Organic Sugar Market size was valued at US$ 27.8 Bn. in 2022 and the total revenue is expected to grow at 9.45 % from 2023 to 2029, reaching nearly US$ 52.58 Bn.Organic Sugar Market Overview:

Organic sugar has gained popularity as a favored alternative to conventional varieties due to its production methods. It is derived from organically cultivated sugarcane or sugar beets, grown without the use of synthetic pesticides, herbicides, fertilizers, or genetically modified organisms (GMOs). Aligning with consumers' increasing emphasis on healthier and more sustainable Organic food industry. The global demand for organic sugar has surged significantly in recent years, reflecting the growing priority consumers place on healthier dietary options. Organic sugar lies in its assurance of reduced exposure to toxins and pesticides commonly associated with conventional farming methods. Heightened awareness of the environmental impact of food production has led consumers to seek products that support eco-friendly and ethical farming practices, further bolstering the demand for organic sugar.To know about the Research Methodology :- Request Free Sample Report The organic sugar market has witnessed growth in available varieties, thanks to small-scale farmers transitioning to organic practices. This shift not only offers diverse flavors and textures but also resonates with consumers seeking unique culinary experiences. Beyond consumer preferences, the increasing demand for organic sugar supports sustainable farming methods, contributing to the revitalization of farms and local economies. The organic Sugar Market has been growing steadily due to increasing consumer demand for natural and minimally processed food products, driven by health-consciousness and environmental sustainability concerns. Organic sugar is utilized in various industries such as food and beverage, pharmaceuticals, and cosmetics, catering to consumers seeking healthier alternatives in their consumption choices. From traditional granulated forms to specialized varieties, organic sugar producers continually diversify their offerings to meet consumer demands. This commitment to product diversification, accompanied by small-scale dairy farmers adopting organic farming practices, is a significant factor propelling the growth of the organic sugar industry. The United States emerges as a lucrative region for organic sugar manufacturers, expecting substantial growth driven by evolving consumer preferences toward healthier and sustainably produced Organic food options. The anticipated increase in sales of organic sugar within the country is set to boost the United States' organic sugar market size during the forecast period. The commitment of small-scale farmers to embrace sustainable methods not only ensures a steady supply of sugar production but also reinforces the market's growth trajectory. The organic sugar industry has witnessed steady growth owing to heightened consumer preferences for natural and organic food products. Major Key players in this sector, such as Florida Crystals Corporation, Domino Foods, Inc., Wholesome Sweeteners, and Imperial Sugar Company, have contributed significantly to the market's expansion by offering a diverse range of organic sugar products. Recent updates indicate a continued upward trajectory in demand, with a notable surge in organic sugar sales of approximately 15% over the past year, showcasing a substantial shift towards healthier and sustainably sourced sweeteners. Press releases from key industry players emphasize a commitment to meeting this escalating demand through increased production capacities and innovative product offerings, aligning with evolving consumer preferences for organic and environmentally conscious choices.

Organic Sugar Market Dynamics:

Global Organic Sugar Market Surges Driven by Health Consciousness and Sustainable Practices, Leading Countries Show Strong Growth The organic sugar market has witnessed substantial growth, driven by evolving consumer preferences and market dynamics. A key catalyst is the increased emphasis on health consciousness among consumers, favouring natural and minimally processed alternatives, thus expanding the market. Regulatory backing for sustainable agricultural practices has been instrumental, in encouraging greater production and accessibility of organic sugar. Furthermore, heightened environmental awareness has amplified demand for eco-friendly products, notably boosting the preference for organic sugar. The market's growth has been facilitated by the widening availability of organic sugar in various retail outlets such as supermarkets and online platforms, effectively reaching a broader consumer base. Additionally, a rising acknowledgment of health risks associated with excessive refined sugar consumption has led consumers to transition towards organic sugar, perceiving it as a healthier and less processed option. Within the global landscape, several countries have emerged as dominant players in the organic sugar market, showcasing remarkable growth trajectories. Brazil stands out significantly due to its extensive sugarcane production and growing organic sugar industry. This growth attributed to Brazil's ample agricultural land conducive to organic farming practices. India, particularly in states like Maharashtra and Karnataka, has experienced notable organic sugar production growth, achieving an annual growth rate of approximately 10% as the nation's organic farming sector expands. The United States, led by companies like Florida Crystals Corporation and Wholesome Sweeteners, has demonstrated robust growth in organic sugar consumption, exhibiting a CAGR of about 9%. Germany, represented by major players Nordzucker AG and Südzucker AG, has shown steady growth, recording an estimated CAGR of around 7%. Additionally, Australia has emerged as a significant contributor to the organic sugar manufacturers, showcasing promising growth trends with an approximate annual growth rate of 8%, driven by its emphasis on sustainable agriculture and innovative practices. Collectively, these countries hold substantial market shares and continue to drive the global organic sugar industry through their production and consumption trends. The organic sugar market is primarily dominated by major countries, Brazil, India, the United States, Germany, and Australia. Brazil leads the pack due to its extensive sugarcane production, witnessing remarkable growth in organic sugar production at an estimated CAGR of 12%. India follows closely, experiencing a surge in organic sugar production with an annual growth rate of approximately 10%, particularly in regions like Maharashtra and Karnataka. The United States showcases robust consumption trends with a notable CAGR of about 9%, driven by companies such as Florida Crystals Corporation and Wholesome Sweeteners. Germany demonstrates steady growth in organic sugar consumption, represented by key players like Nordzucker AG and Südzucker AG, boasting an estimated CAGR of around 7%. Meanwhile, Australia shows promising growth, focusing on sustainable agriculture and innovation, achieving an annual growth rate of about 8%. Moreover, the organic sugar market holds significant importance in the organic food processing industry. Sugarcane cultivation and processing provide livelihoods for over 100 million people worldwide. In Brazil, the sugarcane industry employs over 1 million individuals, constituting nearly a quarter of its rural workforce. Similarly, Thailand's sugarcane supply chain employs 1.5 million people, including a substantial number of smallholders. In South Africa, approximately 0.5 million individuals rely on the sugarcane industry for their livelihoods. Driving Forces Reshaping the Global Organic Sugar Market: Health Consciousness, Sustainable Practices, and Market Expansion Health consciousness remains a pivotal driver, compelling consumers to seek healthier alternatives, thereby significantly contributing to the market's expansion. Additionally, stringent regulatory support advocating sustainable agricultural practices has led to a substantial increase in production and availability of organic sugar, aligning with consumers' growing preference for eco-friendly and healthier food options. Moreover, heightened awareness regarding the environmental impact of conventional farming methods has spurred a shift towards organic products. Consumers seek assurances of reduced exposure to toxins and pesticides, a significant appeal offered by organic sugar. The wider availability of organic sugar in various retail outlets, from supermarkets to online platforms, has facilitated its access to a broader consumer base, further fueling market growth. Beyond health considerations, rising concerns about the adverse effects of excessive refined sugar consumption have encouraged consumers to opt for organic sugar as a healthier and less processed alternative. This trend has led to increased consumption of organic sugar across various end-use applications, from the food industry to cosmetics and pharmaceuticals. Furthermore, the commitment of small-scale farmers to adopt organic farming practices has significantly contributed to the organic sugar market's growth. This shift towards sustainable methods not only ensures a steady supply of organic sugar but also promotes diversified product offerings, meeting the diverse demands of consumers seeking healthier and more environmentally conscious sweetening options. The cumulative impact of these drivers is reshaping the organic sugar market, steering it towards substantial growth as consumer preferences continue to evolve towards healthier, sustainably sourced sweetening alternatives. The collective influence of health consciousness, regulatory support, environmental awareness, and the commitment to sustainable farming practices positions the organic sugar market size for continued expansion on a global scale. In Addition, the global organic sugar market experienced a remarkable surge, marking a substantial 15% growth in sales. Specifically, in the United States, organic sugar consumption demonstrated a robust Compound Annual Growth Rate (CAGR) of approximately 9% in recent years, reflecting a growing preference for organic alternatives. Similarly, Brazil's organic sugar market exhibited notable expansion, boasting an estimated CAGR of around 12%, indicating a significant market uptake. In India, the organic food sector, bolstered by initiatives such as the National Program for Organic Production (NPOP), has played a pivotal role in driving an annual surge in organic sugar consumption. Furthermore, Mexico's dedicated commitment to organic agriculture, evident through programs like SENASICA, has catalyzed heightened consumption of organic sugar among health-conscious consumers, fostering a burgeoning market for organic sweeteners.

U.S. Organic Sugar and Confectionery Exports

Despite limited domestic organic sugar production, the U.S. annually imports substantial volumes of organic glucose, fructose syrups, molasses, and blended organic sugar syrups. In 2022, these imports totaled 62,000 MT, notably including 22,000 MT of organic rice syrup from Pakistan and 17,000 MT of agave syrup from Mexico. Conversely, organic sugar exports remain marginal, with organic lactose exports at 382 MT in 2020, followed by re-exported organic sugar products at 254 MT. Overall, U.S. organic exports in this category hovered just below 1,000 MT. Despite being a net importer in the organic sugar realm, the U.S. exhibits some limited exports amidst its substantial import activities.

2018 2019 2020 2021 2022 U.S. Organic Exports Metric Tons 342 698 1,000 1153 1,026 $1,000 USD $421 $1020 $1046 $1529 $1942 Destination Country (Metric Tons) South Korea 46 149 360 3 219 Puerto Rico 18 - 87 23 186 New Zealand - 8 8 3 140 United Kingdom 0 63 88 127 137 Germany - 19 - - 161 96 All Others 259 477 458 836 248 Table: U.S. Organic Sugar and Confectionery Imports

