The Radar Market has experienced significant growth driven by the increasing digitization of content across industries. The global Radar Market was valued at USD 11.25 billion in 2023 and is projected to reach USD 18.31 billion by 2030, growing at a CAGR of 7.2% during the forecast period.Radar Market Overview

The global radar market develops and deploys radar systems for a variety of applications and is increasing quickly. Radar employs electromagnetic waves to identify and track things in the environment. Defence, aviation, automobile, maritime, weather forecasting, and surveillance employ it. Several factors drive radar market expansion. First, improved radar systems are needed to improve military capabilities as countries spend more on defence. Radar aids military surveillance, target detection, missile guidance, and air traffic control. Radar-based collision avoidance and autonomous driving systems are in demand as aviation and automobile safety and security become increasingly important. Radar technology improves safety and reduces accidents by detecting objects even in bad weather. Phased array, synthetic aperture, and solid-state radar systems are also driving market expansion. These advances boost performance, precision, and reliability, attracting industries.To know about the Research Methodology :- Request Free Sample Report North America and Europe dominate the radar industry due to strong defence sectors, strong R&D, and significant defence spending. However, rising defence budgets, modernization programmes, and the necessity for surveillance and security in emerging economies will fuel market expansion in Asia-Pacific. Market Drivers for the Radar Market: The increasing global defense spending by various countries is a significant driver for the radar market. Governments across the world are prioritizing the modernization of their defense capabilities, leading to the adoption of advanced radar systems for surveillance, target detection and tracking purposes. The growing need for border security, counter-terrorism measures and maritime surveillance is further bolstering the demand for radar technology. The rising emphasis on safety and security in the aviation and automotive sectors is driving the adoption of radar-based collision avoidance and autonomous driving systems. Radar technology enables accurate object detection, even in challenging weather conditions, thereby enhancing safety and reducing the risk of accidents. With the increasing integration of radar systems in aircraft and vehicles, the radar market is witnessing substantial growth. Technological advancements in radar systems are playing a crucial role in driving Radar market growth. The development of innovative radar technologies, such as phased array radars, synthetic aperture radars and solid-state radar systems, is revolutionizing the capabilities of radar systems. These advancements offer improved performance, higher accuracy and greater reliability, driving their adoption across various industries. There is a growing demand for radar systems that provide real-time situational awareness, efficient target tracking and enhanced detection capabilities. Opportunities for the Radar Market: Radar technology has great potential in unmanned systems like UAVs and UGVs. Radar systems help autonomous cars and drones detect, track, and avoid obstacles. Radar systems for unmanned systems in defence, logistics, and agriculture are likely to expand in demand. Radar Market companies might capitalise on emerging economies' radar system demand. Defence spending, technology, and infrastructure are rising in the Asia-Pacific area. Radar-based surveillance systems for smart city, traffic management, and infrastructure monitoring are needed due to rising urbanisation and industrialization in these economies. Radar technology combined with AI and ML creates new industry opportunities. AI and ML techniques improve radar data processing, target classification, and predictive analysis. This integration created intelligent radar systems that adapt to changing settings, detect anomalies, and deliver actionable insights for defence, transportation, and weather forecasting. Restraints for the Radar Market: Radar system prices are a major constraint. Many end-users find modern radar technology costly due to its development, manufacture, and upkeep. This cost element challenges SMEs and developing economies with limited finances. Radar system complexity and the necessity for qualified operators and maintainers increase costs. Thus, cost may limit radar system adoption, especially in price-sensitive areas. Regulatory and legal issues can limit radar sales. Authorities and industry groups regulate radar system deployment and operation. These regulations assure safe and responsible radar technology use, especially in sensitive fields like aviation and defence. Complex regulatory systems and certifications and clearances take time and resources. Radar Market companies must comply with changing regulatory regulations and manage privacy and data protection concerns, which may delay product introductions and slow market growth. Challenges for the Radar Market: The constant need for technological advancements and innovation. The radar industry is highly competitive and staying at the forefront of technology is crucial to meet evolving customer demands. Companies must invest in research and development to develop advanced radar systems that offer superior performance, enhanced capabilities and compatibility with emerging technologies. Keeping up with rapid technological advancements and maintaining a competitive edge be a significant challenge for Radar market players. The interoperability of radar systems with other existing technologies and communication networks is a challenge. Radar systems often need to interface with other systems and platforms, such as command and control systems, data networks and radar data fusion systems. Ensuring seamless integration and compatibility between different systems is complex and time-consuming. With the growing trend of network-centric warfare and the integration of multiple sensors and platforms, the challenge of achieving effective interoperability becomes even more critical.

