Rust Remover market was valued at USD 539.60 Mn in 2023 and is expected to reach USD 747.21 Mn by 2030, at a CAGR of 4.76 % during the forecast period.Rust Remover Market Overview

Rising renovation and reconstruction activities, along with increasing investments in emerging economies such as China, India, Australia, and Brazil, are fuelling the demand for rust removers in the market. These activities, mainly prominent in the construction sector, underscore the essential role of rust removers in maintaining and repairing infrastructure. Furthermore, the growth of the automotive industry in the Asia Pacific region and the growth of the oil & gas sector, especially in North America due to shale gas manufacturing, are additional drivers contributing to the rising demand for rust removers.To know about the Research Methodology :- Request Free Sample Report Emerging economies such as China, India, Brazil, and GCC countries are experiencing a surge in construction activities, resulting in an increased need for rust removers for both new construction projects and the maintenance of existing infrastructure. The uptick in residential projects and investments in commercial infrastructure further amplify the demand for rust removers, propelling market growth. As urban areas expand, the construction sector emerges as a significant consumer of rust removers, driving further demand in the market. The Rust Remover Market experiences robust growth driven by the increasing construction sector and infrastructure development in emerging economies, coupled with the increasing requirements in automotive and oil & gas industries.

Rust Remover Market Dynamics

Oil & gas expansion fuels rust remover market growth The growth of the oil & gas sector plays a pivotal role in driving the growth of the Rust Remover Market. As the oil & gas industry develops its operations, there is a corresponding increase in the demand for rust removal solutions to maintain and preserve infrastructure integrity. Oil pipelines, storage tanks, and various equipment components are susceptible to rust formation due to exposure to harsh environmental conditions and corrosive substances inherent to the industry. Rust not only compromises the efficiency and lifespan of equipment but also poses significant safety risks. Therefore, the need for effective rust removal becomes paramount to ensure the smooth operation and safety of oil & gas facilities. The surge in oil & gas activities creates a lucrative market opportunity for rust remover manufacturers and suppliers. With the oil & gas industry being a major consumer of rust removal products and services, companies specializing in rust removers stand to benefit from the increased demand. Moreover, as the oil & gas sector expands into new regions and undertakes large-scale projects, the demand for rust removers is expected to escalate further. The growth of the oil & gas industry indirectly stimulates the Rust Remover Market by driving investment in infrastructure development and maintenance. As oil & gas companies invest in upgrading and expanding their facilities, the need for rust removal solutions becomes integral to ensure the longevity and efficiency of newly constructed or renovated infrastructure. This, in turn, fuels the growth of the Rust Remover Market as companies seek reliable and efficient solutions to address corrosion challenges. The uptick in renovation and restructuring endeavours is expected to drive revenue growth within the rust remover market. The Rust Remover Market is poised for significant growth due to the rising number of renovation and restructuring activities across various industries. As infrastructure ages and undergoes wear and tear, the need for effective rust removal solutions becomes paramount. Rust, a common byproduct of aging metal structures, can compromise the integrity and safety of infrastructure if left unaddressed. Consequently, industries ranging from construction to automotive are increasingly turning to rust removers to mitigate corrosion and prolong the lifespan of their assets. This surge in demand for rust removal products and services presents lucrative opportunities for players in the Rust Remover Market. Moreover, with emerging economies like China, India, and Brazil witnessing rapid urbanization and industrialization, the demand for rust removers is expected to soar even higher. These regions are hubs of construction and manufacturing activities, where rust removal