The Polycarbonate Composites Market size was valued at USD 2.34 in 2023 and the total Polycarbonate Composites Market revenue is expected to grow at a CAGR of 4.2 % from 2023 to 2030, reaching nearly USD 3.10 Billion in 2030. Polycarbonates are a group of thermoplastic polymers containing carbonate groups in their chemical structures. To the production and usage of polycarbonate materials reinforced with various substances like glass or carbon fibers. These composite materials provide great mechanical qualities such high tensile strength, dimensional stability, heat resistance, and superior insulation. The lower middle class's rising disposable income, the growing need for lightweight materials in the automobile industry, and the growth of the electronics sector are the main drivers of the Polycarbonate composites market. Polycarbonate composites find extensive use in consumer electronics such as handheld devices, personal computers, television sets, video/audio devices, gaming consoles, and personal care products because of their low weight, ease of processing, and mechanical strength. Medical devices are utilized in patient transport devices, surgical instruments, medical device housings, and fixation devices. The use of polycarbonate composites offers environmental benefits, contributing to sustainability advantage is the ability to recycle polycarbonate waste, which incorporated into other materials like gypsum composites for their durability and impact resistance power, which leads to longer product lifecycles and reduced need for frequent replacements.To know about the Research Methodology :- Request Free Sample Report The major players in this market are Covestro AG, Lotte Chemical, Mitsubishi Chemical Corporation, SABIC, and Teijin Limited. Mitsubishi Chemical Corporation focuses on technological advancements and has invested heavily in research and development to strengthen its market position. Europe is the fastest-growing region with a market share of over 23.6% in 2023. The region is expected to grow at a CAGR of 4.2% during the forecast period and maintain its dominance by 2030. Europe’s demand for Polycarbonate composites market due to major rising vehicle production, electrical and electronics. 1. According to MMR, the European Union is the second largest vehicle producer. In 2022, 17 million units were manufactured in the region, or 12.27% of the total volume generated in the Europe region.

Polycarbonate Composites Market Dynamics:

Rising demand for polycarbonate sheets in various industries Rising demand for polycarbonate sheets in various industries because of their exceptional physical and chemical properties. Also as time goes on, the industry want more polycarbonate sheets because of the material's versatile properties, which include its resistance to temperature changes, flexibility, toughness, durability, and simple fitting without breakage. Polycarbonates are used in window glass, skylights, riot gear, healthcare instruments, food processing, exhibitions & displays, and many more applications because they are simple to shape and thermoform. Polycarbonate sheets are known for their great impact resistance and durability. Polycarbonate is a Lightweight and Sustainable Solution for Electric Vehicles Polycarbonate composites are more sustainable than Metal materials because of their lower energy consumption during manufacturing and potential for recyclability. By incorporating these materials into electric vehicles, Automakers meet stricter regulations regarding car emissions and sustainability as well as minimizing the environmental impact of their products. The growing demand for electric vehicles is expected to significantly boost the automobile industry's growth with polycarbonate playing an essential role in this development by serving as a lightweight alternative to traditional materials like metal and glass. Polycarbonate's strength, durability, and transparency make it an ideal choice for various automotive applications, including headlights, interior components, sunroofs, and windows. This shift towards polycarbonate usage not only contributes to weight reduction but also improves safety features in vehicles, leading to an improved driving experience. The demand for flexible packaging from the food and beverage industry is driving market growth, highlighting the flexibility and applicability of polycarbonate in different sectors. However, the price of polycarbonate Composites is significantly impacted by crude oil prices caused by its production process involving petrochemicals derived from crude oil.Recycling Challenges in Polycarbonate Composites Market: Polycarbonate plastics face challenges because of the poor quality of recovered material, which hinders their recyclability and sustainability efforts in the long term. Polycarbonate lose its mechanical properties recycling polycarbonate is its susceptibility to degradation during processing and reuse. Polycarbonate degrade under heat and light, leading to a decrease in its mechanical properties and overall quality. Polycarbonate products often contain additives such as flame retardants and stabilizers, which interfere with the recycling process and affect the quality of the recycled material. Contamination from other plastics or non-plastic materials also reduce the purity of the recycled polycarbonate, making it less suitable for reuse in high-performance application.

