The Pulmonary Function Testing System Market size was valued at USD 154.6 Million in 2023 and the total Pulmonary Function Testing System Market revenue is expected to grow at a CAGR of 4.9% from 2024 to 2030, reaching nearly USD 216.09 Million By 2030Pulmonary Function Testing System Overview

Pulmonary Function Testing System is a non-invasive tests that show how well the lungs are working. Various functions such as respiratory mechanics, lung volume, vital capacity, and diffusion capacity are monitored and people suffering from severe breathing problems such as asthma and COPD are treated after this testing. Pulmonary Function test is divided into two categories Peak expiratory flow (PEF) and Forced expiratory volume in one second (FEV1).To know about the Research Methodology :- Request Free Sample Report The key factors propelling the market for pulmonary function testing include the growing prevalence of a sedentary lifestyle because of socioeconomic status due to which the rate of pulmonary diseases is high. Technological advancements and rising awareness of early diagnosis are the major opportunities that drive the Pulmonary Function testing Market. Other prime factors driving the market include a rise in lung cancer and other respiratory disorders, and air pollution also exacerbates breathing issues. 1. According to MMR analysis, the compound annual growth rate of the Pulmonary Function Testing Market is 4.9% from 2024 to 2030. The market for pulmonary function testing has a wide range of applications that meet different medical conditions. The pulmonary Function Testing Market is categorized such as asthma, chronic shortness of breath, pulmonary fibrosis, and chronic obstructive pulmonary disease (COPD). The Pulmonary Function Testing Market has witnessed many new inventions and technologies such as Portable Testing Systems, Smart Spirometers, and Continuous Monitoring Solutions which have driven the Pulmonary Function Testing Market growth. Maximize market Research analyzed the Pulmonary Function Testing Market over the past 5 years, and by using data, concluded that North America is the most dominating region in the PFT market. Other emerging regions like Europe and Asia-Pacific are witnessing growth because of the rising chronic respiratory diseases. The major key players like COSMED, NSPIRE HEALTH INC, MCG Diagnostics Corporation, Morgan Scientific Inc., and others are mentioned in the report.

Pulmonary Function Testing System Market Dynamics

Occurrence of Respiratory Diseases The growth of the Pulmonary Function Testing Market is driven by factors like increased air pollution, a rise in lung cancer cases, pneumonia, and other respiratory issues as well as rising need for pulmonary function equipment. The more common respiratory diseases are lung cancer, COPD, pneumonia, tuberculosis, and asthma. Exposure to air pollutants, such as allergies and tobacco smoke, as well as environmental factors, genetics, and respiratory infections, can result in asthma. Technological advancements in spirometry diagnostic devices, which show how well the lungs are working fuel the Pulmonary Function Testing system market growth. 1. Asthma affected about 250 million people globally in 2023, especially in North America, 20 % of people suffer from asthma.Trends in the Pulmonary Function Testing System Market

An increase in Technological advancements has gained and improved user experience. The pulmonary Function Testing System Market is consolidating and making strategic partnerships through margins and acquisition to expand their market and strengthen its global presence. Rising incidences of respiratory disorders such as COPD, asthma, and cystic fibrosis are key drivers for the growth of the PFT system market. North America, due to its large population and widespread awareness about respiratory diseases is expected to experience significant growth in the PFT market Challenges in the Pulmonary Function Testing System Market The market for pulmonary function testing is growing, but there are several obstacles in the way, including health providers and the general public not being aware of the test. One of the main barriers to the market for pulmonary function testing is the high cost of the medical equipment needed for the test. The cost of the Pulmonary Function Testing System in China is high, about 245 Chinese Yuan in 2023. In India the cost of the testing equipment range from USD10 to USD15.The absence of competent experts, regulatory policies containing guidelines, and test implementation impacts market expansion. Conflicts over money and terms can arise from rivalry amongst important participants. In developing nations, the emergence of healthcare is challenged by insufficient infrastructure. Opportunities in the Pulmonary Function Testing System Market Various opportunities are expected to drive the Pulmonary Function Testing market such as the market for pulmonary function testing is expected to increase the emphasis on working together with healthcare providers. Businesses are focusing more and more on collaborating with healthcare providers to enhance patient outcomes and care. The growing prevalence of chronic respiratory diseases, the attention that major players are paying to bring portable systems to clinics, and the expanding use of pulmonary function testing systems in clinics are all factors that are linked to this collaboration.Pulmonary Function Testing System Market Segment Analysis

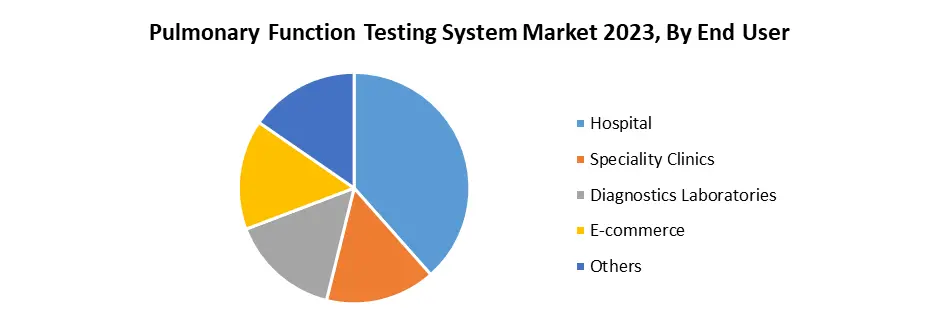

By System, based on the system the segment is divided into two Systems Portable PFT Systems and Complete PFT Systems. As compared to the Portable PFT System, the Complete PFT System is more dominating and is expected to continue dominance in the forecast period. It takes about 1.5 hours and includes lung function tests, spirometry (which measures lung volume), gas measurements, and capacity. The population's rising prevalence of COPD and asthma, along with the growing number of hospitals requiring comprehensive pulmonary function testing systems, are driving the growth of this market segment. By Test System, based on the test System Pulmonary Function Testing Market is segmented into various categories that are Spirometry, Plethysmography, Nitrogen washout, Lung Volume, Gas Exchange Testing, Maximize Voluntary Ventilation, Oxygen titration test, Exercise Stress Test, and others. These examinations evaluate lung function, identify respiratory disorders, and track the efficacy of medical interventions. By Application, The market for pulmonary function testing systems is segmented according to application, including restrictive lung diseases, asthma, chronic shortness of breath, and chronic obstructive pulmonary disease. In 2022, the market with the highest revenue was the asthma segment. The lung function test measures an individual's ability to breathe to assist medical professionals in diagnosing and treating asthma. Over the course of the forecast period, chronic obstructive pulmonary disease is anticipated to dominate the market.Pulmonary function testing systems measure lung volume, capacity, rates of flow, and gas exchange. The most helpful System of pulmonary function testing system is spirometry, which is primarily used to diagnose COPD. By End Users, Based on the End Users, the market is segmented into Hospitals, Specialty Clinics, Diagnostic Laboratories, and others. In 2023, 30% of the hospitals held the largest share of the market for pulmonary function testing systems, and it is expected that they will maintain this position in the forecast period. The main factors propelling this market are the abundance of options and the increasing utilization of pulmonary function testing systems for hospital patient diagnosis. Asthma and COPD patients, among others, have been frequent visitors to the hospitals.

Pulmonary Function Testing System Market Regional Insight

North America is dominating the Pulmonary Function Testing Market and is expected to continue its dominance in the upcoming 5 years, because of the growing number of chronic respiratory diseases, rising geriatric population, and increase in the use of the pulmonary function testing market. North America dominated the global market with a 43.09 % market share in 2023, North America led the world in the hospitals and clinical sectors and is expected to grow at 1.9 Mn by 2030. The US shows the highest adoption in the pulmonary function testing market. Europe is the second largest region witnessing notable growth in the Pulmonary Function Testing Market, due to the presence of key players like NSPIRE HEALTH INC, MCG Diagnostics Corporation, Morgan Scientific Inc., and countries like the UK, France, Spain, and others have a very strong base of industries which drive the pulmonary function testing market. The population's growing prevalence of COPD and asthma, along with improvements to the healthcare system has driven the pulmonary function testing market Asia-Pacific is an emerging region and is expected to show the fastest growth due to the increasing adoption of pulmonary function tests. Developing countries like China, Japan, and South Korea benefit the Asia Pacific by gaining several variables propelling the development of the Pulmonary Function Testing Market. Because of the large population of China, the increase in the number of people suffering from chronic respiratory diseases propels the growth and adoption of pulmonary function tests. Competitive Landscape of Pulmonary Function Testing Market The Pulmonary Function Testing Market is highly competitive and to stay ahead of the competition companies are focusing on innovations and new technologies. Pulmonary Function Testing Market is driven by gaining significance in recent years. The Pulmonary Function Testing Market is characterized by the presence of several global and regional players mentioned in the report. Data Sciences International Inc. is an American company in biochemical research that focuses on the preclinical system and pharmacology. DSI is a subsidiary of Harvard Bioscience Inc. and is based in New Brighton, Minnesota, and the US. DSI had approximately $45 million in revenue in December 2023 Chest M.I Inc. is a Japanese leading producer and distributor of medical electronics equipment for respiratory diagnosis and treatment. The revenue of Chest M.I Inc. is $5.3 for the fiscal year end December 31, 2023, Million The company is well known throughout the world for its high-quality goods and first-rate consumer support. Morgan Scientific Inc. is an American company that manufactures medical equipment like Pulmonary Function Testing devices, Spirometry, oscillometry, Pulse oximetry, and others. The market revenue of Morgan Scientific Inc. is approximately $6.02 million for the year 2022.Pulmonary Function Testing Systems Market Scope: Inquire before buying

Global Pulmonary Function Testing Systems Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 154.6 Mn. Forecast Period 2024 to 2030 CAGR: 4.9% Market Size in 2030: US $ 216.09 Mn. Segments Covered: by System Portable PFT Systems Complete PFT Systems by Test System Spirometry Plethysmography Nitrogen Washout Lung Volume Gas Exchange Testing Maximize Voluntary Ventilation Oxygen Titration Test Exercise Stress Test Others by Application Chronic Obstructive Pulmonary Disorder Asthma Chronic Shortness of Breath Restrictive Lung Disease by End-User Hospital Pharmacy Retail Pharmacy Online Pharmacy Pulmonary Function Testing Systems Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Pulmonary Function Testing Systems Key Player

1. Medizintechnik AG 2. COSMED srl 3. MGC Diagnostics corporation 4. PulmOne Advancd Medical Devices 5. CHEST M.I., Inc 6. VYAIRE MEDICAL,INC. 7. KoKo PFT 8. Morgan Scientific Inc 9. Minato Medical Science Co Ltd 10. Schiller Ag 11. Medical Equipment Europe GmbH 12. NSPIRE HEALTH INC. 13. Koninklijke Philips N.V. 14. Omron Healthcare InC. 15. 3M 16. Ganshorn Medizin Electronic 17. Data Science International 18. Medline Industries Frequently Asked Questions: 1] What is the growth rate of the Global Pulmonary Function Testing Systems Market? Ans. The Global Pulmonary Function Testing Systems Market is growing at a significant rate of 4.9 % during the forecast period. 2] Which region is expected to dominate the Global Pulmonary Function Testing Systems Market? Ans. North America is expected to dominate the Pulmonary Function Testing Systems Market during the forecast period. 3] What is the expected Global Pulmonary Function Testing Systems Market size by 2030? Ans. The Pulmonary Function Testing Systems Market size is expected to reach USD 216.09 Mn by 2030. 4] Which are the top players in the Global Pulmonary Function Testing Systems Market? Ans. The major top players in the Global Pulmonary Function Testing Systems Market are ndd Medizintechnik AG, COSMED srl, MGC Diagnostics Corporation, PulmOne Advancd Medical Devices, CHEST M.I., Inc, VYAIRE MEDICAL ,Inc., KoKo PFT, Medical Electronic Construction, Morgan Scientific Inc, Minato Medical Science Co Ltd and others. 5] What are the factors driving the Global Pulmonary Function Testing Systems Market growth? Ans. Technological advancements in pulmonary function testing systems and the increasing prevalence of respiratory diseases are expected to drive market growth during the forecast period.

1. Pulmonary Function Testing Systems Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Pulmonary Function Testing Systems Market: Dynamics 2.1. Pulmonary Function Testing Systems Market Trends by Region 2.1.1. North America Pulmonary Function Testing Systems Market Trends 2.1.2. Europe Pulmonary Function Testing Systems Market Trends 2.1.3. Asia Pacific Pulmonary Function Testing Systems Market Trends 2.1.4. Middle East and Africa Pulmonary Function Testing Systems Market Trends 2.1.5. South America Pulmonary Function Testing Systems Market Trends 2.2. Pulmonary Function Testing Systems Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Pulmonary Function Testing Systems Market Drivers 2.2.1.2. North America Pulmonary Function Testing Systems Market Restraints 2.2.1.3. North America Pulmonary Function Testing Systems Market Opportunities 2.2.1.4. North America Pulmonary Function Testing Systems Market Challenges 2.2.2. Europe 2.2.2.1. Europe Pulmonary Function Testing Systems Market Drivers 2.2.2.2. Europe Pulmonary Function Testing Systems Market Restraints 2.2.2.3. Europe Pulmonary Function Testing Systems Market Opportunities 2.2.2.4. Europe Pulmonary Function Testing Systems Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Pulmonary Function Testing Systems Market Drivers 2.2.3.2. Asia Pacific Pulmonary Function Testing Systems Market Restraints 2.2.3.3. Asia Pacific Pulmonary Function Testing Systems Market Opportunities 2.2.3.4. Asia Pacific Pulmonary Function Testing Systems Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Pulmonary Function Testing Systems Market Drivers 2.2.4.2. Middle East and Africa Pulmonary Function Testing Systems Market Restraints 2.2.4.3. Middle East and Africa Pulmonary Function Testing Systems Market Opportunities 2.2.4.4. Middle East and Africa Pulmonary Function Testing Systems Market Challenges 2.2.5. South America 2.2.5.1. South America Pulmonary Function Testing Systems Market Drivers 2.2.5.2. South America Pulmonary Function Testing Systems Market Restraints 2.2.5.3. South America Pulmonary Function Testing Systems Market Opportunities 2.2.5.4. South America Pulmonary Function Testing Systems Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Pulmonary Function Testing Systems Industry 2.8. Analysis of Government Schemes and Initiatives For Pulmonary Function Testing Systems Industry 2.9. Pulmonary Function Testing Systems Market Trade Analysis 2.10. The Global Pandemic Impact on Pulmonary Function Testing Systems Market 3. Pulmonary Function Testing Systems Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 3.1.1. Portable PFT Systems 3.1.2. Complete PFT Systems 3.2. Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 3.2.1. Spirometry 3.2.2. Plethysmography 3.2.3. Nitrogen Washout 3.2.4. Lung Volume 3.2.5. Gas Exchange Testing 3.2.6. Maximize Voluntary Ventilation 3.2.7. Oxygen Titration Test 3.2.8. Exercise Stress Test 3.2.9. Others 3.3. Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 3.3.1. Chronic Obstructive Pulmonary Disorder 3.3.2. Asthma 3.3.3. Chronic Shortness of Breath 3.3.4. Restrictive Lung Disease 3.4. Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 3.4.1. Hospital Pharmacy 3.4.2. Retail Pharmacy 3.4.3. Online Pharmacy 3.5. Pulmonary Function Testing Systems Market Size and Forecast, by Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Pulmonary Function Testing Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 4.1.1. Portable PFT Systems 4.1.2. Complete PFT Systems 4.2. North America Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 4.2.1. Spirometry 4.2.2. Plethysmography 4.2.3. Nitrogen Washout 4.2.4. Lung Volume 4.2.5. Gas Exchange Testing 4.2.6. Maximize Voluntary Ventilation 4.2.7. Oxygen Titration Test 4.2.8. Exercise Stress Test 4.2.9. Others 4.3. North America Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 4.3.1. Chronic Obstructive Pulmonary Disorder 4.3.2. Asthma 4.3.3. Chronic Shortness of Breath 4.3.4. Restrictive Lung Disease 4.4. North America Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 4.4.1. Hospital Pharmacy 4.4.2. Retail Pharmacy 4.4.3. Online Pharmacy 4.5. North America Pulmonary Function Testing Systems Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 4.5.1.1.1. Portable PFT Systems 4.5.1.1.2. Complete PFT Systems 4.5.1.2. United States Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 4.5.1.2.1. Spirometry 4.5.1.2.2. Plethysmography 4.5.1.2.3. Nitrogen Washout 4.5.1.2.4. Lung Volume 4.5.1.2.5. Gas Exchange Testing 4.5.1.2.6. Maximize Voluntary Ventilation 4.5.1.2.7. Oxygen Titration Test 4.5.1.2.8. Exercise Stress Test 4.5.1.2.9. Others 4.5.1.3. United States Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 4.5.1.3.1. Chronic Obstructive Pulmonary Disorder 4.5.1.3.2. Asthma 4.5.1.3.3. Chronic Shortness of Breath 4.5.1.3.4. Restrictive Lung Disease 4.5.1.4. United States Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 4.5.1.4.1. Hospital Pharmacy 4.5.1.4.2. Retail Pharmacy 4.5.1.4.3. Online Pharmacy 4.5.2. Canada 4.5.2.1. Canada Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 4.5.2.1.1. Portable PFT Systems 4.5.2.1.2. Complete PFT Systems 4.5.2.2. Canada Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 4.5.2.2.1. Spirometry 4.5.2.2.2. Plethysmography 4.5.2.2.3. Nitrogen Washout 4.5.2.2.4. Lung Volume 4.5.2.2.5. Gas Exchange Testing 4.5.2.2.6. Maximize Voluntary Ventilation 4.5.2.2.7. Oxygen Titration Test 4.5.2.2.8. Exercise Stress Test 4.5.2.2.9. Others 4.5.2.3. Canada Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 4.5.2.3.1. Chronic Obstructive Pulmonary Disorder 4.5.2.3.2. Asthma 4.5.2.3.3. Chronic Shortness of Breath 4.5.2.3.4. Restrictive Lung Disease 4.5.2.4. Canada Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 4.5.2.4.1. Hospital Pharmacy 4.5.2.4.2. Retail Pharmacy 4.5.2.4.3. Online Pharmacy 4.5.3. Mexico 4.5.3.1. Mexico Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 4.5.3.1.1. Portable PFT Systems 4.5.3.1.2. Complete PFT Systems 4.5.3.2. Mexico Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 4.5.3.2.1. Spirometry 4.5.3.2.2. Plethysmography 4.5.3.2.3. Nitrogen Washout 4.5.3.2.4. Lung Volume 4.5.3.2.5. Gas Exchange Testing 4.5.3.2.6. Maximize Voluntary Ventilation 4.5.3.2.7. Oxygen Titration Test 4.5.3.2.8. Exercise Stress Test 4.5.3.2.9. Others 4.5.3.3. Mexico Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 4.5.3.3.1. Chronic Obstructive Pulmonary Disorder 4.5.3.3.2. Asthma 4.5.3.3.3. Chronic Shortness of Breath 4.5.3.3.4. Restrictive Lung Disease 4.5.3.4. Mexico Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 4.5.3.4.1. Hospital Pharmacy 4.5.3.4.2. Retail Pharmacy 4.5.3.4.3. Online Pharmacy 5. Europe Pulmonary Function Testing Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 5.2. Europe Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 5.3. Europe Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 5.4. Europe Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 5.5. Europe Pulmonary Function Testing Systems Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 5.5.1.2. United Kingdom Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 5.5.1.3. United Kingdom Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 5.5.1.4. United Kingdom Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 5.5.2. France 5.5.2.1. France Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 5.5.2.2. France Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 5.5.2.3. France Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 5.5.2.4. France Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 5.5.3.2. Germany Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 5.5.3.3. Germany Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 5.5.3.4. Germany Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 5.5.4.2. Italy Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 5.5.4.3. Italy Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 5.5.4.4. Italy Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 5.5.5.2. Spain Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 5.5.5.3. Spain Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 5.5.5.4. Spain Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 5.5.6.2. Sweden Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 5.5.6.3. Sweden Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 5.5.6.4. Sweden Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 5.5.7.2. Austria Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 5.5.7.3. Austria Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 5.5.7.4. Austria Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 5.5.8.2. Rest of Europe Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 5.5.8.3. Rest of Europe Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 5.5.8.4. Rest of Europe Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 6. Asia Pacific Pulmonary Function Testing Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 6.2. Asia Pacific Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 6.3. Asia Pacific Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 6.4. Asia Pacific Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 6.5. Asia Pacific Pulmonary Function Testing Systems Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 6.5.1.2. China Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 6.5.1.3. China Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 6.5.1.4. China Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 6.5.2.2. S Korea Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 6.5.2.3. S Korea Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 6.5.2.4. S Korea Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 6.5.3.2. Japan Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 6.5.3.3. Japan Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 6.5.3.4. Japan Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 6.5.4. India 6.5.4.1. India Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 6.5.4.2. India Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 6.5.4.3. India Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 6.5.4.4. India Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 6.5.5.2. Australia Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 6.5.5.3. Australia Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 6.5.5.4. Australia Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 6.5.6.2. Indonesia Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 6.5.6.3. Indonesia Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 6.5.6.4. Indonesia Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 6.5.7.2. Malaysia Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 6.5.7.3. Malaysia Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 6.5.7.4. Malaysia Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 6.5.8.2. Vietnam Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 6.5.8.3. Vietnam Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 6.5.8.4. Vietnam Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 6.5.9.2. Taiwan Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 6.5.9.3. Taiwan Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 6.5.9.4. Taiwan Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 6.5.10.2. Rest of Asia Pacific Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 6.5.10.3. Rest of Asia Pacific Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 6.5.10.4. Rest of Asia Pacific Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 7. Middle East and Africa Pulmonary Function Testing Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 7.2. Middle East and Africa Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 7.3. Middle East and Africa Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 7.4. Middle East and Africa Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 7.5. Middle East and Africa Pulmonary Function Testing Systems Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 7.5.1.2. South Africa Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 7.5.1.3. South Africa Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 7.5.1.4. South Africa Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 7.5.2.2. GCC Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 7.5.2.3. GCC Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 7.5.2.4. GCC Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 7.5.3.2. Nigeria Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 7.5.3.3. Nigeria Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 7.5.3.4. Nigeria Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 7.5.4.2. Rest of ME&A Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 7.5.4.3. Rest of ME&A Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 7.5.4.4. Rest of ME&A Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 8. South America Pulmonary Function Testing Systems Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 8.2. South America Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 8.3. South America Pulmonary Function Testing Systems Market Size and Forecast, by Application(2023-2030) 8.4. South America Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 8.5. South America Pulmonary Function Testing Systems Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 8.5.1.2. Brazil Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 8.5.1.3. Brazil Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 8.5.1.4. Brazil Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 8.5.2.2. Argentina Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 8.5.2.3. Argentina Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 8.5.2.4. Argentina Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Pulmonary Function Testing Systems Market Size and Forecast, by System (2023-2030) 8.5.3.2. Rest Of South America Pulmonary Function Testing Systems Market Size and Forecast, by Test System (2023-2030) 8.5.3.3. Rest Of South America Pulmonary Function Testing Systems Market Size and Forecast, by Application (2023-2030) 8.5.3.4. Rest Of South America Pulmonary Function Testing Systems Market Size and Forecast, by End User (2023-2030) 9. Global Pulmonary Function Testing Systems Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Pulmonary Function Testing Systems Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Medizintechnik AG 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. COSMED srl 10.3. MGC Diagnostics corporation 10.4. PulmOne Advancd Medical Devices 10.5. CHEST M.I., Inc 10.6. VYAIRE MEDICAL,INC. 10.7. KoKo PFT 10.8. Morgan Scientific Inc 10.9. Minato Medical Science Co Ltd 10.10. Schiller Ag 10.11. Medical Equipment Europe GmbH 10.12. NSPIRE HEALTH INC. 10.13. Koninklijke Philips N.V. 10.14. Omron Healthcare InC. 10.15. 3M 10.16. Ganshorn Medizin Electronic 10.17. Data Science International 10.18. Medline Industries 11. Key Findings 12. Industry Recommendations 13. Pulmonary Function Testing Systems Market: Research Methodology 14. Terms and Glossary