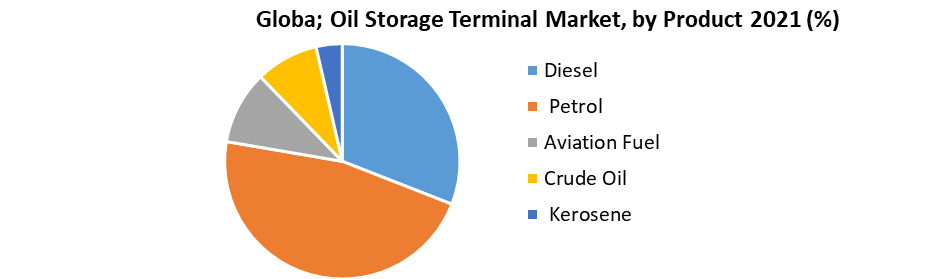

Oil Storage Terminal Market was valued at USD 30.15 Billion in 2021, and it is expected to reach USD 42.54 Billion by 2029, exhibiting a CAGR of 4.4 % during the forecast period (2022-2029). The oil storage terminal market report provides a detailed analysis of the oil storage terminal market. The report focuses on product types, leading applications of the product and leading companies. The report offers insights into the market trends, opportunities, restrains, segment analysis and regional insights. In addition to the above-mentioned factors, the report includes several factors that have contributed to the growth of the market over the recent years.To know about the Research Methodology :- Request Free Sample Report Raw petroleum and its products are kept in storage for commercial and strategic reserve purposes. There are various kinds of storage tanks used to store raw petroleum. The most commonly used rooftop storage tanks are drifting rooftop storage tanks and permanent rooftop storage tanks. Oil storage terminals are the most fundamental components of the global oil and gas production network. These terminals are at the heart of international oil and gas trade. These terminals are found in nations that rely heavily on oil imports and in countries that provide large amounts of oil. The Global Oil Storage Terminal Market is segmented by type, tank type and product. Based on type, the market is segmented into Strategic Reserve and Commercial Reserve. Based on tank type, the market is segmented into Fixed Roof, Floating Roof, Bullet Tank, and Spherical Tank. Based on product, the market is segmented into Diesel, Petrol, Aviation Fuel, Crude Oil, Kerosene and others. Based on region, the market is segmented into North America, Asia Pacific, Europe, Middle East & Africa, and South America.

COVID-19 IMPACT on Oil Storage Terminal Market

The COVID-19 pandemic had a significant impact on the global oil and gas sector, resulting in a scarcity of storage capacity. The blockage of the oil and gas inventory network has the greatest impact on oil producing countries and large exporters. The current situation has forced several oil and gas companies to adjust their consumption plans for the coming year. Expected speculations have fallen short of expectations, and the storage terminal market is expected to revive slowly over the next few years. Changing international crude oil prices, as well as supply and demand trends, might affect market growth during the COVD-19 pandemic. The reduction in demand for oil and oil products has put a halt to the offshore and onshore creation processes. As a result, the global oil and gas industry's slowdown is driving the construction and modernization of oil storage tank terminals. This variable will surely influence yearly market development interests for a predetermined period.Oil Storage Terminal Market Dynamics

Rising Demand for Various Crude Oil derived products is supporting the growth of Terminals A petroleum refinery's outputs include diesel, petroleum, aviation fuel, lubricants, and other petroleum products obtained from crude oil. Every barrel of crude oil processed at a refinery yields a diverse range of products. Propane and butane are the most often produced refined products that are used as feedstock for ethylene cracking and then mixed into Liquefied Petroleum Gas (LPG) for use as a fuel. In industrial facilities and commercial/residential heating, industrial gasoline is utilised as a furnace fuel. Remaining oil is also used as a bunker fuel in power plants and huge ocean-going ships. These factors have increased demand for diesel, petroleum, oils, and other products, which directly drives the desire for additional crude oil and the growth of these products. The demand for oil storage tanks is expected to increase as international crude oil prices drop Reduced crude oil prices are expected to drive the market because as the cost of oil falls, demand for oil storage is expected to rise as consumers store more oil in larger quantities when the price is low. Brent Crude oil's annual average price rose to USD 70.68 per barrel in 2021, more than the annual average in 2021, when crippled demand amid the COVID pandemic triggered an oil emergency. Crude oil prices are the most widely reported of all commodities because they affect expenses at all stages of the manufacturing process and affect consumer pricing. Rising Demand for Energy to Foster Industry Development The increased demand for energy as a result of population growth and rapid urbanisation is an important factor that has influenced the creation of new terminals. The global population is expected to reach 9.8 billion by 2050 and 11.2 billion by 2100. This reason will undoubtedly promote the establishment of similar terminals in industrialised countries to meet domestic oil consumption while also earning revenue through commercial use of the equivalent. Increasing investments in strategic petroleum reserves and increasing international oil trade agreements to boost market growth The need for strategic petroleum reserves (SPR) has compelled countries to concentrate on increasing their storage capacity to meet oil demand in the event of an import disruption or a national emergency. For example, each European Union country is required to maintain a strategic oil reserve equal to 90 days of average domestic use. During the forecast period, oil trade between nations is expected to increase, prompting governments to invest more in storage terminals. In November 2021, China, the world's largest crude customer, imported 10.47 million barrels per day, up from 8.9 million barrels per day in October, the lowest level since September 2018. Adoption of renewable energy resources is emphasised as a way to diversify the oil industry's growth. The increased use of renewable energy sources for electricity generation is a major restraint on the oil storage terminals industry. Because renewable fuels are often less polluting, environmental concerns have surpassed energy security as the primary motivation of government efforts to encourage them. In recent years, research and development of alternative automotive-fuel technologies has centred on oil and natural gas-based fuels, as well as biofuels generated from plant materials, such as ethanol and biodiesel. Hydrogen-based fuel cells and electric vehicles (EVs). Another issue limiting the growth of the oil storage terminal industry is the high cost of construction and maintenance necessary during the terminal's operating lifetime.Oil Storage Terminal Market Segment Analysis

Increasing Oil Trade Agreements Will Surge Demand for Commercial Terminals The market is segmented into strategic reserve and commercial reserve based on type. Commercial reserves have dominated the market in recent years, since a significant portion of the developed terminals is dedicated to crude oil commercialization. Strategic reserves are stored to ensure that a country's energy demand is met in the event of a crisis or import disappointment. The capacity of these terminals is thus limited, although commercial storage expansions are common in response to shifting energy and import demand. Floating Roof Tanks Will Lead Market Due to Their Operational Advantages Based on tank type, the global market is segmented into the floating roof, fixed roof. spherical tanks and bullet tanks. The segment of fixed-rooftop tanks dominates the market. Still, with the presentation of innovation and unique benefits, the market for floating rooftop tanks is expected to grow in the next years. The no-gap distance between the floating rooftop deck and the oil level helps to reduce crude oil evaporation losses. The floating roofing also aids in the preservation of the stored liquids' quality. Utilization of Diesel across Various Sectors Will Lead to its Domination in Market The market is divided into diesel, petrol, aviation fuel, kerosene, crude oil, and others in the product segment. Because diesel is widely utilised in the automobile industry, marine fuels, and aviation fuel manufacture, it is expected to dominate the market. The majority of today's heavy-duty trucks still operate on diesel. With more cars using petroleum and more people flying, petroleum and aviation fuel will continue to rise in popularity.

