Global Single Axis Solar Tracker Market size was valued at USD 22.15 Bn in 2023 and is expected to reach USD 75.30 Bn by 2030, at a CAGR of 19.1%.Single Axis Solar Tracker Market Overview

In the ever-evolving realm of renewable energy, solar power reigns supreme as a sustainable solution for electricity generation. The true potential of solar panels only be fully realized with innovative technologies that optimize their exposure to sunlight. This is where Single-Axis Solar Trackers enter the stage, contributing a ground-breaking approach to boost the efficiency of solar panels. Single-axis solar trackers are intricately designed to diligently track the sun's daily passage across the sky, ensuring that photovoltaic (PV) panels remain in perfect alignment with the sun's path. These trackers enable the controlled rotation of solar panels along a single axis, typically spanning from east to west. This deliberate orientation ensures that the panels consistently face the direction of the sun throughout the day.To know about the Research Methodology :- Request Free Sample Report The result is a remarkable increase in sunlight exposure, significantly enhancing the energy output of solar installations. Single-Axis Solar Trackers have gained recognition in the solar energy industry for their precision in tracking the sun's movement and their ability to optimize solar panel performance. These trackers offer a cost-effective means to boost energy yield without incurring exorbitant costs and drive Single Axis Solar Tracker Market growth. Their straightforward installation and minimal maintenance requirements make them a practical choice for various solar projects, from industrial installations to utility-scale solar farms. In addition, Single-Axis Solar Trackers are renowned for their reliability, boasting a simpler design with fewer moving parts, which translates into extended durability and a longer lifespan. These trackers exhibit significant adaptability in regions with inconsistent or limited sun exposure. In areas where sunlight varies in intensity and duration, Single-Axis Solar Trackers play a pivotal role in ensuring that available sunlight is harnessed to its maximum potential, making them invaluable assets for sustainable energy generation. Single-Axis Solar Trackers offer a spectrum of sub-classifications, each tailored to meet specific user requirements. Manual trackers require human intervention for adjustments, allowing users to manually align panels with the sun's path which helps to fuel Single Axis Solar Tracker Market growth. Passive trackers offer a hands-free approach, employing a liquid-based system that automatically tilts panels toward sunlight as the sun's rays trigger liquid vaporation. Active trackers operate with the assistance of motors and mechanical devices, providing automated solar panel alignment without the need for additional power sources.

Single Axis Solar Tracker Market Dynamics

Drivers Single-Axis Solar Trackers Boost Energy Efficiency for a Sustainable Future Single-axis solar trackers play an essential role in enhancing the energy production of solar installations. By consistently aligning solar panels with the sun's path, these trackers maximize the exposure of panels to sunlight throughout the day. This precision leads to a substantial increase in energy output. In a time characterized by heightened concerns regarding the sustainability of energy sources, there is a rising need for technologies that improve energy efficiency. As the world grapples with the profound impacts of climate change and environmental degradation, there is a global shift towards adopting cleaner and other sustainable energy alternatives. Solar energy stands out as a main instance of renewable energy. Solar panels, when used with tracking systems, capture more energy, reducing the reliance on fossil fuels and mitigating greenhouse gas emissions. The adoption of single-axis solar trackers aligns with this broader sustainability goal which Single Axis Solar Tracker Market growth. The demand for clean energy solutions is driven by rising environmental consciousness. Consumers, businesses, and governments are demonstrating a growing commitment to reducing their carbon footprint. Single-axis solar trackers play a vital role in advancing this objective by enhancing the efficiency of solar power generation, thereby expanding the accessibility of eco-friendly solar energy solutions. While the initial investment in single-axis solar trackers is incurred, the long-term cost-effectiveness of these systems is a fueling factor. Higher energy production means quicker returns on investment, making solar energy an economically attractive option and this boosts the Single Axis Solar Tracker Market growth. The cost savings associated with these trackers, including