The Global Rice Bran Oil Market size was valued at USD 7.88 Bn in 2023 and is expected to reach USD 14.79 Bn by 2030, at a CAGR of 9.4%.Rice Bran Oil Market Overview

Rice bran oil, a vegetable oil derived from the by-product of rice bran, has garnered increasing popularity as a premium edible oil, particularly in Asian nations such as India, China, Japan, Thailand, and Taiwan. This exceptional oil presents itself as a promising asset for culinary applications, owing to its distinctive attributes including extended shelf life, a high smoke (burning) point, reduced greasiness, and enhanced flavor infusion in food. In Japan, it is commonly referred to as 'Heart Oil,' while in Western countries, it is recognized as a 'Functional Food' or 'Health Food.' Notably, it contains oryzanol, a heart-friendly phytochemical, rendering it an ideal choice for cooking oil. For an in-depth exploration of the health benefits, properties, potential side effects, and more pertaining to rice bran oil, let us delve into a comprehensive understanding of this culinary component. The detailed and constructive formation of key drivers, opportunities, and unique segmentation outputs structural and optimistic data. Validated using primary as well as secondary research methodology and scope of the Rice Bran Oil Market.To know about the Research Methodology :- Request Free Sample Report

Rice Bran Oil Market Dynamics

Global Health Consciousness Trend and Food Industry Embracing Healthier Options are driving the Rice Bran Oil Market The rice bran oil market has experienced significant growth due to the pervasive increase in the global health consciousness trend. Consumers, particularly in key markets like India, China, and Japan, are actively seeking heart-healthy cooking oils, positioning rice bran oil as a preferred choice due to its perceived health benefits. This trend aligns with the rising demand for natural and functional foods. The food industry's shift towards healthier cooking oils has been a substantial driver, with consumers becoming more health-conscious and demanding alternatives to traditional cooking oils. Rice bran oil, with its unique nutritional composition, has gained prominence in the food industry, especially in applications such as frying, baking, and salad dressings. This shift resonates with the consumer preference for natural and functional foods. The rich nutritional profile of rice bran oil, which includes antioxidants, vitamin E, and oryzanol, has been a key driver. These unique properties not only cater to health-conscious consumers but also offer advantages in terms of prolonged shelf life, high smoke point, and improved flavor enhancement in various culinary applications. The nutritional superiority contributes to the market's appeal as consumers prioritize healthier alternatives. The upward trajectory of the middle-class population in emerging economies has played a pivotal role in driving the demand for premium and health-focused cooking oils, including rice bran oil. As income levels rise, consumers are willing to invest in healthier alternatives, contributing to the overall growth of the rice bran oil market. This economic factor intersects with socioeconomic influences and market shifts. The versatility of rice bran oil in culinary applications has been a driver for its increased adoption. Its suitability for various cooking methods, such as frying and baking, has expanded its use in both household and commercial settings, contributing to its growing market share. This adaptability aligns with the dynamic market shifts and diverse consumer preferences evolution. Beyond health considerations, the global trend towards natural and functional foods has benefited rice bran oil. As consumers seek products with perceived health benefits and natural origins, rice bran oil's positioning as a "functional food" or "health food" has contributed to its popularity, particularly in Western countries. This consumer preference evolution intersects with competitive landscape shifts. Fluctuating Raw Material Prices and Competition from Other Edible Oils are the major Restraints in the Rice Bran Oil Market The rice bran oil industry, is intricately linked to the fluctuations in the prices of its primary raw material, rice bran. The dynamic nature of raw material costs, a crucial aspect of Economic factors of Rice Bran Oil Market, can significantly impact production costs, leading to challenges in maintaining overall market stability. The rice bran oil industry faces fierce competition from a variety of cooking oils, including soybean oil, sunflower oil, and olive oil. Effectively differentiating rice bran oil in a crowded market becomes crucial for sustaining growth and market share amidst Competitive forces in Market. In some regions, there exists limited awareness or understanding of the benefits associated with rice bran oil. Overcoming this awareness gap is essential for unlocking the full market potential in these areas, requiring targeted marketing and educational initiatives amid Rice Bran Oil Market Environmental factors. The rice bran oil industry grapples with regulatory challenges, including the need to comply with stringent food safety standards and labeling requirements. Navigating complex regulatory landscapes, a key aspect of Rice Bran Oil Market constraints, presents a constraint for market players, necessitating continuous adherence to ensure product compliance. The broader market for edible oils, including rice bran oil, is subject to price volatility influenced by geopolitical events, weather conditions impacting crop yields, and global economic factors. Managing the effects of market price volatility, a component of Rice Bran Oil Industry fluctuations, is crucial for sustaining profitability. Despite a growing awareness of the health benefits associated with rice bran oil, the industry faces the ongoing challenge of aligning consumer perceptions with the actual nutritional benefits. Factors such as cultural considerations and marketing strategies play a pivotal role in influencing consumer preferences over Rice Bran Oil Market Consumer behavior trends. Disruptions in the supply chain, whether arising from natural disasters, geopolitical events, or unforeseen circumstances, pose challenges to the production and distribution of rice bran oil. Ensuring a resilient and adaptable supply chain, a critical aspect of Rice Bran Oil Market shifts, becomes imperative for meeting market demand under various conditions. Maintaining consistent quality and adhering to rigorous standardization processes is a perpetual challenge for the rice bran oil industry. Striving to meet regulatory and consumer expectations requires continuous efforts in quality control throughout the production process, dealing with Rice Bran Oil Industry disruptors.

