The global Self-Healing Grid Market size was valued at 2.58 billion in 2024, and the total Self-Healing Grid Market revenue is expected to grow by 9.7% from 2025 to 2032, reaching nearly USD 5.41 billion.Self-Healing Grid Market Overview

Self-Healing Grid technology is the utilization of sophisticated hardware and software solutions for the automated monitoring, analysis, and restoration of electrical power distribution systems. This includes smart sensors, automated switches and reclosers, Advanced Distribution Management Systems (ADMS), and Outage Management Systems (OMS). The self-healing grid market is growing considerably due to aging power infrastructure and climate change-related power outages (frequency), as well as customers demanding more than reliability and the increased complexity related to integrating renewable energy sources (solar and wind) into the culture of the legacy power grid. The new demands for resilience, efficiency, and regulatory adherence mean utilities must utilize self-healing automation tools. Most market innovation operates in three fashions: maximizing grid uptime (reliability), minimizing outage duration (measured by SAIDI and SAIFI metrics), and optimizing operational efficiency.To know about the Research Methodology :- Request Free Sample Report The purpose of innovation is to maximize automation, minimize outage exposure, maximize energy efficiency, and restore systems nearly instantaneously. To this end, some applications (e.g., Supervisory Control and Data Acquisition [SCADA], remote terminal units [RTUs], basic fault detection-isolation-restoration [FDIR]) have matured sufficiently to be considered commonplace in more modern grid modernization efforts. The past decade has seen additional sophisticated functions in grid modernization, including machine learning (ML) that fuses predictive outage forecasting, the proliferation of IoT sensors, and cloud-based, centralized data environments to enhance grid visibility and influence self-healing evolution. Other advanced concepts (e.g., dynamic grid reconfiguration; integration with distributed energy resources [DERs], and cybersecurity technology for automation units) are additional catalysts both for self-healing grid maturity and sophistication. North America occupies the largest portion of the Self-Healing Grid Market due to the presence of many large utility tech companies, ample investment in grid modernization and resilience applied research and development (R&D), and a strong regulatory environment pushing best practices in order to increase reliability standards. The Asia Pacific region is rapidly growing in part due to large investments in smart grid infrastructure in China, India, Japan, and South Korea, based on increased energy demand, government mandates, and the need to respond to rapid urbanization. Supported by government funded smart city projects and major investments in renewable energy integration, the region has potential for significant growth. The Self-Healing Grid Market leaders are technology leaders such as Siemens, Schneider Electric, ABB, GE Grid Solutions, and Eaton, as well as more specialized software players such as Oracle Utilities and ETAP/OSI, that compete in the market largely on technology leadership and acquired strengths, and deep integration with utility operational technology (OT) and applied research initiatives.

