Panela Market size was valued at USD 63.49 Billion in 2024 and the total Global Panela Market revenue is expected to grow at a CAGR of 5.8% from 2025 to 2032, reaching nearly USD 99.68 Billion.Panela Market Overview

Global panela market has been increasing consumer demand for natural and healthier sweeteners along with rising health consciousness and sustainability concerns. Panela is unrefined cane sugar known for minimal processing and nutrient rich composition is gaining traction favourable alternative to refined sugar and artificial sweeteners. Key drivers of this market include the growing preference for organic products advancements in sugarcane processing technology, and the shift toward clean-label ingredients. The market benefits from the global emphasis on sustainable agriculture and traditional farming methods which support rural economies and reduce environmental impact. Panela market is expanding, particularly through innovation in product formats such as granules and blocks, and through increasing exports via e-commerce platforms.To know about the Research Methodology :- Request Free Sample Report The granular panela segment dominated the market due to convenience, longer shelf life and ease of packaging. Asia Pacific especially India, China, and Thailand led the market owing to strong domestic production and cultural relevance, while the Asia Pacific region is emerging rapidly due to changing dietary habits and rising health awareness. Major players in the market include Sucafina, Just Panela, Coliman Group and Ecuadorian Rainforest LLC, are investing in product quality, certifications, and global distribution. Rising consumer interest in natural, authentic and ethically produced food products the panela market is expected to continue upward path in the coming years. Health Trends, Technological Advancements, and Sustainability to Drive the Panela Market The panela market is experiencing significant growth, driven by key factors such as technological advancements, the increasing demand for natural and healthier sweeteners, and a focus on sustainability. Technological advancements have revolutionized panela production, improving efficiency, quality, and distribution. Advanced techniques for sugarcane harvesting, juice extraction, and packaging have led to higher yields and extended shelf life. Rising consumer demand for natural and healthier sweeteners has fueled the growth of the panela market. Health-conscious individuals seeking alternatives to refined sugars and artificial sweeteners are turning to panela due to its minimal processing and higher nutrient content. Its natural and authentic appeal resonates with those who prioritize their well-being. Sustainability is another driving force in the panela market. Traditional panela production methods, passed down through generations, emphasize manual labor and sustainable farming practices. This approach supports rural economies and reduces the environmental impact associated with industrial sugar refining. Sugarcane cultivation for panela production also contributes to carbon sequestration. Clean-Label Innovation and Global Expansion to Boost the Panela Market Growth The panela market presents growth opportunities for manufacturers through clean-label products, innovation, and global expansion. Consumer demand for clean-label and natural sweeteners has driven the popularity of panela, a minimally processed cane sugar. Manufacturers can tap into this trend by offering clean-label panels derived from natural sources. The versatility of panela allows for Form innovation, enabling manufacturers to develop unique Flavours, textures, and nutritional profiles that cater to evolving consumer preferences. Emerging economies in Asia-Pacific and South America provide a promising market for panela, as there is a growing demand for natural and traditional sweeteners. Manufacturers can expand their presence in these regions by adapting their offerings to suit local needs and preferences. By capitalizing on clean-label attributes, fostering innovation, and pursuing global expansion, manufacturers can unlock the growth potential of the panela market and establish themselves as leaders in the industry. Technological Constraints and Consumer Perception Barriers to Impact Market Growth The panela market faces various restraints and challenges that require careful consideration and strategic actions to overcome. Technological limitations pose a hurdle, as certain processes in panela production may have efficiency or consistency issues. Continued research and development efforts are needed to enhance production techniques and address these limitations. Consumer perception and acceptance are crucial factors affecting the panela market. Some consumers may hold misconceptions or reservations about panela's authenticity, quality, or health benefits compared to other sweeteners. Building consumer trust through transparent communication, education about panela's natural and traditional attributes, and highlighting its nutritional advantages are vital for expanding consumer acceptance and increasing market penetration.