installation and maintenance, make them a smart choice for businesses and utility-scale projects. Single-axis solar trackers are versatile and applicable in a wide range of solar projects. From large commercial installations to expansive utility-scale solar farms, these trackers offer a practical means of optimizing energy yield. Their adaptability to various environments and regions with varying sunlight patterns ensures their relevance in different markets. New investments in solar energy technology, including single-axis solar trackers, are enhancing energy efficiency and contributing to a more sustainable future. These innovations increase solar panel output by following the sun's path, reducing energy costs and greenhouse gas emissions and advancing the transition to clean and renewable energy sources.Cost-Effective and Reliable Single-Axis Solar Trackers Fuel Solar Industry Growth The affordability of single-axis solar trackers positions them as an attractive option for a wide array of solar projects. Although there is an initial investment involved, the substantial long-term advantages outweigh these upfront expenses. These trackers significantly boost energy production, ensuring quicker returns on investment. As the solar industry endeavors to provide cost-effective solutions to a wider market, single-axis trackers are becoming increasingly favored for their ability to enhance solar panel performance without imposing exorbitant expenses. Single-axis solar trackers are designed for straightforward installation. This ease of installation not only reduces the initial setup expenses but also minimizes the time required for deployment which boosts Single Axis Solar Tracker Market growth. Consequently, the quicker installation process contributes to cost savings and allows solar projects to become operational sooner, generating energy and revenue more swiftly. These trackers are renowned for their low maintenance needs. Their simple design with fewer moving parts translates into fewer opportunities for breakdowns or wear and tear. This translates to reduced maintenance costs over the lifespan of the trackers, making them a practical and economical choice for solar projects. Single-axis solar trackers are built to be durable and reliable. Their robust construction ensures that they withstand various environmental conditions, including wind and weather. This resilience minimizes the need for repairs and replacements, contributing to their cost-effectiveness this property of the Single Axis Solar Tracker drives the Single Axis Solar Tracker Market growth. Their reliability in accurately tracking the sun's movement guarantees consistent energy production, making them a trustworthy choice for solar investors. The versatility of single-axis solar trackers extends their applicability to a broad spectrum of solar projects. This includes commercial installations and utility-scale solar farms. Their cost-effectiveness and efficiency are particularly advantageous for large-scale operations where optimizing energy yield is paramount.

Trend

Increasing integration of smart and digital technologies Smart and digital technologies enable single-axis solar trackers to continuously analyze environmental factors, including sunlight intensity and weather conditions. This data is harnessed to dynamically adjust the position of solar panels, guaranteeing that they harness the utmost sunlight throughout the day. As the renewable energy sector places increasing emphasis on energy efficiency, this trend harmonizes with the industry's objective of optimizing power generation. By leveraging sensors and automation, these trackers make precise adjustments to align with the sun's path, reducing the risk of mechanical failures and inefficiencies. This enhanced reliability ensures that solar installations equipped with smart trackers consistently produce energy, making them a dependable and attractive choice for investors. The real-time monitoring capabilities of smart trackers enable early detection of issues or deviations in performance. This proactive approach to maintenance minimizes downtime and repair costs, resulting in significant cost savings over the life of the solar installation and Single Axis Solar Tracker Market growth. Lower maintenance expenses are a compelling incentive for solar project developers. Digital technologies allow for remote monitoring and control of single-axis trackers. This remote accessibility streamlines operations and maintenance, making it more convenient for solar project managers to oversee multiple installations. It also facilitates quick responses to issues, improving the reliability and overall performance of the trackers. The data collected by smart trackers is harnessed for data analytics and trend analysis. This information provides valuable