Self-Healing Grid Market Dynamics

Rising Grid Modernization and Reliability Demands to Drive the Growth of the Self-Healing Grid Market The unstoppable global demand for better power reliability and resiliency against increasing outages due to aging infrastructure and extreme weather conditions is the main reason for self-healing grid adoption. In addition, utility commissions have put stringent regulatory mandates or performance incentives to penalize long outages, while offering a reward for improving SAIDI/SAIFI metrics. This has translated into significant investments in grid automation technologies, ultimately making self-healing systems a part of modern utility strategy for investor-owned and public utilities alike. Integration of Renewable Energy to Drive Self-Healing Grid Market Growth This collective effort to oversee complicated, bi-directional power flows from distributed energy resources (DERs), such as solar and wind farms, has stimulated a dramatic increase in self-healing grid investments. The increases in self-healing grid investments are fuelled by the necessity to modernize the grid infrastructure in order to manage volatility and allow for stability and power quality. The market is seeing significant demand for advanced sensors, complex software platforms (ADMS, OMS), and automated switching equipment that can dynamically reconfigure the network in real-time to isolate faulted areas and to continue serving customers. High Capital Investment and System Integration Complexities to Restrain Self-Healing Grid Market The price point for advanced self-healing technologies, including smart reclosers, sectionalizers, advanced sensors, and sophisticated software and communications networks needed for integrations, constitutes a major barrier to entry and growth. Also, technical challenges, such as the integration of legacy equipment, the volume of data needed to make useful decisions, cybersecurity risks associated with a more automated grid, and the availability of specialized skills that are properly trained, could also limit growth - particularly for small municipal utilities or in cost-conscious developing markets. Advancements in AI and Predictive Analytics to Create Growth Opportunities in the Market Advanced self-healing technologies like smart reclosers, sectionalizers, advanced sensors, and the complex software and communications networks that are essential for integrations, all present a significant price point for entry and growth. In addition to the price point for these technologies other barriers could also limit growth such as technical barriers like integrating legacy equipment, the amount of data it will take for anything useful to be decided, cybersecurity issues brought about by a more automated networked grid and availability of skilled labour who are qualified and trained. All of these issues possibly limit growth, especially amongst small municipalities or in cost-sensitive developing markets. Resilience Mandates to create Lucrative Opportunities in Self-Healing Grid Market Growth The accelerating modernization process of electrical grids in Asia-Pacific and Latin America - spurred on by governments taking action to reduce technical losses and improve electrification rates, together with heightened national spending on grid hardening and resiliency for critical infrastructure protection in North America and Europe - represents a sizable and expanding opportunity. The opportunity is also the automation of microgrids for military bases, campuses, and industrial facilities, in their desire for energy independence and guaranteed uptime. Regulatory Hurdles and Cybersecurity Concerns to Restrain Self-Healing Grid Market Growth The market participants face challenges relating to complicated and often value-delayed regulatory environments that have to approve not only major capital projects, but also the new rate structures that finance the modernization of companies that are formerly vertically-integrated utility companies (i.e., a utility industry not divided into different types of companies). The varying requirements of the utility commissions come with heightened and real concerns about how to secure automated grid systems from cyber-attacks, which are all barriers that can delay project approval and inflate operational costs (and, therefore, slow the rate of adoption and technology development).Self-Healing Grid Market Segment Analysis:

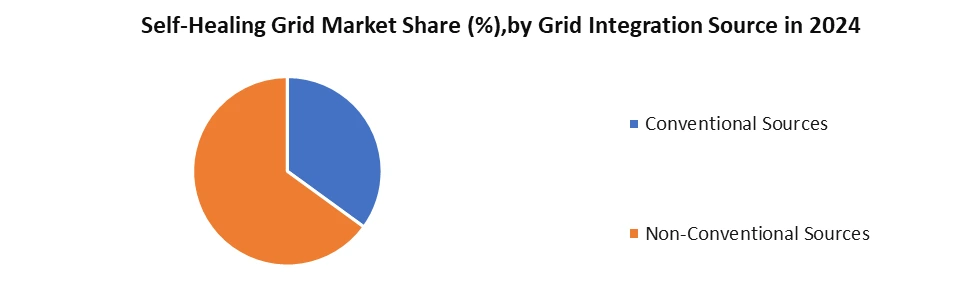

Based on Component, the Global Self-Healing Grid Market in 2024 is segmented by component into Hardware, Software, and Services. The dominant segment is Software, as it forms the intelligent core that enables real-time fault detection, isolation, and restoration through advanced algorithms, AI, and automation. This segment is critical for making the grid resilient and is driven by continuous demand for analytics, control solutions, and system updates.Based on the Grid Integration Source, the Global Self-Healing Grid Market in 2024 is segmented by grid integration source into Conventional and Non-Conventional energy systems. The dominant segment is non-conventional, driven by the global shift toward renewable energy sources like solar and wind, which require advanced self-healing capabilities to manage their variable and distributed nature, ensuring grid stability, reliability, and seamless integration into modern power networks.

