The Server Operating System Market size was valued at USD 183.20 Billion in 2025 and the total Server Operating System revenue is expected to grow at a CAGR of 12.35% from 2025 to 2032, reaching nearly USD 413.95 Billion by 2032.Server Operating System Market Overview:

The Server Operating Systems market, essential for web servers, application servers, and more, is a crucial component in server architectures. These server OS platforms serve as the backbone of software, offering a diverse range of services to client machines throughout networks. Server Operating Systems facilitate the execution of applications, processes, and various server types, including web servers, file servers, and database servers, amongst others. Prominent options in the Server Operating System market include Red Hat Enterprise Linux, Windows Server, and Mac OS x Server, serving as the linchpin for data hubs connecting multiple computers through LAN or WAN. They empower organizations to carry out complex operations such as data transfers, making them indispensable in today's tech landscape.To know about the Research Methodology :- Request Free Sample Report The Server Operating System market is experiencing significant growth due to escalating performance demands, especially in the realm of cloud platforms and data center infrastructure. The rising popularity of Linux server OS, attributable to its open-source nature and cost-effectiveness driving the growth of the Server Operating System market. Market players are focusing on upgrading server OS security solutions and management features, evolving to meet the dynamic requirements of organizations. Recent developments underscore an increasing emphasis on advanced server OS solutions, capable of efficiently managing multi-user demands and ensuring robust data management and seamless service delivery, fulfilling to modern enterprises' ever-expanding needs. The future of the Server Operating System market is expected to rapidly expand, with businesses increasingly relying on server OS platforms to power their critical operations and data services. As the demand for robust, secure, and flexible solutions continues to grow, the Server Operating System market remains at the forefront of technological innovation, facilitating the complex operations of businesses worldwide. Server Operating System Market Scope and Research Methodology The Server Operating System Market report offers a thorough evaluation of the market for the forecast period. It examines patterns and factors shaping the market, including drivers, constraints, opportunities, and challenges. The report also provides expected revenue growth for the Server Operating System Market during the forecast period. The research on the Server Operating System Market analyses major applications, business strategies, and influencing factors. The report examines market trends, volume, cost, share, supply, and demand, and utilizes methods like SWOT and PESTLE analysis. Primary research resources include databases and surveys.

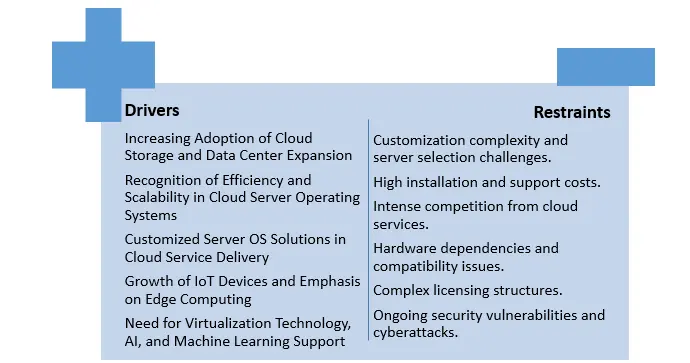

Server Operating System Market Dynamics:

Cloud Adoption, IoT, Security, and Emerging Technologies Driving the Market Growth The increasing adoption of cloud storage infrastructure and the expansion of data center facilities are significant drivers for the growth of the Server Operating System Market. Organizations are increasingly realizing the efficiency and scalability that cloud server operating systems offer, leading to a rapid adoption of Server Operating Systems. Key players in the market, including Amazon Web Services (AWS), are relying on customized server OS solutions to power their cloud infrastructure, further underscoring the central role of server OS in cloud service delivery. A global expansion in the HiTech industry is another noteworthy driver. For instance, In June 2025, HCL Technologies (HCL) opened a new 9,000 sq. ft. delivery center in Vancouver, Canada, significantly expanding its presence to serve clients primarily in the HiTech industry. This strategic move is set to drive growth in the Server Operating Systems Market. The Server Operating System Market benefits from the rising number of broadband users. By the end of March 2025, the top five service providers controlled 98.37% of the total broadband subscribers, including major players such as Reliance Jio Infocomm Ltd and Bharti Airtel. This rise in broadband users contributes to the expansion of the Server Operating Systems Market. The growing importance of IoT devices and the increasing significance of edge computing highlight the need for reliable server OS platforms, with Linux server OS being a popular choice in this context. Cybersecurity concerns are pivotal in driving the adoption of advanced server OS solutions. Red Hat Enterprise Linux, known for its robust security features, is a prime example of such solutions that are in demand. The Server Operating Systems Market plays a crucial role in modern technology with the increasing demand for virtualization technology, support for AI and machine learning, the rise of e-commerce, big data