Polycarbonate Composites Market Segment Analysis:

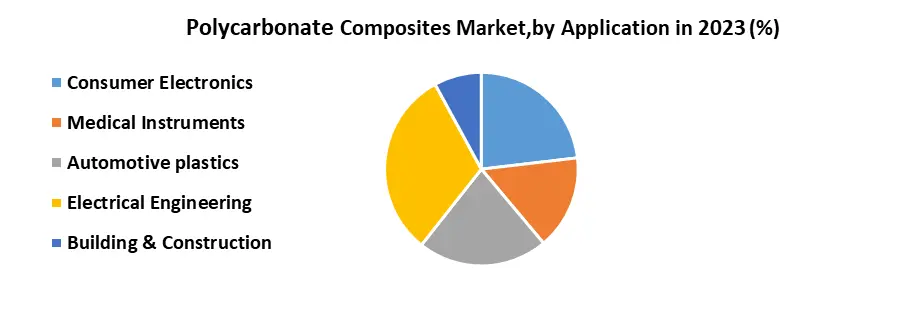

Based on Type, the Glass fibers-filled segment held the largest market share of about 39.23% in the Polycarbonate Composites Market in 2023. According to the MMR analysis, the segment is expected to grow at a CAGR of 4.2 % during the forecast period and maintain its dominance till 2030. Glass Fibers Filled type is dominant because glass fibers are much cheaper than carbon fibers. Also, more affordable. Glass Fibers technology is a well-established manufacturing process and readily available materials, and familiarity in the industry. Glass Fibers are used in many applications such as automotive parts, electrical components, and Consumer electronics, and Good stability properties so used as an alternative to lightweight metal. Based on Application, Electrical Engineering held the largest market share of about 36.87% in the Polycarbonate Composites Market in 2023 and is expected to maintain its dominance till 2030. Polycarbonate Composites have great insulation properties and superior flame-retardant properties which make them highly suitable for electrical and telecommunication hardware. The adoption of polycarbonate composites in electric vehicle components is driven by the need for strong, lightweight, and insulating materials. The rising trend of high-strength and lightweight material in consumer electronics is expected to drive the demand for the polycarbonate Composites Market. Consumer Electronics include handheld devices, personal computers, television sets, video/audio devices, gaming, and personal care products.

Regional Analysis of Polycarbonate Composites Market:

Asia-Pacific region dominates the Polycarbonate Composites Market with the largest market share accounting for 54.03% in 2023, the region is expected to grow during the forecast period and maintain its dominance by 2030. Asia-Pacific region has a demand for the Polycarbonate Composites Market. China, India, and other APAC countries are experiencing rapid economic and industrial growth. Many significant global manufacturers have set up production facilities drawn by lower labor costs and favorable manufacturing policies. So, increases the supply and accessibility of polycarbonate composites. In Japan and South Korea, are heavily investing in R&D for advanced polycarbonate composites leading to use in Polycarbonate Composites Market Development.North America, the fastest-growing region in the Polycarbonate Composites Market held a market share of 18.4% and is significantly growing during its forecast period. North America focuses on demands for lightweight and durable materials in aircraft components. The Polycarbonate Composite Material is ideal for medical equipment for the application in Biocompatibility and strength of material. The environmental impact of polycarbonate manufacture is receiving more attention, and there is a push for composite materials that are recyclable and more sustainable. Competitive Landscape for Polycarbonate Composites Market: The competitive landscape of the Polycarbonate Composites Market is constantly evolving, with new players emerging and established players adapting their strategies. Building Partnerships and collaboration with established players, research institutions, and investors to leverage expertise and resources. SABIC has consistently focused on research and development to increase its product portfolio and meet changing customer needs. The company has seen steady market growth due to its strong presence in emerging economies and strategic partnerships with key players in the industry. 1. In 2023, the government's regular support program for low-income families is expected to keep the flexible packaging business growing at a rate of 2-3% annually, on par with the activity of the food industry. 2. February 2023: Covestro AG introduced Makrolon 3638 polycarbonate for healthcare and life sciences applications such as drug delivery devices, wellness and wearable devices, and single-use containers for biopharmaceutical manufacturing. 3. August 2022: Mitsui Chemicals and Teijin Limited formed a joint venture to produce and supply biomass polycarbonate resins across Japan. 4. August 2022: Covestro AG announced plans to build its first dedicated line for the mechanical recycling (MCR) of polycarbonates in Shanghai, China, to create more sustainable solutions, primarily for electrical and electronic, automotive, and consumer goods applications. 5. In 2021, the country imported 0.75 million tons of plastic products, with 45.8 % coming from China, 5.7 % from the U.S. and the remaining from several different countries. Exports of processed plastics (0.32 million, tons in 2021) went mainly to Argentina (23.8 %), the U.S. (13.6 %), Paraguay (10.7 %), and Chile (10.2%).

