The Pawn Shop Market size was valued at USD 36.20 Billion in 2025 and the total Pawn Shop revenue is expected to grow at a CAGR of 3.6% from 2025 to 2032, reaching nearly USD 46.37 Billion by 2032.Pawn Shop Market Overview:

The pawn shop market defines a diverse niche in the retail industry. It specializes in providing secured loans, popularly known as pawn loans, to individuals who proffer personal possessions, encompassing items of significance like exquisite jewellery, cutting-edge electronics, and an array of other prized valuables. These assets, acting as collateral, underpin the loan agreement. The pawn shop market offers a pragmatic avenue for consumers to swiftly secure short-term loans, aligning with exigent financial demands, while concurrently morphing into a vibrant marketplace where individuals peruse a diverse assortment of pre-owned commodities. The evolutionary growth of pawn shops is due to having transitioned from conventional brick-and-mortar establishments into modern-day, technologically-empowered platforms, expanding their geographical outreach and trade. The uniqueness of the Pawn Shop Market model begets a mutually advantageous ecosystem. Borrowers, grappling with urgent financial needs, find solace in the expeditious loan accessibility, while discerning consumers keen on judicious expenditures are drawn to the realm of cost-effective, previously owned merchandise. The integration of digital platforms into pawn shop operations has unfurled novel landscapes for advancement, enticing tech-savvy patrons and engendering operational efficiencies through streamlined processes. In essence, the pawn shop market exudes resilience and innovation, substantiating its relevance within the evolving landscape of consumer finance and retail commerce.To know about the Research Methodology :- Request Free Sample Report

Pawn Shop Market Scope and Research Methodology

The Pawn Shop Market has been thoroughly analysed in a recent report published by MMR. Offering a strategic analysis, the report covers a wide array of vital aspects, including top players, market size, share, key drivers, challenges, opportunities, competitive landscape, market attractiveness analysis and growth contributors. The Pawn Shop Market report offers a detailed analysis of the global Pawn Shop Market. It classifies the market based on offerings, deployment mode, application, end-user industry, and region, providing valuable insights for stakeholders. The analysis also includes an in-depth assessment of past market dynamics spanning from 2018 to 2023, enabling readers to compare past trends with current market scenarios and better grasp the impact of key players.Pawn Shop Market Dynamics:

Pawn Shop Market Drivers E-commerce Elevating Pawn Shops to the Modern Era by Digital Transformation Integration of digital platforms and e-commerce functionalities within pawn shop operations, exponentially widening their scope. This transformative shift leverages technology's prowess to engage a broader audience, paving the way for remote transactions and propelling the industry into the digital age. The innate flexibility of pawn loans, untethered from conventional credit checks, renders them an attractive recourse for individuals grappling with imperfect credit histories. As global economies burgeon and disposable incomes ascend within emerging markets, pawn shops are positioned to catalyze growth by accommodating the burgeoning middle class's evolving financial requisites. The driver's potency is further accentuated by pawn shops' innovative expansion beyond their traditional portfolio, encompassing ventures such as electronics repair services and strategic collaborations, thereby augmenting their appeal and augmenting revenue streams. Evolving regulations, the final strand of this dynamic driver, assume a pivotal role. A harmonious equilibrium between consumer safeguarding and entrepreneurial latitude engenders a conducive landscape for pawn shops to thrive, innovate, and champion financial inclusion, ultimately affirming their role as agents of transformative change within the economy. Pawn shops stand as a key catalyst for financial inclusion by extending credit accessibility to segments often marginalized by conventional banking channels. This multifaceted market driver is underscored by several key elements. Pawn loans offer a streamlined alternative to traditional credit, swiftly meeting immediate cash requirements sans the protracted approval procedures. The cyclical nature of economic downturns propels individuals toward pawn shops, seeking expedient access to funds in times of adversity, thereby augmenting the demand for Pawn Shop Market. Pawn Shop Market Restraint Unpredictable Swifts and Recovering Loan Amounts Impacting Pawn Shop Revenue The pawn shop market comes across various restraints, including navigating intricate and variable regulations encompassing interest rate caps and licensing prerequisites, which limit operational agility and escalate compliance expenditures. The associated stigma linked to utilizing pawn shops as a financial solution risks potential business, consequently affecting the overall market reach. The burgeoning presence of online lending platforms and e-commerce domains adds to the challenge, as customers lean towards the convenience of digital transactions, potentially diminishing foot traffic to physical pawn shop establishments. Economic upswings decrease the demand for pawn loans, given the availability of more conventional borrowing avenues, thereby potentially impinging on pawn shop financial viability. Instances of loan default precipitate difficulties in recovering loan sums if the pledged items devaluate, potentially culminating in financial delays. The ebb and flow of pawn shop activity, subject to seasonal shifts, influence demand for loans and sales at disparate junctures, thereby unsettling revenue consistency. The perception of risk attached to pawn transactions, fueled by apprehensions of relinquishing cherished possessions, can deter customer participation and compromise loan engagement. Vigilance to avert acceptance of counterfeit or pilfered items necessitates meticulous verification processes, which could engender transactional sluggishness. The technological evolution toward digital platforms and virtual marketplaces mandates substantial investments in tech infrastructure, potentially posing a hurdle for conventional pawn shops. The proliferation of retailers offering buyback and trade-in initiatives for electronics and similar items could divert potential clients from pawn shops, thereby impacting both loan initiation and resale frequency. Pawn Shop Market Opportunities: Enhancing Convenience & Customer Interaction with Apps Offers Market Growth Opportunity The pawn shop market presents a range of enticing opportunities for market growth. Embracing digital platforms and mobile apps holds the potential to extend the market's outreach and capture the interest of tech-savvy consumers. For instance, the introduction of a user-friendly mobile app such as Pawnbroker catering to loan applications and item valuations enhances convenience and boosts customer engagement. Diversifying services to include electronics repair, watch servicing, or customized jewelry design forge fresh revenue streams while attracting a wider customer base. By offering on-site repair services for electronics, a pawn shop positions itself as a comprehensive solution for diverse customer needs. Collaborating with fintech firms emerges as another avenue, with the potential to revolutionize lending solutions and streamline digital payments, ultimately enhancing the customer experience. Aligning with social responsibility practices, like partnering with local charities or backing community events, enhances the shop's reputation, fostering customer loyalty. Implementing sustainable practices, such as utilizing recycled materials for displays and eco-friendly packaging, appeals to environmentally conscious consumers, tapping into sustainability trends. Identifying underserved niches, tailoring products and services, and hosting targeted events create a devoted customer base while cultivating a visually appealing in-store atmosphere and providing personalized service sets a pawn shop apart. Leveraging customer data to suggest complementary items during transactions increase sales, much like proposing relevant accessories when a customer pawns an item. Organizing educational workshops or seminars solidifies the pawn shop's role as a community hub, attracting members while imparting valuable knowledge.

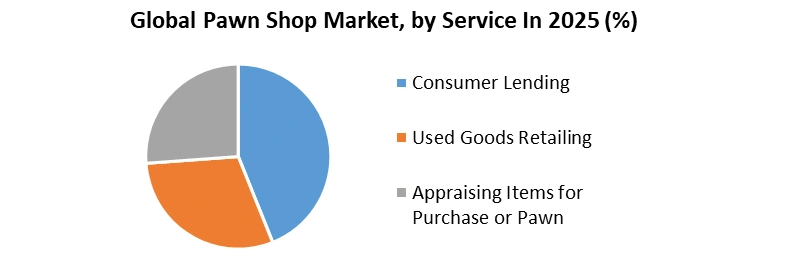

Pawn Shop Market Segment Analysis:

Services: in the analysis of the Pawn Shop Market's service-oriented segmentation, a closer examination reveals distinct categories that delineate the market's operational landscape. The services provided by pawn shops are classified into three primary segments, this segment represents a significant aspect of the pawn shop market, where consumers can obtain secured loans by leveraging personal property as collateral. This service caters to individuals seeking financial assistance by utilizing valuable possessions as a guarantee, making it a cornerstone of pawn shop operations. Another pivotal service offered by pawn shops involves the retailing of used goods. These establishments serve as platforms for buying and selling pre-owned items, fostering a market for diverse consumer goods. This segment contributes to the overall economic dynamics of the pawn shop industry, providing avenues for individuals to acquire or sell second-hand items. The appraisal service represents an integral function within the pawn shop market, where professionals assess the value of items brought in by customers for potential purchase or pawn. This segment ensures fair and accurate evaluations, establishing a foundation for transparent transactions within the pawn shop ecosystem. End-User: This demographic, comprising individuals born between the early 1960s and early 1980s, represents a significant portion of pawn shop clientele. The services provided cater to the unique financial and retail needs of Generation X, contributing to the market's overall stability. Also known as Millennials, Generation Y, born between the early 1980s and mid-1990s, constitutes another key segment of pawn shop consumers. The market adapts its services to align with the preferences and requirements of this generation, ensuring relevance and appeal. Individuals born between the mid-1940s and mid-1960s, known as Baby Boomers, form an additional demographic segment in the pawn shop market. The services offered by pawn shops are tailored to address the distinctive needs of this demographic, acknowledging their preferences and financial considerations.

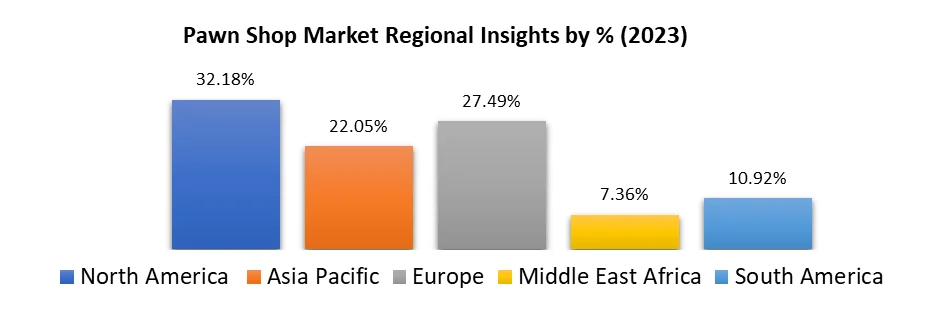

Pawn Shop Market Regional Insights:

The North American pawn shop market benefits from a well-established resale culture, with the United States leading the way. Economic fluctuations and changing consumer preferences drive market dynamics in this region. European pawn shops, particularly in countries like the United Kingdom, have embraced online platforms, catering to tech-savvy consumers seeking a mix of traditional and digital shopping experiences. Growing economies, urbanization, and a rising middle class contribute to the expansion of the pawn shop market in the Asia-Pacific region, with countries like China and India showing significant potential. Pawn shops in South America serve as important financial resources for communities with limited access to formal banking systems, driving market growth and financial inclusion. The pawn shop market in MEA region is influenced by a mix of cultural factors and economic conditions, presenting both challenges and opportunities for growth.

Competitive Landscape:

The competitive landscape of the Pawn Shop Market is comprised of a diverse array of key players, each contributing to the industry's vibrancy and growth. Cash America International, Inc., EZCORP, Inc., and First Cash Financial Services, Inc. are prominent names with expansive networks and a strong market presence. American Jewelry and Loan, Gold & Silver Pawn Shop, and Empire Pawn of Nassau Inc. stand out for their brand recognition and customer engagement. The global influence extends further with Borro, a player specializing in online pawn services, and LoanMart, focusing on innovative lending solutions. In the UK, Browns Pawnbrokers and New Bond Street Pawnbrokers have established themselves as reputable choices. Notably, National Pawnbrokers Association (NPA) plays a pivotal role in shaping industry standards and advocacy. Central Mega Pawn, Maxferd Jewelry & Loan, Prestige Pawnbrokers, Quik Pawn Shop, Pawn America, SuperPawn, and USA Pawn & Jewelry contribute their unique regional strengths and customer-centric approaches. The sector's diversity is enriched by Value Pawn & Jewelry's commitment to sustainability. These players collectively reflect the dynamism of the Pawn Shop Market, offering a range of services from traditional to modern, catering to diverse customer needs, and driving the industry's evolution through innovation and customer engagement.Global Pawn Shop Market Scope: Inquire before buying