Panela Market Segment Analysis

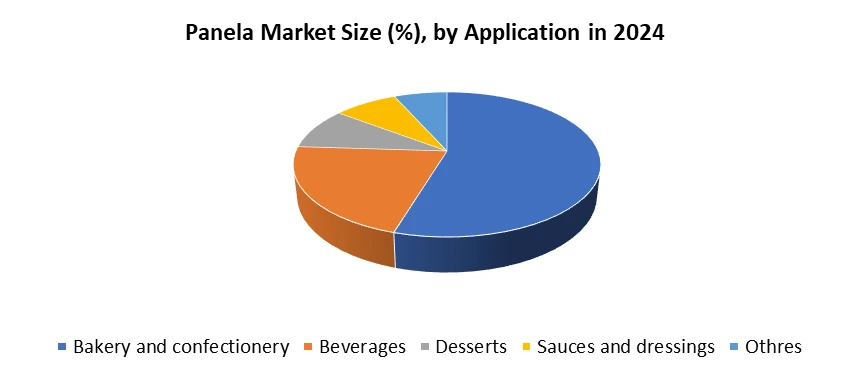

By Form: The form segment in the panela market focuses on the different forms in which panela is available, including solid blocks, granules, liquid syrups, and powdered forms. Solid blocks of panela are the most commonly used form, accounting for a significant market share due to their traditional and convenient usage. Granulated panela is also popular, offering ease of portioning and dissolving. Liquid syrups are gaining traction as a convenient option for sweetening beverages and sauces. Powdered panela provides versatility and ease of incorporation in various food and beverage applications. By Application: The application segment in the panela market highlights the diverse uses of panela across different food and beverage products. It includes applications such as bakery and confectionery, beverages, desserts, sauces and dressings, and others. In the bakery and confectionery sector, panela is utilized as a natural sweetener in bread, cakes, cookies, and chocolates. It is used to sweeten teas, coffees, smoothies, and other non-alcoholic drinks. Panela finds application in desserts like puddings, ice creams, and custards. It is also used in the preparation of sauces and dressings, providing a unique flavor profile. Additionally, panela finds application in various other food products where a natural and traditional sweetener is desired.

Panela Market Regional Insight

Panela market is witnessing significant growth, particularly in the Asia-Pacific region, where increasing health consciousness and a shift towards natural sweeteners are driving demand. Countries such as India, China, and Thailand are emerging as key players in the panela market, propelled by a growing preference for organic and traditional sweeteners over refined sugars. This region's rich agricultural landscape supports the cultivation of sugarcane, facilitating local production of panela and fostering a vibrant market. Additionally, the rising trend of incorporating natural ingredients in food and beverages aligns with the increasing awareness of the health benefits associated with panela, such as its low glycemic index and nutrient content. The food and beverage industry in Asia-Pacific is rapidly adopting panela as a natural sweetener, further boosting its popularity. Moreover, expanding retail channels and e-commerce platforms are enhancing accessibility, allowing consumers to easily obtain Panela products. As the market evolves, collaborations between local farmers and producers are promoting sustainable practices and supporting rural economies, ensuring a steady supply of high-quality panela. Overall, the Asia-Pacific region is set to dominate the panela market, leveraging its agricultural resources and shifting consumer preferences toward healthier, natural alternatives.Panela Market Competitive Landscape

Major key players such as Organic India, 24 Mantra Organic, and Sugarlife form backbone of the panela market. Organic India leverages strong brand reputation in organic wellness segment and promotes ethically sourced, non-GMO sugar with Ayurvedic backing. 24 Mantra Organic dominates across Indian retail and export markets by offering wide portfolio of organic products, including jaggery and sugar and maintains strong farm-to-shelf traceability system. Sugarlife differentiates itself through clean-label products and innovation in sugar alternatives, focusing on diabetic-friendly and chemical free formulations. These companies compete based on product purity, pricing, certification, distribution reach and sustainability practices. The market is growing participation from regional and private-label brands, intensifying price competition. Planned initiatives like contract farming, organic certifications, eco-friendly packaging and direct-to-consumer channels are presence adopted to increase market share. Consumer awareness and health awareness rising the market dynamics are expected to shift toward quality assurance and transparent sourcing.Panela Market Trends

Panela Market Key Developments • On 12 June 2025 Just Panela Inc. (USA) launched a new line of flavored organic panela cubes (ginger, lemon, cinnamon) targeting health-conscious consumers in North America. • On 20 February 2025, 24 Mantra Organic (India) expanded its product portfolio by introducing powdered panela to urban retail outlets and e-commerce platforms across India. • On 5 October 2024, PanelaMarket.eu (Germany) entered into a distribution partnership with organic stores across France and the Netherlands to strengthen its European presence. • On 2 April 2025, Dulzura Panela S.A.S (Colombia) partnered with local cooperatives to expand its sustainable panela production with Fair Trade certification. • On 7 July 2025, Naturz Organics (India) announced its entry into the U.S. market with USDA-certified panela through Amazon and health retail chains.

