Global Pulse Oximeter Market size was valued at USD 2.80 Bn in 2023 and is expected to reach USD 5.53 Bn by 2030, at a CAGR of 10.2%.Pulse Oximeter Market Overview

A pulse oximeter is a portable medical device used to measure oxygen saturation in the blood, typically clipped onto a finger, toe, or earlobe. It operates by emitting light beams into the skin, detecting the absorption pattern to determine oxygen levels. This non-invasive tool is crucial for assessing respiratory health, particularly in conditions such as asthma, pneumonia, and COPD which drives Pulse Oximeter Market growth. It monitors heart rate, providing vital information for individuals with cardiac issues. With the COVID-19 pandemic highlighting the significance of oxygen saturation levels, pulse oximeters have gained widespread recognition for at-home monitoring, aiding in the early detection of respiratory distress. Pulse oximeters remain invaluable for both medical professionals and individuals monitoring their health, offering a quick, accessible method to track oxygenation status and overall well-being.To know about the Research Methodology :- Request Free Sample Report The pulse oximeter industry has experienced significant growth driven by factors such as increasing awareness about the importance of monitoring oxygen saturation levels in both clinical and home settings, the rising prevalence of respiratory diseases such as COPD and asthma, and the ongoing COVID-19 pandemic prominence of the necessity of remote patient monitoring. Pulse oximeters, devices used to measure the oxygen saturation of hemoglobin in the blood and pulse rate, have become indispensable tools for healthcare professionals and individuals. Technological advancements, including the development of portable and wearable pulse oximeters with enhanced accuracy and convenience, have fueled the Pulse Oximeter Market growth. The favorable government initiatives aimed at improving healthcare infrastructure, especially in emerging economies, are contributing to industry growth. With a growing emphasis on telemedicine and remote patient monitoring, the pulse oximeter industry is expected to continue its upward trajectory, catering to the increasing demand for accurate and reliable oxygen saturation monitoring solutions globally.

Pulse Oximeter Market Trend

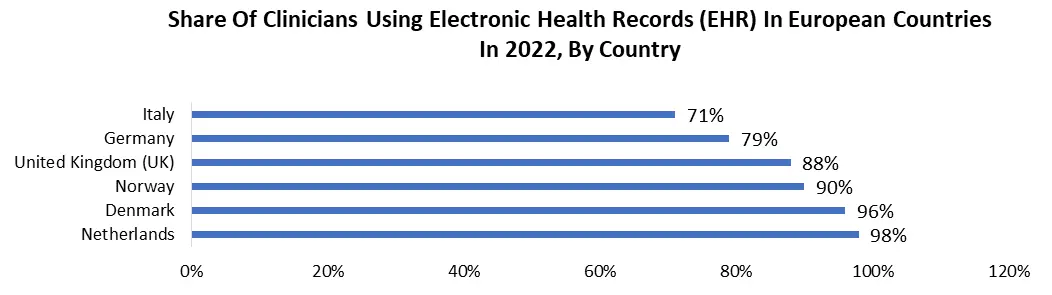

Integration Of Advanced Technology and Connectivity Features to Enhance Monitoring Capabilities and Improve Patient Outcomes Advancements in technology have led to the development of more sophisticated pulse oximeters that offer enhanced functionality and accuracy in measuring arterial blood oxygen saturation levels (SpO2) and pulse rate. These advanced features allow healthcare providers to obtain more reliable and timely information about a patient's respiratory status, enabling early detection of respiratory complications and timely intervention. The integration of connectivity features such as Bluetooth, Wi-Fi, or cellular connectivity enables pulse oximeters to transmit real-time monitoring data to healthcare providers or centralized monitoring systems remotely. This capability is particularly beneficial for patients with chronic respiratory conditions, such as chronic obstructive pulmonary disease (COPD) or sleep apnea, who require continuous monitoring of their SpO2 levels driving Pulse Oximeter Market growth. Remote monitoring allows healthcare providers to track patients' respiratory status outside of traditional clinical settings, facilitating proactive management and intervention when necessary. Connectivity features enable seamless integration with electronic health records (EHR) systems, telehealth platforms, and other healthcare IT systems, facilitating data exchange and interoperability. This integration streamlines workflows for healthcare providers, reduces documentation errors, and improves the continuity of care for patients and drives Pulse Oximeter Market growth. Pulse oximeters are equipped with connectivity features remotely managed and configured, allowing for firmware updates, calibration, and troubleshooting without the need for physical access to the device.