Rice Bran Oil Market Segment Analysis

Type: Embracing the prevailing global trend towards organic and natural products, organic rice bran oil strategically targets health-conscious and environmentally friendly consumers. The emphasis on organic sourcing aligns with evolving consumer preferences for sustainable and healthy choices. Positioned as a mainstream option, non-organic rice bran oil caters to diverse markets, fulfilling the demand for conventional cooking oils. This segment serves consumers who prioritize accessibility and familiarity in their cooking oil choices. Understanding the demographic profiles of consumers is crucial for effectively targeting and tailoring marketing strategies. Demographic factors such as age, income level, and lifestyle preferences influence consumer choices. For instance, health-conscious millennials may be drawn to organic rice bran oil, while cost-conscious families may opt for non-organic variants. This demographic profiling guides marketing efforts, ensuring resonance with specific consumer segments. Identifying and exploring niche markets within the Rice Bran Oil sector allows producers to tap into specialized consumer needs. Niche markets may include segments with unique preferences, such as gourmet cooking oils, specialty skincare formulations, or exclusive industrial applications. Niche exploration fosters innovation, differentiation, and the potential for higher-margin products catering to specific demands. The versatility of Rice Bran Oil extends its presence into unique market sectors beyond traditional applications. Sectors like functional foods, boutique cosmetics, and specialized industrial processes showcase the adaptability and multifunctionality of rice bran oil. These unique sectors represent growth opportunities and avenues for product diversification, contributing to the overall market resilience. Grade: Tailored for health-conscious consumers, refined rice bran oil emerges as a premium choice for culinary applications. Its positioning in the refined grade reflects a commitment to quality, meeting the expectations of consumers seeking a superior edible oil for their cooking needs. Finding applications in both vanaspati and refined oil industries, Raw Grade 1 rice bran oil plays a pivotal role in cooking and food processing. This versatile grade caters to diverse industrial requirements, showcasing its adaptability. Positioned as an essential component in industrial settings, Raw Grade 2 rice bran oil contributes significantly to various non-edible applications. Its importance lies in supporting industries beyond the culinary domain, highlighting its diverse utility. A granular breakdown of the Rice Bran Oil market involves detailed analysis at a microscopic level, considering factors such as regional variations, consumer preferences, and industry-specific requirements. This granular approach allows for a more nuanced understanding of market dynamics, enabling stakeholders to make informed decisions based on specific micro-level insights. A comprehensive sector analysis involves evaluating the market from multiple dimensions, considering factors like economic conditions, regulatory landscapes, and technological advancements. This holistic approach ensures a thorough understanding of the Rice Bran Oil market's ecosystem, enabling stakeholders to navigate challenges, leverage opportunities, and formulate robust long-term strategies.Application: Serving as the primary application segment, rice bran oil integrates seamlessly into cooking, frying, and various food products. Its versatility in culinary applications positions it as a staple in the food and beverage industry. Witnessing increased popularity in the cosmetics industry, rice bran oil finds application in skincare and hair care products due to its skin-friendly properties. This diversification highlights its role in enhancing personal care and cosmetic formulations. Leveraging its health-promoting properties, rice bran oil is utilized in the pharmaceutical industry, contributing to the development of health-focused products. Its inclusion in pharmaceutical applications aligns with the growing trend of utilizing natural ingredients. The inclusion of rice bran oil in personal care products such as soaps and lotions is on the rise, driven by its beneficial properties. Its integration into personal care items signifies its expanding footprint in the broader consumer goods rice bran oil market. Positioned as a functional food ingredient, rice bran oil contributes to health-enhancing properties in nutraceutical applications. This strategic positioning aligns with the increasing demand for functional foods that offer nutritional benefits beyond basic sustenance. Valued for its nutritional content, rice bran oil is utilized in the animal feed industry to promote the well-being of livestock. Its role in animal nutrition underscores its significance in broader agricultural practices. Showcasing the versatility of rice bran oil, this category encompasses diverse applications beyond conventional categories. The adaptability of rice bran oil positions it as a valuable ingredient in emerging and niche rice bran oil markets.

