The Self-Healing Coatings Market was valued at USD 2.5 Billion for the year 2023 and is expected to grow at a CAGR of 34.8% to become a USD 10.8 Billion market by the year 2030Overview

The self-healing coatings market is experiencing high growth and is referred to as the production and distribution of coatings that possess the unique ability to repair themselves when damaged. These coatings have garnered attention and interest across a wide range of industries due to their remarkable capability to automatically mend scratches, cracks, and other forms of damage. One of the major drivers behind the growth of the self-healing coatings market is the increasing demand for durable coatings. Industries are seeking solutions that can extend the lifespan of their products and materials, reducing the need for frequent repairs or replacements. Self-healing coatings provide an innovative approach to address this requirement, offering enhanced protection and longevity to surfaces. By extending the lifespan of materials, they help minimize waste and reduce environmental impact, aligning with the goals of many industries striving for sustainable practices.To know about the Research Methodology :- Request Free Sample Report The applications of self-healing coatings span across various sectors. They find extensive usage in automotive paints, where their self-repairing properties can maintain the appearance and integrity of the vehicle's exterior. The aerospace industry also benefits from self-healing coatings as they protect against wear and tear, impact damage, and harsh environmental conditions. Self-healing coatings have performance limitations when it comes to repairing large-scale or severe damage. While they can effectively mend minor scratches or cracks, more extensive damage may still require manual intervention or alternative repair methods. The self-healing coatings market is expected to continue its upward trajectory. Industries are increasingly recognizing the benefits of these coatings in terms of improved durability, reduced maintenance costs, and enhanced sustainability. Research Methodology The research used primary and secondary data to thoroughly examine and validate all possible market factors. The market size for top-level markets and sub-segments is normalized and the impact of inflation, economic downturns, regulatory & policy changes, and other variables is factored into the market forecast. The bottom-up approach and multiple data triangulation methodologies are used to estimate the market size and forecasts. The percentage splits, market shares and breakdowns of the segments are derived based on weights assigned to each of the segments on their utilization rate and average sale price. The country-wise analysis of the overall market and its sub-segments are based on the percentage adoption or utilization of the given market Size in the respective region or country. Major players in the market are identified through secondary research based on indicators that include market revenue, price, services offered, advancements, mergers and acquisitions, and joint. Extensive primary research was conducted to acquire information and verify and confirm the crucial numbers arrived at after comprehensive market engineering and calculations for market statistics, market size estimations, market forecasts, market breakdown, and data triangulation.

Self-Healing Coatings Market Dynamics

Market Drivers: The self-healing coatings market is primarily driven by several key factors. Plenty of companies need durable coatings. Companies want to increase the lifespan of their goods and materials to reduce repairs and replacements. Self-healing coatings can preserve a vehicle's exterior without periodic touch-ups or repainting. Technology boosts the self-healing coatings sector. Materials science, nanotechnology, and polymer chemistry have improved coatings. Self-healing coatings are also growing due to environmental concerns. Self-healing coatings can preserve building facades from weathering and damage, minimising upkeep. The self-healing coatings market is also driven by industry expansion. Automotive, aerospace, electronics, packaging, and construction industries use these coatings. Market Trends: Research and development are propelling self-healing coatings. R&D is improving these coatings. This involves testing novel materials, formulations, and applications to promote self-repair and efficacy. Researchers are testing polymers and chemicals to create self-healing coatings. Self-healing coatings are using nanotechnology. Coatings using nanoparticles and nanostructured materials improve mechanical and chemical characteristics. This trend allows coatings with better scratch, impact, and self-healing properties. Coatings with nanocapsules holding healing agents can release these compounds upon injury to promote self-repair. Market Challenges: The higher cost limit their adoption in more price-sensitive industries. Performance limitations of self-healing coatings are another challenge. While these coatings can effectively repair minor scratches and cracks, they may have limitations in repairing large-scale or severe damage. In such cases, manual intervention or alternative repair methods may still be required, reducing the effectiveness of self-healing coatings. Continued research and development efforts are focused on addressing these limitations and expanding the scope of damage that can be self-repaired. Market Opportunities: The self-healing coatings market presents significant opportunities for expansion into emerging applications and industries. Sectors such as consumer electronics, medical devices, renewable energy, and infrastructure offer potential growth avenues. For example, self-healing coatings can be applied to the surfaces of consumer electronic devices to protect them from scratches and damage, ensuring longer product lifespans. The emphasis on sustainable coating solutions provides an opportunity for self-healing coatings to gain traction. With increasing environmental regulations and consumer demand for eco-friendly products, self-healing coatings offer a sustainable alternative. These coatings contribute to waste reduction by extending the lifespan of materials, reducing the need for replacements and repairs. Industries can leverage self-healing coatings to align with sustainability goals and improve their environmental footprint. Developing regions present the untapped market potential for self-healing coatings. As industrialization increases in these regions and there is a growing focus on improving infrastructure, automotive manufacturing, and consumer goods production, the demand for advanced coatings is expected to rise. Self-healing coatings can cater to these growing markets by offering superior protection and durability. Market Restraints: The complexity of formulation poses a challenge in the self-healing coatings market. Formulating self-healing coatings requires specialized knowledge and expertise. The intricate nature of these coatings can make the manufacturing process complex and hinder mass production. Overcoming this challenge requires investment in research and development to streamline formulation processes and develop efficient manufacturing techniques. Limited standardization is another restraint in the self-healing coatings market. Standardization efforts will facilitate customer decision-making and promote wider adoption of these coatings.Self-Healing Coatings Market Segmentation

