The Pulmonary Arterial Hypertension Market size was valued at USD 7.1 Bn in 2023. The Pulmonary Arterial Hypertension Market revenue is growing at a CAGR of 5.2 % from 2023 to 2030, reaching nearly USD 10.12 Bn by 2030. Pulmonary Arterial Hypertension Market The Pulmonary Arterial Hypertension (PAH) market growth, is driven by various factors such as increasing awareness, early diagnosis, and a growing patient base. The market players are actively involved in initiatives, leveraging opportunities presented by the expiration of patents to introduce affordable generics. The prevalence of PAH is on the rise, with around 500 to 1000 new cases diagnosed annually in the U.S. Women aged 30 to 60 are more susceptible, and idiopathic or genetic factors contribute to about 15 to 20% of cases.To know about the Research Methodology :- Request Free Sample Report The Pulmonary Arterial Hypertension Market is marked by aggressive competition, with pharmaceutical companies focusing on innovation in treatment options such as prostacyclin analogs and endothelin receptor antagonists. The impact of the COVID-19 pandemic on pulmonary hypertension has been substantial, with increased risk for patients with underlying respiratory conditions. As the geriatric population grows globally, the prevalence of PAH is expected to rise, leading to complications and a surge in demand for effective treatments. Ongoing technological advancements in identifying new molecular pathways further contribute to the Pulmonary Arterial Hypertension Market's growth.

Pulmonary Arterial Hypertension Market Dynamics:

Driver: Increasing Prevalence of Pulmonary Arterial Hypertension Boosts the Market Growth The escalating prevalence of Pulmonary Arterial Hypertension is an important driver boosting the growth of the Pulmonary Arterial Hypertension market. PAH, a condition characterized by elevated blood pressure in the arteries supplying the lungs, has witnessed a surge in diagnosed cases. This upswing results from heightened awareness, improved diagnostic methods, and evolving lifestyles. The expanding patient pool necessitates a corresponding growth in healthcare solutions, fostering a strong market for pharmaceuticals, therapies, and medical devices tailored to PAH management. Companies operating in this sector are likely to respond by investing in research and development, aiming to introduce innovative treatments and capitalize on the burgeoning demand. The growth of the Pulmonary Arterial Hypertension market is indicative of increased disease prevalence reflective of a dynamic healthcare landscape responding to emerging medical challenges. Pharmaceutical firms intensify efforts to develop and introduce novel drugs, while healthcare providers enhance diagnostic and treatment infrastructures. The collaborative response to the rising prevalence of PAH contributes to an evolving healthcare ecosystem that addresses not only the immediate needs of affected individuals but also fosters ongoing advancements and improvements in the understanding and management of pulmonary arterial hypertension. For instance, PAH predominantly affects women aged 30-60 and falls under Group 1 PAH, one of the five types of pulmonary hypertension. While there is no cure for PAH, various treatments exist to manage symptoms and enhance quality of life. Annually, approximately 500-1000 new cases of PAH are diagnosed in the United States. Restrain Limited treatment options hamper the Market Growth The pulmonary arterial hypertension (PAH) market encounters several challenges that impact its dynamics. A primary constraint is the limited treatment options available for patients, leading to the pressing need for ongoing research and development efforts. Additionally, the high cost of PAH medications poses a significant barrier, creating financial burdens for both patients and healthcare systems. The complexity of diagnosing PAH contributes to delays in treatment initiation, and the orphan drug status assigned to many PAH medications, while beneficial for drug development, presents challenges related to market size and commercial viability. Limited awareness about PAH among healthcare professionals and the general public can result in delayed diagnoses and hinder effective management. Furthermore, the requirement for long-term management of PAH introduces challenges related to patient adherence to prescribed treatments. The presence of comorbidities, often associated with PAH, adds an extra layer of complexity to patient care. Lastly, the competitive landscape in the PAH market, with companies striving to develop and market effective therapies, influences market access, pricing, and overall industry dynamics. Keeping abreast of these constraints is essential for stakeholders to navigate the evolving landscape of the Pulmonary Arterial Hypertension market. Opportunity: Innovation of new therapies creates lucrative growth opportunities for the Market. The opportunity in innovative therapies for pulmonary arterial hypertension (PAH) lies in the development of novel treatment approaches that offer improved efficacy, fewer side effects, and potentially better outcomes for patients. This opens new avenues for pharmaceutical companies, enhances patient care, addresses unmet medical needs, and boosts the Pulmonary Arterial Hypertension Market. The example of an innovative therapy in the PAH market is the development of prostacyclin receptor agonists. Prostacyclin is a naturally occurring substance in the body that plays a role in vasodilation and inhibiting the growth of smooth muscle cells in blood vessels. In PAH, there is a deficiency of prostacyclin, contributing to vasoconstriction and vascular remodeling. Innovative therapies aim to address this deficiency by either mimicking the effects of prostacyclin or enhancing its production. For example, is the development of selexipag (brand name Uptravi). Selexipag is an oral prostacyclin receptor agonist that targets the prostacyclin pathway to dilate blood vessels and reduce the elevated pressure in the pulmonary arteries. Unlike traditional prostacyclin analogs that require continuous infusion through an intravenous pump, selexipag's oral administration represents an advancement in convenience and patient compliance. Innovative therapies such as selexipag showcase the potential to improve the treatment landscape for PAH, providing patients with new options that are more accessible and manageable. Continued research and development in this field hold the promise of discovering additional innovative therapies that further enhance the effectiveness and convenience of PAH treatments.Pulmonary Arterial Hypertension Market Segment Analysis:

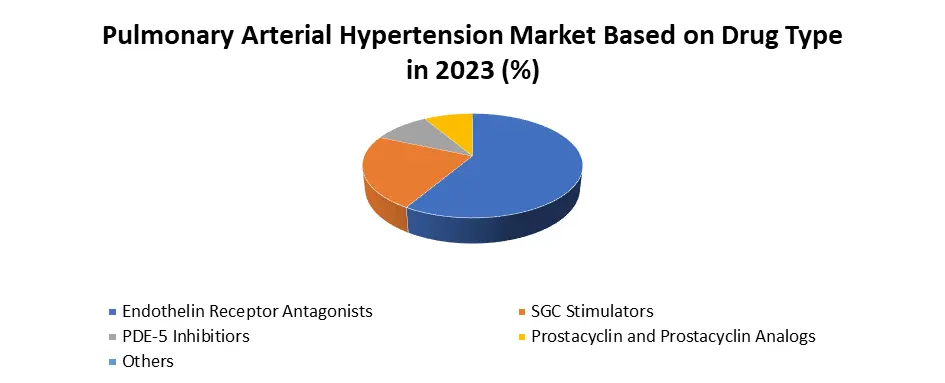

Based on Drug Type: The prostacyclin and prostacyclin analogs segment dominated the Drug Class Segment of the Pulmonary Arterial Hypertension Market in the year 2023. The growth is attributed to the high demand for drugs and the proliferation of life-threatening diseases. Prostacyclin, a naturally occurring vasodilator, helps widen blood vessels, reduce blood pressure in the lungs, and improve overall blood flow. Prostacyclin analogs, synthetic derivatives of prostacyclin, replicate these effects and are administered through various delivery methods. Patients with Pulmonary Arterial Hypertension often experience elevated pulmonary artery pressure, leading to symptoms like shortness of breath and fatigue. Prostacyclin and its analogs effectively target the underlying vascular abnormalities, offering vasodilation and anti-remodeling effects. Their efficacy in improving exercise capacity and hemodynamic parameters has positioned them as a primary choice in PAH treatment, explaining their prominence in the drug class segment and highlighting their crucial role in managing this complex cardiovascular condition.

Pulmonary Arterial Hypertension Market Regional Segment:

North America dominated the Pulmonary Arterial Hypertension market in 2023. Due to the sophisticated healthcare infrastructure in the United States, which enabled access to innovative medicines and healthcare treatment. The growth of the regional Pulmonary Arterial Hypertension Market was guided by increasing awareness, a high diagnosis rate, and supporting government efforts. A good diagnostic rate was achieved owing to a well-planned compensation system and strong awareness. In the United States, supporting laws such as the Rare Disease Act of 2002 and the Orphan Drug Act (ODA) of 1983 aided the development of new PAH medications. Hence, these factors are estimated to motivate the Pulmonary Arterial Hypertension Market. Further, the dominating countries of North America are the US, Canada, and Mexico. Europe expected the fastest market growth in the forecast timeframe. Moreover, the presence of government agencies such as the European Medicines Agency (EMA) and the European Society of Cardiology promoting early and preventive diagnosis of PAH (Pulmonary arterial hypertension) is likely to motivate the growth of the market in the future. The factors boosting the European market are the rising occurrence of chronic diseases such as HIV, PAH, cardiovascular diseases, and various others. Further, increasing elderly populations, changes in lifestyle patterns, immobility in daily routine, and pollution in the environment are likely to boost the Pulmonary Arterial Hypertension Market growth. Report Objective The objective of the report is to present a comprehensive analysis of the Pulmonary Arterial Hypertension Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the Market dynamics, structure by analyzing the market segments and project the Market size. Clear representation of competitive analysis of key players by Grade, price, financial position, Grade portfolio, growth strategies, and regional presence in the Market make the report investor’s guide.Pulmonary Arterial Hypertension Market Scope: Inquire before buying

Global Pulmonary Arterial Hypertension Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 7.1 Bn. Forecast Period 2024 to 2030 CAGR: 5.2% Market Size in 2030: US $ 10.12 Bn. Segments Covered: by Drug Class Endothelin Receptor Antagonists SGC Stimulators PDE-5 Inhibitors Prostacyclin and Prostacyclin Analogs Others by Route of Administration Oral Intravenous Others by Type Innovative Generics by Distribution Channel Hospitals Retail Pharmacies Online Pharmacies Pulmonary Arterial Hypertension Market by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and the Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Pulmonary Arterial Hypertension Market Key Players

North America 1. United Therapeutics Corporation (USA) 2. Gilead Sciences (USA) 3. Pfizer Inc. (USA) 4. Arena Pharmaceuticals (USA) 5. Acceleron Pharma (USA) 6. Bristol Myers Squibb (USA) 7. Merck & Co. (USA) 8. Reata Pharmaceuticals (USA) 9. Stealth BioTherapeutics (USA) Europe: 1. Actelion Pharmaceuticals (Switzerland) 2. Bayer Healthcare:(Germany) 3. GlaxoSmithKline (GSK)(United Kingdom) 4. Novartis (Switzerland) Frequently Asked Questions: 1] What segments are covered in the Global Pulmonary Arterial Hypertension Market report? Ans. The segments covered in the Pulmonary Arterial Hypertension Market report are based on Drug Class, Route of Administration, Type, Distribution Channel and Regions. 2] Which region is expected to hold the highest share in the Global Pulmonary Arterial Hypertension Market? Ans. The North America region is expected to hold the largest share of the Pulmonary Arterial Hypertension Market. 3] What is the market size of the Global Market by 2030? Ans. The market size of the Pulmonary Arterial Hypertension Market by 2030 is expected to reach US$ 10.12 Bn. 4] What is the forecast period for the Global Market? Ans. The forecast period for the Pulmonary Arterial Hypertension Market is 2024-2030. 5] What was the market size of the Global Pulmonary Arterial Hypertension Market in 2023? Ans. The market size of the Pulmonary Arterial Hypertension Market in 2023 was valued at US$ 7.1 Bn.

1. Pulmonary Arterial Hypertension Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Pulmonary Arterial Hypertension Market: Dynamics 2.1. Market Trends by Region 2.1.1. North America 2.1.2. Europe 2.1.3. Asia Pacific 2.1.4. Middle East and Africa 2.1.5. South America 2.2. Market Dynamics by Region 2.2.1. North America 2.2.1.1. Drivers 2.2.1.2. Restraints 2.2.1.3. Opportunities 2.2.1.4. Challenges 2.2.2. Europe 2.2.2.1. Drivers 2.2.2.2. Restraints 2.2.2.3. Opportunities 2.2.2.4. Challenges 2.2.3. Asia Pacific 2.2.3.1. Drivers 2.2.3.2. Restraints 2.2.3.3. Opportunities 2.2.3.4. Challenges 2.2.4. Middle East and Africa 2.2.4.1. Drivers 2.2.4.2. Restraints 2.2.4.3. Opportunities 2.2.4.4. Challenges 2.2.5. South America 2.2.5.1. Drivers 2.2.5.2. Restraints 2.2.5.3. Opportunities 2.2.5.4. Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Value Chain Analysis 2.6. Technological Roadmap 2.7. Regulatory Landscape by Region 2.7.1. North America 2.7.2. Europe 2.7.3. Asia Pacific 2.7.4. Middle East and Africa 2.7.5. South America 2.8. Analysis of Government Schemes and Initiatives for Industry 2.9. Key Opinion Leader Analysis 2.10. The Global Pandemic Impact on Pulmonary Arterial Hypertension Market 3. Pulmonary Arterial Hypertension Market: Global Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 3.1. Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 3.1.1. Endothelin Receptor Antagonists 3.1.2. SGC Stimulators 3.1.3. PDE-5 Inhibitors 3.1.4. Prostacyclin and Prostacyclin Analogs 3.1.5. Others 3.2. Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 3.2.1. Oral 3.2.2. Intravenous 3.2.3. Others 3.3. Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 3.3.1. Innovative 3.3.2. Generics 3.4. Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 3.4.1. Hospitals 3.4.2. Retail Pharmacies 3.4.3. Online Pharmacies 3.5. Pulmonary Arterial Hypertension Market Size and Forecast, By Region (2023-2030) 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. North America Pulmonary Arterial Hypertension Market Size and Forecast by Segmentation (by Value in USD Million) (2023-2030) 4.1. North America Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 4.1.1. Endothelin Receptor Antagonists 4.1.2. SGC Stimulators 4.1.3. PDE-5 Inhibitors 4.1.4. Prostacyclin and Prostacyclin Analogs 4.1.5. Others 4.2. North America Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 4.2.1. Oral 4.2.2. Intravenous 4.2.3. Others 4.3. North America Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 4.3.1. Innovative 4.3.2. Generics 4.4. North America Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 4.4.1. Hospitals 4.4.2. Retail Pharmacies 4.4.3. Online Pharmacies 4.5. North America Pulmonary Arterial Hypertension Market Size and Forecast, by Country (2023-2030) 4.5.1. United States 4.5.1.1. United States Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 4.5.1.1.1. Endothelin Receptor Antagonists 4.5.1.1.2. SGC Stimulators 4.5.1.1.3. PDE-5 Inhibitors 4.5.1.1.4. Prostacyclin and Prostacyclin Analogs 4.5.1.1.5. Others 4.5.1.2. United States Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 4.5.1.2.1. Oral 4.5.1.2.2. Intravenous 4.5.1.2.3. Others 4.5.1.3. United States Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 4.5.1.3.1. Innovative 4.5.1.3.2. Generics 4.5.1.4. United States Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 4.5.1.4.1. Hospitals 4.5.1.4.2. Retail Pharmacies 4.5.1.4.3. Online Pharmacies 4.5.2. Canada 4.5.2.1. Canada Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 4.5.2.1.1. Endothelin Receptor Antagonists 4.5.2.1.2. SGC Stimulators 4.5.2.1.3. PDE-5 Inhibitors 4.5.2.1.4. Prostacyclin and Prostacyclin Analogs 4.5.2.1.5. Others 4.5.2.2. Canada Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 4.5.2.2.1. Oral 4.5.2.2.2. Intravenous 4.5.2.2.3. Others 4.5.2.3. Canada Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 4.5.2.3.1. Innovative 4.5.2.3.2. Generics 4.5.2.4. Canada Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 4.5.2.4.1. Hospitals 4.5.2.4.2. Retail Pharmacies 4.5.2.4.3. Online Pharmacies 4.5.3. Mexico 4.5.3.1. Mexico Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 4.5.3.1.1. Endothelin Receptor Antagonists 4.5.3.1.2. SGC Stimulators 4.5.3.1.3. PDE-5 Inhibitors 4.5.3.1.4. Prostacyclin and Prostacyclin Analogs 4.5.3.1.5. Others 4.5.3.2. Mexico Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 4.5.3.2.1. Oral 4.5.3.2.2. Intravenous 4.5.3.2.3. Others 4.5.3.3. Mexico Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 4.5.3.3.1. Innovative 4.5.3.3.2. Generics 4.5.3.4. Mexico Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 4.5.3.4.1. Hospitals 4.5.3.4.2. Retail Pharmacies 4.5.3.4.3. Online Pharmacies 5. Europe Pulmonary Arterial Hypertension Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 5.1. Europe Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 5.2. Europe Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 5.3. Europe Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 5.4. Europe Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 5.5. Europe Pulmonary Arterial Hypertension Market Size and Forecast, by Country (2023-2030) 5.5.1. United Kingdom 5.5.1.1. United Kingdom Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 5.5.1.2. United Kingdom Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 5.5.1.3. United Kingdom Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 5.5.1.4. United Kingdom Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 5.5.2. France 5.5.2.1. France Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 5.5.2.2. France Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 5.5.2.3. France Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 5.5.2.4. France Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 5.5.3. Germany 5.5.3.1. Germany Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 5.5.3.2. Germany Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 5.5.3.3. Germany Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 5.5.3.4. Germany Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 5.5.4. Italy 5.5.4.1. Italy Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 5.5.4.2. Italy Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 5.5.4.3. Italy Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 5.5.4.4. Italy Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 5.5.5. Spain 5.5.5.1. Spain Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 5.5.5.2. Spain Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 5.5.5.3. Spain Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 5.5.5.4. Spain Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 5.5.6. Sweden 5.5.6.1. Sweden Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 5.5.6.2. Sweden Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 5.5.6.3. Sweden Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 5.5.6.4. Sweden Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 5.5.7. Austria 5.5.7.1. Austria Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 5.5.7.2. Austria Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 5.5.7.3. Austria Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 5.5.7.4. Austria Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 5.5.8. Rest of Europe 5.5.8.1. Rest of Europe Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 5.5.8.2. Rest of Europe Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 5.5.8.3. Rest of Europe Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 5.5.8.4. Rest of Europe Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 6. Asia Pacific Pulmonary Arterial Hypertension Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2023-2030) 6.1. Asia Pacific Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 6.2. Asia Pacific Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 6.3. Asia Pacific Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 6.4. Asia Pacific Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 6.5. Asia Pacific Pulmonary Arterial Hypertension Market Size and Forecast, by Country (2023-2030) 6.5.1. China 6.5.1.1. China Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 6.5.1.2. China Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 6.5.1.3. China Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 6.5.1.4. China Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.2. S Korea 6.5.2.1. S Korea Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 6.5.2.2. S Korea Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 6.5.2.3. S Korea Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 6.5.2.4. S Korea Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.3. Japan 6.5.3.1. Japan Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 6.5.3.2. Japan Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 6.5.3.3. Japan Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 6.5.3.4. Japan Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.4. India 6.5.4.1. India Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 6.5.4.2. India Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 6.5.4.3. India Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 6.5.4.4. India Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.5. Australia 6.5.5.1. Australia Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 6.5.5.2. Australia Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 6.5.5.3. Australia Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 6.5.5.4. Australia Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.6. Indonesia 6.5.6.1. Indonesia Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 6.5.6.2. Indonesia Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 6.5.6.3. Indonesia Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 6.5.6.4. Indonesia Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.7. Malaysia 6.5.7.1. Malaysia Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 6.5.7.2. Malaysia Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 6.5.7.3. Malaysia Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 6.5.7.4. Malaysia Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.8. Vietnam 6.5.8.1. Vietnam Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 6.5.8.2. Vietnam Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 6.5.8.3. Vietnam Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 6.5.8.4. Vietnam Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.9. Taiwan 6.5.9.1. Taiwan Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 6.5.9.2. Taiwan Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 6.5.9.3. Taiwan Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 6.5.9.4. Taiwan Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 6.5.10. Rest of Asia Pacific 6.5.10.1. Rest of Asia Pacific Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 6.5.10.2. Rest of Asia Pacific Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 6.5.10.3. Rest of Asia Pacific Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 6.5.10.4. Rest of Asia Pacific Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 7. Middle East and Africa Pulmonary Arterial Hypertension Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 7.1. Middle East and Africa Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 7.2. Middle East and Africa Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 7.3. Middle East and Africa Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 7.4. Middle East and Africa Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 7.5. Middle East and Africa Pulmonary Arterial Hypertension Market Size and Forecast, by Country (2023-2030) 7.5.1. South Africa 7.5.1.1. South Africa Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 7.5.1.2. South Africa Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 7.5.1.3. South Africa Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 7.5.1.4. South Africa Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 7.5.2. GCC 7.5.2.1. GCC Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 7.5.2.2. GCC Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 7.5.2.3. GCC Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 7.5.2.4. GCC Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 7.5.3. Nigeria 7.5.3.1. Nigeria Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 7.5.3.2. Nigeria Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 7.5.3.3. Nigeria Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 7.5.3.4. Nigeria Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 7.5.4. Rest of ME&A 7.5.4.1. Rest of ME&A Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 7.5.4.2. Rest of ME&A Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 7.5.4.3. Rest of ME&A Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 7.5.4.4. Rest of ME&A Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 8. South America Pulmonary Arterial Hypertension Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) (2022-2029 8.1. South America Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 8.2. South America Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 8.3. South America Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 8.4. South America Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 8.5. South America Pulmonary Arterial Hypertension Market Size and Forecast, by Country (2023-2030) 8.5.1. Brazil 8.5.1.1. Brazil Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 8.5.1.2. Brazil Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 8.5.1.3. Brazil Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 8.5.1.4. Brazil Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 8.5.2. Argentina 8.5.2.1. Argentina Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 8.5.2.2. Argentina Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 8.5.2.3. Argentina Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 8.5.2.4. Argentina Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 8.5.3. Rest Of South America 8.5.3.1. Rest Of South America Pulmonary Arterial Hypertension Market Size and Forecast, By Drug Class (2023-2030) 8.5.3.2. Rest Of South America Pulmonary Arterial Hypertension Market Size and Forecast, By Route of Administration (2023-2030) 8.5.3.3. Rest Of South America Pulmonary Arterial Hypertension Market Size and Forecast, By Type (2023-2030) 8.5.3.4. Rest Of South America Pulmonary Arterial Hypertension Market Size and Forecast, By Distribution Channel (2023-2030) 9. Global Pulmonary Arterial Hypertension Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Service Segment 9.3.3. Distribution Channelr Segment 9.3.4. Revenue (2022) 9.3.5. Manufacturing Locations 9.4. Leading Pulmonary Arterial Hypertension Market Companies, by Market Capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. United Therapeutics Corporation (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Developments 10.2. Gilead Sciences (USA) 10.3. Pfizer Inc. (USA) 10.4. Arena Pharmaceuticals (USA) 10.5. Acceleron Pharma (USA) 10.6. Bristol Myers Squibb (USA) 10.7. Merck & Co. (USA) 10.8. Reata Pharmaceuticals (USA) 10.9. Stealth BioTherapeutics (USA) 10.10. Actelion Pharmaceuticals (Switzerland) 10.11. Bayer Healthcare(Germany) 10.12. GlaxoSmithKline (GSK)(United Kingdom) 10.13. Novartis (Switzerland) 11. Key Findings 12. Industry Recommendations 13. Pulmonary Arterial Hypertension Market: Research Methodology.