Rice Bran Oil Market Regional Analysis

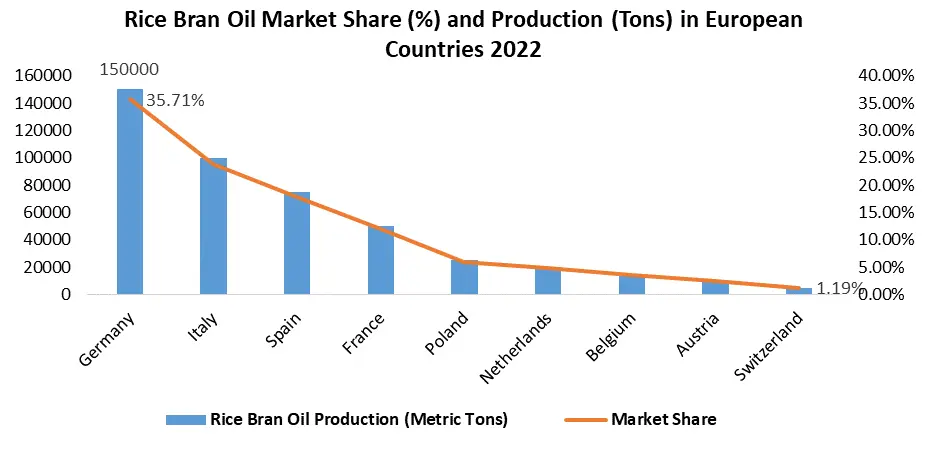

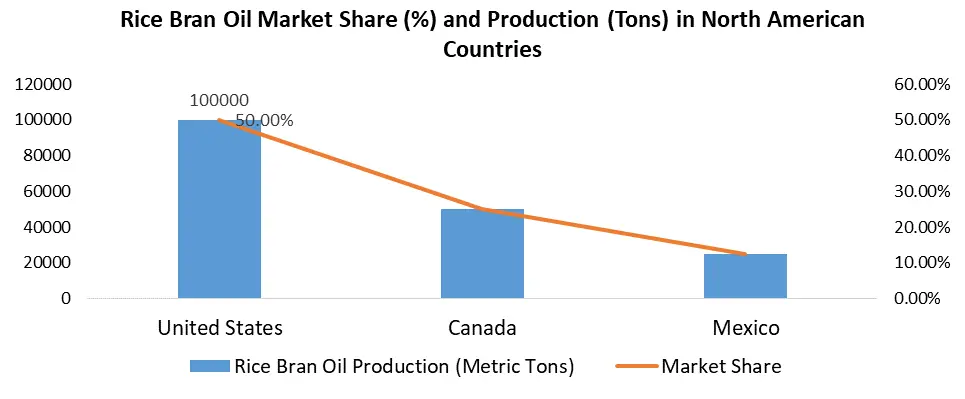

The United States rice bran oil market, estimated at 465.4 thousand tons, faced unique challenges in the form of increasing competition among leading manufacturers. The region, driven by a surge in health-conscious consumer trends, presents significant opportunities for the industry. Salad dressings and baked goods, including brownies and cakes, represent specific areas where rice bran oil is gaining traction. However, challenges persist in the form of an evolving regional competitive landscape and fluctuating market growth. The economic impact varies by region, and the United States demonstrates a positive outlook for rice bran oil market development. Demographic trends underscore the growing preference for veganism, shaping the regional market segmentation. Additionally, nuanced market trends, such as a rising demand for vegetable oils, further influence the regional market performance. Germany stands out as the most lucrative region in Europe for rice bran oil, boasting a growth rate of 1.7%. The health-conscious population in Germany is a demographic trend driving market growth, presenting unique opportunities for industry players. The region's competitive landscape is shaped by its relatively easier access to raw resources, translating into cost advantages and heightened cost-effectiveness. Strict regulations governing agricultural products contribute to a high-quality regional market share and facilitate compliance with international safety standards. The economic impact is notably positive, with a favorable industry outlook contributing to robust regional market development. Germany's regional market segmentation is influenced by changing consumer preferences, with a spotlight on natural foods like rice bran oil. A detailed analysis of the territorial competitive landscape underscores the challenges and opportunities that characterize the market growth in this region. Asia Pacific's dominance in the global rice bran oil market, with a staggering market share exceeding 36.5%, brings about distinct regional market challenges and area-specific opportunities. The region's high volume of rice production, particularly in India, positions it for rapid market expansion. Challenges include navigating complex regional market segmentation and addressing the economic impact on different locations. Despite the vast potential output of rice bran in India, a considerable portion remains untapped, presenting opportunities for further market development. The regional rice bran oil market development is closely tied to the demographic trends in India, where a significant portion of rice bran is used as cattle fodder. The market growth by location varies, with India contributing substantially to the overall Asia Pacific market performance. A granular analysis of market trends in specific regions is essential for understanding the unique dynamics that shape the regional rice bran oil industry.

Rice Bran Oil Market Competitive Landscape