analytics, the emergence of hybrid cloud models, and remote work. Recent developments in the market, exemplified by the 2021 launch of Red Hat Enterprise Linux 8.5, underscore the dynamic evolution of the Server Operating Systems Market. Industry-specific adoption is contributing significantly to the revenue growth of the Server Operating Systems market. Various industries, such as healthcare, retail, and e-commerce, are recognizing the value of server operating systems. Healthcare facilities, in particular, are leveraging server virtualization to enhance server capacity without the need for additional space or staffing. Strategic partnerships, such as the one between Infor and HARMAN International in March 2025, reflect the broader adoption of server operating systems in modernizing data management and analytics within the healthcare sector.High Installation and Support Expenses Impacting Server OS Market Growth The Server Operating System Market faces an array of challenges impacting Linux Server OS market share, Enterprise Server OS, Server OS management, and Cloud Server Operating Systems. The market confronts the issue of growing demand for server operating systems tailored to specific applications and the complexities associated with selecting the right server. These factors are poised to negatively affect market growth. High installation and support costs are another obstacle to Server Operating System Market growth, with the Information Technology Intelligence Consulting Corporation (ITIC) reporting exorbitant downtime costs. For example, in 2020, one hour of server downtime was valued at USD 100,000, with the cost soaring to USD 1,670 per minute per server. Such costs could impede the growth of the Server OS market. The Server Operating System Market faces intense competition from cloud services such as Amazon Web Services (AWS) and Microsoft Azure, which provide scalable and flexible solutions. AWS's Elastic Compute Cloud (EC2) enables users to run virtual servers with various operating systems, thereby diminishing the demand for traditional on-premises server OS. Hardware dependencies are another challenge, as specific configurations limit compatibility. Oracle Solaris OS, optimized for Oracle SPARC servers, constrains those seeking alternative options, affecting market dynamics. Complex licensing structures employed by Server OS providers present barriers for small businesses. For instance, Microsoft's Windows Server offers various editions with different features and pricing, rendering user choices complex. Security concerns loom large, with server OS systems being prime targets for cyber-attacks. The exploitation of vulnerabilities such as Specter and Meltdown in Intel processors has revealed the susceptibility of server OS to security threats. Legacy systems pose compatibility issues, as mainframes running IBM z/OS may not integrate seamlessly with modern server OS. The cost of maintaining and supporting server OS is high, particularly with subscriptions such as Red Hat Enterprise Linux that demand annual fees for updates and support. Regulatory compliance adds complexity, with data protection and security regulations like the General Data Protection Regulation (GDPR) requiring stringent measures that are challenging to implement. The fragmented market ecosystem featuring numerous players offering different solutions leads to compatibility issues and interoperability challenges. Variations in package management and library versions within Linux distributions like Ubuntu and CentOS exacerbate the situation. Virtualization and containerization technologies are reducing the demand for traditional server OS instances, with Docker and Kubernetes allowing applications to operate independently of the underlying OS. The increasing adoption of cost-effective open-source server OS, such as Linux distributions like CentOS and Debian, poses a challenge to commercial server OS providers by impacting market share. These multifaceted challenges necessitate innovative solutions and adaptations to maintain the Server Operating System Market's competitiveness and relevance. Exploring New Horizons with Multilingual and Localized OS Solutions to Unlock Untapped Markets The Server Operating System market offers a range of opportunities driven by evolving IT landscapes. As businesses increasingly transition to the cloud, Server OS providers seize the chance to offer seamless integration and hybrid solutions. Microsoft's Windows Server 2025 is a prime example, as it integrates seamlessly with Azure, enabling businesses to extend their on-premises infrastructure to the cloud. Enhanced security features represent another avenue for growth, as providers develop advanced protocols to counter the growing threat of cyberattacks. For instance, Linux distributions like Red Hat have introduced SELinux to fortify the OS against vulnerabilities. Additionally, the proliferation of IoT devices and edge computing presents opportunities for tailoring Server OS to these environments. Ubuntu Core, optimized for IoT devices, exemplifies the potential for IoT-focused OS