The Server Market size was valued at USD 98.59 Bn in 2023 and is expected to reach USD 184.91 Bn by 2030, at a CAGR of 9.4%.Server Market Overview

The server market is the backbone of countless mission-critical and client-side corporate computing processes, as it powers data centers and supports cloud environments. The demand for higher-performing servers continues to ramp up, as enterprises seek to power big data and advanced workload requirements. The Server Market is thoroughly elaborated by offering several pieces of information such as market size, key players and their market value, their recent developments as well as their partnerships, mergers, and acquisitions. The graphical representation and structural exclusive information showed dominating region of the Market. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Market.To Know About The Research Methodology :- Request Free Sample Report

Server Market Dynamics

Upscaling demand for data storage and processing, Data center expansion, and Modernization are the major drivers of the Server Market The significant growth of data generated by individuals and businesses creates a heightened requirement for servers capable of handling large-scale storage and processing needs. This demand is processed by factors like the proliferation of digital content, the Internet of Things (IoT), and the adoption of big data analytics. A retail company experiences a significant increase in online sales and customer data. To handle the growing data volume and provide real-time analytics, they invest in high-capacity servers with scalable storage solutions. The constant drive of organizations to enhance their IT infrastructure leads to an increased demand for servers. The expansion and modernization of data centers fuel this demand as they require a large number of servers for data storage and processing in the server market. Considerations such as scalability, energy efficiency, and reliability influence organizations' decisions when making server purchases. Cloud Computing Virtualization and Digital Transformation Initiatives are the supporting factors of the server market The server market is significantly functioned by the shift towards cloud computing and virtual technologies. Cloud service providers need extensive server infrastructures to provide services to their consumers, while virtualization allows for the consolidation of a number of virtual servers onto a single physical server, optimizing resource utilization and reducing costs. Organizations are undergoing digital transformation to streamline operations, enhance productivity, and improve customer experience. This transformation often involves deploying new applications and services that rely on robust server infrastructure. A manufacturing company implements IoT devices to monitor production processes and optimize efficiency. They invest in edge servers to process and analyze real-time data from these devices, enabling proactive decision-making and reducing downtime. High Initial Costs and Technological Obsolescence are the biggest restraint for the server market Server infrastructure, specifically for large-scale deployments, involves significantly high costs. This state is an obstacle for small and medium-sized enterprises (SMEs) or organizations with limited capital. A startup with a small budget requires a server infrastructure to upfront its growing user base. As well as the high upfront costs of purchasing servers and related equipment pose financial complications, slowing down their expansion plans. The server market is characterized by rapid technological advancements, leading to frequent hardware and software updates. Organizations need to constantly evaluate and upgrade their server infrastructure to keep up with evolving technologies. An IT services company relies on legacy servers for its operations. However, outdated hardware limits their ability to support modern applications and deliver high-performance services, affecting their competitiveness. Intense