Off-Highway Electric Vehicle Market was valued at USD 5.86 Billion in 2022, and is expected to reach USD 40.28 Billion by 2029, exhibiting a CAGR of 31.7 % during the forecast period (2023-2029) The off-highway electric vehicle market, in terms of value is expected to grow at a CAGR of 31.7% from 2022 to 2029. The increasing stringency of emission standards has diverted the equipment manufacturer’s attention to alternative powertrain sources such as hybrid electric and full electric off-highway vehicles, thus thriving their demand globally. Moreover, the growth of end-use industries and the expanding mining and construction industry is likely to surge the demand for off-highway electric vehicles in the coming years. In 2022, Europe and North America together accounted for around 80% of the off-highway electric vehicle demand due to their consistently growing innovations in electric vehicle technology. North America holds the dominant market share in the off-highway electric vehicles market, with the U.S. being a significant contributor. The Asia Pacific off-highway electric vehicle market is estimated to grow at the highest CAGR of 45%, in terms of revenue over the forecast period. Countries such as India and China recorded a strong performance in 2022 due to the boost in infrastructure investment. The growth is mainly driven by emerging economies such as India and China, which are investing heavily in infrastructure and are among the fastest-growing economies globally.To know about the Research Methodology :- Request Free Sample Report

Off-Highway Electric Vehicle Market Dynamics

Favorable Government Policies and Regulations to Drive the Off-Highway Electric Vehicle Market Growth Electric vehicles are amongst the most prominent technologies that help reduce air pollution. Thus, governments across the globe are implementing policies such as subsidies and tax rebate programs to promote the adoption of off-highway electric vehicles. Environmental and sustainability objectives drive electric vehicle policies that are supported across all governance levels. Governments of several countries globally are drafting tailor-made policies to support the electric vehicle market growth. Growing construction and mining activities in Asian countries such as China and India are increasing the demand for efficient electric vehicles for reducing carbon footprint and exploring other energy resources. Also, the fluctuating prices of crude oil are encouraging the consumer to adopt electric vehicles with high ROI. Growing Rental Market to Drive the Growth of the Off-Highway Electric Vehicle Market The demand for renting construction vehicles such as excavators and loaders is growing at a fast pace; it is estimated that the construction equipment rental market will reach USD 337.30 billion by 2027, growing at a promising CAGR of 8.1% from 2020 to 2027. Customers are now preferring to rent construction equipment rather than spending vast funds on buying, procuring, and maintaining this equipment. Many construction equipment companies such as Mitsubishi Corporation, Hyundai Construction Co., Ltd have started collaborating with rental companies to gain a higher market share. The rental industry can leverage the benefit of off-highway electric vehicles and gain high ROI. Rising Crude Oil Prices to Drive the Off-Highway Electric Vehicle Market Growth Petrol and diesel are the most commonly used fuel sources for internal combustion engine vehicles. Although internal combustion engines have a lower purchase price, the overall cost of owning these vehicles is inclusive of the fuel costs incurred over the vehicle's lifespan. Thus, the rise in fuel prices ultimately adds up to the cost of ownership of the vehicle. The continuous usage of these fuels on a large scale also leads to the depletion of their reserves. Thus, one of the reasons contributing to their rising prices is the decision to discourage their usage among consumers. The increasing fuel prices contribute to the adoption of electric vehicles, which act as a substitute for petrol and diesel vehicles. Thanks to all the above mentioned factors, the rising crude oil prices are expected to drive electric vehicle demand.High Cost of Electrical Components to Restraint the Off-Highway Electric Vehicle Market Growth Although the total overall ownership cost of electric vehicles is lower than that of conventional vehicles, their initial purchase price is considerably higher. Price-sensitive customers may find the high disparity in initial purchase prices challenging and refrain from making the shift. Moreover, OEMs may find it challenging to replace an ICE powertrain with an electric powertrain, which costs USD 5,000 to 13,000 higher than ICE powertrains. With increasing awareness and understanding of the overall benefits and low ownership cost of an EV, this scenario is expected to change over the coming years. Moreover, as the battery technology matures and production volume increases, the difference in purchase prices is expected to significantly reduce in the next few years. Construction Activity Prone to Unstable Demand to Restraint the Growth of the Off-Highway Electric Vehicle Market The off-highway electric vehicle for the construction industry is highly dependent on the rise in residential and non-residential construction activities. Over 2016-17, construction spending registered a 5% rise, thereby boosting the demand for construction electric vehicles. However, uncertainty in growth prospects has led to uneven sales of electric vehicles over the year. Moreover, any legislative actions or regulations pose a threat to the growth prospects of the industry and restrict the growth of the off-highway electric vehicle in construction sector over the coming years. For instance, the Indian Environmental Protection Act prohibits the use of agricultural and forest land for construction in the country. Also, the government has limitations over the digging of soil from rivers, which forms one of the necessary components for construction activity, thus affecting many projects.

Off-Highway Electric Vehicle Market Segment Analysis

Based on Application, the construction segment accounted for the largest revenue share of around 38.2% in 2022. The segment includes electric construction equipment such as electric loaders and electric excavators. Increasing investments by governments across the world for developing public infrastructure has been one of the prime factors driving the market demand for this equipment. The OEMs are launching electric off-highway equipment to abide by the stricter emission norms. Regulations in the future could require zero-emissions on heavy-duty construction equipment which would pave the way for OEMs to drop production of diesel-powered engines and go all-electric. Based on Electric Vehicle, the HEV segment accounted for the largest revenue share of 62.5% in 2022 and is expected to dominate over the forecast period. These types of vehicles are designed to enhance the use of the internal combustion engine in collaboration with the electric powertrain. With the stringent emission norms by government authorities such as the U.S. EPA and the European Commission, the demand for hybrid propulsion off-highway equipment is growing and encouraging manufacturers to develop more environmentally friendly off-highway vehicles. Since 2017, off-highway vehicle manufacturers are essentially adopting hybrid engines, featuring diesel-electric propulsion systems. These diesel-electric hybrid drive systems allow users to run a slightly smaller engine at a lower rpm, providing fewer parts movement and high fuel efficiency.

Off-Highway Electric Vehicle Market Regional Insights

The off-highway electric vehicle market in the Asia Pacific is expected to witness growth thanks to the significant increase in development in infrastructural activities. Countries such as India and China are aggressively investing in infrastructural activities. China, as a country, is rapidly developing its infrastructure to gain a competitive advantage and become an economic superpower. The government plans to move around 250 million people into the countries rapidly growing megacities over the next ten years. In order to accommodate the migration, the country has invested billions of dollars in mega infrastructural projects. The Indian government has set a vision for infrastructure development by connecting different cities with quality roads and highways. The Indian government plans to construct a 65,000 km national highway with an investment of USD 745.5 billion by 2022. The construction equipment manufacturing companies in the regions are also keen on the development of off-highway electric vehicles. Companies such as XCMG and Zoomlion are developing and investing in the electric equipment space. Such development at the forefront of electrification would leverage the off-electric vehicle market in the region. The North American region holds the dominant market share in the off-highway electric vehicles market, with the U.S. being a significant contributor. In June 2020, the U.S. Department of Transportation (DoT) announced that the government plans to invest USD 906 million in the country's infrastructure through the INFRA discretionary grant program. The government is focused on infrastructure improvements across the country. Thus, the growth in road construction and highway infrastructure projects is expected to create opportunities for the off-road electric vehicle market players over the forecast period. The European off-highway electric vehicle market is expected to witness growth during the forecast period thanks to the increasing infrastructural investments and growing regulations pertaining to diesel emissions from heavy equipment. The German government has invested continually in quality infrastructure over the past few years. The rapidly expanding German infrastructure market, especially the road, highway, and transport infrastructure, can be a significant driving factor for the country's growth of other concrete and road machinery markets. Moreover, major construction projects are undertaken by the U.K. government to enable better transportation facilities, creating new homes and providing power to the areas all across the country. The country has planned multiple infrastructural development plans and keens on investing a massive amount in infrastructure projects.Off-Highway Electric Vehicle Market Scope: Inquiry Before Buying

Off-Highway Electric Vehicle Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2018 to 2022 Market Size in 2022: US $ 5.86 Bn. Forecast Period 2023 to 2029 CAGR: 31.7% Market Size in 2029: US $ 40.27 Bn. Segments Covered: by Electric Vehicle 1.Battery Electric Vehicle (BEV) 2.Hybrid Electric Vehicle (HEV) by Application 1.Construction 2.Agriculture 3.Mining by Energy Storage Capacity 1.<50 kWh 2.50–200 kWh 3.>200 kWh by Battery Type 1.Lithium-Ion (Li-Ion) 2.Lead–Acid Off-Highway Electric Vehicle Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Global Off-Highway Electric Vehicle Market Key Players are:

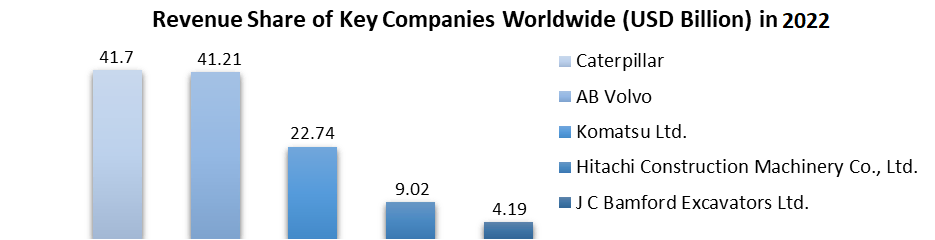

1.DEERE & COMPANY 2. Epiroc AB 3. Hitachi Construction Machinery 4.Hyundai Doosan Infracore Co. Ltd. 5. Komatsu Ltd. 6.AB Volvo 7. Anhui Heli Co., Ltd. 8.Cargotec corporation 9.Caterpillar 10.Clark 11.J C Bamford Excavators Ltd. 12.CNH Industrial N.V. 13.LIEBHERR-International Deutschland GmbH 14. Narrow Isle inc. 15.Sandvik AB 16.SANY Group 17.Toyota Motor Corporation 18. Volvo Construction Equipment AB 19.Doosan Corporation Frequently Asked Questions: 1] What is the growth rate of the Global Off-Highway Electric Vehicle Market? Ans. The Global Off-Highway Electric Vehicle Market is growing at a significant rate of 31.7% during the forecast period. 2] Which region is expected to have the highest growth rate in the Global Off-Highway Electric Vehicle Market? Ans. The Asia Pacific region is expected to hold the highest growth rate in the Off-Highway Electric Vehicle Market during the forecast period. 3] What is the market size of the Global Off-Highway Electric Vehicle Market by 2029? Ans. The market size of the Off-Highway Electric Vehicle Market by 2029 is expected to reach USD 40.28 Bn. 4] What are the major key players of the Global Off-Highway Electric Vehicle Market? Ans. The major key players of the Global Off-Highway Electric Vehicle Market are DEERE & COMPANY, Epiroc AB, Hitachi Construction Machinery, Hyundai Doosan Infracore Co. Ltd., and Komatsu Ltd. 5] What factors are driving the growth of the Global Off-Highway Electric Vehicle Market in 2022? Ans. Favorable government policies and regulations, growing inclination towards electrification of construction equipment, and rising crude oil prices are the major factors expected to drive the Global Off-Highway Electric Vehicle Market during the forecast period.

1. Global Off-Highway Electric Vehicle Market: Research Methodology 2. Global Off-Highway Electric Vehicle Market: Executive Summary 2.1 Market Overview and Definitions 2.1.1. Introduction to Global Off-Highway Electric Vehicle Market 2.2. Summary 2.2.1. Key Findings 2.2.2. Recommendations for Investors 2.2.3. Recommendations for Market Leaders 2.2.4. Recommendations for New Market Entry 3. Global Off-Highway Electric Vehicle Market: Competitive Analysis 3.1 MMR Competition Matrix 3.1.1. Market Structure by region 3.1.2. Competitive Benchmarking of Key Players 3.2 Consolidation in the Market 3.2.1 M&A by region 3.3 Key Developments by Companies 3.4 Market Drivers 3.5 Market Restraints 3.6 Market Opportunities 3.7 Market Challenges 3.8 Market Dynamics 3.9 PORTERS Five Forces Analysis 3.10 PESTLE 3.11 Regulatory Landscape by region • North America • Europe • Asia Pacific • The Middle East and Africa • South America 3.12 COVID-19 Impact 4. Global Off-Highway Electric Vehicle Market Segmentation 4.1 Global Off-Highway Electric Vehicle Market, by Electric Vehicle (2021-2029) • Battery Electric Vehicle (BEV) • Hybrid Electric Vehicle (HEV) 4.2 Global Off-Highway Electric Vehicle Market, by Application (2021-2029) • Construction • Agriculture • Mining 4.3 Global Off-Highway Electric Vehicle Market, by Energy Storage Capacity (2021-2029) • <50 kWh • 50–200 kWh • >200 kWh4.4 Global Off-Highway Electric Vehicle Market, by Battery Type (2021-2029) • Lithium-Ion (Li-Ion) • Lead–Acid 5. North America Off-Highway Electric Vehicle Market(2021-2029) 5.1 North America Off-Highway Electric Vehicle Market, by Electric Vehicle (2021-2029) • Battery Electric Vehicle (BEV) • Hybrid Electric Vehicle (HEV) 5.2 North America Off-Highway Electric Vehicle Market, by Application (2021-2029) • Construction • Agriculture • Mining 5.3 North America Off-Highway Electric Vehicle Market, by Energy Storage Capacity (2021-2029) • <50 kWh • 50–200 kWh • >200 kWh 5.4 North America Off-Highway Electric Vehicle Market, by Battery Type (2021-2029) • Lithium-Ion (Li-Ion) • Lead–Acid 5.5 North America Off-Highway Electric Vehicle Market, by Country (2021-2029) • United States • Canada • Mexico 6. Europe Off-Highway Electric Vehicle Market (2021-2029) 6.1. European Off-Highway Electric Vehicle Market, by Electric Vehicle (2021-2029) 6.2. European Off-Highway Electric Vehicle Market, by Application (2021-2029) 6.3. European Off-Highway Electric Vehicle Market, by Energy Storage Capacity (2021-2029) 6.4. European Off-Highway Electric Vehicle Market, by Battery Type (2021-2029) 6.5. European Off-Highway Electric Vehicle Market, by Country (2021-2029) • UK • France • Germany • Italy • Spain • Sweden • Austria • Rest Of Europe 7. Asia Pacific Off-Highway Electric Vehicle Market (2021-2029) 7.1. Asia Pacific Off-Highway Electric Vehicle Market, by Electric Vehicle (2021-2029) 7.2. Asia Pacific Off-Highway Electric Vehicle Market, by Application (2021-2029) 7.3. Asia Pacific Off-Highway Electric Vehicle Market, by Energy Storage Capacity (2021-2029) 7.4. Asia Pacific Off-Highway Electric Vehicle Market, by Battery Type (2021-2029) 7.5. Asia Pacific Off-Highway Electric Vehicle Market, by Country (2021-2029) • China • India • Japan • South Korea • Australia • ASEAN • Rest Of APAC 8. Middle East and Africa Off-Highway Electric Vehicle Market (2021-2029) 8.1 Middle East and Africa Off-Highway Electric Vehicle Market, by Electric Vehicle (2021-2029) 8.2. Middle East and Africa Off-Highway Electric Vehicle Market, by Application (2021-2029) 8.3. Middle East and Africa Off-Highway Electric Vehicle Market, by Energy Storage Capacity (2021-2029) 8.4. Middle East and Africa Off-Highway Electric Vehicle Market, by Battery Type (2021-2029) 8.5. Middle East and Africa Off-Highway Electric Vehicle Market, by Country (2021-2029) • South Africa • GCC • Egypt • Nigeria • Rest Of ME&A 9. South America Off-Highway Electric Vehicle Market (2021-2029) 9.1. South America Off-Highway Electric Vehicle Market, by Electric Vehicle (2021-2029) 9.2. South America Off-Highway Electric Vehicle Market, by Application (2021-2029) 9.3. South America Off-Highway Electric Vehicle Market, by Energy Storage Capacity (2021-2029) 9.4. South America Off-Highway Electric Vehicle Market, by Battery Type (2021-2029) 9.5. South America Off-Highway Electric Vehicle Market, by Country (2021-2029) • Brazil • Argentina • Rest Of South America 10. Company Profile: Key players 10.1 DEERE & COMPANY 10.1.1. Company Overview 10.1.2. Financial Overview 10.1.3. Global Presence 10.1.4. Capacity Portfolio 10.1.5. Business Strategy 10.1.6. Recent Developments 10.2 Epiroc AB 10.3 Hitachi Construction Machinery 10.4 Hyundai Doosan Infracore Co. Ltd. 10.5 Komatsu Ltd. 10.6 AB Volvo 10.7 Anhui Heli Co., Ltd. 10.8 Cargotec corporation 10.9 Caterpillar 10.10 Clark 10.11 J C Bamford Excavators Ltd. 10.12 CNH Industrial N.V. 10.13 LIEBHERR-International Deutschland GmbH 10.14 Narrow Isle inc. 10.15 Sandvik AB 10.16 SANY Group 10.17 Toyota Motor Corporation 10.18 Volvo Construction Equipment AB 10.19 Doosan Corporation