Self-Healing Grid Market Regional Insights

North America dominated the Self-Healing Grid Market in 2024 and is expected to dominate during the forecast period (2025-2032) North America stands as the dominant region in the global self-healing grid market. The region benefits from a well-established power infrastructure, significant investments from utilities and technology companies, and a regulatory push for modernization. The United States, in particular, has taken the lead with large-scale smart grid deployments, federal funding initiatives, and programs by the Department of Energy aimed at improving grid resilience and reliability. Canada complements this with its strong emphasis on integrating renewable energy and maintaining reliability standards. A key differentiator for North America is the mature ecosystem of advanced grid technologies, supported by global leaders in automation, software, and hardware solutions. The presence of top-tier companies, combined with early adoption of digital and AI-driven grid management systems, ensures North America maintains its leadership. Moreover, frequent climate-related disruptions (wildfires, hurricanes, ice storms) have accelerated the adoption of self-healing technologies, making resilience not just a choice but a necessity.Self-Healing Grid Market Competitive Landscape:

The competitive outlook for the self-healing grid market can be nicely delineated through the competition between the world’s global industrial-scale technology leaders, Siemens AG and Schneider Electric, and as they compete to be the central nervous system for our contemporary power grids through their Advanced Distribution Management Systems (ADMS). Siemens has the advantage of deep integration of Spectrum Power ADMS with its own enhanced pair of grid hardware products. They are offering tightly integrated, end-to-end solutions, for example, in their ambitious project to automate and facilitate full remote operation of Ireland’s distribution network for ESB Networks. Schneider Electric competes with its EcoStruxure ADMS, which focuses on interoperability, and is often offered through its broader IoT enabled architecture. Schneider Electric has successfully rolled out self-healing capabilities, for example, for Eversource in the U.S., for automated fault-finding and restoration. Both companies are competing for customers based on variations of technological breadth; Siemens is promoting a single, complete, robust platform, while Schneider Electric is promoting flexible, modular integration in its race to dominate the development of AI-enabled resilient power grids for the future.Self-Healing Grid Market Key Developments:

• April-2025-GE Vernova- USA GE Vernova's Consulting Services announced a new power systems intelligence library with global reach, which enables integrated systems planning (ISP) in Japan, the UAE, the UK, and many other regions. The team employs high-fidelity modeling to identify the best fuel mixes and decarbonization plans consisting of solutions that support locally aligned decarbonization planning goals. The team simulates thousands of generation and storage possibilities that are cost-efficient and reliable. • August 2025 S&C Electric- USA/Micronesia S&C Electric upped grid-edge resiliency by deploying automation devices and automating solutions, including the IntelliRupter® and TripSaver® II, to various utilities in Florida, Alabama, and in Pohnpei. Utilities experienced a reduction in outages of up to 71%, eliminated over 6,000 interruptions a year, and improved restoration times for major outages by days. The tracking of the smart-grid upgrade showed a positive return on investment, reduced O&M costs, and increased reliability during extreme weather events.Self-Healing Grid Market Key Trends:

• Emergence of Grid-Edge Automation for Resilience and Outages Utilities are deploying smarter grid-edge equipment such as S&C's IntelliRupter®, TripSaver® II, and VacuFuse II. These devices can automatically find the fault, isolate it, and return to service. These benefits support improvement for minimizing truck rolls, eliminating nuisance outages, and accelerating restoration, especially during extreme weather conditions or peak summer loads. • Data-Driven Planning and Simulation for Optimized Energy Mixes Companies such as GE Vernova are using global power system intelligence libraries and high-fidelity modeling (e.g., Integrated Systems Planning) to simulate and optimize energy expansion plans. This helps to meet national decarbonization and grid reliability targets by aligning generation and storage configurations with local requirements and storage configurations to local needs and conditions.Self-Healing Grid Market Scope: Inquire before buying

Self-Healing Grid Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 2.58 Bn. Forecast Period 2025 to 2032 CAGR: 9.7% Market Size in 2032: USD 5.41 Bn. Segments Covered: by Component Hardware Software & Services by Grid Integration Source Conventional Non-Conventional by Application Distribution lines Transmission lines by End-User Public Utility Private Utility Self-Healing Grid Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Self-Healing Grid Market, Key Players

North America 1. General Electric (GE Vernova) 2. S&C Electric Company 3. Eaton Corporation 4. Oracle Utilities 5. Itron, Inc. 6. Duke Energy 7. Florida Power & Light (FPL) 8. Commonwealth Edison (ComEd) Europe 1. Siemens AG (Germany) 2. Schneider Electric (France) 3. ABB Ltd (Switzerland) 4. Landis+Gyr (Switzerland) Asia-Pacific 1. State Grid Corporation of China (China) 2. Hitachi Energy (Japan) 3. Toshiba Energy Systems & Solutions Corporation (Japan) 4. Mitsubishi Electric Corporation (Japan)Frequently Asked Questions

1. What is the market size of the Global Self-Healing Grid Market in 2024? Ans. The Global Self-Healing Grid Market in 2024 was USD 2.58 Billion. 2. What are the different segments of the Global Self-Healing Grid Market? Ans. The Global Self-Healing Grid Market is divided into Component, Application, Grid Integration Source, and End User. 3. What is the study period of this market? Ans. The Global Self-Healing Grid Market will be studied from 2024 to 2032. 4. Which region is expected to hold the highest Global Self-Healing Grid Market share? Ans. The North America is expected to dominate market share in the Self-Healing Grid Market. 5. What is the Forecast Period of the Global Self-Healing Grid Market? Ans. The Forecast Period of the market is 2025-2032 in the Global Self-Healing Grid Market.