Pulse Oximeter Market Dynamics

Increasing Demand for Remote Patient Monitoring Solutions to Boost Market Growth Remote Patient Monitoring (RPM) solutions. RPM solutions have gained prominence due to their ability to support medical devices and users with reliable remote monitoring and care management capabilities. These solutions offer integrated home-installed systems with wireless data transmission capabilities, utilizing medical-grade communication technologies and protocols to enable health-related guidance, personalized care management, and improved adherence to treatment. RPM solutions provide numerous benefits, including improved clinical decision-making, enhanced self-management and care plan adherence for patients, cost reduction for both payors and providers and increased net patient revenue which boost Pulse Oximeter Market growth. RPM helps reduce patient expenses, improves access to care, builds patient engagement, optimizes clinical staff efficiency, prevents the spread of infectious diseases, and boosts caregiver connectivity and involvement in care. Offering RPM programs presents referral opportunities, improves retention, and strengthens the clinician-patient relationship. As the demand for RPM solutions continues to rise, driven by the need for remote healthcare monitoring and management, the pulse oximeter industry has to experience significant growth. The challenge of ensuring accurate readings and reliable performance to hamper Market Growth The susceptibility of pulse oximeters to motion artifacts and poor peripheral perfusion, lead to inaccurate readings, particularly in patients who are moving or have compromised circulation. These factors result in false alarms or misinterpretation of patient data, potentially leading to incorrect clinical decisions or unnecessary interventions. Ambient light interference, such as from surgical lights or sunlight, affects the performance of pulse oximeters, complicating accurate monitoring in clinical environments which hamper Pulse Oximeter Market growth. Certain medical conditions and patient characteristics including anemia, hypotension, or dark skin pigmentation, impact the accuracy of pulse oximeter readings. 1. For Instance, in patients with low hemoglobin levels, pulse oximeters underestimate oxygen saturation levels, leading to underdiagnosis or inadequate oxygen therapy. Similarly, in patients with darker skin tones, pulse oximeters have difficulty accurately detecting oxygen saturation levels due to differences in light absorption and scattering.Pulse Oximeter Market Segment Analysis

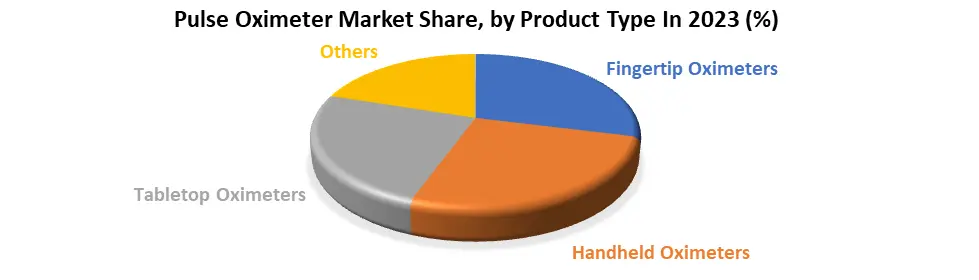

Based on Product Type, the market is segmented into Fingertip Oximeters, Handheld Oximeters, Tabletop Oximeters and Others. Fingertip Oximeters dominated the Product Type for the Pulse Oximeter Market in 2023. Fingertip oximeters provide numerous benefits that make them suitable for various clinical settings, including hospitals, clinics, ambulatory care centers, and home healthcare settings. These devices are compact and lightweight, making them easy to carry and transport. Their small size allows for convenient bedside monitoring of patients in hospitals and clinics, as well as on-the-go monitoring in ambulatory care settings. The fingertip oximeters are suitable for home use, enabling patients to monitor their oxygen saturation levels and pulse rates regularly without the need for frequent visits to healthcare facilities. These fingertip oximeter devices are designed to be user-friendly, with simple interfaces and intuitive operation. Healthcare providers easily attach the fingertip oximeter probe to a patient's fingertip or earlobe and obtain accurate readings within seconds. Patients also use fingertip oximeters independently, requiring minimal training or assistance from healthcare professionals which boosts Pulse Oximeter Market growth. The non-invasive nature of fingertip oximeters is another significant advantage. Unlike invasive methods of monitoring oxygen saturation levels, such as arterial blood gas analysis, fingertip oximeters require no needles or blood samples, minimizing discomfort and risk for patients. This non-invasive approach to monitoring makes fingertip oximeters suitable for use in patients of all ages, including infants, children, and elderly individuals.

Pulse Oximeter Market Regional Insights

North America dominated the Pulse Oximeter Market in 2023 and is expected to continue its dominance over the forecast period. North America leads the pulse oximeter industry due to its robust healthcare infrastructure, advanced medical technology adoption, rising chronic diseases, supportive government initiatives, and growing elderly population. The United States and Canada boast a vast network of hospitals, clinics, and healthcare facilities equipped with state-of-the-art medical equipment and technologies. These facilities have a high demand for pulse oximeters to monitor patients' oxygen saturation levels and pulse rates accurately. The presence of advanced healthcare facilities fosters innovation and drives the development of new and improved pulse oximeter technologies tailored to meet the specific needs of healthcare providers and patients. The region has a high adoption rate of advanced medical technologies, including pulse oximeters. Healthcare providers in the region are early adopters of innovative medical devices and technologies that improve patient care and outcomes. Pulse oximeters are widely used in various clinical settings, including hospitals, ambulatory care centers, and home healthcare settings, to monitor patients' respiratory status and detect early signs of respiratory distress or hypoxemia which boost Pulse Oximeter Market growth. The growing awareness among healthcare providers about the importance of continuous monitoring of oxygen saturation levels further contributes to the widespread adoption of pulse oximeters in the region. The increasing prevalence of chronic diseases such as chronic obstructive pulmonary disease (COPD), asthma, and sleep apnea also drives the demand for pulse oximeters in North America. These chronic respiratory conditions require regular monitoring of patients' oxygen saturation levels to assess disease severity, monitor treatment efficacy, and prevent exacerbations. The rising incidence of cardiovascular diseases, which often coexist with respiratory conditions, emphasizes the importance of continuous monitoring of vital signs, including pulse rate and oxygen saturation levels, using pulse oximeters. The supportive government initiatives and regulations play a significant role in driving the growth of the pulse oximeter market in North America. Regulatory agencies such as the Food and Drug Administration (FDA) in the United States and Health Canada in Canada set stringent quality standards and regulations for medical devices, including pulse oximeters, to ensure their safety, efficacy, and accuracy. Compliance with these regulations is essential for manufacturers to market their pulse oximeters in the region, thereby fostering trust among healthcare providers and patients in the reliability and performance of these devices.Pulse Oximeter Market Scope: Inquire before buying

Global Pulse Oximeter Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 2.80 Bn. Forecast Period 2024 to 2030 CAGR: 10.2% Market Size in 2030: US $ 5.53 Bn. Segments Covered: by Product Type Fingertip Oximeters Handheld Oximeters Tabletop Oximeters Others by Technology Conventional Smart by Age Group Adults Pediatrics by End-User Hospitals and Ambulatory Surgical Centers Clinics Home Healthcare Others Pulse Oximeter Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Pulse Oximeter Key Players