The competitive landscape of the rice bran oil industry undergoes thorough competitor benchmarking, evaluating industry player dynamics and reviewing competitive strategies. An impact analysis of rivalry and an assessment of competitive advantages contribute to an industry competition overview. Market leaders such as Adani Wilmar, Ricela Health Foods, BCL Industries & Infrastructure Ltd., Sethia Oils Ltd., and A.P. Refinery Pvt. Ltd. strategically position themselves, employing player strategies and competitive benchmark analysis to evolve their market share in the rice bran oil industry. Adani Wilmar, through its acquisition of the 'Kohinoor' brand, demonstrates strategic analysis, showcasing opposition tactics within the rice bran oil market. In the Asian market, King Rice Bran Oil employs competitive strategies to replicate its success in the UK, emphasizing its competitive evolution and strategic position in the rice bran oil industry, supported by competitor benchmarking and a focus on industry opposition tactics. The competitive landscape of the rice bran oil industry is dynamic and intricate, influenced by various factors, including established market leaders, emerging players, and strategic initiatives. Below is a comprehensive overview of the competitive dynamics within the rice bran oil market. Recognized market leaders, such as Adani Wilmar, Ricela Health Foods, BCL Industries & Infrastructure Ltd., Sethia Oils Ltd., and A.P. Refinery Pvt. Ltd., significantly contribute to the industry's growth. In a strategic move to reinforce its leadership in basmati rice and the FMCG sector, Adani Wilmar has announced the acquisition of the renowned Basmati rice brand 'Kohinoor' from McCormick Switzerland GMBH.Adani Wilmar revealed the acquisition, stating that it grants exclusive rights over the 'Kohinoor' Basmati rice brand, along with the 'Ready to Cook' and 'Ready to Eat' curries and meals portfolio under the Kohinoor Brand umbrella in India. This acquisition enhances Adani Wilmar’s position in the food FMCG category, leveraging the premium Kohinoor brand and expanding the product basket. It provides synergies across geographies, complementing the flagship brand ‘Fortune’ in the food FMCG domain. The acquisition positions AWL for significant growth, catering to premium customer segments across rice and other value-added food businesses. King Rice Bran Oil, a leading rice bran oil brand in many Asian countries, aims to replicate its success in the UK with the introduction of Rice Bran Oil for chefs and caterers. Rice Bran Oil, popular in the Far East, stands out due to its subtle flavor, making it ideal for frying fish, meat, and vegetables. The oil maintains stability when heated, boasting a high burning point and an extremely high oxidative stability index, lasting almost 16 hours during cooking compared to sunflower oil’s six hours. Rice Bran Oil takes pride in its health benefits, featuring zero cholesterol, an 'ideal' ratio of polyunsaturated, monounsaturated, and saturated fats, and no trans-fat, additives, preservatives, or GM ingredients. Known for its 'oryzanol' content, a powerful antioxidant associated with several health benefits, Rice Bran Oil seeks to establish itself in the UK market and build on its reputation for quality and health-conscious attributes.