Market Trends for the Radar Market:

There is a growing demand for radar systems with increased range and accuracy. End-users, particularly in the defense and surveillance sectors, are seeking radar solutions that provide long-range detection capabilities and precise target tracking. This trend is driven by the need to detect and monitor threats from a greater distance, enhancing situational awareness and enabling timely response actions. These factors are contributing to the Radar Market growth. There is a rising trend of miniaturization and integration of radar systems. This trend is driven by the increasing need for compact and lightweight radar solutions, particularly in the automotive and unmanned systems sectors. The integration of radar technology into smaller devices, such as drones, autonomous vehicles and wearable devices, is gaining traction. This allows for enhanced functionality and broader applications, such as collision avoidance, object detection and navigation assistance. The adoption of digital beamforming technology enables the manipulation of radar beams electronically, offering advantages such as improved target detection, enhanced tracking capabilities and increased flexibility in beam control. This trend is driven by the growing need for radar systems that adapt to dynamic scenarios, provide multi-functionality and support advanced radar signal processing techniques. Digital beamforming technology allows for the efficient allocation of radar resources, enabling rapid scanning, electronic steering and the ability to track multiple targets simultaneously.Segmentation Analysis for the Radar Market:

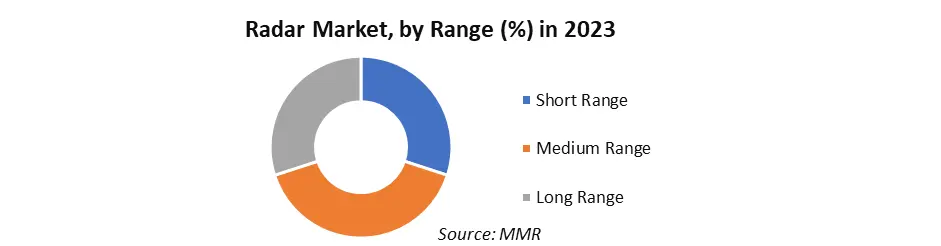

By Range: Radar systems be segmented based on their range capabilities, such as short-range radar, medium-range radar and long-range radar. This segmentation approach allows companies to cater to specific distance requirements for different applications. For example, short-range radar systems are commonly used in parking assistance systems, while long-range radar systems are critical for military surveillance and air traffic control.

Regional Analysis of the Radar Industry:

Due to its strong defence sector and excellent technology, North America dominates the radar industry. Major manufacturers spend in R&D to produce cutting-edge radar solutions in the area, contributing to the global radar market. Leading defence contractors and government defence spending boost market expansion. The region's strong market position is due to its focus on radar system innovation, especially for military and air traffic control. Europe has a strong healthcare system and invests heavily in research and technology. The area has many radar, research, and aerospace industries. Advanced radar systems for defence, aviation, and cars drive the European market. Radar technology is also adopted due to the region's focus on transportation safety, including accident avoidance and autonomous driving. Europe's radar market is also shaped by strict regulations and sustainability. Rising defence budgets, expanding economies, and rapid technology breakthroughs are driving radar industry expansion in Asia-Pacific. China, India, and South Korea are investing considerably in radar technology for defence and border security. The radar market grows due to the region's growing aviation sector and demand for car safety features. Radar-based surveillance systems for smart city and infrastructure projects enhance Asia-Pacific market growth. Latin America's defence and security issues and transportation infrastructure modernisation offer radar industry prospects. Brazil, Mexico, and Argentina are buying radar equipment for military, border, and coastal surveillance. Radar technology is also demanded by the region's growing aviation and maritime safety concerns. However, poor technological infrastructure and economic volatility in some nations impede Latin American market growth. Radar markets in the Middle East and Africa vary. Radar system manufacturers benefit from the region's substantial defense and security reliance, fueled by geopolitical tensions and border surveillance. Radar-based surveillance systems are also in demand due to infrastructure and smart city development. However, economic volatility, political uncertainty, and insufficient technology skills in some regions hinder industry expansion. Competitive Analysis of the Radar Industry: The radar industry exhibits a moderately concentrated market structure, with a few major players dominating the market. These key players possess significant Radar market share and have