Global Pawn Shop Market Report Coverage Details Base Year: 2025 Forecast Period: 2026-2032 Historical Data: 2020 to 2025 Market Size in 2025: USD 36.20 Bn. Forecast Period 2026 to 2032 CAGR: 3.6% Market Size in 2032: USD 46.37 Bn. Segments Covered: by Service Consumer Lending (Secured Loans with Personal Property Used as Collateral) Used Goods Retailing Appraising Items for Purchase or Pawn by End User Generation X Generation Y Baby Boomers Pawn Shop Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Pawn Shop Market, Key Players

1. American Jewelry and Loan 2. Borro 3. Browns Pawnbrokers (UK) 4. Cash America International, Inc. 5. Cash Canada 6. Central Mega Pawn 7. Empire Pawn of Nassau Inc. 8. EZCORP, Inc. 9. First Cash Financial Services, Inc. 10. Gold & Silver Pawn Shop 11. LoanMart 12. Maxferd Jewelry & Loan 13. National Pawnbrokers Association (NPA) 14. New Bond Street Pawnbrokers (UK) 15. Pawn America 16. Prestige Pawnbrokers 17. Quik Pawn Shop 18. SuperPawn 19. USA Pawn & Jewelry 20. Value Pawn & JewelryFrequently Asked Questions:

1] What segments are covered in the Global Pawn Shop Market report? Ans. The segments covered in the Pawn Shop Market report are based on Type, Service, Store Type, End User and Region. 2] Which region is expected to hold the highest share of the Global Pawn Shop Market? Ans. The Asia Pacific region is expected to hold the highest share of the Pawn Shop Market. 3] What is the market size of the Global Pawn Shop Market by 2032? Ans. The market size of the Pawn Shop Market by 2032 is expected to reach USD 46.37 Bn. 4] What is the forecast period for the Global Pawn Shop Market? Ans. The forecast period for the Pawn Shop Market is 2026-2032. 5] What was the Global Pawn Shop Market size in 2025? Ans: The Global Pawn Shop Market size was USD 36.20 Billion in 2025.

