The Pet Accessories Market size was valued at USD 60.33 Billion in 2024 and the total Pet Accessories revenue is expected to grow at a CAGR of 6.2% from 2025 to 2032, reaching nearly USD 97.62 Billion.Pet Accessories Market Overview

Pet accessories are products designed to enhance the comfort and lifestyle of the pet. These products offer both functional and aesthetic benefits to their animal companions. These product accessories are driving market growth as pets have become an integral part of many households, with owners willing to invest in products that improve their pets' lives and reflect their own preferences including the increasing humanization of pets, growing disposable income, and the trend of pet owners treating their animals as family members. Also, social media and celebrity influences play a role in driving demand for fashionable and unique pet accessories. Online retail platforms and specialized pet stores are become key distribution channels, making it easier for pet owners to access a diverse range of accessories for their beloved companions. The market has offer a wide variety of high-quality, innovative, and stylish products.To know about the Research Methodology :- Request Free Sample Report

Pet Accessories Market Dynamics

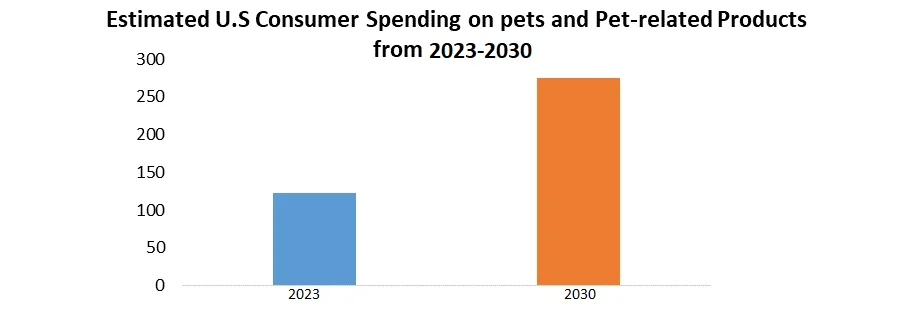

The Development of Smart Pet Accessories The demand for high-quality pet care products and smart accessories is increasing this has driven the development of the Internet of Things technology in this field. Using the technology of IOT pet owners can remotely track their pet’s activities and location, monitor their pet’s health condition or even interact with their pets. The integration of intelligent features such as automated feeding, real-time health tracking, and GPS location services, and remote play in smart pet accessories is revolutionizing the pet care landscape. These innovations provide convenience, and assurance, and foster stronger bonds between pets and their owners. These smart pet care products have become essential in the daily routines of pet owners. With the increasing infusion of Internet of Things (IoT) capabilities and seamless mobile app integration, these accessories enable pet owners to stay connected and engaged with their pets, even when apart. This trend is fueling a rising desire for creative and smart pet accessories in the market. Innovative and stylish pet accessories are driving the market growth The proliferation of innovative and stylish pet accessories in the market is driven by evolving consumer preferences for products that reflect their own lifestyle and aesthetics while providing enhanced comfort and functionality for their pets. As pet humanization continues to rise, owners are seeking accessories that seamlessly blend with their homes and personal fashion choices, leading to a surge in demand for well-designed, visually appealing, and trend-conscious pet products. Manufacturers are responding by leveraging creative designs, premium materials, and sustainable practices, catering to the demand for unique, fashion-forward pet accessories that elevate both the living standards of pets and the overall experience of pet ownership. The pet accessories market's major drivers are fuelled by the growing trend of pet humanization, where pets are increasingly considered as integral family members, leading to increased spending on high-quality, fashionable, and functional accessories. Rising disposable incomes, urbanization, and smaller living spaces have further intensified the demand for space-efficient and aesthetically pleasing pet products. The emphasis on the health and well-being of pets, combined with progress in materials and technology, spurs creative developments in accessories such as intelligent feeders, comfortable grooming implements, and interactive toys. This enriches the general welfare and interaction of pets, propelling the consistent expansion of the market. Spending in the pet industry was estimated at USD 62.75 billion in 2019, consumer spending on animals is a pervasive celebrity pet culture, which encourages splurges on fashions, collars, costumes, leashes, beds, strollers, and other luxury goods from name designers such as Chanel, Burberry, and Coach. NAPHIA’s State of the Industry Report 2023 Highlights states that the total premium volume for pet insurance in the U.S. was nearly USD 3.2 billion. The total number of pets insured in the U.S. at year-end 2022 was 4.8 million, a 22 percent increase since 2021. The average accident and illness premium for dogs was $640 a year or $53 a month. The average accident and illness premium for cats was $387 a year or $32 a month. The largest share of insured pets resides in California, New York, and Florida. Dogs comprised the largest category of insured pets. According to National survey conducted by the American pet products Association in 2022 about 70% of U.S households or about 90.3 million families own a pet. Total pet industry expenditures in the U.S. totalled $123.6 billion, up 19 percent from $103.6 billion in 2020.