Competition and Rapid Technological Advancements are the main challenges facing in the server market The server market is highly competitive, with numerous players offering similar products and services. Differentiating oneself and gaining market share can be challenging, requiring continuous innovation and the ability to meet specific customer demands. Example: A server manufacturer faces intense competition from established players and new entrants. They invest in research and development to create unique server features, such as energy-efficient designs or specialized workload optimization, to attract customers and stay ahead. The server market is characterized by rapid advancements in hardware, software, and networking technologies. Staying abreast of these developments and incorporating them into server designs requires significant investment and R&D capabilities. A server manufacturer needs to keep pace with the emergence of new processor architectures or memory technologies to deliver higher performance and energy efficiency. Failing to adopt these advancements can result in losing server market share to competitors. Edge Computing Expansion, Artificial Intelligence and Machine Learning Workloads, and Green Computing and Energy Efficiency are the trending opportunities in the server market. The rise of edge computing, driven by the growth of IoT devices and real-time applications, presents opportunities for server manufacturers. Edge servers are required to process data closer to the source, enabling low-latency and bandwidth-efficient operations. A telecommunications company plans to deploy edge servers at their network edge to support latency-sensitive services like augmented reality (AR) and autonomous vehicles, opening up new revenue streams. The increasing adoption of AI and ML across various industries demands servers with high-performance computing capabilities. Specialized servers, such as GPU-accelerated systems, are in high demand to support complex data processing and algorithm training in the server market. A healthcare research institute focuses on genomic analysis and drug discovery. They invest in servers with specialized AI processors to accelerate genetic data processing and identify potential drug candidates more efficiently. As environmental concerns grow, organizations are seeking energy-efficient server solutions to reduce their carbon footprint and operational costs. Server manufacturers have the opportunity to develop and market energy-efficient designs and technologies Example: A data center provider aims to achieve sustainability goals by reducing power consumption. They partner with a server manufacturer that offers energy-efficient server market solutions, allowing them to lower energy costs and enhance their environmental credentials.Server Market Segment Analysis:

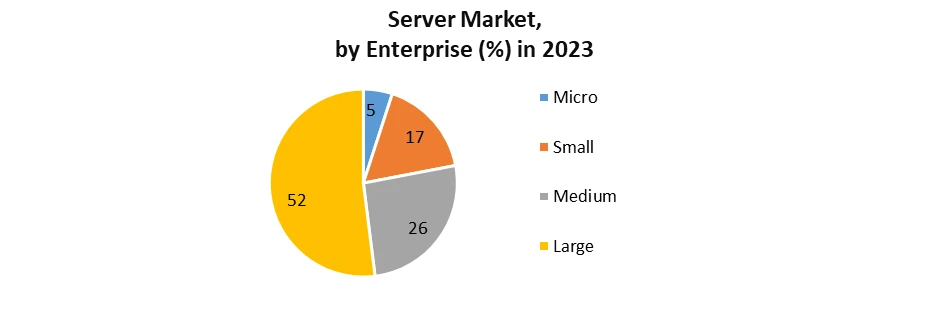

Based on Product: Rack servers are the most common form factor in the server market, designed to be mounted on racks in data centers. They are highly scalable and offer efficient space utilization. Rack servers dominate the market due to their flexibility, ease of management, and support for high-density deployments. They are favored by enterprises, cloud service providers, and data centers. Dell PowerEdge, HPE ProLiant DL Series, Lenovo ThinkSystem RD Series. Based on Enterprise: The Enterprise segment is expected to grow at a high CAGR during the forecast period. Enterprises of significant scale are increasingly prioritizing hosted application servers due to their capacity to manage workloads across various locations, often drawing from a single database. Deploying a hosted application server is more streamlined compared to traditional alternatives, requiring fewer system integrations and eliminating the need for upfront installations, thereby lowering operational and maintenance expenses. Such servers are fully overseen by a hosting service provider, ensuring regular updates and providing ongoing technical and customer support.