Trends Description Clean Label Products Consumers prefer foods with simple, recognizable ingredients. Panela fits clean-label trends due to its minimal processing. This boosts its appeal in health-conscious segments. Sustainable Farming Producers are adopting eco-friendly and organic sugarcane farming practices. This aligns with consumer demand for environmentally responsible products. Certification boosts trust and marketability. Product Innovation Brands are offering panela in new forms like powder, cubes, and flavored variants. These innovations improve usability and consumer interest. Convenience-focused formats are gaining traction. Panela Market Scope : Inquire Before Buying

Global Panela Market Report Coverage Details Base Year: 2024 Forecast Period: 2025-2032 Historical Data: 2019 to 2024 Market Size in 2024: USD 63.49 Bn. Forecast Period 2025 to 2032 CAGR: 5.8% Market Size in 2032: USD 99.68 Bn. Segments Covered: by Form Solid blocks Granules Liquid syrups Powdered forms by Application Bakery and confectionery Beverages Desserts Sauces and dressings Others by Distribution Channel Direct sales Indirect Sale Panela Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, and the Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, ASEAN, Indonesia, Philippines, Malaysia, Vietnam, Thailand, ASEAN, Rest of Asia Pacific) Middle East & Africa (South Africa, GCC, Nigeria, Rest of ME&A) South America (Brazil, Argentina, Rest of South America)Panela Market, Key Players

North America 1. Wholesome Sweeteners Inc. (USA) 2. NOW Foods (USA) 3. Global Goods Inc. (USA) 4. Goya Foods (USA) 5. La Fe Foods (USA) 6. Just Panela Inc. (USA) Europe 7. Naturgreen (Spain) 8. Biona Organic (UK) 9. Nutriops S.L. (Spain) 10. Rapunzel Naturkost (Germany) 11. Probios S.p.A. (Italy) 12. PanelaMarket.eu (Germany) Asia-Pacific 13. Organic India (India) 14. 24 Mantra Organic (India) 15. Sugarlife (Thailand) 16. Phalada Pure & Sure (India) 17. NutraJ (India) 18. Sri Sri Tattva (India) 19. Just Organik (India) 20. Organic Tattva (India) 21. Urban Platter (India) 22. Natureland Organics (India) 23. Naturz Organics (India) South America 24. Incauca S.A.S. (Colombia) 25. C.I. Pacheco y Cía S.A.S. (Colombia) 26. La Felsina S.A. (Ecuador) 27. Agroindustrias San Francisco (Delisse) (Peru) 28. Azúcar Orgánica de Los Andes (Bolivia) 29. Ingenio Providencia S.A. (Colombia) Frequently Asked Questions 1: What is the projected market size of the panela market by 2032? Ans: The panela market is expected to reach nearly USD 99.68 Billion by 2032. 2: What is driving the growth of the panela market? Ans: Increasing health awareness, demand for natural sweeteners, and sustainability trends. 3: What are the key applications of panela? Ans: Bakery, beverages, desserts, sauces, and dressings. 4: What challenges does the panela market face? Ans: Technological constraints and low consumer awareness in some regions. 5: How are companies promoting panela globally? Ans: Through innovation, organic certifications, e-commerce, and sustainable farming practices.

1. Panela Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Panela Market: Competitive Landscape 2.1. Ecosystem Analysis 2.2. MMR Competition Matrix 2.3. Competitive Landscape 2.4. Key Players Benchmarking 2.4.1. Company Name 2.4.2. Business Segment 2.4.3. Application Segment 2.4.4. Revenue (2024) 2.4.5. Company Locations 2.5. Market Structure 2.5.1. Market Leaders 2.5.2. Market Followers 2.5.3. Emerging Players 2.6. Mergers and Acquisitions Details 2.7. KANO Model Analysis 3. Global Safety Instrumented : Dynamics 3.1. Region wise Trends of Panela Market 3.1.1. North America Panela Market Trends 3.1.2. Europe Panela Market Trends 3.1.3. Asia Pacific Panela Market Trends 3.1.4. Middle East and Africa Panela Market Trends 3.1.5. South America Panela Market Trends 3.2. Panela Market Dynamics 3.2.1. Global Panela Market Drivers 3.2.1.1. Rising health and wellness trends 3.2.1.2. Technological advancements in panela production 3.2.1.3. Growing demand for natural sweeteners 3.2.2. Global Panela Market Restraints 3.2.3. Global Panela Market Opportunities 3.2.3.1. Product innovation and diversification 3.2.3.2. Expansion in organic food markets 3.2.4. Global Panela Market Challenges 3.3. PORTER’s Five Forces Analysis 3.4. PESTLE Using Tree-Map Analysis 3.5. Regulatory Landscape by Region 3.5.1. North America 3.5.2. Europe 3.5.3. Asia Pacific 3.5.4. Middle East and Africa 3.5.5. South America 4. Panela Market: Global Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 4.1. Panela Market Size and Forecast, By Form (2024-2032) 4.1.1. Solid blocks 4.1.2. Granules 4.1.3. Liquid syrups 4.1.4. Powdered forms 4.2. Panela Market Size and Forecast, By Application (2024-2032) 4.2.1. Bakery and confectionery 4.2.2. Beverages 4.2.3. Desserts 4.2.4. Sauces and dressings 4.2.5. Others 4.3. Panela Market Size and Forecast, By Distribution Channel (2024-2032) 4.3.1. Direct sales 4.3.2. Indirect Sale 4.4. Panela Market Size and Forecast, by Region (2024-2032) 4.4.1. North America 4.4.2. Europe 4.4.3. Asia Pacific 4.4.4. Middle East and Africa 4.4.5. South America 5. North America Panela Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 5.1. North America Panela Market Size and Forecast, By Form (2024-2032) 5.1.1. Solid blocks 5.1.2. Granules 5.1.3. Liquid syrups 5.1.4. Powdered forms 5.2. North America Panela Market Size and Forecast, By Application (2024-2032) 5.2.1. Bakery and confectionery 5.2.2. Beverages 5.2.3. Desserts 5.2.4. Sauces and dressings 5.2.5. Others 5.3. North America Panela Market Size and Forecast, By Distribution Channel (2024-2032) 5.3.1. Direct sales 5.3.2. Indirect Sale 5.4. North America Panela Market Size and Forecast, by Country (2024-2032) 5.4.1. United States 5.4.1.1. United States Panela Market Size and Forecast, By Form (2024-2032) 5.4.1.1.1. Solid blocks 5.4.1.1.2. Granules 5.4.1.1.3. Liquid syrups 5.4.1.1.4. Powdered forms 5.4.1.2. United States Panela Market Size and Forecast, By Application (2024-2032) 5.4.1.2.1. Bakery and confectionery 5.4.1.2.2. Beverages 5.4.1.2.3. Desserts 5.4.1.2.4. Sauces and dressings 5.4.1.2.5. Others 5.4.1.3. United States Panela Market Size and Forecast, By Distribution Channel (2024-2032) 5.4.1.3.1. Direct sales 5.4.1.3.2. Indirect Sale 5.4.2. Canada 5.4.2.1. Canada Panela Market Size and Forecast, By Form (2024-2032) 5.4.2.1.1. Solid blocks 5.4.2.1.2. Granules 5.4.2.1.3. Liquid syrups 5.4.2.1.4. Powdered forms 5.4.2.2. Canada Panela Market Size and Forecast, By Application (2024-2032) 5.4.2.2.1. Bakery and confectionery 5.4.2.2.2. Beverages 5.4.2.2.3. Desserts 5.4.2.2.4. Sauces and dressings 5.4.2.2.5. Others 5.4.2.3. Canada Panela Market Size and Forecast, By Distribution Channel (2024-2032) 5.4.2.3.1. Direct sales 5.4.2.3.2. Indirect Sale 5.4.2.4. Mexico Panela Market Size and Forecast, By Form (2024-2032) 5.4.2.4.1. Solid blocks 5.4.2.4.2. Granules 5.4.2.4.3. Liquid syrups 5.4.2.4.4. Powdered forms 5.4.2.5. Mexico Panela Market Size and Forecast, By Application (2024-2032) 5.4.2.5.1. Bakery and confectionery 5.4.2.5.2. Beverages 5.4.2.5.3. Desserts 5.4.2.5.4. Sauces and dressings 5.4.2.5.5. Others 5.4.2.6. Mexico Panela Market Size and Forecast, By Distribution Channel (2024-2032) 5.4.2.6.1. Direct sales 5.4.2.6.2. Indirect Sale 6. Europe Panela Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 6.1. Europe Panela Market Size and Forecast, By Form (2024-2032) 6.2. Europe Panela Market Size and Forecast, By Application (2024-2032) 6.3. Europe Panela Market Size and Forecast, By Distribution Channel (2024-2032) 6.4. Europe Panela Market Size and Forecast, by Country (2024-2032) 6.4.1. United Kingdom 6.4.1.1. United Kingdom Panela Market Size and Forecast, By Form (2024-2032) 6.4.1.2. United Kingdom Panela Market Size and Forecast, By Application (2024-2032) 6.4.1.3. United Kingdom Panela Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.2. France 6.4.2.1. France Panela Market Size and Forecast, By Form (2024-2032) 6.4.2.2. France Panela Market Size and Forecast, By Application (2024-2032) 6.4.2.3. France Panela Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.3. Germany 6.4.3.1. Germany Panela Market Size and Forecast, By Form (2024-2032) 6.4.3.2. Germany Panela Market Size and Forecast, By Application (2024-2032) 6.4.3.3. Germany Panela Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.4. Italy 6.4.4.1. Italy Panela Market Size and Forecast, By Form (2024-2032) 6.4.4.2. Italy Panela Market Size and Forecast, By Application (2024-2032) 6.4.4.3. Italy Panela Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.5. Spain 6.4.5.1. Spain Panela Market Size and Forecast, By Form (2024-2032) 6.4.5.2. Spain Panela Market Size and Forecast, By Application (2024-2032) 6.4.5.3. Spain Panela Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.6. Sweden 6.4.6.1. Sweden Panela Market Size and Forecast, By Form (2024-2032) 6.4.6.2. Sweden Panela Market Size and Forecast, By Application (2024-2032) 6.4.6.3. Sweden Panela Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.7. Austria 6.4.7.1. Austria Panela Market Size and Forecast, By Form (2024-2032) 6.4.7.2. Austria Panela Market Size and Forecast, By Application (2024-2032) 6.4.7.3. Austria Panela Market Size and Forecast, By Distribution Channel (2024-2032) 6.4.8. Rest of Europe 6.4.8.1. Rest of Europe Panela Market Size and Forecast, By Form (2024-2032) 6.4.8.2. Rest of Europe Panela Market Size and Forecast, By Application (2024-2032) 6.4.8.3. Rest of Europe Panela Market Size and Forecast, By Distribution Channel (2024-2032) 7. Asia Pacific Panela Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 7.1. Asia Pacific Panela Market Size and Forecast, By Form (2024-2032) 7.2. Asia Pacific Panela Market