Global Nutrition Product Market size was valued at USD 402.51 Billion in 2023 and the total Global Nutrition Product revenue is expected to grow at 6.4 % from 2024 to 2030, reaching nearly USD 621.4 Billion in 2030. Nutrition Product, also known as dietary supplements, are products intended to supplement the diet and provide nutrients that may be missing or not consumed in sufficient quantities in a person's diet. They can include vitamins, minerals, amino acids, fatty acids, and other substances. Nutrition Product can take various forms, including food items, beverages, supplements, or functional foods.To know about the Research Methodology :- Request Free Sample Report The Nutrition Product market is rapidly growing industry that includes a wide range of products designed to promote health and wellness. The Nutrition Product market includes products such as vitamins, minerals, supplements, functional foods, sports Nutrition Product, and weight management products. With an increasing awareness and focus on health, companies innovation and customize Nutrition Product to address specific health concerns, such development drives the market. Followed by North America and Asia Pacific, Europe is expected to grow with the largest share of the Nutrition Product market. Europe Nutrition Product Market is estimated at USD 73.08 billion in 2023. The Digestive Supplements segment accounted for the largest revenue share of 55.4% in 2023. Some of the key players in the European nutrition Product market include Nature's Sunshine Products Inc., Evonik Industries AG, Naturex SA, Etc. due to the increasing health consciousness among consumers and the aging population. The major markets in this region are the United Kingdom, Germany, France, and Italy, with a high demand for vitamins, minerals, and dietary supplements. The report shows descriptive data and pictographs on regional as well as global Nutrition Product market analysis. The report adds to the Nutrition Product Market objectives. It includes leading competitors and their market value with their current trending skims, strategies, targets, and products. The report shed light on the Nutrition Product market's recent growth as well as its informative past.

Nutrition Product Market Dynamics:

Aging Population and Nutritional Need Growing Nutrition Product Market The aging demographic highlights a growing demand for nutritional solutions that simplify health issues like osteoporosis, cognitive decline, and cardiovascular diseases. Age-related concerns require the provision of Nutrition Product fortified with vitamins and protein supplements to support physical health, preventing conditions such as Osteoarthritis and Rheumatoid Arthritis, and aiding in arthritis treatment. Shift in lifestyle increased inactive habits and the consumption of processed foods have propelled the prevalence of chronic diseases like obesity and type 2 diabetes. 57.6% of adults and 34.0% of children and adolescents used dietary supplements in 2023. Consequently, individuals pursue health-enhancing products, such as protein bars and shakes, to optimize overall well-being and proactively combat the onset of chronic ailments. This evolving landscape reflects a heightened awareness and proactive approach toward nutritional choices to promote a healthier lifestyle amidst changing societal habits. Increasing demand for plant-based products drives the Nutrition Product Market The growing plant-based food market significantly influences the overall Nutrition Product landscape, reflecting the increasing consumer preference for plant-based alternatives. Forecasts show substantial growth in the plant-based food market, with an expected CAGR ranging from 11.2% to 12.2% between 2024 and 2030, potentially reaching a market value of USD 34.5 billion to USD 92.52 billion by 2030. The increasing vegan demographic, and heightened venture investments in plant-based food enterprises. In the United States, the retail market for plant-based foods has already reached USD 8 billion, with a significant 60% of plant-based food purchases in 2023. The growing