Oil Storage Terminal Market Regional Insights

Asia Pacific is estimated to dominate the global oil storage terminal market. In 2021, the market for an oil storage facility in Asia Pacific was valued at USD 10.20 billion. China and India have increased their need for energy and oil-based commodities. Crude oil supplies a large portion of these countries' electricity and energy. Around here, South Korea and Singapore are major oil storage hubs. Additionally, divestments by a few local firms will most likely trigger fresh expansion plans and push the business forward. In its Hong Kong-based branch, Bright Oil Petroleum has sold almost 90% of the offers. Yantian Group has acquired the oil storage and terminal offices in Zhoushan. In Europe, the oil storage terminals market is expected to witness a health growth owing to increasing production capacities from several key players. The need for oil storage has been growing, generating interest and increasing competition as companies try to better positioning themselves for the future and maximising profits. The European oil storage terminals market is expected to grow at a healthy rate, thanks to increased production capacity from a few key players. Numerous countries in the region rely on oil imports to meet their energy needs. Furthermore, due to the increase in energy consumption, the storage limit expansion is expected to be completed. In addition, the primary actors' growing efforts to confront natural and inorganic expansions are expected to sustain the territorial landscape.CLH Group was awarded the purchase of 15 Inter fluid item storage terminal offices in Ireland in November 2021. Inter Pipeline serves Germany, Netherlands, and United Kingdom. CLH's all-out limit will increase by 18 million barrels after this acquisition, with a cost of EUR 457 million (about USD 400.78 million). CLH is now one of the major fluid terminal companies in the area as a result of the improvement process related to environmental change and global development having jobs in eight different countries. Due to capacity increases and CAPEX on new build oil storage projects, the United States is expected to dominate the market in North America, followed by Canada. Furthermore, market growth is expected to be aided by investment activity in the area. In December 2021, the development of phase one of the oil and refined products terminal project in Plaquernines Parish, Louisiana, was announced by NOLA Oil Terminal LLC. The United States owns 158 acres and spent $300 on it. Two deepwater ports and one barge dock are included in the project's first water-side phase. When fully operational, the two docks will be capable of anchoring 170.000 tank vessels. To strengthen their product portfolio in the market, Royal Vopak and Oil Tanking GmbH are concentrating on contract acquisition. The oil storage terminal industry's competitive landscape depicts a market dominated by Royal Vopak and Oiltanking Gmbh. With storage terminals distributed across Europe, North America, and Asia Pacific, these companies control a large portion of the industry. Local firms such as HMT Tanks and Containment Solutions are also present in the market. Superior Tank, as well as others with storage terminals in their bustling neighbourhoods. The unmistakable component for organisations like Royal Vopak and other top corporations to lay out a solid impression in the market has been the obvious customer reach in various parts of the world, as well as superior brand esteem when compared to other competitors. The objective of the report is to present a comprehensive analysis of the global Oil Storage Terminal Market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The reports also help in understanding the Oil Storage Terminal Market dynamic, structure by analyzing the market segments and projecting the Oil Storage Terminal Market size. Clear representation of competitive analysis of key players by Vehicle type, price, financial position, product portfolio, growth strategies, and regional presence in the Oil Storage Terminal Market make the report investor’s guide.

Oil Storage Terminal Market Scope: Inquire before buying

Global Oil Storage Terminal Market Report Coverage Details Base Year: 2021 Forecast Period: 2022-2029 Historical Data: 2017 to 2021 Market Size in 2021: US $ 30.15 Bn. Forecast Period 2022 to 2029 CAGR: 4.4% Market Size in 2029: US $ 42.54 Bn. Segments Covered: by Type • Strategic Reserve • Commercial Reserve by Tank Type • Fixed Roof • Floating Roof • Bullet Tank • Spherical Tank by Product • Diesel • Petrol • Aviation Fuel • Crude Oil • Kerosene • Others Oil Storage Terminal Market,by Region

, by Region • North America • Europe • Asia Pacific • Middle East & Africa • South AmericaGlobal Oil Storage Terminal Market Key Players are:

• Belco Manufacturing (U.S.) • Royal Vopak (Netherlands) • Containment Solutions. Inc. (U.S.) • Vitol (Switzerland) • Oiltanking GmbH (Germany) • Koole Terminals (Netherlands) • Brooge Energy (UAE) • Shell (Netherlands) • LBC Tank Terminals (Belgium) • Ergon International (U.S.) • Olivia Petroleum. SAU. (Spain) • Odfjell SE (Norway) • Oman Tank Terminal Company (Oman) • Puma Energy (Singapore) Frequently Asked Questions: 1] What segments are covered in the Global Oil Storage Terminal Market report? Ans. The segments covered in the Oil Storage Terminal Market report are based on Type, Tank Type and Product. 2] Which region is expected to hold the highest share in the Global Oil Storage Terminal Market ? Ans. The Asia Pacific region is expected to hold the highest share in the Oil Storage Terminal Market . 3] What is the market size of the Global Oil Storage Terminal Market by 2029? Ans. The market size of the Oil Storage Terminal Market by 2029 is expected to reach USD 42.54 Bn. 4] What is the forecast period for the Global Oil Storage Terminal Market ? Ans. The forecast period for the Oil Storage Terminal Market is 2021-2029. 5] What was the market size of the Global Oil Storage Terminal Market in 2021? Ans. The market size of the Oil Storage Terminal Market in 2021 was valued at USD 30.15 Bn.

1. Oil Storage Terminal Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Oil Storage Terminal Market: Dynamics 2.1. Oil Storage Terminal Market Trends by Region 2.1.1. North America Oil Storage Terminal Market Trends 2.1.2. Europe Oil Storage Terminal Market Trends 2.1.3. Asia Pacific Oil Storage Terminal Market Trends 2.1.4. Middle East and Africa Oil Storage Terminal Market Trends 2.1.5. South America Oil Storage Terminal Market Trends 2.2. Oil Storage Terminal Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Oil Storage Terminal Market Drivers 2.2.1.2. North America Oil Storage Terminal Market Restraints 2.2.1.3. North America Oil Storage Terminal Market Opportunities 2.2.1.4. North America Oil Storage Terminal Market Challenges 2.2.2. Europe 2.2.2.1. Europe Oil Storage Terminal Market Drivers 2.2.2.2. Europe Oil Storage Terminal Market Restraints 2.2.2.3. Europe Oil Storage Terminal Market Opportunities 2.2.2.4. Europe Oil Storage Terminal Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Oil Storage Terminal Market Drivers 2.2.3.2. Asia Pacific Oil Storage Terminal Market Restraints 2.2.3.3. Asia Pacific Oil Storage Terminal Market Opportunities 2.2.3.4. Asia Pacific Oil Storage Terminal Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Oil Storage Terminal Market Drivers 2.2.4.2. Middle East and Africa Oil Storage Terminal Market Restraints 2.2.4.3. Middle East and Africa Oil Storage Terminal Market Opportunities 2.2.4.4. Middle East and Africa Oil Storage Terminal Market Challenges 2.2.5. South America 2.2.5.1. South America Oil Storage Terminal Market Drivers 2.2.5.2. South America Oil Storage Terminal Market Restraints 2.2.5.3. South America Oil Storage Terminal Market Opportunities 2.2.5.4. South America Oil Storage Terminal Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Oil Storage Terminal Industry 2.8. Analysis of Government Schemes and Initiatives For Oil Storage Terminal Industry 2.9. Oil Storage Terminal Market Trade Analysis 2.10. The Global Pandemic Impact on Oil Storage Terminal Market 3. Oil Storage Terminal Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2021-2029 3.1. Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 3.1.1. Strategic Reserve 3.1.2. Commercial Reserve 3.2. Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 3.2.1. Fixed Roof 3.2.2. Floating Roof 3.2.3. Bullet Tank 3.2.4. Spherical Tank 3.3. Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 3.3.1. Diesel 3.3.2. Petrol 3.3.3. Aviation Fuel 3.3.4. Crude Oil 3.3.5. Kerosene 3.3.6. Others 3.4. Oil Storage Terminal Market Size and Forecast, by Region (2021-2029) 3.4.1. North America 3.4.2. Europe 3.4.3. Asia Pacific 3.4.4. Middle East and Africa 3.4.5. South America 4. North America Oil Storage Terminal Market Size and Forecast by Segmentation (by Value in USD Million) 2021-2029 4.1. North America Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 4.1.1. Strategic Reserve 4.1.2. Commercial Reserve 4.2. North America Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 4.2.1. Fixed Roof 4.2.2. Floating Roof 4.2.3. Bullet Tank 4.2.4. Spherical Tank 4.3. North America Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 4.3.1. Diesel 4.3.2. Petrol 4.3.3. Aviation Fuel 4.3.4. Crude Oil 4.3.5. Kerosene 4.3.6. Others 4.4. North America Oil Storage Terminal Market Size and Forecast, by Country (2021-2029) 4.4.1. United States 4.4.1.1. United States Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 4.4.1.1.1. Strategic Reserve 4.4.1.1.2. Commercial Reserve 4.4.1.2. United States Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 4.4.1.2.1. Fixed Roof 4.4.1.2.2. Floating Roof 4.4.1.2.3. Bullet Tank 4.4.1.2.4. Spherical Tank 4.4.1.3. United States Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 4.4.1.3.1. Diesel 4.4.1.3.2. Petrol 4.4.1.3.3. Aviation Fuel 4.4.1.3.4. Crude Oil 4.4.1.3.5. Kerosene 4.4.1.3.6. Others 4.4.2. Canada 4.4.2.1. Canada Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 4.4.2.1.1. Strategic Reserve 4.4.2.1.2. Commercial Reserve 4.4.2.2. Canada Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 4.4.2.2.1. Fixed Roof 4.4.2.2.2. Floating Roof 4.4.2.2.3. Bullet Tank 4.4.2.2.4. Spherical Tank 4.4.2.3. Canada Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 4.4.2.3.1. Diesel 4.4.2.3.2. Petrol 4.4.2.3.3. Aviation Fuel 4.4.2.3.4. Crude Oil 4.4.2.3.5. Kerosene 4.4.2.3.6. Others 4.4.3. Mexico 