insights into the performance of solar installations, helping to refine operational strategies and long-term planning. Data-driven decision-making is increasingly vital in the renewable energy sector, aiding in the optimization of solar projects. Restraint Upfront Costs Pose a Restraint on Single-Axis Solar Tracker Adoption One of the primary reasons for the restraint is the considerable upfront capital required for purchasing and installing single-axis solar trackers. These tracking systems involve complex technology, including sensors, motors, and control systems, which contribute to their initial cost. Solar project developers and investors must allocate a substantial budget for acquiring and implementing these trackers. For many solar projects, especially those with budget limitations, the initial capital outlay for single-axis trackers is a substantial barrier. In cases where projects are already working with tight budgets, allocating additional funds for trackers may not be feasible. This budget constraint hinders the adoption of these trackers, particularly for smaller or financially constrained projects which restrain the Single Axis Solar Tracker Market growth. The restraint is exacerbated by the necessity to evaluate the Return on Investment (ROI) throughout the lifespan of a solar installation. Although single-axis trackers promise substantial long-term advantages, including heightened energy generation and decreased maintenance expenses, these benefits have not manifested immediately to investors. Projects that place a premium on short-term financial gains choose fixed solar panels, sidestepping the elevated initial investment, even at the expense of forfeiting the long-term efficiency enhancements that trackers offer.Single Axis Solar Tracker Market Segment Analysis

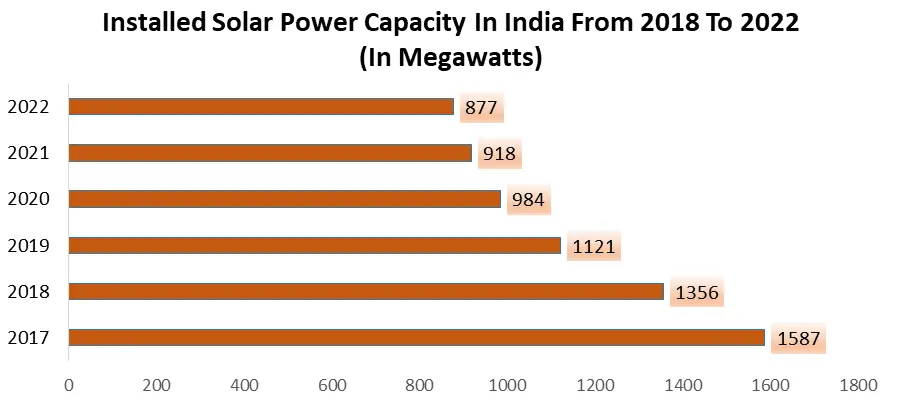

Based on Product Type, the market is segmented into the Photovoltaic (PV) Trackers and Concentrated Solar Power (CSP) Trackers. Photovoltaic (PV) Trackers dominated the Single Axis Solar Tracker Market in 2023 and are expected to continue their dominance during the forecast period. Photovoltaic (PV) solar panels hold a main position in the solar energy landscape due to their wide-ranging applications. These panels are extensively utilized in various settings, surrounding residential, commercial and utility-scale solar installations. The adaptability of PV solar panels to these diverse applications has propelled PV trackers into popularity. In regions where the primary objective of solar installations is to generate electricity for grid integration, PV trackers take center stage. They are precisely engineered to optimize sunlight capture, ensuring the efficient generation of electricity for homes, businesses and the grid. As the demand for grid-connected solar power continues to surge, PV trackers have cemented their Single Axis Solar Tracker market. PV trackers are also exceptionally well-suited for residential and commercial solar installations. Many homeowners and businesses opt for PV panels because they are tailored to provide on-site electricity consumption or surplus energy feed-in to the grid. This alignment with smaller-scale applications makes PV trackers a preferred choice. The maturity of the PV solar market, coupled with its extensive adoption over the years, has granted it a well-established status. This market enjoys the advantages of economies of scale, further reinforcing the dominance of PV trackers. Cost-effectiveness is another pivotal factor driving the widespread use of PV trackers. These systems offer cost advantages in terms of manufacturing, installation, and ongoing maintenance when compared to Concentrated Solar Power (CSP) trackers, making them an attractive choice for a wide spectrum of solar projects. Government incentives and policies play a crucial role in promoting the adoption of PV solar panels. Many governments and regions around the world have implemented supportive measures to encourage the use of PV technology. These incentives provide an additional impetus for the widespread deployment of PV trackers. Furthermore, the global presence of the PV solar market is undeniable, with installations spanning across various corners of the world. This extensive market reach has contributed to the dominance of PV trackers in many regions, solidifying their status as the preferred choice in the Single Axis Solar Tracker Market. For instance, India has significantly increased its installed solar power capacity in recent years. The adoption of single-axis solar tracker photovoltaic (PV) technology has played a decisive role in this growth. These tracking systems optimize sunlight capture, improving energy generation and enhancing India's solar energy potential for a cleaner and more sustainable energy future.