is an essential part of infrastructure maintenance and safety protocols. Furthermore, stringent regulations regarding environmental protection and workplace safety are driving industries worldwide to invest in high-quality rust removal solutions. Consequently, the Rust Remover Market is witnessing robust growth, with manufacturers and suppliers continuously innovating to meet the evolving needs of industries. Amidst this backdrop of increasing demand and regulatory scrutiny, the Rust Remover Market is poised to thrive in the coming years, offering a wide array of solutions tailored to various industry requirements. Continuous growth in many end-use industries Many end-use sectors, mainly the automotive industry, are expected to witness a surge in demand for rust removers. Rust removers play a crucial role in the automotive sector for cleaning metal surfaces and preparing them before metal stamping and die casting processes used in the manufacturing of automobile components. Additionally, with the rapid growth of the aerospace sector and the increasing need for maintenance operations on existing fleets, the utilization of rust removers for cleaning aerospace equipment like jet engines, body frames, and other components has expanded significantly. Consequently, the global Rust Remover Market is poised to experience a notable uptick in demand. Motor vehicle production volume worldwide in 2023, by country (in 1,000 units)The positive impact of the aforementioned factors on the Rust Remover Market is significant. With increasing demand from sectors such as automotive and aerospace, the market experiences a boost in sales and revenue. As more industries recognize the importance of rust removal in maintaining the integrity and efficiency of their equipment, the demand for rust removers continues to grow. This growing demand not only opens up new opportunities for manufacturers and suppliers but also drives innovation in the development of advanced rust removal solutions. Moreover, as the Rust Remover Market expands to cater to diverse industry needs, it fosters competition, leading to improved product offerings and better value for customers. The increasing demand from various end-use sectors positively influences the Rust Remover Market, driving its growth and evolution. New technology for effective rust removal The rise of innovative rust removal technologies such as laser and ultrasonic methods signifies a notable transformation in the market landscape. These state-of-the-art approaches have garnered significant attention owing to their distinctive capabilities. Unlike traditional methods, laser and ultrasonic techniques excel at removing contaminants from substrates without altering the surface, thereby preserving material integrity. This standout feature has spurred their adoption across diverse industries seeking efficient and non-destructive solutions for rust removal. The rising popularity of laser and ultrasonic methods can be attributed to the myriad benefits they offer. Renowned for their precision, speed, and effectiveness in rust removal, these technologies contribute to enhanced productivity and reduced downtime. Additionally, their environmentally friendly nature and minimal risk to operators make them attractive choices for companies emphasizing safety and sustainability. Nevertheless, the adoption of laser and ultrasonic rust removal methods presents challenges for the conventional rust remover market. With industries increasingly favouring these advanced technologies, the demand for traditional rust remover products is on the decline. This shift in preference adversely affects manufacturers and suppliers specializing in traditional rust removal solutions. The widespread adoption of laser and ultrasonic methods may intensify competition within the rust remover market. Key players in the industry may face heightened competition from emerging entrants offering innovative technologies. Additionally, transitioning to laser and ultrasonic methods may necessitate substantial investments in equipment and training, posing entry barriers for some companies. While the emergence of laser and ultrasonic rust removal technologies brings opportunities for enhanced efficiency and performance, it also presents challenges for traditional rust remover market participants. Adaptation to evolving market dynamics and customer preferences will be vital for maintaining competitiveness amidst technological advancements.