4.4.3.1. Mexico Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 4.4.3.1.1. Strategic Reserve 4.4.3.1.2. Commercial Reserve 4.4.3.2. Mexico Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 4.4.3.2.1. Fixed Roof 4.4.3.2.2. Floating Roof 4.4.3.2.3. Bullet Tank 4.4.3.2.4. Spherical Tank 4.4.3.3. Mexico Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 4.4.3.3.1. Diesel 4.4.3.3.2. Petrol 4.4.3.3.3. Aviation Fuel 4.4.3.3.4. Crude Oil 4.4.3.3.5. Kerosene 4.4.3.3.6. Others 5. Europe Oil Storage Terminal Market Size and Forecast by Segmentation (by Value in USD Million) 2021-2029 5.1. Europe Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 5.2. Europe Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 5.3. Europe Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 5.4. Europe Oil Storage Terminal Market Size and Forecast, by Country (2021-2029) 5.4.1. United Kingdom 5.4.1.1. United Kingdom Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 5.4.1.2. United Kingdom Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 5.4.1.3. United Kingdom Oil Storage Terminal Market Size and Forecast, by Product(2021-2029) 5.4.2. France 5.4.2.1. France Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 5.4.2.2. France Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 5.4.2.3. France Oil Storage Terminal Market Size and Forecast, by Product(2021-2029) 5.4.3. Germany 5.4.3.1. Germany Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 5.4.3.2. Germany Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 5.4.3.3. Germany Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 5.4.4. Italy 5.4.4.1. Italy Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 5.4.4.2. Italy Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 5.4.4.3. Italy Oil Storage Terminal Market Size and Forecast, by Product(2021-2029) 5.4.5. Spain 5.4.5.1. Spain Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 5.4.5.2. Spain Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 5.4.5.3. Spain Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 5.4.6. Sweden 5.4.6.1. Sweden Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 5.4.6.2. Sweden Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 5.4.6.3. Sweden Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 5.4.7. Austria 5.4.7.1. Austria Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 5.4.7.2. Austria Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 5.4.7.3. Austria Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 5.4.8. Rest of Europe 5.4.8.1. Rest of Europe Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 5.4.8.2. Rest of Europe Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 5.4.8.3. Rest of Europe Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 6. Asia Pacific Oil Storage Terminal Market Size and Forecast by Segmentation (by Value in USD Million) 2021-2029 6.1. Asia Pacific Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 6.2. Asia Pacific Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 6.3. Asia Pacific Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 6.4. Asia Pacific Oil Storage Terminal Market Size and Forecast, by Country (2021-2029) 6.4.1. China 6.4.1.1. China Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 6.4.1.2. China Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 6.4.1.3. China Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 6.4.2. S Korea 6.4.2.1. S Korea Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 6.4.2.2. S Korea Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 6.4.2.3. S Korea Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 6.4.3. Japan 6.4.3.1. Japan Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 6.4.3.2. Japan Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 6.4.3.3. Japan Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 6.4.4. India 6.4.4.1. India Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 6.4.4.2. India Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 6.4.4.3. India Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 6.4.5. Australia 6.4.5.1. Australia Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 6.4.5.2. Australia Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 6.4.5.3. Australia Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 6.4.6. Indonesia 6.4.6.1. Indonesia Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 6.4.6.2. Indonesia Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 6.4.6.3. Indonesia Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 6.4.7. Malaysia 6.4.7.1. Malaysia Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 6.4.7.2. Malaysia Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 6.4.7.3. Malaysia Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 6.4.8. Vietnam 6.4.8.1. Vietnam Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 6.4.8.2. Vietnam Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 6.4.8.3. Vietnam Oil Storage Terminal Market Size and Forecast, by Product(2021-2029) 6.4.9. Taiwan 6.4.9.1. Taiwan Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 6.4.9.2. Taiwan Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 6.4.9.3. Taiwan Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 6.4.10. Rest of Asia Pacific 6.4.10.1. Rest of Asia Pacific Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 6.4.10.2. Rest of Asia Pacific Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 6.4.10.3. Rest of Asia Pacific Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 7. Middle East and Africa Oil Storage Terminal Market Size and Forecast by Segmentation (by Value in USD Million) 2021-2029 7.1. Middle East and Africa Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 7.2. Middle East and Africa Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 7.3. Middle East and Africa Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 7.4. Middle East and Africa Oil Storage Terminal Market Size and Forecast, by Country (2021-2029) 7.4.1. South Africa 7.4.1.1. South Africa Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 7.4.1.2. South Africa Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 7.4.1.3. South Africa Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 7.4.2. GCC 7.4.2.1. GCC Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 7.4.2.2. GCC Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 7.4.2.3. GCC Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 7.4.3. Nigeria 7.4.3.1. Nigeria Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 7.4.3.2. Nigeria Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 7.4.3.3. Nigeria Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 7.4.4. Rest of ME&A 7.4.4.1. Rest of ME&A Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 7.4.4.2. Rest of ME&A Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 7.4.4.3. Rest of ME&A Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 8. South America Oil Storage Terminal Market Size and Forecast by Segmentation (by Value in USD Million) 2021-2029 8.1. South America Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 8.2. South America Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 8.3. South America Oil Storage Terminal Market Size and Forecast, by Product(2021-2029) 8.4. South America Oil Storage Terminal Market Size and Forecast, by Country (2021-2029) 8.4.1. Brazil 8.4.1.1. Brazil Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 8.4.1.2. Brazil Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 8.4.1.3. Brazil Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 8.4.2. Argentina 8.4.2.1. Argentina Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 8.4.2.2. Argentina Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 8.4.2.3. Argentina Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 8.4.3. Rest Of South America 8.4.3.1. Rest Of South America Oil Storage Terminal Market Size and Forecast, by Type (2021-2029) 8.4.3.2. Rest Of South America Oil Storage Terminal Market Size and Forecast, by Tank Type (2021-2029) 8.4.3.3. Rest Of South America Oil Storage Terminal Market Size and Forecast, by Product (2021-2029) 9. Global Oil Storage Terminal Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2021) 9.3.5. Company Locations 9.4. Leading Oil Storage Terminal Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Belco Manufacturing (U.S.) 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Royal Vopak (Netherlands) 10.3. Containment Solutions. Inc. (U.S.) 10.4. Vitol (Switzerland) 10.5. Oiltanking GmbH (Germany) 10.6. Koole Terminals (Netherlands) 10.7. Brooge Energy (UAE) 10.8. Shell (Netherlands) 10.9. LBC Tank Terminals (Belgium) 10.10. Ergon International (U.S.) 10.11. Olivia Petroleum. SAU. (Spain) 10.12. Odfjell SE (Norway) 10.13. Oman Tank Terminal Company (Oman) 10.14. Puma Energy (Singapore) 11. Key Findings 12. Industry Recommendations 13. Oil Storage Terminal Market: Research Methodology 14. Terms and Glossary