Global Rubber Tire Market size was valued at USD 155.08 Bn. in 2023 and the total Rubber Tire revenue is expected to grow by 3.8 % from 2024 to 2030, reaching nearly USD 201.35 Bn.Rubber Tire Market Overview:

A rubber tire is a component that is ring-shaped and surrounded by the axle of the wheel’s rim, to transfer the load from the rim to the ground. As more people started driving cars, and vehicles, there is a great desire for higher growth of automobiles, which led further to rising in vehicle manufacturing across the market. The automotive rubber tire market has anticipated to be driven by increasing vehicle production and high demands for passenger cars across the world over the forecast period. These aspects are expected to boost the rubber tire market. Consumers can choose different quality tires which have includes high-performance and speed-rated tires and they can also choose from different brands of rubber tires. Asia Pacific is the chief region for natural rubber production. In 2018, the region produced about 12.64 million tons of natural rubber. Moreover, Thailand is considered the world’s largest producer with 33.4% of the global natural rubber market share. The rubber tire market is getting a major boost from developing infrastructure and rising vehicle export. The government also taking diverse measures to gear up for automotive production, which create a positive impact on Thailand's tire market in the forecast year.To know about the Research Methodology :- Request Free Sample Report

Rubber Tire Market Dynamics:

Market Drivers Rising Focus on performance and consumer requirements Rubber Tire Manufacturers have developed technology that connects a tire to its vehicle, informing drivers of routine maintenance needs via tire pressure monitoring systems. The rubber tire makers are taking this a step further, taking the technology beyond the tire, and even beyond the vehicle. As the automotive industry drives toward an autonomous future, tires-being the sole connection between the vehicle and the road-need to do more, especially if there's potentially no driver to check the tire or the hazards on the road. High-performance and speed-rated tires have been increasing in popularity in the historical period. These premium-priced tires, which produce wider profit margins for tire companies, now account for 36 % of all original equipment passenger car tires and about 34 % of all replacement passenger car tires. Although these premium tires are of radial design, they tend to wear out much faster than conventional radials and thus increase the frequency at which tires are replaced. This change in consumers’ preferences contributes to the demand for replacement tires. Vehicle manufacturers and consumers of replacement tires have several options as to the type of tire they put on a vehicle. They can choose from different qualities of tires, including high-performance and speed-rated tires, and they can also choose from different brands. The rubber tire market is fairly concentrated and dominated by multinational companies. This market is concentrated on the influence of brand loyalty, capital requirement required to build and modernize manufacturing facilities, and maintaining high advance research and development facilities. High demand for industrial, Agricultural vehicles increases demand for rubber tire products. Various commercial vehicles such as cars, bicycles, motorcycles, electric vehicles, and other luxurious vehicles create opportunities to boost the rubber tire market. Increase in Awareness and Economic Expansion in the Rubber Tire Market Increase in awareness among customers about vehicle maintenance, adoption of tire monitoring systems, and expansion of retailers and dealers network in rural areas to drive the projected rubber tire market during the forecast period. Economic growth and expansion over the globe tend to the development of roads, and infrastructures. The increase in the number of cross borders and haul freight transport is boosting the demand for the rubber tires market. The extensive spread of the pandemic across the globe promotes consumers to own their new vehicles. Which drives the sale of vehicles and subsequently boosts the demand for rubber tires across the market. Rubber Tire Market Restraints: High cost of the raw material hampering the market In the manufacturing process of rubber tires, environmental concerns are fugitive air emissions, wastewater, and solid and hazardous waste. The emission is generated from chemicals, in sealed polyethylene bags. Raw material cost is usually 32 % of the entire cost of rubber tires which directly affects the cost of rubber tires. Shortage of raw materials such as synthetic rubber, and natural rubber affects the rise in the overall cost of rubber tires. Rubber Tire Market Opportunities: Expansion of Industrialization and urbanization helps to grow the rubber tire market A rapid increase in industrialization and urbanization across the globe is likely to boost the rubber market, due to an increase in industrialization and construction activities demand for heavy vehicles increases. Urbanization increases the commercial vehicle and subsequently boosts the rubber tire market across the world. A strong brand name with a reputation for high-quality products may possibly rise in prices without a negative impact on demand, the innovation in the product not only improves its quality, and life expectancy and increase security also. An increase in the number of automotive industries and increasing population also tends to increase productivity in vehicular tires for various products in industrial and domestic use. Becoming a more active participant in the EU market to which, know how to utilize as well as import and export opportunities for boosting the rate of overall GDP growth.Rubber Tire Market Segment Analysis:

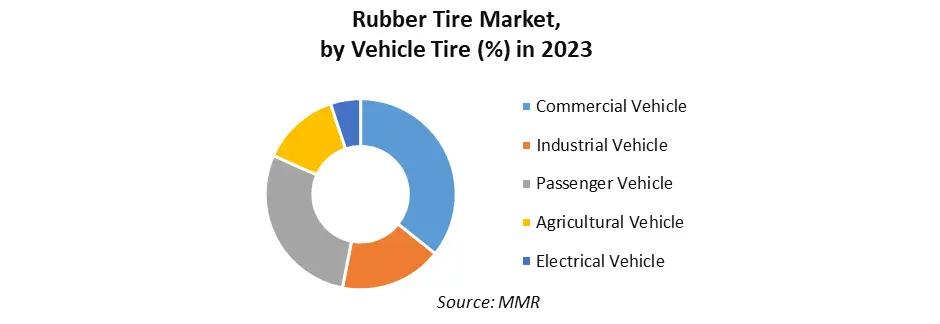

Based on vehicle type: The rubber tire market is divided into different categories such as commercial vehicles, passenger vehicles, agricultural vehicles, industrial vehicles, construction, and mining vehicle, motorcycle, buses, scooters, trucks, and bicycles. Passenger vehicles and Commercial vehicles play vital anticipated roles for substantial share owing to the rising purchase power of society, which increases the high demands for vehicle Urbanization and industrialization significantly increase advanced agricultural vehicles and their productivity and continued advancements have flourished the segment growth of the market. Commercial vehicles, motorcycles, and buses also play a major role in driving the rubber tire market. Additionally electric vehicles along with advanced and integrated technology such as passenger vehicles especially luxury and semi-luxury vehicles are expected to boost the demand for rubber tire over the forecasting period.

Rubber Tire Market Regional Insights:

In 2023, the North American Rubber Tire Market held the major share in the global market. The factors which help to attribute to the dominant country that is increasing urbanization and industrialization, increasing population, and increasing sources of incomes of populations The United States dominates the area of the North American rubber tire market, it holds about half of the total rubber tire market share. The annual share of the United States is around 10.05 million units. Which strengthens the market in this region. The combined market share of Canada and Mexico is about 15% and the rest of the North American market. The rubber tire market in Europe stood at USD 8.2 billion in 2023. This region holds the dominant market. It owing to increasing stringency in government regulation to reduce carbon emissions, and they promote environment–friendly vehicles and other vehicular components. China is the central hub for the rubber tire market industries and one of the firmest rising economies in the world. The request for materials like coal, gold, copper, and iron ore is growing. As a result, mining trucks are growing up as well. The surge in mining production is pushing the demand for new building machinery fields by replacement of old machinery, which boosts the mining Market demand Rubber Tire Market Competitive Landscape: The rubber tire market is fragmented, there is a high level of competition. The key players are operating the huge market. The prominent players are constantly adopting various, different strategies to grow in the market. There is a high demand for the rubber tires. So it very scalable market having huge competition. The rubber tire market is competitive, with many global and regional manufacturers vying for market share. Various key players invest in product innovation and brand promotion to maintain a competitive edge. Some of the leading key players dominating the rubber tire market are Bridgestone Corporation, Goodyear Tire & Rubber Company (US), Continental AG, Michelin, and other prominent players. To further enhance their market share, these companies employ various strategies such as mergers and acquisitions, partnerships, license agreements, and launching new products.Rubber Tire Market Scope: Inquiry Before Buying

Global Rubber Tire Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 155.08 Bn. Forecast Period 2024 to 2030 CAGR: 3.8% Market Size in 2030: US $ 201.35 Bn. Segments Covered: by Tire Type Bias tire Radial tire Solid tire by Vehicle Type Commercial Vehicle Industrial Vehicle Passenger Vehicle Agricultural Vehicle Electrical Vehicle by Rim Type Less than 15 inches 15 to 20 inches More than 20 inches Rubber Tire Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Rubber Tire Key Players

1.Apollo Tyres Ltd 2. Bridgestone Corporation 3. CEAT Limited 4. Continental AG 5. Hankook & Company Co., Ltd. 6. JK Tyre & INDUSTRIES LTD. 7. Michelin 8. MRF Limited 9. Nokian Tyres PLC 10. Pirelli & C. S.p.A 11. Sailun Group Co., Ltd. 12. Salsons Impex Pvt. Ltd 13. Shandong Linglong Group Co. Ltd. 14. Sumitomo Rubber Industries, Ltd. 15. The Goodyear Tire & Rubber Company 16. The Yokohama Rubber Co., Ltd. 17. Triangle Tire Co., Ltd., 18. Toyo Tire Corporation 19. Wanli Tire Co., Ltd. 20. Zhongce Rubber Group Co., Ltd. Frequently Asked Questions: 1. Which region has the largest share in Global Rubber Tire Market? Ans: Asia Pacific region held the highest share in 2023. 2. What is the growth rate of the Global Market? Ans: The Global Rubber Tire Market is expected to grow at a CAGR of 3.8% during the forecast period 2024-2030. 3. Who are the key players in the Global Rubber Tire market? Ans: The important key players in the Global Rubber Tire Market are - Bridgestone, Michelin., Goodyear, Continental, Sumitomo, Appolo Tires, MRF, JK Tires, CEAT, NEXEN tire co, Giti Tire, Nokian Tires plc, Yokohama tire corporation, Hankook tire, and Pirelli. 4. What was the global Rubber tire market size in 2023? Ans: In 2023, the global tire market attended a volume of nearly USD 155.08 billion. 5. What has been the impact of COVID-19 on the Asia Pacific tire market? Ans: The sudden outbreak of the COVID-19 pandemic led to the implementation of stringent lockdown regulations across several Asia Pacific nations, resulting in the temporary closure of numerous manufacturing units for vehicles, thereby negatively impacting the Asia Pacific market for tires.

1. Rubber Tire Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Rubber Tire Market: Dynamics 2.1. Rubber Tire Market Trends by Region 2.1.1. North America Rubber Tire Market Trends 2.1.2. Europe Rubber Tire Market Trends 2.1.3. Asia Pacific Rubber Tire Market Trends 2.1.4. Middle East and Africa Rubber Tire Market Trends 2.1.5. South America Rubber Tire Market Trends 2.2. Rubber Tire Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Rubber Tire Market Drivers 2.2.1.2. North America Rubber Tire Market Restraints 2.2.1.3. North America Rubber Tire Market Opportunities 2.2.1.4. North America Rubber Tire Market Challenges 2.2.2. Europe 2.2.2.1. Europe Rubber Tire Market Drivers 2.2.2.2. Europe Rubber Tire Market Restraints 2.2.2.3. Europe Rubber Tire Market Opportunities 2.2.2.4. Europe Rubber Tire Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Rubber Tire Market Drivers 2.2.3.2. Asia Pacific Rubber Tire Market Restraints 2.2.3.3. Asia Pacific Rubber Tire Market Opportunities 2.2.3.4. Asia Pacific Rubber Tire Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Rubber Tire Market Drivers 2.2.4.2. Middle East and Africa Rubber Tire Market Restraints 2.2.4.3. Middle East and Africa Rubber Tire Market Opportunities 2.2.4.4. Middle East and Africa Rubber Tire Market Challenges 2.2.5. South America 2.2.5.1. South America Rubber Tire Market Drivers 2.2.5.2. South America Rubber Tire Market Restraints 2.2.5.3. South America Rubber Tire Market Opportunities 2.2.5.4. South America Rubber Tire Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Rubber Tire Industry 2.8. Analysis of Government Schemes and Initiatives For Rubber Tire Industry 2.9. Rubber Tire Market Trade Analysis 2.10. The Global Pandemic Impact on Rubber Tire Market 3. Rubber Tire Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 3.1.1. Bias tire 3.1.2. Radial tire 3.1.3. Solid tire 3.2. Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 3.2.1. Commercial Vehicle 3.2.2. Industrial Vehicle 3.2.3. Passenger Vehicle 3.2.4. Agricultural Vehicle 3.2.5. Electrical Vehicle 3.3. Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 3.3.1. Less than 15 inches 3.3.2. 15 to 20 inches 3.3.3. More than 20 inches 3.4. Rubber Tire Market Size and Forecast, by Region (2023-2030) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Rubber Tire Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 4.1.1. Bias tire 4.1.2. Radial tire 4.1.3. Solid tire 4.2. North America Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 4.2.1. Commercial Vehicle 4.2.2. Industrial Vehicle 4.2.3. Passenger Vehicle 4.2.4. Agricultural Vehicle 4.2.5. Electrical Vehicle 4.3. North America Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 4.3.1. Less than 15 inches 4.3.2. 15 to 20 inches 4.3.3. More than 20 inches 4.4. North America Rubber Tire Market Size and Forecast, by Country (2023-2030) 4.4.1. United States 4.4.1.1. United States Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 4.4.1.1.1. Bias tire 4.4.1.1.2. Radial tire 4.4.1.1.3. Solid tire 4.4.1.2. United States Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.1.2.1. Commercial Vehicle 4.4.1.2.2. Industrial Vehicle 4.4.1.2.3. Passenger Vehicle 4.4.1.2.4. Agricultural Vehicle 4.4.1.2.5. Electrical Vehicle 4.4.1.3. United States Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 4.4.1.3.1. Less than 15 inches 4.4.1.3.2. 15 to 20 inches 4.4.1.3.3. More than 20 inches 4.4.2. Canada 4.4.2.1. Canada Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 4.4.2.1.1. Bias tire 4.4.2.1.2. Radial tire 4.4.2.1.3. Solid tire 4.4.2.2. Canada Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.2.2.1. Commercial Vehicle 4.4.2.2.2. Industrial Vehicle 4.4.2.2.3. Passenger Vehicle 4.4.2.2.4. Agricultural Vehicle 4.4.2.2.5. Electrical Vehicle 4.4.2.3. Canada Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 4.4.2.3.1. Less than 15 inches 4.4.2.3.2. 15 to 20 inches 4.4.2.3.3. More than 20 inches 4.4.3. Mexico 4.4.3.1. Mexico Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 4.4.3.1.1. Bias tire 4.4.3.1.2. Radial tire 4.4.3.1.3. Solid tire 4.4.3.2. Mexico Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 4.4.3.2.1. Commercial Vehicle 4.4.3.2.2. Industrial Vehicle 4.4.3.2.3. Passenger Vehicle 4.4.3.2.4. Agricultural Vehicle 4.4.3.2.5. Electrical Vehicle 4.4.3.3. Mexico Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 4.4.3.3.1. Less than 15 inches 4.4.3.3.2. 15 to 20 inches 4.4.3.3.3. More than 20 inches 5. Europe Rubber Tire Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 5.2. Europe Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.3. Europe Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 5.4. Europe Rubber Tire Market Size and Forecast, by Country (2023-2030) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.1.2. United Kingdom Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.1.3. United Kingdom Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 5.4.2. France 5.4.2.1. France Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.2.2. France Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.2.3. France Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 5.4.3. Germany 5.4.3.1. Germany Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.3.2. Germany Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.3.3. Germany Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 5.4.4. Italy 5.4.4.1. Italy Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.4.2. Italy Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.4.3. Italy Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 5.4.5. Spain 5.4.5.1. Spain Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.5.2. Spain Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.5.3. Spain Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 5.4.6. Sweden 5.4.6.1. Sweden Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.6.2. Sweden Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.6.3. Sweden Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 5.4.7. Austria 5.4.7.1. Austria Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.7.2. Austria Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.7.3. Austria Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 5.4.8.2. Rest of Europe Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 5.4.8.3. Rest of Europe Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 6. Asia Pacific Rubber Tire Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 6.2. Asia Pacific Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.3. Asia Pacific Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 6.4. Asia Pacific Rubber Tire Market Size and Forecast, by Country (2023-2030) 6.4.1. China 6.4.1.1. China Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.1.2. China Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.1.3. China Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 6.4.2. S Korea 6.4.2.1. S Korea Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.2.2. S Korea Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.2.3. S Korea Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 6.4.3. Japan 6.4.3.1. Japan Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.3.2. Japan Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.3.3. Japan Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 6.4.4. India 6.4.4.1. India Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.4.2. India Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.4.3. India Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 6.4.5. Australia 6.4.5.1. Australia Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.5.2. Australia Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.5.3. Australia Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 6.4.6. Indonesia 6.4.6.1. Indonesia Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.6.2. Indonesia Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.6.3. Indonesia Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 6.4.7. Malaysia 6.4.7.1. Malaysia Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.7.2. Malaysia Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.7.3. Malaysia Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 6.4.8. Vietnam 6.4.8.1. Vietnam Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.8.2. Vietnam Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.8.3. Vietnam Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 6.4.9. Taiwan 6.4.9.1. Taiwan Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.9.2. Taiwan Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.9.3. Taiwan Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 6.4.10.2. Rest of Asia Pacific Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 6.4.10.3. Rest of Asia Pacific Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 7. Middle East and Africa Rubber Tire Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 7.2. Middle East and Africa Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 7.3. Middle East and Africa Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 7.4. Middle East and Africa Rubber Tire Market Size and Forecast, by Country (2023-2030) 7.4.1. South Africa 7.4.1.1. South Africa Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 7.4.1.2. South Africa Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.1.3. South Africa Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 7.4.2. GCC 7.4.2.1. GCC Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 7.4.2.2. GCC Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.2.3. GCC Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 7.4.3. Nigeria 7.4.3.1. Nigeria Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 7.4.3.2. Nigeria Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.3.3. Nigeria Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 7.4.4.2. Rest of ME&A Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 7.4.4.3. Rest of ME&A Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 8. South America Rubber Tire Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 8.2. South America Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 8.3. South America Rubber Tire Market Size and Forecast, by Rim Type(2023-2030) 8.4. South America Rubber Tire Market Size and Forecast, by Country (2023-2030) 8.4.1. Brazil 8.4.1.1. Brazil Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 8.4.1.2. Brazil Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.1.3. Brazil Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 8.4.2. Argentina 8.4.2.1. Argentina Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 8.4.2.2. Argentina Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.2.3. Argentina Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Rubber Tire Market Size and Forecast, by Tire Type (2023-2030) 8.4.3.2. Rest Of South America Rubber Tire Market Size and Forecast, by Vehicle Type (2023-2030) 8.4.3.3. Rest Of South America Rubber Tire Market Size and Forecast, by Rim Type (2023-2030) 9. Global Rubber Tire Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Rubber Tire Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Apollo Tyres Ltd 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Bridgestone Corporation 10.3. CEAT Limited 10.4. Continental AG 10.5. Hankook & Company Co., Ltd. 10.6. JK Tyre & INDUSTRIES LTD. 10.7. Michelin 10.8. MRF Limited 10.9. Nokian Tyres PLC 10.10. Pirelli & C. S.p.A 10.11. Sailun Group Co., Ltd. 10.12. Salsons Impex Pvt. Ltd 10.13. Shandong Linglong Group Co. Ltd. 10.14. Sumitomo Rubber Industries, Ltd. 10.15. The Goodyear Tire & Rubber Company 10.16. The Yokohama Rubber Co., Ltd. 10.17. Triangle Tire Co., Ltd., 10.18. Toyo Tire Corporation 10.19. Wanli Tire Co., Ltd. 10.20. Zhongce Rubber Group Co., Ltd. 11. Key Findings 12. Industry Recommendations 13. Rubber Tire Market: Research Methodology 14. Terms and Glossary