Regional Analysis of the Server Market

North America has traditionally been a leading market share holder for the server market due to its advanced IT infrastructure and the presence of major technology companies. The United States, specifically, delivers an important dominating market for servers, driven by different systems such as banking and finance, healthcare, e-commerce, and cloud service suppliers. In North American countries, there is a high requirement for advanced server technologies, including high-performance computing technologies and cloud-based solution servers, in the northern region. Europe represents another significant position for the server market, with countries such as Germany, the United Kingdom, and France playing important roles. The region benefits via a strong industrial base, emphasizes digital transformation, and Europe has enlarged established enterprises. These factors contribute to the demand for server Markets. The European region is showcasing increasing importance on data privacy and security, leading to a higher demand for on-premises servers and robust infrastructure. The Asia-Pacific region is experiencing fast growth in the server market due to rising digitization, expanding e-commerce, and rising demand for cloud-based services. Countries such as China, Japan, South Korea, and India are major players in this Asia-Pacific region. China specifically, has a significant server market driven by its booming tech industries and government initiatives and policies while emerging economies in Southeast Asia offer growth opportunities as businesses adopt server technologies to provide support for their digital transformation efforts. Competitive Landscape Analysis of the Server Market Dell Technologies is a leading contender in the server market, offering a broad spectrum of server solutions. The company has made significant advancements in the server domain, Dell PowerEdge servers, encompassing the PowerEdge R series and PowerEdge C series, recognized for their scalability, performance, and reliability these are the flagship products of Dell Technologies. Dell Technologies acquired VMware, a prominent virtualization software company, to fortify its server and infrastructure offerings. Furthermore, Dell introduced new server models featuring improved attributes such as increased memory capacity and enhanced power efficiency. Hewlett Packard Enterprise (HPE) holds a substantial position in the server market, delivering a comprehensive portfolio of server solutions. Noteworthy developments by HPE encompass HPE ProLiant servers, including the ProLiant DL and ProLiant BL series, distinguished for their versatility and robust performance these are the flagship products of HPE. HPE actively engages in the development of innovative server technologies, with a particular focus on edge computing solutions. They have introduced servers specifically designed for edge deployments. Additionally, HPE has forged strategic partnerships with leading technology companies to drive advancements in areas like hybrid cloud and artificial intelligence (AI). IBM holds a prominent position in the server market, providing a diverse range of server solutions tailored to various industries and workloads. Key developments by IBM include IBM Power Systems servers, equipped with high-performance processors and advanced virtualization capabilities these are the flagship products of IBM. IBM actively participates in the development of hybrid cloud and AI solutions. They collaborate with industry leaders to establish open-source initiatives like Open POWER, aimed at fostering innovation in server architecture. Moreover, IBM has made strategic acquisitions in the cloud and data center infrastructure space to expand its service offerings. Lenovo Group Limited enjoys substantial recognition in the server market, offering a wide array of server solutions. Recent developments by Lenovo include Lenovo Think System servers, renowned for their reliability, scalability, and ease of management these are the flagship products of Lenovo. Lenovo concentrates on expanding its server portfolio through strategic acquisitions. Notably, they acquired IBM's x86 server business, bolstering their presence in the server market. Lenovo also engages in collaborations with other companies to develop joint solutions and drive innovation in areas such as edge computing and software-defined infrastructure. Cisco is an emerging key player in the server market, particularly in networking and data center solutions. Key developments by Cisco include Cisco UCS (Unified Computing System) servers, seamlessly integrating computing, networking, and virtualization capabilities these are the flagship products of Cisco. Cisco actively engages in the development of hyper-converged infrastructure (HCI) solutions, which unite servers, storage, and networking into a single integrated system. They have also forged partnerships with software vendors and cloud service providers to offer comprehensive server and cloud solutions.Server Market Scope: Inquire Before Buying

Global Server Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 98.59 Bn. Forecast Period 2024 to 2030 CAGR: 9.4% Market Size in 2030: US $ 184.91 Bn. Segments Covered: by Product Blade Micro Open Compute Project Rack Tower by Enterprize Size Micro Small Medium Large by Channel Direct Reseller Systems Integrator Others by End-User BFSI Energy Government & Defense Healthcare IT & Telecom Manufacturing Others Server Market,by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Server Key Players

1. Dell Technologies 2. Hewlett Packard Enterprise (HPE) 3. IBM Corporation 4. Lenovo Group Limited 5. Cisco Systems, Inc. 6. Oracle Corporation 7. Fujitsu Limited 8. Huawei Technologies Co., Ltd. 9. Super Micro Computer, Inc. 10. Inspur Group Co., Ltd. 11. NEC Corporation 12. Hitachi, Ltd. 13. Quanta Computer Inc. 14. Wistron Corporation 15. ASUSTeK Computer Inc. 16. Sugon Information Industry Co., Ltd. 17. MiTAC Holdings Corporation 18. Penguin Computing Frequently Asked Questions and Answers for Server Market 1. What recent developments are happening in the server market? Ans: Recent developments in the server market include advancements in server technology, such as increased performance, improved power efficiency, and enhanced management capabilities. Additionally, there are ongoing developments in areas like edge computing, hybrid cloud solutions, and collaboration between server vendors and software providers. 2. What factors contribute to the growth of the server market? Ans: Factors such as increasing data volumes, digital transformation initiatives, cloud computing adoption, growing demand for data centers, and advancements in technologies like artificial intelligence (AI), Internet of Things (IoT), and 5G drive the growth of the server market. 3. What are the major operating systems used in servers? Ans: The major operating systems used in servers include Windows Server, Linux (with distributions like Ubuntu, CentOS, and Red Hat Enterprise Linux), and Unix-based systems (such as Solaris, AIX, and HP-UX). 4. Which industries rely heavily on servers? Ans: Industries such as banking and finance, healthcare, education, e-commerce, government, and many others heavily rely on servers for their day-to-day operations, data storage, and processing requirements. 5. What are the key applications of servers? Ans: Servers are used for various applications such as web hosting, database management, file sharing, email services, virtualization, and running specialized software. They play a critical role in supporting IT infrastructure and powering businesses.