Single Axis Solar Tracker Market Regional Insights

North America boasts a strong and advanced technological infrastructure, making it well-suited for the adoption of solar tracking systems. This infrastructure helps the integration of innovative solar technologies such as single-axis trackers, into existing energy grids and fuels Single Axis Solar Tracker industry growth. The region has showcased a strong dedication to sustainable energy sources, particularly solar power. Federal and state-level initiatives and policies actively encourage the adoption of solar energy solutions. This dedication to sustainability boosts the adoption of technologies including single-axis trackers that improve solar energy production. North America and the United States, in particular, have established a favorable regulatory environment for solar technology adoption. Incentives, tax credits and other supportive policies boost businesses and consumers to invest in solar energy solutions, including single-axis trackers. The region has seen substantial investments in renewable energy projects, including utility-scale solar installations. These projects often incorporate single-axis trackers to maximize energy output which drive regional Single Axis Solar Tracker Market growth. The accessibility of funding and investment opportunities has contributed to the widespread use of this technology. North America's growing prominence on sustainability and environmental responsibility has driven the adoption of solar energy solutions. North America serves as a prominent center for research and development within the solar energy sector. This persistent commitment to innovation results in the advancement of more efficient and economically viable single-axis tracking systems, strengthening their leadership in the market. The region's proficiency in technological innovation has spurred the creation of state-of-the-art single-axis tracking systems, delivering superior performance and reliability. These advancements have improved the appeal of this technology. North America's population is environmentally conscious, which has translated into a strong demand for clean and sustainable energy sources. Solar power, facilitated by single-axis trackers, aligns with this awareness, contributing to the technology's dominance. Single Axis Solar Tracker Market Competitive Landscape The Competitive Landscape of the Single Axis Solar Tracker market covers the number of key companies, company size, their strengths, weaknesses, barriers and threats. It also focuses on the power of the company’s competitive rivals, potential, new market entrants, customers, suppliers and substitute products that drive the profitability of the companies in the Single Axis Solar Tracker industry. The global Single Axis Solar Tracker markets include several market players at the country, regional and global levels. Some of the key players are Nextracker Inc., Array Technologies Inc., Soltec Power Holdings S.L.U., ZNShine New Energy Technology Co., Ltd., Arctech Solar Holding Co., Ltd., Trina Solar Co., Ltd.,Huawei Technologies Co., Ltd. , Ingeteam Power Electronics S.A. , Enel Green Power S.p.A. , BayWa r.e. New Energies GmbH, Amerisolar Inc and Others. Many companies have conducted research and development activities to fulfill consumer demand and increase their portfolio. For instance, FTC Solar introduced its innovative Pioneer 1P single-axis solar tracker, designed to optimize energy production and reduce installation costs. The Pioneer 1P tracker features a one-in-portrait (1P) configuration, allowing for higher density and more efficient land utilization compared to traditional two-in-portrait (2P) trackers. It also utilizes FTC Solar's patented Torque Tube technology, providing superior torsional rigidity and positive alignment of components.Single Axis Solar Tracker Market Scope : Inquire Before Buying

Global Single Axis Solar Tracker Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 22.15 Bn. Forecast Period 2024 to 2030 CAGR: 19.1% Market Size in 2030: US $ 75.30 Bn. Segments Covered: by Product Type Photovoltaic (PV) Trackers Concentrated Solar Power (CSP) Trackers by Axis Rotation Horizontal Single-Axis Trackers Vertical Single-Axis Trackers by Application Residential Commercial Utility-Scale Single Axis Solar Tracker Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and the Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Single Axis Solar Tracker Key Players

1. Nextracker Inc. 2. Array Technologies Inc. 3. Soltec Power Holdings S.L.U. 4. ZNShine New Energy Technology Co., Ltd. 5. Arctech Solar Holding Co., Ltd. 6. Trina Solar Co., Ltd. 7. Huawei Technologies Co., Ltd. 8. Ingeteam Power Electronics S.A. 9. Enel Green Power S.p.A. 10. BayWa r.e. New Energies GmbH 11. Amerisolar Inc. 12. New England Clean Energy (NEC) 13. FTC Solar, Inc. 14. GameChange Solar 15. Solvest Inc. 16. Deger Canada Inc 17. trackerPI GmbH 18. Claren Solar 19. PV Hardware Ltd. 20. MKS Instruments, Inc. 21. SolAero Technologies LLC 22. Solar Power Systems Ltd. 23. NewEra Solar Technologies Frequently Asked Questions: 1] What is the growth rate of the Global Single Axis Solar Tracker Market? Ans. The Global Single Axis Solar Tracker Market is growing at a significant rate of 19.1% during the forecast period. 2] Which region is expected to dominate the Global Single Axis Solar Tracker Market? Ans. North America is expected to dominate the Single Axis Solar Tracker Market during the forecast period. 3] What is the expected Global Single Axis Solar Tracker Market size by 2030? Ans. The Single Axis Solar Tracker Market size is expected to reach USD 75.30 Bn by 2030. 4] Which are the top players in the Global Single Axis Solar Tracker Market? Ans. The major top players in the Global Single Axis Solar Tracker Market are Nextracker Inc., Array Technologies Inc., Soltec Power Holdings S.L.U., ZNShine New Energy Technology Co., Ltd., Arctech Solar Holding Co., Ltd., Trina Solar Co., Ltd.,Huawei Technologies Co., Ltd. , Ingeteam Power Electronics S.A. , Enel Green Power S.p.A. , BayWa r.e. New Energies GmbH, Amerisolar Inc and Others. 5] What are the factors driving the Global Single Axis Solar Tracker Market growth? Ans. Increased solar energy adoption and energy storage integration are expected to drive market growth during the forecast period.

1. Single Axis Solar Tracker Market: Research Methodology 2. Single Axis Solar Tracker Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Single Axis Solar Tracker Market: Dynamics 3.1 Single Axis Solar Tracker Market Trends by Region 3.1.1 North America Single Axis Solar Tracker Market Trends 3.1.2 Europe Single Axis Solar Tracker Market Trends 3.1.3 Asia Pacific Single Axis Solar Tracker Market Trends 3.1.4 Middle East and Africa Single Axis Solar Tracker Market Trends 3.1.5 South America Single Axis Solar Tracker Market Trends 3.2 Single Axis Solar Tracker Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Single Axis Solar Tracker Market Drivers 3.2.1.2 North America Single Axis Solar Tracker Market Restraints 3.2.1.3 North America Single Axis Solar Tracker Market Opportunities 3.2.1.4 North America Single Axis Solar Tracker Market Challenges 3.2.2 Europe 3.2.2.1 Europe Single Axis Solar Tracker Market Drivers 3.2.2.2 Europe Single Axis Solar Tracker Market Restraints 3.2.2.3 Europe Single Axis Solar Tracker Market Opportunities 3.2.2.4 Europe Single Axis Solar Tracker Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Single Axis Solar Tracker Market Drivers 3.2.3.2 Asia Pacific Single Axis Solar Tracker Market Restraints 3.2.3.3 Asia Pacific Single Axis Solar Tracker Market Opportunities 3.2.3.4 Asia Pacific Single Axis Solar Tracker Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Single Axis Solar Tracker Market Drivers 3.2.4.2 Middle East and Africa Single Axis Solar Tracker Market Restraints 3.2.4.3 Middle East and Africa Single Axis Solar Tracker Market Opportunities 3.2.4.4 Middle East and Africa Single Axis Solar Tracker Market Challenges 3.2.5 South America 3.2.5.1 South America Single Axis Solar Tracker Market Drivers 3.2.5.2 South America Single Axis Solar Tracker Market Restraints 3.2.5.3 South America Single Axis Solar Tracker Market Opportunities 3.2.5.4 South America Single Axis Solar Tracker Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Regulatory Landscape by Region 3.5.1 North America 3.5.2 Europe 3.5.3 Asia Pacific 3.5.4 Middle East and Africa 3.5.5 South America 3.6 Analysis of Government Schemes and Initiatives For the Single Axis Solar Tracker Industry 3.7 The Global Pandemic Impact on the Single Axis Solar Tracker Industry 3.8 Technological Road Map 4. Global Single Axis Solar Tracker Market: Global Market Size and Forecast by Segmentation (By Value) (2023-2030) 4.1 Global Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 4.1.1 Photovoltaic (PV) Trackers 4.1.2 Concentrated Solar Power (CSP) Trackers 4.2 Global Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 4.2.1 Horizontal Single-Axis Trackers 4.2.2 Vertical Single-Axis Trackers 4.3 Global Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 4.3.1 Residential 4.3.2 Commercial 4.3.3 Utility-Scale 4.4 Global Single Axis Solar Tracker Market Size and Forecast, by Region (2023-2030) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Single Axis Solar Tracker Market Size and Forecast by Segmentation (By Value) (2023-2030) 5.1 North America Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 5.1.1 Photovoltaic (PV) Trackers 5.1.2 Concentrated Solar Power (CSP) Trackers 5.2 North America Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 5.2.1 Horizontal Single-Axis Trackers 5.2.2 Vertical Single-Axis Trackers 5.3 North America Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 5.3.1 Residential 5.3.2 Commercial 5.3.3 Utility-Scale 5.4 North America Single Axis Solar Tracker Market Size and Forecast, by Country (2023-2030) 5.4.1 United States 5.4.1.1 United States Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 5.4.1.1.1 Photovoltaic (PV) Trackers 5.4.1.1.2 Concentrated Solar Power (CSP) Trackers 5.4.1.2 United States Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 5.4.1.2.1 Horizontal Single-Axis Trackers 5.4.1.2.2 Vertical Single-Axis Trackers 5.4.1.3 United States Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 5.4.1.3.1 Residential 5.4.1.3.2 Commercial 5.4.1.3.3 Utility-Scale 5.4.2 Canada 5.4.2.1 Canada Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 5.4.2.1.1 Photovoltaic (PV) Trackers 5.4.2.1.2 Concentrated Solar Power (CSP) Trackers 5.4.2.2 Canada Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 5.4.2.2.1 Horizontal Single-Axis Trackers 5.4.2.2.2 Vertical Single-Axis Trackers 5.4.2.3 Canada Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 5.4.2.3.1 Residential 5.4.2.3.2 Commercial 5.4.2.3.3 Utility-Scale 5.4.3 Mexico 5.4.3.1 Mexico Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 5.4.3.1.1 Photovoltaic (PV) Trackers 5.4.3.1.2 Concentrated Solar Power (CSP) Trackers 5.4.3.2 Mexico Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 5.4.3.2.1 Horizontal Single-Axis Trackers 5.4.3.2.2 Vertical Single-Axis Trackers 5.4.3.3 Mexico Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 5.4.3.3.1 Residential 5.4.3.3.2 Commercial 5.4.3.3.3 Utility-Scale 6. Europe Single Axis Solar Tracker Market Size and Forecast by Segmentation (By Value) (2023-2030) 6.1 Europe Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 6.2 Europe Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 6.3 Europe Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 6.4 Europe Single Axis Solar Tracker Market Size and Forecast, by Country (2023-2030) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 6.4.1.2 United Kingdom Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 6.4.1.3 United Kingdom Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 6.4.2 France 6.4.2.1 France Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 6.4.2.2 France Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 6.4.2.3 France Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 6.4.3 Germany 6.4.3.1 Germany Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 6.4.3.2 Germany Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 6.4.3.3 Germany Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 6.4.4 Italy 6.4.4.1 Italy Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 6.4.4.2 Italy Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 6.4.4.3 Italy Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 6.4.5 Spain 6.4.5.1 Spain Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 6.4.5.2 Spain Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 6.4.5.3 Spain Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 6.4.6 Sweden 6.4.6.1 Sweden Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 6.4.6.2 Sweden Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 6.4.6.3 Sweden Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 6.4.7 Austria 6.4.7.1 Austria Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 6.4.7.2 Austria Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 6.4.7.3 Austria Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 6.4.8.2 Rest of Europe Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030). 6.4.8.3 Rest of Europe Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 7. Asia Pacific Single Axis Solar Tracker Market Size and Forecast by Segmentation (By Value) (2023-2030) 7.1 Asia Pacific Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 7.2 Asia Pacific Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 7.3 Asia Pacific Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 7.4 Asia Pacific Single Axis Solar Tracker Market Size and Forecast, by Country (2023-2030) 7.4.1 China 7.4.1.1 China Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 7.4.1.2 China Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 7.4.1.3 China Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 7.4.2 South Korea 7.4.2.1 S Korea Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 7.4.2.2 S Korea Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 7.4.2.3 S Korea Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 7.4.3 Japan 7.4.3.1 Japan Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 7.4.3.2 Japan Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 7.4.3.3 Japan Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 7.4.4 India 7.4.4.1 India Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 7.4.4.2 India Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 7.4.4.3 India Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 7.4.5 Australia 7.4.5.1 Australia Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 7.4.5.2 Australia Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 7.4.5.3 Australia Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 7.4.6 Indonesia 7.4.6.1 Indonesia Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 7.4.6.2 Indonesia Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 7.4.6.3 Indonesia Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 7.4.7 Malaysia 7.4.7.1 Malaysia Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 7.4.7.2 Malaysia Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 7.4.7.3 Malaysia Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 7.4.8 Vietnam 7.4.8.1 Vietnam Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 7.4.8.2 Vietnam Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 7.4.8.3 Vietnam Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 7.4.9 Taiwan 7.4.9.1 Taiwan Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 7.4.9.2 Taiwan Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 7.4.9.3 Taiwan Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 7.4.10.2 Bangladesh Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 7.4.10.3 Bangladesh Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 7.4.11 Pakistan 7.4.11.1 Pakistan Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 7.4.11.2 Pakistan Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 7.4.11.3 Pakistan Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 7.4.12.2 Rest of Asia Pacific Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 7.4.12.3 Rest of Asia Pacific Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 8. Middle East and Africa Single Axis Solar Tracker Market Size and Forecast by Segmentation (By Value) (2023-2030) 8.1 Middle East and Africa Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 8.2 Middle East and Africa Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 8.3 Middle East and Africa Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 8.4 Middle East and Africa Single Axis Solar Tracker Market Size and Forecast, by Country (2023-2030) 8.4.1 South Africa 8.4.1.1 South Africa Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 8.4.1.2 South Africa Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 8.4.1.3 South Africa Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 8.4.2 GCC 8.4.2.1 GCC Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 8.4.2.2 GCC Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 8.4.2.3 GCC Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 8.4.3 Egypt 8.4.3.1 Egypt Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 8.4.3.2 Egypt Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 8.4.3.3 Egypt Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 8.4.4 Nigeria 8.4.4.1 Nigeria Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 8.4.4.2 Nigeria Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 8.4.4.3 Nigeria Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 8.4.5.2 Rest of ME&A Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 8.4.5.3 Rest of ME&A Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 9. South America Single Axis Solar Tracker Market Size and Forecast by Segmentation (By Value) (2023-2030) 9.1 South America Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 9.2 South America Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 9.3 South America Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 9.4 South America Single Axis Solar Tracker Market Size and Forecast, by Country (2023-2030) 9.4.1 Brazil 9.4.1.1 Brazil Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 9.4.1.2 Brazil Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 9.4.1.3 Brazil Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 9.4.2 Argentina 9.4.2.1 Argentina Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 9.4.2.2 Argentina Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 9.4.2.3 Argentina Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Single Axis Solar Tracker Market Size and Forecast, by Product Type (2023-2030) 9.4.3.2 Rest Of South America Single Axis Solar Tracker Market Size and Forecast, by Axis Rotation (2023-2030) 9.4.3.3 Rest Of South America Single Axis Solar Tracker Market Size and Forecast, by Application (2023-2030) 10. Global Single Axis Solar Tracker Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Type Segment 10.3.3 Application Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Leading Single Axis Solar Tracker Global Companies, by market capitalization 10.5 Market Structure 10.5.1 Market Leaders 10.5.2 Market Followers 10.5.3 Emerging Players 10.6 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Nextracker Inc. 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium and large) 11.1.7 Recent Developments 11.2 Array Technologies Inc. 11.3 Soltec Power Holdings S.L.U. 11.4 ZNShine New Energy Technology Co., Ltd. 11.5 Arctech Solar Holding Co., Ltd. 11.6 Trina Solar Co., Ltd. 11.7 Huawei Technologies Co., Ltd. 11.8 Ingeteam Power Electronics S.A. 11.9 Enel Green Power S.p.A. 11.10 BayWa r.e. New Energies GmbH 11.11 Amerisolar Inc. 11.12 New England Clean Energy (NEC) 11.13 FTC Solar, Inc. 11.14 GameChange Solar 11.15 Solvest Inc. 11.16 Deger Canada Inc 11.17 trackerPI GmbH 11.18 Claren Solar 11.19 PV Hardware Ltd. 11.20 MKS Instruments, Inc. 11.21 SolAero Technologies LLC 11.22 Solar Power Systems Ltd. 11.23 NewEra Solar Technologies 12. Key Findings 13. Industry Recommendations