Road Assistance Insurance Market size was valued at USD 6.30 Bn. in 2022 and the total Road Assistance Insurance revenue is expected to grow at a CAGR of 10.3% from 2023 to 2029, reaching nearly USD 12.51 Bn. To remain competitive, Aftersales services are widely offered by auto manufacturers and its gaining popularity among end-users. Road assistance insurance services are one of the aftersales services given for vehicles to assist in the incidences such as vehicle crashes, damages, and breakdowns. Organizations provide road assistance services 24*7 for a year to their customers. According to analysis, approximately 69 million breakdowns happen on America's roadways each year. In addition, increasing sales of premium vehicles, the adoption of personal vehicles, long-route vocational trips, etc. increased the demand for road assistance insurance services, thereby driving the road assistance insurance market growth.To know about the Research Methodology :- Request Free Sample Report

Road Assistance Insurance Market Dynamics:

Increasing frequency of road crashes and the need for security and safety concerns According to the analysis, approximately 1.3 million people die each year as a result of road traffic crashes. Approximately, 3,700 people are killed all around the world in road crashes involving cars, buses, motorcycles, bicycles, trucks, or pedestrians. Crash injuries are estimated to be the eighth leading cause of death globally for all age groups and the leading cause of death for children and young people 5–29 years of age. In addition, with the increased cruising activities, like traveling using an automobile to tourist spots and adventure rides, the demand for road assistance insurance services for security and safety purposes is expected to increase significantly thereby driving the road assistance insurance market growth. Road assistance insurance services are critical to ensuring the safety and security of motorists and vehicle drivers, and they may be provided to customers 24 hours a day, 365 days a year. If a car breaks down or is involved in a road accident, road assistance insurance may usually fix the problem on the spot and cover the costs. Additionally, in the event of a catastrophic collision in which the issue cannot be remedied on the spot, road assistance insurance services ensure that the car arrives at its intended destination, such as a vehicle repair shop, towing, or other similar services. These benefits drive the demand for road assistance insurance services. Growing preferences for hybrid and electric vehicles Growing preferences for hybrid and electric vehicles all across the world are expected to offer lucrative growth opportunities for market players. To minimize carbon emissions, governments have taken initiatives such as providing subsidies and tax breaks to encourage the usage of hybrid and electric vehicles. In addition, Demand for hybrid vehicles is increasing in developing countries such as Brazil, India, and Mexico due to strict emission regulatory rules and a growing need for low or zero-emission vehicles. As a result, hybrid and electric vehicle sales have increased, necessitating the growth of vehicle roadside help services. In addition, connected automobiles create a large amount of data that may be used to get insights such as current vehicle position, real-time operating status, and other critical vehicle usage information. This allows the firm to determine the reason for the breakdown and provide prompt car roadside service. Additionally, the data supplied by connected cars assists the organization in quickly resolving the vehicle breakdown problem. Thus, these factor is expected to provide lucrative opportunities for the road assistance insurance market to grow during the forecast period. Expensive Insurance Premiums, Operational Costs Expensive insurance premiums, high costs of operational costs, and towing services are all factors expected to restrain the road assistance insurance market growth. The demand for roadside services is growing, owing to the rise in both vehicle miles traveled and average vehicle age climb to all-time highs. However, the expensive services and high cost of service renewables are expected to lower the customer’s preferences towards services. Insurance of vehicles in developing countries such as India, China, etc. is helping to narrow the gap between insurance companies and customers. But, mandatory renewables, and premium charges for the services are expected to hamper the market growth.Road Assistance Insurance Market Segment Analysis:

Based on Vehicle Type, the global road assistance insurance market is segmented into passenger vehicles and commercial vehicles. The passenger vehicles segment dominated the market with the highest market share of 82% in 2022 and is expected to maintain its dominance by 2029. Multiple passenger car manufacturers provided road assistance insurance services free of cost during their warranty period. As a result, increasing sales of passenger cars are expected to drive segment growth during the forecast period. In addition, various motor insurance providers also cover roadside assistance services in their insurance plan on pay per usage.Credit card companies and motor insurance companies are increasingly adopting road assistance insurance services for passenger cars as well as additional coverage services such as towing, tire replacement, fuel delivery, etc. In addition, increasing sales of new generation connected cars is expected to positively benefit the segment growth. The commercial vehicles segment is expected to grow at a CAGR of 8.5% during the forecast period. The increased need for long-haul roadside assistance services in the logistics and trucking industries is expected to drive segment growth. Hundreds of breakdown incidences happen in a day. The majority of service providers are providing customized emergency assistance for commercial vehicles. This factor is expected to benefit the segment growth during the forecast period. Based on Coverage, the Towing segment held the largest market share of 38% and dominated the global road assistance insurance market in 2022. The segment is expected to grow at a CAGR of 10.4% during the forecast period and maintain its dominance by 2029. Towing is the act of pulling a vehicle behind another vehicle. Towing is the most basic service required for the breakdown of vehicles. As a result, increasing road accidents in developed countries are expected to drive segment growth. In addition, increasing brake failure occurrence, and technical damage to components within the automobile such as a dead battery, tire failure, bad ignition switch, etc. increased the demand for towing services. Based on the distribution channel, the auto manufacturers segment dominated the global road assistance insurance market with the highest market share of 32% in 2022. The segment is expected to grow at a CAGR of 10.6% during the forecast period. The increasing adoption of strategies of automakers to give aftersales services to help customers through free warranties is expected to drive the segment growth throughout the forecast period. Besides that, an increase in passenger car sales due to rising living standards, congested public transportation, and the availability of financing services for vehicle purchases are further factors expected to support the segment's growth. The Motor insurance providers segment is expected to grow at a significant CAGR and offer lucrative growth prospects for market players during the forecast period. Car accidents can be expensive, especially if the vehicle is badly damaged. Thus, motor insurance providers play a major role in the market. The insurance providers provide the plans for multiple years and the plans can extend as per the requirements. As a result, consumers rely on motor insurance providers for help. This factor is expected to drive the road assistance insurance market growth.

Regional Insights:

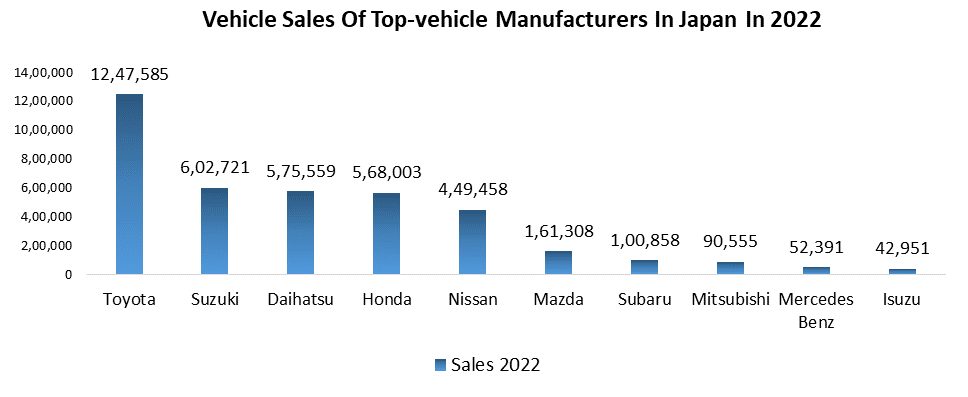

Europe dominated the global road assistance insurance market with the highest market share of 36.5% in 2022. The region is expected to grow at a CAGR of 10.8% and maintain its dominance by 2029. Increased per capita income has enabled the population to spend more on luxury products. As a result, changing consumer preferences for quality products, and a high standard of living have increased sales of premium vehicles in the region. As a result, increased vehicle sales benefited the regional market growth. Europe's new-car sales rose 11% to 911,064 in January 2023, the sixth consecutive month of growth, led by robust growth in Spain and Italy, as supply issues ease and fuel hopes for a post-pandemic rebound. United Kingdom automotive vehicle sales rise by 26% in February 2023, helped by electric vehicle demand. German registrations rose 2.8% in February as demand for EVs recovered. In addition, increasing awareness regarding road assistance services due to their advantages and rapid service is further expected to support regional road assistance insurance market growth. Asia-Pacific region is expected to grow at a CAGR of 11.3% during the forecast period and offer lucrative growth potentials for the market players. Rising demand for personal vehicles due to increased standard of living, and changing consumer preferences are expected to increase vehicle density in emerging countries. Increasing road crash incidence, traffic congestion coupled with human error while driving are expected to increase the chances of vehicle collisions. This, in turn, is expected to boost the road assistance insurance service demand, thereby driving the road assistance insurance market growth. ASEAN has become a dominant player in the automotive industry. Automotive exports from ASEAN have increased significantly over the past decade, partly due to an expanding middle-class population within the region. Technological innovation in the automotive sector has led to multiple sales of automobiles. Thus, aftermarket services provided by manufacturers to maintain brand loyalty among consumers are further expected to support the road assistance insurance industry growth during the forecast period. China, Japan, and India are expected to offer the highest growth opportunities for the market players. Rising middle-class income and a huge youth population are expected to result in strong demand for personal automotive and aftermarket services. Increasing production and sales of automotive vehicles in these countries are expected to support the road assistance insurance market during the forecast period. According to the MMR analysis, In October 2022, the total production of passenger vehicles, three-wheelers, two-wheelers, and quadricycles was 2,191,090 units in India. Chinese carmakers produced 27.02 million units in 2022, up by 3.4% year on year, while sales rose by 2.1% to 26.86 million units. While in Japan, 4,201,321 new cars in total were sold in the country in 2022.

Road Assistance Insurance Market Scope: Inquiry Before Buying

Road Assistance Insurance Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 6.30 Bn. Forecast Period 2023 to 2029 CAGR: 10.3% Market Size in 2029: US $ 12.51 Bn. Segments Covered: by Vehicle Type 1. Passenger Vehicle 2. Commercial Vehicle by Coverage 1. Towing 2. Jump Start/Pull Start 3. Lockout/Replacement Key Service 4. Flat Tire 5. Fuel Delivery 6. Others Distribution Channel 1. Independent Agents/Brokers 2. Auto Manufacturer 3. Motor Insurance providers 4. Independent Warranty 5. Automotive Club 6.Others (Direct Response, Banks) Road Assistance Insurance Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Market, Key Players are :

1. Good Sam Enterprise LLC. (Illinois, United States) 2. Auto Vantage (Connecticut, United States) 3. Best Roadside Service (Texas, United States) 4. Falck A/S (Denmark, Europe) 5. Roadside Transportation LLC. (Florida, United States) 6. DBA, Agero, Inc. (The Cross Country Group) (Florida, United States) 7. Allstate Insurance Company (San Francisco, United States) 8. Agero, Inc., (Massachusetts, United States) 9. American Express Company (New York, United States) 10. Erie Indemnity Co. (Pennsylvania, United States) 11. GEICO, USAA (Maryland, United States) 12. IFFCO-Tokio General Insurance Company Limited (India) 13. Progressive Casualty Insurance Company (Ohio, Unites States) 14. Nationwide Mutual Insurance Company (Ohio, Unites States) 15. Viking Assistance Group (Norway, Europe) 16. Access Roadside Assistance (Canada) 17. Paragom Motorclub (Texas, United States) 18. Roadside Masters (Florida, United States) 19. ARC Europe SA, (Belgium, Europe) 20. Agero, Inc., (Massachusetts, United States) 21. Allianz Global Assistance (Germany, Europe) 22. ASSURANT, INC. (New York, United States) 23. GM Motor Club (Michigan, United States) 24. National Motor Club (Texas, United States) 25. SO S International A / S (London, United Kingdom) FAQs: 1. What are the growth drivers for the Road Assistance Insurance market? Ans. The increasing sales of premium vehicles need safety and security concerns, and the rising trend of personal vehicles is expected to be the major driver for the Road Assistance Insurance market. 2. What is the major restraint for the Road Assistance Insurance market growth? Ans. Expensive Insurance Premiums, Operational Costs are expected to be the major restraining factor for the Road Assistance Insurance market growth. 3. Which region is expected to lead the global Road Assistance Insurance market during the forecast period? Ans. Europe is expected to lead the global road assistance insurance market during the forecast period. 4. What is the projected market size & growth rate of the Road Assistance Insurance Market? Ans. The Road Assistance Insurance Market size was valued at USD 6.30 Bn. in 2022 and the total Road Assistance Insurance revenue is expected to grow at a CAGR of 10.3% from 2023 to 2029, reaching nearly USD 12.51 Bn. 5. What segments are covered in the Road Assistance Insurance Market report? Ans. The segments covered in the Road Assistance Insurance market report are Vehicle Type, Coverage, Distribution Channel, and Region.

1. Road Assistance Insurance Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Road Assistance Insurance Market: Dynamics 2.1. Road Assistance Insurance Market Trends by Region 2.1.1. North America Road Assistance Insurance Market Trends 2.1.2. Europe Road Assistance Insurance Market Trends 2.1.3. Asia Pacific Road Assistance Insurance Market Trends 2.1.4. Middle East and Africa Road Assistance Insurance Market Trends 2.1.5. South America Road Assistance Insurance Market Trends 2.2. Road Assistance Insurance Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Road Assistance Insurance Market Drivers 2.2.1.2. North America Road Assistance Insurance Market Restraints 2.2.1.3. North America Road Assistance Insurance Market Opportunities 2.2.1.4. North America Road Assistance Insurance Market Challenges 2.2.2. Europe 2.2.2.1. Europe Road Assistance Insurance Market Drivers 2.2.2.2. Europe Road Assistance Insurance Market Restraints 2.2.2.3. Europe Road Assistance Insurance Market Opportunities 2.2.2.4. Europe Road Assistance Insurance Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Road Assistance Insurance Market Drivers 2.2.3.2. Asia Pacific Road Assistance Insurance Market Restraints 2.2.3.3. Asia Pacific Road Assistance Insurance Market Opportunities 2.2.3.4. Asia Pacific Road Assistance Insurance Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Road Assistance Insurance Market Drivers 2.2.4.2. Middle East and Africa Road Assistance Insurance Market Restraints 2.2.4.3. Middle East and Africa Road Assistance Insurance Market Opportunities 2.2.4.4. Middle East and Africa Road Assistance Insurance Market Challenges 2.2.5. South America 2.2.5.1. South America Road Assistance Insurance Market Drivers 2.2.5.2. South America Road Assistance Insurance Market Restraints 2.2.5.3. South America Road Assistance Insurance Market Opportunities 2.2.5.4. South America Road Assistance Insurance Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Road Assistance Insurance Industry 2.8. Analysis of Government Schemes and Initiatives For Road Assistance Insurance Industry 2.9. Road Assistance Insurance Market Trade Analysis 2.10. The Global Pandemic Impact on Road Assistance Insurance Market 3. Road Assistance Insurance Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 3.1.1. Passenger Vehicle 3.1.2. Commercial Vehicle 3.2. Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 3.2.1. Towing 3.2.2. Jump Start/Pull Start 3.2.3. Lockout/Replacement Key Service 3.2.4. Flat Tire 3.2.5. Fuel Delivery 3.2.6. Others 3.3. Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 3.3.1. Independent Agents/Brokers 3.3.2. Auto Manufacturer 3.3.3. Motor Insurance providers 3.3.4. Independent Warranty 3.3.5. Automotive Club 3.3.6. Others (Direct Response, Banks) 3.4. Road Assistance Insurance Market Size and Forecast, by Region (2022-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Road Assistance Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 4.1.1. Passenger Vehicle 4.1.2. Commercial Vehicle 4.2. North America Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 4.2.1. Towing 4.2.2. Jump Start/Pull Start 4.2.3. Lockout/Replacement Key Service 4.2.4. Flat Tire 4.2.5. Fuel Delivery 4.2.6. Others 4.3. North America Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 4.3.1. Independent Agents/Brokers 4.3.2. Auto Manufacturer 4.3.3. Motor Insurance providers 4.3.4. Independent Warranty 4.3.5. Automotive Club 4.3.6. Others (Direct Response, Banks) 4.4. North America Road Assistance Insurance Market Size and Forecast, by Country (2022-2029) 4.4.1. United States 4.4.1.1. United States Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 4.4.1.1.1. Passenger Vehicle 4.4.1.1.2. Commercial Vehicle 4.4.1.2. United States Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 4.4.1.2.1. Towing 4.4.1.2.2. Jump Start/Pull Start 4.4.1.2.3. Lockout/Replacement Key Service 4.4.1.2.4. Flat Tire 4.4.1.2.5. Fuel Delivery 4.4.1.2.6. Others 4.4.1.3. United States Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1.3.1. Independent Agents/Brokers 4.4.1.3.2. Auto Manufacturer 4.4.1.3.3. Motor Insurance providers 4.4.1.3.4. Independent Warranty 4.4.1.3.5. Automotive Club 4.4.1.3.6. Others (Direct Response, Banks) 4.4.2. Canada 4.4.2.1. Canada Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 4.4.2.1.1. Passenger Vehicle 4.4.2.1.2. Commercial Vehicle 4.4.2.2. Canada Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 4.4.2.2.1. Towing 4.4.2.2.2. Jump Start/Pull Start 