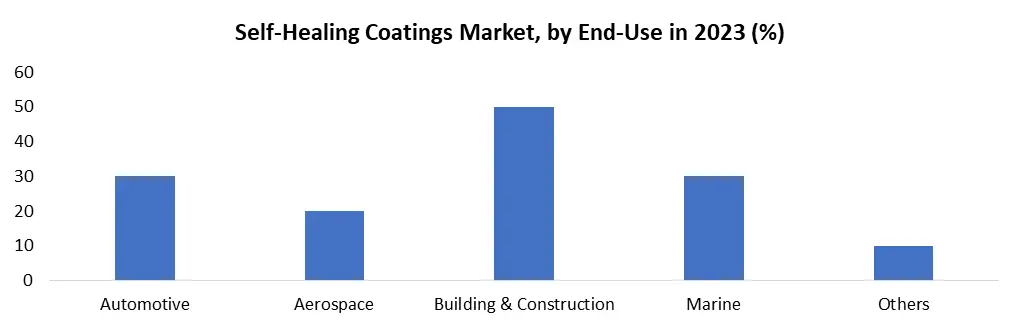

By Form: The Self-Healing Coatings Market is segmented based on form, distinguishing between Extrinsic and Intrinsic self-healing coatings. Extrinsic self-healing coatings typically involve the incorporation of microcapsules containing healing agents, which are released upon damage to repair the coating. This form is often preferred for its versatility and applicability in various industries. On the other hand, Intrinsic self-healing coatings are designed with the healing agents directly embedded into the coating matrix, providing continuous protection against damage. The choice between extrinsic and intrinsic forms depends on specific application requirements, durability needs, and the desired level of self-healing capabilities. By End-Use: The segmentation based on end-use reflects the diverse applications of self-healing coatings across industries. In the Automotive sector, these coatings play a crucial role in protecting vehicle surfaces from scratches and abrasions, enhancing the overall aesthetic and durability. The Aerospace industry benefits from self-healing coatings, ensuring prolonged structural integrity and reduced maintenance costs. In the Building & Construction sector, these coatings contribute to the longevity of structures, providing resistance against weathering and environmental factors. In the Marine industry, self-healing coatings are employed to protect ship surfaces from corrosion and fouling, improving fuel efficiency. The "Others" category encompasses additional applications, such as electronics and consumer goods, where self-healing coatings find utility in safeguarding surfaces from wear and tear. Each end-use segment showcases the adaptability of self-healing coatings across various industries, emphasizing their role in enhancing performance and extending the lifespan of diverse materials.

