The Global Nut Oil Market was valued at US$ 5.84 billion in 2022 and is projected to reach US$ 8.13 billion by 2029, growing at a CAGR of 5.5% from 2023 to 2029.Nut Oil Market Overview and Scope

The nut oil industry includes production, distribution, and use of oils from different nuts. Nut oils are in demand in food, beverage, pharmaceutical, cosmetic, and personal care sectors. Market growth and innovation are driven by health-conscious consumers seeking natural ingredients and plant-based alternatives. The report analyses the global nut oil market, covering production, distribution, usage, and growth potential. The research covers nut cultivation, oil extraction, refining, and product development trends. For this market, the growth is driven by clean-label, natural ingredients and functional foods demand. Report features market forecasts, regional perspectives, and industry segmentation for detailed nut oil industry outlook. It also analyses R&D strategies, product portfolios, and collaborations of industry leaders. The detailed report assesses nut oil production methods and regulations. The full report explores sustainability practises in nut cultivation, including organic farming and eco-friendly packaging. Maximize’s analysis helps stakeholder make informed decisions in this dynamic market landscape. The research is aimed to aid organisations & professionals in profiting from nut oil market growth and overcoming the challenges by providing a comprehensive global outlook of the nut oil market, including trends, drivers, challenges, and opportunities. The report provides insights on market competition, consumer preferences, and emerging markets. This report serves as a valuable resource for industry players navigating the evolving nut oil industry with a focus on sustainability and innovation.To know about the Research Methodology :- Request Free Sample Report

Nut Oil Market Dynamics

Nut Oil Market Drivers: The global nut oil market is fueled by various factors that contribute to its strong growth. Growing demand for natural and healthy ingredients drives the food and beverage industry has a strong influence on the market growth. Nut oils are popular among manufacturers for their perceived health benefits and growing demand for plant-based alternatives. They are also popular for enhancing taste and nutritional value due to their distinctive flavours, nutritional profiles, and functional properties. Increasing awareness of nutritional content in nut oils drives market demand. Nut oils' versatility in culinary and cosmetic industries boosts their market appeal and growth prospects. Market Restraints: Despite the positive growth outlook, the global nut oil market faces certain restraints. One significant challenge is the availability and sourcing of high-quality nuts for oil production. The cultivation and availability of specific nuts required for extracting oil can be influenced by factors such as climate conditions, geographical limitations, and seasonal variations, leading to supply constraints. Additionally, variations in the composition and quality of nut oils based on nut varieties, harvesting practices, and processing techniques can pose challenges for ensuring consistent quality and standardization. Compliance with regulatory requirements and evolving food safety regulations related to nut oil production and labeling also add complexity and costs for market players. Opportunities in the Nut Oil Market: The nut oil market presents several opportunities for growth and innovation. The increasing demand for natural and healthy ingredients in the food and beverage industry creates opportunities for innovative product development using nut oils. Nut oils can be utilized as natural flavorings, cooking oils, and nutritional supplements, offering unique sensory experiences and health benefits. The rising popularity of natural and organic personal care products provides opportunities for nut oils in skincare and haircare applications. Collaborations with suppliers, farmers, and research institutions can foster innovation, improve production techniques, and expand market segments, enabling market players to capitalize on these opportunities. Challenges in the Nut Oil Market: The global nut oil market also faces certain challenges that need to be addressed for sustained growth. Ensuring consistent quality and standardization across different nut varieties can be challenging due to natural variations in the nuts and their oil composition. Investments in research and development are required to optimize extraction methods and processing techniques, ensuring consistent product performance. Educating consumers about the nutritional benefits and applications of nut oils is crucial, particularly in regions where awareness may be limited. Keeping up with evolving regulations and standards in different regions and ensuring compliance pose challenges for market players operating in the global nut oil market.Trends in the Global Nut Oil Market:

The global nut oil market is experiencing notable trends that are shaping its landscape. A prominent trend is the shift towards natural and clean-label products, where nut oils are being utilized as alternatives to synthetic oils and additives. Consumers are increasingly seeking products with natural and transparent ingredient lists, driving the demand for nut oils as cooking oils, salad dressings, and flavor enhancers. Nut oils are also gaining traction in the cosmetic and personal care industry, where they are valued for their moisturizing, nourishing, and antioxidant properties. Sustainability practices, such as responsible sourcing of nuts, organic certifications, and eco-friendly packaging solutions, are gaining importance as consumers prioritize environmental consciousness, influencing the decisions and strategies of market players.Global Nut Oil Market Segment Analysis