established their position through years of experience, technological expertise and strong customer relationships. They invest heavily in research and development to maintain a competitive edge and introduce innovative radar systems. However, there are also numerous smaller and niche players in the market, catering to specific applications or targeting regional markets. These players often focus on differentiated offerings or niche markets to carve out their space within the competitive landscape. The radar industry presents certain barriers to entry, primarily due to the need for substantial investments in research, development and manufacturing capabilities. Developing sophisticated radar systems requires advanced technological expertise, extensive testing and compliance with stringent regulations. Existing players benefit from established customer relationships, extensive distribution networks and brand recognition. With the rapid evolution of technology and the emergence of niche markets, opportunities exist for new entrants to bring disruptive innovations or cater to specific customer segments. Start-ups and smaller players often focus on niche applications or develop specialized radar solutions to gain a foothold in the market. Technological advancements play a significant role in shaping the competitive landscape of the radar industry. Companies that deliver cutting-edge radar systems with enhanced capabilities, improved performance and innovative features have a competitive advantage. These advancements include developments in signal processing, digital beamforming, multi-function radars and integration with other sensors and communication networks. Advancements in semiconductor technology, materials science and miniaturization enable the development of compact and lightweight radar systems, opening up new applications and market segments. Companies that invest in research and development and stay at the forefront of technological advancements differentiate themselves in the competitive market.Radar Market Scope: Inquire before buying

Radar Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 11.25 Bn. Forecast Period 2024 to 2030 CAGR: 7.2% Market Size in 2030: US $ 18.31 Bn. Segments Covered: by Platform Land Naval Airborne Space by Service Installation/Integration Support & Maintenance Training & Consulting by Type Defense & Aerospace Marine Weather Forecasting Remote Sensing Automotive by Range Short Range Medium Range Long Range Radar Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Radar Key Players

North America: 1. Raytheon Technologies Corporation (United States) 2. Lockheed Martin Corporation (United States) 3. Northrop Grumman Corporation (United States) 4. Collins Aerospace (United States) 5. L3Harris Technologies, Inc. (United States) Europe: 1. Thales Group (France) 2. BAE Systems plc (United Kingdom) 3. Leonardo S.p.A. (Italy) 4. Saab AB (Sweden) 5. Hensoldt (Germany) Asia Pacific: 1. Mitsubishi Electric Corporation (Japan) 2. Bharat Electronics Limited (India) 3. Hanwha Corporation (South Korea) 4. NEC Corporation (Japan) 5. Toshiba Electronic Devices & Storage Corporation (Japan) Latin America: 1. Atech (Brazil) 2. Omnisys Engenharia Ltda. (Brazil) 3. Condor S.A. (Argentina) 4. CEIIA - Center for Engineering and Product Development (Portugal/Brazil) 5. Omnidea S.A. (Uruguay) Middle East and Africa: 1. Israel Aerospace Industries Ltd. (Israel) 2. RADA Electronic Industries Ltd. (Israel) 3. Denel Dynamics (South Africa) 4. Aselsan A.S. (Turkey) 5. Leonardo MW Ltd. (United Kingdom/Italy) FAQs: 1. What are the growth drivers for the Radar Market? Ans. Increasing global defense spending and safety and security in the aviation and automotive sectors are the major drivers for the Radar Market. 2. What is the major restraint for the Radar Market growth? Ans. The complexity and cost of implementing a radar system are the major restraining factors for the Radar Market growth. 3. Which region is expected to lead the global Radar Market during the forecast period? Ans. North America and Europe are expected to lead the global Radar Market during the forecast period with Asia Pacific to be the fastest growing region of the market. 4. What is the projected market size & growth rate of the Radar Market? Ans. The Radar Market size was valued at USD 11.25 Billion in 2023 and the total revenue is expected to grow at a CAGR of 7.2% from 2024 to 2030, reaching nearly USD 18.31 Billion. 5. What segments are covered in the Radar Market report? Ans. The segments covered in the Radar Market report are service, type, platform, range and region.

