Global Polyurethane Additive Market size was valued at USD 3.84 Bn in 2022 and is expected to reach USD 5.45 Bn by 2029, at a CAGR of 5.12 %.Polyurethane Additive Market Overview

Polyurethane additives constitute a diverse category of compounds that substantially enhance the properties and performance of polyurethane-based products across several industries. These additives are meticulously formulated to precisely fine-tune and optimize various aspects of polyurethane such as its durability, resistance and overall functionality. Polyurethane is a versatile and widely utilized polymer and is celebrated for its exceptional qualities including flexibility, durability, and resilience. It serves as a foundational material in a myriad of products encompassing foams, coatings, adhesives and elastomers. Polyurethane additives, available in the form of specialized chemicals and compounds, are intricately blended into polyurethane formulations, introducing a widespread range of highly desirable properties and characteristics. Key players in this ecosystem involve Polyurethane additive suppliers and manufacturers, who offer the essential expertise and materials to drive innovation and tailor polyurethane solutions to meet the specific requirements of various industries and applications, aiding the continued growth and flexibility of polyurethane in the market. A primary function of polyurethane additives is to enhance resistance and durability. In the construction industry, for example, these additives are meticulously incorporated into materials including insulation foams to bolster their resistance to environmental factors, UV radiation, and wear. By doing so, the lifespan of construction materials is extended, while the structural integrity and long-term performance of buildings and infrastructure are ensured. Oxidation is a common challenge across several applications, where exposure to oxygen has led to material degradation. In response, polyurethane additives turn into antioxidants or stabilizers, inhibiting the detrimental effects of oxidation on polyurethane materials. This preserves the integrity of these materials and maintains their appearance as well as performance. In the automotive industry, these additives are used in coatings to shield vehicles from UV radiation and environmental pollutants, thereby extending the life and aesthetic demand of vehicles.To know about the Research Methodology :- Request Free Sample Report