Rust Remover Market Segment Analysis

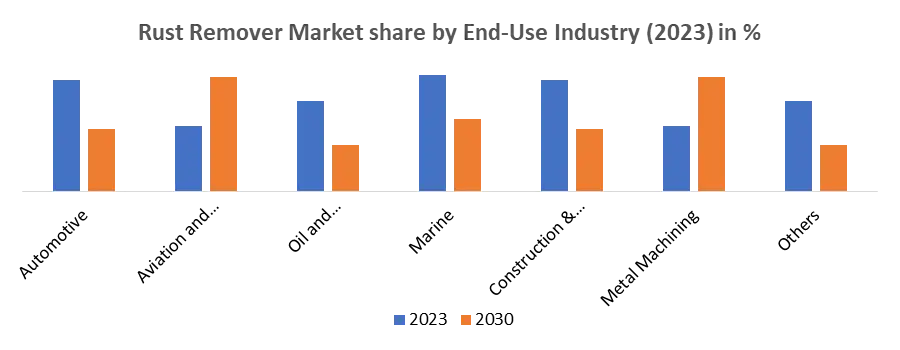

Based on Product Type, Acid Rust Removers emerge as the dominant segment, maintaining a leading position during the forecast period with a market share exceeding 60 %. Acid Rust Removers are favoured for their rapid action and efficacy in dissolving rust from metal surfaces. Their widespread use across various industries, including automotive, construction, and manufacturing, contributes to their dominance in the market. On the other hand, the Neutral Rust Removers segment is expected to witness significant growth over the forecast period. Neutral Rust Removers offer an alternative to acid-based solutions, mainly favoured in applications where the use of strong acids is not feasible or desirable. These solutions are preferred for their ability to remove rust effectively without causing damage to the underlying metal surface. Additionally, the rising emphasis on environmental sustainability and workplace safety drives the demand for neutral rust removal solutions. The growth of the Neutral Rust Removers segment can also be attributed to evolving consumer preferences and regulatory requirements. As industries increasingly prioritize eco-friendly and safer alternatives, the demand for neutral rust removal products is expected to surge. Moreover, advancements in technology and formulation techniques enhance the performance and versatility of neutral rust removers, further fuelling their adoption across various end-use sectors. Based on End-Use, the market is segmented by Automotive, Aviation and Aerospace, Oil and Gas/Petrochemical, Marine, Construction & Infrastructure, Metal Machining and Others. The Construction & Infrastructure segment plays a significant role in driving demand within the Rust Remover Market and is expected to experience substantial growth during the forecast period. This sector encompasses various construction activities such as residential and commercial building projects, as well as infrastructure development like roads and bridges. With urbanization on the rise and increasing demands for new infrastructure, the need for rust removal products is expected to surge. Rust removers are essential for maintaining the safety and longevity of metal structures, ensuring they remain structurally sound over time. Additionally, the Oil and Gas/Petrochemical represents another key segment within the Rust Remover Market. This sector heavily relies on metal equipment such as pipes and tanks, which are susceptible to rust and corrosion. Rust removers are vital for preserving the integrity of this equipment and mitigating the risk of accidents. Given the stringent environmental regulations governing the industry, companies prioritize investing in high-quality rust removal products to ensure compliance and prevent environmental hazards. both the segments present lucrative opportunities for the Rust Remover Market. As urbanization continues and industrial activities expand, the demand for rust removal solutions is expected to grow substantially. Manufacturers and suppliers of rust removers are well-positioned to capitalize on these opportunities by providing innovative and reliable products tailored to the specific needs of these industries.

Rust Remover Market Regional Insight

The Asia-Pacific (APAC) region commands a dominant market share of 38% and is expected to maintain its leadership position during the forecast period. The region's consistent growth across key sectors like aerospace, automotive, transportation, and construction is expected to significantly drive revenue growth in the rust remover market. This growth is fuelled by a substantial increase in demand from various end-use industries. Moreover, there's a rising preference for mild and environmentally friendly aqueous rust removers across the APAC region. Japan, in particular, is experiencing rapid growth in its automotive and construction sectors, further boosting revenue growth in the rust remover market. A notable trend in the Japanese market is the ongoing focus on producing bio-based and eco-friendly rust removers, aligning with sustainable practices and consumer preferences. Key Players Recent Developments1. In April 2021, CRC Industries, Inc. completed the acquisition of the EVAPO-RUST brand of rust removal products from Harris International Laboratories, Inc. EVAPO-RUST is a leading name in rust treatment and stands as one of the top-selling brands of non-acid rust removers globally.

2. In March 2021, Cortec Corporation introduced an eco-friendly corrosion protection solution named EcoAir 422 Rust Remover. This innovative product utilizes renewable technology and is biodegradable, boasting 92% USDA certified biobased content. Packaged in an air-powered spray can, it effectively removes rust and stains without causing pollution and is also non-flammable.

Rust Remover Market Scope: Inquire Before Buying

Global Rust Remover Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 539.60 Mn. Forecast Period 2024 to 2030 CAGR: 4.76% Market Size in 2030: US $ 747.21 Mn. Segments Covered: by End Use Industry Automotive Aviation and Aerospace Oil and Gas/Petrochemical Marine Construction & Infrastructure Metal Machining Others by Product Type Acid Rust Removers Neutral Rust Removers Alkaline Rust Removers Rust Remover Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Leading Rust Remover Key Players include:

1. Reckitt Benckiser Group - United Kingdom 2. Jelmar LLC - United States 3. 3M Company - United States 4. The Sherwin-Williams Company - United States 5. Corrosion Technologies, LLC - United States 6. Chempace Corporation - United States 7. Fuchs Petrolub SE - Germany 8. Henkel Adhesives - Germany 9. Quaker Chemical Corporation - United States 10. PPG Industries, Inc. - United States 11. Akzo Nobel N.V. - Netherlands 12. Taiyo Chemicals & Engineering Co., Ltd. - Japan 13. Nola Chemie GmbH - Germany 14. Buchem Chemie + Technik GmbH & Co. KG - Germany 15. Summit Brands - United States 16. Armor Inc. - United States 17. Harris International Laboratories, Inc. - United States 18. American Building Restoration Products, Inc. - United States 19. Zerust Excor - United States 20. Eurochem International - Belgium 21. Daubert Cromwell - United States 22. Rust-Oleum - United States Frequently asked Questions: 1. What is the growth rate of Global Rust Remover Market? Ans: The Global Rust Remover Market is growing at a CAGR of 4.76% during forecasting period 2024-2030. 2. What is scope of the Global Rust Remover Market report? Ans: Global Rust Remover Market report helps with the PESTEL, PORTER, COVID-19 Impact analysis, Recommendations for Investors & Leaders, and market estimation of the forecast period. 3. Who are the key players in Global Rust Remover Market? Ans: The important key players in the Global Rust Remover Market are – Reckitt Benckiser Group - United Kingdom, Jelmar LLC - United States, The 3M Company - United States, The Sherwin-Williams Company - United States, Corrosion Technologies, LLC - United States, Chempace Corporation - United States, Fuchs Petrolub SE – Germany, Henkel Adhesives - Germany. 4. What is the study period of this market? Ans: The Global Rust Remover Market is studied from 2023 to 2030.

1. Rust Remover Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Rust Remover Market: Dynamics 2.1. Rust Remover Market Trends by Region 2.1.1. North America Rust Remover Market Trends 2.1.2. Europe Rust Remover Market Trends 2.1.3. Asia Pacific Rust Remover Market Trends 2.1.4. Middle East and Africa Rust Remover Market Trends 2.1.5. South America Rust Remover Market Trends 2.2. Rust Remover Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Rust Remover Market Drivers 2.2.1.2. North America Rust Remover Market Restraints 2.2.1.3. North America Rust Remover Market Opportunities 2.2.1.4. North America Rust Remover Market Challenges 2.2.2. Europe 2.2.2.1. Europe Rust Remover Market Drivers 2.2.2.2. Europe Rust Remover Market Restraints 2.2.2.3. Europe Rust Remover Market Opportunities 2.2.2.4. Europe Rust Remover Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Rust Remover Market Drivers 2.2.3.2. Asia Pacific Rust Remover Market Restraints 2.2.3.3. Asia Pacific Rust Remover Market Opportunities 2.2.3.4. Asia Pacific Rust Remover Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Rust Remover Market Drivers 2.2.4.2. Middle East and Africa Rust Remover Market Restraints 2.2.4.3. Middle East and Africa Rust Remover Market Opportunities 2.2.4.4. Middle East and Africa Rust Remover Market Challenges 2.2.5. South America 2.2.5.1. South America Rust Remover Market Drivers 2.2.5.2. South America Rust Remover Market Restraints 2.2.5.3. South America Rust Remover Market Opportunities 2.2.5.4. South America Rust Remover Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Rust Remover Industry 2.8. Analysis of Government Schemes and Initiatives For Rust Remover Industry 2.9. Rust Remover Market Trade Analysis 2.10. The Global Pandemic Impact on Rust Remover Market 3. Rust Remover Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 3.1.1. Automotive 3.1.2. Aviation and Aerospace 3.1.3. Oil and Gas/Petrochemical 3.1.4. Marine 3.1.5. Construction & Infrastructure 3.1.6. Metal Machining 3.1.7. Others 3.2. Rust Remover Market Size and Forecast, by Product Type (2023-2030) 3.2.1. Acid Rust Removers 3.2.2. Neutral Rust Removers 3.2.3. Alkaline Rust Removers 3.3. Rust Remover Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Rust Remover Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 4.1.1. Automotive 4.1.2. Aviation and Aerospace 4.1.3. Oil and Gas/Petrochemical 4.1.4. Marine 4.1.5. Construction & Infrastructure 4.1.6. Metal Machining 4.1.7. Others 4.2. North America Rust Remover Market Size and Forecast, by Product Type (2023-2030) 4.2.1. Acid Rust Removers 4.2.2. Neutral Rust Removers 4.2.3. Alkaline Rust Removers 4.3. North America Rust Remover Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 4.3.1.1.1. Automotive 4.3.1.1.2. Aviation and Aerospace 4.3.1.1.3. Oil and Gas/Petrochemical 4.3.1.1.4. Marine 4.3.1.1.5. Construction & Infrastructure 4.3.1.1.6. Metal Machining 4.3.1.1.7. Others 4.3.1.2. United States Rust Remover Market Size and Forecast, by Product Type (2023-2030) 4.3.1.2.1. Acid Rust Removers 4.3.1.2.2. Neutral Rust Removers 4.3.1.2.3. Alkaline Rust Removers 4.3.2. Canada 4.3.2.1. Canada Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 4.3.2.1.1. Automotive 4.3.2.1.2. Aviation and Aerospace 4.3.2.1.3. Oil and Gas/Petrochemical 4.3.2.1.4. Marine 4.3.2.1.5. Construction & Infrastructure 4.3.2.1.6. Metal Machining 4.3.2.1.7. Others 4.3.2.2. Canada Rust Remover Market Size and Forecast, by Product Type (2023-2030) 4.3.2.2.1. Acid Rust Removers 4.3.2.2.2. Neutral Rust Removers 4.3.2.2.3. Alkaline Rust Removers 4.3.3. Mexico 4.3.3.1. Mexico Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 4.3.3.1.1. Automotive 4.3.3.1.2. Aviation and Aerospace 4.3.3.1.3. Oil and Gas/Petrochemical 4.3.3.1.4. Marine 4.3.3.1.5. Construction & Infrastructure 4.3.3.1.6. Metal Machining 4.3.3.1.7. Others 4.3.3.2. Mexico Rust Remover Market Size and Forecast, by Product Type (2023-2030) 4.3.3.2.1. Acid Rust Removers 4.3.3.2.2. Neutral Rust Removers 4.3.3.2.3. Alkaline Rust Removers 5. Europe Rust Remover Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 5.2. Europe Rust Remover Market Size and Forecast, by Product Type (2023-2030) 5.3. Europe Rust Remover Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 5.3.1.2. United Kingdom Rust Remover Market Size and Forecast, by Product Type (2023-2030) 5.3.2. France 5.3.2.1. France Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 5.3.2.2. France Rust Remover Market Size and Forecast, by Product Type (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 5.3.3.2. Germany Rust Remover Market Size and Forecast, by Product Type (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 5.3.4.2. Italy Rust Remover Market Size and