Self-Healing Coatings Market Segmentation by Region

North America: North America holds a significant presence in the self-healing coatings market. The region is driven by the strong demand for self-healing coatings from industries such as automotive, aerospace, electronics, and construction. The presence of key market players, technological advancements, and stringent regulations related to environmental sustainability contributes to the growth of the market in this region. Europe: Europe is another important market for self-healing coatings. The region emphasizes environmental regulations and the adoption of sustainable coating solutions. The automotive, aerospace, and construction industries in Europe are key drivers of the demand for self-healing coatings. Growing awareness of the benefits of self-healing coatings and the focus on enhancing durability and surface protection contribute to market growth in this region. Asia-Pacific: The Asia-Pacific region is experiencing rapid industrialization, infrastructure development, and automotive manufacturing, driving the demand for self-healing coatings. Countries like China, India, and Japan are significant contributors to the market growth in this region. The growing middle-class population, increasing disposable income, and rising demand for quality products in various industries propel the adoption of self-healing coatings. South America: South America is an emerging market for self-healing coatings. The region showcases growth potential in industries such as automotive, construction, and packaging. The construction industry in countries like Brazil and Argentina, along with the expanding automotive sector, drives the demand for self-healing coatings. Market players are focusing on penetrating the South American market and meeting the region's specific requirements. Middle East and Africa (MEA): The Middle East and Africa region exhibit opportunities for the self-healing coatings market. The construction and infrastructure sectors, driven by ongoing development projects and urbanization, contribute to the demand for self-healing coatings. Additionally, the growing automotive industry and increased awareness of surface protection solutions fuel the market growth in this region. Market players are expanding their presence in the MEA region to cater to the evolving needs of these industries. Self-Healing Coatings Market Competitive Analysis The self-healing coatings market is highly competitive, with several key players striving to gain a larger market share and maintain a competitive edge. The competitive landscape is shaped by factors such as product innovation, technological advancements, strategic partnerships, and market expansion efforts The market consists of a mix of established multinational companies, medium-sized enterprises, and niche players specializing in self-healing coatings. Key players in the market include Covestro AG, Akzo Nobel N.V., PPG Industries Inc., 3M Company, Axalta Coating Systems LLC, Dow Chemical Company, Sherwin-Williams Company, Hempel A/S, NEI Corporation, and Sub-One Technology, among others. These companies invest in research and development activities to enhance their product portfolios and maintain their market position. Product innovation plays a vital role in gaining a competitive advantage in the self-healing coatings market. Market players focus on developing advanced formulations and coating systems with improved self-repairing properties, extended durability, and enhanced performance characteristics. They invest in R&D efforts to develop novel encapsulation techniques, incorporate nanomaterials, and improve the healing mechanisms of coatings to meet the evolving customer demands. Collaborations, partnerships, and strategic alliances among market players, research institutions, and end-use industries play a crucial role in enhancing market competitiveness. These partnerships enable the exchange of knowledge, expertise, and resources, leading to joint development efforts, shared intellectual property, and accelerated market penetration. The competitive analysis in the self-healing coatings market is characterized by ongoing research and development, technological advancements, strategic collaborations, and market expansion efforts. As the market continues to grow, companies are expected to intensify their competitive strategies to gain a larger market share and capitalize on the increasing demand for self-healing coatings across various industries.Self-Healing Coatings Market Scope: Inquire before buying

Global Self-Healing Coatings Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.5 Bn. Forecast Period 2024 to 2030 CAGR: 34.8% Market Size in 2030: US $ 10.8 Bn. Segments Covered: by Form Extrinsic Intrinsic by End Use Automotive Aerospace Building & Construction Marine Others Self-Healing Coatings Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Self-Healing Coatings Market, Key Players

The report has covered the profiles of the below-Self-Healing Coatings Market companies from a strategic perspective. These key Self-Healing Coatings Manufacturers have been selected based on certain criteria. 1. Covestro AG 2. Akzo Nobel N.V. 3. PPG Industries Inc. 4. 3M Company 5. Axalta Coating Systems LLC 6. Dow Chemical Company 7. Sherwin-Williams Company 8. Hempel A/S 9. NEI Corporation 10. Sub-One Technology 11. Autonomic Materials Inc. 12. Devan Chemicals 13. CTC Nanotechnology GmbH 14. Sensor Coating Systems Ltd. 15. Advanced Soft Materials Inc. 16. Armor Guys Inc. 17. NobelClad 18. Arkema Group 19. Clariant AG 20. DuPont de Nemours, Inc. 21. Rust-Oleum Corporation 22. Wacker Chemie AG 23. DSM Coating Resins 24. Nanovere Technologies LLC 25. Henkel AG & Co. KGaA FAQ 1. What are the growth drivers for the Self-Healing Coatings market? Ans. Self-healing coatings can preserve a vehicle's exterior without periodic touch-ups or repainting. Technology boosts the self-healing coatings sector. Materials science, nanotechnology, and polymer chemistry have improved coatings and is expected to be the major driver for the self-healing coatings market. 2. What is the major restraint for the Self-Healing Coatings market growth? Ans. The higher cost limit their adoption in more price-sensitive industries is expected to be the major restraining factor for the Self-Healing Coatings market growth. 3. Which region is expected to lead the Global Self-Healing Coatings market during the forecast period? Ans. North America is expected to lead the global Self-Healing Coatings market during the forecast period. 4. What is the projected market size & growth rate of the Self-Healing Coatings Market? Ans. The Global Self-Healing Coatings Market size was valued at USD 2.5 Billion in 2023 and the total revenue is expected to grow at a CAGR of 34.8% from 2024 to 2030, reaching nearly USD 10.8 Billion. 5. What segments are covered in the Self-Healing Coatings Market report? Ans. The segments covered in the Self-Healing Coatings Market report are Product Type, Material Type, Application Technique, Distribution channel, End-use industry, and Region.

1. Self-Healing Coatings Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Self-Healing Coatings Market: Dynamics 2.1. Self-Healing Coatings Market Trends by Region 2.1.1. North America Self-Healing Coatings Market Trends 2.1.2. Europe Self-Healing Coatings Market Trends 2.1.3. Asia Pacific Self-Healing Coatings Market Trends 2.1.4. Middle East and Africa Self-Healing Coatings Market Trends 2.1.5. South America Self-Healing Coatings Market Trends 2.2. Self-Healing Coatings Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Self-Healing Coatings Market Drivers 2.2.1.2. North America Self-Healing Coatings Market Restraints 2.2.1.3. North America Self-Healing Coatings Market Opportunities 2.2.1.4. North America Self-Healing Coatings Market Challenges 2.2.2. Europe 2.2.2.1. Europe Self-Healing Coatings Market Drivers 2.2.2.2. Europe Self-Healing Coatings Market Restraints 2.2.2.3. Europe Self-Healing Coatings Market Opportunities 2.2.2.4. Europe Self-Healing Coatings Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Self-Healing Coatings Market Drivers 2.2.3.2. Asia Pacific Self-Healing Coatings Market Restraints 2.2.3.3. Asia Pacific Self-Healing Coatings Market Opportunities 2.2.3.4. Asia Pacific Self-Healing Coatings Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Self-Healing Coatings Market Drivers 2.2.4.2. Middle East and Africa Self-Healing Coatings Market Restraints 2.2.4.3. Middle East and Africa Self-Healing Coatings Market Opportunities 2.2.4.4. Middle East and Africa Self-Healing Coatings Market Challenges 2.2.5. South America 2.2.5.1. South America Self-Healing Coatings Market Drivers 2.2.5.2. South America Self-Healing Coatings Market Restraints 2.2.5.3. South America Self-Healing Coatings Market Opportunities 2.2.5.4. South America Self-Healing Coatings Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Self-Healing Coatings Industry 2.8. Analysis of Government Schemes and Initiatives For Self-Healing Coatings Industry 2.9. Self-Healing Coatings Market Trade Analysis 2.10. The Global Pandemic Impact on Self-Healing Coatings Market 3. Self-Healing Coatings Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 3.1.1. Extrinsic 3.1.2. Intrinsic 3.2. Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 3.2.1. Automotive 3.2.2. Aerospace 3.2.3. Building & Construction 3.2.4. Marine 3.2.5. Others 3.3. Self-Healing Coatings Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Self-Healing Coatings Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 4.1.1. Extrinsic 4.1.2. Intrinsic 4.2. North America Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 4.2.1. Automotive 4.2.2. Aerospace 4.2.3. Building & Construction 4.2.4. Marine 4.2.5. Others 4.3. North America Self-Healing Coatings Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 4.3.1.1.1. Extrinsic 4.3.1.1.2. Intrinsic 4.3.1.2. United States Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 4.3.1.2.1. Automotive 4.3.1.2.2. Aerospace 4.3.1.2.3. Building & Construction 4.3.1.2.4. Marine 4.3.1.2.5. Others 4.3.2. Canada 4.3.2.1. Canada Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 4.3.2.1.1. Extrinsic 4.3.2.1.2. Intrinsic 4.3.2.2. Canada Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 4.3.2.2.1. Automotive 4.3.2.2.2. Aerospace 4.3.2.2.3. Building & Construction 4.3.2.2.4. Marine 4.3.2.2.5. Others 4.3.3. Mexico 4.3.3.1. Mexico Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 4.3.3.1.1. Extrinsic 4.3.3.1.2. Intrinsic 4.3.3.2. Mexico Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 4.3.3.2.1. Automotive 4.3.3.2.2. Aerospace 4.3.3.2.3. Building & Construction 4.3.3.2.4. Marine 4.3.3.2.5. Others 5. Europe Self-Healing Coatings Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 5.2. Europe Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 5.3. Europe Self-Healing Coatings Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 5.3.1.2. United Kingdom Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 5.3.2. France 5.3.2.1. France Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 5.3.2.2. France Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 5.3.3.2. Germany Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 5.3.4.2. Italy Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 5.3.5.2. Spain Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 5.3.6.2. Sweden Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 5.3.7.2. Austria Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 5.3.8.2. Rest of Europe Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 6. Asia Pacific Self-Healing Coatings Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 6.2. Asia Pacific Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 6.3. Asia Pacific Self-Healing Coatings Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 6.3.1.2. China Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 6.3.2.2. S Korea Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 6.3.3.2. Japan Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 6.3.4. India 6.3.4.1. India Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 6.3.4.2. India Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 6.3.5.2. Australia Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 6.3.6.2. Indonesia Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 6.3.7.2. Malaysia Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 6.3.8.2. Vietnam Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 6.3.9.2. Taiwan Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 6.3.10.2. Rest of Asia Pacific Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 7. Middle East and Africa Self-Healing Coatings Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 7.2. Middle East and Africa Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 7.3. Middle East and Africa Self-Healing Coatings Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 7.3.1.2. South Africa Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 7.3.2.2. GCC Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 7.3.3.2. Nigeria Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 7.3.4.2. Rest of ME&A Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 8. South America Self-Healing Coatings Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 8.2. South America Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 8.3. South America Self-Healing Coatings Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 8.3.1.2. Brazil Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 8.3.2.2. Argentina Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Self-Healing Coatings Market Size and Forecast, by Form (2023-2030) 8.3.3.2. Rest Of South America Self-Healing Coatings Market Size and Forecast, by End Use (2023-2030) 9. Global Self-Healing Coatings Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Self-Healing Coatings Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Covestro AG 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Akzo Nobel N.V. 10.3. PPG Industries Inc. 10.4. 3M Company 10.5. Axalta Coating Systems LLC 10.6. Dow Chemical Company 10.7. Sherwin-Williams Company 10.8. Hempel A/S 10.9. NEI Corporation 10.10. Sub-One Technology 10.11. Autonomic Materials Inc. 10.12. Devan Chemicals 10.13. CTC Nanotechnology GmbH 10.14. Sensor Coating Systems Ltd. 10.15. Advanced Soft Materials Inc. 10.16. Armor Guys Inc. 10.17. NobelClad 10.18. Arkema Group 10.19. Clariant AG 10.20. DuPont de Nemours, Inc. 10.21. Rust-Oleum Corporation 10.22. Wacker Chemie AG 10.23. DSM Coating Resins 10.24. Nanovere Technologies LLC 10.25. Henkel AG & Co. KGaA 11. Key Findings 12. Industry Recommendations 13. Self-Healing Coatings Market: Research Methodology 14. Terms and Glossary