Polyurethane Additive Market Dynamics

Increasing Emphasis on Sustainability and Environmental Regulations to Drive Market Growth With increasing awareness about the environment, consumers are growingly looking for products and materials that have a reduced impact on the environment. This shift in consumer preferences has a direct influence on market demand. Companies are recognizing the requirement to align their products with these consumer values to remain competitive. Consequently, the development and adoption of sustainable additives such as bio-based polyurethane additives, are becoming key strategies to meet this demand and gain a competitive edge in the market. Around the world Governments and regulatory bodies are implementing stricter environmental regulations and standards. These regulations goal to reduce the use of hazardous materials, minimize waste and encourage sustainable practices in manufacturing. To comply with these regulations, companies are revolving to eco-friendly additives. By using sustainable polyurethane additives, manufacturers have been navigating this regulatory landscape more effectively, minimizing the risk of non-compliance and associated consequences. Beyond regulatory compliance, several global sustainability initiatives and agreements including the Paris Agreement, have highlighted the importance of minimizing carbon emissions and promoting sustainable practices across industries. Businesses that align with these initiatives contribute to global environmental goals and enhance their reputation and access to markets that prioritize sustainable products. The integration of sustainable polyurethane additives has significantly diminished the carbon footprint of products and manufacturing processes. With growing apprehensions over carbon emissions and environmental repercussions, businesses are taking proactive steps to curtail their carbon footprint and embrace more eco-conscious operations. Sustainable additives, such as those in the realm of polyurethane, play an essential role in ameliorating the environmental ramifications of the end products. These additives, designed to be eco-friendly enhance the performance of polyurethane-based materials and align with a broader commitment to sustainability. They are instrumental in fostering greener practices in sectors such as construction, automotive and packaging, contributing to an environmentally responsible future. Rapid Expansion in Emerging Economies and Infrastructure Development to Fuel Market Growth Emerging economies are experiencing significant urbanization, population growth and increased infrastructure development. This increase in construction activities needs a higher demand for construction materials, many of which integrate polyurethane additives to improve their properties. Whether it's in insulation, sealants, or adhesives, polyurethane additives play an essential role in improving the quality, durability and performance of these construction materials, aligning with strong construction and infrastructure development. The burgeoning middle-class population in emerging economies has greater purchasing power and a higher demand for enhanced living standards. As a result, there is a considerable necessity for better housing, commercial spaces and infrastructure development to provide to this expanding middle-class segment. Polyurethane additives play a vital role in meeting these demands by augmenting the quality and durability of construction materials used in housing and infrastructure projects. Infrastructure projects and large-scale construction demand high-quality, long-lasting materials to ensure the longevity and safety of the structures. Polyurethane additives have the capability to improve resistance, durability and other essential characteristics of construction materials. As such, they are essential to the development of long-lasting, structurally sound buildings and infrastructure, making them a valuable component in these projects. The automotive industry also experiences significant growth in emerging economies. As more vehicles are manufactured, there is an increased demand for automotive materials and coatings that employ polyurethane additives to enhance resistance and durability. Whether its automotive interiors or exterior coatings, these additives contribute to the enhanced performance and aesthetics of vehicles. The worldwide demand for polyurethane coatings raw materials is experiencing significant growth, driven by expansion of applications in industries such as automotive, construction and furniture. Concurrently, the Polyurethane Additives market is on the increase, responding to the essential for enhancing performance and sustainability in polyurethane-based products across several sectors.Opportunity New Advancement and the Affordable Cost of Polyurethane Additives Innovative flame retardants are developed and used such as inorganic phosphorus, organ phosphorus, nitrogen, halogen and phosphorus-halogen-based compounds. Flexible polyurethane foam is a highly adaptable material applied in a variety of products, including mattresses, furniture, bedding and automotive interiors. Due to its highly flammable nature, the transportation sector acquired the largest share with 28 percent in the Polyurethane Additive Market in 2020. Polyurethane additives such as catalysts, surfactants, fillers and flame retardants are used in the formulation of foams, coatings and elastomers. Polyurethane coatings offer the vehicle exterior with high gloss, durability, scratch resistance and corrosion resistance. It is also used to glaze windshields and windows, increase strength, and provide resistance to fog. It is also used to glaze windshields and windows, increase strength, and provide resistance to fog. Polyurethane additives improve emulsification and nucleation, prevent coalescence, stabilize cell membranes, increase ingredient compatibility, and decrease surface tension. Polyurethane additives improve emulsification and nucleation, prevent coalescence, stabilize cell membranes, increase ingredient compatibility, and decrease tension. Flame retardants are typically added to industrial and consumer products to meet flammability standards for furniture, textiles, electronics, and building products like insulation Thus, due to these factors the demand for polyurethane additives is anticipated to rise with the flourishing transportation sector in the forecast period. Thus, due to these factors, the demand for polyurethane additives is anticipated to rise with the flourishing transportation sector in the forecast period these aspects boost the Polyurethane Additive Market.

Restraints

Health and Safety Concerns to hamper Polyurethane Additive Market Growth Manufacturers have prioritized the safety of their workforce. Workers included in the production, handling, and transportation of polyurethane additives are exposed to various chemical compounds. This exposure poses health risks if not managed properly. It's vital for manufacturers to implement stringent safety protocols, provide adequate training and supply protective equipment to mitigate these risks and ensure the well-being of their employees. Polyurethane additives come in several forms including liquids and solids. Proper handling and storage of these chemicals are essential to prevent accidents, spills, or chemical reactions. Storage facilities and transportation methods have to fulfill safety standards to reduce the likelihood of incidents. The industry is subject to regulations and standards set by governmental bodies and agencies concerned with occupational safety and environmental protection. Manufacturers have invested in compliance measures to meet these standards. Health and safety considerations extend beyond the factory floor. The environmental impact of polyurethane additives is a concern. Manufacturers have measures in place to prevent chemical spills and leaks that harm the environment, which lead to legal and reputational issues.Polyurethane Additive Market Segment Analysis