solutions. The popularity of containerization and virtualization technologies further offers opportunities for Server OS providers. Solutions optimized for these technologies, like Red Hat's support for Docker containers, cater to the needs of containerized applications. Server OS also tap into the growth of edge AI and machine learning, as demonstrated by Ubuntu's support for machine learning frameworks such as TensorFlow, attracting users interested in running AI workloads at the edge. As environmental concerns mount, there is a growing demand for energy-efficient server operating systems. Opportunities lie in developing OS solutions that optimize power consumption, much like the Green IT initiatives supported by SUSE Linux Enterprise Server. Collaboration with open-source communities represents another avenue for growth. Participation in projects like the Linux Kernel allows Server OS providers to ensure the continuous improvement and relevance of their products. The increasing focus on data privacy and regulatory compliance offers further opportunities. Server OS providers offer solutions that simplify adherence to data protection laws such as GDPR, attracting customers concerned with compliance. With the growth of data-intensive applications, scalability and resource management become crucial. Server OS providers seize opportunities by optimizing their systems for efficient resource allocation and scalability, akin to how Oracle Linux caters to the needs of database-intensive workloads. Additionally, expanding into emerging markets and catering to diverse linguistic and cultural needs presents growth potential. By localizing their products and providing multilingual support, Server Operating System providers access untapped markets. The growth of the Server Operating System market is underpinned by several macro-level factors. Businesses' increased spending on robust data center infrastructure is driving market expansion. Moreover, the surge in the adoption of hybrid cloud environments, combined with the rollout of 5G networking technology, further fuels the growth of the server operating system market. However, challenges such as high server downtime and costs related to server operating systems, along with a shortage of trained IT staff in data center facilities, restrict market growth. On the flip side, technological proliferation and the escalating security needs in IT infrastructure are expected to provide remunerative opportunities for the expansion of the Server Operating System market during the forecast period. Additionally, the adoption of cloud-based solutions is accelerating globally, creating a need for servers. The development of IoT and Big Data technologies, among other factors, are key drivers of this demand. Big Data and cloud computing are crucial technologies gaining traction in mainstream information technology. As the cloud becomes more widely adopted, there are opportunities for companies to leverage Big Data for various applications. For instance, Amazon Web Services introduced new solutions that met the requirements for Microsoft Windows Server on the Amazon Elastic Compute Cloud (EC2) in January 2022. This enhanced solution increased EC2 speed by 65% while reducing the possibility of expensive delays, significantly boosting market expansion. The market's growth is attributed to enterprise spending on creating a robust data center infrastructure. In addition, the increasing adoption of hybrid cloud environments and deployment of 5G networking technologies fuel the market's growth. Furthermore, technological advancements and increasing security requirements in infrastructure are anticipated to provide lucrative expansion opportunities for the market during the forecast period. Servers used in various applications in smart cities, including delivering high-performance, low-latency services such as 5G and AI applications for intelligent transportation systems (ITS) and vehicle-to-everything (V2X) communication. They also be used to host cloud-based voice-over-IP (VoIP) communication systems for public transportation and storing and managing data from IoT sensors and devices. Additionally, high-availability servers play a role in smart city services' security and authentication processes. For example, Globally, many smart city projects and efforts are being implemented, encouraging global investments owing to urbanization. The OECD estimates that between 2010 and 2030, international investments in smart city initiatives would total around USD 1.8 trillion for all urban city infrastructure projects. This would create an opportunity for the players to develop a new version of OS to capture the market share. According to Thales Group, as of 2025, around 60% of all corporate information is stored in the cloud. As companies progressively move their resources into cloud environments to enhance security, dependability, and enterprise agility, this proportion hit 30% in 2015 and has since continued to grow. These factors create a massive growth opportunity for the market-studied vendors to expand their offerings in the coming years.

Server Operating System Market Segment Analysis:

Based on Type, the Windows segment dominated the Server Operating System Market as it has advanced multi-layer security and flexibility in supporting workloads across cloud and on-premises environments, and is expected to maintain its top position. Linux is expected a rapid growth, driven by its attributes of cost-effectiveness, superior performance, compatibility, and security, making it an attractive choice for enterprises seeking a balanced solution. UNIX segment is expected to grow rapidly as it offers multitasking and multiuser benefits, and is also expected to see growth during the forecast period. These sub-segments in the Server OS market fulfil diverse needs, with Linux appealing to cost-conscious organizations, Windows providing secure and versatile solutions, and UNIX meeting the demands of multitasking and multiuser functionality. Based on Deployment Model, On-Premises deployment dominated the market share with 43.16 % market share, primarily due to the increasing integration and implementation of analytical solutions within various organizations. This deployment model offers a high level of control and security, making it suitable for enterprises with stringent data privacy and compliance requirements. While, Cloud Deployment is a rapidly growing segment in Server Operating System Market as it gaining popularity among organizations because of its cost-effectiveness, reduced maintenance burden, and scalability. Cloud-based server OS solutions allow organizations to access a vast array of OS options quickly, making it an attractive choice for businesses looking to streamline their operations, reduce IT infrastructure costs, and leverage the flexibility offered by cloud platforms.Server Operating System Market Regional Insights:

North America dominated the Server Operating Systems Market with a 38.2% share. This dominance was due to the widespread adoption of enterprise server OS solutions and the implementation of advanced server OS management practices in the region. An important factor driving this shift in the use of Server Operating Systems is an increase in small businesses in the United States, reaching an astonishing count of 33.2 million in 2025, accounting for 99.9% of all businesses in the country. This upward trend reflects a consistent annual growth rate of 2.2% compared to the preceding year (2025) and a remarkable 12.2% increase over the five-year period from 2018 to 2025. The rising number of small and medium-sized enterprises (SMEs), especially in the United States, presents a compelling opportunity for market players to introduce innovative solutions tailored to capture a substantial market share. The Asia-Pacific (APAC) region stands out as a significant growth hotspot, expected to achieve an impressive Compound Annual Growth Rate over the forecast period. The remarkable growth in APAC is largely attributed to the rising presence of cloud service providers, positioning it as the fastest-growing market for white box servers. Competitive Landscape Server Operating System Market: The competitive landscape of the Server Operating Systems Market is marked by significant developments and investments from key industry players. In November 2021, Red Hat, Inc., a prominent operating system solutions provider, introduced an advanced version of the Linux 8.5 Red Hat Enterprise Linux platform, catering to the evolving demands of data centers, clouds, and traditional data center operations. This platform extension empowers IT teams to create transformative applications necessary for businesses. In February 2023, Oracle Corporation unveiled ambitious plans for a public cloud in Saudi Arabia, committing a substantial investment of USD 1.5 billion, responding to the escalating demand for cloud services.Similarly, Google LLC, in July 2021, embarked on a noteworthy cloud infrastructure development project in India and invested approximately USD 4.5 billion in Jio Platforms, furthering digitization efforts in the region. Microsoft Corporation, in September 2021, presented an innovative Windows Server 2023, boasting enhancements in hybrid capabilities, security, and container functionalities, including support for 2,048 logical cores and 48TB of memory. Additionally, Red Hat Enterprise Linux (RHEL) introduced the Beta 9 version in November 2021, built on kernel upstream version 5.14, offering a glimpse of significant RHEL updates designed for hybrid multi-cloud deployments, on-premises installations, physical infrastructure, public cloud, and edge computing. This landscape underscores the intense competition and dynamic innovation in the Server Operating Systems Market, as key players strive to offer cutting-edge solutions and adapt to the evolving needs of businesses in an ever-expanding market.