Polycarbonate Composites Market Scope: Inquire before buying

Polycarbonate Composites Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US$ 2.34 Bn. Forecast Period 2024 to 2030 CAGR: 4.2% Market Size in 2030: US$ 3.10 Bn. Segments Covered: by Type Glass Fiber Filled Carbon Fiber Filled by Application Automotive Plastic Medical Instruments Electrical Engineering Consumer Electronics Building & Construction Polycarbonate Composites Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan, and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria, and the Rest of ME&A) South America (Brazil, Argentina Rest of South America)Polycarbonate Composites Market Key Players:

North America 1. ExxonMobil Chemical Company (Texas) 2. SABIC Innovative Plastics ( North America) 3. Trinseo (U.S.) Europe 1. Covestro (Germany) 2. Lanxess ( Cologne , Germany) 3. Ensinger GmbH ( Germany) 4. The Bond Laminates GmbH (Ettlingen) 5. Solvay ( Belgium) 6. 3A Composites GmbH (Switzerlan) 7. Arla Plast (Sweden) 8. Brett Martin Ltd. (London) 9. Ensinger (Germany) Asia-Pacific Region 1. Teijin Limited (Japan) 2. Toray Industries, Inc. (Tokyo) 3. Chi Mei Corporation (China) 4. Formosa Chemicals & Fibre Corporation (China) 5. Mitsubishi Chemical Corporation ( Tokyo, Japan) 6. LG Chem ( South Korea) 7. Asahi Kasei Advance Corporation (Japan) 8. China National Bluestar (Group) Co., Ltd. ( China) Middle East & Africa : 1. Sabic Innovative Plastics (Saudi Arabia) 2. Plazit Polygal (Israel) South America Region 1. Latin American Plastics Industry Association (ALIPLAST) 2. Brazilian Association of the Chemical Industry (ABIQ) Frequently Asked Questions: 1] What is the growth rate of the Polycarbonate Composites Market? Ans. The Polycarbonate Composites Market is expected to grow at a CAGR of 4.2 % during the forecast period of 2023 to 2030. 2] Which region is expected to hold the highest share in the Polycarbonate Composites Market? Ans. Asia-Pacific region is expected to hold the highest share of the Polycarbonate Composites Market. 3] What is the market size of the Polycarbonate Composites Market? Ans. The Polycarbonate Composites Market size was valued at USD 2.34 Billion in 2023 reaching nearly USD 3.10 Billion in 2030. 4] What is the forecast period for the Polycarbonate Composites Market? Ans. The forecast period for the Polycarbonate Composites Market is 2023-2030. 5] What segments are covered in the Polycarbonate Composites Market report? Ans. The segments covered in the Polycarbonate Composites Market report are based on Type and Application.