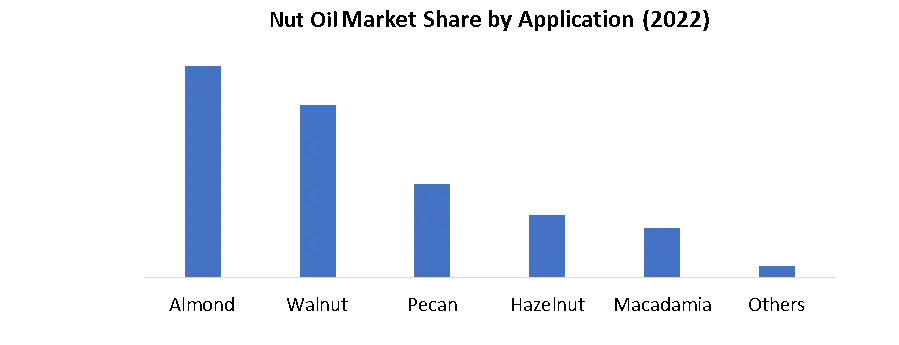

The global nut oil market is segmented based on nut type, application, extraction method, end-use industry, and region. Different types of nuts, including almond, walnut, pecan, hazelnut, macadamia, and others, offer distinct flavors and nutritional profiles, making them suitable for various applications in the food and beverage, cosmetics and personal care, pharmaceutical, and dietary supplement industries. Extraction methods such as cold-pressing, solvent extraction, and supercritical CO2 extraction are utilized to obtain nut oils, each influencing the quality and characteristics of the final product. The end-use industries for nut oils include food and beverages, where they are used as cooking oils and flavor enhancers, as well as cosmetics and personal care, where they find applications in skincare and haircare products. Regional variations in consumer preferences and regulations also play a significant role in the nut oil market, with different regions favoring specific nut types and applications. Overall, segment analysis provides valuable insights for market players to identify opportunities, tailor their strategies, and meet the specific needs of different market segments, facilitating their success in the global nut oil market.

Nut Oil Market Regional Analysis

The global nut oil market is analyzed by region, considering market trends and demand patterns in North America, Europe, Asia Pacific, South America, and the Middle East & Africa. Each region exhibits unique characteristics and market dynamics that influence the consumption and growth potential of nut oils. North American consumers prefer natural and healthy ingredients, leading to increased demand for nut oils in food, beverage, cosmetics, and personal care industries. Nut oils are popular for their unique taste, health benefits, and use in beauty products. Europe's demand for nut oils is increasing due to the rising use of natural and botanical ingredients in Germany, the UK, France, and Italy. This trend is driven by the food, cosmetics, and pharmaceutical sectors. Nut oils are popular in Europe due to their nutritional content and sensory attributes. Asia Pacific leads the nut oil industry due to cultural heritage and traditional medicine practises. Nut oils are essential components in traditional medicine formulations in China, India, and Japan. Growing population, rising income levels, and increasing health-consciousness drive demand for nut oils in pharmaceuticals, cosmetics, and food industries in the region. South America, specifically Brazil, Argentina, and Chile, offer potential for nut oils in the beauty and personal care sector. Consumers in the region prefer natural and organic ingredients, resulting in increased demand for nut oils in skincare products. Functional foods and dietary supplements drive nut oil growth in South America. Middle East and Africa region prefers natural and herbal products. Nut oils are used in cosmetics, personal care, and traditional medicine due to the demand for natural and organic products. MEA's nut oil market is driven by holistic well-being and natural ingredient benefits. The full report has detailed analysis on market trends which helps stakeholders understand consumer preferences, guide product offerings, and find growth opportunities. Regional variations inform market strategies and meet specific demands, fostering success globally.Nut Oil Market Competitive Analysis

The global nut oil market is highly competitive as the demand for natural and healthy ingredients continues to rise across industries. Leading nut oil companies cater to diverse sectors such as food and beverages, cosmetics and personal care, pharmaceuticals, and dietary supplements with a wide range of product offerings. Maintaining competitiveness in this market requires continuous innovation and investment in research and development. Companies strive to improve extraction methods, enhance the quality and purity of nut oils, and explore new applications to meet evolving consumer needs.Innovation is crucial in the nut oil industry, with companies developing advanced extraction technologies to ensure efficient extraction of oils while preserving their beneficial properties for various industries. Collaborations and alliances are essential strategies employed by nut oil companies to expand their market reach and achieve synergies. Partnerships between manufacturers, suppliers, and end-use industries can enhance distribution capabilities, increase visibility, and penetrate new markets. Additionally, mergers and acquisitions are common in the market, allowing companies to consolidate their market position, access new technologies, and gain a broader customer base. To meet the growing demand for healthier products, nut oil companies focus on creating natural and clean-label formulations with minimal additives and preservatives. The market is driven by consumers' preference for nut oil products with functional properties such as antioxidants, anti-inflammatory benefits, and nutritional value. As sustainability becomes increasingly important, companies are implementing sustainable practices in their supply chains. This includes sourcing nuts from environmentally responsible and ethically conscious suppliers, utilizing sustainable packaging materials, and obtaining fair trade certifications. Entering the nut oil market can pose regulatory and quality challenges for new companies. Compliance with product quality standards, accurate labeling, and safety certifications are essential for building consumer trust. Quality control, rigorous certifications, and laboratory testing are crucial for regulatory compliance and gaining a competitive edge. Technological advancements play a significant role in the competition within the market. Companies that leverage advanced extraction techniques, automation in production processes, and data-driven analytics gain efficiency, improve product quality, and achieve competitive pricing. Personalized digital marketing strategies can also help companies differentiate their nut oil products and cultivate brand loyalty among consumers. Competitive analysis of the nut oil industry encompasses evaluating competition, understanding key players, tracking market trends, assessing technological advancements, and identifying growth opportunities. Such analysis enables organizations to comprehend market dynamics, evaluate their competitive position, and develop winning strategies in the global market.

Nut Oil Market Scope: Inquire before buying

Nut Oil Market Report Coverage Details Base Year: 2022 Forecast Period: 2023-2029 Historical Data: 2017 to 2022 Market Size in 2022: US $ 5.84 Bn. Forecast Period 2023 to 2029 CAGR: 5.5% Market Size in 2029: US $ 8.13 Bn. Segments Covered: by Nut Type Almond Walnut Pecan Hazelnut Macadamia Others by Application Food and Beverage Cosmetics and Personal Care Pharmaceutical Dietary Supplement by Extraction Method Cold-Pressing Solvent Extraction Supercritical Co2 Extraction Nut Oil Market, by Region

North America (United States, Canada and Mexico) Europe (UK, France, Germany, Italy, Spain, Sweden, Austria and Rest of Europe) Asia Pacific (China, South Korea, Japan, India, Australia, Indonesia, Malaysia, Vietnam, Taiwan, Bangladesh, Pakistan and Rest of APAC) Middle East and Africa (South Africa, GCC, Egypt, Nigeria and Rest of ME&A) South America (Brazil, Argentina Rest of South America)Nut Oil Market Key Players

The captured list of leading manufacturers of Nut Oil industry has been compiled after an analysis of multiple factors. It is not an exhaustive list based only on market share ranking. After a regional analysis, a competitive analysis and other such considerations, the company profiles were selected based on a variety of factors. The comprehensive report contains information on the position of each company in the market from local and global perspective. 1. Bunge Limited 2. Cargill Incorporated 3. Archer Daniels Midland Company 4. Wilmar International Limited 5. Associated British Foods PLC 6. Ventura Foods, LLC 7. Borges Mediterranean Group 8. Olam International Limited 9. ConAgra Foods, Inc. 10. ADM Specialty Oils 11. Golden Peanut & Tree Nuts 12. Kerry Group 13. The Hain Celestial Group, Inc. 14. Sunkist Growers, Inc. 15. Meridian Foods 16. Nutiva Inc. 17. Spectrum Naturals 18. NOW Foods 19. Nature's Way Products, Inc. 20. Frontier Natural Products Co-op 21. The Republic of Nuts 22. Nuts.com 23. Justin's 24. Blue Diamond Growers 25. California AlmondsFAQs