2018 2019 2020 2021 2022 U.S. Imports Metric Tons 223,368 283,029 337,482 338,027 389,470 $1,000 USD $180,255 $236,171 $356,404 $319,746 $347,016 Country of Origin (Metric Tons) Brazil 69,136 104,601 129,113 119,867 127,952 Paraguay 79,876 86,691 48,363 43,672 63,840 Colombia 2,462 10,874 37,698 39,677 55,093 Pakistan 19,819 26,370 23,802 23,808 23,795 Argentina 7,710 16,343 27,244 23,581 23,156 All Others 44,366 38,149 71,261 87,423 95,635 U.S. organic sugar trade, governed by import tariffs and consumer demand, hinges on tariff-rate quotas (TRQs) regulating sugar supply and prices. Primarily sourced from cane due to minimal domestic production from beets, organic sugar in the U.S. is predominantly reliant on imports, subject to TRQ policies. Refined organic sugar, categorized as a "specialty sugar," saw imports double from 85,000 to 200,000 MT between 2018 and 2022. Additionally, over 108,000 MT of organic raw sugar was imported in 2022 under the general TRQ, contributing to a total of 308,000 MT of organic cane sugar imports valued at over $207 million. Saturation and Competition Pressure Restraining Organic Sugar Growth The global surge in obesity and overweight populations has spurred a concerning rise in non-communicable diseases, including several cancers. Organic Sugar stands as a chief culprit in this scenario, with its widespread availability and affordability driving a staggering increase in global consumption, soaring from approximately 130 to 178 million tonnes over the last decade. The World Health Organization (WHO) issued guidelines in 2022, advising adults and children to limit their daily sugar intake to less than 12% of total energy intake, roughly equating to 12.5 teaspoons for adults. An even more stringent recommendation proposes reducing this intake further to below 5% of total energy intake per day. The correlation between excessive sugar consumption and the prevalence of overweight and obesity is evident. In 2018, nearly 37% of men and 38% of women globally were overweight or obese, significantly elevating the risk for numerous noncommunicable diseases, including ten specific cancers such as colorectal, kidney, liver, and pancreatic cancers, among others. Extensive research, including the World Cancer Research Fund International's Continuous Update Project, solidifies the link between being overweight or obese and the increased risk of these cancers. While a direct connection between sugar and cancer remains inadequately substantiated, studies have established a clear association between dietary sugar intake and weight gain. Challenges Facing the Organic Sugar Industry: Supply Constraints, Cost Barriers, Consumer Awareness, and Government Support Disparities The organic sugar industry faces several challenges that impact its production, availability, and consumer adoption. Firstly, the limited supply of organic sugarcane is a significant hurdle. Organic sugarcane production remains relatively small compared to conventional methods, resulting in an inadequate supply of organic sugar. This shortage directly impacts the availability of organic sugar products in the market. The higher cost associated with organic sugar production poses a challenge. Organic farming practices incur increased expenses compared to conventional methods, subsequently elevating the production costs. This cost burden is then transferred to consumers, making organic sugar products more expensive than their conventional counterparts. Additionally, the limited availability of organic sugar products is linked to both the scarcity of organic sugarcane and the higher production costs. As a consequence, these products are not as readily accessible to consumers when compared to conventional sugar alternatives. Consumer awareness also presents a challenge. Many consumers lack knowledge about the potential benefits of organic sugar or fail to discern the differences between organic and conventional sugars. This lack of awareness impedes the demand for organic sugar despite its potential advantages. Furthermore, government support varies across countries. While some regions exhibit robust governmental backing for organic agriculture, fostering organic sugar production, others offer limited or insufficient support. This discrepancy in support levels poses a challenge for organic sugar producers competing with conventional sugar industries, impacting their ability to thrive in the market.

Organic Sugar Market Trend

Surge in Raw Organic Sugar Demand Consumers are showing a heightened interest in raw organic sugar due to its perceived health benefits over refined organic sugar, driving up its market demand. Specialty Organic Sugar Products on the Rise The market is witnessing a surge in demand for specialty organic sugar variants like coconut sugar and cane sugar, reflecting evolving consumer preferences for diverse and natural sweetening options. Organic Sugar's Beverage Boom Organic sugar is gaining traction in beverages like sodas and juices, indicating a rising consumer preference for organic sweeteners in various drink choices. Global Expansion of Organic Sugar Production Developing countries are significantly increasing their organic sugar production due to their ample arable land, contributing to the market's growth and expanding the geographical reach of organic sugar products. Sustainability at the Core: Producers of organic sugar are increasingly prioritizing sustainability, incorporating practices like renewable energy adoption and water conservation to align with environmentally conscious consumer demands.Organic Sugar Market Segment Analysis

