The Rigid Packaging Market size is valued at USD 212.4 Billion in 2022 and is forecast to grow at a CAGR of 5.7% from 2023 to 2029, reaching nearly USD 313.5 Billion. The Rigid Packaging Market includes the production and supply of packaging materials with a substantial structure designed to safeguard the contents they enclose. It caters to various industries including food and beverages, pharmaceuticals, personal care products, household chemicals and industrial goods. Rigid packaging utilizes materials like plastic, metal, glass and paperboard to manufacture containers, boxes and other packaging solutions. Plastic is the most prevalent material due to its versatility and affordability while metal and glass offer durability and premium quality. Rigid packaging serves multiple purposes such as preserving freshness, ensuring product safety and enhancing brand visibility. Packaging innovations like active and intelligent packaging are offering features such as extended shelf life and interactive elements. The rigid packaging market continues to evolve to meet consumer demands, environmental considerations and industry specific requirements. Asia Pacific is leading region in the global Rigid Packaging industry with a share of 43.7% in 2022 and is forecasted to have continuous growth in the period from 2023-2029.To know about the Research Methodology :- Request Free Sample Report

Rigid Packaging Market Dynamics

Rigid Packaging Market Drivers Consumer Demand, Product Protection, Sustainability, E-commerce Expansion, Branding, Technology and Regulatory Compliance The Rigid Packaging market is influenced by various drivers that propel its growth and advancement. Evolving demands of consumers who are seeking packaging that is convenient, visually appealing and user-friendly. Need for product protection and safety as rigid packaging plays a vital role in preserving the quality and integrity of goods during storage, transportation and handling. The market is strongly influenced by sustainability concerns with a growing emphasis on eco-friendly materials and recyclability. The growth of e-commerce has also fueled the demand for robust and protective packaging solutions. Branding and shelf appeal are driving the adoption of attractive and differentiated rigid packaging while technological advancements such as active and intelligent packaging are creating new opportunities. Regulatory compliance is another driver as manufacturers and brands must meet safety, labeling and environmental requirements. Rigid Packaging Market Opportunities Sustainability, Customization, E-commerce, Lightweight Materials, Intelligent Packaging, Emerging Markets, Collaboration and Premium Solutions The rigid packaging market offers various opportunities for growth and evolution. These opportunities stem from trends, consumer needs, technological progress and market dynamics. Key prospects include the development of sustainable packaging solutions through the use of recyclable materials and innovative recycling technologies. Customization and personalization options caters to consumers seeking unique experiences. The e-commerce sector offers potential for packaging optimized for online retail such as secure sealing and easy-open features. Lightweight materials and intelligent packaging solutions present cost savings and enhanced functionality. Emerging markets provide avenues for growth while collaborations and partnerships foster innovation and market reach. Premium and luxury packaging offer opportunities to meet the demands of high-end consumers. Rigid Packaging Market Restraints and Challenges The Rigid Packaging Market encounters various obstacles and challenges that impede its progress and functioning. These constraints include environmental concerns and regulations surrounding sustainability which requires the adoption of eco-friendly practices and materials. The market also faces cost pressures stemming from fluctuating raw material prices and transportation expenses. The limited availability of recycling infrastructure for certain packaging materials poses challenges in achieving higher recycling rates. Shifting consumer preferences and market trends towards alternative packaging formats disrupt the rigid packaging industry necessitating the adoption of new technologies and equipment. Supply chain disruptions such as natural disasters and geopolitical tensions impacts the availability of raw materials and delay production and delivery. The rapid pace of technological advancements becomes demanding for companies to implement while educating consumers about the benefits of rigid packaging and differentiating brands in a crowded market becomes more challenging. Overcoming these challenges requires adaptability, innovation, collaboration and a focus on sustainability. Rigid Packaging Market Trends The Rigid Packaging Market is experiencing significant trends that are reshaping the industry and responding to evolving consumer demands and technological advancements. These trends include a strong focus on sustainability with the adoption of eco-friendly materials and designs that promote recycling and minimize waste. Convenience and user-friendly features are gaining popularity with resealability and easy to use mechanisms becoming key considerations. Digital printing technology enables customization and personalized designs allowing brands to engage consumers and create unique packaging experiences. Intelligent packaging incorporating smart labels and sensors provides real time information while e-commerce friendly packaging ensures secure and efficient shipping for online retail. Minimalist and premium packaging designs with high quality finishes cater to consumers seeking simplicity and luxury. Visual impact and storytelling through packaging graphics and shapes are being utilized to enhance brand communication. Health and safety considerations have also gained importance with features addressing consumer concerns during the COVID-19 pandemic.Rigid Packaging Market Segmentation

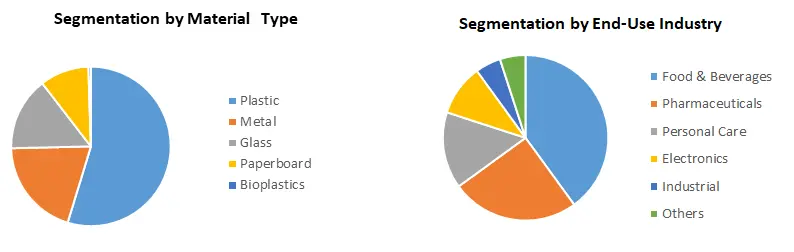

The Rigid Packaging Market has following segments which gives the details about market by Material Type, Product Type, End-Use Industry, Focus, Distribution Channel and by Region. By Material Type, the Rigid Packaging Market is segmented into Plastic, Glass, Metal, Paperboard and Bioplastics. Plastic is the most used for rigid packaging with share of over 55%. It is lightweight, durable, and relatively inexpensive making it a popular choice for a wide range of applications. Metals are strong, durable, and can provide excellent protection against contamination. Followed by is glass, paperboard and bioplastics in the segmentation by material. By Product Type, the Rigid Packaging Market is segmented into Food & Beverages, Pharmaceuticals, Personal Care, Electronics, Industrial and Others. Food and beverages is the largest product type for rigid packaging with share of over 40%. It is used to package a wide range of food and beverage products such as snacks, juices, beverages, and canned goods. Pharmaceuticals has applications in packaging such as tablets, capsules and injectable. Followed by are other segments in same order. By End-Use Industry, the Rigid Packaging Market is segmented as Consumer Goods, Industrial, Healthcare and Others. Consumer goods is the largest end use industry for rigid packaging with share of over 80%. It is used to package a wide range of consumer goods such as food and beverages, pharmaceuticals and personal care products. Industrial rigid packaging is used to package chemicals, paints and lubricants. Healthcare is a small but growing end-use industry for rigid packaging and is used to package a variety of medical devices and pharmaceuticals. By Distribution Channel, the Rigid Packaging Market is segmented as Direct and Indirect. Direct distribution is the process of selling rigid packaging directly to the end-user without the use of a middleman. This channel is often used for high value rigid packaging products such as pharmaceuticals and cosmetics. Indirect distribution is the process of selling rigid packaging through a middleman such as a distributor or retailer. This channel is often used for lower value rigid packaging products such as food and beverage packaging. The Rigid Packaging Market is analyzed within 5 regions: North America, Europe, Asia Pacific, Middle East & Africa and South America.

Rigid Packaging Market Regional Insights

North America, South America, Europe, Asia-Pacific, Middle East and Africa and South America are the five geographic regions that provides complete analysis for the investment and future growth. The Rigid Packaging Market is led by Asia-Pacific market and is forecasted to be largest region for Rigid Packaging Market in the forecast period 2023-2029. Asia Pacific: Asia Pacific is the largest region for Rigid Packaging Market in 2022 with share of over 40%. China, India, Japan and South Korea are key shareholders to the market in this region. Rapid industrialization, increasing disposable income and changing lifestyles are driving demand for rigid packaging across various industries such as food and beverages, healthcare, personal care and consumer goods. The region is also experiencing a shift towards sustainable packaging solutions, with a focus on eco-friendly materials and improved recycling infrastructure. North America: North America is the second largest region for Rigid Packaging Market with share of over 24% in the global market share. The market is witnessing a growing focus on sustainable packaging solutions with increased adoption of recyclable materials and eco-friendly practices. The food and beverage industry is a key driver of demand followed by healthcare and pharmaceuticals. The region also sees a rise in e-commerce packaging due to the growing popularity of online shopping. Europe: Europe is the third largest region for Rigid Packaging Market with share of over 20% in the global market share. The region exhibits a high level of technological innovation and packaging research and development. Rising demand for lightweight and recyclable packaging materials along with an increasing focus on reducing carbon footprint. The food and beverage sector leads the market with a growing demand for premium and customized packaging solutions. The cosmetics and personal care industry also drives market growth emphasizing visually appealing and sustainable packaging designs. South America: The South America is forecasted to be the fourth largest region for Rigid Packaging market. The market growth is driven by the rising demand for packaged food and beverages as well as the healthcare and personal care sectors. The region presents opportunities for sustainable packaging solutions including bio-based plastics and recycling initiatives. However, economic volatility and political factors impacts market growth in some countries. Middle East & Africa: The Middle East & Africa is the growing region for Rigid Packaging Market. The demand for premium packaging solutions is on the rise driven by the growth of luxury products and rising focus on branding and visual appeal. Sustainable packaging practices are gaining importance with a focus on reducing waste and adopting eco-friendly materials.Rigid Packaging Market Competitive Analysis

The Rigid Packaging market observes significant contributions from key players which are highly influential in the competitive landscape of the rigid packaging market in 2022. Amcor PLC, a global leader in rigid packaging solutions, expanded its product portfolio and market presence through strategic collaborations and acquisitions. Berry Global Inc., another key player, focused on enhancing manufacturing capabilities, geographic expansion and introduction of innovative packaging solutions. Ball Corporation, a renowned supplier of metal packaging, emphasized sustainable packaging initiatives, investing in recycling infrastructure and introducing new packaging designs. Crown Holdings Inc., a leading provider of metal packaging and closures, expanded its product offerings to meet the growing demand for sustainable solutions. Tetra Pak International S.A., specializing in carton packaging, continued to innovate by offering sustainable and customizable packaging options. DS Smith Plc, known for its corrugated packaging solutions invested in digital printing capabilities to provide customized packaging solutions. Sealed Air Corporation, a prominent player in protective packaging, focused on sustainability initiatives and the development of recyclable and renewable materials.Rigid Packaging Market Scope : Inquire Before Buying

Global Rigid Packaging Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 212.4 Bn. Forecast Period 2023 to 2029 CAGR: 5.7% Market Size in 2029: US $ 313.5 Bn. Segments Covered: by Material Type Plastic Glass Metal Paperboard Bioplastics by Product Type Food & Beverages Pharmaceuticals Personal Care Electronics Industrial Others by End Use Industry Consumer Goods Industrial Healthcare Others by Distribution Channel Direct Indirect Rigid Packaging Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Key players in the Global Rigid Packaging Market

In the report, the company portfolio of leading Global Rigid Packaging Market manufacturer has been covered on the basis of study and research of the global Rigid Packaging industry. 1. Amcor PLC 2. Berry Global Inc. 3. Ball Corporation 4. Crown Holdings Inc. 5. Tetra Pak International S.A. 6. DS Smith Plc 7. Sealed Air Corporation 8. Reynolds Group Holdings Limited 9. AptarGroup Inc. 10. Smurfit Kappa Group 11. Bemis Company Inc. 12. Sonoco Products Company 13. Graphic Packaging Holding Company 14. Silgan Holdings Inc. 15. Ardagh Group S.A. 16. Huhtamaki Group 17. WestRock Company 18. RPC Group Plc 19. International Paper Company 20. Mondi Group 21. Owens-Illinois Inc. 22. Greif Inc. 23. Anchor Packaging LLC 24. Novolex Holdings Inc. 25. Genpak LLC 26. Pactiv LLC 27. Constantia Flexibles Group GmbH 28. Coveris Holdings S.A. 29. Graham Packaging Company 30. Huhtamaki Oyj FAQs 1) What is the estimated value of the Global Rigid Packaging Market in 2022? Ans. The Global market was estimated to be valued at USD 212.4 Billion in 2022. 2) What is the growth rate of the Global Rigid Packaging Market? Ans. The market growth rate at the global level is 5.7% CAGR with a forecasted value of USD 313.5 Billion by 2029. 3) Which region has the highest growth potential globally? Ans. Asia Pacific region is forecasted to grow at a CAGR of 5.7% in the Rigid Packaging Market at highest rate among all regions in the forecast period of 2023-2029. 4) How is Global Rigid Packaging Market Segmented by Product Type? Ans. The Rigid Packaging Market is segmented as – Food & Beverages, Pharmaceuticals, Personal Care, Electronics, Industrial, and Others. 5) By End-Use Industry, how is Global Rigid Packaging Market segmented? Ans. The Rigid Packaging Market is segmented as – Consumer Goods, Industrial, Healthcare and Others. 6) How are the top players in Global Rigid Packaging Market? Ans. The research and analysis on the report encompasses the key companies in the Rigid Packaging industry are Amcor PLC, Berry Global Inc., Ball Corporation, Bemis Company Inc., Sonoco Products Company, Graphic Packaging Holding Company, Silgan Holdings Inc. and Ardagh Group S.A.

1. Rigid Packaging Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Rigid Packaging Market: Dynamics 2.1. Rigid Packaging Market Trends by Region 2.1.1. North America Rigid Packaging Market Trends 2.1.2. Europe Rigid Packaging Market Trends 2.1.3. Asia Pacific Rigid Packaging Market Trends 2.1.4. Middle East and Africa Rigid Packaging Market Trends 2.1.5. South America Rigid Packaging Market Trends 2.2. Rigid Packaging Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Rigid Packaging Market Drivers 2.2.1.2. North America Rigid Packaging Market Restraints 2.2.1.3. North America Rigid Packaging Market Opportunities 2.2.1.4. North America Rigid Packaging Market Challenges 2.2.2. Europe 2.2.2.1. Europe Rigid Packaging Market Drivers 2.2.2.2. Europe Rigid Packaging Market Restraints 2.2.2.3. Europe Rigid Packaging Market Opportunities 2.2.2.4. Europe Rigid Packaging Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Rigid Packaging Market Drivers 2.2.3.2. Asia Pacific Rigid Packaging Market Restraints 2.2.3.3. Asia Pacific Rigid Packaging Market Opportunities 2.2.3.4. Asia Pacific Rigid Packaging Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Rigid Packaging Market Drivers 2.2.4.2. Middle East and Africa Rigid Packaging Market Restraints 2.2.4.3. Middle East and Africa Rigid Packaging Market Opportunities 2.2.4.4. Middle East and Africa Rigid Packaging Market Challenges 2.2.5. South America 2.2.5.1. South America Rigid Packaging Market Drivers 2.2.5.2. South America Rigid Packaging Market Restraints 2.2.5.3. South America Rigid Packaging Market Opportunities 2.2.5.4. South America Rigid Packaging Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Rigid Packaging Industry 2.8. Analysis of Government Schemes and Initiatives For Rigid Packaging Industry 2.9. Rigid Packaging Market Trade Analysis 2.10. The Global Pandemic Impact on Rigid Packaging Market 3. Rigid Packaging Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2022-2029 3.1. Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 3.1.1. Plastic 3.1.2. Glass 3.1.3. Metal 3.1.4. Paperboard 3.1.5. Bioplastics 3.2. Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 3.2.1. Food & Beverages 3.2.2. Pharmaceuticals 3.2.3. Personal Care 3.2.4. Electronics 3.2.5. Industrial 3.2.6. Others 3.3. Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 3.3.1. Consumer Goods 3.3.2. Industrial 3.3.3. Healthcare 3.3.4. Others 3.4. Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 3.4.1. Direct 3.4.2. Indirect 3.5. Rigid Packaging Market Size and Forecast, by Region (2022-2029) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Rigid Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 4.1. North America Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 4.1.1. Plastic 4.1.2. Glass 4.1.3. Metal 4.1.4. Paperboard 4.1.5. Bioplastics 4.2. North America Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 4.2.1. Food & Beverages 4.2.2. Pharmaceuticals 4.2.3. Personal Care 4.2.4. Electronics 4.2.5. Industrial 4.2.6. Others 4.3. North America Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 4.3.1. Consumer Goods 4.3.2. Industrial 4.3.3. Healthcare 4.3.4. Others 4.4. North America Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 4.4.1. Direct 4.4.2. Indirect 4.5. North America Rigid Packaging Market Size and Forecast, by Country (2022-2029) 4.5.1. United States 4.5.1.1. United States Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 4.5.1.1.1. Plastic 4.5.1.1.2. Glass 4.5.1.1.3. Metal 4.5.1.1.4. Paperboard 4.5.1.1.5. Bioplastics 4.5.1.2. United States Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 4.5.1.2.1. Food & Beverages 4.5.1.2.2. Pharmaceuticals 4.5.1.2.3. Personal Care 4.5.1.2.4. Electronics 4.5.1.2.5. Industrial 4.5.1.2.6. Others 4.5.1.3. United States Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 4.5.1.3.1. Consumer Goods 4.5.1.3.2. Industrial 4.5.1.3.3. Healthcare 4.5.1.3.4. Others 4.5.1.4. United States Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.1.4.1. Direct 4.5.1.4.2. Indirect 4.5.2. Canada 4.5.2.1. Canada Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 4.5.2.1.1. Plastic 4.5.2.1.2. Glass 4.5.2.1.3. Metal 4.5.2.1.4. Paperboard 4.5.2.1.5. Bioplastics 4.5.2.2. Canada Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 4.5.2.2.1. Food & Beverages 4.5.2.2.2. Pharmaceuticals 4.5.2.2.3. Personal Care 4.5.2.2.4. Electronics 4.5.2.2.5. Industrial 4.5.2.2.6. Others 4.5.2.3. Canada Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 4.5.2.3.1. Consumer Goods 4.5.2.3.2. Industrial 4.5.2.3.3. Healthcare 4.5.2.3.4. Others 4.5.2.4. Canada Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.2.4.1. Direct 4.5.2.4.2. Indirect 4.5.3. Mexico 4.5.3.1. Mexico Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 4.5.3.1.1. Plastic 4.5.3.1.2. Glass 4.5.3.1.3. Metal 4.5.3.1.4. Paperboard 4.5.3.1.5. Bioplastics 4.5.3.2. Mexico Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 4.5.3.2.1. Food & Beverages 4.5.3.2.2. Pharmaceuticals 4.5.3.2.3. Personal Care 4.5.3.2.4. Electronics 4.5.3.2.5. Industrial 4.5.3.2.6. Others 4.5.3.3. Mexico Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 4.5.3.3.1. Consumer Goods 4.5.3.3.2. Industrial 4.5.3.3.3. Healthcare 4.5.3.3.4. Others 4.5.3.4. Mexico Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 4.5.3.4.1. Direct 4.5.3.4.2. Indirect 5. Europe Rigid Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 5.1. Europe Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 5.1. Europe Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 5.1. Europe Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 5.1. Europe Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.5. Europe Rigid Packaging Market Size and Forecast, by Country (2022-2029) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 5.5.1.2. United Kingdom Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 5.5.1.3. United Kingdom Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 5.5.1.4. United Kingdom Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.2. France 5.5.2.1. France Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 5.5.2.2. France Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 5.5.2.3. France Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 5.5.2.4. France Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.3. Germany 5.5.3.1. Germany Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 5.5.3.2. Germany Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 5.5.3.3. Germany Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 5.5.3.4. Germany Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.4. Italy 5.5.4.1. Italy Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 5.5.4.2. Italy Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 5.5.4.3. Italy Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 5.5.4.4. Italy Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.5. Spain 5.5.5.1. Spain Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 5.5.5.2. Spain Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 5.5.5.3. Spain Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 5.5.5.4. Spain Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.6. Sweden 5.5.6.1. Sweden Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 5.5.6.2. Sweden Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 5.5.6.3. Sweden Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 5.5.6.4. Sweden Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.7. Austria 5.5.7.1. Austria Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 5.5.7.2. Austria Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 5.5.7.3. Austria Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 5.5.7.4. Austria Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 5.5.8.2. Rest of Europe Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 5.5.8.3. Rest of Europe Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 5.5.8.4. Rest of Europe Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6. Asia Pacific Rigid Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 6.1. Asia Pacific Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 6.2. Asia Pacific Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 6.3. Asia Pacific Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 6.4. Asia Pacific Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.5. Asia Pacific Rigid Packaging Market Size and Forecast, by Country (2022-2029) 6.5.1. China 6.5.1.1. China Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 6.5.1.2. China Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 6.5.1.3. China Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 6.5.1.4. China Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.2. S Korea 6.5.2.1. S Korea Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 6.5.2.2. S Korea Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 6.5.2.3. S Korea Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 6.5.2.4. S Korea Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.3. Japan 6.5.3.1. Japan Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 6.5.3.2. Japan Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 6.5.3.3. Japan Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 6.5.3.4. Japan Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.4. India 6.5.4.1. India Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 6.5.4.2. India Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 6.5.4.3. India Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 6.5.4.4. India Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.5. Australia 6.5.5.1. Australia Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 6.5.5.2. Australia Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 6.5.5.3. Australia Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 6.5.5.4. Australia Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.6. Indonesia 6.5.6.1. Indonesia Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 6.5.6.2. Indonesia Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 6.5.6.3. Indonesia Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 6.5.6.4. Indonesia Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.7. Malaysia 6.5.7.1. Malaysia Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 6.5.7.2. Malaysia Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 