Number Households in U.S that own a Pet, by Type of Animal in 2022 Sr. No. Types of Pet Number of households (Mn.) 1 Dog 69.0 2 Cat 45.4 3 Freshwater Fish 11.6 4 Bird 9.9 5 Small Animal 6.2 6 Reptile 5.7 7 Horse 3.6 8 Reptile 2.8 Pet Accessories Market trends Trendy Pet Accessories- Trendy pet accessories encapsulate the latest style and design trends, reflecting the modern pet owner's desire for both functional and fashionable products. These accessories encompass a range of items, from chic clothing and stylish collars to luxury beds and cutting-edge gadgets. With a focus on aesthetics and innovation, trendy pet accessories not only enhance pets' comfort and well-being but also allow owners to express their personal tastes and elevate their pets' status as fashionable companions. Social Media Influences Pet Fashion- Social media exerts a profound influence on the realm of pet fashion, shaping trends and driving consumer choices. Platforms like Instagram, TikTok, and Pinterest enable pet owners to showcase their furry companions in trendy outfits, sparking viral challenges and inspiring others to adopt similar styles. Pet influencers and celebrities amplify this impact by flaunting fashionable pet accessories, prompting their followers to seek similar looks. Consequently, social media cultivates a dynamic ecosystem where pet fashion evolves rapidly, creating a symbiotic relationship between digital culture and the pet accessories market. Pet Accessories Market Restraint Local and Unorganized Pet Accessory Suppliers Compete The intense competition by local and unorganized pet accessories suppliers stands out as a significant market restraint for the rapid expansion of the pet accessories industry. Despite the market's ample growth and profitability prospects, these suppliers introduce formidable challenges to established enterprises. These suppliers establish direct relationships with pet owners in their communities, understanding their unique preferences and needs. They might offer customized or handmade accessories, tapping into the demand for artisanal and locally sourced products. However, they may face challenges in terms of distribution, branding, and keeping up with industry standards. Premium and Opulent Pet Accessories are Expensive Premium and luxury products are expensive, which challenges the pet accessories market due to their premium pricing, these items have better profit margins but fewer customers. Premium pet accessories must exhibit superior craftsmanship, lasting resilience, and a sophisticated aesthetic. The elevated pricing of these items is a reflection of their utilization of top-notch materials, skilled artisanship, and advanced production methods.

Total U.S. Pet industry Expenditures on Pet Accessories (in USD Bn), in Year Expenditure (USD Bn) 2017 73.9 2018 92.4 2019 98.9 2020 103.2 2021 118.7 2022 128.4 Pet Accessories Market Regional Analysis

North America region contributes the largest share of around 42.4% in 2024 and is expected to dominate during the forecast period. The growth of the market in this region is influenced by the large increasing population of elderly people that like companionship, and the adoption rate of pets is high. The pet humanization trend is also driving the market in North America. The U.S. has the highest share owing to the more significant number of pet owners as per a national pet owner survey conducted by the American pet product association about 92.3 million families, owned a pet during 2019-2024. According to a study in North America, there are about 83 million households owning pets in the US and about 48% of homes have pets with them. Dogs and cats are the most common pets in these countries. This is due to the fact that these countries are developed and thus, lie in the high-income category. The disposable income of these countries is quite high which has led to an increased pet adoption rate. Europe is expected to grow with a significant annual growth rate during the forecast period. The demand for pet grooming products in Europe region is continuously rising owing to a rise in awareness regarding pet hygiene. The growth of the cat and dog population in Europe during the lockdown is a major contributing factor to the market growth in the region.