accessibility of plant-based options, coupled with changes in the food industry and heightened consumer interest in health and sustainability, is propelling the adoption of plant-based foods. Costly food prices for nutritional products High-quality Nutrition Product can be expensive, hence it limits access to a wider audience. Nearly 3 billion people cannot afford a healthy diet due to the high prices of food and drugs of nutritional products. In 2023 the global average daily cost of a healthy diet in current purchasing power parties was USD 3.54. In low-income countries, the average cost was USD 3.20, while in high-income countries it was slightly higher at USD 3.35. The highest cost was observed in upper-middle-income countries, where a healthy diet cost USD 3.76, while in lower-middle-income countries the average was slightly less at USD 3.70.Nutrition Product Market Segment Analysis:

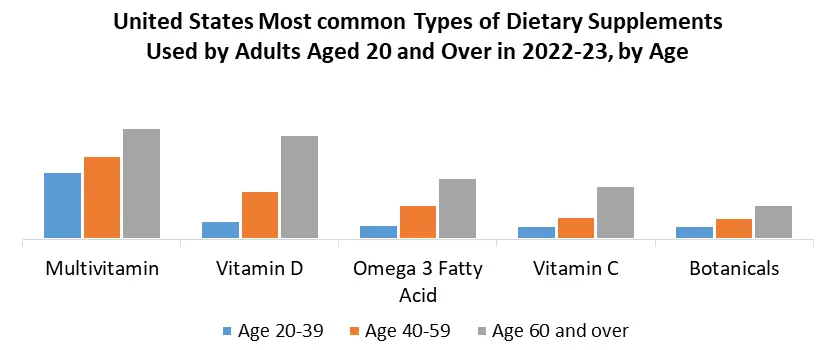

By Type, The global dietary supplements market is estimated at USD 170 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 8% from 2023 to 2030 in the Nutrition Product Market. The dietary supplements market is driven by factors such as increasing health awareness, the aging population, and the growing demand for immunity boosters and personalized dietary supplements. The United States leads the global dietary supplements market, with the soft gel and capsule segment having a significant share of the market in 2023. These include vitamins, minerals, fiber, fatty acids, and amino acids, and are available in various forms such as tablets, capsules, softgels, gelcaps, powders, and liquids. The dietary supplements, in the Nutrition Product Market, are highly competitive, with key players like Amway Abbott Bayer AGG lanbia Plc. Pfizer Inc. Archer Daniels Midland focuses on product innovation and strategic partnerships to gain a competitive advantage. The global digestive health supplements market is driven by the rising occurrence of chronic digestive disorders, increasing consumer awareness of health, and the growing demand for digestive health supplements. The global digestive health products market size was valued at USD 51.62 billion in 2023 and is expected to grow at a CAGR of 8.3% from 2024 to 2030 and The United States digestive supplements market is also poised to grow at a CAGR of 7.02%.By Age group, with an aging population, there is a greater need for Nutrition Product Market that support healthy aging and help prevent age-related health conditions such as osteoporosis, cognitive decline, and cardiovascular disease. As concerns with the age factor, there is a need for nutritional supply to the bone and muscles with the help of vitamins and protein supplements that prevent Osteoarthritis, Rheumatoid Arthritis, and treatment for Arthritis. Changes in lifestyle, including increased sedentary behavior and consumption of processed foods, have contributed to the rise of chronic diseases such as obesity and type 2 diabetes. As a result, people are looking for products that can help them improve their overall health and prevent chronic diseases such as protein bars, shakes, etc.

Nutrition Product Market Regional Insights:

North America Holds a Significant Revenue Share in the Nutrition Product Market North America Nutrition Product Market size was valued at USD 285.58 Billion in 2023 and the total Nutrition Product revenue is expected to grow at 10.9% %. Amway is a significant player in the North American dietary supplements market, along with other major companies such as Abbott, Glanbia Plc., Bayer AG, NOW Foods, and Herbalife Nutrition. The Asia-Pacific sports nutrition market is growing by USD 109.13 billion in 2023, at a CAGR of 6.64%. Major companies effective in the Nutrition Product market include The Coca-Cola Company, PepsiCo, Inc., and Glanbia plc. Herbalife International of America, Inc., and Otsuka Pharmaceutical Co. Ltd. Rapid rate of the growing middle class and increasing health consciousness among consumers and China, Japan, and India are the major regions in Nutrition Product markets. Competitive Landscapes: 1. Nestlé has introduced the first Kit Kat made with cocoa from January 2024 Nestlé's income accelerator program has so far supported more than 10,000 families in Côte d'Ivoire and is expanding to Ghana this year to include a total of 30,000 families. By 2030, the program aims to reach an estimated 160,000 cocoa-farming families in Nestlé's global cocoa supply chain to create an impact at scale. 