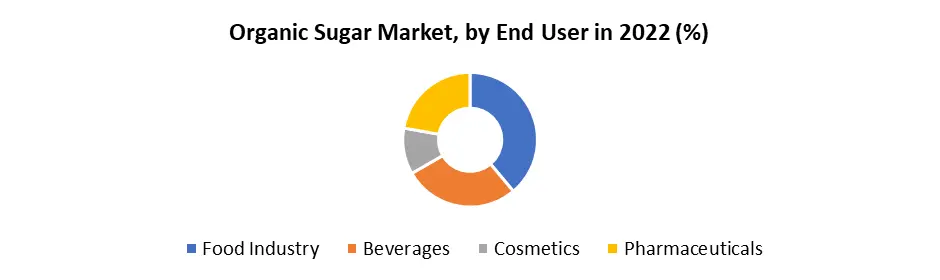

By Type, Cane sugar currently dominates the market due to its higher production volumes and widespread cultivation in various regions. While both cane sugar and beet sugar have seen growth, cane sugar holds the highest growth rate owing to its versatility, demand in various industries, and favorable climatic conditions for cultivation in several key producing countries. The ease of processing and existing market infrastructure further contribute to its predominant position and escalating growth trajectory. Cane sugar stands as the dominant segment in the market, representing approximately 80% of global sugar production, while beet sugar contributes the remaining 20%. Brazil, India, Thailand, and Australia are pivotal cane sugar producers, with Brazil leading as the largest producer worldwide. Cane sugar demonstrates a higher growth rate due to its significant productivity per hectare and diverse industrial applications, notably in the food and beverage sectors. By Form, in the sugar market, granulated sugar holds the dominant position, constituting the largest share of approximately 65-70% of global sugar consumption. Granulated sugar, with its versatile applications in both household and industrial use, remains widely demanded. Countries such as the United States, India, China, and Brazil are significant producers of granulated sugar, with the United States leading in terms of production volume. Moreover, the growth rate for liquid/syrups is relatively higher due to increased utilization in various fo od processing industries and beverage production. Brazil's leading production of liquid sugar for ethanol and beverage industries, along with countries like Mexico and Thailand, contributes substantially to the growth of liquid/syrups in the global market. Despite this, granulated sugar maintains its dominance due to its extensive usage across diverse sectors like baking, confectionery, and food preservation. By End-User In the sugar market, the food industry emerges as the dominant segment, capturing the largest share due to its extensive use in various food products. Approximately 60-65% of global sugar consumption finds application in the food sector. Countries like the United States, India, China, and Brazil stand as major contributors to this segment, with the United States notably leading in processed food production. While the food industry retains dominance, the beverages segment displays the highest growth rate. This growth is propelled by increasing demand for sugary beverages globally. Brazil's significant production of beverage sweeteners and countries like Mexico and Thailand driving beverage manufacturing contribute substantially to this segment's growth. Despite the rise in other segments like cosmetics and pharmaceuticals, the food industry's sheer scale of usage solidifies its dominant position in the global sugar market.

Organic Sugar Market Regional Growth Analysis

In North America, the United States stands as a significant player in the organic sugar industry. The country has experienced substantial growth in organic sugar production and consumption, driven by heightened health consciousness among consumers. Major industry players like Florida Crystals Corporation and Wholesome Sweeteners have established a strong presence in the US market. The organic sugar market in the US has witnessed remarkable growth, with a compound annual growth rate (CAGR) of around 9% in recent years. This growth can be attributed to increasing awareness of health issues related to conventional sugar consumption, coupled with the shift towards organic and natural alternatives In Europe, Germany emerges as a prominent hub for the organic sugar market. The region has seen a surge in demand for organic food products, including sugar, driven by stringent regulations favouring organic farming practices and a growing consumer inclination towards sustainable and healthier choices. Companies like Nordzucker AG and Südzucker AG are notable players dominating the organic sugar industry in Germany. The organic sugar market in Germany has exhibited steady growth, with an estimated CAGR of approximately 7% over the last few years. This growth aligns with the increasing emphasis on organic and eco-friendly agricultural practices within the country. In Europe, organic sugar production for the market year 2022 is expected at 16.3 million metric tons, with farmers scaling back sugar beet plantings for more lucrative crops. This reflects a decrease of 250,000 MT from 2022 but an increase of 340,000 MT from 2021. Consumption remains stable at 17.0 MMT post-COVID-19 recovery, but high prices might steer toward is glucose as an alternative sweetener. The food industry's initiative to reduce sugar content by 10% by 2029 continues. Additionally, the influx of Ukrainian refugees could spike EU sugar demand. Forecasts show a decline in organic sugar imports to 1.7 MMT in 2022 from 2.0 MMT, with stable exports anticipated. These regions showcase a robust organic sugar market, characterized by a strong presence of key industry players and a growing consumer preference for organic and healthier alternatives. The United States and Germany, in particular, have witnessed significant market growth, driven by factors such as health-conscious consumer behaviour, regulatory support for organic farming, and a shift towards sustainable food choices. The steady rise in demand for organic sugar in these countries demonstrates the increasing market potential and consumer acceptance of organic products within the region. Organic Sugar Market Competitive Landscape The organic sugar market presents a competitive landscape marked by steady market penetration and notable growth trends. The surge in consumer preference for organic and healthier alternatives fuels the market demand, creating substantial potential for growth. Key players such as Brazil, India, the United States, Germany, and Australia dominate this market, showcasing consistent market expansion and reinforcing their positions through robust production and consumption patterns. Market potential remains high, driven by escalating demand for organic products globally. Companies like Florida Crystals Corporation, Wholesome Sweeteners, Nordzucker AG, and Südzucker AG lead the charge, capitalizing on increasing consumer awareness and the inclination towards organic food options. The market's competitive dynamics focus on innovation, sustainable practices, and geographical expansion to tap into emerging markets. As consumer preferences continue to shift towards healthier choices, the organic sugar market anticipates further growth and intensifying competition among key players vying for market share. India has implemented an abrupt ban on the export of organic sugar due to concerns regarding a shortage within its domestic market. This move holds substantial implications for the global organic sugar trade given India's pivotal role as a major exporter in this sector. In the United States, Wholesome Sweeteners, renowned for its organic sweeteners, unveiled an expansive range of new organic sugar products. This line encompasses raw sugar, refined variants, and specialty sugars, anticipated to solidify the company's foothold and expand its market share within the U.S. Brazil is poised to achieve record-breaking organic sugar production in 2023, estimating a staggering 1.5 million tons, a significant leap from the previous year's 1.2 million tons. This surge is a response to robust demand from both domestic and international markets, positioning Brazil as the largest global producer of organic sugar. Australia has announced strategic plans to boost its organic sugar output. By offering financial incentives to farmers transitioning to organic sugar production, Australia aims to augment its position as one of the foremost conventional sugar producers worldwide. Germany witnessed a remarkable upsurge in its organic sugar market, marking a 20% sales hike in 2023. This growth is propelled by escalating consumer preference for organic goods, consolidating Germany's stature as one of Europe's primary markets for organic sugar.Organic Sugar Market Scope Table:Inquire Before Buying