Global 1. Masimo Corporation (United States) 2. Medtronic plc (Ireland) 3. Koninklijke Philips N.V. (Netherlands) 4. Nonin Medical, Inc. (United States) 5. Smiths Medical (United Kingdom) North American 1. Nihon Kohden Corporation (United States) 2. GE Healthcare (United States) 3. Welch Allyn, Inc. (United States) Europe 1. Draegerwerk AG & Co. KGaA (Germany) 2. GE Healthcare (United Kingdom) Asia Pacific 1. Mindray Medical International Limited (China) 2. Nihon Kohden Corporation (Japan) 3. Heal Forsce Bio-Meditech Holdings Limited (China) 4. Contec Medical Systems Co., Ltd. (China) 5. ChoiceMMed (China) Frequently Asked Questions: 1] What is the growth rate of the Global Pulse Oximeter Market? Ans. The Global Pulse Oximeter Market is growing at a significant rate of 10.2% during the forecast period. 2] Which region is expected to dominate the Global Pulse Oximeter Market? Ans. North America is expected to dominate the Pulse Oximeter Market during the forecast period. 3] What is the expected Global Pulse Oximeter Market size by 2030? Ans. The Pulse Oximeter Market size is expected to reach USD 5.53 Billion by 2030. 4] Which are the top players in the Global Pulse Oximeter Market? Ans. The major top players in the Global Pulse Oximeter Market are Masimo Corporation (United States), Medtronic plc (Ireland), Koninklijke Philips N.V. (Netherlands), Nonin Medical, Inc. (United States), Smiths Medical (United Kingdom), Nihon Kohden Corporation (United States) and Others. 5] What are the factors driving the Global Pulse Oximeter Market growth? Ans. Rising Prevalence of Respiratory Disorders and technological advances are expected to drive market growth during the forecast period.

1. Pulse Oximeter Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Pulse Oximeter Market: Dynamics 2.1. Pulse Oximeter Market Trends by Region 2.1.1. North America Pulse Oximeter Market Trends 2.1.2. Europe Pulse Oximeter Market Trends 2.1.3. Asia Pacific Pulse Oximeter Market Trends 2.1.4. Middle East and Africa Pulse Oximeter Market Trends 2.1.5. South America Pulse Oximeter Market Trends 2.2. Pulse Oximeter Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Pulse Oximeter Market Drivers 2.2.1.2. North America Pulse Oximeter Market Restraints 2.2.1.3. North America Pulse Oximeter Market Opportunities 2.2.1.4. North America Pulse Oximeter Market Challenges 2.2.2. Europe 2.2.2.1. Europe Pulse Oximeter Market Drivers 2.2.2.2. Europe Pulse Oximeter Market Restraints 2.2.2.3. Europe Pulse Oximeter Market Opportunities 2.2.2.4. Europe Pulse Oximeter Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Pulse Oximeter Market Drivers 2.2.3.2. Asia Pacific Pulse Oximeter Market Restraints 2.2.3.3. Asia Pacific Pulse Oximeter Market Opportunities 2.2.3.4. Asia Pacific Pulse Oximeter Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Pulse Oximeter Market Drivers 2.2.4.2. Middle East and Africa Pulse Oximeter Market Restraints 2.2.4.3. Middle East and Africa Pulse Oximeter Market Opportunities 2.2.4.4. Middle East and Africa Pulse Oximeter Market Challenges 2.2.5. South America 2.2.5.1. South America Pulse Oximeter Market Drivers 2.2.5.2. South America Pulse Oximeter Market Restraints 2.2.5.3. South America Pulse Oximeter Market Opportunities 2.2.5.4. South America Pulse Oximeter Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Pulse Oximeter Industry 2.8. Analysis of Government Schemes and Initiatives For Pulse Oximeter Industry 2.9. Pulse Oximeter Market Trade Analysis 2.10. The Global Pandemic Impact on Pulse Oximeter Market 3. Pulse Oximeter Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 3.1.1. Fingertip Oximeters 3.1.2. Handheld Oximeters 3.1.3. Tabletop Oximeters 3.1.4. Others 3.2. Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 3.2.1. Conventional 3.2.2. Smart 3.3. Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 3.3.1. Adults 3.3.2. Pediatrics 3.4. Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 3.4.1. Hospitals and Ambulatory Surgical Centers 3.4.2. Clinics 3.4.3. Home Healthcare 3.4.4. Others 3.5. Pulse Oximeter Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Pulse Oximeter Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 4.1.1. Fingertip Oximeters 4.1.2. Handheld Oximeters 4.1.3. Tabletop Oximeters 4.1.4. Others 4.2. North America Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 4.2.1. Conventional 4.2.2. Smart 4.3. North America Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 4.3.1. Adults 4.3.2. Pediatrics 4.4. North America Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 4.4.1. Hospitals and Ambulatory Surgical Centers 4.4.2. Clinics 4.4.3. Home Healthcare 4.4.4. Others 4.5. North America Pulse Oximeter Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 4.5.1.1.1. Fingertip Oximeters 4.5.1.1.2. Handheld Oximeters 4.5.1.1.3. Tabletop Oximeters 4.5.1.1.4. Others 4.5.1.2. United States Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 4.5.1.2.1. Conventional 4.5.1.2.2. Smart 4.5.1.3. United States Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 4.5.1.3.1. Adults 4.5.1.3.2. Pediatrics 4.5.1.4. United States Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Hospitals and Ambulatory Surgical Centers 4.5.1.4.2. Clinics 4.5.1.4.3. Home Healthcare 4.5.1.4.4. Others 4.5.2. Canada 4.5.2.1. Canada Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 4.5.2.1.1. Fingertip Oximeters 4.5.2.1.2. Handheld Oximeters 4.5.2.1.3. Tabletop Oximeters 4.5.2.1.4. Others 4.5.2.2. Canada Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 4.5.2.2.1. Conventional 4.5.2.2.2. Smart 4.5.2.3. Canada Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 4.5.2.3.1. Adults 4.5.2.3.2. Pediatrics 4.5.2.4. Canada Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Hospitals and Ambulatory Surgical Centers 4.5.2.4.2. Clinics 4.5.2.4.3. Home Healthcare 4.5.2.4.4. Others 4.5.3. Mexico 4.5.3.1. Mexico Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 4.5.3.1.1. Fingertip Oximeters 4.5.3.1.2. Handheld Oximeters 4.5.3.1.3. Tabletop Oximeters 4.5.3.1.4. Others 4.5.3.2. Mexico Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 4.5.3.2.1. Conventional 4.5.3.2.2. Smart 4.5.3.3. Mexico Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 4.5.3.3.1. Adults 4.5.3.3.2. Pediatrics 4.5.3.4. Mexico Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Hospitals and Ambulatory Surgical Centers 4.5.3.4.2. Clinics 4.5.3.4.3. Home Healthcare 4.5.3.4.4. Others 5. Europe Pulse Oximeter Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 5.2. Europe Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 5.3. Europe Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 5.4. Europe Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 5.5. Europe Pulse Oximeter Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 5.5.1.2. United Kingdom Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 5.5.1.3. United Kingdom Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 5.5.1.4. United Kingdom Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 5.5.2.2. France Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 5.5.2.3. France Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 5.5.2.4. France Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 5.5.3.2. Germany Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 5.5.3.3. Germany Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 5.5.3.4. Germany Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 5.5.4.2. Italy Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 5.5.4.3. Italy Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 5.5.4.4. Italy Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 5.5.5.2. Spain Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 5.5.5.3. Spain Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 5.5.5.4. Spain Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 5.5.6.2. Sweden Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 5.5.6.3. Sweden Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 5.5.6.4. Sweden Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 5.5.7.2. Austria Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 5.5.7.3. Austria Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 5.5.7.4. Austria Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 5.5.8.2. Rest of Europe Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 5.5.8.3. Rest of Europe Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 5.5.8.4. Rest of Europe Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Pulse Oximeter Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 6.2. Asia Pacific Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 6.3. Asia Pacific Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 6.4. Asia Pacific Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Pulse Oximeter Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 6.5.1.2. China Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 6.5.1.3. China Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 6.5.1.4. China Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 6.5.2.2. S Korea Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 6.5.2.3. S Korea Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 6.5.2.4. S Korea Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 6.5.3.2. Japan Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 6.5.3.3. Japan Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 6.5.3.4. Japan Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 6.5.4.2. India Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 6.5.4.3. India Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 6.5.4.4. India Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 6.5.5.2. Australia Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 6.5.5.3. Australia Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 6.5.5.4. Australia Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 6.5.6.2. Indonesia Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 6.5.6.3. Indonesia Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 6.5.6.4. Indonesia Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 6.5.7.2. Malaysia Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 6.5.7.3. Malaysia Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 6.5.7.4. Malaysia Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 6.5.8.2. Vietnam Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 6.5.8.3. Vietnam Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 6.5.8.4. Vietnam Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 6.5.9.2. Taiwan Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 6.5.9.3. Taiwan Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 6.5.9.4. Taiwan Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 6.5.10.2. Rest of Asia Pacific Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 6.5.10.3. Rest of Asia Pacific Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 6.5.10.4. Rest of Asia Pacific Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Pulse Oximeter Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 7.2. Middle East and Africa Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 7.3. Middle East and Africa Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 7.4. Middle East and Africa Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Pulse Oximeter Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 7.5.1.2. South Africa Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 7.5.1.3. South Africa Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 7.5.1.4. South Africa Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 7.5.2.2. GCC Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 7.5.2.3. GCC Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 7.5.2.4. GCC Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 7.5.3.2. Nigeria Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 7.5.3.3. Nigeria Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 7.5.3.4. Nigeria Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 7.5.4.2. Rest of ME&A Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 7.5.4.3. Rest of ME&A Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 7.5.4.4. Rest of ME&A Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 8. South America Pulse Oximeter Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 8.2. South America Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 8.3. South America Pulse Oximeter Market Size and Forecast, by Age Group(2023-2030) 8.4. South America Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 8.5. South America Pulse Oximeter Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 8.5.1.2. Brazil Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 8.5.1.3. Brazil Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 8.5.1.4. Brazil Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 8.5.2.2. Argentina Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 8.5.2.3. Argentina Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 8.5.2.4. Argentina Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Pulse Oximeter Market Size and Forecast, by Product Type (2023-2030) 8.5.3.2. Rest Of South America Pulse Oximeter Market Size and Forecast, by Technology (2023-2030) 8.5.3.3. Rest Of South America Pulse Oximeter Market Size and Forecast, by Age Group (2023-2030) 8.5.3.4. Rest Of South America Pulse Oximeter Market Size and Forecast, by End User (2023-2030) 9. Global Pulse Oximeter Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Pulse Oximeter Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Masimo Corporation (United States) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Medtronic plc (Ireland) 10.3. Koninklijke Philips N.V. (Netherlands) 10.4. Nonin Medical, Inc. (United States) 10.5. Smiths Medical (United Kingdom) 10.6. Nihon Kohden Corporation (United States) 10.7. GE Healthcare (United States) 10.8. Welch Allyn, Inc. (United States) 10.9. Draegerwerk AG & Co. KGaA (Germany) 10.10. GE Healthcare (United Kingdom) 10.11. Mindray Medical International Limited (China) 10.12. Nihon Kohden Corporation (Japan) 10.13. Heal Forsce Bio-Meditech Holdings Limited (China) 10.14. Contec Medical Systems Co., Ltd. (China) 10.15. ChoiceMMed (China) 11. Key Findings 12. Industry Recommendations 13. Pulse Oximeter Market: Research Methodology 14. Terms and Glossary