2. Amway Company recently launched XS Sports Nutrition, a line of sports Nutrition Product that includes pre-workout drinks, protein bars, and energy drinks. Amway also acquired XS Energy, a California-based energy drink company. 3. GNC Company recently launched its GNC4U personalized nutrition program, which offers customized supplement recommendations based on an individual's DNA and lifestyle factors. GNC has also entered into a partnership with Harbin Pharmaceutical Group, a USD 300 Million Strategic Investment and China Joint Venture with a leading Chinese pharmaceutical company, to expand its presence in China. 4. Abbott Laboratories recently launched Pedialyte Electrolyte Water with Immune Support, a new product designed to help support the immune system. Abbott also acquired FitPay, a digital payment platform, to expand its presence in the mobile payment space. Abbott acquired JETi, and Cephea Valve Technologies medical device company developing a less-invasive heart valve replacement Distribution Channel for people with mitral valve disease.Nutrition Product Market Scope: Inquire before buying

Global Nutrition Product Market Report Coverage Details Base Year: 2023 Forecast Period: 2024-2030 Historical Data: 2018 to 2023 Market Size in 2023: US $ 402.51 Bn. Forecast Period 2024 to 2030 CAGR: 6.4% Market Size in 2030: US $ 621.4 Bn. Segments Covered: by Age Group Age 20-39 Age 40-59 Age 60 and above by Type Dietary Supplements Meal Replacement Products Medical Foods Plant-Based Products Others (Digestive Supplements, Active Measurement Products, Etc.) by Lifestyle Vegans/Vegetarians Active Lifestyle Busy Lifestyle by Ingredients Organic Synthetic Herbal supplements by Distribution Channel Supermarkets/hypermarkets Online stores Health food stores Direct sales Nutrition Products Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria, Turkey, Russia and Rest of Europe) Asia Pacific (China, India, Japan, South Korea, Australia, ASEAN and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina, Columbia and Rest of South America)Nutrition Product Market Key Players:

North America Nutrition Product Market Key Players 1. Herbalife International 2. Omega Protein Corporation 3. Archer Daniels Midland 4. Amway 5. United Naturals Food, Inc. 6. Nutraceutical International Corporation 7. Nestle 8. Mead Johnson&Company,LLC 9. Abbott 10. Synutra International Inc. Europe Nutrition Product Market Key Players 1. Evonik Industries AG 2. Naturex SA Asia Pacific Nutrition Product Market Key Players 1. Blackmores 2. Feihe 3. Yili 4. Mengniu 5. Biostime 6. Beingmate 7. Wondersun 8. Wissun 9. Shijiazhuang Junlebao Dairy Co., Ltd. FAQs: 1. What are the growth drivers for the market? Ans. Aging population and nutritional need, Increasing demand for plant-based products are expected to be the major drivers for the Nutrition Product market. 2. Which region is expected to lead the global Nutrition Product Market during the forecast period? Ans. North America is expected to lead the global Nutrition Product Market during the forecast period. 3. What is the projected market size and growth rate of the Nutrition Product Market? Ans. The Nutrition Product Market size was valued at USD 402.51 Billion in 2023 and the total Nutrition Product revenue is expected to grow at a CAGR of 6.4% from 2024 to 2030, reaching nearly USD 621.4 Billion by 2030. 4. What segments are covered in the Nutrition Product Market report? Ans. The segments covered in the Nutrition Product Market report are by Age Group, Type, Lifestyle, Ingredients, Distribution Channel, and Region. 5. What is the study period of the Nutrition Product Market? Ans: The Global Nutrition Product Market is studied from 2023 to 2030.

1. Nutrition Product Market Introduction 1.1. Study Assumption and Market Definition 1.2. Scope of the Study 1.3. Executive Summary 2. Nutrition Product Market: Dynamics 2.1. Nutrition Product Market Trends by Region 2.1.1. North America Nutrition Product Market Trends 2.1.2. Europe Nutrition Product Market Trends 2.1.3. Asia Pacific Nutrition Product Market Trends 2.1.4. Middle East and Africa Nutrition Product Market Trends 2.1.5. South America Nutrition Product Market Trends 2.2. Nutrition Product Market Dynamics by Region 2.2.1. North America 2.2.1.1. North America Nutrition Product Market Drivers 2.2.1.2. North America Nutrition Product Market Restraints 2.2.1.3. North America Nutrition Product Market Opportunities 2.2.1.4. North America Nutrition Product Market Challenges 2.2.2. Europe 2.2.2.1. Europe Nutrition Product Market Drivers 2.2.2.2. Europe Nutrition Product Market Restraints 2.2.2.3. Europe Nutrition Product Market Opportunities 2.2.2.4. Europe Nutrition Product Market Challenges 2.2.3. Asia Pacific 2.2.3.1. Asia Pacific Nutrition Product Market Drivers 2.2.3.2. Asia Pacific Nutrition Product Market Restraints 2.2.3.3. Asia Pacific Nutrition Product Market Opportunities 2.2.3.4. Asia Pacific Nutrition Product Market Challenges 2.2.4. Middle East and Africa 2.2.4.1. Middle East and Africa Nutrition Product Market Drivers 2.2.4.2. Middle East and Africa Nutrition Product Market Restraints 2.2.4.3. Middle East and Africa Nutrition Product Market Opportunities 2.2.4.4. Middle East and Africa Nutrition Product Market Challenges 2.2.5. South America 2.2.5.1. South America Nutrition Product Market Drivers 2.2.5.2. South America Nutrition Product Market Restraints 2.2.5.3. South America Nutrition Product Market Opportunities 2.2.5.4. South America Nutrition Product Market Challenges 2.3. PORTER’s Five Forces Analysis 2.4. PESTLE Analysis 2.5. Technology Roadmap 2.6. Regulatory Landscape by Region 2.6.1. North America 2.6.2. Europe 2.6.3. Asia Pacific 2.6.4. Middle East and Africa 2.6.5. South America 2.7. Key Opinion Leader Analysis For Nutrition Product Industry 2.8. Analysis of Government Schemes and Initiatives For Nutrition Product Industry 2.9. Nutrition Product Market Trade Analysis 2.10. The Global Pandemic Impact on Nutrition Product Market 3. Nutrition Product Market: Global Market Size and Forecast by Segmentation by Demand and Supply Side (by Value in USD Million) 2023-2030 3.1. Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 3.1.1. Age 20-39 3.1.2. Age 40-59 3.1.3. Age 60 and above 3.2. Nutrition Product Market Size and Forecast, by Type (2023-2030) 3.2.1. Dietary Supplements 3.2.2. Meal Replacement Products 3.2.3. Medical Foods 3.2.4. Plant-Based Products 3.2.5. Others (Digestive Supplements, Active Measurement Products, Etc.) 3.3. Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 3.3.1. Vegans/Vegetarians 3.3.2. Active Lifestyle 3.3.3. Busy Lifestyle 3.4. Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 3.4.1. Organic 3.4.2. Synthetic 3.4.3. Herbal supplements 3.5. Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 3.5.1. Supermarkets/hypermarkets 3.5.2. Online stores 3.5.3. Health food stores 3.5.4. Direct sales 3.6. Nutrition Product Market Size and Forecast, by Region (2023-2030) 3.6.1. North America 3.6.2. Europe 3.6.3. Asia Pacific 3.6.4. Middle East and Africa 3.6.5. South America 4. North America Nutrition Product Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 4.1. North America Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 4.1.1. Age 20-39 4.1.2. Age 40-59 4.1.3. Age 60 and above 4.2. North America Nutrition Product Market Size and Forecast, by Type (2023-2030) 4.2.1. Dietary Supplements 4.2.2. Meal Replacement Products 4.2.3. Medical Foods 4.2.4. Plant-Based Products 4.2.5. Others (Digestive Supplements, Active Measurement Products, Etc.) 4.3. North America Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 4.3.1. Vegans/Vegetarians 4.3.2. Active Lifestyle 4.3.3. Busy Lifestyle 4.4. North America Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 4.4.1. Organic 4.4.2. Synthetic 4.4.3. Herbal supplements 4.5. North America Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 4.5.1. Supermarkets/hypermarkets 4.5.2. Online stores 4.5.3. Health food stores 4.5.4. Direct sales 4.6. North America Nutrition Product Market Size and Forecast, by Country (2023-2030) 4.6.1. United States 4.6.1.1. United States Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 4.6.1.1.1. Age 20-39 4.6.1.1.2. Age 40-59 4.6.1.1.3. Age 60 and above 4.6.1.2. United States Nutrition Product Market Size and Forecast, by Type (2023-2030) 4.6.1.2.1. Dietary Supplements 4.6.1.2.2. Meal Replacement Products 4.6.1.2.3. Medical Foods 4.6.1.2.4. Plant-Based Products 4.6.1.2.5. Others (Digestive Supplements, Active Measurement Products, Etc.) 4.6.1.3. United States Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 4.6.1.3.1. Vegans/Vegetarians 4.6.1.3.2. Active Lifestyle 4.6.1.3.3. Busy Lifestyle 4.6.1.4. United States Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 4.6.1.4.1. Organic 4.6.1.4.2. Synthetic 