Silver Graphite Market size was valued at USD 124.4 Mn. in 2022 and the total Silver Graphite revenue is expected to grow by 6.8 % from 2023 to 2029, reaching nearly USD 197.2 Mn.Silver Graphite Market Overview:

The silver graphite market refers to the production and sale of graphite materials with a high silver content, which is used in various industrial applications, such as electrical contacts and brushes. The silver graphite market is a niche segment of the graphite industry, focused on the production and sale of graphite materials with high silver content. These materials are used in various industrial applications, such as electrical contacts and brushes, thanks to their excellent conductivity, low friction, and resistance to wear and tear. The market is driven by the demand for these materials in the electronics, automotive, and aerospace industries, as well as the increasing use of renewable energy sources, which require high-performance electrical contacts. However, the market is also constrained by factors such as the high cost of silver and the availability of alternative materials. In terms of applications, silver graphite materials are commonly used in switches, relays, and connectors in the electronics industry, as well as in industrial equipment such as generators, motors, and transformers. The silver content in these materials can vary depending on the application and the performance requirements, typically ranging from 5% to 30%. While the silver graphite market is relatively small compared to the overall graphite industry, it is expected to grow as the demand for high-performance electrical contacts increases in various industries. The market is highly competitive, with key players such as Mersen, SGL Group, Toyo Tanso, Tokai Carbon, and GrafTech International. Despite the challenges of high silver costs and the availability of alternative materials such as copper graphite and silver-tin oxide, the superior performance of silver graphite materials in certain applications makes them a preferred choice for several industries.To know about the Research Methodology :- Request Free Sample Report

Silver Graphite Market Market Dynamics:

Competitive Landscape: The silver graphite market is highly competitive, with several global players offering these materials. Some of the key players in the market include Mersen: Mersen is a French company that produces a wide range of graphite-based products, including silver graphite materials for various industrial applications. SGL Group: SGL Group is a German company that specializes in carbon-based materials and solutions, including silver graphite materials for the electronics industry. Toyo Tanso: Toyo Tanso is a Japanese company that produces graphite materials and components for a range of industries, including silver graphite materials for electrical contacts.Tokai Carbon: Tokai Carbon is a Japanese company that produces carbon-based products, including silver graphite materials for various industrial applications. Additionally GrafTech International: GrafTech International is an American company that produces graphite-based products, including silver graphite materials for electrical contacts and other applications. These companies compete on the basis of product quality, performance, price, and customer service. They also invest in research and development to improve the performance and properties of silver graphite materials, as well as to develop new applications and markets. The competitive landscape of the silver graphite market is expected to evolve as new players enter the market and existing players expand their product offerings and distribution channels.Silver Graphite Market Trend Bolstering Demand for High-Performance Electrical Contacts Drives Silver Graphite Market Growth The silver graphite market is experiencing steady growth thanks to the increasing demand for electrical contacts with high levels of performance in various industries such as automotive, aerospace, telecommunications, and power generation. The growing adoption of electric vehicles and renewable energy sources is also fueling the demand for silver graphite contacts in battery systems and solar panels. Additionally, the development of advanced technologies like 5G networks and artificial intelligence is driving the need for high-performance electrical contacts that can handle high current densities and operate at high temperatures. Moreover, the silver graphite market is expected to continue its growth trend in the forecast years, with both established players and new entrants competing to meet the demand for high-quality silver graphite. Silver Graphite Market Driver Increased Adoption of Electric Vehicles Drives Demand for Silver Graphite The chief driver of the silver graphite market is the growing adoption of electric vehicles (EVs), which require high-performance electrical contacts in their battery systems. Silver graphite contacts are used in EV batteries due to their high electrical and thermal conductivity, low contact resistance, and good resistance to wear and oxidation. As the global automotive industry shifts towards electric and hybrid vehicles, the demand for silver graphite contacts is expected to increase significantly. According to a report by MMR, the global market for EV battery materials, including silver graphite, is expected to grow at a CAGR of 12.9% during the forecast period. In addition to the automotive industry, the demand for silver graphite contacts is also being driven by the increasing adoption of renewable energy sources like solar power. Silver graphite contacts are used in solar panels to facilitate the flow of electricity between the cells, enhancing the overall efficiency of the system. Moreover, the increased adoption of electric vehicles and renewable energy sources is a key driver of the silver graphite market, and this trend is expected to continue in the forecast years as countries around the world set ambitious targets for reducing carbon emissions and transitioning to cleaner energy sources. Silver Graphite Market Restraint High Production Costs of Silver Graphite Impede Market Growth The production process of Silver Graphite involves several complex steps, including mixing the silver powder with graphite powder, shaping the mixture into the desired form, and sintering the material at high temperatures. The cost of raw materials, particularly silver, can also be volatile and can impact the profitability of silver graphite manufacturers. Additionally, the manufacturing process requires specialized equipment and skilled labor, which can add to the production costs. As a result of these factors, the cost of silver graphite products can be significantly higher than other types of graphite, making it less attractive to end-users who are looking for cost-effective solutions. In some cases, end-users may opt for cheaper alternatives, such as copper graphite, which can offer similar performance at a lower cost. The high production costs of silver graphite have also led to a concentration of production among a few key players who have the resources and expertise to produce high-quality silver graphite at a competitive cost. This concentration of production can limit the entry of new players into the market, further hampering the market growth. Silver Graphite Market Opportunity Growing Demand for Renewable Energy Creates Opportunity for Silver Graphite Market Renewable energy sources are becoming increasingly important as countries around the world seek to reduce their carbon emissions and transition to cleaner energy sources. Silver graphite is an essential component of solar panels, where it is used as an electrical contact to facilitate the flow of electricity between the cells. The demand for solar panels is expected to grow significantly in the forecast years, particularly in developing countries where there is a need for affordable and sustainable energy solutions. According to a report by the International Energy Agency (IEA), solar power is set to become the cheapest source of electricity in many countries by 2025. In addition to solar power, silver graphite also has applications in wind turbines, where it is used in pitch control systems to ensure that the turbine blades are positioned correctly for maximum efficiency. The global wind power market is also expected to grow significantly in the forecast years, as governments and businesses seek to reduce their reliance on fossil fuels. However, the growing demand for renewable energy sources presents a significant opportunity for the silver graphite market. As the demand for solar panels and wind turbines increases, the demand for high-quality silver graphite contacts is also expected to rise, creating new opportunities for manufacturers in the industry.

Silver Graphite Market Segment Analysis:

Based on Graphite Structure, The vertical segment referred to in the statement likely pertains to the various industries or end-use applications where silver graphite contacts are utilized. The forecast period could range from a few years to a decade, depending on the scope of the market analysis. EVs require high-performance electrical contacts in their battery systems, and silver graphite contacts are preferred due to their excellent electrical and thermal conductivity, low contact resistance, and durability. As the demand for EVs continues to rise, the use of silver graphite contacts in the automotive industry is expected to increase significantly. The use of silver graphite contacts in solar panels and wind turbines is another key driver of the market. The demand for solar panels and wind turbines is expected to grow significantly in the forecast years as countries around the world set ambitious targets for reducing their carbon emissions and transitioning to cleaner energy sources. The development of advanced technologies like 5G networks and artificial intelligence is driving the need for high-performance electrical contacts that can handle high current densities and operate at high temperatures. Silver graphite contacts are well-suited for such applications, and as the demand for these technologies grows, the demand for silver graphite contacts is also expected to rise. The vertical segment of the silver graphite market is expected to grow significantly during the forecast period thanks to the increasing adoption of EVs and renewable energy sources, as well as advancements in technology that require high-performance electrical contacts.Based on Type, The statement "the 1-5 μm segment is expected to grow significantly during the forecast period for the silver graphite market" likely pertains to the particle size range of silver graphite powder, which is used as a raw material in various applications. The use of silver graphite powder in lithium-ion batteries is a key driver of the market. The particle size of the silver graphite powder plays a crucial role in determining the battery's performance, with smaller particle sizes leading to better electrochemical performance. The 1-5 μm particle size range is ideal for use in high-performance batteries, making it a preferred choice for manufacturers. Silver graphite powder is also used in the electronics industry as a conductive filler in polymer composites, such as electronic inks and coatings. The 1-5 μm particle size range is preferred in this industry as it allows for the production of smooth and even coatings with good electrical conductivity. The development of advanced technologies like 5G networks and artificial intelligence is driving the need for high-performance batteries and electronic components that can handle high current densities and operate at high temperatures. The use of silver graphite powder in these applications is expected to increase significantly, particularly in the 1-5 μm particle size range. The 1-5 μm segment of the silver graphite market is expected to grow significantly during the forecast period thanks to the increasing demand for high-performance batteries and electronic components, as well as advancements in technology that require smaller particle sizes for improved performance.

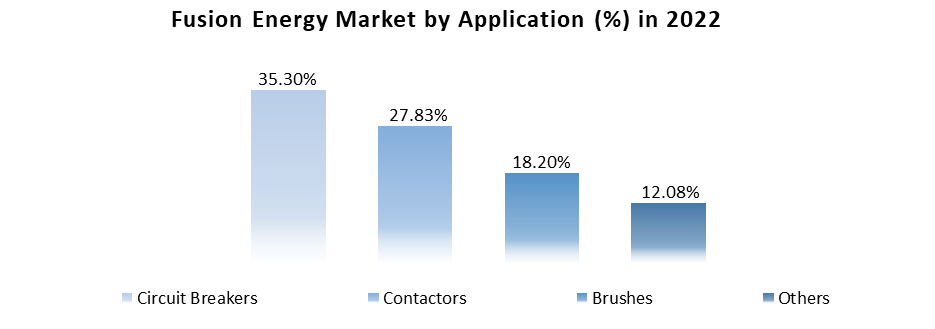

Based on the Application, The statement "the Circuit Breakers segment is dominating the market in the year 2022 and is expected to do the same during the forecast period for the silver graphite market" suggests that the circuit breakers application segment of the silver graphite market is currently the largest and most dominant, and is expected to maintain its position in the market during the forecast period. With the rising global population and increasing industrialization, the demand for electricity is also growing rapidly. Circuit breakers are essential components in power distribution systems that protect the electrical network from overloads and short circuits. As the demand for electricity continues to rise, the demand for circuit breakers is also expected to increase. Many countries around the world are replacing their aging power infrastructure with modern and efficient systems. This is driving the demand for new circuit breakers that can handle higher voltages and currents while providing reliable and safe operation. The development of smart grid systems is also driving the demand for advanced circuit breakers that can operate automatically and communicate with other devices in the network. Silver graphite contacts are preferred in such applications due to their excellent electrical conductivity and durability. The circuit breakers segment of the silver graphite market is expected to remain dominant during the forecast period due to the increasing demand for electricity, replacement of aging infrastructure, and advancements in technology that require high-performance circuit breakers.

Silver Graphite Market Regional Insights:

North America dominated the market in the year 2022 with 43% of the market share. North America's dominance in the silver graphite market can be attributed to several factors such as the presence of well-established automotive and electronics industries, the increasing demand for fuel-efficient vehicles, and the growing adoption of renewable energy sources. In the automotive industry, silver graphite is widely used in brake pads due to its superior thermal conductivity and frictional properties. As the demand for fuel-efficient vehicles increases, the demand for silver graphite-based brake pads also rises, which is driving the growth of the silver graphite market in North America. The electronics industry is another major consumer of silver graphite,which is used as a thermal interface material in electronic devices such as smartphones, laptops, and tablets. With the increasing demand for these devices, the demand for silver graphite is also growing. In contrast, the European market for silver graphite is growing at a slower pace due to the economic slowdown and declining automotive industry. However, the increasing adoption of electric vehicles and the growing demand for renewable energy sources are expected to drive the growth of the silver graphite market in Europe. The Asia Pacific region is also a significant market for silver graphite, with China and Japan being the major contributors. The growth of the market in this region can be attributed to the growing automotive and electronics industries, as well as the increasing investment in renewable energy sources. Additionally, the presence of a large consumer base and the growing urbanization and industrialization in countries like India and China are expected to further fuel the demand for silver graphite in the region.Silver Graphite Market Scope: Inquiry Before Buying

Silver Graphite Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 124.4 Mn. Forecast Period 2023 to 2029 CAGR: 6.8% Market Size in 2029: US$ 197.2 Mn Segments Covered: by Graphite Structure 1. Vertical 2. Parallel 3. Random by Type 1. 1-5 μm 2. 5-40 μm 3. 20-160 μm 4. Others by Application 1. Circuit Breakers 2. Contactors 3. Brushes 4. Others Silver Graphite Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Silver Graphite Market, Key Players are

1. Mersen 2. SGL Group 3. Toyo Tanso 4. Tokai Carbon 5. GrafTech International 6. Carbon Brush Company Private Limited, 7. Madison Limited, 8. Fabricast, Inc., 9. KARBOTECHNIK, 10. Helwig Carbon Products, Inc., 11. Guilin Coninst Electrical & Electronic Material Co., Ltd., 12. Morgan Advanced Materials 13. Tirupati Carbon Products PVT LTD., 14. St Marys Carbon 15. Umicore Frequently Asked Questions: 1] What segments are covered in the Global Silver Graphite Market report? Ans. The segments covered in the Silver Graphite Market report are based on Graphite Structure, Type, Application, and Region. 2] Which region is expected to hold the highest share in the Global Silver Graphite Market? Ans. The North America region is expected to hold the highest share of the Silver Graphite Market. 3] What is the market size of the Global Silver Graphite Market by 2029? Ans. The market size of the Silver Graphite Market by 2029 is expected to reach US$ 197.2 Mn. 4] What is the forecast period for the Global Silver Graphite Market? Ans. The forecast period for the Silver Graphite Market is 2022-2029. 5] What was the market size of the Global Silver Graphite Market in 2022? Ans. The market size of the Silver Graphite Market in 2022 was valued at US$ 124.4 Mn.

1. Silver Graphite Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Silver Graphite Market: Dynamics 2.1. Silver Graphite Market Trends by Region 2.1.1. North America Silver Graphite Market Trends 2.1.2. Europe Silver Graphite Market Trends 2.1.3. Asia Pacific Silver Graphite Market Trends 2.1.4. Middle East and Africa Silver Graphite Market Trends 2.1.5. South America Silver Graphite Market Trends 2.2. Silver Graphite Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Silver Graphite Market Drivers 2.2.1.2. North America Silver Graphite Market Restraints 2.2.1.3. North America Silver Graphite Market Opportunities 2.2.1.4. North America Silver Graphite Market Challenges 2.2.2. Europe 2.2.2.1. Europe Silver Graphite Market Drivers 2.2.2.2. Europe Silver Graphite Market Restraints 2.2.2.3. Europe Silver Graphite Market Opportunities 2.2.2.4. Europe Silver Graphite Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Silver Graphite Market Drivers 2.2.3.2. Asia Pacific Silver Graphite Market Restraints 2.2.3.3. Asia Pacific Silver Graphite Market Opportunities 2.2.3.4. Asia Pacific Silver Graphite Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Silver Graphite Market Drivers 2.2.4.2. Middle East and Africa Silver Graphite Market Restraints 2.2.4.3. Middle East and Africa Silver Graphite Market Opportunities 2.2.4.4. Middle East and Africa Silver Graphite Market Challenges 2.2.5. South America 2.2.5.1. South America Silver Graphite Market Drivers 2.2.5.2. South America Silver Graphite Market Restraints 2.2.5.3. South America Silver Graphite Market Opportunities 2.2.5.4. South America Silver Graphite Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Silver Graphite Industry 2.8. Analysis of Government Schemes and Initiatives For Silver Graphite Industry 2.9. Silver Graphite Market Trade Analysis 2.10. The Global Pandemic Impact on Silver Graphite Market 3. Silver Graphite Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 3.1.1. Vertical 3.1.2. Parallel 3.1.3. Random 3.2. Silver Graphite Market Size and Forecast, by Type (2022-2029) 3.2.1. 1-5 μm 3.2.2. 5-40 μm 3.2.3. 20-160 μm 3.2.4. Others 3.3. Silver Graphite Market Size and Forecast, by Application (2022-2029) 3.3.1. Circuit Breakers 3.3.2. Contactors 3.3.3. Brushes 3.3.4. Others 3.4. Silver Graphite Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Silver Graphite Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 4.1.1. Vertical 4.1.2. Parallel 4.1.3. Random 4.2. North America Silver Graphite Market Size and Forecast, by Type (2022-2029) 4.2.1. 1-5 μm 4.2.2. 5-40 μm 4.2.3. 20-160 μm 4.2.4. Others 4.3. North America Silver Graphite Market Size and Forecast, by Application (2022-2029) 4.3.1. Circuit Breakers 4.3.2. Contactors 4.3.3. Brushes 4.3.4. Others 4.4. North America Silver Graphite Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 4.4.1.1.1. Vertical 4.4.1.1.2. Parallel 4.4.1.1.3. Random 4.4.1.2. United States Silver Graphite Market Size and Forecast, by Type (2022-2029) 4.4.1.2.1. 1-5 μm 4.4.1.2.2. 5-40 μm 4.4.1.2.3. 20-160 μm 4.4.1.2.4. Others 4.4.1.3. United States Silver Graphite Market Size and Forecast, by Application (2022-2029) 4.4.1.3.1. Circuit Breakers 4.4.1.3.2. Contactors 4.4.1.3.3. Brushes 4.4.1.3.4. Others 4.4.2. Canada 4.4.2.1. Canada Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 4.4.2.1.1. Vertical 4.4.2.1.2. Parallel 4.4.2.1.3. Random 4.4.2.2. Canada Silver Graphite Market Size and Forecast, by Type (2022-2029) 4.4.2.2.1. 1-5 μm 4.4.2.2.2. 5-40 μm 4.4.2.2.3. 20-160 μm 4.4.2.2.4. Others 4.4.2.3. Canada Silver Graphite Market Size and Forecast, by Application (2022-2029) 4.4.2.3.1. Circuit Breakers 4.4.2.3.2. Contactors 4.4.2.3.3. Brushes 4.4.2.3.4. Others 4.4.3. Mexico 4.4.3.1. Mexico Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 4.4.3.1.1. Vertical 4.4.3.1.2. Parallel 4.4.3.1.3. Random 4.4.3.2. Mexico Silver Graphite Market Size and Forecast, by Type (2022-2029) 4.4.3.2.1. 1-5 μm 4.4.3.2.2. 5-40 μm 4.4.3.2.3. 20-160 μm 4.4.3.2.4. Others 4.4.3.3. Mexico Silver Graphite Market Size and Forecast, by Application (2022-2029) 4.4.3.3.1. Circuit Breakers 4.4.3.3.2. Contactors 4.4.3.3.3. Brushes 4.4.3.3.4. Others 5. Europe Silver Graphite Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 5.2. Europe Silver Graphite Market Size and Forecast, by Type (2022-2029) 5.3. Europe Silver Graphite Market Size and Forecast, by Application (2022-2029) 5.4. Europe Silver Graphite Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 5.4.1.2. United Kingdom Silver Graphite Market Size and Forecast, by Type (2022-2029) 5.4.1.3. United Kingdom Silver Graphite Market Size and Forecast, by Application(2022-2029) 5.4.2. France 5.4.2.1. France Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 5.4.2.2. France Silver Graphite Market Size and Forecast, by Type (2022-2029) 5.4.2.3. France Silver Graphite Market Size and Forecast, by Application(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 5.4.3.2. Germany Silver Graphite Market Size and Forecast, by Type (2022-2029) 5.4.3.3. Germany Silver Graphite Market Size and Forecast, by Application (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 5.4.4.2. Italy Silver Graphite Market Size and Forecast, by Type (2022-2029) 5.4.4.3. Italy Silver Graphite Market Size and Forecast, by Application(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 5.4.5.2. Spain Silver Graphite Market Size and Forecast, by Type (2022-2029) 5.4.5.3. Spain Silver Graphite Market Size and Forecast, by Application (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 5.4.6.2. Sweden Silver Graphite Market Size and Forecast, by Type (2022-2029) 5.4.6.3. Sweden Silver Graphite Market Size and Forecast, by Application (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 5.4.7.2. Austria Silver Graphite Market Size and Forecast, by Type (2022-2029) 5.4.7.3. Austria Silver Graphite Market Size and Forecast, by Application (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 5.4.8.2. Rest of Europe Silver Graphite Market Size and Forecast, by Type (2022-2029) 5.4.8.3. Rest of Europe Silver Graphite Market Size and Forecast, by Application (2022-2029) 6. Asia Pacific Silver Graphite Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 6.2. Asia Pacific Silver Graphite Market Size and Forecast, by Type (2022-2029) 6.3. Asia Pacific Silver Graphite Market Size and Forecast, by Application (2022-2029) 6.4. Asia Pacific Silver Graphite Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 6.4.1.2. China Silver Graphite Market Size and Forecast, by Type (2022-2029) 6.4.1.3. China Silver Graphite Market Size and Forecast, by Application (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 6.4.2.2. S Korea Silver Graphite Market Size and Forecast, by Type (2022-2029) 6.4.2.3. S Korea Silver Graphite Market Size and Forecast, by Application (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 6.4.3.2. Japan Silver Graphite Market Size and Forecast, by Type (2022-2029) 6.4.3.3. Japan Silver Graphite Market Size and Forecast, by Application (2022-2029) 6.4.4. India 6.4.4.1. India Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 6.4.4.2. India Silver Graphite Market Size and Forecast, by Type (2022-2029) 6.4.4.3. India Silver Graphite Market Size and Forecast, by Application (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 6.4.5.2. Australia Silver Graphite Market Size and Forecast, by Type (2022-2029) 6.4.5.3. Australia Silver Graphite Market Size and Forecast, by Application (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 6.4.6.2. Indonesia Silver Graphite Market Size and Forecast, by Type (2022-2029) 6.4.6.3. Indonesia Silver Graphite Market Size and Forecast, by Application (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 6.4.7.2. Malaysia Silver Graphite Market Size and Forecast, by Type (2022-2029) 6.4.7.3. Malaysia Silver Graphite Market Size and Forecast, by Application (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 6.4.8.2. Vietnam Silver Graphite Market Size and Forecast, by Type (2022-2029) 6.4.8.3. Vietnam Silver Graphite Market Size and Forecast, by Application(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 6.4.9.2. Taiwan Silver Graphite Market Size and Forecast, by Type (2022-2029) 6.4.9.3. Taiwan Silver Graphite Market Size and Forecast, by Application (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 6.4.10.2. Rest of Asia Pacific Silver Graphite Market Size and Forecast, by Type (2022-2029) 6.4.10.3. Rest of Asia Pacific Silver Graphite Market Size and Forecast, by Application (2022-2029) 7. Middle East and Africa Silver Graphite Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 7.2. Middle East and Africa Silver Graphite Market Size and Forecast, by Type (2022-2029) 7.3. Middle East and Africa Silver Graphite Market Size and Forecast, by Application (2022-2029) 7.4. Middle East and Africa Silver Graphite Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 7.4.1.2. South Africa Silver Graphite Market Size and Forecast, by Type (2022-2029) 7.4.1.3. South Africa Silver Graphite Market Size and Forecast, by Application (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 7.4.2.2. GCC Silver Graphite Market Size and Forecast, by Type (2022-2029) 7.4.2.3. GCC Silver Graphite Market Size and Forecast, by Application (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 7.4.3.2. Nigeria Silver Graphite Market Size and Forecast, by Type (2022-2029) 7.4.3.3. Nigeria Silver Graphite Market Size and Forecast, by Application (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 7.4.4.2. Rest of ME&A Silver Graphite Market Size and Forecast, by Type (2022-2029) 7.4.4.3. Rest of ME&A Silver Graphite Market Size and Forecast, by Application (2022-2029) 8. South America Silver Graphite Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 8.2. South America Silver Graphite Market Size and Forecast, by Type (2022-2029) 8.3. South America Silver Graphite Market Size and Forecast, by Application(2022-2029) 8.4. South America Silver Graphite Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 8.4.1.2. Brazil Silver Graphite Market Size and Forecast, by Type (2022-2029) 8.4.1.3. Brazil Silver Graphite Market Size and Forecast, by Application (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 8.4.2.2. Argentina Silver Graphite Market Size and Forecast, by Type (2022-2029) 8.4.2.3. Argentina Silver Graphite Market Size and Forecast, by Application (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Silver Graphite Market Size and Forecast, by Graphite Structure (2022-2029) 8.4.3.2. Rest Of South America Silver Graphite Market Size and Forecast, by Type (2022-2029) 8.4.3.3. Rest Of South America Silver Graphite Market Size and Forecast, by Application (2022-2029) 9. Global Silver Graphite Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Silver Graphite Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Mersen 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. SGL Group 10.3. Toyo Tanso 10.4. Tokai Carbon 10.5. GrafTech International 10.6. Carbon Brush Company Private Limited, 10.7. Madison Limited, 10.8. Fabricast, Inc., 10.9. KARBOTECHNIK, 10.10. Helwig Carbon Products, Inc., 10.11. Guilin Coninst Electrical & Electronic Material Co., Ltd., 10.12. Morgan Advanced Materials 10.13. Tirupati Carbon Products PVT LTD., 10.14. St Marys Carbon 10.15. Umicore 11. Key Findings 12. Industry Recommendations 13. Silver Graphite Market: Research Methodology 14. Terms and Glossary