1. Server Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Server Market: Dynamics 2.1. Server Market Trends by Region 2.1.1. North America Server Market Trends 2.1.2. Europe Server Market Trends 2.1.3. Asia Pacific Server Market Trends 2.1.4. Middle East and Africa Server Market Trends 2.1.5. South America Server Market Trends 2.2. Server Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Server Market Drivers 2.2.1.2. North America Server Market Restraints 2.2.1.3. North America Server Market Opportunities 2.2.1.4. North America Server Market Challenges 2.2.2. Europe 2.2.2.1. Europe Server Market Drivers 2.2.2.2. Europe Server Market Restraints 2.2.2.3. Europe Server Market Opportunities 2.2.2.4. Europe Server Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Server Market Drivers 2.2.3.2. Asia Pacific Server Market Restraints 2.2.3.3. Asia Pacific Server Market Opportunities 2.2.3.4. Asia Pacific Server Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Server Market Drivers 2.2.4.2. Middle East and Africa Server Market Restraints 2.2.4.3. Middle East and Africa Server Market Opportunities 2.2.4.4. Middle East and Africa Server Market Challenges 2.2.5. South America 2.2.5.1. South America Server Market Drivers 2.2.5.2. South America Server Market Restraints 2.2.5.3. South America Server Market Opportunities 2.2.5.4. South America Server Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Server Industry 2.8. Analysis of Government Schemes and Initiatives For Server Industry 2.9. Server Market Trade Analysis 2.10. The Global Pandemic Impact on Server Market 3. Server Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Server Market Size and Forecast, by Product (2023-2030) 3.1.1. Blade 3.1.2. Micro 3.1.3. Open Compute Project 3.1.4. Rack 3.1.5. Tower 3.2. Server Market Size and Forecast, by Enterprise Size (2023-2030) 3.2.1. Micro 3.2.2. Small 3.2.3. Medium 3.2.4. Large 3.3. Server Market Size and Forecast, by Channel (2023-2030) 3.3.1. Direct 3.3.2. Reseller 3.3.3. Systems Integrator 3.3.4. Others 3.4. Server Market Size and Forecast, by End User (2023-2030) 3.4.1. BFSI 3.4.2. Energy 3.4.3. Government & Defense 3.4.4. Healthcare 3.4.5. IT & Telecom 3.4.6. Manufacturing 3.4.7. Others 3.5. Server Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Server Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Server Market Size and Forecast, by Product (2023-2030) 4.1.1. Blade 4.1.2. Micro 4.1.3. Open Compute Project 4.1.4. Rack 4.1.5. Tower 4.2. North America Server Market Size and Forecast, by Enterprise Size (2023-2030) 4.2.1. Micro 4.2.2. Small 4.2.3. Medium 4.2.4. Large 4.3. North America Server Market Size and Forecast, by Channel (2023-2030) 4.3.1. Direct 4.3.2. Reseller 4.3.3. Systems Integrator 4.3.4. Others 4.4. North America Server Market Size and Forecast, by End User (2023-2030) 4.4.1. BFSI 4.4.2. Energy 4.4.3. Government & Defense 4.4.4. Healthcare 4.4.5. IT & Telecom 4.4.6. Manufacturing 4.4.7. Others 4.5. North America Server Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Server Market Size and Forecast, by Product (2023-2030) 4.5.1.1.1. Blade 4.5.1.1.2. Micro 4.5.1.1.3. Open Compute Project 4.5.1.1.4. Rack 4.5.1.1.5. Tower 4.5.1.2. United States Server Market Size and Forecast, by Enterprise Size (2023-2030) 4.5.1.2.1. Micro 4.5.1.2.2. Small 4.5.1.2.3. Medium 4.5.1.2.4. Large 4.5.1.3. United States Server Market Size and Forecast, by Channel (2023-2030) 4.5.1.3.1. Direct 4.5.1.3.2. Reseller 4.5.1.3.3. Systems Integrator 4.5.1.3.4. Others 4.5.1.4. United States Server Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. BFSI 4.5.1.4.2. Energy 4.5.1.4.3. Government & Defense 4.5.1.4.4. Healthcare 4.5.1.4.5. IT & Telecom 4.5.1.4.6. Manufacturing 4.5.1.4.7. Others 4.5.2. Canada 4.5.2.1. Canada Server Market Size and Forecast, by Product (2023-2030) 4.5.2.1.1. Blade 4.5.2.1.2. Micro 4.5.2.1.3. Open Compute Project 4.5.2.1.4. Rack 4.5.2.1.5. Tower 4.5.2.2. Canada Server Market Size and Forecast, by Enterprise Size (2023-2030) 4.5.2.2.1. Micro 4.5.2.2.2. Small 4.5.2.2.3. Medium 4.5.2.2.4. Large 4.5.2.3. Canada Server Market Size and Forecast, by Channel (2023-2030) 4.5.2.3.1. Direct 4.5.2.3.2. Reseller 4.5.2.3.3. Systems Integrator 4.5.2.3.4. Others 4.5.2.4. Canada Server Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. BFSI 4.5.2.4.2. Energy 4.5.2.4.3. Government & Defense 4.5.2.4.4. Healthcare 4.5.2.4.5. IT & Telecom 4.5.2.4.6. Manufacturing 4.5.2.4.7. Others 4.5.3. Mexico 4.5.3.1. Mexico Server Market Size and Forecast, by Product (2023-2030) 4.5.3.1.1. Blade 4.5.3.1.2. Micro 4.5.3.1.3. Open Compute Project 4.5.3.1.4. Rack 4.5.3.1.5. Tower 4.5.3.2. Mexico Server Market Size and Forecast, by Enterprise Size (2023-2030) 4.5.3.2.1. Micro 4.5.3.2.2. Small 4.5.3.2.3. Medium 4.5.3.2.4. Large 4.5.3.3. Mexico Server Market Size and Forecast, by Channel (2023-2030) 4.5.3.3.1. Direct 4.5.3.3.2. Reseller 4.5.3.3.3. Systems Integrator 4.5.3.3.4. Others 4.5.3.4. Mexico Server Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. BFSI 4.5.3.4.2. Energy 4.5.3.4.3. Government & Defense 4.5.3.4.4. Healthcare 4.5.3.4.5. IT & Telecom 4.5.3.4.6. Manufacturing 4.5.3.4.7. Others 5. Europe Server Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Server Market Size and Forecast, by Product (2023-2030) 5.2. Europe Server Market Size and Forecast, by Enterprise Size (2023-2030) 5.3. Europe Server Market Size and Forecast, by Channel (2023-2030) 5.4. Europe Server Market Size and Forecast, by End User (2023-2030) 5.5. Europe Server Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Server Market Size and Forecast, by Product (2023-2030) 5.5.1.2. United Kingdom Server Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.1.3. United Kingdom Server Market Size and Forecast, by Channel (2023-2030) 5.5.1.4. United Kingdom Server Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Server Market Size and Forecast, by Product (2023-2030) 5.5.2.2. France Server Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.2.3. France Server Market Size and Forecast, by Channel (2023-2030) 5.5.2.4. France Server Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Server Market Size and Forecast, by Product (2023-2030) 5.5.3.2. Germany Server Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.3.3. Germany Server Market Size and Forecast, by Channel (2023-2030) 5.5.3.4. Germany Server Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Server Market Size and Forecast, by Product (2023-2030) 5.5.4.2. Italy Server Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.4.3. Italy Server Market Size and Forecast, by Channel (2023-2030) 5.5.4.4. Italy Server Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Server Market Size and Forecast, by Product (2023-2030) 5.5.5.2. Spain Server Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.5.3. Spain Server Market Size and Forecast, by Channel (2023-2030) 5.5.5.4. Spain Server Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Server Market Size and Forecast, by Product (2023-2030) 5.5.6.2. Sweden Server Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.6.3. Sweden Server Market Size and Forecast, by Channel (2023-2030) 5.5.6.4. Sweden Server Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Server Market Size and Forecast, by Product (2023-2030) 5.5.7.2. Austria Server Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.7.3. Austria Server Market Size and Forecast, by Channel (2023-2030) 5.5.7.4. Austria Server Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Server Market Size and Forecast, by Product (2023-2030) 5.5.8.2. Rest of Europe Server Market Size and Forecast, by Enterprise Size (2023-2030) 5.5.8.3. Rest of Europe Server Market Size and Forecast, by Channel (2023-2030) 5.5.8.4. Rest of Europe Server Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Server Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Server Market Size and Forecast, by Product (2023-2030) 6.2. Asia Pacific Server Market Size and Forecast, by Enterprise Size (2023-2030) 6.3. Asia Pacific Server Market Size and Forecast, by Channel (2023-2030) 6.4. Asia Pacific Server Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Server Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Server Market Size and Forecast, by Product (2023-2030) 6.5.1.2. China Server Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.1.3. China Server Market Size and Forecast, by Channel (2023-2030) 6.5.1.4. China Server Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Server Market Size and Forecast, by Product (2023-2030) 6.5.2.2. S Korea Server Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.2.3. S Korea Server Market Size and Forecast, by Channel (2023-2030) 6.5.2.4. S Korea Server Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Server Market Size and Forecast, by Product (2023-2030) 6.5.3.2. Japan Server Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.3.3. Japan Server Market Size and Forecast, by Channel (2023-2030) 6.5.3.4. Japan Server Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Server Market Size and Forecast, by Product (2023-2030) 6.5.4.2. India Server Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.4.3. India Server Market Size and Forecast, by Channel (2023-2030) 6.5.4.4. India Server Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Server Market Size and Forecast, by Product (2023-2030) 6.5.5.2. Australia Server Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.5.3. Australia Server Market Size and Forecast, by Channel (2023-2030) 6.5.5.4. Australia Server Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Server Market Size and Forecast, by Product (2023-2030) 6.5.6.2. Indonesia Server Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.6.3. Indonesia Server Market Size and Forecast, by Channel (2023-2030) 6.5.6.4. Indonesia Server Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Server Market Size and Forecast, by Product (2023-2030) 6.5.7.2. Malaysia Server Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.7.3. Malaysia Server Market Size and Forecast, by Channel (2023-2030) 6.5.7.4. Malaysia Server Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Server Market Size and Forecast, by Product (2023-2030) 6.5.8.2. Vietnam Server Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.8.3. Vietnam Server Market Size and Forecast, by Channel (2023-2030) 6.5.8.4. Vietnam Server Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Server Market Size and Forecast, by Product (2023-2030) 6.5.9.2. Taiwan Server Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.9.3. Taiwan Server Market Size and Forecast, by Channel (2023-2030) 6.5.9.4. Taiwan Server Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Server Market Size and Forecast, by Product (2023-2030) 6.5.10.2. Rest of Asia Pacific Server Market Size and Forecast, by Enterprise Size (2023-2030) 6.5.10.3. Rest of Asia Pacific Server Market Size and Forecast, by Channel (2023-2030) 6.5.10.4. Rest of Asia Pacific Server Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Server Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Server Market Size and Forecast, by Product (2023-2030) 7.2. Middle East and Africa Server Market Size and Forecast, by Enterprise Size (2023-2030) 7.3. Middle East and Africa Server Market Size and Forecast, by Channel (2023-2030) 7.4. Middle East and Africa Server Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Server Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Server Market Size and Forecast, by Product (2023-2030) 7.5.1.2. South Africa Server Market Size and Forecast, by Enterprise Size (2023-2030) 7.5.1.3. South Africa Server Market Size and Forecast, by Channel (2023-2030) 7.5.1.4. South Africa Server Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Server Market Size and Forecast, by Product (2023-2030) 7.5.2.2. GCC Server Market Size and Forecast, by Enterprise Size (2023-2030) 7.5.2.3. GCC Server Market Size and Forecast, by Channel (2023-2030) 7.5.2.4. GCC Server Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Server Market Size and Forecast, by Product (2023-2030) 7.5.3.2. Nigeria Server Market Size and Forecast, by Enterprise Size (2023-2030) 7.5.3.3. Nigeria Server Market Size and Forecast, by Channel (2023-2030) 7.5.3.4. Nigeria Server Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Server Market Size and Forecast, by Product (2023-2030) 7.5.4.2. Rest of ME&A Server Market Size and Forecast, by Enterprise Size (2023-2030) 7.5.4.3. Rest of ME&A Server Market Size and Forecast, by Channel (2023-2030) 7.5.4.4. Rest of ME&A Server Market Size and Forecast, by End User (2023-2030) 8. South America Server Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Server Market Size and Forecast, by Product (2023-2030) 8.2. South America Server Market Size and Forecast, by Enterprise Size (2023-2030) 8.3. South America Server Market Size and Forecast, by Channel (2023-2030) 8.4. South America Server Market Size and Forecast, by End User (2023-2030) 8.5. South America Server Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Server Market Size and Forecast, by Product (2023-2030) 8.5.1.2. Brazil Server Market Size and Forecast, by Enterprise Size (2023-2030) 8.5.1.3. Brazil Server Market Size and Forecast, by Channel (2023-2030) 8.5.1.4. Brazil Server Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Server Market Size and Forecast, by Product (2023-2030) 8.5.2.2. Argentina Server Market Size and Forecast, by Enterprise Size (2023-2030) 8.5.2.3. Argentina Server Market Size and Forecast, by Channel (2023-2030) 8.5.2.4. Argentina Server Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Server Market Size and Forecast, by Product (2023-2030) 8.5.3.2. Rest Of South America Server Market Size and Forecast, by Enterprise Size (2023-2030) 8.5.3.3. Rest Of South America Server Market Size and Forecast, by Channel (2023-2030) 8.5.3.4. Rest Of South America Server Market Size and Forecast, by End User (2023-2030) 9. Global Server Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Server Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Dell Technologies 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Hewlett Packard Enterprise (HPE) 10.3. IBM Corporation 10.4. Lenovo Group Limited 10.5. Cisco Systems, Inc. 10.6. Oracle Corporation 10.7. Fujitsu Limited 10.8. Huawei Technologies Co., Ltd. 10.9. Super Micro Computer, Inc. 10.10. Inspur Group Co., Ltd. 10.11. NEC Corporation 10.12. Hitachi, Ltd. 10.13. Quanta Computer Inc. 10.14. Wistron Corporation 10.15. ASUSTeK Computer Inc. 10.16. Sugon Information Industry Co., Ltd. 10.17. MiTAC Holdings Corporation 10.18. Penguin Computing 11. Key Findings 12. Industry Recommendations 13. Server Market: Research Methodology 14. Terms and Glossary