Size and Forecast, By Application (2024-2032) 7.3. Asia Pacific Panela Market Size and Forecast, By Distribution Channel (2024-2032) 7.4. Asia Pacific Panela Market Size and Forecast, by Country (2024-2032) 7.4.1. China 7.4.1.1. China Panela Market Size and Forecast, By Form (2024-2032) 7.4.1.2. China Panela Market Size and Forecast, By Application (2024-2032) 7.4.1.3. China Panela Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.2. S Korea 7.4.2.1. S Korea Panela Market Size and Forecast, By Form (2024-2032) 7.4.2.2. S Korea Panela Market Size and Forecast, By Application (2024-2032) 7.4.2.3. S Korea Panela Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.3. Japan 7.4.3.1. Japan Panela Market Size and Forecast, By Form (2024-2032) 7.4.3.2. Japan Panela Market Size and Forecast, By Application (2024-2032) 7.4.3.3. Japan Panela Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.4. India 7.4.4.1. India Panela Market Size and Forecast, By Form (2024-2032) 7.4.4.2. India Panela Market Size and Forecast, By Application (2024-2032) 7.4.4.3. India Panela Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.5. Australia 7.4.5.1. Australia Panela Market Size and Forecast, By Form (2024-2032) 7.4.5.2. Australia Panela Market Size and Forecast, By Application (2024-2032) 7.4.5.3. Australia Panela Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.6. Indonesia 7.4.6.1. Indonesia Panela Market Size and Forecast, By Form (2024-2032) 7.4.6.2. Indonesia Panela Market Size and Forecast, By Application (2024-2032) 7.4.6.3. Indonesia Panela Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.7. Philippines 7.4.7.1. Philippines Panela Market Size and Forecast, By Form (2024-2032) 7.4.7.2. Philippines Panela Market Size and Forecast, By Application (2024-2032) 7.4.7.3. Philippines Panela Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.8. Malaysia 7.4.8.1. Malaysia Panela Market Size and Forecast, By Form (2024-2032) 7.4.8.2. Malaysia Panela Market Size and Forecast, By Application (2024-2032) 7.4.8.3. Malaysia Panela Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.9. Vietnam 7.4.9.1. Vietnam Panela Market Size and Forecast, By Form (2024-2032) 7.4.9.2. Vietnam Panela Market Size and Forecast, By Application (2024-2032) 7.4.9.3. Vietnam Panela Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.10. Thailand 7.4.10.1. Thailand Panela Market Size and Forecast, By Form (2024-2032) 7.4.10.2. Thailand Panela Market Size and Forecast, By Application (2024-2032) 7.4.10.3. Thailand Panela Market Size and Forecast, By Distribution Channel (2024-2032) 7.4.11. Rest of Asia Pacific 7.4.11.1. Rest of Asia Pacific Panela Market Size and Forecast, By Form (2024-2032) 7.4.11.2. Rest of Asia Pacific Panela Market Size and Forecast, By Application (2024-2032) 7.4.11.3. Rest of Asia Pacific Panela Market Size and Forecast, By Distribution Channel (2024-2032) 8. Middle East and Africa Panela Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 8.1. Middle East and Africa Panela Market Size and Forecast, By Form (2024-2032) 8.2. Middle East and Africa Panela Market Size and Forecast, By Application (2024-2032) 8.3. Middle East and Africa Panela Market Size and Forecast, By Distribution Channel (2024-2032) 8.4. Middle East and Africa Panela Market Size and Forecast, by Country (2024-2032) 8.4.1. South Africa 8.4.1.1. South