6.5.7.3. Malaysia Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 6.5.7.4. Malaysia Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.8. Vietnam 6.5.8.1. Vietnam Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 6.5.8.2. Vietnam Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 6.5.8.3. Vietnam Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 6.5.8.4. Vietnam Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.9. Taiwan 6.5.9.1. Taiwan Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 6.5.9.2. Taiwan Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 6.5.9.3. Taiwan Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 6.5.9.4. Taiwan Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 6.5.10.2. Rest of Asia Pacific Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 6.5.10.3. Rest of Asia Pacific Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 6.5.10.4. Rest of Asia Pacific Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 7. Middle East and Africa Rigid Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 7.1. Middle East and Africa Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 7.2. Middle East and Africa Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 7.3. Middle East and Africa Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 7.4. Middle East and Africa Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 7.5. Middle East and Africa Rigid Packaging Market Size and Forecast, by Country (2022-2029) 7.5.1. South Africa 7.5.1.1. South Africa Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 7.5.1.2. South Africa Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 7.5.1.3. South Africa Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 7.5.1.4. South Africa Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.2. GCC 7.5.2.1. GCC Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 7.5.2.2. GCC Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 7.5.2.3. GCC Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 7.5.2.4. GCC Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.3. Nigeria 7.5.3.1. Nigeria Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 7.5.3.2. Nigeria Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 7.5.3.3. Nigeria Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 7.5.3.4. Nigeria Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 7.5.4.2. Rest of ME&A Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 7.5.4.3. Rest of ME&A Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 7.5.4.4. Rest of ME&A Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 8. South America Rigid Packaging Market Size and Forecast by Segmentation (by Value in USD Million) 2022-2029 8.1. South America Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 8.2. South America Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 8.3. South America Rigid Packaging Market Size and Forecast, by End Use Industry(2022-2029) 8.4. South America Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 8.5. South America Rigid Packaging Market Size and Forecast, by Country (2022-2029) 8.5.1. Brazil 8.5.1.1. Brazil Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 8.5.1.2. Brazil Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 8.5.1.3. Brazil Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 8.5.1.4. Brazil Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.2. Argentina 8.5.2.1. Argentina Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 8.5.2.2. Argentina Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 8.5.2.3. Argentina Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 8.5.2.4. Argentina Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Rigid Packaging Market Size and Forecast, by Material Type (2022-2029) 8.5.3.2. Rest Of South America Rigid Packaging Market Size and Forecast, by Product Type (2022-2029) 8.5.3.3. Rest Of South America Rigid Packaging Market Size and Forecast, by End Use Industry (2022-2029) 8.5.3.4. Rest Of South America Rigid Packaging Market Size and Forecast, by Distribution Channel (2022-2029) 9. Global Rigid Packaging Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Rigid Packaging Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Amcor PLC 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Berry Global Inc. 10.3. Ball Corporation 10.4. Crown Holdings Inc. 10.5. Tetra Pak International S.A. 10.6. DS Smith Plc 10.7. Sealed Air Corporation 10.8. Reynolds Group Holdings Limited 10.9. AptarGroup Inc. 10.10. Smurfit Kappa Group 10.11. Bemis Company Inc. 10.12. Sonoco Products Company 10.13. Graphic Packaging Holding Company 10.14. Silgan Holdings Inc. 10.15. Ardagh Group S.A. 10.16. Huhtamaki Group 10.17. WestRock Company 10.18. RPC Group Plc 10.19. International Paper Company 10.20. Mondi Group 10.21. Owens-Illinois Inc. 10.22. Greif Inc. 10.23. Anchor Packaging LLC 10.24. Novolex Holdings Inc. 10.25. Genpak LLC 10.26. Pactiv LLC 10.27. Constantia Flexibles Group GmbH 10.28. Coveris Holdings S.A. 10.29. Graham Packaging Company 10.30. Huhtamaki Oyj 11. Key Findings 12. Industry Recommendations 13. Rigid Packaging Market: Research Methodology 14. Terms and Glossary