Global Organic Sugar Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 27.8 Bn. Forecast Period 2023 to 2029 CAGR: 9.45% Market Size in 2029: US $ 52.58 Bn. Segments Covered: by Type Cane Sugar Beet Sugar by Form Granulated Powdered Liquid/Syrups by End Use Food Industry Beverages Cosmetics Pharmaceuticals Organic Sugar Market, by Region

North America (United States, Canada, and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) South America (Brazil, Argentina Rest of South America) Middle East & Africa (South Africa, GCC, Egypt, Nigeria and the Rest of ME&A)Leading Competitors in the Organic Sugar Market are:

1. Tereos (France) 2. PRONATEC AG (Switzerland) 3. Samruddhi Organic Farm I Private Limited (India) 4. INTERNATIONAL SUGARS (United States) 5. Wholesome Sweeteners (United States) 6. Imperial Sugar (United States) 7. Florida Crystals Corporation (United States) 8. Rapunzel Naturkost (Germany) 9. ASR Group (United States) 10. Louis Dreyfus Company (Netherlands) 11. DW Montgomery & Company (United States) 12. Tradin Organic Agriculture B.V. (Netherlands) 13. Bunge (United States) 14. Trader Joe's (United States) 15. The Hain Celestial Group (United States) 16. Lantic Inc. (Canada) 17. Now Foods (United States) Frequently asked questions: 1. What is the market growth of the Organic Sugar Market? Ans. The Organic Sugar Market was valued at USD 27.8 Billion in 2022 and is expected to reach USD 52.58 Billion by 2029, at a CAGR of 9.45 % during the forecast period. 2. Which are the major key players in the Organic Sugar Market? Ans. The key players in this Organic Sugar Market are Tereos (France), PRONATEC AG (Switzerland), Samruddhi Organic Farm I Private Limited (India), and INTERNATIONAL SUGARS (United States) 3. Which region is anticipated to account for the largest market share? Ans. North America is anticipated to dominate the Organic Sugar Market. 4. What are the new opportunities in Organic Sugar Market entrants? Ans. New entrants in the Organic Sugar Market can capitalize on rising health-consciousness, sustainability trends, and increasing demand for natural sweeteners. Opportunities abound in innovative production methods, eco-friendly packaging, ethical sourcing, and targeted marketing strategies to cater to evolving consumer preferences for organic and responsibly produced sugar products. 5. What is the forecast period for the Organic Sugar Market? Ans. The forecast period for the Organic Sugar Market is from 2023 to 2029.

1. Organic Sugar Market Introduction 1.1 Study Assumption and Market Definition 1.2 Scope of the Study 1.3 Executive Summary 2. Organic Sugar Market: Dynamics 2.1 Organic Sugar Market Trends by Region 2.1.1 Global 2.1.2 North America 2.1.3 Europe 2.1.4 Asia Pacific 2.1.5 Middle East and Africa 2.1.6 South America 2.2 Organic Sugar Market Drivers by Region 2.2.1 Global 2.2.2 North America 2.2.3 Europe 2.2.4 Asia Pacific 2.2.5 Middle East and Africa 2.2.6 South America 2.3 Organic Sugar Market Restraints 2.4 Organic Sugar Market Opportunities 2.5 Organic Sugar Market Challenges 2.6 PORTER’s Five Forces Analysis 2.6.1 Bargaining Power Of Suppliers 2.6.2 Bargaining Power Of Buyers 2.6.3 Threat Of New Entrants 2.6.4 Threat Of Substitutes 2.6.5 Intensity Of Rivalry 2.7 PESTLE Analysis 2.8 Value Chain Analysis 2.9 Regulatory Landscape by Region 2.9.1 Global 2.9.2 North America 2.9.3 Europe 2.9.4 Asia Pacific 2.9.5 Middle East and Africa 2.9.6 South America 2.10 Analysis of Government Schemes and Initiatives For Organic Sugar Industry 2.11 The Global Pandemic and Redefining Organic Sugar Industry Landscape 2.12 Price Trend Analysis 2.13 Global Organic Sugar Trade Analysis (2017-2022) 2.13.1 Global Import of Organic Sugar 2.13.1.1 Ten Largest Importer 2.13.2 Global Export of Organic Sugar 2.13.2.1 Ten Largest Exporters 2.14 Organic Sugar Production Capacity Analysis 2.14.1 Chapter Overview 2.14.2 Key Assumptions and Methodology 2.14.3 Organic Sugar Manufacturers: Global Installed Capacity 2.14.4 Analysis by Size of Manufacturer 2.14.5 Analysis by Demand Side 2.14.6 Analysis by Supply Side 3. Organic Sugar Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 3.1 Global Organic Sugar Market, by Type (2022-2029) 3.1.1 Cane Sugar 3.1.2 Beet Sugar 3.2 Global Organic Sugar Market, by Form (2022-2029) 3.2.1 Granulated 3.2.2 Powdered 3.2.3 Liquid/Syrups 3.3 Global Organic Sugar Market, by End-use (2022-2029) 3.3.1 Food Industry 3.3.2 Beverages 3.3.3 Cosmetics 3.3.4 Pharmaceuticals 3.4 Global Organic Sugar Market, by Region (2022-2029) 3.4.1 North America 3.4.2 Europe 3.4.3 Asia Pacific 3.4.4 Middle East and Africa 3.4.5 South America 4. North American Organic Sugar Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 4.1 North America Organic Sugar Market, by Type (2022-2029) 4.1.1 Cane Sugar 4.1.2 Beet Sugar 4.2 North America Organic Sugar Market, by Form (2022-2029) 4.2.1 Granulated 4.2.2 Powdered 4.2.3 Liquid/Syrups 4.3 Organic Sugar Market, by End-use (2022-2029) 4.3.1 Food Industry 4.3.2 Beverages 4.3.3 Cosmetics 4.3.4 Pharmaceuticals 4.4 North America Organic Sugar Market, by Country (2022-2029) 4.4.1 United States 4.4.1.1 United States Organic Sugar Market, by Type (2022-2029) 4.4.1.1.1 Cane Sugar 4.4.1.1.2 Beet Sugar 4.4.1.2 United States Organic Sugar Market, by Form (2022-2029) 4.4.1.2.1 Granulated 4.4.1.2.2 Powdered 4.4.1.2.3 Liquid/Syrups 4.4.1.3 United States Organic Sugar Market, by End-use (2022-2029) 4.4.1.3.1 Food Industry 4.4.1.3.2 Beverages 4.4.1.3.3 Cosmetics 4.4.1.3.4 Pharmaceuticals 4.4.2 Canada 4.4.2.1 Canada Organic Sugar Market, by Type (2022-2029) 4.4.2.1.1 Cane Sugar 4.4.2.1.2 Beet Sugar 4.4.2.2 Canada Organic Sugar Market, by Form (2022-2029) 4.4.2.2.1 Granulated 4.4.2.2.2 Powdered 4.4.2.2.3 Liquid/Syrups 4.4.2.3 Organic Sugar Market, by End-use (2022-2029) 4.4.2.3.1 Food Industry 4.4.2.3.2 Beverages 4.4.2.3.3 Cosmetics 4.4.2.3.4 Pharmaceuticals 4.4.3 Mexico 4.4.3.1 Mexico Organic Sugar Market, by Type (2022-2029) 4.4.3.1.1 Cane Sugar 4.4.3.1.2 Beet Sugar 4.4.3.2 Mexico Organic Sugar Market, by Form (2022-2029) 4.4.3.2.1 Granulated 4.4.3.2.2 Powdered 4.4.3.2.3 Liquid/Syrups 4.4.3.3 Organic Sugar Market, by End-use (2022-2029) 4.4.3.3.1 Food Industry 4.4.3.3.2 Beverages 4.4.3.3.3 Cosmetics 4.4.3.3.4 Pharmaceuticals 5. Europe Organic Sugar Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 5.1 Europe Organic Sugar Market, by Type (2022-2029) 5.2 Europe Organic Sugar Market, by Form (2022-2029) 5.3 Europe Organic Sugar Market, by End-use (2022-2029) 5.4 Europe Organic Sugar Market, by Country (2022-2029) 5.4.1 United Kingdom 5.4.1.1 United Kingdom Organic Sugar Market, by Type (2022-2029) 5.4.1.2 United Kingdom Organic Sugar Market, by Form (2022-2029) 5.4.1.3 United Kingdom Organic Sugar Market, by End-use (2022-2029) 5.4.2 France 5.4.2.1 France Organic Sugar Market, by Type (2022-2029) 5.4.2.2 France Organic Sugar Market, by Form (2022-2029) 5.4.2.3 France Organic Sugar Market, by End-use (2022-2029) 5.4.2.4 5.4.3 Germany 5.4.3.1 Germany Organic Sugar Market, by Type (2022-2029) 5.4.3.2 Germany Organic Sugar Market, by Form (2022-2029) 5.4.3.3 Germany Organic Sugar Market, by End-use (2022-2029) 5.4.4 Italy 5.4.4.1 Italy Organic Sugar Market, by Type (2022-2029) 5.4.4.2 Italy Organic Sugar Market, by Form (2022-2029) 5.4.4.3 Italy Organic Sugar Market, by End-use (2022-2029) 5.4.5 Spain 5.4.5.1 Spain Organic Sugar Market, by Type (2022-2029) 5.4.5.2 Spain Organic Sugar Market, by Form (2022-2029) 5.4.5.3 Spain Organic Sugar Market, by End-use (2022-2029) 5.4.6 Sweden 5.4.6.1 Sweden Organic Sugar Market, by Type (2022-2029) 5.4.6.2 Sweden Organic Sugar Market, by Form (2022-2029) 5.4.6.3 Sweden Organic Sugar Market, by End-use (2022-2029) 5.4.7 Austria 5.4.7.1 Austria Organic Sugar Market, by Type (2022-2029) 5.4.7.2 Austria Organic Sugar Market, by Form (2022-2029) 5.4.7.3 Austria Organic Sugar Market, by End-use (2022-2029) 5.4.8 Rest of Europe 5.4.8.1 Rest of Europe Organic Sugar Market, by Type (2022-2029) 5.4.8.2 Rest of Europe Organic Sugar Market, by Form (2022-2029). 5.4.8.3 Rest of Europe Organic Sugar Market, by End-use (2022-2029) 6. Asia Pacific Organic Sugar Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 6.1 Asia Pacific Organic Sugar Market, by Type (2022-2029) 6.2 Asia Pacific Organic Sugar Market, by Form (2022-2029) 6.3 Asia Pacific Organic Sugar Market, by End-use (2022-2029) 6.4 Asia Pacific Organic Sugar Market, by Country (2022-2029) 6.4.1 China 6.4.1.1 China Organic Sugar Market, by Type (2022-2029) 6.4.1.2 China Organic Sugar Market, by Form (2022-2029) 6.4.1.3 China Organic Sugar Market, by End-use (2022-2029) 6.4.2 South Korea 6.4.2.1 S Korea Organic Sugar Market, by Type (2022-2029) 6.4.2.2 S Korea Organic Sugar Market, by Form (2022-2029) 6.4.2.3 S Korea Organic Sugar Market, by End-use (2022-2029) 6.4.3 Japan 6.4.3.1 Japan Organic Sugar Market, by Type (2022-2029) 6.4.3.2 Japan Organic Sugar Market, by Form (2022-2029) 6.4.3.3 Japan Organic Sugar Market, by End-use (2022-2029) 6.4.4 India 6.4.4.1 India Organic Sugar Market, by Type (2022-2029) 6.4.4.2 India Organic Sugar Market, by Form (2022-2029) 6.4.4.3 India Organic Sugar Market, by End-use (2022-2029) 6.4.5 Australia 6.4.5.1 Australia Organic Sugar Market, by Type (2022-2029) 6.4.5.2 Australia Organic Sugar Market, by Form (2022-2029) 6.4.5.3 Australia Organic Sugar Market, by End-Use (2022-2029) 6.4.6 Indonesia 6.4.6.1 Indonesia Organic Sugar Market, by Type (2022-2029) 6.4.6.2 Indonesia Organic Sugar Market, by Form (2022-2029) 6.4.6.3 Indonesia Organic Sugar Market, by End-use (2022-2029) 6.4.7 Malaysia 6.4.7.1 Malaysia Organic Sugar Market, by Type (2022-2029) 6.4.7.2 Malaysia Organic Sugar Market, by Form (2022-2029) 6.4.7.3 Malaysia Organic Sugar Market, by End-use (2022-2029) 6.4.8 Vietnam 6.4.8.1 Vietnam Organic Sugar Market, by Type (2022-2029) 6.4.8.2 Vietnam Organic Sugar Market, by Form (2022-2029) 6.4.8.3 Vietnam Organic Sugar Market, by End-use (2022-2029) 6.4.9 Taiwan 6.4.9.1 Taiwan Organic Sugar Market, by Type (2022-2029) 6.4.9.2 Taiwan Organic Sugar Market, by Form (2022-2029) 6.4.9.3 Taiwan Organic Sugar Market, by End-use (2022-2029) 6.4.10 Bangladesh 6.4.10.1 Bangladesh Organic Sugar Market, by Type (2022-2029) 6.4.10.2 Bangladesh Organic Sugar Market, by Form (2022-2029) 6.4.10.3 Bangladesh Organic Sugar Market, by End-use (2022-2029) 6.4.11 Pakistan 6.4.11.1 Pakistan Organic Sugar Market, by Type (2022-2029) 6.4.11.2 Pakistan Organic Sugar Market, by Form (2022-2029) 6.4.11.3 Pakistan Organic Sugar Market, by End-use (2022-2029) 6.4.12 Rest of Asia Pacific 6.4.12.1 Rest of Asia Pacific Organic Sugar Market, by Type (2022-2029) 6.4.12.2 Rest of Asia Pacific Organic Sugar Market, by Form (2022-2029) 6.4.12.3 Rest of Asia Pacific