Roadside Drug Testing Devices Market size was valued at USD 468.9 Mn. in 2022 and the total Roadside Drug Testing Devices revenue is expected to grow by 6.5 % from 2023 to 2029, reaching nearly USD 728.69 Mn.Roadside Drug Testing Devices Market Overview:

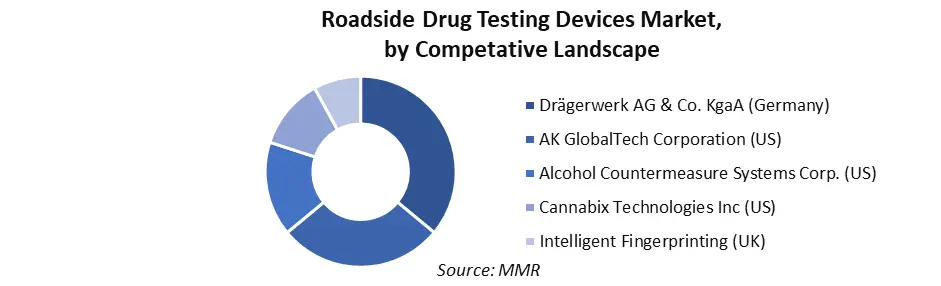

Roadside Drug Testing Devices analyze biological samples such as hair, blood, and urine to determine the presence of drugs or their metabolites in a person's body. Stringent law enforcement, rising drug, and alcohol use among youth and the elderly, and an alarming rate of deaths caused by drink-and-drive situations are the factors that are expected to drive the growth of the roadside drug testing devices market. According to MMR analysis, Every day, approximately 32 people in the United States are killed in drunk-driving accidents — one every 45 minutes. In 2020, 11,654 people died in traffic accidents caused by drunk driving, a 14% increase from 2019. The roadside drug testing devices market is growing rapidly as the number of end-users for roadside drug testing devices increases dramatically. Increased awareness about drunk driving fatalities, government support and regulations, and increasing volumes of adoption of advanced roadside drug testing devices in various law enforcement departments in most countries such as Germany, China, and United States is expected to accelerate market growth. The highway policies sub-segment leads the market among end-users due to the incorporation and adoption of the greatest number of roadside drug testing device units for the highway patrol. The market is dominated by medical stores and brand outlets, but the online retailing sub-segment is expected to grow at a faster rate.To know about the Research Methodology :- Request Free Sample Report Competitive Landscape: The roadside drug testing devices market is extremely competitive. In terms of market share, major market players currently dominate the industry. Among the leading market players are Drägerwerk AG & Co. KgaA (Germany), AK GlobalTech Corporation (US), Alcohol Countermeasure Systems Corp. (US), Cannabix Technologies Inc (US), and Intelligent Fingerprinting (UK). It was discovered that these industry participants have a diverse product portfolio for roadside drug testing devices. The industry's leading players are developing new devices to improve efficiency and thus gain a larger market share. Dräger DrugTest 5000 Remains the Only Device Approved for Roadside Testing of THC and Cocaine in Canada One Year After Federal Approval: The Dräger DrugTest 5000 was approved by the Canadian federal government as the first roadside oral fluid drug screening device. It is still the only device approved for use by law enforcement to test for both THC and cocaine. The device is now used by law enforcement agencies in Ontario, Manitoba, Saskatchewan, Prince Edward Island, Alberta, and Nova Scotia. Warren County, PA Police to Pilot Cannabix Marijuana Breathalyzer Technology: Cannabix Technologies Inc. (CSE: BLO) (OTC PINK: BLOZF) (the "Company or Cannabix"), a developer of marijuana breathalyzer devices for law enforcement and the workplace, has entered into an agreement with the Warren County, Pennsylvania, District Attorney's office to pilot the Company's technology for detection of 9-tetrahydrocannabinol ("THC") and in human breath. THC in breath samples will be collected and confirmed using the Company's proprietary breath capture and laboratory-based marijuana detection equipment. Cannabix intends to supply Warren police with two handheld Breath Collection Units (BCU) before the end of the year, and such devices will be used in Warren County at the discretion of its police force for up to three months or longer. The report includes both global players and local market holdings in each country. This report provides an in-depth and insightful industry outlook based on the market structure by country, including market holdings by market leaders, market followers, and local players. The report examined mergers and acquisitions, strategic alliances, joint ventures, and partnerships in the market by region, investment, and strategic intent.

Roadside Drug Testing Devices Market Dynamics:

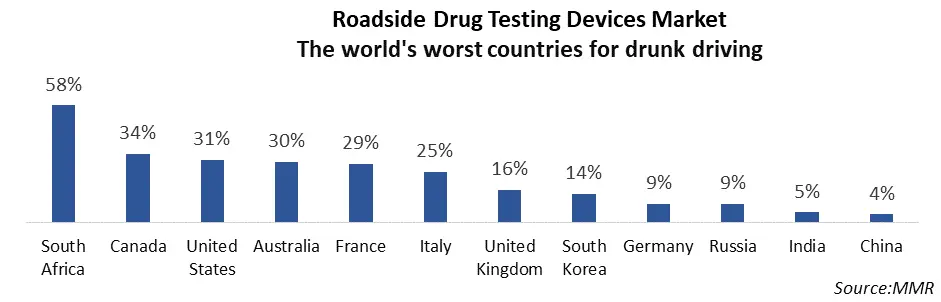

Roadside Drug Testing Devices Market Drivers Increasing number of road accidents to Boost Roadside Drug Testing Devices Market Growth The global increase in drink and drive incidents is fueling the growth of the roadside drug testing devices market. Drinking and driving cases were 43% in 2022 and are expected to rise to 63% in 2029. The cases have been brought forward as a result of increased the number of late-night parties and pubs, as well as the number of young people’s increased alcohol consumption. According to a 2021 report by the National Institute on Alcohol Abuse and Alcoholism, 11,252 people died as a result of drunk driving. The alarming rise in the prevalence of death from drunk driving is a primary factor driving the market growth. According to the World Health Organization (WHO), increased dependence on psychoactive drugs increases the risk of road accidents. For example, those who have used amphetamines are about five times more likely to be killed in a car accident than those who have not. Additionally, in high-income countries, approximately 20% of injured drivers have elevated blood alcohol levels. As a result, there is an increase in demand for breath analyzers, which is driving the roadside drug testing devices market growth. Significant government funding for the deployment of breath analyzers to control alcohol and drug abuse is expected to drive demand for breath analyzers. Furthermore, the global adoption of breath analyzers by police and other law enforcement agencies boosting the market forward.