1. Pawn Shop Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Pawn Shop Market: Dynamics 2.1. Pawn Shop Market Trends by Region 2.1.1. North America Pawn Shop Market Trends 2.1.2. Europe Pawn Shop Market Trends 2.1.3. Asia Pacific Pawn Shop Market Trends 2.1.4. Middle East and Africa Pawn Shop Market Trends 2.1.5. South America Pawn Shop Market Trends 2.2. Pawn Shop Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Pawn Shop Market Drivers 2.2.1.2. North America Pawn Shop Market Restraints 2.2.1.3. North America Pawn Shop Market Opportunities 2.2.1.4. North America Pawn Shop Market Challenges 2.2.2. Europe 2.2.2.1. Europe Pawn Shop Market Drivers 2.2.2.2. Europe Pawn Shop Market Restraints 2.2.2.3. Europe Pawn Shop Market Opportunities 2.2.2.4. Europe Pawn Shop Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Pawn Shop Market Drivers 2.2.3.2. Asia Pacific Pawn Shop Market Restraints 2.2.3.3. Asia Pacific Pawn Shop Market Opportunities 2.2.3.4. Asia Pacific Pawn Shop Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Pawn Shop Market Drivers 2.2.4.2. Middle East and Africa Pawn Shop Market Restraints 2.2.4.3. Middle East and Africa Pawn Shop Market Opportunities 2.2.4.4. Middle East and Africa Pawn Shop Market Challenges 2.2.5. South America 2.2.5.1. South America Pawn Shop Market Drivers 2.2.5.2. South America Pawn Shop Market Restraints 2.2.5.3. South America Pawn Shop Market Opportunities 2.2.5.4. South America Pawn Shop Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Pawn Shop Industry 2.8. Analysis of Government Schemes and Initiatives For Pawn Shop Industry 2.9. Pawn Shop Market Trade Analysis 2.10. The Global Pandemic Impact on Pawn Shop Market 3. Pawn Shop Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2025-2032 3.1. Pawn Shop Market Size and Forecast, by Service (2025-2032) 3.1.1. Consumer Lending (Secured Loans with Personal Property Used as Collateral) 3.1.2. Used Goods Retailing 3.1.3. Appraising Items for Purchase or Pawn 3.2. Pawn Shop Market Size and Forecast, by End Users (2025-2032) 3.2.1. Generation X 3.2.2. Generation Y 3.2.3. Baby Boomers 3.3. Pawn Shop Market Size and Forecast, by Region (2025-2032) 3.3.1. North America 3.3.2. Europe 3.3.3. Asia Pacific 3.3.4. Middle East and Africa 3.3.5. South America 4. North America Pawn Shop Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 4.1. North America Pawn Shop Market Size and Forecast, by Service (2025-2032) 4.1.1. Consumer Lending (Secured Loans with Personal Property Used as Collateral) 4.1.2. Used Goods Retailing 4.1.3. Appraising Items for Purchase or Pawn 4.2. North America Pawn Shop Market Size and Forecast, by End Users (2025-2032) 4.2.1. Generation X 4.2.2. Generation Y 4.2.3. Baby Boomers 4.3. North America Pawn Shop Market Size and Forecast, by Country (2025-2032) 4.3.1. United States 4.3.1.1. United States Pawn Shop Market Size and Forecast, by Service (2025-2032) 4.3.1.1.1. Consumer Lending (Secured Loans with Personal Property Used as Collateral) 4.3.1.1.2. Used Goods Retailing 4.3.1.1.3. Appraising Items for Purchase or Pawn 4.3.1.2. United States Pawn Shop Market Size and Forecast, by End Users (2025-2032) 4.3.1.2.1. Generation X 4.3.1.2.2. Generation Y 4.3.1.2.3. Baby Boomers 4.3.2. Canada 4.3.2.1. Canada Pawn Shop Market Size and Forecast, by Service (2025-2032) 4.3.2.1.1. Consumer Lending (Secured Loans with Personal Property Used as Collateral) 4.3.2.1.2. Used Goods Retailing 4.3.2.1.3. Appraising Items for Purchase or Pawn 4.3.2.2. Canada