Server Operating System Market Scope: Inquiry Before Buying

Server Operating System Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 183.20 Bn. Forecast Period 2026 to 2032 CAGR: 12.35% Market Size in 2032: USD 413.95 Bn. Segments Covered: by Type Windows Linux UNIX Others by Deployment Model On-Premises Cloud-Based by End-User Industry IT and Telecommunications BFSI Healthcare Government and Public Sector Manufacturing Others Server Operating System Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest) South America (Brazil, Argentina Rest of South America)Server Operating System Market Key Players are:

North America: 1. Amazon Web Services, Inc. - Seattle, Washington, USA 2. Ntegral Inc. - United States 3. Cisco Systems, Inc. - San Jose, California, USA 4. Microsoft - Redmond, Washington, USA 5. Cloud Software Group, Inc. (Citrix Systems) - Florida, USA 6. ClearCenter - Salt Lake City, Utah, USA 7. Dell Inc. - Round Rock, Texas, USA 8. IBM - Armonk, New York, USA 9. Joyent - San Francisco, California, USA 10. PC/OpenSystems LLC. - Black Mountain, North Carolina, USA 11. Hewlett Packard Enterprise Development LP - Houston, Texas, USA 12. HP Development Company, L.P. - Palo Alto, California, USA 13. Google - Mountain View, California, USA 14. Red Hat, Inc. - Raleigh, North Carolina, USA 15. Stratus Technologies - Maynard, Massachusetts, USA 16. Unisys - Blue Bell, Pennsylvania, USA 17. VMware, Inc. - Palo Alto, California, USA Europe: 1. Canonical Ltd. - London, United Kingdom 2. Debian GNU/Linux - (Community-driven project, no fixed headquarters) 3. SUSE - Nuremberg, Germany 4. Univention GmbH - Bremen, Germany 5. Zentyal Linux Server - Zaragoza, Spain Asia-Pacific: 1. Fujitsu - Tokyo, Japan 2. NEC Corporation - Tokyo, Japan 3. Alibaba Cloud - Hangzhou, China 4. Huawei Technologies Co., Ltd. - Shenzhen, ChinaFrequently Asked Questions:

1] What segments are covered in the Global Server Operating System Market report? Ans. The segments covered in the Server Operating System Market report are based on Type, Deployment Model, Virtualization Status, Component, Organization Size, and Industry Vertical. 2] Which region is expected to hold the highest share in the Global Server Operating System Market? Ans. The North America region is expected to hold the highest share in the Server Operating System Market. 3] What is the market size of the Global Server Operating System Market by 2032? Ans. The market size of the Server Operating System Market by 2032 is expected to reach USD 413.95 Bn. 4] What is the forecast period for the Global Server Operating System Market? Ans. The forecast period for the Server Operating System Market is 2025-2032. 5] What was the Global Server Operating System Market size in 2025? Ans. The Global Server Operating System Market size was USD 183.20 Bn in 2025.

1. Server Operating System Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Global Server Operating System Market: Competitive Landscape 2.1. MMR Competition Matrix 2.2. Key Players Benchmarking 2.2.1. Company Name 2.2.2. Headquarter 2.2.3. Product Segment 2.2.4. End User Segment 2.2.5. Revenue (2025) 2.2.6. Global Presence 2.3. Market Structure 2.3.1. Market Leaders 2.3.2. Market Followers 2.3.3. Emerging Players 2.4. Mergers and Acquisitions Details 3. Comparative Analysis: Open-Source OS vs. Commercial OS 3.1. Comparative Analysis of Features 3.2. Cost Comparison: Open-Source vs. Commercial 3.3. Industry-Specific Preferences for Open-Source vs. Commercial OS 4. Penetration Rate of Server Operating Systems Over the Last 5 Years 4.1. . Penetration Rate Trends (2019-2024) 4.2. Market Share and Adoption Rates of Leading Server OS Vendors 5. Factors Considered While Choosing a Server Operating System 5.1. Performance Requirements 5.2. Scalability and Flexibility 5.3. Security and Compliance 5.4. Compatibility with Existing Infrastructure 6. Server Operating System Market: Dynamics 6.1. Server Operating System Market Trends 6.2. Server Operating System Market Dynamics 6.2.1. Drivers 6.2.2. Restraints 6.2.3. Opportunities 6.2.4. Challenges 6.3. PORTER’s Five Forces Analysis 6.4. PESTLE Analysis 6.5. Technological Roadmap 6.6. Value Chain Analysis 6.7. Regulatory Landscape by Region 6.7.1. North America 6.7.2. Europe 6.7.3. Asia Pacific 6.7.4. Middle East and Africa 6.7.5. South America 6.8. Key Opinion Leader Analysis For the Global Server Operating System Industry 6.9. Government Schemes and Initiatives for the Global Server Operating System Industry 7. Server Operating System Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 7.1. Server Operating System Market Size and Forecast, By Type (2025-2032) 7.1.1. Windows 7.1.2. Linux 7.1.3. UNIX 7.1.4. Others 7.2. Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 7.2.1. On-Premises 7.2.2. Cloud-Based 7.3. Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 7.3.1. IT and Telecommunications 7.3.2. BFSI 7.3.3. Healthcare 7.3.4. Government and Public Sector 7.3.5. Manufacturing 7.3.6. Others 7.4. Server Operating System Market Size and Forecast, By Region (2025-2032) 7.4.1. North America 7.4.2. Europe 7.4.3. Asia Pacific 7.4.4. Middle East and Africa 7.4.5. South America 8. North America Server Operating System Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 8.1. North America Server Operating System Market Size and Forecast, By Type (2025-2032) 8.1.1. Windows 8.1.2. Linux 8.1.3. UNIX 8.1.4. Others 8.2. North America Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 8.2.1. On-Premises 8.2.2. Cloud-Based 8.3. North America Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 8.3.1. IT and Telecommunications 8.3.2. BFSI 8.3.3. Healthcare 8.3.4. Government and Public Sector 8.3.5. Manufacturing 8.3.6. Others 8.4. North America Server Operating System Market Size and Forecast, by Country (2025-2032) 8.4.1. United States 8.4.1.1. United States Server Operating System Market Size and Forecast, By Type (2025-2032) 8.4.1.1.1. Windows 8.4.1.1.2. Linux 8.4.1.1.3. UNIX 8.4.1.1.4. Others 8.4.1.2. United States Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 8.4.1.2.1. On-Premises 8.4.1.2.2. Cloud-Based 8.4.1.3. United States Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 8.4.1.3.1. IT and Telecommunications 8.4.1.3.2. BFSI 8.4.1.3.3. Healthcare 8.4.1.3.4. Government and Public Sector 8.4.1.3.5. Manufacturing 8.4.1.3.6. Others 8.4.2. Canada 8.4.2.1. Canada Server Operating System Market Size and Forecast, By Type (2025-2032) 8.4.2.1.1. Windows 8.4.2.1.2. Linux 8.4.2.1.3. UNIX 8.4.2.1.4. Others 8.4.2.2. Canada Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 8.4.2.2.1. On-Premises 8.4.2.2.2. Cloud-Based 8.4.2.3. Canada Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 8.4.2.3.1. IT and Telecommunications 8.4.2.3.2. BFSI 8.4.2.3.3. Healthcare 8.4.2.3.4. Government and Public Sector 8.4.2.3.5. Manufacturing 8.4.2.3.6. Others 8.4.3. Mexico 8.4.3.1. Mexico Server Operating System Market Size and Forecast, By Type (2025-2032) 8.4.3.1.1. Windows 8.4.3.1.2. Linux 8.4.3.1.3. UNIX 8.4.3.1.4. Others 8.4.3.2. Mexico Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 8.4.3.2.1. On-Premises 8.4.3.2.2. Cloud-Based 8.4.3.3. Mexico Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 8.4.3.3.1. IT and Telecommunications 8.4.3.3.2. BFSI 8.4.3.3.3. Healthcare 8.4.3.3.4. Government and Public Sector 8.4.3.3.5. Manufacturing 8.4.3.3.6. Others 9. Europe Server Operating System Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 9.1. Europe Server Operating System Market Size and Forecast, By Type (2025-2032) 9.2. Europe Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 9.3. Europe Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 9.4. Europe Server Operating System Market Size and Forecast, by Country (2025-2032) 9.4.1. United Kingdom 9.4.1.1. United Kingdom Server Operating System Market Size and Forecast, By Type (2025-2032) 9.4.1.2. United Kingdom Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 9.4.1.3. United Kingdom Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 9.4.2. France 9.4.2.1. France Server Operating System Market Size and Forecast, By Type (2025-2032) 9.4.2.2. France Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 9.4.2.3. France Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 9.4.3. Germany 9.4.3.1. Germany Server Operating System Market Size and Forecast, By Type (2025-2032) 9.4.3.2. Germany Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 9.4.3.3. Germany Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 9.4.4. Italy 9.4.4.1. Italy Server Operating System Market Size and Forecast, By Type (2025-2032) 9.4.4.2. Italy Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 9.4.4.3. Italy Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 9.4.5. Spain 9.4.5.1. Spain Server Operating System Market Size and Forecast, By Type (2025-2032) 9.4.5.2. Spain Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 9.4.5.3. Spain Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 