Roadside Drug Testing Devices Market Restraints

Inaccurate results by the device are hampering the market growth Concerns about the effectiveness and efficiency of roadside drug testing devices have grown in recent years. For example, in a study involving over 330 Norwegian drivers who were tested for impairment using both the oral device and a blood sample, it was discovered that the ratio of false-positive results generated by the device to blood sample findings was 16.5% for cannabis and 88.3% for cocaine. Inaccurate results (false-positive or false-negative results) associated with roadside drug testing devices are expected to limit the roadside drug testing devices market during the forecast period. Roadside Drug Testing Devices Market Opportunity New technology to help in roadside drug testing devices Two devices in development make presumptive drug testing as simple as alcohol testing with a preliminary breath tester. Intelligent Fingerprinting, a spin-off company from the University of East Anglia in the United Kingdom, developed the technology. It looks for metabolites of cannabis, cocaine, and opiates in perspiration contained in a latent fingerprint. A metabolite is a substance formed in the body when a drug is broken down or metabolized. The researchers believe it can be modified to detect other drugs such as methamphetamine and MDMA (ecstasy). The detection method involves coating the fingerprint in an antibody-covered particle microfluidic solution. The solution changes color when the antibodies bind to the drug or drug metabolites. A second antibody fluoresces, allowing for the detection of very low levels of drugs or metabolites. Antibodies are dormant particles that become active when they come into contact with the substances to which they are sensitive. Intelligent Fingerprinting is already using technology to replace urinalysis in the detection of drug use. Within six months, the company believes it can produce a handheld device. These recent advances in the roadside drug testing devices market are expected to boost the business during the forecast period Nanoparticles and microbeads: The other device in development is from Philips and will use a different technology developed by the US Navy (your tax dollars at work). The Naval Research Laboratory in Washington, DC developed magnetic nanoparticles known as microbeads that could bind to biological warfare agents such as anthrax and ricin. The microbeads are then scanned for using giant magnetoresistant (GMR) sensors similar to those found in computer hard drives. Philips extended this research by employing an optical (rather than a magnetic) sensor that operates on an odd-sounding process known as frustrated total internal reflection, or FTIR. Philips has a lot of experience with optical sensors because they made some of the first CD drives. Magnotech is the name Philips has given to its new biosensor technology. New advancements made by the market players are boosting the roadside drug testing devices market and are expected to do the same during the forecast period.Roadside Drug Testing Devices Market Segment Analysis:

Based on Type, The Roadside Drug Testing Devices Market is divided into saliva, breath, and other sample types. The breath segment dominated the market in the year 2022. The most common sample used to identify alcohol is breath. The most commonly abused substance among drivers is alcohol. Manufacturers focus on creating quick tests that, when compared to lab tests, provide shorter results, are easy to use, and are less expensive. The saliva segment is expected to grow the fastest during the forecast period. Roadside oral fluid or saliva testing is commonly used in many countries to detect the presence of narcotics. MMR analyzed that the breath tester equipment is used by the traffic police by about 48% in 2022.Based on the Substance, the market is divided into drugs and alcohol. The alcohol segment dominated the roadside drug testing devices market with 48 % of the market share in the year 2022 and is expected to the same during the forecast period. This is due to the fact that alcohol is the most commonly abused substance among drivers. Because of rising alcohol consumption and an increase in the number of drunk driving incidents, the global market for roadside drug testing equipment is growing faster than average. Moreover, the growing impact of alcohol abuse on public health and the licensing of roadside drug testing equipment contribute to the global market's growth.

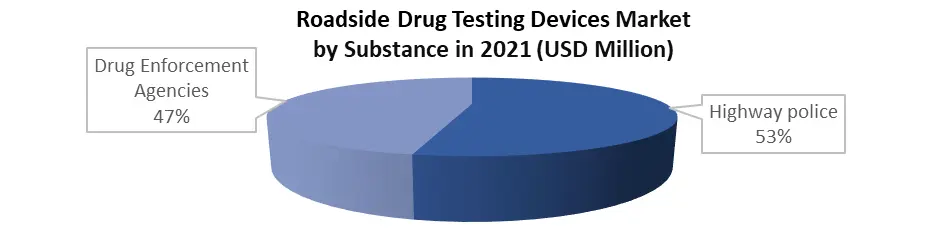

Based on the End-User, the highway police segment dominated the roadside drug testing devices market in the year 2022, because of the increasing number of driving motor vehicles under the influence of alcohol & drugs. The number of motor vehicle buyers also increased compared to 2019 buyers there were 38% of buyers and in the year 2022, there were about 53% of motor vehicle buyers. The highway police detected that 23% of the motor vehicle buyers were driving in alcoholic conditions and also in drug-addicted conditions. Moreover, The highway pol ice collected 63% of the fine from drunk and driving people.

