POS Security Market Size – Industry Structure Evaluation, Demand Drivers Analysis, Regional Growth Analysis and Identification, Competitive Positioning Review & Global Market Size Forecast to 2032

Overview

The POS Security Market size was valued at USD 5.36 Billion in 2024 and the total POS Security revenue is expected to grow at a CAGR of 11.28% from 2025 to 2032, reaching nearly USD 12.60 Billion.

POS Security Market Overview:

Point-of-Sale (POS) security provides safe environments for consumers to purchase & complete transactions. The security features are crucial for reducing the risk of credit card information loss or fraud and preventing unauthorized individuals from accessing electronic payment systems. POS systems are used by businesses to process transactions and payments, and they typically include a combination of hardware devices, software applications, and communication networks.

POS security is vital for protecting sensitive customer information and preventing financial losses owing to data breaches or fraud. It is important for businesses to take a proactive approach to POS security and implement a comprehensive security strategy that contains both technical and non-technical measures. Henceforth, according to the MMR report, Global POS Security Market is expected to grow at the CAGR of 11.28% from 2025 to 2032. To know about the Research Methodology :- Request Free Sample Report

To know about the Research Methodology :- Request Free Sample Report

POS Security Market Dynamics:

The Global POS Security Market dynamics are thoroughly studied and explained in the MMR report, which helps reader to understand emerging market trends, drivers, restraints, opportunities, and challenges at global and regional level for the POS Security Market. Some of the driving factors are illustrate below, their detailed explanation is discussed in the report with other supporting:

Advancements in technology: Advancements in technology, such as machine learning and artificial intelligence, are enabling more sophisticated and proactive POS security solutions. This has led to an increased demand for advanced POS security solutions that can detect and prevent emerging threats in real-time.

Growing awareness of the importance of data security: There is a growing awareness among businesses and consumers of the importance of protecting sensitive customer data, particularly with the increasing number of high-profile data breaches. This has led to increased investment in POS security solutions to prevent data breaches and protect against cyber threats.

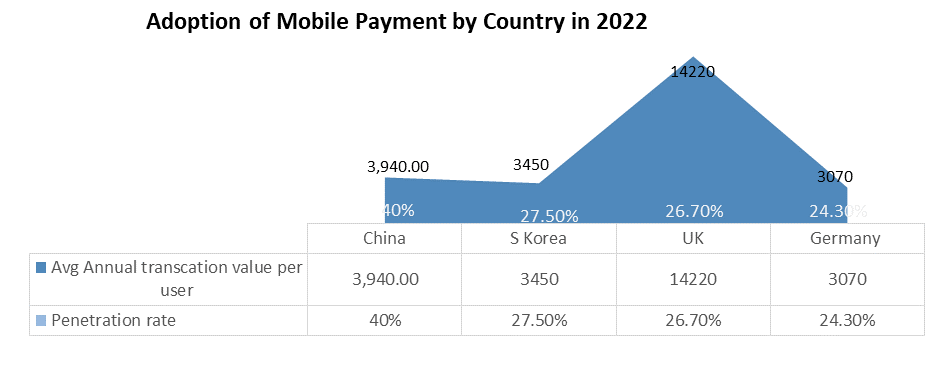

Adoption of electronic payments: With the rise of electronic payments and digital transactions, the need for secure POS systems has become critical. This has led to an increased demand for POS security solutions to protect against cyber-attacks, data breaches, and fraud.

Regulatory compliance requirements: Various regulatory bodies and standards organizations have established guidelines for the protection of sensitive data, including payment card information. Compliance with these standards, such as the Payment Card Industry Data Security Standard (PCI DSS), requires businesses to implement robust POS security solutions.

Use of mobile POS systems: The increasing adoption of mobile POS systems, such as smartphones and tablets, has created new security challenges. This has led to an increased demand for POS security solutions that can protect against mobile-specific threats, such as malware and unauthorized access.

Market Challenges faced by POS security:

1. Rapidly evolving threats: Cyber threats are constantly evolving, which can make it difficult for POS security solutions to keep up. This can result in gaps in security that can be exploited by cybercriminals.

2. User education: POS security is not just about technology; it also involves user education and training. Employees need to be educated on how to use POS systems securely and to be aware of the risks associated with cyber threats and data breaches.

3. Compliance requirements: Compliance with regulations such as the Payment Card Industry Data Security Standard (PCI DSS) can be challenging for businesses, particularly smaller businesses that may not have the resources to dedicate to compliance efforts.

4. Complexity & Cost: POS security solutions can be complex, particularly for businesses that may not have dedicated IT staff or expertise. This can make it difficult for businesses to implement and manage effective POS security measures. POS security solutions can be expensive, particularly for smaller businesses. This can make it difficult for businesses to invest in the necessary security measures to protect their POS systems.

POS Security Market Trends:

1. Contactless payment security: The COVID-19 pandemic has led to an increased adoption of contactless payment methods, such as mobile payments and QR codes. This has created new security challenges, and there is a growing demand for POS security solutions that can protect against contactless payment fraud and other related threats.

2. Cloud-based POS security solutions: More businesses are moving their POS systems to the cloud, which has led to an increased demand for cloud-based POS security solutions. Cloud-based solutions offer benefits such as scalability, flexibility, and lower costs, and they can provide robust security features such as encryption and multi-factor authentication.

3. Increased focus on user-friendly design: POS security solutions are being designed with user-friendliness in mind, to make it easier for businesses to implement and manage security measures. This can help to increase adoption rates and ensure that businesses are able to effectively protect their POS systems from cyber threats.

4. Integration with other security solutions: POS security solutions are being integrated with other security solutions, such as antivirus software and firewalls, to provide a more comprehensive security approach. This can help to provide a more seamless and effective security solution for businesses.

Competitive Landscapes:

The POS Security Market is highly competitive, with numerous players offering a range of solutions and services to address the increasing threat landscape. Major industry participants are pursuing a number of both organic and inorganic growth strategy in to expand their product and service portfolios and strengthen their market position in the global market. In addition, Companies are focusing on Research and Development (R&D) activities, and the adoption of technologically advanced solutions to gain a competitive edge. For example,

1. In April 2022, PayPal launched its new product, PayPal Checkout. In comparison to PayPal PLUS, this solution offers greater payment options, more flexibility, and enhanced user friendliness.

2.In Nov 2021, CyberRes introduced Voltage SecureData Services, enabling the deployment of data security solutions into cloud-based corporate applications and the pseudonymization and anonymization of sensitive personal data.

POS Security Market Segment Analysis:

By Enterprises Size, Large Enterprises segment was valued nearly US$ 3.05 Bn in 2024. Large Enterprises own a lot of information on cybersecurity attacks. Large businesses employ more than 250 people, according to the OECD. POS security solutions are becoming widely adopted by large businesses. These businesses are able to integrate the POS security solutions and services into their systems because they have the necessary finances and human resources. Big businesses are prime targets for cybersecurity assaults because they have a lot of data. One of the most frequent types of cybersecurity attacks is the theft of credit and debit card information, which is increasingly done by attacking POS systems. Enterprises are using products and solutions including technologies like P2PE, tokenization, and the usage of EMV cards to prevent POS attacks.

Some governments have made investments in payment data rules throughout the years. Owing to the stringent regulatory standards on payment data and other data privacy laws as well as to prevent significant financial losses brought on by POS attacks, large businesses all over the world have been compelled to deploy POS security solutions.

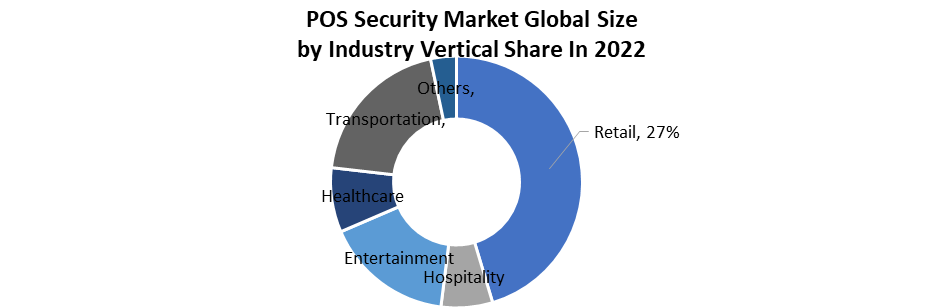

By Industry Vertical, Retail segment held the largest market share of 27.4% in 2024. The segment is expected to grow at a CAGR of 12.2% and is expected to dominate the global POS security market by 2032. Improved convenience provided by good communication between companies and consumers at various checkpoints has prompted hackers to target POS systems more frequently in an effort to steal payment cards and personally identifiable information (PII). As a result, retailers widely utilise POS systems for their operations.

POS Security Market Regional Analysis:

North American region held the largest market share of 34.85% and dominated the global POS security market in 2024. The region is further expected to grow at a CAGR of 11.8% and maintain its dominance by 2032. North America POS security market has the presence of the largest number vendors among all the regions considered. As per the Payment systems in the US report by the Bank for International Settlements, to fulfil payment responsibilities between and among financial institutions and their clients in the US, a number of payment instruments and settlement procedures are accessible. However, the use of electronic payment systems including POS networks, ATMs, and automated clearing houses (ACH) has been growing rapidly. The considerable use of POS systems by industries including retail, dining, and hospitality has resulted in a rise in the use of POS security solutions. An increase in POS system attacks is also being seen in the area.

The Asia Pacific POS security market accounted for the second largest revenue share in 2024. Various APAC countries such as India, China, and Japan, have implemented strict regulations &guidelines for payment security, foremost to the market's growth. Such as, the Indian government launched the Unified Payments Interface (UPI) and BHIM as well as the Payments Infrastructure Development Fund (PIDF) in January. In order to create a competitive environment that prioritises consumer protection, authorities have been steering the payments industry through litigation and regulations.

POS Security Market Country-wise Analysis:

The US POS security market is the largest and most developed, thanks to the country's advanced payment infrastructure, presence of major POS security solution providers and high adoption of digital payment solutions. The US POS security market is expected to growing at a nearly CAGR of 13.11% during the forecast period.

China POS security market is expected to witness significant growth owing to the growing adoption of POS systems, increasing disposable incomes, and cumulative digitalization. However, Japan POS security market is also significant and is driven by the country's advanced payment infrastructure and high adoption of POS systems.

The POS security market in the UK is projected to witness significant growth attributable to the growing adoption of digital payment solutions and the increasing investments in security solutions by enterprises. Also, Germany POS security market is also significant and is driven by the country's advanced payment infrastructure and high adoption of digital payment solutions.

POS security market players strategies: M&A, Partnership, Collaboration and Agreement:

Key players in POS security market have adopted various strategies to expand their global presence and increase their market shares. Partnerships, agreements, and M&A are some of the major strategies adopted by the market players, to achieve growth in the POS security market globally. For example,

1. In May 2022: Lavu, a significant global provider of restaurant software and payment solutions, and Verifone joined forces. Customers of Lavu and Verifone would benefit from the combination of Lavu's comprehensive restaurant software portfolio with Verifone's FLEX payment solution utilising its Advanced Payment Methods platform.

2. In Aug 2022, PayPal arrived into an agreement with Visa, an American multinational financial services corporation. This agreement aims to support PayPal's collaboration with Visa, financial institutions, and others in the payments sector in order to give joint consumers more value, better options, and better experiences wherever they transact, whether it be online, in an app, or in a physical location.

POS Security Market Scope: Inquiry Before Buying

| POS Security Market | |||

|---|---|---|---|

| Report Coverage | Details | ||

| Base Year: | 2024 | Forecast Period: | 2025-2032 |

| Historical Data: | 2019 to 2024 | Market Size in 2024: | USD 5.36 Billion |

| Forecast Period 2025 to 2032 CAGR: | 11.28% | Market Size in 2032: | USD 12.60 Billion |

| Segments Covered: | by Product | Solution Services |

|

| by Type | On-Premise Cloud |

||

| by Application | Large Enterprises Small and Medium-sized Enterprises |

||

| by End-User | Retail Hospitality Entertainment Healthcare Transportation Others |

||

POS Security Market, by Region

North America (United States, Canada and Mexico)

Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe)

Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC)

Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A)

South America (Brazil, Argentina Rest of South America)

POS Security Market Key Players:

1. Acunetix

2. Bluefin

3. BPAPOS

4. CardConnect

5. Check Point

6. Clover

7. Elavon

8. Fortinet

9. Helcim

10. Hideez

11. Kaspersky

12. Micro Focus

13. Morphisec

14. NCR

15. Oracle

16. PayPal

17. Sophos

18. SquareUp

19. TempusPayment

20. TeskaLabs

21. Thales

22. TokenEx

23. Tripwire

24. Upserve

25. Vend

26. Verifone

FAQs:

1. What are the growth drivers for the POS Security market?

Ans. Increased adoption of digital payment modes, is expected to be the major driver for the POS Security market.

2. What is the major restraint for the POS Security market growth?

Ans. Lack of awareness among employees for the use of PoS systems are expected to be the major restraining factor for the POS Security market growth.

3. Which region is expected to lead the global POS Security market during the forecast period?

Ans. North America is expected to lead the global POS Security market during the forecast period.

4. What was the Global POS Security Market size in 2024?

Ans: The Global POS Security Market size was USD 5.36 Billion in 2024.

5. What segments are covered in the POS Security Market report?

Ans. The segments covered in the POS Security market report are Offering, Deployment Mode, Enterprise Size, Industry Vertical, and Region.