9.4.6. Sweden 9.4.6.1. Sweden Server Operating System Market Size and Forecast, By Type (2025-2032) 9.4.6.2. Sweden Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 9.4.6.3. Sweden Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 9.4.7. Russia 9.4.7.1. Russia Server Operating System Market Size and Forecast, By Type (2025-2032) 9.4.7.2. Russia Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 9.4.7.3. Russia Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 9.4.8. Rest of Europe 9.4.8.1. Rest of Europe Server Operating System Market Size and Forecast, By Type (2025-2032) 9.4.8.2. Rest of Europe Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 9.4.8.3. Rest of Europe Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 10. Asia Pacific Server Operating System Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032) 10.1. Asia Pacific Server Operating System Market Size and Forecast, By Type (2025-2032) 10.2. Asia Pacific Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 10.3. Asia Pacific Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 10.4. Asia Pacific Server Operating System Market Size and Forecast, by Country (2025-2032) 10.4.1. China 10.4.1.1. China Server Operating System Market Size and Forecast, By Type (2025-2032) 10.4.1.2. China Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 10.4.1.3. China Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 10.4.2. S Korea 10.4.2.1. S Korea Server Operating System Market Size and Forecast, By Type (2025-2032) 10.4.2.2. S Korea Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 10.4.2.3. S Korea Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 10.4.3. Japan 10.4.3.1. Japan Server Operating System Market Size and Forecast, By Type (2025-2032) 10.4.3.2. Japan Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 10.4.3.3. Japan Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 10.4.4. India 10.4.4.1. India Server Operating System Market Size and Forecast, By Type (2025-2032) 10.4.4.2. India Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 10.4.4.3. India Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 10.4.5. Australia 10.4.5.1. Australia Server Operating System Market Size and Forecast, By Type (2025-2032) 10.4.5.2. Australia Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 10.4.5.3. Australia Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 10.4.6. Indonesia 10.4.6.1. Indonesia Server Operating System Market Size and Forecast, By Type (2025-2032) 10.4.6.2. Indonesia Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 10.4.6.3. Indonesia Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 10.4.7. Philippines 10.4.7.1. Philippines Server Operating System Market Size and Forecast, By Type (2025-2032) 10.4.7.2. Philippines Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 10.4.7.3. Philippines Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 10.4.8. Malaysia 10.4.8.1. Malaysia Server Operating System Market Size and Forecast, By Type (2025-2032) 10.4.8.2. Malaysia Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 10.4.8.3. Malaysia Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 10.4.9. Vietnam 10.4.9.1. Vietnam Server Operating System Market Size and Forecast, By Type (2025-2032) 10.4.9.2. Vietnam Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 10.4.9.3. Vietnam Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 10.4.10. Thailand 10.4.10.1. Thailand Server Operating System Market Size and Forecast, By Type (2025-2032) 10.4.10.2. Thailand Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 10.4.10.3. Thailand Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 10.4.11. Rest of Asia Pacific 10.4.11.1. Rest of Asia Pacific Server Operating System Market Size and Forecast, By Type (2025-2032) 10.4.11.2. Rest of Asia Pacific Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 10.4.11.3. Rest of Asia Pacific Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 11. Middle East and Africa Server Operating System Market Size and Forecast (by Value in USD Billion) (2025-2032 11.1. Middle East and Africa Server Operating System Market Size and Forecast, By Type (2025-2032) 11.2. Middle East and Africa Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 11.3. Middle East and Africa Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 11.4. Middle East and Africa Server Operating System Market Size and Forecast, by Country (2025-2032) 11.4.1. South Africa 11.4.1.1. South Africa Server Operating