4.6.1.4.3. Herbal supplements 4.6.1.5. United States Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 4.6.1.5.1. Supermarkets/hypermarkets 4.6.1.5.2. Online stores 4.6.1.5.3. Health food stores 4.6.1.5.4. Direct sales 4.6.2. Canada 4.6.2.1. Canada Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 4.6.2.1.1. Age 20-39 4.6.2.1.2. Age 40-59 4.6.2.1.3. Age 60 and above 4.6.2.2. Canada Nutrition Product Market Size and Forecast, by Type (2023-2030) 4.6.2.2.1. Dietary Supplements 4.6.2.2.2. Meal Replacement Products 4.6.2.2.3. Medical Foods 4.6.2.2.4. Plant-Based Products 4.6.2.2.5. Others (Digestive Supplements, Active Measurement Products, Etc.) 4.6.2.3. Canada Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 4.6.2.3.1. Vegans/Vegetarians 4.6.2.3.2. Active Lifestyle 4.6.2.3.3. Busy Lifestyle 4.6.2.4. Canada Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 4.6.2.4.1. Organic 4.6.2.4.2. Synthetic 4.6.2.4.3. Herbal supplements 4.6.2.5. Canada Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 4.6.2.5.1. Supermarkets/hypermarkets 4.6.2.5.2. Online stores 4.6.2.5.3. Health food stores 4.6.2.5.4. Direct sales 4.6.3. Mexico 4.6.3.1. Mexico Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 4.6.3.1.1. Age 20-39 4.6.3.1.2. Age 40-59 4.6.3.1.3. Age 60 and above 4.6.3.2. Mexico Nutrition Product Market Size and Forecast, by Type (2023-2030) 4.6.3.2.1. Dietary Supplements 4.6.3.2.2. Meal Replacement Products 4.6.3.2.3. Medical Foods 4.6.3.2.4. Plant-Based Products 4.6.3.2.5. Others (Digestive Supplements, Active Measurement Products, Etc.) 4.6.3.3. Mexico Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 4.6.3.3.1. Vegans/Vegetarians 4.6.3.3.2. Active Lifestyle 4.6.3.3.3. Busy Lifestyle 4.6.3.4. Mexico Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 4.6.3.4.1. Organic 4.6.3.4.2. Synthetic 4.6.3.4.3. Herbal supplements 4.6.3.5. Mexico Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 4.6.3.5.1. Supermarkets/hypermarkets 4.6.3.5.2. Online stores 4.6.3.5.3. Health food stores 4.6.3.5.4. Direct sales 5. Europe Nutrition Product Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 5.1. Europe Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 5.2. Europe Nutrition Product Market Size and Forecast, by Type (2023-2030) 5.3. Europe Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 5.4. Europe Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 5.5. Europe Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.6. Europe Nutrition Product Market Size and Forecast, by Country (2023-2030) 5.6.1. United Kingdom 5.6.1.1. United Kingdom Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 5.6.1.2. United Kingdom Nutrition Product Market Size and Forecast, by Type (2023-2030) 5.6.1.3. United Kingdom Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 5.6.1.4. United Kingdom Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 5.6.1.5. United Kingdom Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.2. France 5.6.2.1. France Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 5.6.2.2. France Nutrition Product Market Size and Forecast, by Type (2023-2030) 5.6.2.3. France Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 5.6.2.4. France Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 5.6.2.5. France Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.3. Germany 5.6.3.1. Germany Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 5.6.3.2. Germany Nutrition Product Market Size and Forecast, by Type (2023-2030) 5.6.3.3. Germany Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 5.6.3.4. Germany Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 5.6.3.5. Germany Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.4. Italy 5.6.4.1. Italy Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 5.6.4.2. Italy Nutrition Product Market Size and Forecast, by Type (2023-2030) 5.6.4.3. Italy Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 5.6.4.4. Italy Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 5.6.4.5. Italy Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.5. Spain 5.6.5.1. Spain Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 5.6.5.2. Spain Nutrition Product Market Size and Forecast, by Type (2023-2030) 5.6.5.3. Spain Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 5.6.5.4. Spain Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 5.6.5.5. Spain Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.6. Sweden 5.6.6.1. Sweden Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 5.6.6.2. Sweden Nutrition Product Market Size and Forecast, by Type (2023-2030) 5.6.6.3. Sweden Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 5.6.6.4. Sweden Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 5.6.6.5. Sweden Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.7. Austria 5.6.7.1. Austria Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 5.6.7.2. Austria Nutrition Product Market Size and Forecast, by Type (2023-2030) 5.6.7.3. Austria Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 5.6.7.4. Austria Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 5.6.7.5. Austria Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 5.6.8. Rest of Europe 5.6.8.1. Rest of Europe Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 5.6.8.2. Rest of Europe Nutrition Product Market Size and Forecast, by Type (2023-2030) 5.6.8.3. Rest of Europe Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 5.6.8.4. Rest of Europe Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 5.6.8.5. Rest of Europe Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 6. Asia Pacific Nutrition Product Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 6.1. Asia Pacific Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 6.2. Asia Pacific Nutrition Product Market Size and Forecast, by Type (2023-2030) 6.3. Asia Pacific Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 6.4. Asia Pacific Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 6.5. Asia Pacific Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.6. Asia Pacific Nutrition Product Market Size and Forecast, by Country (2023-2030) 6.6.1. China 6.6.1.1. China Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 6.6.1.2. China Nutrition Product Market Size and Forecast, by Type (2023-2030) 6.6.1.3. China Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 6.6.1.4. China Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 6.6.1.5. China Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.2. S Korea 6.6.2.1. S Korea Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 6.6.2.2. S Korea Nutrition Product Market Size and Forecast, by Type (2023-2030) 6.6.2.3. S Korea Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 6.6.2.4. S Korea Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 6.6.2.5. S Korea Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.3. Japan 6.6.3.1. Japan Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 6.6.3.2. Japan Nutrition Product Market Size and Forecast, by Type (2023-2030) 6.6.3.3. Japan Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 6.6.3.4. Japan Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 6.6.3.5. Japan Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.4. India 6.6.4.1. India Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 6.6.4.2. India Nutrition Product Market Size and Forecast, by Type (2023-2030) 6.6.4.3. India Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 6.6.4.4. India Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 6.6.4.5. India Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.5. Australia 6.6.5.1. Australia Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 6.6.5.2. Australia Nutrition Product Market Size and Forecast, by Type (2023-2030) 6.6.5.3. Australia Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 6.6.5.4. Australia Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 6.6.5.5. Australia Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.6. Indonesia 6.6.6.1. Indonesia Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 6.6.6.2. Indonesia Nutrition Product Market Size and Forecast, by Type (2023-2030) 6.6.6.3. Indonesia Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 6.6.6.4. Indonesia Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 6.6.6.5. Indonesia Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.7. Malaysia 6.6.7.1. Malaysia Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 6.6.7.2. Malaysia Nutrition Product Market Size and Forecast, by Type (2023-2030) 6.6.7.3. Malaysia Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 6.6.7.4. Malaysia Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 6.6.7.5. Malaysia Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.8. Vietnam 6.6.8.1. Vietnam Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 6.6.8.2. Vietnam Nutrition Product Market Size and Forecast, by Type (2023-2030) 6.6.8.3. Vietnam Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 6.6.8.4. Vietnam Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 6.6.8.5. Vietnam Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.9. Taiwan 6.6.9.1. Taiwan Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 6.6.9.2. Taiwan Nutrition Product Market Size and Forecast, by Type (2023-2030) 6.6.9.3. Taiwan Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 6.6.9.4. Taiwan Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 6.6.9.5. Taiwan Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 6.6.10. Rest of Asia Pacific 6.6.10.1. Rest of Asia Pacific Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 6.6.10.2. Rest of Asia Pacific Nutrition Product Market Size and Forecast, by Type (2023-2030) 6.6.10.3. Rest of Asia Pacific Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 6.6.10.4. Rest of Asia Pacific Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 6.6.10.5. Rest of Asia Pacific Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 7. Middle East and Africa Nutrition Product Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 7.1. Middle East and Africa Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 7.2. Middle East and Africa Nutrition Product Market Size and Forecast, by Type (2023-2030) 7.3. Middle East and Africa Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 7.4. Middle East and Africa Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 7.5. Middle East and Africa Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 7.6. Middle East and Africa Nutrition Product Market Size and Forecast, by Country (2023-2030) 7.6.1. South Africa 7.6.1.1. South Africa Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 7.6.1.2. South Africa Nutrition Product Market Size and Forecast, by Type (2023-2030) 7.6.1.3. South Africa Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 7.6.1.4. South Africa Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 7.6.1.5. South Africa Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.2. GCC 7.6.2.1. GCC Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 7.6.2.2. GCC Nutrition Product Market Size and Forecast, by Type (2023-2030) 7.6.2.3. GCC Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 7.6.2.4. GCC Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 7.6.2.5. GCC Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.3. Nigeria 7.6.3.1. Nigeria Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 7.6.3.2. Nigeria Nutrition Product Market Size and Forecast, by Type (2023-2030) 7.6.3.3. Nigeria Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 7.6.3.4. Nigeria Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 7.6.3.5. Nigeria Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 7.6.4. Rest of ME&A 7.6.4.1. Rest of ME&A Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 7.6.4.2. Rest of ME&A Nutrition Product Market Size and Forecast, by Type (2023-2030) 7.6.4.3. Rest of ME&A Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 7.6.4.4. Rest of ME&A Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 7.6.4.5. Rest of ME&A Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 8. South America Nutrition Product Market Size and Forecast by Segmentation (by Value in USD Million) 2023-2030 8.1. South America Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 8.2. South America Nutrition Product Market Size and Forecast, by Type (2023-2030) 8.3. South America Nutrition Product Market Size and Forecast, by Lifestyle(2023-2030) 8.4. South America Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 8.5. South America Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 8.6. South America Nutrition Product Market Size and Forecast, by Country (2023-2030) 8.6.1. Brazil 8.6.1.1. Brazil Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 8.6.1.2. Brazil Nutrition Product Market Size and Forecast, by Type (2023-2030) 8.6.1.3. Brazil Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 8.6.1.4. Brazil Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 8.6.1.5. Brazil Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.2. Argentina 8.6.2.1. Argentina Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 8.6.2.2. Argentina Nutrition Product Market Size and Forecast, by Type (2023-2030) 8.6.2.3. Argentina Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 8.6.2.4. Argentina Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 8.6.2.5. Argentina Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 8.6.3. Rest Of South America 8.6.3.1. Rest Of South America Nutrition Product Market Size and Forecast, by Age Group (2023-2030) 8.6.3.2. Rest Of South America Nutrition Product Market Size and Forecast, by Type (2023-2030) 8.6.3.3. Rest Of South America Nutrition Product Market Size and Forecast, by Lifestyle (2023-2030) 8.6.3.4. Rest Of South America Nutrition Product Market Size and Forecast, by Ingredients (2023-2030) 8.6.3.5. Rest Of South America Nutrition Product Market Size and Forecast, by Distribution Channel (2023-2030) 9. Global Nutrition Product Market: Competitive Landscape 9.1. MMR Competition Matrix 9.2. Competitive Landscape 9.3. Key Players Benchmarking 9.3.1. Company Name 9.3.2. Business Segment 9.3.3. End-user Segment 9.3.4. Revenue (2022) 9.3.5. Company Locations 9.4. Leading Nutrition Product Market Companies, by market capitalization 9.5. Market Structure 9.5.1. Market Leaders 9.5.2. Market Followers 9.5.3. Emerging Players 9.6. Mergers and Acquisitions Details 10. Company Profile: Key Players 10.1. Herbalife International 10.1.1. Company Overview 10.1.2. Business Portfolio 10.1.3. Financial Overview 10.1.4. SWOT Analysis 10.1.5. Strategic Analysis 10.1.6. Scale of Operation (small, medium, and large) 10.1.7. Details on Partnership 10.1.8. Regulatory Accreditations and Certifications Received by Them 10.1.9. Awards Received by the Firm 10.1.10. Recent Developments 10.2. Omega Protein Corporation 10.3. Archer Daniels Midland 10.4. Amway 10.5. United Naturals Food, Inc. 10.6. Nutraceutical International Corporation 10.7. Nestle 10.8. Mead Johnson&Company,LLC 10.9. Abbott 10.10. Synutra International Inc. 10.11. Evonik Industries AG 10.12. Naturex SA 10.13. Blackmores 10.14. Feihe 10.15. Yili 10.16. Mengniu 10.17. Biostime 10.18. Beingmate 10.19. Wondersun 10.20. Wissun 10.21. Shijiazhuang Junlebao Dairy Co., Ltd. 11. Key Findings 12. Industry Recommendations 13. Nutrition Product Market: Research Methodology 14. Terms and Glossary