Pet Accessories Market Segment Analysis

By Pet Type, The Pet Accessories market is categorized into Dog, Cat, Fish, Bird, and Other among these segments the pet type segment the Dog segment is dominating the market in 2024 and the market accounted for over 39% of the revenue. Dogs are known to relieve anxiety, stress, and depression, as well as loneliness, promote cardiovascular health and encourage exercise all of which contribute to their popularity. By Product Type, Pet Toys dominate the pet accessories market in 2024. This is due to the increasing emphasis on pet enrichment and entertainment, driving higher demand for a wide range of engaging and interactive toys. Pet owners seek to enhance their pets' mental and physical stimulation, leading to sustained growth in this segment. Additionally, the trend toward the humanization of pets has contributed to the popularity of toys, creating a lucrative market for pet entertainment products.By Distribution Channel, in the pet accessories market, distribution channels shape industry dynamics. Specialty Stores are the most dominant channel. This section will delve into their dominance and explore the factors for their anticipated growth pace. Pet Products Specialty Stores dominate the Pet Accessories market. These stores carry several pet-related products. Pet owners who are looking for high-quality and distinctive products for their pets frequently choose these stores due to their expertise, knowledge, and specialized inventory.The adoption and growth of Specialty Stores in the pet accessories market might be attributed to emerging economies' economic growth. More pet owners are shopping at specialized stores with a variety of products as these countries urbanize and change lifestyles. Economic growth has led to an increase in the number of people who can afford to purchase at Specialty Stores, which has led to their dominance in the distribution channel landscape.

Pet Accessories Market Competitive Landscape

The pet accessories market boasts a dynamic competitive landscape characterized by a blend of established industry leaders and innovative newcomers. Key players, known for their wide-ranging product portfolios and robust distribution networks, vie for market dominance through brand recognition and product diversification. Simultaneously, agile and niche-focused entrants carve out their space by delivering specialized and unique offerings that resonate with discerning consumers. E-commerce platforms further intensify competition, enabling both traditional and emerging players to showcase their products on a global scale. This environment fuels continuous innovation, quality enhancements, and a customer-centric approach, driving the industry's overall growth and evolution.Pet Accessories Market Scope: Inquire before buying

Pet Accessories Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 60.33 Bn. Forecast Period 2025 to 2032 CAGR: 6.2% Market Size in 2032: USD 97.62 Bn. Segments Covered: by Product Type Grooming Products Collars& Harness Bedding and Feeding Pet Toys Pet Housing Other by Pet Type Dog Cat Fish Bird Other by Distribution Channel Online Supermarket Hypermarket Specialty store Factory Outlets Other Pet Accessories Market by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Pet Accessories Market key players include

1. Hartz Mountain Corporation 2. Petsafe 3. Chewy 4. Petro.com 5. Smartpark 6. Petsmart 7. Petflow 8. barkbox 9. Ancol pet products limited 10. Rosewood Pet Products Limited 11. Bob Martin 12. Platinum Pets 13. Ferplast S.p.A. 14. Just for Pets 15. Muttluks Inc. 16. Petco 17. ferplast S.p.A 18. country vetFrequently Asked Questions:

1] What is the growth rate of the Global Pet Accessories Market? Ans. The Global Pet Accessories Market is growing at a significant rate of 6.2 % over the forecast period. 2] Which region is expected to dominate the Global Pet Accessories Market? Ans. North American region is expected to dominate the Pet Accessories Market over the forecast period. 3] What is the expected Global Pet Accessories Market size by 2032? Ans. The market size of the Pet Accessories Market is expected to reach USD 97.62 Bn by 2032. 4] Who are the top players in the Global Ice Tools Industry? Ans. The major key players in the Global Pet Accessories Market are Hartz Mountain Corporation, Petsafe, Chewy, Petro.com, and Smartpark 5] What was the Global Pet Accessories Market size in 2024? Ans: The Global Pet Accessories Market size was USD 60.33 Billion in 2024.