Forecast, by Product Type (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 5.3.5.2. Spain Rust Remover Market Size and Forecast, by Product Type (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 5.3.6.2. Sweden Rust Remover Market Size and Forecast, by Product Type (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 5.3.7.2. Austria Rust Remover Market Size and Forecast, by Product Type (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 5.3.8.2. Rest of Europe Rust Remover Market Size and Forecast, by Product Type (2023-2030) 6. Asia Pacific Rust Remover Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 6.2. Asia Pacific Rust Remover Market Size and Forecast, by Product Type (2023-2030) 6.3. Asia Pacific Rust Remover Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 6.3.1.2. China Rust Remover Market Size and Forecast, by Product Type (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 6.3.2.2. S Korea Rust Remover Market Size and Forecast, by Product Type (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 6.3.3.2. Japan Rust Remover Market Size and Forecast, by Product Type (2023-2030) 6.3.4. India 6.3.4.1. India Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 6.3.4.2. India Rust Remover Market Size and Forecast, by Product Type (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 6.3.5.2. Australia Rust Remover Market Size and Forecast, by Product Type (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 6.3.6.2. Indonesia Rust Remover Market Size and Forecast, by Product Type (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 6.3.7.2. Malaysia Rust Remover Market Size and Forecast, by Product Type (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 6.3.8.2. Vietnam Rust Remover Market Size and Forecast, by Product Type (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 6.3.9.2. Taiwan Rust Remover Market Size and Forecast, by Product Type (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 6.3.10.2. Rest of Asia Pacific Rust Remover Market Size and Forecast, by Product Type (2023-2030) 7. Middle East and Africa Rust Remover Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 7.2. Middle East and Africa Rust Remover Market Size and Forecast, by Product Type (2023-2030) 7.3. Middle East and Africa Rust Remover Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 7.3.1.2. South Africa Rust Remover Market Size and Forecast, by Product Type (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 7.3.2.2. GCC Rust Remover Market Size and Forecast, by Product Type (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 7.3.3.2. Nigeria Rust Remover Market Size and Forecast, by Product Type (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 7.3.4.2. Rest of ME&A Rust Remover Market Size and Forecast, by Product Type (2023-2030) 8. South America Rust Remover Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 8.2. South America Rust Remover Market Size and Forecast, by Product Type (2023-2030) 8.3. South America Rust Remover Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 8.3.1.2. Brazil Rust Remover Market Size and Forecast, by Product Type (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 8.3.2.2. Argentina Rust Remover Market Size and Forecast, by Product Type (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Rust Remover Market Size and Forecast, by End Use Industry (2023-2030) 8.3.3.2. Rest Of South America Rust Remover Market Size and Forecast, by Product Type (2023-2030) 9. Global Rust Remover Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Rust Remover Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Reckitt Benckiser Group - United Kingdom 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Jelmar LLC - United States 10.3. The 3M Company - United States 10.4. The Sherwin-Williams Company - United States 10.5. Corrosion Technologies, LLC - United States 10.6. Chempace Corporation - United States 10.7. Fuchs Petrolub SE - Germany 10.8. Henkel Adhesives - Germany 10.9. Quaker Chemical Corporation - United States 10.10. PPG Industries, Inc. - United States 10.11. Akzo Nobel N.V. - Netherlands 10.12. Taiyo Chemicals & Engineering Co., Ltd. - Japan 10.13. Nola Chemie GmbH - Germany 10.14. Buchem Chemie + Technik GmbH & Co. KG - Germany 10.15. Summit Brands - United States 10.16. Armor Inc. - United States 10.17. Harris International Laboratories, Inc. - United States 10.18. American Building Restoration Products, Inc. - United States 10.19. Zerust Excor - United States 10.20. Eurochem International - Belgium 10.21. Daubert Cromwell - United States 10.22. Rust-Oleum - United States 11. Key Findings 12. Industry Recommendations 13. Rust Remover Market: Research Methodology 14. Terms and Glossary