1. Radar Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Radar Market: Dynamics 2.1. Radar Market Trends by Region 2.1.1. North America Radar Market Trends 2.1.2. Europe Radar Market Trends 2.1.3. Asia Pacific Radar Market Trends 2.1.4. Middle East and Africa Radar Market Trends 2.1.5. South America Radar Market Trends 2.2. Radar Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Radar Market Drivers 2.2.1.2. North America Radar Market Restraints 2.2.1.3. North America Radar Market Opportunities 2.2.1.4. North America Radar Market Challenges 2.2.2. Europe 2.2.2.1. Europe Radar Market Drivers 2.2.2.2. Europe Radar Market Restraints 2.2.2.3. Europe Radar Market Opportunities 2.2.2.4. Europe Radar Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Radar Market Drivers 2.2.3.2. Asia Pacific Radar Market Restraints 2.2.3.3. Asia Pacific Radar Market Opportunities 2.2.3.4. Asia Pacific Radar Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Radar Market Drivers 2.2.4.2. Middle East and Africa Radar Market Restraints 2.2.4.3. Middle East and Africa Radar Market Opportunities 2.2.4.4. Middle East and Africa Radar Market Challenges 2.2.5. South America 2.2.5.1. South America Radar Market Drivers 2.2.5.2. South America Radar Market Restraints 2.2.5.3. South America Radar Market Opportunities 2.2.5.4. South America Radar Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Radar Industry 2.8. Analysis of Government Schemes and Initiatives For Radar Industry 2.9. Radar Market Trade Analysis 2.10. The Global Pandemic Impact on Radar Market 3. Radar Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Radar Market Size and Forecast, by Platform (2023-2030) 3.1.1. Land 3.1.2. Naval 3.1.3. Airborne 3.1.4. Space 3.2. Radar Market Size and Forecast, by Service (2023-2030) 3.2.1. Installation/Integration 3.2.2. Support & Maintenance 3.2.3. Training & Consulting 3.3. Radar Market Size and Forecast, by Type (2023-2030) 3.3.1. Defense & Aerospace 3.3.2. Marine 3.3.3. Weather Forecasting 3.3.4. Remote Sensing 3.3.5. Automotive 3.4. Radar Market Size and Forecast, by Range (2023-2030) 3.4.1. Short Range 3.4.2. Medium Range 3.4.3. Long Range 3.5. Radar Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Radar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Radar Market Size and Forecast, by Platform (2023-2030) 4.1.1. Land 4.1.2. Naval 4.1.3. Airborne 4.1.4. Space 4.2. North America Radar Market Size and Forecast, by Service (2023-2030) 4.2.1. Installation/Integration 4.2.2. Support & Maintenance 4.2.3. Training & Consulting 4.3. North America Radar Market Size and Forecast, by Type (2023-2030) 4.3.1. Defense & Aerospace 4.3.2. Marine 4.3.3. Weather Forecasting 4.3.4. Remote Sensing 4.3.5. Automotive 4.4. North America Radar Market Size and Forecast, by Range (2023-2030) 4.4.1. Short Range 4.4.2. Medium Range 4.4.3. Long Range 4.5. North America Radar Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Radar Market Size and Forecast, by Platform (2023-2030) 4.5.1.1.1. Land 4.5.1.1.2. Naval 4.5.1.1.3. Airborne 4.5.1.1.4. Space 4.5.1.2. United States Radar Market Size and Forecast, by Service (2023-2030) 4.5.1.2.1. Installation/Integration 4.5.1.2.2. Support & Maintenance 4.5.1.2.3. Training & Consulting 4.5.1.3. United States Radar Market Size and Forecast, by Type (2023-2030) 4.5.1.3.1. Defense & Aerospace 4.5.1.3.2. Marine 4.5.1.3.3. Weather Forecasting 4.5.1.3.4. Remote Sensing 4.5.1.3.5. Automotive 4.5.1.4. United States Radar Market Size and Forecast, by Range (2023-2030) 4.5.1.4.1. Short Range 4.5.1.4.2. Medium Range 4.5.1.4.3. Long Range 4.5.2. Canada 4.5.2.1. Canada Radar Market Size and Forecast, by Platform (2023-2030) 4.5.2.1.1. Land 4.5.2.1.2. Naval 4.5.2.1.3. Airborne 4.5.2.1.4. Space 4.5.2.2. Canada Radar Market Size and Forecast, by Service (2023-2030) 4.5.2.2.1. Installation/Integration 4.5.2.2.2. Support & Maintenance 