1. How big is the global nut oil market? Ans: The global market was valued at USD 5.84 billion in 2022. 2. What is the projected growth rate of the global nut oil market? Ans: The forecasted CAGR of the global market is 5.5%. 3. What are the different types of nut oils available in the market? Ans: The global market offers various types of nut oils, including almond oil, walnut oil, pecan oil, hazelnut oil, macadamia oil, and others. 4. Which industries are the major consumers of nut oils? Ans: Nut oils find application in various industries including food and beverage, cosmetics and personal care, pharmaceutical, and dietary supplement industries. 5. What are the key factors driving the growth of the global nut oil market? Ans: Growing demand for natural and healthy ingredients, rising consumer awareness of nut oil's nutritional benefits, and its versatile applications are driving the global market.

1. Nut Oil Market: Research Methodology 2. Nut Oil Market Introduction 2.1 Study Assumption and Market Definition 2.2 Scope of the Study 2.3 Executive Summary 3. Nut Oil Market: Dynamics 3.1 Nut Oil Market Trends by Region 3.1.1 Global Nut Oil Market Trends 3.1.2 North America Nut Oil Market Trends 3.1.3 Europe Nut Oil Market Trends 3.1.4 Asia Pacific Nut Oil Market Trends 3.1.5 Middle East and Africa Nut Oil Market Trends 3.1.6 South America Nut Oil Market Trends 3.2 Nut Oil Market Dynamics by Region 3.2.1 North America 3.2.1.1 North America Nut Oil Market Drivers 3.2.1.2 North America Nut Oil Market Restraints 3.2.1.3 North America Nut Oil Market Opportunities 3.2.1.4 North America Nut Oil Market Challenges 3.2.2 Europe 3.2.2.1 Europe Nut Oil Market Drivers 3.2.2.2 Europe Nut Oil Market Restraints 3.2.2.3 Europe Nut Oil Market Opportunities 3.2.2.4 Europe Nut Oil Market Challenges 3.2.3 Asia Pacific 3.2.3.1 Asia Pacific Nut Oil Market Market Drivers 3.2.3.2 Asia Pacific Nut Oil Market Restraints 3.2.3.3 Asia Pacific Nut Oil Market Opportunities 3.2.3.4 Asia Pacific Nut Oil Market Challenges 3.2.4 Middle East and Africa 3.2.4.1 Middle East and Africa Nut Oil Market Drivers 3.2.4.2 Middle East and Africa Nut Oil Market Restraints 3.2.4.3 Middle East and Africa Nut Oil Market Opportunities 3.2.4.4 Middle East and Africa Nut Oil Market Challenges 3.2.5 South America 3.2.5.1 South America Nut Oil Market Drivers 3.2.5.2 South America Nut Oil Market Restraints 3.2.5.3 South America Nut Oil Market Opportunities 3.2.5.4 South America Nut Oil Market Challenges 3.3 PORTER’s Five Forces Analysis 3.3.1 Bargaining Power Of Suppliers 3.3.2 Bargaining Power Of Buyers 3.3.3 Threat Of New Entrants 3.3.4 Threat Of Substitutes 3.3.5 Intensity Of Rivalry 3.4 PESTLE Analysis 3.5 Value Chain Analysis 3.6 Regulatory Landscape by Region 3.6.1 Global 3.6.2 North America 3.6.3 Europe 3.6.4 Asia Pacific 3.6.5 Middle East and Africa 3.6.6 South America 3.7 Analysis of Government Schemes and Initiatives For the By Nut Oil Industry 3.8 The Global Pandemic and Redefining of The By Nut Oil Industry Landscape 3.9 Price Trend Analysis 3.10 Technological Road Map 3.11 Global By Nut Oil Trade Analysis (2017-2022) 3.11.1 Global Import of By Nut Oil 3.11.2 Global Export of By Nut Oil 3.12 Global By Nut Oil Production Capacity Analysis 3.12.1 Chapter Overview 3.12.2 Key Assumptions and Methodology 3.12.3 By Nut Oil Manufacturers: Global Installed Capacity 3.12.4 Analysis by Size of Manufacturer 4. Global Nut Oil Market: Global Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 4.1 Global Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 4.1.1 Almond 4.1.2 Walnut 4.1.3 Pecan 4.1.4 Hazelnut 4.1.5 Macadamia 4.1.6 Others 4.2 Global Nut Oil Market Size and Forecast, by Application (2022-2029) 4.2.1 Food and Beverage 4.2.2 Cosmetics and Personal Care 4.2.3 Pharmaceutical 4.2.4 Dietary Supplement 4.3 Global Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 4.3.1 Cold-Pressing 4.3.2 Solvent Extraction 4.3.3 Supercritical Co2 Extraction 4.4 Global Nut Oil Market Size and Forecast, by Region (2022-2029) 4.4.1 North America 4.4.2 Europe 4.4.3 Asia Pacific 4.4.4 Middle East and Africa 4.4.5 South America 5. North America Nut Oil Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 5.1 North America Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 5.1.1 Almond 5.1.2 Walnut 5.1.3 Pecan 5.1.4 Hazelnut 5.1.5 Macadamia 5.1.6 Others 5.2 North America Nut Oil Market Size and Forecast, by Application (2022-2029) 5.2.1 Food and Beverage 5.2.2 Cosmetics and Personal Care 5.2.3 Pharmaceutical 5.2.4 Dietary Supplement 5.3 North America Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 5.3.1 Cold-Pressing 5.3.2 Solvent Extraction 5.3.3 Supercritical Co2 Extraction 5.4 North America Nut Oil Market Size and Forecast, by Country (2022-2029) 5.4.1 United States 5.4.1.1 United States Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 5.4.1.1.1 Almond 5.4.1.1.2 Walnut 5.4.1.1.3 Pecan 5.4.1.1.4 Hazelnut 5.4.1.1.5 Macadamia 5.4.1.1.6 Others 5.4.1.2 United States Nut Oil Market Size and Forecast, by Application (2022-2029) 5.4.1.2.1 Food and Beverage 5.4.1.2.2 Cosmetics and Personal Care 5.4.1.2.3 Pharmaceutical 5.4.1.2.4 Dietary Supplement 5.4.1.3 United States Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 5.4.1.3.1 Cold-Pressing 5.4.1.3.2 Solvent Extraction 5.4.1.3.3 Supercritical Co2 Extraction 5.4.2 Canada 5.4.2.1 Canada Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 5.4.2.1.1 Almond 5.4.2.1.2 Walnut 5.4.2.1.3 Pecan 5.4.2.1.4 Hazelnut 5.4.2.1.5 Macadamia 5.4.2.1.6 Others 5.4.2.2 Canada Nut Oil Market Size and Forecast, by Application (2022-2029) 5.4.2.2.1 Food and Beverage 5.4.2.2.2 Cosmetics and Personal Care 5.4.2.2.3 Pharmaceutical 5.4.2.2.4 Dietary Supplement 5.4.2.3 Canada Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 5.4.2.3.1 Cold-Pressing 5.4.2.3.2 Solvent Extraction 5.4.2.3.3 Supercritical Co2 Extraction 5.4.3 Mexico 5.4.3.1 Mexico Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 5.4.3.1.1 Almond 5.4.3.1.2 Walnut 5.4.3.1.3 Pecan 5.4.3.1.4 Hazelnut 5.4.3.1.5 Macadamia 5.4.3.1.6 Others 5.4.3.2 Mexico Nut Oil Market Size and Forecast, by Application (2022-2029) 5.4.3.2.1 Food and Beverage 5.4.3.2.2 Cosmetics and Personal Care 5.4.3.2.3 Pharmaceutical 5.4.3.2.4 Dietary Supplement 5.4.3.3 Mexico Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 5.4.3.3.1 Cold-Pressing 5.4.3.3.2 Solvent Extraction 5.4.3.3.3 Supercritical Co2 Extraction 6. Europe Nut Oil Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 6.1 Europe Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 6.2 Europe Nut Oil Market Size and Forecast, by Application (2022-2029) 6.3 Europe Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 6.4 Europe Nut Oil Market Size and Forecast, by Country (2022-2029) 6.4.1 United Kingdom 6.4.1.1 United Kingdom Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 6.4.1.2 United Kingdom Nut Oil Market Size and Forecast, by Application (2022-2029) 6.4.1.3 United Kingdom Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 6.4.2 France 6.4.2.1 France Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 6.4.2.2 France Nut Oil Market Size and Forecast, by Application (2022-2029) 6.4.2.3 France Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 6.4.3 Germany 6.4.3.1 Germany Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 6.4.3.2 Germany Nut Oil Market Size and Forecast, by Application (2022-2029) 6.4.3.3 Germany Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 6.4.4 Italy 6.4.4.1 Italy Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 6.4.4.2 Italy Nut Oil Market Size and Forecast, by Application (2022-2029) 6.4.4.3 Italy Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 6.4.5 Spain 6.4.5.1 Spain Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 6.4.5.2 Spain Nut Oil Market Size and Forecast, by Application (2022-2029) 6.4.5.3 Spain Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 6.4.6 Sweden 6.4.6.1 Sweden Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 6.4.6.2 Sweden Nut Oil Market Size and Forecast, by Application (2022-2029) 6.4.6.3 Sweden Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 6.4.7 Austria 6.4.7.1 Austria Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 6.4.7.2 Austria Nut Oil Market Size and Forecast, by Application (2022-2029) 6.4.7.3 Austria Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 6.4.8 Rest of Europe 6.4.8.1 Rest of Europe Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 6.4.8.2 Rest of Europe Nut Oil Market Size and Forecast, by Application (2022-2029). 6.4.8.3 Rest of Europe Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 7. Asia Pacific Nut Oil Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 7.1 Asia Pacific Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 7.2 Asia Pacific Nut Oil Market Size and Forecast, by Application (2022-2029) 7.3 Asia Pacific Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 7.4 Asia Pacific Nut Oil Market Size and Forecast, by Country (2022-2029) 7.4.1 China 7.4.1.1 China Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 7.4.1.2 China Nut Oil Market Size and Forecast, by Application (2022-2029) 7.4.1.3 China Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 7.4.2 South Korea 7.4.2.1 S Korea Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 7.4.2.2 S Korea Nut Oil Market Size and Forecast, by Application (2022-2029) 7.4.2.3 S Korea Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 7.4.3 Japan 7.4.3.1 Japan Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 7.4.3.2 Japan Nut Oil Market Size and Forecast, by Application (2022-2029) 7.4.3.3 Japan Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 7.4.4 India 7.4.4.1 India Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 7.4.4.2 India Nut Oil Market Size and Forecast, by Application (2022-2029) 7.4.4.3 India Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 7.4.5 Australia 7.4.5.1 Australia Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 7.4.5.2 Australia Nut Oil Market Size and Forecast, by Application (2022-2029) 7.4.5.3 Australia Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 7.4.6 Indonesia 7.4.6.1 Indonesia Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 7.4.6.2 Indonesia Nut Oil Market Size and Forecast, by Application (2022-2029) 7.4.6.3 Indonesia Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 7.4.7 Malaysia 7.4.7.1 Malaysia Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 7.4.7.2 Malaysia Nut Oil Market Size and Forecast, by Application (2022-2029) 7.4.7.3 Malaysia Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 7.4.8 Vietnam 7.4.8.1 Vietnam Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 7.4.8.2 Vietnam Nut Oil Market Size and Forecast, by Application (2022-2029) 7.4.8.3 Vietnam Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 7.4.9 Taiwan 7.4.9.1 Taiwan Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 7.4.9.2 Taiwan Nut Oil Market Size and Forecast, by Application (2022-2029) 7.4.9.3 Taiwan Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 7.4.10 Bangladesh 7.4.10.1 Bangladesh Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 7.4.10.2 Bangladesh Nut Oil Market Size and Forecast, by Application (2022-2029) 7.4.10.3 Bangladesh Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 7.4.11 Pakistan 7.4.11.1 Pakistan Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 7.4.11.2 Pakistan Nut Oil Market Size and Forecast, by Application (2022-2029) 7.4.11.3 Pakistan Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 7.4.12 Rest of Asia Pacific 7.4.12.1 Rest of Asia Pacific Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 7.4.12.2 Rest of Asia PacificNut Oil Market Size and Forecast, by Application (2022-2029) 7.4.12.3 Rest of Asia Pacific Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 8. Middle East and Africa Nut Oil Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 8.1 Middle East and Africa Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 8.2 Middle East and Africa Nut Oil Market Size and Forecast, by Application (2022-2029) 8.3 Middle East and Africa Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 8.4 Middle East and Africa Nut Oil Market Size and Forecast, by Country (2022-2029) 8.4.1 South Africa 