The Global Sea Freight Forwarding Market is projected to grow at a CAGR of 2.42% during the forecast period, from 2025 to 2032, to reach a market size of USD 107.85 billion by 2032, up from USD 89.07 billion in 2024.Sea Freight Forwarding Market Overview

Sea freight forwarding refers to the comprehensive range of services involved in the storage, transportation, and delivery of spare parts and components used in various industries. These services encompass activities such as warehousing, inventory management, packaging, customs clearance, documentation, and distribution. Sea freight forwarding companies provide end-to-end solutions to ensure the smooth and efficient movement of spare parts across global supply chains via sea routes.To know about the Research Methodology :- Request Free Sample Report The sea freight forwarding market serves a wide array of industries, including automotive, aerospace, industrial machinery, electronics, and healthcare. It caters to the demand for spare parts and components required to maintain and repair equipment, thereby ensuring optimal performance and minimizing operational downtime. The market has witnessed significant growth due to the increasing complexity of modern machinery and equipment, coupled with the need for just-in-time delivery to support uninterrupted operations. The market for sea freight forwarding is highly competitive, with numerous global players offering a diverse range of services. These companies strive to develop innovative logistics solutions to meet the evolving needs of their customers and gain a competitive edge. The adoption of digital technologies, such as automation, real-time tracking, and predictive analytics, has been a driving force in transforming and enhancing the efficiency of the sea freight forwarding industry. Sea Freight Forwarding Market Research Methodology Primary and secondary data sources was used to gather information for the study of the Sea Freight Forwarding Market. The study has considered the potential market influencing aspects and these were assessed to produce results. The market prediction has taken into account the effects of numerous economic factors including inflation, regulatory changes, and policy changes, as well as the market size for top-level markets and sub-segments. The bottom-up methodology and various data triangulation approaches was considered to assess the market size and forecast. The weights allocated to each segment based on their utilisation rate and average sale price will be used to determine the percentage splits, market shares, and segment breakdowns. Based on the proportion of the provided market size that is adopted or used in each area or nation, the total market and its sub-segments was analysed by country. The major competitors in the market were also analysed based on metrics such as market revenue, pricing, services supplied, developments, mergers and acquisitions, and joint ventures. Market engineering and calculations for market statistics, market size estimations, market projections, market breakdown, and data triangulation were considered to gather information and verify and confirm the key figures. To provide decision-makers with a clear future vision of the Sea Freight Forwarding industry, external and internal elements that are predicted to have an impact on the firm positively or adversely will be evaluated. By examining market segments and estimating market size, the research can also help in understanding the dynamic structure of the industry. The study will be an investor's guide thanks to the clear depiction of competition analysis of important companies by pricing, financial condition, development plans, and regional presence in the market.

Sea Freight Forwarding Market Dynamics

Sea Freight Forwarding Market Drivers There is a growing need for efficient supply chain management and inventory optimization across various industries. With the increasing complexity of modern machinery and equipment, there is a significant demand for spare parts and components to ensure their maintenance and repair, driving the market's expansion. Secondly, the adoption of advanced technologies such as automation, real-time tracking, and predictive analytics is revolutionizing logistics operations. These technologies enable companies to optimize their inventory management processes, reduce operational costs, and enhance overall supply chain efficiency, thus driving the growth of the Sea Freight Forwarding Market. Furthermore, the expansion of e-commerce has become a key driver for the market. As online retail continues to grow, there is a significant demand for efficient spare parts logistics services to ensure timely delivery of products to customers. Additionally, the rise of e-commerce has led to an increased need for reverse logistics, where companies must efficiently manage the return of defective or damaged products, further fueling the market's growth. The Sea Freight Forwarding Market is also driven by the increasing demand for aftermarket services and the rise of the circular economy. With a growing emphasis on sustainability and resource efficiency, there is a significant need for the repair, refurbishment, and remanufacturing of products. Efficient spare parts logistics services play a crucial role in ensuring the availability and timely delivery of components to support these processes. Lastly, the growth of various industries such as automotive, aerospace, and healthcare is driving the demand for spare parts logistics services. These industries have complex supply chains and require just-in-time delivery of components to maintain their operations, presenting significant opportunities for market participants in the Sea Freight Forwarding Market. In conclusion, the Sea Freight Forwarding Market is driven by the growing need for efficient supply chain management, adoption of advanced technologies, expansion of e-commerce, increasing demand for aftermarket services and the circular economy, as well as the growth of various industries. These drivers collectively contribute to the market's expansion, creating opportunities for companies operating in the sea freight forwarding sector.Top 15 Sea Freight Forwarding in the World in 2022

Rank 2023 Company Headquarters Revenue(US$ M) Ocean Containers 1 Kuehne + Nagel Switzerland 25,787 4,386,000 2 Sinotrans Ltd. China 12,174 3,890,000 3 DHL Supply Chain & Global Forwarding Germany 28,453 3,294,000 4 DSV A/S Denmark XX 2,665,147 5 DB Schenker Germany 20,761 1,935,000 6 LX Pantos South Korea XX 1,527,000 7 C.H. Robinson Worldwide United States 15,490 1,425,000 8 Ceva Logistics France 7,516 1,300,000 9 Kerry Logistics Hong Kong 6,867 1,176,370 10 Geodisdis France XX 1,146,100 11 Hellmann Worldwide Logistics Germany 2,740 977,500 12 Expeditors International of Washington United States 6,369 942,500 13 DACHSER China 6,591 862,742 14 CTS International Logistics China 2,160 805,651 15 Mainfreight Germany 2,467 800,000 Sea Freight Forwarding Market Opportunities The Sea Freight Forwarding Market offers significant growth and innovation opportunities driven by the evolving needs of businesses in optimizing supply chains and enhancing inventory management. Adopting advanced technologies like automation, AI, and IoT can streamline processes, enable predictive analytics, and provide real-time tracking capabilities. The expansion of e-commerce creates a demand for specialized logistics solutions, such as last-mile delivery and reverse logistics services. Sea freight forwarders can cater to this trend to ensure prompt and reliable delivery to online customers. The rise of the circular economy presents an opportunity for companies to contribute to sustainability and resource efficiency by providing efficient spare parts logistics. Offering value-added services like predictive maintenance and field service support allows companies to differentiate themselves in the market and create additional revenue streams. The ongoing globalization of trade, especially in emerging markets, provides opportunities for sea freight forwarding services to offer comprehensive logistics solutions and navigate the complexities of international trade. Prioritizing technology adoption, developing specialized solutions, and exploring partnerships and collaborations are key strategies to seize these opportunities, drive growth, and improve operational efficiency in the sea freight forwarding market. Sea Freight Forwarding Market Major Restraints One major restraint in the Sea Freight Forwarding Market is regulatory and compliance issues. The industry is subject to numerous regulations, including customs regulations, import/export restrictions, and safety regulations. Complying with these regulations can be complex and time-consuming, adding administrative burdens and costs to sea freight operations. Additionally, varying regulatory requirements across different countries and regions can create challenges in ensuring compliance throughout the supply chain. Navigating these regulatory complexities requires dedicated resources and expertise to mitigate risks and maintain operational efficiency. Sea Freight Forwarding Market Challenges One of the key challenges in the Sea Freight Forwarding Industry is fluctuating market conditions. The market is influenced by various factors, such as global economic trends, geopolitical events, and trade uncertainties. Fluctuations in fuel prices, currency exchange rates, and trade policies can significantly impact the profitability and cost-effectiveness of sea freight operations. Sudden changes in market conditions can disrupt supply chains, alter trade flows, and introduce uncertainties in demand and pricing. To navigate these challenges, sea freight forwarders need to stay agile, closely monitor market dynamics, and adopt strategic approaches to mitigate risks and maintain profitability. Sea Freight Forwarding Market trends The Sea Freight Forwarding Market trends are driven by various factors. There is a growing need for efficient supply chain management and inventory optimization across industries. The complexity of modern machinery and equipment necessitates a steady supply of spare parts and components, leading to increased demand for sea freight forwarding services. The adoption of advanced technologies such as automation, real-time tracking, and predictive analytics is transforming the logistics landscape and enhancing supply chain efficiency. The growth of e-commerce and online retail has created a significant demand for spare parts logistics services, requiring efficient sea freight forwarding to handle the transportation and distribution of goods. Additionally, the increasing focus on aftermarket services and circular economy practices, including repair and remanufacturing, is driving the demand for timely and efficient delivery of spare parts. Lastly, the growth of industries such as automotive, aerospace, and healthcare, with their complex supply chains and just-in-time delivery requirements, presents opportunities for sea freight forwarding providers. These drivers collectively shape the sea freight market trends, emphasizing the importance of efficient supply chain management, advanced technologies, e-commerce expansion, sustainability, and industry growth.