Rice Bran Oil Market Scope: Inquiry Before Buying

Rice Bran Oil Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 7.88 Bn. Forecast Period 2024 to 2030 CAGR: 9.4% Market Size in 2030: US $ 14.79 Bn. Segments Covered: by Type Organic Non-organic by Grade Refined Grade:(Edible Oil) Raw Grade 1:(Vanaspati & Refined Oil) Raw Grade 2:(Industrial) by Application Food and beverages Cosmetics Pharmaceuticals Personal care Nutraceutical Animal feed Others by Sales Channel Supermarkets and hypermarkets convenience stores specialty stores Online Shops Others Rice Bran Oil Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Rice Bran Oil Market, Key Players

1. Adani Wilmar (Gujarat, India) 2. Modi Naturals (New Delhi, India) 3. Marico (Maharashtra, India) 4. Conagra Foods (Chicago, U.S.) 5. BCL Industries Limited (Punjab, India) 6. King Rice Oil Group (Bangkok, Thailand) 7. California Rice Oil Company (California, U.S.) 8. Ricela Health Foods Ltd. (Punjab, India) 9. Sethia Oils Ltd. (India) 10. A.P. Refinery Pvt. Ltd. (India)Frequently Asked Questions

1. What are the key drivers for the growth of the Rice Bran Oil market? Ans: Growing health consciousness, increased demand in the food industry, unique nutritional properties, and the expanding middle-class population are driving factors fostering the growth of the Rice Bran Oil market. 2. How is the Rice Bran Oil market segmented? Ans: The market is segmented by type (organic and non-organic), grade (refined, raw grade 1, raw grade 2), application (food and beverages, cosmetics, pharmaceuticals, etc.), and sales channel (supermarkets, convenience stores, online shops, etc.). 3. What challenges does the Rice Bran Oil industry face? Ans: Challenges include fluctuating raw material prices, competition from other edible oils, limited awareness in certain regions, stringent regulations, market price volatility, and the need for effective quality control and standardization. 4. Which regions dominate the Rice Bran Oil market? Ans: The United States, Germany, and Asia Pacific, particularly India, play significant roles in the global Rice Bran Oil market. The market dynamics vary across regions due to factors such as consumer preferences, health consciousness, and regulatory environments. 5. Who are the key players in the Rice Bran Oil market? Ans: Prominent companies include Adani Wilmar, Ricela Health Foods, BCL Industries & Infrastructure Ltd., Sethia Oils Ltd., and A.P. Refinery Pvt. Ltd., contributing significantly to the industry's growth and competitive landscape.