Africa Panela Market Size and Forecast, By Form (2024-2032) 8.4.1.2. South Africa Panela Market Size and Forecast, By Application (2024-2032) 8.4.1.3. South Africa Panela Market Size and Forecast, By Distribution Channel (2024-2032) 8.4.2. GCC 8.4.2.1. GCC Panela Market Size and Forecast, By Form (2024-2032) 8.4.2.2. GCC Panela Market Size and Forecast, By Application (2024-2032) 8.4.2.3. GCC Panela Market Size and Forecast, By Distribution Channel (2024-2032) 8.4.3. Nigeria 8.4.3.1. Nigeria Panela Market Size and Forecast, By Form (2024-2032) 8.4.3.2. Nigeria Panela Market Size and Forecast, By Application (2024-2032) 8.4.3.3. Nigeria Panela Market Size and Forecast, By Distribution Channel (2024-2032) 8.4.4. Rest of ME&A 8.4.4.1. Rest of ME&A Panela Market Size and Forecast, By Form (2024-2032) 8.4.4.2. Rest of ME&A Panela Market Size and Forecast, By Application (2024-2032) 8.4.4.3. Rest of ME&A Panela Market Size and Forecast, By Distribution Channel (2024-2032) 9. South America Panela Market Size and Forecast by Segmentation (by Value in USD Billion) (2024-2032) 9.1. South America Panela Market Size and Forecast, By Form (2024-2032) 9.2. South America Panela Market Size and Forecast, By Application (2024-2032) 9.3. South America Panela Market Size and Forecast, By Distribution Channel (2024-2032) 9.4. South America Panela Market Size and Forecast, by Country (2024-2032) 9.4.1. Brazil 9.4.1.1. Brazil Panela Market Size and Forecast, By Form (2024-2032) 9.4.1.2. Brazil Panela Market Size and Forecast, By Application (2024-2032) 9.4.1.3. Brazil Panela Market Size and Forecast, By Distribution Channel (2024-2032) 9.4.2. Argentina 9.4.2.1. Argentina Panela Market Size and Forecast, By Form (2024-2032) 9.4.2.2. Argentina Panela Market Size and Forecast, By Application (2024-2032) 9.4.2.3. Argentina Panela Market Size and Forecast, By Distribution Channel (2024-2032) 9.4.3. Rest of South America 9.4.3.1. Rest of South America Panela Market Size and Forecast, By Form (2024-2032) 9.4.3.2. Rest of South America Panela Market Size and Forecast, By Application (2024-2032) 9.4.3.3. Rest of South America Panela Market Size and Forecast, By Distribution Channel (2024-2032) 10. Company Profile: Key Players (Detailed Profile for all Major Form Players) 10.1. Wholesome Sweeteners Inc. (USA) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Recent Development 10.2. NOW Foods (USA) 10.3. Global Goods Inc. (USA) 10.4. Just Panela Inc. (USA) 10.5. Goya Foods (USA) 10.6. La Fe Foods (USA) 10.7. Naturgreen (Spain) 10.8. Biona Organic (UK) 10.9. Nutriops S.L. (Spain) 10.10. PanelaMarket.eu (Germany) 10.11. Rapunzel Naturkost (Germany) 10.12. Probios S.p.A. (Italy) 10.13. Organic India (India) 10.14. 24 Mantra Organic (India) 10.15. Sugarlife (Thailand) 10.16. Phalada Pure & Sure (India) 10.17. NutraJ (India) 10.18. Sri Sri Tattva (India) 10.19. Just Organik (India) 10.20. Organic Tattva (India) 10.21. Urba Platter (India) 10.22. Natureland Organics (India) 10.23. Naturz Organics (India) 10.24. Incauca S.A.S. (Colombia) 10.25. C.I. Pacheco y Cía S.A.S. (Colombia) 10.26. La Felsina S.A. (Ecuador) 10.27. Agroindustrias San Francisco (Delisse) (Peru) 10.28. Azúcar Orgánica de Los Andes (Bolivia) 10.29. Ingenio Providencia S.A. (Colombia) 11. Key Findings 12. Analyst Recommendations 13. Panela Market: Research Methodology