8.4.1.1 South Africa Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 8.4.1.2 South Africa Nut Oil Market Size and Forecast, by Application (2022-2029) 8.4.1.3 South Africa Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 8.4.2 GCC 8.4.2.1 GCC Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 8.4.2.2 GCC Nut Oil Market Size and Forecast, by Application (2022-2029) 8.4.2.3 GCC Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 8.4.3 Egypt 8.4.3.1 Egypt Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 8.4.3.2 Egypt Nut Oil Market Size and Forecast, by Application (2022-2029) 8.4.3.3 Egypt Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 8.4.4 Nigeria 8.4.4.1 Nigeria Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 8.4.4.2 Nigeria Nut Oil Market Size and Forecast, by Application (2022-2029) 8.4.4.3 Nigeria Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 8.4.5 Rest of ME&A 8.4.5.1 Rest of ME&A Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 8.4.5.2 Rest of ME&A Nut Oil Market Size and Forecast, by Application (2022-2029) 8.4.5.3 Rest of ME&A Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 9. South America Nut Oil Market Size and Forecast by Segmentation for Demand and Supply Side (Value and Volume) (2022-2029) 9.1 South America Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 9.2 South America Nut Oil Market Size and Forecast, by Application (2022-2029) 9.3 South America Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 9.4 South America Nut Oil Market Size and Forecast, by Country (2022-2029) 9.4.1 Brazil 9.4.1.1 Brazil Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 9.4.1.2 Brazil Nut Oil Market Size and Forecast, by Application (2022-2029) 9.4.1.3 Brazil Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 9.4.2 Argentina 9.4.2.1 Argentina Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 9.4.2.2 Argentina Nut Oil Market Size and Forecast, by Application (2022-2029) 9.4.2.3 Argentina Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 9.4.3 Rest Of South America 9.4.3.1 Rest Of South America Nut Oil Market Size and Forecast, By Nut Oil (2022-2029) 9.4.3.2 Rest Of South America Nut Oil Market Size and Forecast, by Application (2022-2029) 9.4.3.3 Rest Of South America Nut Oil Market Size and Forecast, by Extraction Method (2022-2029) 10. Global Nut Oil Market: Competitive Landscape 10.1 MMR Competition Matrix 10.2 Competitive Landscape 10.3 Key Players Benchmarking 10.3.1 Company Name 10.3.2 Product Segment 10.3.3 End-user Segment 10.3.4 Revenue (2022) 10.3.5 Manufacturing Locations 10.3.6 SKU Details 10.3.7 Production Capacity 10.3.8 Production for 2022 10.3.9 No. of Stores 10.4 Market Analysis by Organized Players vs. Unorganized Players 10.4.1 Organized Players 10.4.2 Unorganized Players 10.5 Leading By Nut Oil Global Companies, by market capitalization 10.6 Market Structure 10.6.1 Market Leaders 10.6.2 Market Followers 10.6.3 Emerging Players 10.7 Mergers and Acquisitions Details 11. Company Profile: Key Players 11.1 Bunge Limited 11.1.1 Company Overview 11.1.2 Business Portfolio 11.1.3 Financial Overview 11.1.4 SWOT Analysis 11.1.5 Strategic Analysis 11.1.6 Scale of Operation (small, medium, and large) 11.1.7 Details on Partnership 11.1.8 Regulatory Accreditations and Certifications Received by Them 11.1.9 Awards Received by the Firm 11.1.10 Recent Developments 11.2 Cargill Incorporated 11.3 Archer Daniels Midland Company 11.4 Wilmar International Limited 11.5 Associated British Foods PLC 11.6 Ventura Foods, LLC 11.7 Borges Mediterranean Group 11.8 Olam International Limited 11.9 ConAgra Foods, Inc. 11.10 ADM Specialty Oils 11.11 Golden Peanut & Tree Nuts 11.12 Kerry Group 11.13 The Hain Celestial Group, Inc. 11.14 Sunkist Growers, Inc. 11.15 Meridian Foods 11.16 Nutiva Inc. 11.17 Spectrum Naturals 11.18 NOW Foods 11.19 Nature's Way Products, Inc. 11.20 Frontier Natural Products Co-op 11.21 The Republic of Nuts 11.22 Nuts.com 11.23 Justin's 11.24 Blue Diamond Growers 11.25 California Almonds 12. Key Findings 13. Industry Recommendations 14. Terms and Glossary