4.5.2.2.3. Training & Consulting 4.5.2.3. Canada Radar Market Size and Forecast, by Type (2023-2030) 4.5.2.3.1. Defense & Aerospace 4.5.2.3.2. Marine 4.5.2.3.3. Weather Forecasting 4.5.2.3.4. Remote Sensing 4.5.2.3.5. Automotive 4.5.2.4. Canada Radar Market Size and Forecast, by Range (2023-2030) 4.5.2.4.1. Short Range 4.5.2.4.2. Medium Range 4.5.2.4.3. Long Range 4.5.3. Mexico 4.5.3.1. Mexico Radar Market Size and Forecast, by Platform (2023-2030) 4.5.3.1.1. Land 4.5.3.1.2. Naval 4.5.3.1.3. Airborne 4.5.3.1.4. Space 4.5.3.2. Mexico Radar Market Size and Forecast, by Service (2023-2030) 4.5.3.2.1. Installation/Integration 4.5.3.2.2. Support & Maintenance 4.5.3.2.3. Training & Consulting 4.5.3.3. Mexico Radar Market Size and Forecast, by Type (2023-2030) 4.5.3.3.1. Defense & Aerospace 4.5.3.3.2. Marine 4.5.3.3.3. Weather Forecasting 4.5.3.3.4. Remote Sensing 4.5.3.3.5. Automotive 4.5.3.4. Mexico Radar Market Size and Forecast, by Range (2023-2030) 4.5.3.4.1. Short Range 4.5.3.4.2. Medium Range 4.5.3.4.3. Long Range 5. Europe Radar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Radar Market Size and Forecast, by Platform (2023-2030) 5.2. Europe Radar Market Size and Forecast, by Service (2023-2030) 5.3. Europe Radar Market Size and Forecast, by Type (2023-2030) 5.4. Europe Radar Market Size and Forecast, by Range (2023-2030) 5.5. Europe Radar Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Radar Market Size and Forecast, by Platform (2023-2030) 5.5.1.2. United Kingdom Radar Market Size and Forecast, by Service (2023-2030) 5.5.1.3. United Kingdom Radar Market Size and Forecast, by Type (2023-2030) 5.5.1.4. United Kingdom Radar Market Size and Forecast, by Range (2023-2030) 5.5.2. France 5.5.2.1. France Radar Market Size and Forecast, by Platform (2023-2030) 5.5.2.2. France Radar Market Size and Forecast, by Service (2023-2030) 5.5.2.3. France Radar Market Size and Forecast, by Type (2023-2030) 5.5.2.4. France Radar Market Size and Forecast, by Range (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Radar Market Size and Forecast, by Platform (2023-2030) 5.5.3.2. Germany Radar Market Size and Forecast, by Service (2023-2030) 5.5.3.3. Germany Radar Market Size and Forecast, by Type (2023-2030) 5.5.3.4. Germany Radar Market Size and Forecast, by Range (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Radar Market Size and Forecast, by Platform (2023-2030) 5.5.4.2. Italy Radar Market Size and Forecast, by Service (2023-2030) 5.5.4.3. Italy Radar Market Size and Forecast, by Type (2023-2030) 5.5.4.4. Italy Radar Market Size and Forecast, by Range (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Radar Market Size and Forecast, by Platform (2023-2030) 5.5.5.2. Spain Radar Market Size and Forecast, by Service (2023-2030) 5.5.5.3. Spain Radar Market Size and Forecast, by Type (2023-2030) 5.5.5.4. Spain Radar Market Size and Forecast, by Range (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Radar Market Size and Forecast, by Platform (2023-2030) 5.5.6.2. Sweden Radar Market Size and Forecast, by Service (2023-2030) 5.5.6.3. Sweden Radar Market Size and Forecast, by Type (2023-2030) 5.5.6.4. Sweden Radar Market Size and Forecast, by Range (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Radar Market Size and Forecast, by Platform (2023-2030) 5.5.7.2. Austria Radar Market Size and Forecast, by Service (2023-2030) 5.5.7.3. Austria Radar Market Size and Forecast, by Type (2023-2030) 5.5.7.4. Austria Radar Market Size and Forecast, by Range (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Radar Market Size and Forecast, by Platform (2023-2030) 5.5.8.2. Rest of Europe Radar Market Size and Forecast, by Service (2023-2030) 5.5.8.3. Rest of Europe Radar Market Size and Forecast, by Type (2023-2030) 5.5.8.4. Rest of Europe Radar Market Size and Forecast, by Range (2023-2030) 6. Asia Pacific