The Global Skin Biopsy Market size was valued at USD 101.2 Million in 2022 and the total Skin Biopsy Market is expected to grow at a CAGR of 6% from 2023 to 2029, reaching nearly USD 181.6 Million. The skin biopsy technique is an integral part of the diagnosis of skin cancer and other skin disorders, such as actinic keratosis, dermatitis, and psoriasis, among others. This technique involves the removal of a skin sample from a lesion or infection, which is then examined under a microscope to detect cancerous cells. Skin biopsy is not only a diagnostic tool for skin cancer, but it can also assist in the treatment of cancer by completely removing cancerous cells. Additionally, this technique is minimally invasive, causing small incisions to the skin, resulting in shorter recovery times. Due to the benefits offered by skin biopsy, it has gained immense popularity for the diagnosis of skin cancer. The skin biopsy market is a significant part of the medical industry, driven by the increasing prevalence of skin cancer and the need for effective diagnostic tools. The market includes various companies, such as Stryker, which is a global leader in medical technology. Stryker offers innovative products and services in the Medical and Surgical, Neurotechnology, Orthopaedics, and Spine fields, with the aim of improving patient and healthcare outcomeTo know about the Research Methodology :- Request Free Sample Report

Competitive Landscapes:

The skin biopsy market is highly competitive, with various companies focusing on both organic and inorganic growth strategies to expand their customer base and increase their market share. Organic growth strategies such as product launches, product approvals, patents, and events are some of the ways in which companies are aiming to achieve growth. Inorganic growth strategies, including partnerships, collaborations, and acquisitions, have also been witnessed in the market, paving the way for business expansion. For instance, in April 2022, Guardant Health, Inc. partnered with Epic, the nation's most widely used comprehensive health record, to integrate the company's portfolio of cancer tests with Epic. This partnership is expected to help Guardant Health expand its customer base and strengthen its market position. Additionally, regulatory approvals have also played a crucial role in providing a competitive advantage to companies in the skin biopsy market. In March 2022, Guardant Health, Inc. received regulatory approval for Guardant360 CDx, a liquid biopsy test for tumor mutation profiling, from the Japanese Ministry of Health, Labour and Welfare (MHLW). This regulatory approval is expected to enhance the company's market position in Japan and globally.Skin Biopsy Market Dynamics:

Increasing Prevalence of Skin Cancer and Other Skin Disorders Driving Growth of Skin Biopsy Market

The skin biopsy market is expected to experience significant growth due to the rising number of skin cancer cases, which will subsequently increase the demand for skin biopsy as a diagnostic procedure. The industry is poised for growth as skin cancer becomes more prevalent. For example, according to the American Academy of Dermatology Association, more than 1 million Americans were living with melanoma as of 2022, and it is estimated that 197,700 new cases of melanoma were diagnosed in the U.S. in 2022 alone. This underscores the expected increase in skin cancer cases in the U.S. in the coming years, which will drive the demand for skin biopsy for diagnostic purposes. Increasing no of people receive skin cancer diagnoses each year in the U.S. than all other cancers combined, including breast, prostate, lung, and colon cancer, thus, further boosting the growth of the skin biopsy market. Other than skin cancer, there is an increase in the prevalence of various skin disorders that drives the growth of the skin biopsy market during the forecast period. Skin conditions such as actinic keratosis, dermatitis, psoriasis, skin infections, and others can also be diagnosed using the skin biopsy procedure. As the number of cases of these skin conditions increases, so does the demand for skin biopsy, which will further boost the growth of the market.Public Awareness Initiatives by the governments & Institutes to fuel the market growth the forecast period

The Skin Biopsy Market is being propelled by various initiatives taken by governments and institutes to increase public awareness about skin cancer and related disorders. For example, the American Academy of Dermatology (AAD) is making efforts to reduce the incidence and mortality of skin cancer by educating the public about techniques to minimize the risk of skin cancer and facilitate identification of skin cancer or potentially cancerous skin lesions. The AAD is also aiming to set high clinical practice standards and conducting public awareness programs and research activities in the field of dermatology to enhance patient care. Similarly, the Canadian Dermatology Association is aiming to increase public awareness levels regarding sun protection and prevention of skin cancer. These initiatives by governments and institutes are expected to drive the growth of the Skin Biopsy Market during the forecast period. As public awareness about skin cancer and related disorders increases, the demand for skin biopsy as a diagnostic procedure is expected to increase. Moreover, these initiatives can also lead to increased investment in research and development of advanced skin biopsy technologies, further boosting the growth of the Skin Biopsy Market.Skin Biopsy Market Segment Analysis:

Based on Type

In terms of type, the skin biopsy market is classified into shave biopsy, punch biopsy, and excisional biopsy. The punch biopsy segment held the largest market share in 2022 and is expected to grow at the highest CAGR during the forecast period. The growth of this segment is attributed to the increasing adoption of biopsy punches for the detection of skin cancer and the advancements in biopsy punches for more accurate diagnosis. Key market players are also focusing on creating advanced biopsy punches that are easy to use and affordable, further propelling the growth of the market. Additionally, major players in the skin biopsy industry offer a wide range of products, which is expected to drive the market growth during the forecast period.Based on Indication

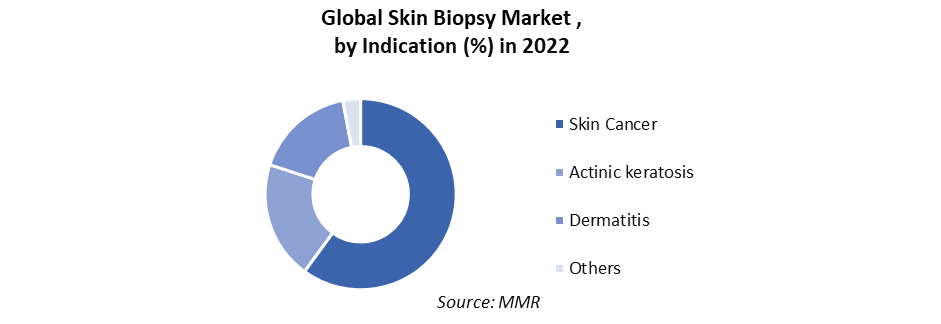

The Skin Biopsy Market is segmented by indication into skin cancer, actinic keratosis, dermatitis, and others. Among these segments, the skin cancer segment dominated the global market in 2022 and is expected to maintain its dominance during the forecast period. This is primarily due to the increasing prevalence of skin cancer across the globe and the need for early detection and diagnosis of skin conditions. Skin cancer is a serious condition that requires prompt identification and treatment, and skin biopsy is a crucial diagnostic tool used for this purpose. As a result, the demand for skin biopsy devices and instruments is expected to increase, leading to the growth of the market. Additionally, advancements in technology and the availability of a wide range of skin biopsy products from key market players are expected to further drive the growth of the market during the forecast period.

By End User

In terms of end-users, the skin biopsy market is further categorized into stand-alone practices, multispecialty clinics, hospitals, diagnostic centres, and others. The hospital segment held the largest market share of 40.2% in 2022 and is expected to witness the fastest growth rate from 2022 to 2030. The high demand for healthcare services and procedures in this setting, along with the purchase of devices in large numbers, is considered to play a vital role in the growth of the hospital segment over the coming years. Moreover, the presence of public insurance systems and the availability of advanced technologies and procedures in hospitals are also expected to drive segment growth. The multispecialty clinics held relatively higher market shares than the stand-alone practices segment in 2022. The increased costs and complexities of solo practices, along with relatively higher dermatologist compensation in the group setting and higher bargaining power of group practices are expected the drive the segment growth during forecast period Multispecialty clinics offer a comprehensive range of effective services and diagnoses of cancer treatments, which allow effective treatment plans and easy patient management. Additionally, these clinics are equipped with the latest, technologically advanced devices and offer 24/7 emergency facilities along with pharmacy, assistance with the blood bank, ICU, NICU, PICU, and ambulance services. All these factors are projected to boost the segment's growth.Regional Insights:

The skin biopsy market is analysed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, North America held a significant share of the skin biopsy market and is expected to continue dominating during the forecast period. The U.S. dominated the market in North America in 2022 and Canada is expected to grow at the fastest rate during the forecast period. The market growth in North America is driven by the presence of major players such as Integra Lifesciences, Becton, Dickinson and Company, Innovia Medical and others. The advancements in manufacturing technology of skin biopsy products by companies in this region is anticipated to further drive skin biopsy market growth. The rise in the prevalence of skin cancer cases in major countries such as the U.S. is another factor contributing to the growth of the market, as patients visit hospitals for skin cancer diagnosis and thus, demand for skin biopsy instruments rises. The Asia-Pacific region is expected to grow at the highest rate during the forecast period. Rest of Asia-Pacific dominated the market in Asia-Pacific region in 2022 and India is anticipated to grow at the fastest rate during the forecast period. The market growth in this region is attributed to the presence of pharmaceutical companies as well as the growing purchasing power of densely populated countries such as China and India. Furthermore, an increase in awareness regarding skin health and its diagnosis and treatment procedures in the population is anticipated to drive Industry growth during the forecast period.Skin Biopsy Market Scope: Inquiry Before Buying

Skin Biopsy Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: USD 101.2 Million Forecast Period 2023 to 2029 CAGR: 6% Market Size in 2029: USD 181.6 Million Segments Covered: by Product 1. Shave Biopsy 2. Excisional Biopsy 3. Punch Biopsy by Indication 1. Skin Cancer 2. Actinic keratosis 3. Dermatitis by End User 1. Hospitals 2. Multispecialty Clinics 3. Diagnostic Centers 4. Other Global Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Skin Biopsy Market Key Players:

1. AccuTec, Inc. 2. Cardinal Health Inc. 3. Innovia Medical 4. Jai Surgicals Ltd. 5. Integra LifeSciences, 6. Vernacare, 7. Becton, 8. Dickinson and Company 9. KAI Group 10. Paramount Surgimed Limited 11. Devicor Medical Products,Inc. 12. part of Leica Biosystems. 13. Gallini Srl 14. Hologic, Inc. 15. Boston Scientific Corporation 16. World Precision Instruments 17. Firefly 18. SkinIO 19. Canfield Scientific, Inc. 20. FotoFinder Systems, Inc. 21. 3Gen 22. MetaOptima 23. Agilent Technologies 24. SkinVision 25. Speclipse, Inc. 26. Skin AnalyticsFAQs:

1] What segments are covered in the Global Skin Biopsy Market report? Ans. The segments covered in the Skin Biopsy report are based on type, Indication, End User and region. 2] Which region is expected to hold the highest share in the Global Skin Biopsy Market during the forecast period? Ans. The North America region is expected to hold the highest share of the Skin Biopsy market during the forecast period. 3] What is the market size of the Global Skin Biopsy by 2029? Ans. The market size of the Skin Biopsy by 2029 is expected to reach US$ 181.6 Mn. 4] What is the forecast period for the Global Skin Biopsy Market? Ans. The forecast period for the Skin Biopsy market is 2023-2029. 5] What was the market size of the Global Skin Biopsy in 2022? Ans. The market size of the Skin Biopsy in 2022 was valued at US$ 101.2 Mn.

1. Skin Biopsy Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Skin Biopsy Market: Dynamics 2.1. Skin Biopsy Market Trends by Region 2.1.1. North America Skin Biopsy Market Trends 2.1.2. Europe Skin Biopsy Market Trends 2.1.3. Asia Pacific Skin Biopsy Market Trends 2.1.4. Middle East and Africa Skin Biopsy Market Trends 2.1.5. South America Skin Biopsy Market Trends 2.2. Skin Biopsy Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Skin Biopsy Market Drivers 2.2.1.2. North America Skin Biopsy Market Restraints 2.2.1.3. North America Skin Biopsy Market Opportunities 2.2.1.4. North America Skin Biopsy Market Challenges 2.2.2. Europe 2.2.2.1. Europe Skin Biopsy Market Drivers 2.2.2.2. Europe Skin Biopsy Market Restraints 2.2.2.3. Europe Skin Biopsy Market Opportunities 2.2.2.4. Europe Skin Biopsy Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Skin Biopsy Market Drivers 2.2.3.2. Asia Pacific Skin Biopsy Market Restraints 2.2.3.3. Asia Pacific Skin Biopsy Market Opportunities 2.2.3.4. Asia Pacific Skin Biopsy Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Skin Biopsy Market Drivers 2.2.4.2. Middle East and Africa Skin Biopsy Market Restraints 2.2.4.3. Middle East and Africa Skin Biopsy Market Opportunities 2.2.4.4. Middle East and Africa Skin Biopsy Market Challenges 2.2.5. South America 2.2.5.1. South America Skin Biopsy Market Drivers 2.2.5.2. South America Skin Biopsy Market Restraints 2.2.5.3. South America Skin Biopsy Market Opportunities 2.2.5.4. South America Skin Biopsy Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Skin Biopsy Industry 2.8. Analysis of Government Schemes and Initiatives For Skin Biopsy Industry 2.9. Skin Biopsy Market Trade Analysis 2.10. The Global Pandemic Impact on Skin Biopsy Market 3. Skin Biopsy Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Skin Biopsy Market Size and Forecast, by Product (2022-2029) 3.1.1. Shave Biopsy 3.1.2. Excisional Biopsy 3.1.3. Punch Biopsy 3.2. Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 3.2.1. Skin Cancer 3.2.2. Actinic keratosis 3.2.3. Dermatitis 3.3. Skin Biopsy Market Size and Forecast, by End User (2022-2029) 3.3.1. Hospitals 3.3.2. Multispecialty Clinics 3.3.3. Diagnostic Centers 3.3.4. Other 3.4. Skin Biopsy Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Skin Biopsy Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Skin Biopsy Market Size and Forecast, by Product (2022-2029) 4.1.1. Shave Biopsy 4.1.2. Excisional Biopsy 4.1.3. Punch Biopsy 4.2. North America Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 4.2.1. Skin Cancer 4.2.2. Actinic keratosis 4.2.3. Dermatitis 4.3. North America Skin Biopsy Market Size and Forecast, by End User (2022-2029) 4.3.1. Hospitals 4.3.2. Multispecialty Clinics 4.3.3. Diagnostic Centers 4.3.4. Other 4.4. North America Skin Biopsy Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Skin Biopsy Market Size and Forecast, by Product (2022-2029) 4.4.1.1.1. Shave Biopsy 4.4.1.1.2. Excisional Biopsy 4.4.1.1.3. Punch Biopsy 4.4.1.2. United States Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 4.4.1.2.1. Skin Cancer 4.4.1.2.2. Actinic keratosis 4.4.1.2.3. Dermatitis 4.4.1.3. United States Skin Biopsy Market Size and Forecast, by End User (2022-2029) 4.4.1.3.1. Hospitals 4.4.1.3.2. Multispecialty Clinics 4.4.1.3.3. Diagnostic Centers 4.4.1.3.4. Other 4.4.2. Canada 4.4.2.1. Canada Skin Biopsy Market Size and Forecast, by Product (2022-2029) 4.4.2.1.1. Shave Biopsy 4.4.2.1.2. Excisional Biopsy 4.4.2.1.3. Punch Biopsy 4.4.2.2. Canada Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 4.4.2.2.1. Skin Cancer 4.4.2.2.2. Actinic keratosis 4.4.2.2.3. Dermatitis 4.4.2.3. Canada Skin Biopsy Market Size and Forecast, by End User (2022-2029) 4.4.2.3.1. Hospitals 4.4.2.3.2. Multispecialty Clinics 4.4.2.3.3. Diagnostic Centers 4.4.2.3.4. Other 4.4.3. Mexico 4.4.3.1. Mexico Skin Biopsy Market Size and Forecast, by Product (2022-2029) 4.4.3.1.1. Shave Biopsy 4.4.3.1.2. Excisional Biopsy 4.4.3.1.3. Punch Biopsy 4.4.3.2. Mexico Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 4.4.3.2.1. Skin Cancer 4.4.3.2.2. Actinic keratosis 4.4.3.2.3. Dermatitis 4.4.3.3. Mexico Skin Biopsy Market Size and Forecast, by End User (2022-2029) 4.4.3.3.1. Hospitals 4.4.3.3.2. Multispecialty Clinics 4.4.3.3.3. Diagnostic Centers 4.4.3.3.4. Other 5. Europe Skin Biopsy Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Skin Biopsy Market Size and Forecast, by Product (2022-2029) 5.2. Europe Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 5.3. Europe Skin Biopsy Market Size and Forecast, by End User (2022-2029) 5.4. Europe Skin Biopsy Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Skin Biopsy Market Size and Forecast, by Product (2022-2029) 5.4.1.2. United Kingdom Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 5.4.1.3. United Kingdom Skin Biopsy Market Size and Forecast, by End User(2022-2029) 5.4.2. France 5.4.2.1. France Skin Biopsy Market Size and Forecast, by Product (2022-2029) 5.4.2.2. France Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 5.4.2.3. France Skin Biopsy Market Size and Forecast, by End User(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Skin Biopsy Market Size and Forecast, by Product (2022-2029) 5.4.3.2. Germany Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 5.4.3.3. Germany Skin Biopsy Market Size and Forecast, by End User (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Skin Biopsy Market Size and Forecast, by Product (2022-2029) 5.4.4.2. Italy Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 5.4.4.3. Italy Skin Biopsy Market Size and Forecast, by End User(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Skin Biopsy Market Size and Forecast, by Product (2022-2029) 5.4.5.2. Spain Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 5.4.5.3. Spain Skin Biopsy Market Size and Forecast, by End User (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Skin Biopsy Market Size and Forecast, by Product (2022-2029) 5.4.6.2. Sweden Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 5.4.6.3. Sweden Skin Biopsy Market Size and Forecast, by End User (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Skin Biopsy Market Size and Forecast, by Product (2022-2029) 5.4.7.2. Austria Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 5.4.7.3. Austria Skin Biopsy Market Size and Forecast, by End User (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Skin Biopsy Market Size and Forecast, by Product (2022-2029) 5.4.8.2. Rest of Europe Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 5.4.8.3. Rest of Europe Skin Biopsy Market Size and Forecast, by End User (2022-2029) 6. Asia Pacific Skin Biopsy Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Skin Biopsy Market Size and Forecast, by Product (2022-2029) 6.2. Asia Pacific Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 6.3. Asia Pacific Skin Biopsy Market Size and Forecast, by End User (2022-2029) 6.4. Asia Pacific Skin Biopsy Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Skin Biopsy Market Size and Forecast, by Product (2022-2029) 6.4.1.2. China Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 6.4.1.3. China Skin Biopsy Market Size and Forecast, by End User (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Skin Biopsy Market Size and Forecast, by Product (2022-2029) 6.4.2.2. S Korea Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 6.4.2.3. S Korea Skin Biopsy Market Size and Forecast, by End User (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Skin Biopsy Market Size and Forecast, by Product (2022-2029) 6.4.3.2. Japan Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 6.4.3.3. Japan Skin Biopsy Market Size and Forecast, by End User (2022-2029) 6.4.4. India 6.4.4.1. India Skin Biopsy Market Size and Forecast, by Product (2022-2029) 6.4.4.2. India Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 6.4.4.3. India Skin Biopsy Market Size and Forecast, by End User (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Skin Biopsy Market Size and Forecast, by Product (2022-2029) 6.4.5.2. Australia Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 6.4.5.3. Australia Skin Biopsy Market Size and Forecast, by End User (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Skin Biopsy Market Size and Forecast, by Product (2022-2029) 6.4.6.2. Indonesia Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 6.4.6.3. Indonesia Skin Biopsy Market Size and Forecast, by End User (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Skin Biopsy Market Size and Forecast, by Product (2022-2029) 6.4.7.2. Malaysia Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 6.4.7.3. Malaysia Skin Biopsy Market Size and Forecast, by End User (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Skin Biopsy Market Size and Forecast, by Product (2022-2029) 6.4.8.2. Vietnam Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 6.4.8.3. Vietnam Skin Biopsy Market Size and Forecast, by End User(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Skin Biopsy Market Size and Forecast, by Product (2022-2029) 6.4.9.2. Taiwan Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 6.4.9.3. Taiwan Skin Biopsy Market Size and Forecast, by End User (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Skin Biopsy Market Size and Forecast, by Product (2022-2029) 6.4.10.2. Rest of Asia Pacific Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 6.4.10.3. Rest of Asia Pacific Skin Biopsy Market Size and Forecast, by End User (2022-2029) 7. Middle East and Africa Skin Biopsy Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Skin Biopsy Market Size and Forecast, by Product (2022-2029) 7.2. Middle East and Africa Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 7.3. Middle East and Africa Skin Biopsy Market Size and Forecast, by End User (2022-2029) 7.4. Middle East and Africa Skin Biopsy Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Skin Biopsy Market Size and Forecast, by Product (2022-2029) 7.4.1.2. South Africa Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 7.4.1.3. South Africa Skin Biopsy Market Size and Forecast, by End User (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Skin Biopsy Market Size and Forecast, by Product (2022-2029) 7.4.2.2. GCC Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 7.4.2.3. GCC Skin Biopsy Market Size and Forecast, by End User (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Skin Biopsy Market Size and Forecast, by Product (2022-2029) 7.4.3.2. Nigeria Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 7.4.3.3. Nigeria Skin Biopsy Market Size and Forecast, by End User (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Skin Biopsy Market Size and Forecast, by Product (2022-2029) 7.4.4.2. Rest of ME&A Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 7.4.4.3. Rest of ME&A Skin Biopsy Market Size and Forecast, by End User (2022-2029) 8. South America Skin Biopsy Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Skin Biopsy Market Size and Forecast, by Product (2022-2029) 8.2. South America Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 8.3. South America Skin Biopsy Market Size and Forecast, by End User(2022-2029) 8.4. South America Skin Biopsy Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Skin Biopsy Market Size and Forecast, by Product (2022-2029) 8.4.1.2. Brazil Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 8.4.1.3. Brazil Skin Biopsy Market Size and Forecast, by End User (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Skin Biopsy Market Size and Forecast, by Product (2022-2029) 8.4.2.2. Argentina Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 8.4.2.3. Argentina Skin Biopsy Market Size and Forecast, by End User (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Skin Biopsy Market Size and Forecast, by Product (2022-2029) 8.4.3.2. Rest Of South America Skin Biopsy Market Size and Forecast, by Indication (2022-2029) 8.4.3.3. Rest Of South America Skin Biopsy Market Size and Forecast, by End User (2022-2029) 9. Global Skin Biopsy Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Skin Biopsy Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. AccuTec, Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Cardinal Health Inc. 10.3. Innovia Medical 10.4. Jai Surgicals Ltd. 10.5. Integra LifeSciences, 10.6. Vernacare, 10.7. Becton, 10.8. Dickinson and Company 10.9. KAI Group 10.10. Paramount Surgimed Limited 10.11. Devicor Medical Products,Inc. 10.12. part of Leica Biosystems. 10.13. Gallini Srl 10.14. Hologic, Inc. 10.15. Boston Scientific Corporation 10.16. World Precision Instruments 10.17. Firefly 10.18. SkinIO 10.19. Canfield Scientific, Inc. 10.20. FotoFinder Systems, Inc. 10.21. 3Gen 10.22. MetaOptima 10.23. Agilent Technologies 10.24. SkinVision 10.25. Speclipse, Inc. 10.26. Skin Analytics 11. Key Findings 12. Industry Recommendations 13. Skin Biopsy Market: Research Methodology 14. Terms and Glossary