1. Self-Healing Grid Market Introduction 1.1. Study Assumptions and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Self-Healing Grid Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. End-User Segment 2.4.4. Revenue (2024) 2.4.5. Company Location 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Self-Healing Grid Market: Dynamics 3.1. Region-wise Trends of Self-Healing Grid Market 3.1.1. North America Self-Healing Grid Market Trends 3.1.2. Europe Self-Healing Grid Market Trends 3.1.3. Asia Pacific Self-Healing Grid Market Trends 3.1.4. Middle East and Africa Self-Healing Grid Market Trends 3.1.5. South America Self-Healing Grid Market Trends 3.2. Self-Healing Grid Market Dynamics 3.2.1. Self-Healing Grid Market Drivers 3.2.2. Self-Healing Grid Market Opportunity 3.2.3. Self-Healing Grid Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Self-Healing Grid Market: Global Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 4.1. Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 4.1.1. Hardware 4.1.2. Software & Services 4.2. Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 4.2.1. Conventional 4.2.2. Non-Conventional 4.3. Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 4.3.1. Distribution lines 4.3.2. Transmission lines 4.4. Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 4.4.1. Public Utility 4.4.2. Private Utility 4.5. Self-Healing Grid Market Size and Forecast, By region (2024-2032) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Self-Healing Grid Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 5.1. North America Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 5.1.1. Computer-Aided Engineering (CAE) 5.1.2. Software & Services 5.2. North America Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 5.2.1. Conventional 5.2.2. Non-Conventional 5.3. North America Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 5.3.1. Distribution lines 5.3.2. Transmission lines 5.4. North America Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 5.4.1. Public Utility 5.4.2. Private Utility 5.5. North America Self-Healing Grid Market Size and Forecast, By Country (2024-2032) 5.5.1. United States 5.5.1.1. United States Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 5.5.1.1.1. Hardware 5.5.1.1.2. Software & Services 5.5.1.2. United States Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 5.5.1.2.1. Conventional 5.5.1.2.2. Non-Conventional 5.5.1.3. United States Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 5.5.1.3.1. Distribution lines 5.5.1.3.2. Transmission lines 5.5.1.4. United States Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 5.5.1.4.1. Public Utility 5.5.1.4.2. Private Utility 5.5.2. Canada 5.5.2.1. Canada Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 5.5.2.1.1. Hardware 5.5.2.1.2. Software & Services 5.5.2.2. Canada Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 5.5.2.2.1. Conventional 5.5.2.2.2. Non-Conventional 5.5.2.3. Canada Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 5.5.2.3.1. Distribution lines 5.5.2.3.2. Transmission lines 5.5.2.4. Canada Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 5.5.2.4.1. Public Utility 5.5.2.4.2. Private Utility 5.5.3. Mexico 5.5.3.1. Mexico Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 5.5.3.1.1. Hardware 5.5.3.1.2. Software & Services 5.5.3.2. Mexico Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 5.5.3.2.1. Conventional 5.5.3.2.2. Non-Conventional 5.5.3.3. Mexico Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 5.5.3.3.1. Distribution lines 5.5.3.3.2. Transmission lines 5.5.3.4. Mexico Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 5.5.3.4.1. Public Utility 5.5.3.4.2. Private Utility 6. Europe Self-Healing Grid Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 6.1. Europe Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 6.2. Europe Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 6.3. Europe Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 6.4. Europe Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 6.5. Europe Self-Healing Grid Market Size and Forecast, By Country (2024-2032) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 6.5.1.2. United Kingdom Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 6.5.1.3. United Kingdom Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 6.5.1.4. United Kingdom Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 6.5.2. France 6.5.2.1. France Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 6.5.2.2. France Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 6.5.2.3. France Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 6.5.2.4. France Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 6.5.3. Germany 6.5.3.1. Germany Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 6.5.3.2. Germany Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 6.5.3.3. Germany Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 6.5.3.4. Germany Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 6.5.4. Italy 6.5.4.1. Italy Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 6.5.4.2. Italy Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 6.5.4.3. Italy Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 6.5.4.4. Italy Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 6.5.5. Spain 6.5.5.1. Spain Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 6.5.5.2. Spain Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 6.5.5.3. Spain Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 6.5.5.4. Spain Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 6.5.6. Sweden 6.5.6.1. Sweden Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 6.5.6.2. Sweden Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 6.5.6.3. Sweden Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 6.5.6.4. Sweden Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 6.5.7. Austria 6.5.7.1. Austria Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 6.5.7.2. Austria Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 6.5.7.3. Austria Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 6.5.7.4. Austria Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 6.5.8.2. Rest of Europe Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 6.5.8.3. Rest of Europe Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 6.5.8.4. Rest of Europe Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 7. Asia Pacific Self-Healing Grid Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 7.1. Asia Pacific Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 7.2. Asia Pacific Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 7.3. Asia Pacific Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 7.4. Asia Pacific Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 7.5. Asia Pacific Self-Healing Grid Market Size and Forecast, By Country (2024-2032) 7.5.1. China 7.5.1.1. China Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 7.5.1.2. China Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 7.5.1.3. China Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 7.5.1.4. China Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 7.5.2. S Korea 7.5.2.1. S Korea Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 7.5.2.2. S Korea Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 7.5.2.3. S Korea Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 7.5.2.4. S Korea Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 7.5.3. Japan 7.5.3.1. Japan Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 7.5.3.2. Japan Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 7.5.3.3. Japan Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 7.5.3.4. Japan Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 7.5.4. India 7.5.4.1. India Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 7.5.4.2. India Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 7.5.4.3. India Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 7.5.4.4. India Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 7.5.5. Australia 7.5.5.1. Australia Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 7.5.5.2. Australia Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 7.5.5.3. Australia Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 7.5.5.4. Australia Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 7.5.6. Indonesia 7.5.6.1. Indonesia Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 7.5.6.2. Indonesia Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 7.5.6.3. Indonesia Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 7.5.6.4. Indonesia Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 7.5.7. Philippines 7.5.7.1. Philippines Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 7.5.7.2. Philippines Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 7.5.7.3. Philippines Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 7.5.7.4. Philippines Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 7.5.8. Malaysia 7.5.8.1. Malaysia Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 7.5.8.2. Malaysia Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 7.5.8.3. Malaysia Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 7.5.8.4. Malaysia Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 7.5.9. Vietnam 7.5.9.1. Vietnam Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 7.5.9.2. Vietnam Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 7.5.9.3. Vietnam Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 7.5.9.4. Vietnam Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 7.5.10. Thailand 7.5.10.1. Thailand Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 7.5.10.2. Thailand Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 7.5.10.3. Thailand Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 7.5.10.4. Thailand Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 7.5.11. Rest of Asia Pacific 7.5.11.1. Rest of Asia Pacific Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 7.5.11.2. Rest of Asia Pacific Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 7.5.11.3. Rest of Asia Pacific Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 7.5.11.4. Rest of Asia Pacific Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 8. Middle East and Africa Self-Healing Grid Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 8.1. Middle East and Africa Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 8.2. Middle East and Africa Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 8.3. Middle East and Africa Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 8.4. Middle East and Africa Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 8.5. Middle East and Africa Self-Healing Grid Market Size and Forecast, By Country (2024-2032) 8.5.1. South Africa 8.5.1.1. South Africa Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 8.5.1.2. South Africa Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 8.5.1.3. South Africa Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 8.5.1.4. South Africa Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 8.5.2. GCC 8.5.2.1. GCC Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 8.5.2.2. GCC Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 8.5.2.3. GCC Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 8.5.2.4. GCC Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 8.5.3. Nigeria 8.5.3.1. Nigeria Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 8.5.3.2. Nigeria Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 8.5.3.3. Nigeria Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 8.5.3.4. Nigeria Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 8.5.4.2. Rest of ME&A Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 8.5.4.3. Rest of ME&A Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 8.5.4.4. Rest of ME&A Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 9. South America Self-Healing Grid Market Size and Forecast by Segmentation (by Value in USD Bn) (2024-2032) 9.1. South America Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 9.2. South America Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 9.3. South America Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 9.4. South America Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 9.5. South America Self-Healing Grid Market Size and Forecast, By Country (2024-2032) 9.5.1. Brazil 9.5.1.1. Brazil Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 9.5.1.2. Brazil Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 9.5.1.3. Brazil Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 9.5.1.4. Brazil Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 9.5.2. Argentina 9.5.2.1. Argentina Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 9.5.2.2. Argentina Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 9.5.2.3. Argentina Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 9.5.2.4. Argentina Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 9.5.3. Rest of South America 9.5.3.1. Rest of South America Self-Healing Grid Market Size and Forecast, By Component (2024-2032) 9.5.3.2. Rest of South America Self-Healing Grid Market Size and Forecast, By Grid Integration Source (2024-2032) 9.5.3.3. Rest of South America Self-Healing Grid Market Size and Forecast, By Application (2024-2032) 9.5.3.4. Rest of South America Self-Healing Grid Market Size and Forecast, By End-User (2024-2032) 10. Company Profile (Detailed Profile for all Major Industry Players) 10.1. Schneider Electric (France) 10.1.1. Business Portfolio 10.1.2. Financial Overview 10.1.3. SWOT Analysis 10.1.4. Strategic Analysis 10.1.5. Recent Developments 10.2. General Electric (GE Vernova) 10.3. S&C Electric Company 10.4. Eaton Corporation 10.5. Oracle Utilities 10.6. Itron, Inc. 10.7. Duke Energy 10.8. Florida Power & Light (FPL) 10.9. Commonwealth Edison (ComEd) 10.10. Siemens AG (Germany) 10.11. ABB Ltd (Switzerland) 10.12. Landis+Gyr (Switzerland) 10.13. State Grid Corporation of China (China) 10.14. Hitachi Energy (Japan) 10.15. Toshiba Energy Systems & Solutions Corporation (Japan) 10.16. Mitsubishi Electric Corporation (Japan) 11. Analyst Recommendations 12. Self-Healing Grid Market: Research Methodology