Radar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Radar Market Size and Forecast, by Platform (2023-2030) 6.2. Asia Pacific Radar Market Size and Forecast, by Service (2023-2030) 6.3. Asia Pacific Radar Market Size and Forecast, by Type (2023-2030) 6.4. Asia Pacific Radar Market Size and Forecast, by Range (2023-2030) 6.5. Asia Pacific Radar Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Radar Market Size and Forecast, by Platform (2023-2030) 6.5.1.2. China Radar Market Size and Forecast, by Service (2023-2030) 6.5.1.3. China Radar Market Size and Forecast, by Type (2023-2030) 6.5.1.4. China Radar Market Size and Forecast, by Range (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Radar Market Size and Forecast, by Platform (2023-2030) 6.5.2.2. S Korea Radar Market Size and Forecast, by Service (2023-2030) 6.5.2.3. S Korea Radar Market Size and Forecast, by Type (2023-2030) 6.5.2.4. S Korea Radar Market Size and Forecast, by Range (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Radar Market Size and Forecast, by Platform (2023-2030) 6.5.3.2. Japan Radar Market Size and Forecast, by Service (2023-2030) 6.5.3.3. Japan Radar Market Size and Forecast, by Type (2023-2030) 6.5.3.4. Japan Radar Market Size and Forecast, by Range (2023-2030) 6.5.4. India 6.5.4.1. India Radar Market Size and Forecast, by Platform (2023-2030) 6.5.4.2. India Radar Market Size and Forecast, by Service (2023-2030) 6.5.4.3. India Radar Market Size and Forecast, by Type (2023-2030) 6.5.4.4. India Radar Market Size and Forecast, by Range (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Radar Market Size and Forecast, by Platform (2023-2030) 6.5.5.2. Australia Radar Market Size and Forecast, by Service (2023-2030) 6.5.5.3. Australia Radar Market Size and Forecast, by Type (2023-2030) 6.5.5.4. Australia Radar Market Size and Forecast, by Range (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Radar Market Size and Forecast, by Platform (2023-2030) 6.5.6.2. Indonesia Radar Market Size and Forecast, by Service (2023-2030) 6.5.6.3. Indonesia Radar Market Size and Forecast, by Type (2023-2030) 6.5.6.4. Indonesia Radar Market Size and Forecast, by Range (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Radar Market Size and Forecast, by Platform (2023-2030) 6.5.7.2. Malaysia Radar Market Size and Forecast, by Service (2023-2030) 6.5.7.3. Malaysia Radar Market Size and Forecast, by Type (2023-2030) 6.5.7.4. Malaysia Radar Market Size and Forecast, by Range (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Radar Market Size and Forecast, by Platform (2023-2030) 6.5.8.2. Vietnam Radar Market Size and Forecast, by Service (2023-2030) 6.5.8.3. Vietnam Radar Market Size and Forecast, by Type (2023-2030) 6.5.8.4. Vietnam Radar Market Size and Forecast, by Range (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Radar Market Size and Forecast, by Platform (2023-2030) 6.5.9.2. Taiwan Radar Market Size and Forecast, by Service (2023-2030) 6.5.9.3. Taiwan Radar Market Size and Forecast, by Type (2023-2030) 6.5.9.4. Taiwan Radar Market Size and Forecast, by Range (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Radar Market Size and Forecast, by Platform (2023-2030) 6.5.10.2. Rest of Asia Pacific Radar Market Size and Forecast, by Service (2023-2030) 6.5.10.3. Rest of Asia Pacific Radar Market Size and Forecast, by Type (2023-2030) 6.5.10.4. Rest of Asia Pacific Radar Market Size and Forecast, by Range (2023-2030) 7. Middle East and Africa Radar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Radar Market Size and Forecast, by Platform (2023-2030) 7.2. Middle East and Africa Radar Market Size and Forecast, by Service (2023-2030) 7.3. Middle East and Africa Radar Market Size and Forecast, by Type (2023-2030) 7.4. Middle East and Africa Radar Market Size and Forecast, by Range (2023-2030) 7.5. Middle East and Africa