Pawn Shop Market Size and Forecast, by End Users (2025-2032) 4.3.2.2.1. Generation X 4.3.2.2.2. Generation Y 4.3.2.2.3. Baby Boomers 4.3.3. Mexico 4.3.3.1. Mexico Pawn Shop Market Size and Forecast, by Service (2025-2032) 4.3.3.1.1. Consumer Lending (Secured Loans with Personal Property Used as Collateral) 4.3.3.1.2. Used Goods Retailing 4.3.3.1.3. Appraising Items for Purchase or Pawn 4.3.3.2. Mexico Pawn Shop Market Size and Forecast, by End Users (2025-2032) 4.3.3.2.1. Generation X 4.3.3.2.2. Generation Y 4.3.3.2.3. Baby Boomers 5. Europe Pawn Shop Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 5.1. Europe Pawn Shop Market Size and Forecast, by Service (2025-2032) 5.2. Europe Pawn Shop Market Size and Forecast, by End Users (2025-2032) 5.3. Europe Pawn Shop Market Size and Forecast, by Country (2025-2032) 5.3.1. United Kingdom 5.3.1.1. United Kingdom Pawn Shop Market Size and Forecast, by Service (2025-2032) 5.3.1.2. United Kingdom Pawn Shop Market Size and Forecast, by End Users (2025-2032) 5.3.2. France 5.3.2.1. France Pawn Shop Market Size and Forecast, by Service (2025-2032) 5.3.2.2. France Pawn Shop Market Size and Forecast, by End Users (2025-2032) 5.3.3. Germany 5.3.3.1. Germany Pawn Shop Market Size and Forecast, by Service (2025-2032) 5.3.3.2. Germany Pawn Shop Market Size and Forecast, by End Users (2025-2032) 5.3.4. Italy 5.3.4.1. Italy Pawn Shop Market Size and Forecast, by Service (2025-2032) 5.3.4.2. Italy Pawn Shop Market Size and Forecast, by End Users (2025-2032) 5.3.5. Spain 5.3.5.1. Spain Pawn Shop Market Size and Forecast, by Service (2025-2032) 5.3.5.2. Spain Pawn Shop Market Size and Forecast, by End Users (2025-2032) 5.3.6. Sweden 5.3.6.1. Sweden Pawn Shop Market Size and Forecast, by Service (2025-2032) 5.3.6.2. Sweden Pawn Shop Market Size and Forecast, by End Users (2025-2032) 5.3.7. Austria 5.3.7.1. Austria Pawn Shop Market Size and Forecast, by Service (2025-2032) 5.3.7.2. Austria Pawn Shop Market Size and Forecast, by End Users (2025-2032) 5.3.8. Rest of Europe 5.3.8.1. Rest of Europe Pawn Shop Market Size and Forecast, by Service (2025-2032) 5.3.8.2. Rest of Europe Pawn Shop Market Size and Forecast, by End Users (2025-2032) 6. Asia Pacific Pawn Shop Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 6.1. Asia Pacific Pawn Shop Market Size and Forecast, by Service (2025-2032) 6.2. Asia Pacific Pawn Shop Market Size and Forecast, by End Users (2025-2032) 6.3. Asia Pacific Pawn Shop Market Size and Forecast, by Country (2025-2032) 6.3.1. China 6.3.1.1. China Pawn Shop Market Size and Forecast, by Service (2025-2032) 6.3.1.2. China Pawn Shop Market Size and Forecast, by End Users (2025-2032) 6.3.2. S Korea 6.3.2.1. S Korea Pawn Shop Market Size and Forecast, by Service (2025-2032) 6.3.2.2. S Korea Pawn Shop Market Size and Forecast, by End Users (2025-2032) 6.3.3. Japan 6.3.3.1. Japan Pawn Shop Market Size and Forecast, by Service (2025-2032) 6.3.3.2. Japan Pawn Shop Market Size and Forecast, by End Users (2025-2032) 6.3.4. India 6.3.4.1. India Pawn Shop Market Size and Forecast, by Service (2025-2032) 6.3.4.2. India Pawn Shop Market Size and Forecast, by End Users (2025-2032) 6.3.5. Australia 6.3.5.1. Australia Pawn Shop Market Size and Forecast, by Service (2025-2032) 6.3.5.2. Australia Pawn Shop Market Size and Forecast, by End Users (2025-2032) 6.3.6. Indonesia 6.3.6.1. Indonesia Pawn Shop Market Size and Forecast, by Service (2025-2032) 6.3.6.2. Indonesia Pawn Shop Market Size and Forecast, by End Users (2025-2032) 6.3.7. Malaysia 6.3.7.1. Malaysia Pawn Shop Market Size and Forecast, by Service (2025-2032) 6.3.7.2. Malaysia Pawn Shop Market Size and Forecast, by End Users (2025-2032) 6.3.8. Vietnam 6.3.8.1. Vietnam Pawn Shop Market Size and Forecast, by Service (2025-2032) 6.3.8.2. Vietnam Pawn Shop Market Size and Forecast, by End Users (2025-2032) 6.3.9. Taiwan 6.3.9.1. Taiwan Pawn Shop Market Size and Forecast, by Service (2025-2032) 6.3.9.2. Taiwan Pawn Shop Market Size and Forecast, by End Users (2025-2032) 6.3.10. Rest of Asia Pacific 6.3.10.1. Rest of Asia Pacific Pawn Shop Market Size and Forecast, by Service (2025-2032) 6.3.10.2. Rest of Asia Pacific Pawn Shop Market Size and Forecast, by End Users (2025-2032) 7. Middle East and Africa Pawn Shop Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 7.1. Middle East and Africa Pawn Shop Market Size and Forecast, by Service (2025-2032) 7.2. Middle East and Africa Pawn Shop Market Size and Forecast, by End Users (2025-2032) 7.3. Middle East and Africa Pawn Shop Market Size and Forecast, by Country (2025-2032) 7.3.1. South Africa 7.3.1.1. South Africa Pawn Shop Market Size and Forecast, by Service (2025-2032) 7.3.1.2. South Africa Pawn Shop Market Size and Forecast, by End Users (2025-2032) 7.3.2. GCC 7.3.2.1. GCC Pawn Shop Market Size and Forecast, by Service (2025-2032) 7.3.2.2. GCC Pawn Shop Market Size and Forecast, by End Users (2025-2032) 7.3.3. Nigeria 7.3.3.1. Nigeria Pawn Shop Market Size and Forecast, by Service (2025-2032) 7.3.3.2. Nigeria Pawn Shop Market Size and Forecast, by End Users (2025-2032) 7.3.4. Rest of ME&A 7.3.4.1. Rest of ME&A Pawn Shop Market Size and Forecast, by Service (2025-2032) 7.3.4.2. Rest of ME&A Pawn Shop Market Size and Forecast, by End Users (2025-2032) 8. South America Pawn Shop Market Size and Forecast by Segmentation (by Value in USD Million) 2025-2032 8.1. South America Pawn Shop Market Size and Forecast, by Service (2025-2032) 8.2. South America Pawn Shop Market Size and Forecast, by End Users (2025-2032) 8.3. South America Pawn Shop Market Size and Forecast, by Country (2025-2032) 8.3.1. Brazil 8.3.1.1. Brazil Pawn Shop Market Size and Forecast, by Service (2025-2032) 8.3.1.2. Brazil Pawn Shop Market Size and Forecast, by End Users (2025-2032) 8.3.2. Argentina 8.3.2.1. Argentina Pawn Shop Market Size and Forecast, by Service (2025-2032) 8.3.2.2. Argentina Pawn Shop Market Size and Forecast, by End Users (2025-2032) 8.3.3. Rest Of South America 8.3.3.1. Rest Of South America Pawn Shop Market Size and Forecast, by Service (2025-2032) 8.3.3.2. Rest Of South America Pawn Shop Market Size and Forecast, by End Users (2025-2032) 9. Global Pawn Shop Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Pawn Shop Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. American Jewelry and Loan 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Borro 10.3. Browns Pawnbrokers (UK) 10.4. Cash America International, Inc. 10.5. Cash Canada 10.6. Central Mega Pawn 10.7. Empire Pawn of Nassau Inc. 10.8. EZCORP, Inc. 10.9. First Cash Financial Services, Inc. 10.10. Gold & Silver Pawn Shop 10.11. LoanMart 10.12. Maxferd Jewelry & Loan 10.13. National Pawnbrokers Association (NPA) 10.14. New Bond Street Pawnbrokers (UK) 10.15. Pawn America 10.16. Prestige Pawnbrokers 10.17. Quik Pawn Shop 10.18. SuperPawn 10.19. USA Pawn & Jewelry 10.20. Value Pawn & Jewelry 11. Key Findings 12. Industry Recommendations 13. Pawn Shop Market: Research Methodology 14. Terms and Glossary