1. Polycarbonate Composites Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Polycarbonate Composites Market: Dynamics 2.1. Polycarbonate Composites Market Trends by Region 2.1.1. North America Polycarbonate Composites Market Trends 2.1.2. Europe Polycarbonate Composites Market Trends 2.1.3. Asia Pacific Polycarbonate Composites Market Trends 2.1.4. Middle East and Africa Polycarbonate Composites Market Trends 2.1.5. South America Polycarbonate Composites Market Trends 2.2. Polycarbonate Composites Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Polycarbonate Composites Market Drivers 2.2.1.2. North America Polycarbonate Composites Market Restraints 2.2.1.3. North America Polycarbonate Composites Market Opportunities 2.2.1.4. North America Polycarbonate Composites Market Challenges 2.2.2. Europe 2.2.2.1. Europe Polycarbonate Composites Market Drivers 2.2.2.2. Europe Polycarbonate Composites Market Restraints 2.2.2.3. Europe Polycarbonate Composites Market Opportunities 2.2.2.4. Europe Polycarbonate Composites Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Polycarbonate Composites Market Drivers 2.2.3.2. Asia Pacific Polycarbonate Composites Market Restraints 2.2.3.3. Asia Pacific Polycarbonate Composites Market Opportunities 2.2.3.4. Asia Pacific Polycarbonate Composites Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Polycarbonate Composites Market Drivers 2.2.4.2. Middle East and Africa Polycarbonate Composites Market Restraints 2.2.4.3. Middle East and Africa Polycarbonate Composites Market Opportunities 2.2.4.4. Middle East and Africa Polycarbonate Composites Market Challenges 2.2.5. South America 2.2.5.1. South America Polycarbonate Composites Market Drivers 2.2.5.2. South America Polycarbonate Composites Market Restraints 2.2.5.3. South America Polycarbonate Composites Market Opportunities 2.2.5.4. South America Polycarbonate Composites Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Polycarbonate Composites Industry 2.8. Analysis of Government Schemes and Initiatives For Polycarbonate Composites Industry 2.9. Polycarbonate Composites Market Trade Analysis 2.10. The Global Pandemic Impact on Polycarbonate Composites Market 3. Polycarbonate Composites Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 3.1.1. Glass Fiber Filled 3.1.2. Carbon Fiber Filled 3.2. Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 3.2.1. Automotive Plastic 3.2.2. Medical Instruments 3.2.3. Electrical Engineering 3.2.4. Consumer Electronics 3.2.5. Building & Construction 3.3. Polycarbonate Composites Market Size and Forecast, by Region (2023-2030) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Polycarbonate Composites Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 4.1.1. Glass Fiber Filled 4.1.2. Carbon Fiber Filled 4.2. North America Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 4.2.1. Automotive Plastic 4.2.2. Medical Instruments 4.2.3. Electrical Engineering 4.2.4. Consumer Electronics 4.2.5. Building & Construction 4.3. North America Polycarbonate Composites Market Size and Forecast, by Country (2023-2030) 4.3.1. United States 4.3.1.1. United States Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 4.3.1.1.1. Glass Fiber Filled 4.3.1.1.2. Carbon Fiber Filled 4.3.1.2. United States Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 4.3.1.2.1. Automotive Plastic 4.3.1.2.2. Medical Instruments 4.3.1.2.3. Electrical Engineering 4.3.1.2.4. Consumer Electronics 4.3.1.2.5. Building & Construction 4.3.2. Canada 4.3.2.1. Canada Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 4.3.2.1.1. Glass Fiber Filled 4.3.2.1.2. Carbon Fiber Filled 4.3.2.2. Canada Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 4.3.2.2.1. Automotive Plastic 4.3.2.2.2. Medical Instruments 4.3.2.2.3. Electrical Engineering 4.3.2.2.4. Consumer Electronics 4.3.2.2.5. Building & Construction 4.3.3. Mexico 4.3.3.1. Mexico Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 4.3.3.1.1. Glass Fiber Filled 4.3.3.1.2. Carbon Fiber Filled 4.3.3.2. Mexico Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 4.3.3.2.1. Automotive Plastic 4.3.3.2.2. Medical Instruments 4.3.3.2.3. Electrical Engineering 4.3.3.2.4. Consumer Electronics 4.3.3.2.5. Building & Construction 5. Europe Polycarbonate Composites Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 5.2. Europe Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 5.3. Europe Polycarbonate Composites Market Size and Forecast, by Country (2023-2030) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 5.3.1.2. United Kingdom Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 5.3.2. France 5.3.2.1. France Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 5.3.2.2. France Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 5.3.3. Germany 5.3.3.1. Germany Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 5.3.3.2. Germany Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 5.3.4. Italy 5.3.4.1. Italy Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 5.3.4.2. Italy Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 5.3.5. Spain 5.3.5.1. Spain Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 5.3.5.2. Spain Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 5.3.6. Sweden 5.3.6.1. Sweden Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 5.3.6.2. Sweden Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 5.3.7. Austria 5.3.7.1. Austria Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 5.3.7.2. Austria Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 5.3.8.2. Rest of Europe Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 6. Asia Pacific Polycarbonate Composites Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 6.2. Asia Pacific Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 6.3. Asia Pacific Polycarbonate Composites Market Size and Forecast, by Country (2023-2030) 6.3.1. China 6.3.1.1. China Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 6.3.1.2. China Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 6.3.2. S Korea 6.3.2.1. S Korea Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 6.3.2.2. S Korea Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 6.3.3. Japan 6.3.3.1. Japan Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 6.3.3.2. Japan Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 6.3.4. India 6.3.4.1. India Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 6.3.4.2. India Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 6.3.5. Australia 6.3.5.1. Australia Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 6.3.5.2. Australia Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 6.3.6. Indonesia 6.3.6.1. Indonesia Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 6.3.6.2. Indonesia Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 6.3.7. Malaysia 6.3.7.1. Malaysia Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 6.3.7.2. Malaysia Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 6.3.8. Vietnam 6.3.8.1. Vietnam Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 6.3.8.2. Vietnam Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 6.3.9. Taiwan 6.3.9.1. Taiwan Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 6.3.9.2. Taiwan Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 6.3.10.2. Rest of Asia Pacific Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 7. Middle East and Africa Polycarbonate Composites Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 7.2. Middle East and Africa Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 7.3. Middle East and Africa Polycarbonate Composites Market Size and Forecast, by Country (2023-2030) 7.3.1. South Africa 7.3.1.1. South Africa Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 7.3.1.2. South Africa Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 7.3.2. GCC 7.3.2.1. GCC Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 7.3.2.2. GCC Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 7.3.3. Nigeria 7.3.3.1. Nigeria Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 7.3.3.2. Nigeria Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 7.3.4.2. Rest of ME&A Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 8. South America Polycarbonate Composites Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 8.2. South America Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 8.3. South America Polycarbonate Composites Market Size and Forecast, by Country (2023-2030) 8.3.1. Brazil 8.3.1.1. Brazil Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 8.3.1.2. Brazil Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 8.3.2. Argentina 8.3.2.1. Argentina Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 8.3.2.2. Argentina Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Polycarbonate Composites Market Size and Forecast, by Type (2023-2030) 8.3.3.2. Rest Of South America Polycarbonate Composites Market Size and Forecast, by Application (2023-2030) 9. Global Polycarbonate Composites Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Polycarbonate Composites Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. ExxonMobil Chemical Company (Texas) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. SABIC Innovative Plastics ( North America) 10.3. Trinseo (U.S.) 10.4. Covestro (Germany) 10.5. Lanxess ( Cologne , Germany) 10.6. Ensinger GmbH ( Germany) 10.7. The Bond Laminates GmbH (Ettlingen) 10.8. Solvay ( Belgium) 10.9. 3A Composites GmbH (Switzerlan) 10.10. Arla Plast (Sweden) 10.11. Brett Martin Ltd. (London) 10.12. Ensinger (Germany) 10.13. Teijin Limited (Japan) 10.14. Toray Industries, Inc. (Tokyo) 10.15. Chi Mei Corporation (China) 10.16. Formosa Chemicals & Fibre Corporation (China) 10.17. Mitsubishi Chemical Corporation ( Tokyo, Japan) 10.18. LG Chem ( South Korea) 10.19. Asahi Kasei Advance Corporation (Japan) 10.20. China National Bluestar (Group) Co., Ltd. ( China) 10.21. Sabic Innovative Plastics (Saudi Arabia) 10.22. Plazit Polygal (Israel) 10.23. Latin American Plastics Industry Association (ALIPLAST) 10.24. Brazilian Association of the Chemical Industry (ABIQ) 11. Key Findings 12. Industry Recommendations 13. Polycarbonate Composites Market: Research Methodology 14. Terms and Glossary