4.4.2.2.3. Lockout/Replacement Key Service 4.4.2.2.4. Flat Tire 4.4.2.2.5. Fuel Delivery 4.4.2.2.6. Others 4.4.2.3. Canada Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.2.3.1. Independent Agents/Brokers 4.4.2.3.2. Auto Manufacturer 4.4.2.3.3. Motor Insurance providers 4.4.2.3.4. Independent Warranty 4.4.2.3.5. Automotive Club 4.4.2.3.6. Others (Direct Response, Banks) 4.4.3. Mexico 4.4.3.1. Mexico Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 4.4.3.1.1. Passenger Vehicle 4.4.3.1.2. Commercial Vehicle 4.4.3.2. Mexico Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 4.4.3.2.1. Towing 4.4.3.2.2. Jump Start/Pull Start 4.4.3.2.3. Lockout/Replacement Key Service 4.4.3.2.4. Flat Tire 4.4.3.2.5. Fuel Delivery 4.4.3.2.6. Others 4.4.3.3. Mexico Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.3.3.1. Independent Agents/Brokers 4.4.3.3.2. Auto Manufacturer 4.4.3.3.3. Motor Insurance providers 4.4.3.3.4. Independent Warranty 4.4.3.3.5. Automotive Club 4.4.3.3.6. Others (Direct Response, Banks) 5. Europe Road Assistance Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 5.2. Europe Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 5.3. Europe Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.4. Europe Road Assistance Insurance Market Size and Forecast, by Country (2022-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.1.2. United Kingdom Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 5.4.1.3. United Kingdom Road Assistance Insurance Market Size and Forecast, by Distribution Channel(2022-2029) 5.4.2. France 5.4.2.1. France Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.2.2. France Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 5.4.2.3. France Road Assistance Insurance Market Size and Forecast, by Distribution Channel(2022-2029) 5.4.3. Germany 5.4.3.1. Germany Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.3.2. Germany Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 5.4.3.3. Germany Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.4. Italy 5.4.4.1. Italy Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.4.2. Italy Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 5.4.4.3. Italy Road Assistance Insurance Market Size and Forecast, by Distribution Channel(2022-2029) 5.4.5. Spain 5.4.5.1. Spain Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.5.2. Spain Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 5.4.5.3. Spain Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.6. Sweden 5.4.6.1. Sweden Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.6.2. Sweden Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 5.4.6.3. Sweden Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.7. Austria 5.4.7.1. Austria Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.7.2. Austria Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 5.4.7.3. Austria Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 5.4.8.2. Rest of Europe Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 5.4.8.3. Rest of Europe Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Road Assistance Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 6.2. Asia Pacific Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 6.3. Asia Pacific Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4. Asia Pacific Road Assistance Insurance Market Size and Forecast, by Country (2022-2029) 6.4.1. China 6.4.1.1. China Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.1.2. China Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 6.4.1.3. China Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.2. S Korea 6.4.2.1. S Korea Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.2.2. S Korea Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 6.4.2.3. S Korea Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.3. Japan 6.4.3.1. Japan Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.3.2. Japan Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 6.4.3.3. Japan Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.4. India 6.4.4.1. India Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.4.2. India Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 6.4.4.3. India Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.5. Australia 6.4.5.1. Australia Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.5.2. Australia Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 6.4.5.3. Australia Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.6.2. Indonesia Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 6.4.6.3. Indonesia Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.7.2. Malaysia Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 6.4.7.3. Malaysia Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.8.2. Vietnam Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 6.4.8.3. Vietnam Road Assistance Insurance Market Size and Forecast, by Distribution Channel(2022-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.9.2. Taiwan Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 6.4.9.3. Taiwan Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 6.4.10.2. Rest of Asia Pacific Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 6.4.10.3. Rest of Asia Pacific Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Road Assistance Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 7.2. Middle East and Africa Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 7.3. Middle East and Africa Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 7.4. Middle East and Africa Road Assistance Insurance Market Size and Forecast, by Country (2022-2029) 7.4.1. South Africa 7.4.1.1. South Africa Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 7.4.1.2. South Africa Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 7.4.1.3. South Africa Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.2. GCC 7.4.2.1. GCC Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 7.4.2.2. GCC Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 7.4.2.3. GCC Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 7.4.3.2. Nigeria Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 7.4.3.3. Nigeria Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 7.4.4.2. Rest of ME&A Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 7.4.4.3. Rest of ME&A Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Road Assistance Insurance Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 8.2. South America Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 8.3. South America Road Assistance Insurance Market Size and Forecast, by Distribution Channel(2022-2029) 8.4. South America Road Assistance Insurance Market Size and Forecast, by Country (2022-2029) 8.4.1. Brazil 8.4.1.1. Brazil Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 8.4.1.2. Brazil Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 8.4.1.3. Brazil Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.2. Argentina 8.4.2.1. Argentina Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 8.4.2.2. Argentina Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 8.4.2.3. Argentina Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Road Assistance Insurance Market Size and Forecast, by Vehicle Type (2022-2029) 8.4.3.2. Rest Of South America Road Assistance Insurance Market Size and Forecast, by Coverage (2022-2029) 8.4.3.3. Rest Of South America Road Assistance Insurance Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Road Assistance Insurance Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Road Assistance Insurance Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Good Sam Enterprise LLC. (Illinois, United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Auto Vantage (Connecticut, United States) 10.3. Best Roadside Service (Texas, United States) 10.4. Falck A/S (Denmark, Europe) 10.5. Roadside Transportation LLC. (Florida, United States) 10.6. DBA, Agero, Inc. (The Cross Country Group) (Florida, United States) 10.7. Allstate Insurance Company (San Francisco, United States) 10.8. Agero, Inc., (Massachusetts, United States) 10.9. American Express Company (New York, United States) 10.10. Erie Indemnity Co. (Pennsylvania, United States) 10.11. GEICO, USAA (Maryland, United States) 10.12. IFFCO-Tokio General Insurance Company Limited (India) 10.13. Progressive Casualty Insurance Company (Ohio, Unites States) 10.14. Nationwide Mutual Insurance Company (Ohio, Unites States) 10.15. Viking Assistance Group (Norway, Europe) 10.16. Access Roadside Assistance (Canada) 10.17. Paragom Motorclub (Texas, United States) 10.18. Roadside Masters (Florida, United States) 10.19. ARC Europe SA, (Belgium, Europe) 10.20. Agero, Inc., (Massachusetts, United States) 10.21. Allianz Global Assistance (Germany, Europe) 10.22. ASSURANT, INC. (New York, United States) 10.23. GM Motor Club (Michigan, United States) 10.24. National Motor Club (Texas, United States) 10.25. SO S International A / S (London, United Kingdom) 11. Key Findings 12. Industry Recommendations 13. Road Assistance Insurance Market: Research Methodology 14. Terms and Glossary