1. Pet Accessories Market: Research Methodology 2. Pet Accessories Market: Executive Summary 3. Pet Accessories Market: Competitive Landscape 3.1. MMR Competition Matrix 3.2. Competitive Landscape 3.3. Key Players Benchmarking 3.4. Market Structure 3.4.1. Market Leaders 3.4.2. Market Followers 3.4.3. Emerging Players 3.5. Consolidation of the Market 4. Pet Accessories Market: Dynamics 4.1. Market Trends by Region 4.1.1. North America 4.1.2. Europe 4.1.3. Asia Pacific 4.1.4. Middle East and Africa 4.1.5. South America 4.2. Market Drivers by Region 4.2.1. North America 4.2.2. Europe 4.2.3. Asia Pacific 4.2.4. Middle East and Africa 4.2.5. South America 4.3. Market Restraints 4.4. Market Opportunities 4.5. Market Challenges 4.6. PORTER’s Five Forces Analysis 4.7. PESTLE Analysis 4.8. Value Chain Analysis 4.9. Regulatory Landscape by Region 4.9.1. North America 4.9.2. Europe 4.9.3. Asia Pacific 4.9.4. Middle East and Africa 4.9.5. South America 5. Pet Accessories Market Size and Forecast by Segments (by Value USD and Volume Units) 5.1. Pet Accessories Market Size and Forecast, by Product Type (2024-2032) 5.1.1. Grooming Products 5.1.2. Collars& Harness 5.1.3. Bedding and Feeding 5.1.4. Pet Toys 5.1.5. Pet Housing 5.1.6. Other 5.2. Pet Accessories Market Size and Forecast, by Pet Type (2024-2032) 5.2.1. Dog 5.2.2. Cat 5.2.3. Fish 5.2.4. Bird 5.2.5. Other 5.3. Pet Accessories Market Size and Forecast, by Distribution Channel (2024-2032) 5.3.1. Online 5.3.2. Supermarket 5.3.3. Hypermarket 5.3.4. Specialty store 5.3.5. Factory Outlets 5.3.6. Other 5.4. Pet Accessories Market Size and Forecast, by Region (2024-2032) 5.4.1. North America 5.4.2. Europe 5.4.3. Asia Pacific 5.4.4. Middle East and Africa 5.4.5. South America 6. North America Pet Accessories Market Size and Forecast (by Value USD and Volume Units) 6.1. North America Pet Accessories Market Size and Forecast, by Product Type (2024-2032) 6.1.1. Grooming Products 6.1.2. Collars& Harness 6.1.3. Bedding and Feeding 6.1.4. Pet Toys 6.1.5. Pet Housing 6.1.6. Other 6.2. North America Pet Accessories Market Size and Forecast, by Pet Type (2024-2032) 6.2.1. Dog 6.2.2. Cat 6.2.3. Fish 6.2.4. Bird 6.2.5. Other 6.3. North America Pet Accessories Market Size and Forecast, by Distribution Channel (2024-2032) 6.3.1. Online 6.3.2. Supermarket 6.3.3. Hypermarket 6.3.4. Specialty store 6.3.5. Factory Outlets 6.3.6. Other 6.4. North America Pet Accessories Market Size and Forecast, by Country (2024-2032) 6.4.1. United States 6.4.2. Canada 6.4.3. Mexico 7. Europe Pet Accessories Market Size and Forecast (by Value USD and Volume Units) 7.1. Europe Pet Accessories Market Size and Forecast, by Product Type (2024-2032) 7.1.1. Grooming Products 7.1.2. Collars& Harness 7.1.3. Bedding and Feeding 7.1.4. Pet Toys 7.1.5. Pet Housing 7.1.6. Other 7.2. Europe Pet Accessories Market Size and Forecast, by Pet Type (2024-2032) 7.2.1. Dog 7.2.2. Cat 7.2.3. Fish 7.2.4. Bird 7.2.5. Other 7.3. Europe Pet Accessories Market Size and Forecast, by Distribution Channel (2024-2032) 7.3.1. Online 7.3.2. Supermarket 7.3.3. Hypermarket 7.3.4. Specialty store 7.3.5. Factory Outlets 7.3.6. Other 7.4. Europe Pet Accessories Market Size and Forecast, by Country (2024-2032) 7.4.1. UK 7.4.2. France 7.4.3. Germany 7.4.4. Italy 7.4.5. Spain 7.4.6. Sweden 7.4.7. Austria 7.4.8. Rest of Europe 8. Asia Pacific Pet Accessories Market Size and Forecast (by Value USD and Volume Units) 8.1. Asia Pacific Pet Accessories Market Size and Forecast, by Product Type (2024-2032) 8.1.1. Grooming Products 8.1.2. Collars& Harness 8.1.3. Bedding and Feeding 8.1.4. Pet Toys 8.1.5. Pet Housing 8.1.6. Other 8.2. Asia Pacific Pet Accessories Market Size and Forecast, by Pet Type (2024-2032) 8.2.1. Dog 8.2.2. Cat 8.2.3. Fish 8.2.4. Bird 8.2.5. Other 8.3. Asia Pacific Pet Accessories Market Size and Forecast, by Distribution Channel (2024-2032) 8.3.1. Online 8.3.2. Supermarket 8.3.3. Hypermarket 8.3.4. Specialty store 8.3.5. Factory Outlets 8.3.6. Other 8.4. Asia Pacific Pet Accessories Market Size and Forecast, by Country (2024-2032) 8.4.1. China 8.4.2. S Korea 8.4.3. Japan 8.4.4. India 8.4.5. Australia 8.4.6. Indonesia 8.4.7. Malaysia 8.4.8. Vietnam 8.4.9. Taiwan 8.4.10. Bangladesh 8.4.11. Pakistan 8.4.12. Rest of Asia Pacific 9. Middle East and Africa Pet Accessories Market Size and Forecast (by Value USD and Volume Units) 9.1. Middle East and Africa Pet Accessories Market Size and Forecast, by Product Type (2024-2032) 9.1.1. Grooming Products 9.1.2. Collars& Harness 9.1.3. Bedding and Feeding 9.1.4. Pet Toys 9.1.5. Pet Housing 9.1.6. Other 9.2. Middle East and Africa Pet Accessories Market Size and Forecast, by Pet Type (2024-2032) 9.2.1. Dog 9.2.2. Cat 9.2.3. Fish 9.2.4. Bird 9.2.5. Other 9.3. Middle East and Africa Pet Accessories Market Size and Forecast, by Distribution Channel (2024-2032) 9.3.1. Online 9.3.2. Supermarket 9.3.3. Hypermarket 9.3.4. Specialty store 9.3.5. Factory Outlets 9.3.6. Other 9.4. Middle East and Africa Pet Accessories Market Size and Forecast, by Country (2024-2032) 9.4.1. South Africa 9.4.2. GCC 9.4.3. Egypt 9.4.4. Nigeria 9.4.5. Rest of ME&A 10. South America Pet Accessories Market Size and Forecast (by Value USD and Volume Units) 10.1. South America Pet Accessories Market Size and Forecast, by Product Type (2024-2032) 10.1.1. Grooming Products 10.1.2. Collars& Harness 10.1.3. Bedding and Feeding 10.1.4. Pet Toys 10.1.5. Pet Housing 10.1.6. Other 10.2. South America Pet Accessories Market Size and Forecast, by Pet Type (2024-2032) 10.2.1. Dog 10.2.2. Cat 10.2.3. Fish 10.2.4. Bird 10.2.5. Other 10.3. South America Pet Accessories Market Size and Forecast, by Distribution Channel (2024-2032) 10.3.1. Online 10.3.2. Supermarket 10.3.3. Hypermarket 10.3.4. Specialty store 10.3.5. Factory Outlets 10.3.6. Other 10.4. South America Pet Accessories Market Size and Forecast, by Country (2024-2032) 10.4.1. Brazil 10.4.2. Argentina 10.4.3. Rest of South America 11. Company Profile: Key players 11.1. Petsafe 11.1.1. Company Overview 11.1.2. Financial Overview 11.1.3. Business Portfolio 11.1.4. SWOT Analysis 11.1.5. Business Strategy 11.1.6. Recent Developments 11.2. Hartz Mountain Corporation 11.3. Chewy.com 11.4. Petro.com 11.5. Smartpark 11.6. Petsmart 11.7. Petflow 11.8. barkbox 11.9. Ancol pet products limited 11.10. Rosewood Pet Products Limited 11.11. Bob Martin 11.12. Platinum Pets 11.13. Ferplast S.p.A. 11.14. Just for Pets 11.15. Muttluks Inc. 11.16. Petco 11.17. ferplast S.p.A 11.18. country vet 12. Key Findings 13. Industry Recommendation