Radar Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Radar Market Size and Forecast, by Platform (2023-2030) 7.5.1.2. South Africa Radar Market Size and Forecast, by Service (2023-2030) 7.5.1.3. South Africa Radar Market Size and Forecast, by Type (2023-2030) 7.5.1.4. South Africa Radar Market Size and Forecast, by Range (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Radar Market Size and Forecast, by Platform (2023-2030) 7.5.2.2. GCC Radar Market Size and Forecast, by Service (2023-2030) 7.5.2.3. GCC Radar Market Size and Forecast, by Type (2023-2030) 7.5.2.4. GCC Radar Market Size and Forecast, by Range (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Radar Market Size and Forecast, by Platform (2023-2030) 7.5.3.2. Nigeria Radar Market Size and Forecast, by Service (2023-2030) 7.5.3.3. Nigeria Radar Market Size and Forecast, by Type (2023-2030) 7.5.3.4. Nigeria Radar Market Size and Forecast, by Range (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Radar Market Size and Forecast, by Platform (2023-2030) 7.5.4.2. Rest of ME&A Radar Market Size and Forecast, by Service (2023-2030) 7.5.4.3. Rest of ME&A Radar Market Size and Forecast, by Type (2023-2030) 7.5.4.4. Rest of ME&A Radar Market Size and Forecast, by Range (2023-2030) 8. South America Radar Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Radar Market Size and Forecast, by Platform (2023-2030) 8.2. South America Radar Market Size and Forecast, by Service (2023-2030) 8.3. South America Radar Market Size and Forecast, by Type(2023-2030) 8.4. South America Radar Market Size and Forecast, by Range (2023-2030) 8.5. South America Radar Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Radar Market Size and Forecast, by Platform (2023-2030) 8.5.1.2. Brazil Radar Market Size and Forecast, by Service (2023-2030) 8.5.1.3. Brazil Radar Market Size and Forecast, by Type (2023-2030) 8.5.1.4. Brazil Radar Market Size and Forecast, by Range (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Radar Market Size and Forecast, by Platform (2023-2030) 8.5.2.2. Argentina Radar Market Size and Forecast, by Service (2023-2030) 8.5.2.3. Argentina Radar Market Size and Forecast, by Type (2023-2030) 8.5.2.4. Argentina Radar Market Size and Forecast, by Range (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Radar Market Size and Forecast, by Platform (2023-2030) 8.5.3.2. Rest Of South America Radar Market Size and Forecast, by Service (2023-2030) 8.5.3.3. Rest Of South America Radar Market Size and Forecast, by Type (2023-2030) 8.5.3.4. Rest Of South America Radar Market Size and Forecast, by Range (2023-2030) 9. Global Radar Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Radar Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Raytheon Technologies Corporation (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Lockheed Martin Corporation (United States) 10.3. Northrop Grumman Corporation (United States) 10.4. Collins Aerospace (United States) 10.5. L3Harris Technologies, Inc. (United States) 10.6. Thales Group (France) 10.7. BAE Systems plc (United Kingdom) 10.8. Leonardo S.p.A. (Italy) 10.9. Saab AB (Sweden) 10.10. Hensoldt (Germany) 10.11. Mitsubishi Electric Corporation (Japan) 10.12. Bharat Electronics Limited (India) 10.13. Hanwha Corporation (South Korea) 10.14. NEC Corporation (Japan) 10.15. Toshiba Electronic Devices & Storage Corporation (Japan) 10.16. Atech (Brazil) 10.17. Omnisys Engenharia Ltda. (Brazil) 10.18. Condor S.A. (Argentina) 10.19. CEIIA - Center for Engineering and Product Development (Portugal/Brazil) 10.20. Omnidea S.A. (Uruguay) 10.21. Israel Aerospace Industries Ltd. (Israel) 10.22. RADA Electronic Industries Ltd. (Israel) 10.23. Denel Dynamics (South Africa) 10.24. Aselsan A.S. (Turkey) 10.25. Leonardo MW Ltd. (United Kingdom/Italy) 11. Key Findings 12. Industry Recommendations 13. Radar Market: Research Methodology 14. Terms and Glossary