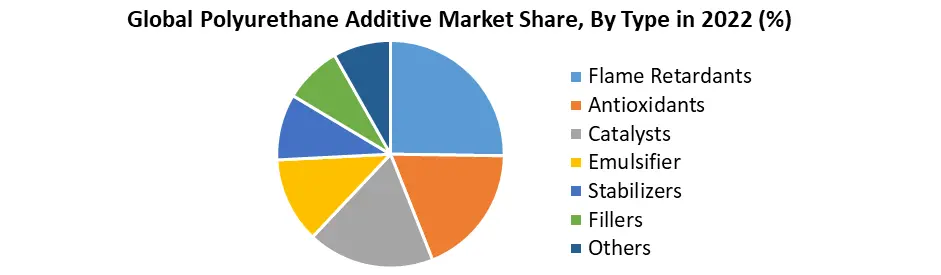

Based on Type, the market is segmented into Flame Retardants, Antioxidants, Catalysts, Emulsifier, Stabilizers Fillers and Others. In 2022, Flame Retardants exerted their dominance in the Polyurethane Additive Market and this trend is poised to persist during the forecast period. The effectiveness of flame retardant chemicals in minimizing the flammability of consumer products during household fires remains a subject of ongoing debate, fuelled by environmental and health concerns. Polyurethane additives are vital components used across diverse industries such as Construction, Automotive, Transportation and Electronics. These additives are used to refine the properties and performance of polyurethane-based materials, enhancing their resilience, durability and versatility. Polyurethane additives in the construction sector are fundamental to stimulating the durability and resistance of insulation materials and sealants which contributes to energy efficiency as well as the structural integrity of buildings. The automotive industry benefits from these additives, which enhance the performance of automotive coatings, interior materials and several components, ensuring long-term durability and safety. In the electronics sector, polyurethane additives optimize the properties of electronic materials and components, boosting overall functionality and reliability. The Polyurethane Catalyst market, a key segment within the Polyurethane Additive Market, plays an acute role. These catalysts are instrumental in initiating and expediting chemical reactions within polyurethane formulations, a vital process for curing and solidifying polyurethane materials. This curing process is paramount for accomplishing the desired properties and performance characteristics in the final products of polyurethane. With the increasing demand for high-performance and specialty polyurethane products in industries including automotive, construction and electronics, the Polyurethane Catalyst market is poised for substantial growth. Polyurethane additives tailored for foam applications constitute a specific niche within the market. Foam materials such as flexible foams used in mattresses and furniture and rigid foams employed in insulation, packaging and construction, depend on these additives to achieve properties including comfort, durability, insulation and resistance. The burgeoning consumer demand for comfortable and long-lasting foam-based products is expected to drive the market for polyurethane additives tailored for foam applications.

Polyurethane Additive Market Regional Insights

Asia Pacific dominated the largest Polyurethane Additive Market share in 2022 and is expected to have a significant CAGR during the forecast period. Asia Pacific has been experiencing prompt economic growth over the past few decades. This growth has led to increased industrialization, infrastructure development and construction activities. As economies expand, the demand for polyurethane additives in applications including construction, automotive and manufacturing has surged. Many Asia Pacific countries are undergoing wide urbanization and investing heavily in infrastructure development. This includes the construction of buildings, roads, bridges and other critical infrastructure. Polyurethane additives are broadly used in construction materials to increase durability, insulation and resistance, making them essential for these projects. The region's growing middle-class population has higher disposable income and demands improved living standards. This has resulted in increased construction and housing projects. Polyurethane additives are used in materials that enhance the quality and longevity of residential and commercial buildings, meeting the requirements of this expanding middle-class segment. The automotive industry in the region has experienced substantial growth. As more vehicles are manufactured, there is an increasing demand for automotive materials that integrate polyurethane additives. These additives are used in automotive interiors, coatings and other applications to enhance resistance and durability. Asia Pacific has become more environmentally aware, with an emphasis on sustainability and reducing the carbon footprint. This has driven the demand for eco-friendly and bio-based polyurethane additives that align with these environmental goals. Government initiatives in many Asia Pacific countries have highlighted infrastructure development, manufacturing growth and environmental sustainability. These initiatives include regulations and incentives that promote the use of advanced materials including polyurethane additives.Polyurethane Additive Market Competitive Landscape