Sea Freight Forwarding Market Segment Analysis

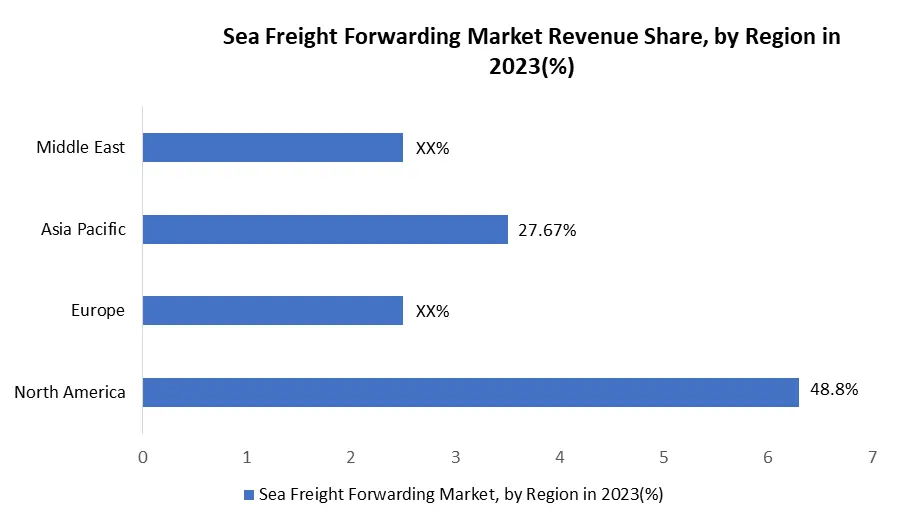

The service segment is further segmented into FCL and LCL. FCL is the most popular service segment, as it offers a more cost-effective way to ship goods internationally. LCL is a less expensive option, but it is also more time-consuming. The vertical segment is further segmented into manufacturing, retail, healthcare, consumer goods, and others. Manufacturing is the largest vertical segment, as it requires the transportation of large volumes of goods. Retail is the second-largest vertical segment, as it requires the transportation of smaller volumes of goods more frequently. The geography segment is further segmented into North America, Europe, Asia Pacific, Latin America, and Middle East & Africa. Asia Pacific is the largest market for sea freight forwarding, followed by Europe and North America.Sea Freight Forwarding Market Regional insights

In North America, the sea freight forwarding market is driven by the strong presence of major industries such as automotive, manufacturing, and healthcare. The region has a well-developed infrastructure and advanced logistics networks, which contribute to the efficient movement of goods. The adoption of advanced technologies and emphasis on supply chain optimization further propel the market growth. Additionally, the expansion of e-commerce and increasing cross-border trade between the United States and Canada create opportunities for sea freight forwarding services in the region. Europe is a significant market for sea freight forwarding, characterized by a robust manufacturing sector and extensive trade relationships with global partners. The region benefits from its strategic location, well-established ports, and efficient transport infrastructure. The European market is driven by the adoption of advanced logistics technologies, strict compliance regulations, and a focus on sustainability. The rise of e-commerce and the need for efficient supply chain management further contribute to the growth of the sea freight forwarding market in Europe. The Asia Pacific region is a major hub for sea freight forwarding, primarily driven by the presence of emerging economies, such as China, India, and Southeast Asian countries. The region's rapid industrialization, booming manufacturing sector, and increasing international trade volumes contribute to the growth of sea freight services. With a vast consumer market and a strong focus on export-oriented industries, Asia Pacific offers significant opportunities for sea freight forwarders. The region is also witnessing increased adoption of advanced technologies, such as IoT and automation, to enhance supply chain efficiency. The LAMEA region is experiencing steady growth in the sea freight forwarding market. Latin American countries, such as Brazil and Mexico, are major contributors, driven by their expanding manufacturing sectors and international trade activities. The Middle East region, particularly the United Arab Emirates, benefits from its strategic location as a transshipment hub and its investment in port infrastructure. Africa presents untapped potential due to its growing population, increasing consumer demand, and efforts to improve logistics infrastructure. The sea freight forwarding market in LAMEA is influenced by factors such as economic development, infrastructure investments, and cross-border trade agreements.

Sea Freight Forwarding Market Competitive Landscape

The sea freight forwarding market is highly competitive, characterized by the presence of both global and regional players. The industry is dominated by well-established companies with extensive global networks and a wide range of service offerings. Some of the major players in the market include DHL Global Forwarding, Kuehne + Nagel, DB Schenker, Expeditors, and C.H. Robinson. These companies have a strong market presence and offer comprehensive sea freight forwarding services, including ocean transportation, customs clearance, and value-added logistics solutions. They leverage their extensive networks, technological capabilities, and expertise to provide efficient and reliable services to their customers. In addition to these global players, there are also numerous regional and local logistics providers that cater to specific markets and niche segments. The competitive landscape is further shaped by factors such as service quality, pricing, operational efficiency, customer relationships, and innovation. As the demand for sea freight forwarding services continues to grow, competition is expected to intensify, leading to further advancements and differentiation in the industry.Sea Freight Forwarding Market Scope: Inquire before buying

Sea Freight Forwarding Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 89.07 Bn Forecast Period 2025 to 2032 CAGR: 2.42% Market Size in 2032: USD 107.85 Bn Segments Covered: by Product Full container load(FCL) Less-than container load(LCL) by Type Manufacturing Retail Health care Consumer Goods Sea Freight Forwarding Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Sea Freight Forwarding Market Key Players:

Asia-Pacific: 1. Nippon Express (Japan) 2. Sinotrans (China) 3. Hitachi Transport System (Japan) 4. Toll Group (Australia) 5. Kerry Logistics (Hong Kong) 6. CJ Logistics (South Korea) Europe: 1. DHL Global Forwarding (Germany) 2. Kuehne + Nagel (Switzerland) 3. Panalpina (Switzerland) 4. Agility Logistics (Switzerland) 5. DSV (Denmark) 6. Hellmann Worldwide Logistics (Germany) 7. CEVA Logistics (Switzerland) 8. Bolloré Logistics (France) 9. Geodis (France) 10. Dachser (Germany) 11. Damco (Netherlands) 12. Yusen Logistics (Netherlands) 13. XPO Logistics (United Kingdom) North America: 1. Expeditors (United States) 2. C.H. Robinson (United States) 3. UPS Supply Chain Solutions (United States) 4. NNR Global Logistics (United States) FAQS: 1. What are the growth drivers for the Market? Ans. The growth drivers for the Market include increasing demand for spare parts, technological advancements in logistics operations, and expanding e-commerce activities 2. What is the major restraint for the Sea Freight Forwarding Market growth? Ans. The major restraint for the Sea Freight Forwarding Market growth is the high cost of logistics operations and inventory management. 3. Which region is expected to lead the global Sea Freight Forwarding Market during the forecast period? Ans. The Asia Pacific region is expected to lead the global Sea Freight Forwarding Market during the forecast period. 4. What is the projected market size & growth rate of the Sea Freight Forwarding Market? Ans. The Sea Freight Forwarding Market size was valued at USD 89.07 Billion in 2024 and the total revenue is expected to grow at a CAGR of 2.42% from 2025 to 2032, reaching USD 107.85 Billion. 5. What segments are covered in the Sea Freight Forwarding Market report? Ans. The segments covered in the Sea Freight Forwarding Market report are Type, Applications, and Region.

1. Sea Freight Forwarding Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Sea Freight Forwarding Market: Dynamics 2.1. Sea Freight Forwarding Market Trends by Region 2.1.1. Global Sea Freight Forwarding Market Trends 2.1.2. North America Sea Freight Forwarding Market Trends 2.1.3. Europe Sea Freight Forwarding Market Trends 2.1.4. Asia Pacific Sea Freight Forwarding Market Trends 2.1.5. Middle East and Africa Sea Freight Forwarding Market Trends 2.1.6. South America Sea Freight Forwarding Market Trends 2.2. Sea Freight Forwarding Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Sea Freight Forwarding Market Drivers 2.2.1.2. North America Sea Freight Forwarding Market Restraints 2.2.1.3. North America Sea Freight Forwarding Market Opportunities 2.2.1.4. North America Sea Freight Forwarding Market Challenges 2.2.2. Europe 2.2.2.1. Europe Sea Freight Forwarding Market Drivers 2.2.2.2. Europe Sea Freight Forwarding Market Restraints 2.2.2.3. Europe Sea Freight Forwarding Market Opportunities 2.2.2.4. Europe Sea Freight Forwarding Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Sea Freight Forwarding Market Drivers 2.2.3.2. Asia Pacific Sea Freight Forwarding Market Restraints 2.2.3.3. Asia Pacific Sea Freight Forwarding Market Opportunities 2.2.3.4. Asia Pacific Sea Freight Forwarding Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Sea Freight Forwarding Market Drivers 2.2.4.2. Middle East and Africa Sea Freight Forwarding Market Restraints 2.2.4.3. Middle East and Africa Sea Freight Forwarding Market Opportunities 2.2.4.4. Middle East and Africa Sea Freight Forwarding Market Challenges 2.2.5. South America 2.2.5.1. South America Sea Freight Forwarding Market Drivers 2.2.5.2. South America Sea Freight Forwarding Market Restraints 2.2.5.3. South America Sea Freight Forwarding Market Opportunities 2.2.5.4. South America Sea Freight Forwarding Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Regulatory Landscape by Region 2.6.1. Global 2.6.2. North America 2.6.3. Europe 2.6.4. Asia Pacific 2.6.5. Middle East and Africa 2.6.6. South America 2.7. Key Opinion Leader Analysis for Sea Freight Forwarding Industry 2.8. Analysis of Government Schemes and Initiatives for Sea Freight Forwarding Industry 2.9. The Global Pandemic Impact on Sea Freight Forwarding Market 2.10. Sea Freight Forwarding Price Trend Analysis (2021-22) 3. Sea Freight Forwarding Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2024-2032) 3.1. Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 3.1.1. Full container load(FCL) 3.1.2. Less-than container load(LCL) 3.2. Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 3.2.1. Manufacturing 3.2.2. Retail 3.2.3. Health care 3.2.4. Consumer Goods 3.3. Sea Freight Forwarding Market Size and Forecast, by region (2024-2032) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Sea Freight Forwarding Market Size and Forecast by Segmentation for (by Value in USD Million) (2024-2032) 4.1. North America Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 4.1.1. Full container load(FCL) 4.1.2. Less-than container load(LCL) 4.2. North America Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 4.2.1. Manufacturing 4.2.2. Retail 4.2.3. Health care 4.2.4. Consumer Goods 4.3. North America Sea Freight Forwarding Market Size and Forecast, by Country (2024-2032) 4.3.1. United States 4.3.1.1. United States Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 4.3.1.1.1. Full container load(FCL) 4.3.1.1.2. Less-than container load(LCL) 4.3.1.2. United States Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 4.3.1.2.1. Manufacturing 4.3.1.2.2. Retail 4.3.1.2.3. Health care 4.3.1.2.4. Consumer Goods 4.3.2. Canada 4.3.2.1. Canada Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 4.3.2.1.1. Full container load(FCL) 4.3.2.1.2. Less-than container load(LCL) 4.3.2.2. Canada Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 4.3.2.2.1. Manufacturing 4.3.2.2.2. Retail 4.3.2.2.3. Health care 4.3.2.2.4. Consumer Goods 4.3.3. Mexico 4.3.3.1. Mexico Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 4.3.3.1.1. Full container load(FCL) 4.3.3.1.2. Less-than container load(LCL) 4.3.3.2. Mexico Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 4.3.3.2.1. Manufacturing 4.3.3.2.2. Retail 4.3.3.2.3. Health care 4.3.3.2.4. Consumer Goods 5. Europe Sea Freight Forwarding Market Size and Forecast by Segmentation for (by Value in USD Million) (2024-2032) 5.1. Europe Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 5.2. Europe Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 5.3. Europe Sea Freight Forwarding Market Size and Forecast, by Country (2024-2032) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 5.3.1.2. United Kingdom Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 5.3.2. France 5.3.2.1. France Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 5.3.2.2. France Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 5.3.3. Germany 5.3.3.1. Germany Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 5.3.3.2. Germany Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 5.3.4. Italy 5.3.4.1. Italy Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 5.3.4.2. Italy Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 5.3.5. Spain 5.3.5.1. Spain Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 5.3.5.2. Spain Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 5.3.6. Sweden 5.3.6.1. Sweden Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 5.3.6.2. Sweden Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 5.3.7. Austria 5.3.7.1. Austria Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 5.3.7.2. Austria Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 5.3.8.2. Rest of Europe Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 6. Asia Pacific Sea Freight Forwarding Market Size and Forecast by Segmentation for (by Value in USD Million) (2024-2032) 6.1. Asia Pacific Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 6.2. Asia Pacific Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 6.3. Asia Pacific Sea Freight Forwarding Market Size and Forecast, by Country (2024-2032) 6.3.1. China 6.3.1.1. China Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 6.3.1.2. China Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 6.3.2. S Korea 6.3.2.1. S Korea Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 6.3.2.2. S Korea Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 6.3.3. Japan 6.3.3.1. Japan Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 6.3.3.2. Japan Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 6.3.4. India 6.3.4.1. India Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 6.3.4.2. India Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 6.3.5. Australia 6.3.5.1. Australia Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 6.3.5.2. Australia Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 6.3.6. Indonesia 6.3.6.1. Indonesia Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 6.3.6.2. Indonesia Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 6.3.7. Malaysia 6.3.7.1. Malaysia Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 6.3.7.2. Malaysia Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 6.3.8. Vietnam 6.3.8.1. Vietnam Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 6.3.8.2. Vietnam Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 6.3.9. Taiwan 6.3.9.1. Taiwan Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 6.3.9.2. Taiwan Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 6.3.10.2. Rest of Asia Pacific Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 7. Middle East and Africa Sea Freight Forwarding Market Size and Forecast by Segmentation for (by Value in USD Million) (2024-2032 7.1. Middle East and Africa Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 7.2. Middle East and Africa Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 7.3. Middle East and Africa Sea Freight Forwarding Market Size and Forecast, by Country (2024-2032) 7.3.1. South Africa 7.3.1.1. South Africa Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 7.3.1.2. South Africa Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 7.3.2. GCC 7.3.2.1. GCC Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 7.3.2.2. GCC Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 7.3.3. Nigeria 7.3.3.1. Nigeria Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 7.3.3.2. Nigeria Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 7.3.4.2. Rest of ME&A Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 8. South America Sea Freight Forwarding Market Size and Forecast by Segmentation for (by Value in USD Million) (2024-2032 8.1. South America Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 8.2. South America Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 8.3. South America Sea Freight Forwarding Market Size and Forecast, by Country (2024-2032) 8.3.1. Brazil 8.3.1.1. Brazil Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 8.3.1.2. Brazil Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 8.3.2. Argentina 8.3.2.1. Argentina Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 8.3.2.2. Argentina Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Sea Freight Forwarding Market Size and Forecast, by Product (2024-2032) 8.3.3.2. Rest Of South America Sea Freight Forwarding Market Size and Forecast, by Type (2024-2032) 9. Global Sea Freight Forwarding Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Product Segment 9.3.3. End-user Segment 9.3.4. Revenue (2023) 9.3.5. Company Locations 9.4. Market Analysis by Organized Players vs. Unorganized Players 9.4.1. Organized Players 9.4.2. Unorganized Players 9.5. Leading Sea Freight Forwarding Market Companies, by market capitalization 9.6. Market Structure 9.6.1. Market Leaders 9.6.2. Market Followers 9.6.3. Emerging Players 9.7. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Nippon Express (Japan) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Regulatory Accreditations and Certifications Received by Them 10.1.7. Awards Received by the Firm 10.1.8. Recent Developments 10.2. Sinotrans (China) 10.3. Hitachi Transport System (Japan) 10.4. Toll Group (Australia) 10.5. Kerry Logistics (Hong Kong) 10.6. CJ Logistics (South Korea) 10.7. DHL Global Forwarding (Germany) 10.8. Kuehne + Nagel (Switzerland) 10.9. Panalpina (Switzerland) 10.10. Agility Logistics (Switzerland) 10.11. DSV (Denmark) 10.12. Hellmann Worldwide Logistics (Germany) 10.13. CEVA Logistics (Switzerland) 10.14. Bolloré Logistics (France) 10.15. Geodis (France) 10.16. Dachser (Germany) 10.17. Damco (Netherlands) 10.18. Yusen Logistics (Netherlands) 10.19. XPO Logistics (United Kingdom) 10.20. Expeditors (United States) 10.21. C.H. Robinson (United States) 10.22. UPS Supply Chain Solutions (United States) 10.23. NNR Global Logistics (United States) 10.24. Alpha Equipments 10.25. Thorson Industries LLP 10.26. Irontech Engineering 10.27. Vibrant Thermal Engineering 11. Key Findings 12. Industry Recommendations 13. Sea Freight Forwarding Market: Research Methodology 14. Terms and Glossary