Roadside Drug Testing Devices Market Regional Insights:

North America dominated the roadside drug testing devices market in the year 2022 with 48% of the market share. The majority of the market was contributed by an increase in late-night pubs and drinking bars in Canada. An increase in late-night parties for entertainment contributes to drink-related accidents and increases demand for drug-detection devices at the roadside. East and South Asia are expected to be the second-largest markets for roadside drug testing devices after the United States. The changing lifestyle and late-night working hours that encourage drinking and driving are expected to increase demand for roadside drug testing devices in the region. Moreover, improved and more vigilant roadside drug testing law enforcement agencies are expected to fuel regional sales of roadside drug testing devices. Europe is expected to contribute significantly to the roadside drug testing devices market share due to its growing student union clubs and night pubs. Moreover, the growing preference for weekend club parties among new-generation youths, as well as the adoption of western culture, is expected to increase sales of roadside drug testing devices in European countries. Mexico and Brazil, the world's largest drug trafficking markets, are expected to be the major revenue-generating countries in America for the global roadside drug testing market, followed by the Middle East and Africa. MEA roadside drug testing devices market share growth is hampered by the region's high poverty and religious influence, which prohibits the majority of the population from consuming alcoholic beverages.Roadside Drug Testing Devices Market Scope: Inquiry Before Buying

Roadside Drug Testing Devices Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US$ 468.91 Mn. Forecast Period 2023 to 2029 CAGR: 6.5% Market Size in 2029: US$ 728.69 Mn. Segments Covered: by Sample Type 1. Saliva 2. Breath 3. Others by Substance 1. Alcohol 2. Drugs by End-User 1. Highway Police 2. Drug Enforcement Agencies Roadside Drug Testing Devices Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Roadside Drug Testing Devices Market, Key Players are

1. Drägerwerk AG & Co. KgaA (Germany) 2. AK GlobalTech Corporation (US) 3. Alcohol Countermeasure Systems Corp. (Canada) 4. Cannabix Technologies Inc (Canada) 5. Intelligent Fingerprinting (UK) 6. Lifeloc Technologies (US) 7. Abbott Laboratories (US) 8. Oranoxis Inc. (US) 9. CareHealth America (US) 10. MAVAND Solutions GmbH (Germany) 11. Pacific Data Systems Pty Ltd (Australia) 12. UriTox, LLC (US) 13. Agilent Technologies (US) 14. Bio-Rad Laboratories (US) 15. Clinical Reference Laboratory (CRL) (US) 16. Cordant Health (US) 17. LabCorp (US) 18. Legacy Medical Services (US) 19. Omega Laboratories (US) 20. Quest Diagnostics (US) 21. Quidel (US) 22. Roche (Switzerland) 23. Philips (Netherlands) 24. Siemens Healthineers (Germany) 25. Thermo Fisher Scientific (US) Frequently Asked Questions: 1] What segments are covered in the Global Market report? Ans. The segments covered in the Roadside Drug Testing Devices Market report are based on Sample Type, Substance, End-User, and Region. 2] Which region is expected to hold the highest share in the Global Market? Ans. The North America region is expected to hold the highest share of the Roadside Drug Testing Devices Market. 3] What is the market size of the Global Market by 2029? Ans. The market size of the Roadside Drug Testing Devices Market by 2029 is expected to reach US$ 728.69 Mn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Roadside Drug Testing Devices Market is 2023-2029. 5] What was the market size of the Global Market in 2022? Ans. The market size of the Market in 2022 was valued at US$ 468.91 Mn.

1. Global Roadside Drug Testing Devices Market Size: Research Methodology 2. Global Roadside Drug Testing Devices Market Size: Executive Summary 2.1. Market Overview and Definitions 2.1.1. Introduction to Global Roadside Drug Testing Devices Market Size 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Roadside Drug Testing Devices Market Size: Competitive Analysis 3.1. MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2. Consolidation in the Market 3.2.1 M&A by region 3.3. Key Developments by Companies 3.4. Market Drivers 3.5. Market Restraints 3.6. Market Opportunities 3.7. Market Challenges 3.8. Market Dynamics 3.9. PORTERS Five Forces Analysis 3.10. PESTLE 3.11. Regulatory Landscape by region • North America • Europe • Asia Pacific • Middle East and Africa • South America 3.12. COVID-19 Impact 4. Global Roadside Drug Testing Devices Market Size Segmentation 4.1. Global Roadside Drug Testing Devices Market Size, by Sample Type (2022-2029) • Saliva • Breath • Others 4.2. Global Roadside Drug Testing Devices Market Size, by Substance (2022-2029) • Alcohol • Drugs 4.3. Global Roadside Drug Testing Devices Market Size, by End-User (2022-2029) • Highway Police • Drug Enforcement Agencies 5. North America Roadside Drug Testing Devices Market (2022-2029) 5.1. North America Roadside Drug Testing Devices Market Size, by Sample Type (2022-2029) • Saliva • Breath • Others 5.2. North America Roadside Drug Testing Devices Market Size, by Substance (2022-2029) • Alcohol • Drugs 5.3. North America Roadside Drug Testing Devices Market Size, by End-User (2022-2029) • Highway Police • Drug Enforcement Agencies 5.4. North America Semiconductor Memory Market, by Country (2022-2029) • United States • Canada • Mexico 6. European Roadside Drug Testing Devices Market (2022-2029) 6.1. European Roadside Drug Testing Devices Market, by Sample Type (2022-2029) 6.2. European Roadside Drug Testing Devices Market, by Substance (2022-2029) 6.3. European Roadside Drug Testing Devices Market, by End-User (2022-2029) 6.4. European Roadside Drug Testing Devices Market, by Country (2022-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Roadside Drug Testing Devices Market (2022-2029) 7.1. Asia Pacific Roadside Drug Testing Devices Market, by Sample Type (2022-2029) 7.2. Asia Pacific Roadside Drug Testing Devices Market, by Substance (2022-2029) 7.3. Asia Pacific Roadside Drug Testing Devices Market, by End-User (2022-2029) 7.4. Asia Pacific Roadside Drug Testing Devices Market, by Country (2022-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Roadside Drug Testing Devices Market (2022-2029) 8.1. Middle East and Africa Roadside Drug Testing Devices Market, by Sample Type (2022-2029) 8.2. Middle East and Africa Roadside Drug Testing Devices Market, by Substance (2022-2029) 8.3. Middle East and Africa Roadside Drug Testing Devices Market, by End-User (2022-2029) 8.4. Middle East and Africa Roadside Drug Testing Devices Market, by Country (2022-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Roadside Drug Testing Devices Market (2022-2029) 9.1. South America Roadside Drug Testing Devices Market, by Sample Type (2022-2029) 9.2. South America Roadside Drug Testing Devices Market, by Substance (2022-2029) 9.3. South America Roadside Drug Testing Devices Market, by End-User (2022-2029) 9.4. South America Roadside Drug Testing Devices Market, by Country (2022-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1. Drägerwerk AG & Co. KgaA (Germany) 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2. AK GlobalTech Corporation (US) 10.3. Alcohol Countermeasure Systems Corp. (Canada) 10.4. Cannabix Technologies Inc (Canada) 10.5. Intelligent Fingerprinting (UK) 10.6. Lifeloc Technologies (US) 10.7. Abbott Laboratories (US) 10.8. Oranoxis Inc. (US) 10.9. CareHealth America (US) 10.10. MAVAND Solutions GmbH (Germany) 10.11. Pacific Data Systems Pty Ltd (Australia) 10.12. UriTox, LLC (US) 10.13. Agilent Technologies (US) 10.14. Bio-Rad Laboratories (US) 10.15. Clinical Reference Laboratory (CRL) (US) 10.16. Cordant Health (US) 10.17. LabCorp (US) 10.18. Legacy Medical Services (US) 10.19. Omega Laboratories (US) 10.20. Quest Diagnostics (US) 10.21. Quidel (US) 10.22. Roche (Switzerland) 10.23. Philips (Netherlands) 10.24. Siemens Healthineers (Germany) 10.25. Thermo Fisher Scientific (US)