1. Rice Bran Oil Market: Research Methodology 2. Rice Bran Oil Market Introduction 2.1. Study Assumption and Market Definition 2.2. Scope of the Study 2.3. Executive Summary 3. Rice Bran Oil Market: Dynamics 3.1. Rice Bran Oil Market Trends by Region 3.1.1. Global Rice Bran Oil Market Trends 3.1.2. North America Rice Bran Oil Market Trends 3.1.3. Europe Rice Bran Oil Market Trends 3.1.4. Asia Pacific Rice Bran Oil Market Trends 3.1.5. Middle East and Africa Rice Bran Oil Market Trends 3.1.6. South America Rice Bran Oil Market Trends 3.2. Rice Bran Oil Market Dynamics by Region 3.2.1. North America 3.2.1.1. North America Rice Bran Oil Market Drivers 3.2.1.2. North America Rice Bran Oil Market Restraints 3.2.1.3. North America Rice Bran Oil Market Opportunities 3.2.1.4. North America Rice Bran Oil Market Challenges 3.2.2. Europe 3.2.2.1. Europe Rice Bran Oil Market Drivers 3.2.2.2. Europe Rice Bran Oil Market Restraints 3.2.2.3. Europe Rice Bran Oil Market Opportunities 3.2.2.4. Europe Rice Bran Oil Market Challenges 3.2.3. Asia Pacific 3.2.3.1. Asia Pacific Rice Bran Oil Market Drivers 3.2.3.2. Asia Pacific Rice Bran Oil Market Restraints 3.2.3.3. Asia Pacific Rice Bran Oil Market Opportunities 3.2.3.4. Asia Pacific Rice Bran Oil Market Challenges 3.2.4. Middle East and Africa 3.2.4.1. Middle East and Africa Rice Bran Oil Market Drivers 3.2.4.2. Middle East and Africa Rice Bran Oil Market Restraints 3.2.4.3. Middle East and Africa Rice Bran Oil Market Opportunities 3.2.4.4. Middle East and Africa Rice Bran Oil Market Challenges 3.2.5. South America 3.2.5.1. South America Rice Bran Oil Market Drivers 3.2.5.2. South America Rice Bran Oil Market Restraints 3.2.5.3. South America Rice Bran Oil Market Opportunities 3.2.5.4. South America Rice Bran Oil Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Analysis 3.5. Technology Roadmap 3.6. Regulatory Landscape by Region 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 3.7. Key Opinion Leader Analysis For Rice Bran Oil Market 3.8. Analysis of Government Schemes and Initiatives For Rice Bran Oil Market 3.9. The Global Pandemic Impact on Rice Bran Oil Market 4. Rice Bran Oil Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 4.1. Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 4.1.1. Wheat 4.1.2. Rice 4.1.3. Corn 4.2. Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 4.2.1. Organic 4.2.2. Conventional 4.3. Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 4.3.1. Supermarkets and hypermarkets 4.3.2. Conventional stores 4.3.3. Online 4.3.4. Others 4.4. Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 4.5. Rice Bran Oil Market Size and Forecast, by Region (2023-2030) 4.5.1. North America 4.5.2. Europe 4.5.3. Asia Pacific 4.5.4. Middle East and Africa 4.5.5. South America 5. North America Rice Bran Oil Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. North America Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 5.1.1. Wheat 5.1.2. Rice 5.1.3. Corn 5.2. North America Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 5.2.1. Organic 5.2.2. Conventional 5.3. North America Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 5.3.1. Supermarkets and hypermarkets 5.3.2. Conventional stores 5.3.3. Online 5.3.4. Others 5.4. North America Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 5.5. North America Rice Bran Oil Market Size and Forecast, by Country (2023-2030) 5.5.1. United States 5.5.1.1. United States Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 5.5.1.1.1. Wheat 5.5.1.1.2. Rice 5.5.1.1.3. Corn 5.5.1.2. United States Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 5.5.1.2.1. Organic 5.5.1.2.2. Conventional 5.5.1.3. United States Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 5.5.1.3.1. Supermarkets and hypermarkets 5.5.1.3.2. Conventional stores 5.5.1.3.3. Online 5.5.1.3.4. Others 5.5.1.4. United States Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 5.5.2. Canada 5.5.2.1. Canada Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 5.5.2.1.1. Wheat 5.5.2.1.2. Rice 5.5.2.1.3. Corn 5.5.2.2. Canada Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 5.5.2.2.1. Organic 5.5.2.2.2. Conventional 5.5.2.3. Canada Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 5.5.2.3.1. Supermarkets and hypermarkets 5.5.2.3.2. Conventional stores 5.5.2.3.3. Online 5.5.2.3.4. Others 5.5.2.4. Canada Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 5.5.3. Mexico 5.5.3.1. Mexico Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 5.5.3.1.1. Wheat 5.5.3.1.2. Rice 5.5.3.1.3. Corn 5.5.3.2. Mexico Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 5.5.3.2.1. Organic 5.5.3.2.2. Conventional 5.5.3.3. Mexico Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 5.5.3.3.1. Supermarkets and hypermarkets 5.5.3.3.2. Conventional stores 5.5.3.3.3. Online 5.5.3.3.4. Others 5.5.3.4. Mexico Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 6. Europe Rice Bran Oil Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Europe Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 6.2. Europe Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 6.3. Europe Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 6.4. Europe Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 6.5. Europe Rice Bran Oil Market Size and Forecast, by Country (2023-2030) 6.5.1. United Kingdom 6.5.1.1. United Kingdom Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 6.5.1.2. United Kingdom Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 6.5.1.3. United Kingdom Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 6.5.1.4. United Kingdom Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 6.5.2. France 6.5.2.1. France Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 6.5.2.2. France Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 6.5.2.3. France Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 6.5.2.4. France Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 6.5.3. Germany 6.5.3.1. Germany Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 6.5.3.2. Germany Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 6.5.3.3. Germany Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Germany Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 6.5.4. Italy 6.5.4.1. Italy Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 6.5.4.2. Italy Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 6.5.4.3. Italy Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 6.5.4.4. Italy Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 6.5.5. Spain 6.5.5.1. Spain Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 6.5.5.2. Spain Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 6.5.5.3. Spain Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Spain Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 6.5.6. Sweden 6.5.6.1. Sweden Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 6.5.6.2. Sweden Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 6.5.6.3. Sweden Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Sweden Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 6.5.7. Austria 6.5.7.1. Austria Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 6.5.7.2. Austria Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 6.5.7.3. Austria Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Austria Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 6.5.8. Rest of Europe 6.5.8.1. Rest of Europe Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 6.5.8.2. Rest of Europe Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 6.5.8.3. Rest of Europe Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Rest of Europe Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 7. Asia Pacific Rice Bran Oil Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 7.1. Asia Pacific Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 7.2. Asia Pacific Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 7.3. Asia Pacific Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 7.4. Asia Pacific Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 7.5. Asia Pacific Rice Bran Oil Market Size and Forecast, by Country (2023-2030) 7.5.1. China 7.5.1.1. China Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 7.5.1.2. China Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 7.5.1.3. China Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 7.5.1.4. China Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 7.5.2. S Korea 7.5.2.1. S Korea Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 7.5.2.2. S Korea Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 7.5.2.3. S Korea Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 7.5.2.4. S Korea Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 7.5.3. Japan 7.5.3.1. Japan Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 7.5.3.2. Japan Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 7.5.3.3. Japan Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Japan Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 7.5.4. India 7.5.4.1. India Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 7.5.4.2. India Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 7.5.4.3. India Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 7.5.4.4. India Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 7.5.5. Australia 7.5.5.1. Australia Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 7.5.5.2. Australia Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 7.5.5.3. Australia Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 7.5.5.4. Australia Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 7.5.6. Indonesia 7.5.6.1. Indonesia Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 7.5.6.2. Indonesia Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 7.5.6.3. Indonesia Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 7.5.6.4. Indonesia Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 7.5.7. Malaysia 7.5.7.1. Malaysia Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 7.5.7.2. Malaysia Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 7.5.7.3. Malaysia Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 7.5.7.4. Malaysia Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 7.5.8. Vietnam 7.5.8.1. Vietnam Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 7.5.8.2. Vietnam Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 7.5.8.3. Vietnam Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 7.5.8.4. Vietnam Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 7.5.9. Taiwan 7.5.9.1. Taiwan Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 7.5.9.2. Taiwan Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 7.5.9.3. Taiwan Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 7.5.9.4. Taiwan Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 7.5.10. Rest of Asia Pacific 7.5.10.1. Rest of Asia Pacific Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 7.5.10.2. Rest of Asia Pacific Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 7.5.10.3. Rest of Asia Pacific Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 7.5.10.4. Rest of Asia Pacific Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 8. Middle East and Africa Rice Bran Oil Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 8.1. Middle East and Africa Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 8.2. Middle East and Africa Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 8.3. Middle East and Africa Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 8.4. Middle East and Africa Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 8.5. Middle East and Africa Rice Bran Oil Market Size and Forecast, by Country (2023-2030) 8.5.1. South Africa 8.5.1.1. South Africa Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 8.5.1.2. South Africa Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 8.5.1.3. South Africa Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 8.5.1.4. South Africa Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 8.5.2. GCC 8.5.2.1. GCC Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 8.5.2.2. GCC Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 8.5.2.3. GCC Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 8.5.2.4. GCC Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 8.5.3. Nigeria 8.5.3.1. Nigeria Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 8.5.3.2. Nigeria Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 8.5.3.3. Nigeria Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Nigeria Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 8.5.4. Rest of ME&A 8.5.4.1. Rest of ME&A Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 8.5.4.2. Rest of ME&A Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 8.5.4.3. Rest of ME&A Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 8.5.4.4. Rest of ME&A Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 9. South America Rice Bran Oil Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 9.1. South America Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 9.2. South America Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 9.3. South America Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 9.4. South America Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 9.5. South America Rice Bran Oil Market Size and Forecast, by Country (2023-2030) 9.5.1. Brazil 9.5.1.1. Brazil Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 9.5.1.2. Brazil Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 9.5.1.3. Brazil Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 9.5.1.4. Brazil Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 9.5.2. Argentina 9.5.2.1. Argentina Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 9.5.2.2. Argentina Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 9.5.2.3. Argentina Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 9.5.2.4. Argentina Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 9.5.3. Rest Of South America 9.5.3.1. Rest Of South America Rice Bran Oil Market Size and Forecast, by Type (2023-2030) 9.5.3.2. Rest Of South America Rice Bran Oil Market Size and Forecast, by Grade (2023-2030) 9.5.3.3. Rest Of South America Rice Bran Oil Market Size and Forecast, by Application (2023-2030) 9.5.3.4. Rest Of South America Rice Bran Oil Market Size and Forecast, by Sales Channel (2023-2030) 10. Global Rice Bran Oil Market: Competitive Landscape 10.1. MMR Competition Matrix 10.2. Competitive Landscape 10.3. Key Players Benchmarking 10.3.1. Company Name 10.3.2. Service Segment 10.3.3. End-user Segment 10.3.4. Revenue (2023) 10.3.5. Company Locations 10.4. Leading Rice Bran Oil Market Companies, by Market Capitalization 10.5. Market Structure 10.5.1. Market Leaders 10.5.2. Market Followers 10.5.3. Emerging Players 10.6. Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1. Adani Wilmar (Gujarat, India) 11.1.1. Company Overview 11.1.2. Business Portfolio 11.1.3. Financial Overview 11.1.4. SWOT Analysis 11.1.5. Strategic Analysis 11.1.6. Scale of Operation (Small, Medium, and Large) 11.1.7. Details on Partnership 11.1.8. Regulatory Accreditations and Certifications Received by Them 11.1.9. Awards Received by the Firm 11.1.10. Recent Developments 11.2. Modi Naturals (New Delhi, India) 11.3. Marico (Maharashtra, India) 11.4. Conagra Foods (Chicago, U.S.) 11.5. BCL Industries Limited (Punjab, India) 11.6. King Rice Oil Group (Bangkok, Thailand) 11.7. California Rice Oil Company (California, U.S.) 11.8. Ricela Health Foods Ltd. (Punjab, India) 11.9. Sethia Oils Ltd. (India) 11.10. A.P. Refinery Pvt. Ltd. (India) 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary