or other stimuli. It’s created striking visual effects and makes the wearer more visible in low-light conditions. 2. Smart textiles are used to create clothing that incorporates wearable technology, such as heart rate monitors or GPS trackers. Technology provides valuable data to the wearer and helps them track their fitness goals. Manufacturing locally to minimize operational costs is one of the key business tactics used by manufacturers in the Smart Textile industry to benefit clients and increase the market sector. In recent years, the Smart Textile industry has offered some of the most significant advantages to medicine. Major players in the Smart Textile Market, including Textronics, Inc. (U.S.), Outlast Technologies LLC (U.S.), Sensoria Inc. (U.S.), Thermosoft International Corporation (U.S.), and Ohmatex ApS (Denmark) and others, are attempting to increase market demand by investing in research and development operations.

Smart Clothing Market Regional Analysis:

The Asia-Pacific region is expected to become the fastest-growing region with a market share of 35 % in the Smart Clothing Market. It is owing to the increasing adoption of various wearable devices, as well as the increasing demand for new features in the products. Additionally, rising security concerns as well as rising military and defence budgets in nations such as China and India are expected to drive a surge in demand for the products. The active smart fabric is the fastest growing among other products in the Asia Pacific smart factory market because of the integration of sensors as well as actuators. They are available in the form of heat-evolving fabrics and also in electrically heated suits along with the features such as shape memory, heat storage, and water resistance. Among other materials light emitting or luminous fabric is a type of fabric material that lights up; it is generally made of ultra-thin optic fiber directly woven with synthetic fiber. The most well-known and extensively used healthcare wearables for monitoring important indicators are sports and fitness gadgets. Wearable devices are used by athletes to keep track of their heart rate, blood pressure, and other vital indications. As a result of the rising prevalence of lifestyle problems such as obesity, stroke, type 2 diabetes, heart disease, and atherosclerosis throughout Asia Pacific, people have begun to pay more attention to their health. As a result, the number of gyms and fitness centers in the region is expanding, boosting sales of wearable medical devices. China's wearable market has taken on a new shape, fueled in part by purchases from increasingly affluent customers. Chinese government think tank, about 80% of the world's smart clothing is manufactured in the southern Chinese port city and manufacturing hub of Shenzhen. According to the China Information Industry Development Center, Shenzhen, the home base of many of China's tech titans, is the largest center of R&D and production for smart clothing. India is becoming a great potential market for wearable tech companies as more of the population is now putting health first as a priority. As consumers increasingly look for methods to monitor their health and well-being, demand for smart clothing such as shirts, jackets, vests, socks, and other categories seems to be on the rise. With advances in technology and the slowly growing demand from consumers, India is providing market participants with growth opportunities.Smart Clothing Market Competitive Scope: 1. In February 2023, a collaborative effort between researchers at Finland's Aalto University and the University of Cambridge resulted in the development of innovative textiles capable of changing their shape in response to temperature variations. These responsive smart fabrics offer customizable aesthetics and hold the potential for monitoring people's health, improving thermal insulation, and providing tools for controlling room acoustics and design. 2. In April 2023, researchers at the University of Waterloo achieved a breakthrough by developing a pioneering 'smart fabric.' The fabric is crafted from polymer nano-composite fibers containing embedded stainless-steel wires. The fabric exhibits a unique response to both heat and electricity. When subjected to heat, the embedded wires contract, leading to a change in fabric shape. Additionally, the fabric can be controlled using electricity to alter its form. 3. In April 2023, the UK achieved a significant development by producing the world's inaugural smart fabric capable of transforming its shape and color in response to two distinct stimuli: heat and electricity. This breakthrough development unlocks many possibilities in numerous domains, including virtual reality and robotics. The fabric comprises stimuli-responsive materials (SRMs) that react to external stimuli such as light, temperature, magnetic fields, or electricity. When exposed to these stimuli, the SRM undergoes molecular composition, mechanical properties, or shape alterations. This advancement paves the way for innovative applications and advancements in responsive textiles. 4. In September 2023, the U.S. government unveiled a USD 22 million investment initiative named SMART ePANTS, dedicated to advancing smart surveillance clothing technology. The program aims to develop wearable garments capable of recording audio and video, tracking geolocation, and monitoring physiological data. The high-tech garments are intended for intelligence agencies and military personnel in high-risk environments, enhancing situational awareness and data collection capabilities.

Smart Clothing Market Scope: Inquire before buying

Global Smart Clothing Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.79 Bn. Forecast Period 2024 to 2030 CAGR: 27.4% Market Size in 2030: US $ 15.20 Bn. Segments Covered: by Product Type upper wear lower wear innerwear others by Textile Type active smart passive smart ultra-smart by Connectivity Wi-Fi Bluetooth GPS RFID by End User Fashion & Entertainment healthcare sports & fitness others Smart Clothing Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Smart Clothing Market Key Players:

1. Google (United States) 2. Nike Inc. (United States) 3. Under Armour Inc. (United States) 4. Adidas AG (Germany) 5. Samsung Electronics Co., Ltd. (South Korea) 6. Apple Inc. (United States) 7. Ralph Lauren Corporation (United States) 8. Garmin Ltd. (Switzerland) 9. Fitbit Inc. (United States) 10. Hexoskin (Canada) 11. Athos (United States) 12. Sensoria Inc. (United States) 13. Lumo Bodytech Inc. (United States) 14. OMsignal (Canada) 15. Heddoko Inc. (Canada) 16. Catapult Sports (Australia) 17. Xi'an Chinastar M&C Limited (China) 18. AiQ Smart Clothing Inc. (Taiwan) 19. Clothing+ (Taiwan) 20. Myontec Ltd. (Finland) Frequently Asked Questions: 1] What segments are covered in the Smart Clothing Market report? Ans. The segments covered in the Smart Clothing Market report are based on, Product Type, Textile Type, and Connectivity, End Users. 2] Which region is expected to hold the highest share in the Smart Clothing Market? Ans. The North American region is expected to hold the highest share of the Smart Clothing Market. 3] What is the market size of the Smart Clothing Market by 2030? Ans. The market size of the Smart Clothing Market by 2030 will be $ 15.20 Billion. 4] What is the forecast period for the Smart Clothing Market? Ans. The Forecast period for the Smart Clothing Market is 2024- 2030.

1. Smart Clothing Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Smart Clothing Market: Dynamics 2.1. Smart Clothing Market Trends by Region 2.1.1. North America Smart Clothing Market Trends 2.1.2. Europe Smart Clothing Market Trends 2.1.3. Asia Pacific Smart Clothing Market Trends 2.1.4. Middle East and Africa Smart Clothing Market Trends 2.1.5. South America Smart Clothing Market Trends 2.2. Smart Clothing Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Smart Clothing Market Drivers 2.2.1.2. North America Smart Clothing Market Restraints 2.2.1.3. North America Smart Clothing Market Opportunities 2.2.1.4. North America Smart Clothing Market Challenges 2.2.2. Europe 2.2.2.1. Europe Smart Clothing Market Drivers 2.2.2.2. Europe Smart Clothing Market Restraints 2.2.2.3. Europe Smart Clothing Market Opportunities 2.2.2.4. Europe Smart Clothing Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Smart Clothing Market Drivers 2.2.3.2. Asia Pacific Smart Clothing Market Restraints 2.2.3.3. Asia Pacific Smart Clothing Market Opportunities 2.2.3.4. Asia Pacific Smart Clothing Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Smart Clothing Market Drivers 2.2.4.2. Middle East and Africa Smart Clothing Market Restraints 2.2.4.3. Middle East and Africa Smart Clothing Market Opportunities 2.2.4.4. Middle East and Africa Smart Clothing Market Challenges 2.2.5. South America 2.2.5.1. South America Smart Clothing Market Drivers 2.2.5.2. South America Smart Clothing Market Restraints 2.2.5.3. South America Smart Clothing Market Opportunities 2.2.5.4. South America Smart Clothing Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Smart Clothing Industry 2.8. Analysis of Government Schemes and Initiatives For Smart Clothing Industry 2.9. Smart Clothing Market Trade Analysis 2.10. The Global Pandemic Impact on Smart Clothing Market 3. Smart Clothing Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 3.1.1. upper wear 3.1.2. lower wear 3.1.3. Innerwear 3.1.4. others 3.2. Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 3.2.1. active smart 3.2.2. passive smart 3.2.3. ultra-smart 3.3. Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 3.3.1. Wi-Fi 3.3.2. Bluetooth 3.3.3. GPS 3.3.4. RFID 3.4. Smart Clothing Market Size and Forecast, by End User (2023-2030) 3.4.1. Fashion & Entertainment 3.4.2. healthcare 3.4.3. sports & fitness 3.4.4. others 3.5. Smart Clothing Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Smart Clothing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 4.1.1. upper wear 4.1.2. lower wear 4.1.3. Innerwear 4.1.4. others 4.2. North America Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 4.2.1. active smart 4.2.2. passive smart 4.2.3. ultra-smart 4.3. North America Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 4.3.1. Wi-Fi 4.3.2. Bluetooth 4.3.3. GPS 4.3.4. RFID 4.4. North America Smart Clothing Market Size and Forecast, by End User (2023-2030) 4.4.1. Fashion & Entertainment 4.4.2. healthcare 4.4.3. sports & fitness 4.4.4. others 4.5. North America Smart Clothing Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 4.5.1.1.1. upper wear 4.5.1.1.2. lower wear 4.5.1.1.3. Innerwear 4.5.1.1.4. others 4.5.1.2. United States Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 4.5.1.2.1. active smart 4.5.1.2.2. passive smart 4.5.1.2.3. ultra-smart 4.5.1.3. United States Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 4.5.1.3.1. Wi-Fi 4.5.1.3.2. Bluetooth 4.5.1.3.3. GPS 4.5.1.3.4. RFID 4.5.1.4. United States Smart Clothing Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Fashion & Entertainment 4.5.1.4.2. healthcare 4.5.1.4.3. sports & fitness 4.5.1.4.4. others 4.5.2. Canada 4.5.2.1. Canada Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 4.5.2.1.1. upper wear 4.5.2.1.2. lower wear 4.5.2.1.3. Innerwear 4.5.2.1.4. others 4.5.2.2. Canada Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 4.5.2.2.1. active smart 4.5.2.2.2. passive smart 4.5.2.2.3. ultra-smart 4.5.2.3. Canada Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 4.5.2.3.1. Wi-Fi 4.5.2.3.2. Bluetooth 4.5.2.3.3. GPS 4.5.2.3.4. RFID 4.5.2.4. Canada Smart Clothing Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Fashion & Entertainment 4.5.2.4.2. healthcare 4.5.2.4.3. sports & fitness 4.5.2.4.4. others 4.5.3. Mexico 4.5.3.1. Mexico Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 4.5.3.1.1. upper wear 4.5.3.1.2. lower wear 4.5.3.1.3. Innerwear 4.5.3.1.4. others 4.5.3.2. Mexico Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 4.5.3.2.1. active smart 4.5.3.2.2. passive smart 4.5.3.2.3. ultra-smart 4.5.3.3. Mexico Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 4.5.3.3.1. Wi-Fi 4.5.3.3.2. Bluetooth 4.5.3.3.3. GPS 4.5.3.3.4. RFID 4.5.3.4. Mexico Smart Clothing Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Fashion & Entertainment 4.5.3.4.2. healthcare 4.5.3.4.3. sports & fitness 4.5.3.4.4. others 5. Europe Smart Clothing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 5.3. Europe Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 5.4. Europe Smart Clothing Market Size and Forecast, by End User (2023-2030) 5.5. Europe Smart Clothing Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 5.5.1.2. United Kingdom Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 5.5.1.3. United Kingdom Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 5.5.1.4. United Kingdom Smart Clothing Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 5.5.2.2. France Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 5.5.2.3. France Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 5.5.2.4. France Smart Clothing Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 5.5.3.2. Germany Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 5.5.3.3. Germany Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 5.5.3.4. Germany Smart Clothing Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 5.5.4.2. Italy Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 5.5.4.3. Italy Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 5.5.4.4. Italy Smart Clothing Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 5.5.5.2. Spain Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 5.5.5.3. Spain Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 5.5.5.4. Spain Smart Clothing Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 5.5.6.2. Sweden Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 5.5.6.3. Sweden Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 5.5.6.4. Sweden Smart Clothing Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 5.5.7.2. Austria Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 5.5.7.3. Austria Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 5.5.7.4. Austria Smart Clothing Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 5.5.8.2. Rest of Europe Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 5.5.8.3. Rest of Europe Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 5.5.8.4. Rest of Europe Smart Clothing Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Smart Clothing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 6.3. Asia Pacific Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 6.4. Asia Pacific Smart Clothing Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Smart Clothing Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 6.5.1.2. China Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 6.5.1.3. China Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 6.5.1.4. China Smart Clothing Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 6.5.2.2. S Korea Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 6.5.2.3. S Korea Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 6.5.2.4. S Korea Smart Clothing Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 6.5.3.2. Japan Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 6.5.3.3. Japan Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 6.5.3.4. Japan Smart Clothing Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 6.5.4.2. India Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 6.5.4.3. India Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 6.5.4.4. India Smart Clothing Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 6.5.5.2. Australia Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 6.5.5.3. Australia Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 6.5.5.4. Australia Smart Clothing Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 6.5.6.2. Indonesia Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 6.5.6.3. Indonesia Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 6.5.6.4. Indonesia Smart Clothing Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 6.5.7.2. Malaysia Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 6.5.7.3. Malaysia Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 6.5.7.4. Malaysia Smart Clothing Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 6.5.8.2. Vietnam Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 6.5.8.3. Vietnam Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 6.5.8.4. Vietnam Smart Clothing Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 6.5.9.2. Taiwan Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 6.5.9.3. Taiwan Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 6.5.9.4. Taiwan Smart Clothing Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 6.5.10.3. Rest of Asia Pacific Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 6.5.10.4. Rest of Asia Pacific Smart Clothing Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Smart Clothing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 7.3. Middle East and Africa Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 7.4. Middle East and Africa Smart Clothing Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Smart Clothing Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 7.5.1.2. South Africa Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 7.5.1.3. South Africa Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 7.5.1.4. South Africa Smart Clothing Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 7.5.2.2. GCC Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 7.5.2.3. GCC Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 7.5.2.4. GCC Smart Clothing Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 7.5.3.2. Nigeria Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 7.5.3.3. Nigeria Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 7.5.3.4. Nigeria Smart Clothing Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 7.5.4.2. Rest of ME&A Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 7.5.4.3. Rest of ME&A Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 7.5.4.4. Rest of ME&A Smart Clothing Market Size and Forecast, by End User (2023-2030) 8. South America Smart Clothing Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 8.3. South America Smart Clothing Market Size and Forecast, by Connectivity(2023-2030) 8.4. South America Smart Clothing Market Size and Forecast, by End User (2023-2030) 8.5. South America Smart Clothing Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 8.5.1.2. Brazil Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 8.5.1.3. Brazil Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 8.5.1.4. Brazil Smart Clothing Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 8.5.2.2. Argentina Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 8.5.2.3. Argentina Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 8.5.2.4. Argentina Smart Clothing Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Smart Clothing Market Size and Forecast, by Product Type (2023-2030) 8.5.3.2. Rest Of South America Smart Clothing Market Size and Forecast, by Textile Type (2023-2030) 8.5.3.3. Rest Of South America Smart Clothing Market Size and Forecast, by Connectivity (2023-2030) 8.5.3.4. Rest Of South America Smart Clothing Market Size and Forecast, by End User (2023-2030) 9. Global Smart Clothing Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Leading Smart Clothing Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Google (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Nike Inc. (United States) 10.3. Under Armour Inc. (United States) 10.4. Adidas AG (Germany) 10.5. Samsung Electronics Co., Ltd. (South Korea) 10.6. Apple Inc. (United States) 10.7. Ralph Lauren Corporation (United States) 10.8. Garmin Ltd. (Switzerland) 10.9. Fitbit Inc. (United States) 10.10. Hexoskin (Canada) 10.11. Athos (United States) 10.12. Sensoria Inc. (United States) 10.13. Lumo Bodytech Inc. (United States) 10.14. OMsignal (Canada) 10.15. Heddoko Inc. (Canada) 10.16. Catapult Sports (Australia) 10.17. Xi'an Chinastar M&C Limited (China) 10.18. AiQ Smart Clothing Inc. (Taiwan) 10.19. Clothing+ (Taiwan) 10.20. Myontec Ltd. (Finland) 11. Key Findings 12. Industry Recommendations 13. Smart Clothing Market: Research Methodology 14. Terms and Glossary