System Market Size and Forecast, By Type (2025-2032) 11.4.1.2. South Africa Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 11.4.1.3. South Africa Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 11.4.2. GCC 11.4.2.1. GCC Server Operating System Market Size and Forecast, By Type (2025-2032) 11.4.2.2. GCC Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 11.4.2.3. GCC Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 11.4.3. Egypt 11.4.3.1. Egypt Server Operating System Market Size and Forecast, By Type (2025-2032) 11.4.3.2. Egypt Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 11.4.3.3. Egypt Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 11.4.4. Nigeria 11.4.4.1. Nigeria Server Operating System Market Size and Forecast, By Type (2025-2032) 11.4.4.2. Nigeria Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 11.4.4.3. Nigeria Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 11.4.5. Rest of ME&A 11.4.5.1. Rest of ME&A Server Operating System Market Size and Forecast, By Type (2025-2032) 11.4.5.2. Rest of ME&A Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 11.4.5.3. Rest of ME&A Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 12. South America Server Operating System Market Size and Forecast by Segmentation (by Value in USD Billion) (2025-2032 12.1. South America Server Operating System Market Size and Forecast, By Type (2025-2032) 12.2. South America Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 12.3. South America Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 12.4. South America Server Operating System Market Size and Forecast, by Country (2025-2032) 12.4.1. Brazil 12.4.1.1. Brazil Server Operating System Market Size and Forecast, By Type (2025-2032) 12.4.1.2. Brazil Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 12.4.1.3. Brazil Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 12.4.2. Argentina 12.4.2.1. Argentina Server Operating System Market Size and Forecast, By Type (2025-2032) 12.4.2.2. Argentina Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 12.4.2.3. Argentina Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 12.4.3. Chile 12.4.3.1. Chile Server Operating System Market Size and Forecast, By Type (2025-2032) 12.4.3.2. Chile Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 12.4.3.3. Chile Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 12.4.4. Colombia 12.4.4.1. Colombia Server Operating System Market Size and Forecast, By Type (2025-2032) 12.4.4.2. Colombia Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 12.4.4.3. Colombia Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 12.4.5. Rest Of South America 12.4.5.1. Rest Of South America Server Operating System Market Size and Forecast, By Type (2025-2032) 12.4.5.2. Rest Of South America Server Operating System Market Size and Forecast, By Deployment Type (2025-2032) 12.4.5.3. Rest Of South America Server Operating System Market Size and Forecast, By End-User Industry (2025-2032) 13. Company Profile: Key Players 13.1. Amazon Web Services, Inc. - Seattle, Washington, USA 13.1.1. Company Overview 13.1.2. Business Portfolio 13.1.3. Financial Overview 13.1.4. SWOT Analysis 13.1.5. Strategic Analysis 13.1.6. Recent Developments 13.2. Ntegral Inc. - United States 13.3. Cisco Systems, Inc. - San Jose, California, USA 13.4. Microsoft - Redmond, Washington, USA 13.5. Cloud Software Group, Inc. (Citrix Systems) - Florida, USA 13.6. ClearCenter - Salt Lake City, Utah, USA 13.7. Dell Inc. - Round Rock, Texas, USA 13.8. IBM - Armonk, New York, USA 13.9. Joyent - San Francisco, California, USA 13.10. PC/OpenSystems LLC. - Black Mountain, North Carolina, USA 13.11. Hewlett Packard Enterprise Development LP - Houston, Texas, USA 13.12. HP Development Company, L.P. - Palo Alto, California, USA 13.13. Google - Mountain View, California, USA 13.14. Red Hat, Inc. - Raleigh, North Carolina, USA 13.15. Stratus Technologies - Maynard, Massachusetts, USA 13.16. Unisys - Blue Bell, Pennsylvania, USA 13.17. VMware, Inc. - Palo Alto, California, USA 13.18. Canonical Ltd. - London, United Kingdom 13.19. Debian GNU/Linux 13.20. SUSE - Nuremberg, Germany 13.21. Univention GmbH - Bremen, Germany 13.22. Zentyal Linux Server - Zaragoza, Spain 13.23. Fujitsu - Tokyo, Japan 13.24. Alibaba Cloud - Hangzhou, China 13.25. Huawei Technologies Co., Ltd. - Shenzhen, China 13.26. NEC Corporation - Tokyo, Japan 14. Key Findings 15. Industry Recommendations 16. Server Operating System Market: Research Methodology