The competitive landscape of the global Polyurethane Additive market entails an analysis of key companies, their size, strengths, weaknesses, barriers and threats. This comprehensive overview delves into the influence of competitive rivals, potential market entrants, customers, suppliers, and substitute products that significantly impact the Polyurethane Additive market's profitability. Market players operate at various levels, spanning from local to regional and global scales, shaping the dynamic Polyurethane Additive market analysis, where competition and innovation drive industry evolution and growth. Some of the key players are BASF SE (Germany), Covestro AG (Germany), Evonik Industries AG (Germany), Kao Corporation (Japan), Huntsman International LLC (US), Tosoh Corporation (Japan), The Dow Chemical Company (US), Momentive(US), Air Products and Chemicals Inc. (US), Suzhou Xiangyuan Special Fine Chemical Co. Ltd (China), Wanhua Chemical Group Co., Ltd. (China) and others. Many companies have conducted research and development activities to fulfill consumer demand and increase their portfolio. For instance, BASF SE development in the Polyurethane Additive in 2022 was substantial, with the company making several investments and launching new products. • BASF broke ground on its new Polyurethane Application Development Laboratory in Mumbai, India, in October 2022. The lab is expected to be invested in 2024 and will strengthen BASF's collaboration with Indian customers from high-growth industries. • BASF also announced plans to invest USD 100 million in its polyurethane additive production site in Ludwigshafen, Germany. The investment is expected to be completed by 2025 and will increase BASF's production capacity for polyurethane additives by 20%Polyurethane Additive Market Scope: Inquiry Before Buying

Polyurethane Additive Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 3.84 Bn. Forecast Period 2023 to 2029 CAGR: 5.12% Market Size in 2029: US $ 5.45 Bn. Segments Covered: by Type Flame Retardants Antioxidants Catalysts Emulsifier Stabilizers Fillers Others by Application Flexible Foam Rigid Foam Coating Adhesives And Sealants Others by End User Building And Construction Automotive And Transportation Furniture Packaging Others Polyurethane Additive Market, by region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Polyurethane Additive Key Players

1. BASF SE (Germany) 2. Covestro AG (Germany) 3. Evonik Industries AG (Germany) 4. Kao Corporation (Japan) 5. Huntsman International LLC (US) 6. Tosoh Corporation (Japan) 7. The Dow Chemical Company (US) 8. Momentive(US) 9. Air Products and Chemicals Inc. (US) 10. Suzhou Xiangyuan Special Fine Chemical Co. Ltd (China) 11. Wanhua Chemical Group Co., Ltd. (China) 12. Covestro AG (Germany) 13. Momentive (US) 14. Lanxess AG (Germany) 15. TOSOH Corporation (Japan) 16. Sika AG (Switzerland) 17. Perstorp AB (Sweden) 18. Adeka Corporation (Japan) 19. The Lubrizol Corporation(US) 20. DIC Corporation(Japan) 21. Lamberti S.p.A.(Italy)Frequently Asked Questions:

1] What segments are covered in the Global Polyurethane Additive Market report? Ans. The segments covered in the Global Polyurethane Additive Market report are based on Type, Application and End User. 2] Which region is expected to hold the highest share in the Global Polyurethane Additive Market? Ans. Asia Pacific is expected to hold the highest share of the Global Polyurethane Additive Market. 3] Who are the key players in the Global Polyurethane Additive Market? Ans. BASF SE (Germany), Covestro AG (Germany), Evonik Industries AG (Germany), Kao Corporation (Japan), Huntsman International LLC (US), Tosoh Corporation (Japan), The Dow Chemical Company (US), Momentive(US), Air Products and Chemicals Inc. (US), Suzhou Xiangyuan Special Fine Chemical Co. Ltd (China), Wanhua Chemical Group Co., Ltd. (China) and others are the key players in the Global Polyurethane Additive Market. 4] Which segment hold the largest market share in the Global Polyurethane Additive market by 2029? Ans. The Type segment hold the largest market share in the Global Polyurethane Additive market by 2029. 5] What is the market size of the Global Polyurethane Additive market by 2029? Ans. The market size of the Global Polyurethane Additive market is USD 5.45 Bn. by 2029. 6] What was the market size of the Global Polyurethane Additive market in 2022? Ans. The market size of the Global Polyurethane Additive market was worth USD 3.84 Bn. in 2022.

1. Polyurethane Additive Market: Research Methodology 2. Polyurethane Additive Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Polyurethane Additive Market: Dynamics 3.1 Polyurethane Additive Market Trends by Region 3.1.1 North America Polyurethane Additive Market Trends 3.1.2 Europe Polyurethane Additive Market Trends 3.1.3 Asia Pacific Polyurethane Additive Market Trends 3.1.4 Middle East and Africa Polyurethane Additive Market Trends 3.1.5 South America Polyurethane Additive Market Trends 3.2 Polyurethane Additive Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Polyurethane Additive Market Drivers 3.2.1.2 North America Polyurethane Additive Market Restraints 3.2.1.3 North America Polyurethane Additive Market Opportunities 3.2.1.4 North America Polyurethane Additive Market Challenges 3.2.2 Europe 3.2.2.1 Europe Polyurethane Additive Market Drivers 3.2.2.2 Europe Polyurethane Additive Market Restraints 3.2.2.3 Europe Polyurethane Additive Market Opportunities 3.2.2.4 Europe Polyurethane Additive Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Polyurethane Additive Market Market Drivers 3.2.3.2 Asia Pacific Polyurethane Additive Market Restraints 3.2.3.3 Asia Pacific Polyurethane Additive Market Opportunities 3.2.3.4 Asia Pacific Polyurethane Additive Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Polyurethane Additive Market Drivers 3.2.4.2 Middle East and Africa Polyurethane Additive Market Restraints 3.2.4.3 Middle East and Africa Polyurethane Additive Market Opportunities 3.2.4.4 Middle East and Africa Polyurethane Additive Market Challenges 3.2.5 South America 3.2.5.1 South America Polyurethane Additive Market Drivers 3.2.5.2 South America Polyurethane Additive Market Restraints 3.2.5.3 South America Polyurethane Additive Market Opportunities 3.2.5.4 South America Polyurethane Additive Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Regulatory Landscape by Region 3.5.1 Global 3.5.2 North America 3.5.3 Europe 3.5.4 Asia Pacific 3.5.5 Middle East and Africa 3.5.6 South America 3.6 Analysis of Government Schemes and Initiatives For the Polyurethane Additive Industry 3.7 The Global Pandemic and Redefining of The Polyurethane Additive Industry Landscape 3.8 Price Trend Analysis 3.9 Technological Road Map 4. Global Polyurethane Additive Market: Global Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 4.1 Global Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 4.1.1 Flame Retardants 4.1.2 Antioxidants 4.1.3 Catalysts 4.1.4 Emulsifier 4.1.5 Stabilizers 4.1.6 Fillers 4.1.7 Others 4.2 Global Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 4.2.1 Flexible Foam 4.2.2 Rigid Foam 4.2.3 Coating 4.2.4 Adhesives And Sealants 4.2.5 Others 4.3 Global Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 4.3.1 Building And Construction 4.3.2 Automotive And Transportation 4.3.3 Furniture 4.3.4 Packaging 4.3.5 Others 4.4 Global Polyurethane Additive Market Size and Forecast, by Region (2022-2029) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Polyurethane Additive Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 5.1 North America Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 5.1.1 Flame Retardants 5.1.2 Antioxidants 5.1.3 Catalysts 5.1.4 Emulsifier 5.1.5 Stabilizers 5.1.6 Fillers 5.1.7 Others 5.2 North America Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 5.2.1 Flexible Foam 5.2.2 Rigid Foam 5.2.3 Coating 5.2.4 Adhesives And Sealants 5.2.5 Others 5.3 North America Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 5.3.1 Building And Construction 5.3.2 Automotive And Transportation 5.3.3 Furniture 5.3.4 Packaging 5.3.5 Others 5.4 North America Polyurethane Additive Market Size and Forecast, by Country (2022-2029) 5.4.1 United States 5.4.1.1 United States Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 5.4.1.1.1 Flame Retardants 5.4.1.1.2 Antioxidants 5.4.1.1.3 Catalysts 5.4.1.1.4 Emulsifier 5.4.1.1.5 Stabilizers 5.4.1.1.6 Fillers 5.4.1.1.7 Others 5.4.1.2 United States Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 5.4.1.2.1 Flexible Foam 5.4.1.2.2 Rigid Foam 5.4.1.2.3 Coating 5.4.1.2.4 Adhesives And Sealants 5.4.1.2.5 Others 5.4.1.3 United States Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 5.4.1.3.1 Building And Construction 5.4.1.3.2 Automotive And Transportation 5.4.1.3.3 Furniture 5.4.1.3.4 Packaging 5.4.1.3.5 Others 5.4.2 Canada 5.4.2.1 Canada Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 5.4.2.1.1 Flame Retardants 5.4.2.1.2 Antioxidants 5.4.2.1.3 Catalysts 5.4.2.1.4 Emulsifier 5.4.2.1.5 Stabilizers 5.4.2.1.6 Fillers 5.4.2.1.7 Others 5.4.2.2 Canada Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 5.4.2.2.1 Flexible Foam 5.4.2.2.2 Rigid Foam 5.4.2.2.3 Coating 5.4.2.2.4 Adhesives And Sealants 5.4.2.2.5 Others 5.4.2.3 Canada Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 5.4.2.3.1 Building And Construction 5.4.2.3.2 Automotive And Transportation 5.4.2.3.3 Furniture 5.4.2.3.4 Packaging 5.4.2.3.5 Others 5.4.3 Mexico 5.4.3.1 Mexico Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 5.4.3.1.1 Flame Retardants 5.4.3.1.2 Antioxidants 5.4.3.1.3 Catalysts 5.4.3.1.4 Emulsifier 5.4.3.1.5 Stabilizers 5.4.3.1.6 Fillers 5.4.3.1.7 Others 5.4.3.2 Mexico Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 5.4.3.2.1 Flexible Foam 5.4.3.2.2 Rigid Foam 5.4.3.2.3 Coating 5.4.3.2.4 Adhesives And Sealants 5.4.3.2.5 Others 5.4.3.3 Mexico Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 5.4.3.3.1 Building And Construction 5.4.3.3.2 Automotive And Transportation 5.4.3.3.3 Furniture 5.4.3.3.4 Packaging 5.4.3.3.5 Others 6. Europe Polyurethane Additive Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 6.1 Europe Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 6.2 Europe Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 6.3 Europe Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 6.4 Europe Polyurethane Additive Market Size and Forecast, by Country (2022-2029) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 6.4.1.2 United Kingdom Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 6.4.1.3 United Kingdom Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 6.4.2 France 6.4.2.1 France Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 6.4.2.2 France Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 6.4.2.3 France Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 6.4.3 Germany 6.4.3.1 Germany Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 6.4.3.2 Germany Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 6.4.3.3 Germany Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 6.4.4 Italy 6.4.4.1 Italy Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 6.4.4.2 Italy Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 6.4.4.3 Italy Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 6.4.5 Spain 6.4.5.1 Spain Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 6.4.5.2 Spain Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 6.4.5.3 Spain Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 6.4.6 Sweden 6.4.6.1 Sweden Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 6.4.6.2 Sweden Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 6.4.6.3 Sweden Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 6.4.7 Austria 6.4.7.1 Austria Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 6.4.7.2 Austria Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 6.4.7.3 Austria Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 6.4.8.2 Rest of Europe Polyurethane Additive Market Size and Forecast, by Application (2022-2029). 6.4.8.3 Rest of Europe Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 7. Asia Pacific Polyurethane Additive Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 7.1 Asia Pacific Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 7.2 Asia Pacific Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 7.3 Asia Pacific Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 7.4 Asia Pacific Polyurethane Additive Market Size and Forecast, by Country (2022-2029) 7.4.1 China 7.4.1.1 China Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 7.4.1.2 China Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 7.4.1.3 China Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 7.4.2 South Korea 7.4.2.1 S Korea Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 7.4.2.2 S Korea Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 7.4.2.3 S Korea Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 7.4.3 Japan 7.4.3.1 Japan Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 7.4.3.2 Japan Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 7.4.3.3 Japan Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 7.4.4 India 7.4.4.1 India Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 7.4.4.2 India Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 7.4.4.3 India Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 7.4.5 Australia 7.4.5.1 Australia Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 7.4.5.2 Australia Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 7.4.5.3 Australia Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 7.4.6 Indonesia 7.4.6.1 Indonesia Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 7.4.6.2 Indonesia Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 7.4.6.3 Indonesia Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 7.4.7 Malaysia 7.4.7.1 Malaysia Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 7.4.7.2 Malaysia Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 7.4.7.3 Malaysia Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 7.4.8 Vietnam 7.4.8.1 Vietnam Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 7.4.8.2 Vietnam Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 7.4.8.3 Vietnam Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 7.4.9 Taiwan 7.4.9.1 Taiwan Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 7.4.9.2 Taiwan Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 7.4.9.3 Taiwan Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 7.4.10.2 Bangladesh Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 7.4.10.3 Bangladesh Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 7.4.11 Pakistan 7.4.11.1 Pakistan Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 7.4.11.2 Pakistan Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 7.4.11.3 Pakistan Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 7.4.12.2 Rest of Asia PacificPolyurethane Additive Market Size and Forecast, by Application (2022-2029) 7.4.12.3 Rest of Asia Pacific Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 8. Middle East and Africa Polyurethane Additive Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 8.1 Middle East and Africa Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 8.2 Middle East and Africa Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 8.3 Middle East and Africa Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 8.4 Middle East and Africa Polyurethane Additive Market Size and Forecast, by Country (2022-2029) 8.4.1 South Africa 8.4.1.1 South Africa Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 8.4.1.2 South Africa Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 8.4.1.3 South Africa Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 8.4.2 GCC 8.4.2.1 GCC Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 8.4.2.2 GCC Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 8.4.2.3 GCC Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 8.4.3 Egypt 8.4.3.1 Egypt Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 8.4.3.2 Egypt Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 8.4.3.3 Egypt Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 8.4.4 Nigeria 8.4.4.1 Nigeria Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 8.4.4.2 Nigeria Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 8.4.4.3 Nigeria Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 8.4.5.2 Rest of ME&A Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 8.4.5.3 Rest of ME&A Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 9. South America Polyurethane Additive Market Size and Forecast by Segmentation (By Value and Volume) (2022-2029) 9.1 South America Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 9.2 South America Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 9.3 South America Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 9.4 South America Polyurethane Additive Market Size and Forecast, by Country (2022-2029) 9.4.1 Brazil 9.4.1.1 Brazil Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 9.4.1.2 Brazil Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 9.4.1.3 Brazil Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 9.4.2 Argentina 9.4.2.1 Argentina Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 9.4.2.2 Argentina Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 9.4.2.3 Argentina Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Polyurethane Additive Market Size and Forecast, by Type (2022-2029) 9.4.3.2 Rest Of South America Polyurethane Additive Market Size and Forecast, by Application (2022-2029) 9.4.3.3 Rest Of South America Polyurethane Additive Market Size and Forecast, by End User (2022-2029) 10. Global Polyurethane Additive Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Service Segment 10.3.3 End User Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.4 Leading Polyurethane Additive Global Companies, by market capitalization 10.5 Market Structure 10.5.1 Market Leaders 10.5.2 Market Followers 10.5.3 Emerging Players 10.6 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 BASF SE (Germany) 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 BASF SE (Germany) 11.3 Covestro AG (Germany) 11.4 Evonik Industries AG (Germany) 11.5 Kao Corporation (Japan) 11.6 Huntsman International LLC (US) 11.7 Tosoh Corporation (Japan) 11.8 The Dow Chemical Company (US) 11.9 Momentive(US) 11.10 Air Products and Chemicals Inc. (US) 11.11 Suzhou Xiangyuan Special Fine Chemical Co. Ltd (China) 11.12 Wanhua Chemical Group Co., Ltd. (China) 11.13 Covestro AG (Germany) 11.14 Momentive (US) 11.15 Lanxess AG (Germany) 11.16 TOSOH Corporation (Japan) 11.17 Sika AG (Switzerland) 11.18 Perstorp AB (Sweden) 11.19 Adeka Corporation (Japan) 11.20 The Lubrizol Corporation(US) 11.21 DIC Corporation(Japan) 11.22 Lamberti S.p.A.(Italy) 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary