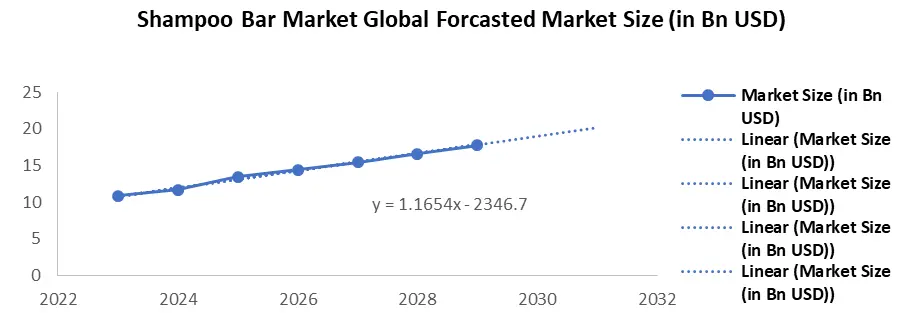

The Global Shampoo Bar Market is witnessing tremendous demand and is projected to reach USD 19.08 Bn by 2030 from USD 11.65 Bn at a CAGR of 7.3 %.Shampoo Bar Market Overview

Shampoo Bars, which looks exactly like normal soap bars serves the same function as the traditional shampoo does. One of the major reason the shampoo bar’s popularity is its lasting usage, the shampoo bars typically last more than the liquid shampoo thus making it an effective alternative. Most of the shampoo bars are sulphate free and use less packaging material than the traditional shampoo liquids thus making it an eco-friendly option for the consumer. Owing to the fact that people are diverting towards the natural and are becoming more and more health conscious towards health and hygiene,the Market is witnessing tremendous demand. Also, due to the rise in the plastic waste, people are promoting the shampoo bar as it has less wastage as compared to the traditional product thus adding to the popularity of shampoo bars. The market is experiencing a surge in product innovation, with companies introducing new formulations and fragrances to meet the preferences of an ever-changing consumer base. Market participants are concentrating on improving the performance of shampoo bars, ensuring that they sanitise effectively and provide conditioning benefits. The report includes all such parameters which drives and acts as restraining factor for the Market and the challenges and opportunities that it brings along with them.Competitive analysis is also been done mapping down key companies including Lush cosmetics, friendly soap and other major players.Shampoo Bar Market Research Methodology

The report on the Market covers an in-depth analysis of the industry. Key insights of the report include the Market size and the growth rate. A thorough regional analysis of the industry is conducted at a global, regional and country level. Such an analysis provides valuable information on market penetration, regional dominance and growth strategies adopted by the key players in the market. The major countries in each region are mapped according to their revenue contribution to the global Shampoo Bar Market. To understand the competitive landscape of the Market, key players and new entrants in the market are listed. Growth indicators such as company profiles, revenue, and share, core competitors, recent developments, new growth strategies, technological advancements and mergers and acquisitions are covered. The report provides a competitive analysis of Shampoo Bar Market drivers, restraints, opportunities, and growth strategies. PESTLE, SWOT and Porter’s five forces were used for industry analysis of the Market. Swot analysis is used to identify the strength and weaknesses of the market. The bottom-up approach was used to estimate the Market size. The report includes the Shampoo Bar Market’s major strategic developments, comprising R&D, new product launches, M&A, partnerships, agreements, collaborations, joint ventures, and regional growth of the key competitors. The report includes an analysis of the global, regional and country levels.To know about the Research Methodology :- Request Free Sample Report

Shampoo Bar Market Dynamics

There are several factors that drive or restraint the Global Shampoo Bar Market. These includes several government initiatives, awareness among the public, demand of the product and perspective of the consumers. The complete analysis is been donein the report along with the opportunity that the Shampoo Bar manufacturer could harness. Overview of some of the driver is been discussed below. Awareness regarding the environmental impact of plastic drives the Shampoo Bar Market Shampoo bars are more environmentally friendly than liquid shampoo because they do not require plastic containers. This is a significant market driver for shampoo bars, as consumers become increasingly conscious of their impact on the environment.According to the World Economic Forum, the plastic pollution is amongst the top 5 factor affecting the marine environment and is expected to reach 33 Bn USD by the end of 2050.People are getting aware of this and are diverting their focus towards more environmentally friendly option and shampoo bar is one of them. Thus, this helps the Shampoo Bar market to thrive in the current times. Minimalistic beauty routines contribute towards the growth of Shampoo Bar Market Social media's growth has made it simpler than ever for consumers to share their beauty rituals with the world thanks to sites like Instagram and TikTok. People are adopting a more minimalist approach to beauty as a consequence, as they observe how others get outstanding results using fewer items.As individuals become more aware of the damaging impact that chemicals and synthetic compounds have on their skin and hair, there is a growing movement towards natural beauty. More natural beauty products are now in demand as a result, and they frequently take the shape of simple regimens.As people look for methods to simplify their lives, this often extends to their beauty regimens. Simpler beauty regimens sometimes take less time and effort to complete and are simpler to follow than more involved ones.Because oneis not continually purchasing new items, minimalist beauty routines might be less expensive than more sophisticated ones. High cost of shampoo bars affects the Shampoo Bar Market Typically, the cost of shampoo bars is on the higher side as compared to the traditional options available. Hence this creates a perception among the consumer that the product belongs to the luxury product side and hence they hesitate of refrain from buying the product. This conception acts as a restraining factor to the overall Shampoo Bar Market. This challenge could be addressed by bringing out much cheaper option or launching the bar in smaller sizes to the consumer.

Shampoo Bar Market Regional Insights:

The Shampoo Bar market study includes regional insights on market trends, government initiatives and market development drivers. North America dominates the market because to high consumer awareness, well-established distribution channels and a focus on sustainability. Due to a vast customer base, rising disposable income and government measures encouraging sustainable and eco-friendly products, the Asia Pacific region is projected to lead the market soon. North America's shampoo bar market supremacy is due to customer awareness of sustainable living. Shampoo bars are becoming more popular in North America as eco-friendly personal care items. Shampoo bars are also simple to get in the region because to well-established distribution channels including online retail platforms and specialty stores. The US and Canada have laws and programmes to encourage sustainable products and minimise plastic waste. These measures and customer desire for eco-friendly products have boosted the Shampoo Bar market in the area. Shampoo Bar sales are predicted to rise throughout Asia Pacific. Personal care products are popular in India, China and Japan. Shampoo bars are appealing to customers in the region due to rising disposable income and environmental consciousness.Asia Pacific nations are promoting sustainable personal care. The Indian government's "Make in India" programme and "Swachh Bharat Abhiyan" (Clean India Mission) have encouraged the use of eco-friendly shampoo bars.Shampoo Bar Market Segment Analysis:

The report provides a thorough analysis of the Shampoo Bar market, highlighting key market trends, market dynamics and growth opportunities. The market is divided into eight distinct segments, each of which caters to particular consumer preferences and requirements. The identified segments are as follows: By Product Type:The Shampoo Bar Market is segmented based on product types, including solid shampoo bars and shampoo bars with additional properties such as conditioning, anti-dandruff and herbal variants. The solid shampoo bars segment dominates the market due to their convenience, eco-friendly nature and rising consumer awareness about reducing plastic waste. By Distribution Channel:This segment classifies the Shampoo Bar Market based on distribution channels, including online retail, specialty stores, supermarkets and hypermarkets and others. Online retail is the most widely used distribution channel, driven by the increasing popularity of e-commerce platforms and the convenience they offer to consumers. By Price Range: The report segments the market into different price ranges, such as economy, mid-range and premium. The economy segment holds the largest market share due to its affordability and growing adoption among price-sensitive consumers. By End User: The Shampoo Bar Market is segmented based on end-user categories, including men, women and unisex. Currently, women are the primary consumers of shampoo bars, but the men's segment is witnessing significant growth due to increasing awareness about sustainable personal care products. By Ingredient Type: This segment categorizes shampoo bars based on ingredient types, such as natural/organic, herbal and synthetic. The natural/organic ingredient segment is widely used and preferred by consumers due to its perceived safety, environmental benefits and growing demand for chemical-free products. By Packaging Type: The market is segmented based on packaging types, including minimalistic packaging, recyclable packaging and plastic-free packaging. With increasing environmental concerns, consumers are gravitating towards shampoo bars packaged in sustainable and plastic-free materials. By Consumer Age Group: This segment classifies the Shampoo Bar Market based on consumer age groups, including millennials, Generation X and baby boomers. Millennials are the most prominent consumer segment, driving the demand for shampoo bars through their preference for sustainable, natural and eco-friendly personal care products. Among these segments, the natural/organic ingredient segment is expected to witness substantial growth in the future. Consumers' increasing focus on health and wellness, coupled with rising concerns over chemical exposure, will drive the demand for natural/organic ingredient-based shampoo bars. This segment offers opportunities for Shampoo Bar Market players to innovate and develop products that align with consumer preferences.Shampoo Bar Market Competitive Landscape:

Shampoo Bar market companies compete fiercely for market share. This section describes the market's top players and their tactics for success. Lush Retail, a worldwide cosmetic company, has introduced paper-packaged shampoo bars. Natural shampoo bars are more sustainable than bottles. Lush Retail's eco-friendly packaging meets consumer desire for sustainable personal care items. P&G, a multinational consumer products firm, introduced the first high-performing shampoo bars in Europe. These chemical-free bars clean and condition. P&G prioritises product performance and sustainability by offering high-quality shampoo bars in recyclable paperboard. Galaxy Surfactants, an Indian surfactant company, launched a new shampoo bar line with Galseer Tresscon. Coconut oil surfactant makes shampoo bars mild on hair and scalp. Galaxy Surfactants' revolutionary shampoo bars demonstrate their devotion to natural and sustainable ingredients. Product innovation, brand positioning, price tactics and packaging activities define Shampoo Bar market competition. Lush Retail, P&G and Galaxy Surfactants are using their capabilities in these areas to gain market share and satisfy ecologically concerned consumers. Eco-friendly packaging, natural and gentle chemicals and high-performance shampoo bars may survive as consumer awareness of sustainable living and plastic waste reduction grows. Companies may acquire a competitive edge and develop the Shampoo Bar market by matching customer preferences.Shampoo Bar Market Scope: Inquire before buying

Shampoo Bar Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 11.65 Bn. Forecast Period 2024 to 2030 CAGR: 7.3 % Market Size in 2030: US $ 19.08 Bn. Segments Covered: by Product Type Solid shampoo bars Conditioning Anti-dandruff Herbal variants by Distribution Channel Online retail Specialty stores Supermarkets Hypermarkets Others by Price Range Economy Mid-range Premium by End User Men Women Unisex by Ingredient Type Natural/organic Herbal Synthetic by Packaging Type Minimalistic packaging Recyclable packaging Plastic-free packaging by Consumer Age Group Millennials Generation X Baby boomers Shampoo Bar Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Shampoo Bar Market, Key Players:

The report has in detail information about the Strategies adopted by the following key companies to sustain and grow in the market. These Shampoo Bar Manufacturers covered in the report are selected on the basis of certain criteria. 1. Lush Cosmetics (United Kingdom) 2. Ethique (New Zealand) 3. Chagrin Valley Soap & Salve (United States) 4. J.R. Liggett's (United States) 5. Meow Meow Tweet (United States) 6. Plaine Products (United States) 7. Friendly Soap (United Kingdom) 8. Whiff Botanicals (United States) 9. Basin (United States) 10. Chagrin Valley Soap & Salve (United States) 11. Viori (United States) 12. Samaya (India) 13. The Yellow Bird (United States) 14. Beauty and the Bees (Australia) 15. The Natural French Soap Company (France) 16. The Australian Natural Soap Company (Australia) 17. Unwrapped Life (Canada) 18. Naples Soap Company (United States) 19. Soul and Soap (United Kingdom) 20. Saavy Naturals (United States) 21. MooGoo (Australia) 22. Beauty Kubes (United Kingdom) 23. Dindi Naturals (Australia) 24. Butter Me Up Organics (United States) 25. Dr. Bronner's (United States) 26. Pachamamaï (France) 27. Hand in Hand (United States) FAQs: 1. What are the growth drivers for the Shampoo Bar Market? Ans: Awareness regarding the ill-effect of the plastics and hence opting for the eco-friendly solution is the major factor contributing towards the growth of Shampoo Bar Market. 2. What is the major restraint for the Shampoo Bar Market growth? Ans:High cost of the product is the major restraint for the Shampoo Bar Market. 3. Which region is expected to lead the global Shampoo Bar Market during the forecast period? Ans: North America is the leading region in the Global Shampoo Bar Market. 4. What is the projected market size & growth rate of the Shampoo Bar Market? Ans: Shampoo Bar Market is witnessing tremendous demand and is projected to reach $ 19.08 Bn USD by 2030 with CAGR of 7.3 %. 5. What segments are covered in the Shampoo Bar Market report? Ans: Price range, distribution channel, price range and end user are some of the segments included in the report for the Shampoo Bar Market.

Table of content 1. Shampoo Bar Market: Research Methodology 2. Shampoo Bar Market: Executive Summary 3. Shampoo Bar Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Shampoo Bar Market: Dynamics 4.1. Market Trends by region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Shampoo Bar Market: Segmentation (by Value USD and Volume Units) 5.1. Shampoo Bar Market, By Product Type 5.1.1. Solid shampoo bars 5.1.2. Conditioning 5.1.3. Anti-dandruff 5.1.4. Herbal variants 5.2. Shampoo Bar Market, By Distribution Channel 5.2.1. Online retail 5.2.2. Specialty stores 5.2.3. Supermarkets 5.2.4. Hypermarkets 5.2.5. Others 5.3. Shampoo Bar Market, By Price Range 5.3.1. Economy 5.3.2. Mid-range 5.3.3. Premium 5.4. Shampoo Bar Market, By End User 5.4.1. Men 5.4.2. Women 5.4.3. Unisex 5.5. Shampoo Bar Market, By Ingredient Type 5.5.1. Natural/organic 5.5.2. Herbal 5.5.3. Synthetic 5.6. Shampoo Bar Market, By Packaging Type 5.6.1. Minimalistic packaging 5.6.2. Recyclable packaging 5.6.3. Plastic-free packaging 5.7. Shampoo Bar Market, By Consumer Age Group 5.7.1. Millennials 5.7.2. Generation X 5.7.3. Baby boomers 6. North America Shampoo Bar Market (by Value USD and Volume Units) 6.1. North America Shampoo Bar Market, By Product Type 6.1.1. Solid shampoo bars 6.1.2. Conditioning 6.1.3. Anti-dandruff 6.1.4. Herbal variants 6.2. North America Shampoo Bar Market, By Distribution Channel 6.2.1. Online retail 6.2.2. Specialty stores 6.2.3. Supermarkets 6.2.4. Hypermarkets 6.2.5. Others 6.3. North America Shampoo Bar Market, By Price Range 6.3.1. Economy 6.3.2. Mid-range 6.3.3. Premium 6.4. North America Shampoo Bar Market, By End User 6.4.1. Men 6.4.2. Women 6.4.3. Unisex 6.5. North America Shampoo Bar Market, By Ingredient Type 6.5.1. Natural/organic 6.5.2. Herbal 6.5.3. Synthetic 6.6. North America Shampoo Bar Market, By Packaging Type 6.6.1. Minimalistic packaging 6.6.2. Recyclable packaging 6.6.3. Plastic-free packaging 6.7. North America Shampoo Bar Market, By Consumer Age Group 6.7.1. Millennials 6.7.2. Generation X 6.7.3. Baby boomers 6.8. North America Shampoo Bar Market, By Country 6.8.1. United States 6.8.2. Canada 6.8.3. Mexico 7. Europe Shampoo Bar Market (by Value USD and Volume Units) 7.1. Europe Shampoo Bar Market, By Product Type 7.1.1. Solid shampoo bars 7.1.2. Conditioning 7.1.3. Anti-dandruff 7.1.4. Herbal variants 7.2. Europe Shampoo Bar Market, By Distribution Channel 7.2.1. Online retail 7.2.2. Specialty stores 7.2.3. Supermarkets 7.2.4. Hypermarkets 7.2.5. Others 7.3. Europe Shampoo Bar Market, By Price Range 7.3.1. Economy 7.3.2. Mid-range 7.3.3. Premium 7.4. Europe Shampoo Bar Market, By End User 7.4.1. Men 7.4.2. Women 7.4.3. Unisex 7.5. Europe Shampoo Bar Market, By Ingredient Type 7.5.1. Natural/organic 7.5.2. Herbal 7.5.3. Synthetic 7.6. Europe Shampoo Bar Market, By Packaging Type 7.6.1. Minimalistic packaging 7.6.2. Recyclable packaging 7.6.3. Plastic-free packaging 7.7. Europe Shampoo Bar Market, By Consumer Age Group 7.7.1. Millennials 7.7.2. Generation X 7.7.3. Baby boomers 7.8. Europe Shampoo Bar Market, By Country 7.8.1. UK 7.8.2. France 7.8.3. Germany 7.8.4. Italy 7.8.5. Spain 7.8.6. Sweden 7.8.7. Austria 8. Asia Pacific Shampoo Bar Market (by Value USD and Volume Units) 8.1. Asia Pacific Shampoo Bar Market, By Product Type 8.1.1. Solid shampoo bars 8.1.2. Conditioning 8.1.3. Anti-dandruff 8.1.4. Herbal variants 8.2. Asia Pacific Shampoo Bar Market, By Distribution Channel 8.2.1. Online retail 8.2.2. Specialty stores 8.2.3. Supermarkets 8.2.4. Hypermarkets 8.2.5. Others 8.3. Asia Pacific Shampoo Bar Market, By Price Range 8.3.1. Economy 8.3.2. Mid-range 8.3.3. Premium 8.4. Asia Pacific Shampoo Bar Market, By End User 8.4.1. Men 8.4.2. Women 8.4.3. Unisex 8.5. Asia Pacific Shampoo Bar Market, By Ingredient Type 8.5.1. Natural/organic 8.5.2. Herbal 8.5.3. Synthetic 8.6. Asia Pacific Shampoo Bar Market, By Packaging Type 8.6.1. Minimalistic packaging 8.6.2. Recyclable packaging 8.6.3. Plastic-free packaging 8.7. Asia Pacific Shampoo Bar Market, By Consumer Age Group 8.7.1. Millennials 8.7.2. Generation X 8.7.3. Baby boomers 8.8. Asia Pacific Shampoo Bar Market, By Country 8.8.1. China 8.8.2. S Korea 8.8.3. Japan 8.8.4. India 8.8.5. Australia 8.8.6. Indonesia 8.8.7. Malaysia 8.8.8. Vietnam 8.8.9. Taiwan 8.8.10. Bangladesh 8.8.11. Pakistan 8.8.12. Rest of Asia Pacific 9. Middle East and Africa Shampoo Bar Market (by Value USD and Volume Units) 9.1. Middle East and Africa Shampoo Bar Market, By Product Type 9.1.1. Solid shampoo bars 9.1.2. Conditioning 9.1.3. Anti-dandruff 9.1.4. Herbal variants 9.2. Middle East and Africa Shampoo Bar Market, By Distribution Channel 9.2.1. Online retail 9.2.2. Specialty stores 9.2.3. Supermarkets 9.2.4. Hypermarkets 9.2.5. Others 9.3. Middle East and Africa Shampoo Bar Market, By Price Range 9.3.1. Economy 9.3.2. Mid-range 9.3.3. Premium 9.4. Middle East and Africa Shampoo Bar Market, By End User 9.4.1. Men 9.4.2. Women 9.4.3. Unisex 9.5. Middle East and Africa Shampoo Bar Market, By Ingredient Type 9.5.1. Natural/organic 9.5.2. Herbal 9.5.3. Synthetic 9.6. Middle East and Africa Shampoo Bar Market, By Packaging Type 9.6.1. Minimalistic packaging 9.6.2. Recyclable packaging 9.6.3. Plastic-free packaging 9.7. Middle East and Africa Shampoo Bar Market, By Consumer Age Group 9.7.1. Millennials 9.7.2. Generation X 9.7.3. Baby boomers 9.8. Middle East and Africa Shampoo Bar Market, By Country 9.8.1. South Africa 9.8.2. GCC 9.8.3. Egypt 9.8.4. Nigeria 9.8.5. Rest of ME&A 10. South America Shampoo Bar Market (by Value USD and Volume Units) 10.1. South America Shampoo Bar Market, By Product Type 10.1.1. Solid shampoo bars 10.1.2. Conditioning 10.1.3. Anti-dandruff 10.1.4. Herbal variants 10.2. South America Shampoo Bar Market, By Distribution Channel 10.2.1. Online retail 10.2.2. Specialty stores 10.2.3. Supermarkets 10.2.4. Hypermarkets 10.2.5. Others 10.3. South America Shampoo Bar Market, By Price Range 10.3.1. Economy 10.3.2. Mid-range 10.3.3. Premium 10.4. South America Shampoo Bar Market, By End User 10.4.1. Men 10.4.2. Women 10.4.3. Unisex 10.5. South America Shampoo Bar Market, By Ingredient Type 10.5.1. Natural/organic 10.5.2. Herbal 10.5.3. Synthetic 10.6. South America Shampoo Bar Market, By Packaging Type 10.6.1. Minimalistic packaging 10.6.2. Recyclable packaging 10.6.3. Plastic-free packaging 10.7. South America Shampoo Bar Market, By Consumer Age Group 10.7.1. Millennials 10.7.2. Generation X 10.7.3. Baby boomers 10.8. South America Shampoo Bar Market, By Country 10.8.1. Brazil 10.8.2. Argentina 10.8.3. Rest of South America 11. Company Profile: Key players 11.1. Lush Cosmetics (United Kingdom) 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Ethique (New Zealand) 11.3. Chagrin Valley Soap & Salve (United States) 11.4. J.R. Liggett's (United States) 11.5. Meow Meow Tweet (United States) 11.6. Plaine Products (United States) 11.7. Friendly Soap (United Kingdom) 11.8. Whiff Botanicals (United States) 11.9. Basin (United States) 11.10. Chagrin Valley Soap & Salve (United States) 11.11. Viori (United States) 11.12. Samaya (India) 11.13. The Yellow Bird (United States) 11.14. Beauty and the Bees (Australia) 11.15. The Natural French Soap Company (France) 11.16. The Australian Natural Soap Company (Australia) 11.17. Unwrapped Life (Canada) 11.18. Naples Soap Company (United States) 11.19. Soul and Soap (United Kingdom) 11.20. Saavy Naturals (United States) 11.21. MooGoo (Australia) 11.22. Beauty Kubes (United Kingdom) 11.23. Dindi Naturals (Australia) 11.24. Butter Me Up Organics (United States) 11.25. Dr. Bronner's (United States) 11.26. Pachamamaï (France) 11.27. Hand in Hand (United States) 12. Key Findings 13. Industry Recommendation