Organic Sugar Market, by End-use (2022-2029) 7. Middle East and Africa Organic Sugar Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 7.1 Middle East and Africa Organic Sugar Market, by Type (2022-2029) 7.2 Middle East and Africa Organic Sugar Market, by Form (2022-2029) 7.3 Middle East and Africa Organic Sugar Market, by End-use (2022-2029) 7.4 Middle East and Africa Organic Sugar Market, by Country (2022-2029) 7.4.1 South Africa 7.4.1.1 South Africa Organic Sugar Market, by Type (2022-2029) 7.4.1.2 South Africa Organic Sugar Market, by Form (2022-2029) 7.4.1.3 South Africa Organic Sugar Market, by End-use (2022-2029) 7.4.2 GCC 7.4.2.1 GCC Organic Sugar Market, by Type (2022-2029) 7.4.2.2 GCC Organic Sugar Market, by Form (2022-2029) 7.4.2.3 GCC Organic Sugar Market, by End-use (2022-2029) 7.4.3 Egypt 7.4.3.1 Egypt Organic Sugar Market, by Type (2022-2029) 7.4.3.2 Egypt Organic Sugar Market, by Form (2022-2029) 7.4.3.3 Egypt Organic Sugar Market, by End-use (2022-2029) 7.4.4 Nigeria 7.4.4.1 Nigeria Organic Sugar Market, by Type (2022-2029) 7.4.4.2 Nigeria Organic Sugar Market, by Form (2022-2029) 7.4.4.3 Nigeria Organic Sugar Market, by End-use (2022-2029) 7.4.5 Rest of ME&A 7.4.5.1 Rest of ME&A Organic Sugar Market, by Type (2022-2029) 7.4.5.2 Rest of ME&A Organic Sugar Market, by Form (2022-2029) 7.4.5.3 Rest of ME&A Organic Sugar Market, by End-use (2022-2029) 8. South America Organic Sugar Market Size and Forecast by Segmentation by Demand and Supply Side (Value and Volume) 8.1 South America Organic Sugar Market, by Type (2022-2029) 8.2 South America Organic Sugar Market, by Form (2022-2029) 8.3 South America Organic Sugar Market, by End-use (2022-2029) 8.4 South America Organic Sugar Market, by Country (2022-2029) 8.4.1 Brazil 8.4.1.1 Brazil Organic Sugar Market, by Type (2022-2029) 8.4.1.2 Brazil Organic Sugar Market, by Form (2022-2029) 8.4.1.3 Brazil Organic Sugar Market, by End-use (2022-2029) 8.4.2 Argentina 8.4.2.1 Argentina Organic Sugar Market, by Type (2022-2029) 8.4.2.2 Argentina Organic Sugar Market, by Form (2022-2029) 8.4.2.3 Argentina Organic Sugar Market, by End-use (2022-2029) 8.4.3 Rest Of South America 8.4.3.1 Rest Of South America Organic Sugar Market, by Type (2022-2029) 8.4.3.2 Rest Of South America Organic Sugar Market, by Form (2022-2029) 8.4.3.3 Rest Of South America Organic Sugar Market, by End-use (2022-2029) 9. Global Organic Sugar Market: Competitive Landscape 9.1 MMR Competition Matrix 9.2 Competitive Landscape 9.3 Key Players Benchmarking 9.3.1 Company Name 9.3.2 Product Segment 9.3.3 End-user Segment 9.3.4 Revenue (2022) 9.3.5 Manufacturing Locations 9.3.6 SKU Details 9.3.7 Production Capacity 9.3.8 Production for 2022 9.3.9 No. of Stores 9.4 Market Analysis by Organized Players vs. Unorganized Players 9.4.1 Organized Players 9.4.2 Unorganized Players 9.5 Leading Organic Sugar Global Companies, by market capitalization 9.6 Market Structure 9.6.1 Market Leaders 9.6.2 Market Followers 9.6.3 Emerging Players 9.7 Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1 Tereos (France) 10.1.1 Company Overview 10.1.2 Business Portfolio 10.1.3 Financial Overview 10.1.4 SWOT Analysis 10.1.5 Strategic Analysis 10.1.6 Scale of Operation (small, medium, and large) 10.1.7 Details on Partnership 10.1.8 Regulatory Accreditations and Certifications Received by Them 10.1.9 Awards Received by the Firm 10.1.10 Recent Developments 10.2 PRONATEC AG (Switzerland) 10.3 Samruddhi Organic Farm I Private Limited (India) 10.4 INTERNATIONAL SUGARS (United States) 10.5 Wholesome Sweeteners (United States) 10.6 Imperial Sugar (United States) 10.7 Florida Crystals Corporation (United States) 10.8 Rapunzel Naturkost (Germany) 10.9 ASR Group (United States) 10.10 Louis Dreyfus Company (Netherlands) 10.11 DW Montgomery & Company (United States) 10.12 Tradin Organic Agriculture B.V. (Netherlands) 10.13 Bunge (United States) 10.14 Trader Joe's (United States) 10.15 The Hain Celestial Group (United States) 10.16 Lantic Inc. (Canada) 10.17 Now Foods (United States) 11. Key Findings 12. Industry Recommendations 13. Organic Sugar Market: Research Methodology 14. Terms and Glossary