Global Self Balancing Scooter Market size was valued at USD 1700 million in 2022 and expected to reach USD 2901 million by 2029, at CAGR of 7.9%.Self Balancing Scooter Market Overview

The Self Balancing Scooter Market continues to expand in recent years as because of a number of factors including urbanization, a greater emphasis on environmentally friendly transportation, and the improvement of electric mobility technologies. Self-balancing scooters, also known as hover boards, electric scooters and other forms of personal transportation, have become increasingly popular due to their ease of use and ability to meet a variety of consumer needs. The market is expected to grow and develop as battery life and range improve, advanced security features are integrated, and communication via smartphone apps improves. The market for self-balancing scooters is expected to grow further as cities around the world strive for sustainable transportation solutions and customers look for more efficient and fun ride options. Self Balancing Scooter Market is highly competitive and fragmented. There are many major players in the market, from scooter manufacturer to distributors and retailers. They focuses on expansion of product line, enhancement of supply chain, and strengthening their distribution channel. Some of the major players are Ninebot Inc., Inventist Inc., IPS Electric Unicycle Co., Robstep GB, Airwheel, ESWING TECH., and many more.To know about the Research Methodology :- Request Free Sample Report

Self Balancing Scooter Market Scope & Research Methodology

The report provides a detailed analysis of the competitive market view, segments based on the Product Type, End-User Industry, Battery type and Region. First, the market overview describes the market trends, key market drivers, market restraints, opportunities, and challenges for the Self Balancing Scooter Market. The Market is segmented by product type into Single wheeled and double wheeled self- balancing scooter. Market is segmented by End-User Industry into personal use and commercial use. Market also segmented by Battery Type includes Lithium-ion batteries and Lead-acid batteries. The market size and trends for the Self Balancing Scooter Market were analysed by using both primary and secondary data. Top down approach is used to estimate Self Balancing Scooter market size. Market projections were based on historical data, present sector developments, and future market opportunities and challenges. The SWOT analysis of the major market players, which included their strengths, weaknesses, opportunities, and threats, is also provided in the report. By employing the PESTLE analysis, the operating environment of an organization can be assessed. Porter's analysis were used to identify crucial factors that directly affect market profitability.Self Balancing Scooter Market Dynamics

Key Drivers Rising urbanization and severe traffic congestion are important drivers of the Self Balancing Scooter Market's expansion. Commuters are actively seeking easy and effective ways to navigate urban surroundings as more people relocate to cities and traffic congestion becomes a significant concern. Self-balancing scooters offers a fast and environment friendly solution for short and medium distance transportation, allowing users to avoid traffic and travel quickly. Their compact form makes them suitable for urban environments and are an attractive alternative to traditional means of transport, encouraging the expansion of the self-balancing scooter industry as urban population grow and traffic congestion worsens. As people's disposable income increases, they are more likely to invest in personal transportation solutions that are both comfortable and environmentally friendly, helping them adapt to urban life. This trend is expected to further accelerate with increasing awareness of the benefits of self-balancing scooters, which not only reduce time and money spent on daily commutes, but also help reduce carbon emissions. As more people become aware of the benefits of these scooters, they are likely to see them as a viable option, leading to market expansion. Additionally, the advancement in technology and design is likely to make these scooters more attractive and accessible to a wider consumer base, thereby contributing to the growth of the market.Market Trends

The market for self-balancing scooters has been driven by advancements in technology. This trend had a huge impact on the appeal and functionality of the scooter, making it more popular with a broader audience. With built-in smart tech, the Xiaomi M365 Pro extends battery life, increases distance, and reduces charging time. In addition, smartphone connectivity has been implemented through dedicated apps, offering users greater comfort and control over the scooter, allowing them to monitor their performance and even adjust settings. In addition, safety features have been improved with advanced self-balancing algorithms, LED lighting systems and a regenerative braking mechanism to ensure a safer and more reliable driving experience. Self Balancing Scooter Market is becoming popular among the youngsters due to various factors. These includes the scooter’s attractive and technologically advanced design, and eco-friendly nature. Additionally its price and accessibility make it a realistic option for young individuals who are searching for more convenient options for traveling. As the self-balancing scooter’s popularity grows, the design and feature of the scooter will probably match the needs of the customers. These personal transport scooters can be used in many different industries and applications. For example, they can be used in corporate campuses or warehouses to streamline logistics. They can also be used in tourism and hospitality to provide guided tours and to transport staff efficiently. They can also be used for security patrolling and event management. They can be used for delivery services and even for promotional activities. As more and more businesses and organizations recognize the cost savings, mobility benefits, and environmental advantages that Self-Balancing scooters offer, their popularity is expected to continue to grow and evolve.Market Opportunities

In the Self Balancing Scooter Market, there is always opportunity for innovation. New entrepreneurs may develop self-balancing scooters with improved performance, longer battery life, or more economical rates. The Market is not homogeneous and there are many different types of customers. New entrepreneurs can focus on specific market segments like commuters, students or tourists and create Self-Balancing scooters based on their needs. The self- balancing scooter market is still relatively new and there is an opportunity for expansion in emerging countries. New entrepreneurs can take advantage of these opportunities by developing self-balancing scooters that meet new market needs. Many consumers are still unaware of the benefits and advantages of self-balancing scooters. New entrepreneurs could market and educate consumers about self-balancing scooters through advertising and promotional activities. The opportunity expected to drive the Self Balancing Scooter Market consists of increased demand on college campuses due to its fashionable appearance and entertaining ride experience. It is also noiseless and runs on electricity, resulting in minimal pollution. Apart from being environment friendly, it also has sophisticated features such as wireless charging and Bluetooth. As a result, the growing preference for smart electronic devices is projected to open up chances for the Market on college campuses in the near future. Self-balancing scooters are also expected to open up new opportunities for assisting security guards and police officials in monitoring areas of public gatherings where autos may not be an efficient solution. Market Restraints / Challenges Despite the positive market environment, the self-balancing scooter industry still faces several obstacles. Fuel prices can be a major factor in determining transportation costs and service profitability. In addition, formal requirements, safety protocols and a lack of qualified drivers hinder the efficient operation of the service. In addition, the competitive environment of the market requires that brokers remain competitive in terms of prices and service quality. The self-balancing scooter is in direct competition with other forms of transportation such as bicycles, scooters and public transportation. In addition to these challenges, Self Balancing Scooter Market is still relatively new, leading to a lack of knowledge among consumers about the advantages and drawbacks of this type of scooter.Self Balancing Scooter Market Segment Analysis

On the basis of Product Type, Self Balancing Scooter Market is segmented into Single wheeled and double wheeled self- balancing scooter. The double wheeled self-balancing scooter segment held largest share in 2022 due to its different application in manufacturing and commercial sectors. In 2022, the double wheeled market segment accounted for 90% of the global Market. And anticipated to maintain its dominance with an anticipated CAGR of 7% during the estimate period. This is due to various factors such as stability, affordability, and versatility of double wheeled self-balancing scooters.On the basis of end user industry, Self Balancing Scooter Market is segmented into personal use and commercial use. The commercial use segment is expected to experience a significant growth during forecasted period. This is due to increasing popularity of self-balancing scooters in office campuses, manufacturing areas, government sites as well as airports and railways. The increased use of scooters in residential and educational environments, particularly among the younger population, will stimulate the personal use segment. On the basis of battery type, self-balancing scooters market is classified into two segments such as Lithium-ion batteries and Lead-acid batteries. Lithium-ion batteries are expected to dominate the global Self Balancing Scooter Market, as they combine exceptional energy efficiency, lightweight construction and long-term durability. Its battery has a high power-to-weight ratio that allows for longer driving distances and lower overall weight, which is critical for the scooter's portability and mobility. Lithium-on battery also as a low self-loading rate which helps scooters to remain stationery for longer period of time without loss of power.

Self Balancing Scooter Market Regional Insights

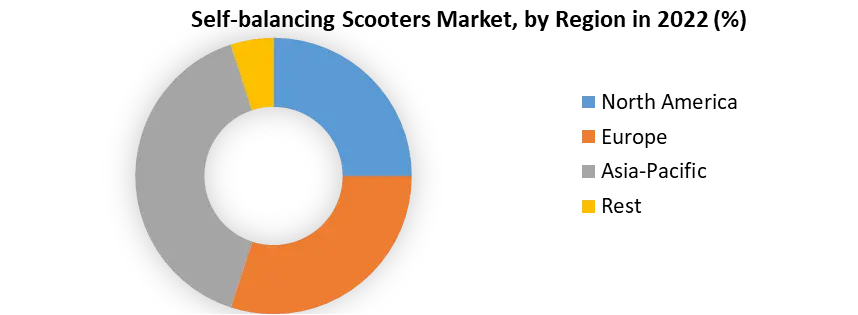

The global market for self balancing scooters is dominated by the Asia-Pacific region with market share of 40%. Asia Pacific is the leading Self Balancing Scooter Market due to several factors. Asia-Pacific region is a centre for the manufacturing and production of electronic devices and components. This means lower production cost and more accessible supply chains. The population of Asia-Pacific is growing rapidly especially in urban areas where the scooters are more popular as a more convenient and environment friendly mode to travel short distances. In addition, the regulatory environment in many Asian countries is more lenient than in the West, allowing the introduction of e-scooters with fewer restrictions. Because of the presence of big manufacturers and major start-ups in the region, a competitive market environment favourable to product development and market expansion has been developed. The majority of the global market is accounted for by China, with a revenue of more than 49% of the total. Europe is the second largest contributor, with a market share of approximately 30%. Major manufacturers in the market include Aerlang, Chiku, INTEMOTION, Ford Wheel & Dye, Razor, Segere-Ninebot and Airwheel, among others. The top three companies account for approximately 57% of the market share.

Self Balancing Scooter Market Competitive Landscape

There is a growing demand for customized transportation solutions and a growing need for self-balancing scooters for commercial purposes such as tourism and law enforcement. There is also a growing demand for more premium products with longer battery life, faster speeds, and better security features. The Self Balancing Scooter Market is expected to grow in the coming years due to the increasing use of personal transportation and the popularity of e-commerce. The market is expected to continue to grow, with a trend toward more premium products with longer battery life, faster speeds, and better security features. Major Key players of Self Balancing Scooter Market are Hangzhou Chic Intelligent Technology Co., Ltd., Ninebot Inc., Shenzhen Counterbalance Technology Co., Ltd., Inventist, Inc., Segway, Inc., Koogo Technology Inc., Freego Inc., Oxboard B.V., Robstep GB, IPS Electric Unicycle Co., Limited, Evoy Technologies LLC, Razor USA LLC, Sky Walkers USA, RioRand Advanced Technology, ESWING, Airwheel, Esway, Solowheel, Evoy Technologies, and Shenzhen Iezway Technology etc., The leading players in the self-balancing scooter production market are focusing on sales and increasing product quality. They are aiming to capture the maximum market share opportunities in global markets. They are focused on expanding their supply chain network and retail distribution capabilities. Some of the emerging players of self-balancing scooters market are Liger Mobility, Evolve Skateboards, Solowheel, Hoverboard Technologies, and Gotcha. In addition to the above companies, there are a number of other emerging companies in the Self Balancing Scooter Market. These companies are primarily from China and Taiwan. They sell low-cost self-balancing scooters with basic features. These new entrants compete with the market's existing players by introducing new products with distinctive features. They are also concentrating their efforts on specific market areas, such as the high-performance or affordable segments.Self Balancing Scooter Market Scope: Inquiry Before Buying

Self Balancing Scooter Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 1700 Mn. Forecast Period 2023 to 2029 CAGR: 7.9% Market Size in 2029: US $ 2901 Mn. Segments Covered: by Product Type Single wheeled Double wheeled by End-User Industry Personal Use Commercial Use by Battery type Lithium-ion Battery Lead-acid Battery Self Balancing Scooter Market, by Region

North America (United States, Canada and Mexico) Europe (United Kingdom, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Self Balancing Scooter Key Players

1. Ninebot Inc. 2. Hangzhou Chic Intelligent Technology Co., Ltd., 3. Robstep GB 4. Freego Inc., 5. Sky Walkers USA 6. Shenzhen Counterbalance Technology Co., Ltd. 7. Inventist, Inc. 8. Segway, Inc. 9. Koogo Technology Inc. 10. Oxboard B.V. 11. IPS Electric Unicycle Co., 12. Limited, Evoy Technologies LLC 13. Razor USA LLC 14. RioRand Advanced Technology 15. ESWING, Airwheel 16. Esway 17. Solowheel 18. Evoy Technologies 19. Shenzhen Iezway Technology 20. Liger Mobility 21. Evolve Skateboards 22. Solowheel 23. Hoverboard Technologies 24. GotchaFrequently Asked Questions:

1] What segments are covered in the Global Self Balancing Scooter Market report? Ans. The segments covered in the Self Balancing Scooter Market report are based on Product Type, End-Use Industry, Battery Type and Region. 2] Which region dominated the Global Self Balancing Scooter Market in 2022? Ans. The Asia Pacific region dominated the global Self Balancing Scooter Market in 2022. 3] What is the market size of the Global Self Balancing Scooter Market by 2029? Ans. The market size of the Self Balancing Scooter Market by 2029 is expected to reach USD 2901 million. 4] What is the forecast period for the Global Self Balancing Scooter Market? Ans. The forecast period for the Self Balancing Scooter Market is 2023-2029. 5] What was the market size of the Global Self Balancing Scooter Market in 2022? Ans. The market size of the Self Balancing Scooter Market in 2022 was valued at USD 1700 million.

1. Self Balancing Scooter Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Self Balancing Scooter Market: Dynamics 2.1. Self Balancing Scooter Market Trends by Region 2.1.1. Global Self Balancing Scooter Market Trends 2.1.2. North America Self Balancing Scooter Market Trends 2.1.3. Europe Self Balancing Scooter Market Trends 2.1.4. Asia Pacific Self Balancing Scooter Market Trends 2.1.5. Middle East and Africa Self Balancing Scooter Market Trends 2.1.6. South America Self Balancing Scooter Market Trends 2.2. Self Balancing Scooter Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Self Balancing Scooter Market Drivers 2.2.1.2. North America Self Balancing Scooter Market Restraints 2.2.1.3. North America Self Balancing Scooter Market Opportunities 2.2.1.4. North America Self Balancing Scooter Market Challenges 2.2.2. Europe 2.2.2.1. Europe Self Balancing Scooter Market Drivers 2.2.2.2. Europe Self Balancing Scooter Market Restraints 2.2.2.3. Europe Self Balancing Scooter Market Opportunities 2.2.2.4. Europe Self Balancing Scooter Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Self Balancing Scooter Market Drivers 2.2.3.2. Asia Pacific Self Balancing Scooter Market Restraints 2.2.3.3. Asia Pacific Self Balancing Scooter Market Opportunities 2.2.3.4. Asia Pacific Self Balancing Scooter Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Self Balancing Scooter Market Drivers 2.2.4.2. Middle East and Africa Self Balancing Scooter Market Restraints 2.2.4.3. Middle East and Africa Self Balancing Scooter Market Opportunities 2.2.4.4. Middle East and Africa Self Balancing Scooter Market Challenges 2.2.5. South America 2.2.5.1. South America Self Balancing Scooter Market Drivers 2.2.5.2. South America Self Balancing Scooter Market Restraints 2.2.5.3. South America Self Balancing Scooter Market Opportunities 2.2.5.4. South America Self Balancing Scooter Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Supply Chain Analysis 2.7. Regulatory Landscape by Region 2.7.1. Global 2.7.2. North America 2.7.3. Europe 2.7.4. Asia Pacific 2.7.5. Middle East and Africa 2.7.6. South America 2.8. Analysis of Government Schemes and Initiatives For Self-balancing Scooter Industry 2.9. The Global Pandemic Impact on Self Balancing Scooter Market 2.10. Self-balancing Scooter Price Trend Analysis (2021-22) 2.11. Global Self Balancing Scooter Market Trade Analysis (2017-2022) 2.11.1. Global Import of self-balancing scooters 2.11.1.1. Ten Largest Importer 2.11.2. Global Export of self-balancing scooters 2.11.3. Ten Largest Exporter 2.12. Production Capacity Analysis 2.12.1. Chapter Overview 2.12.2. Key Assumptions and Methodology 2.12.3. Self-balancing Scooter Manufacturers: Global Installed Capacity 2.12.3.1. Analysis by Size of Manufacturer 2.12.3.2. Analysis by Scale of Operation 2.12.4. Analysis by Location of Manufacturing Facility 2.13. Demand and Supply Analysis 3. Self Balancing Scooter Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2022-2029) 3.1. Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 3.1.1. Single wheeled 3.1.2. Double wheeled 3.1.3. Kitchenware 3.1.4. Others 3.2. Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 3.2.1. Self-balancing Scooter Stores 3.2.2. Franchised Stores 3.2.3. Kitchenware 3.3. Self Balancing Scooter Market Size and Forecast, by Region (2022-2029) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Self Balancing Scooter Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2022-2029) 4.1. North America Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 4.1.1. Single wheeled 4.1.2. Double wheeled 4.2. North America Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 4.2.1. Personal Use 4.2.2. Commercial Use 4.3. United States Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 4.3.1. Lithium-ion Battery 4.3.2. Lead-acid Battery 4.4. Self Balancing Scooter Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 4.4.1.1.1. Single wheeled 4.4.1.1.2. Double wheeled 4.4.1.2. United States Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 4.4.1.2.1. Personal Use 4.4.1.2.2. Commercial Use 4.4.1.3. United States Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 4.4.1.3.1. Lithium-ion Battery 4.4.1.3.2. Lead-acid Battery 4.4.2. Canada 4.4.2.1. Canada Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 4.4.2.1.1. Single wheeled 4.4.2.1.2. Double wheeled 4.4.2.2. Canada Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 4.4.2.2.1. Personal Use 4.4.2.2.2. Commercial Use 4.4.2.3. Canada Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 4.4.2.3.1. Lithium-ion Battery 4.4.2.3.2. Lead-acid Battery 4.4.3. Mexico 4.4.3.1. Mexico Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 4.4.3.1.1. Single wheeled 4.4.3.1.2. Double wheeled 4.4.3.2. Mexico Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 4.4.3.2.1. Personal Use 4.4.3.2.2. Commercial Use 4.4.3.3. Mexico Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 4.4.3.3.1. Lithium-ion Battery 4.4.3.3.2. Lead-acid Battery 5. Europe Self Balancing Scooter Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2022-2029) 5.1. Europe Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 5.2. Europe Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 5.3. Europe Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 5.4. Europe Self Balancing Scooter Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 5.4.1.2. United Kingdom Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 5.4.1.3. United Kingdom Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 5.4.2. France 5.4.2.1. France Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 5.4.2.2. France Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 5.4.2.3. France Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 5.4.3. Germany 5.4.3.1. Germany Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 5.4.3.2. Germany Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 5.4.3.3. Germany Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 5.4.4.2. Italy Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 5.4.4.3. Italy Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 5.4.4.4. 5.4.5. Spain 5.4.5.1. Spain Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 5.4.5.2. Spain Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 5.4.5.3. Spain Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 5.4.6.2. Sweden Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 5.4.6.3. Sweden Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 5.4.7.2. Austria Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 5.4.7.3. Austria Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 5.4.8.2. Rest of Europe Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 5.4.8.3. Mexico Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 5.4.8.4. Rest Of Europe Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 6. Asia Pacific Self Balancing Scooter Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2022-2029) 6.1. Asia Pacific Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 6.2. Asia Pacific Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 6.3. Asia Pacific Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 6.4. Asia Pacific Self Balancing Scooter Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 6.4.1.2. China Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 6.4.1.3. China Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 6.4.2.2. S Korea Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 6.4.2.3. South Korea Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 6.4.3.2. Japan Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 6.4.3.3. Japan Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 6.4.4. India 6.4.4.1. India Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 6.4.4.2. India Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 6.4.4.3. India Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 6.4.5.2. Australia Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 6.4.5.3. Australia Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 6.4.6.2. Indonesia Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 6.4.6.3. Indonesia Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 6.4.7.2. Malaysia Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 6.4.7.3. Malaysia Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 6.4.8.2. Vietnam Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 6.4.8.3. Vietnam Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 6.4.9.2. Taiwan Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 6.4.9.3. Taiwan Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 6.4.10.3. Rest Of Asia-Pacific Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 7. Middle East and Africa Self Balancing Scooter Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2022-2029) 7.1. Middle East and Africa Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 7.2. Middle East and Africa Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 7.3. Middle East and Africa Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 7.4. Middle East and Africa Self Balancing Scooter Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 7.4.1.2. South Africa Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 7.4.1.3. South Africa Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 7.4.2.2. GCC Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 7.4.2.3. Mexico Self Balancing Scooter Market Size and Forecast, by GCC (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 7.4.3.2. Nigeria Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 7.4.3.3. Nigeria Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 7.4.4.2. Rest of ME&A Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 7.4.4.3. Rest Of ME&A Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 8. South America Self Balancing Scooter Market Size and Forecast by Segmentation by Demand and Supply Side (by Value and Volume) (2022-2029) 8.1. South America Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 8.2. South America Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 8.3. South America Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 8.4. South America Self Balancing Scooter Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 8.4.1.2. Brazil Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 8.4.1.3. Brazil Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 8.4.2.2. Argentina Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 8.4.2.3. Argentina Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Self Balancing Scooter Market Size and Forecast, by Product Type (2022-2029) 8.4.3.2. Rest Of South America Self Balancing Scooter Market Size and Forecast, by End-User Industry (2022-2029) 8.4.3.3. Rest Of South America Self Balancing Scooter Market Size and Forecast, by Battery Type (2022-2029) 9. Global Self Balancing Scooter Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.3.6. SKU Details 9.3.7. Production Capacity 9.3.8. Production for 2022 9.3.9. No. of Stores 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Self Balancing Scooter Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Ninebot Inc. 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Hangzhou Chic Intelligent Technology Co., Ltd., 10.3. Robstep GB 10.4. Freego Inc., 10.5. Sky Walkers USA 10.6. Shenzhen Counterbalance Technology Co., Ltd. 10.7. Inventist, Inc. 10.8. Segway, Inc. 10.9. Koogo Technology Inc. 10.10. Oxboard B.V. 10.11. IPS Electric Unicycle Co., 10.12. Limited, Evoy Technologies LLC 10.13. Razor USA LLC 10.14. RioRand Advanced Technology 10.15. ESWING, Airwheel 10.16. Esway 10.17. Solowheel 10.18. Evoy Technologies 10.19. Shenzhen Iezway Technology 10.20. Liger Mobility 10.21. Evolve Skateboards 10.22. Solowheel 10.23. Hoverboard Technologies 10.24. Gotcha 11. Key Findings 12. Industry Recommendations 13. Self Balancing Scooter Market: Research Methodology 14. Terms and Glossary