Norway Electric Car Market size was valued US$ XX Mn in 2019 and the total revenue is expected to grow at XX% from 2020 to 2027, reaching US$ XX Mn.To know about the Research Methodology :- Request Free Sample Report

Norway Electric Car Market Overview:

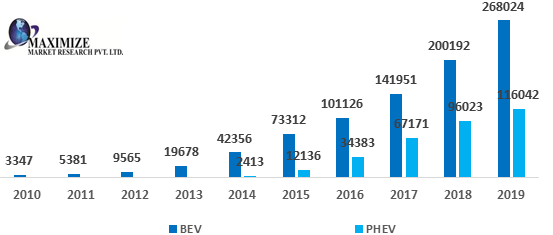

Nearly 60 percent of new electric cars were sold in Norway in March 2019. This is the newest record-breaking figure involving Norway & EV records as the Scandinavian country looks to end sales of fossil-fueled vehicles by the year 2025. The figures could be even greater, but many Norwegians find themselves on big waiting lists as franchises fight to import sufficient cars. According to industry numbers, a total of 11,518 electric vehicles were recorded in Norway in the first quarter of 2019, double as several as the last year. The new Tesla Model 3, Nissan Leaf & Volkswagen Golf accounts for the highest registrations. Though unit sales in China & the U.S. are extremely greater, Norway remains the picture child of Electric vehicle development. This is due to more Electric Vehicles on Norway streets compare to total cars than anywhere else in the world. Continuous headlines over the last few years have left several societies scratching their heads to know why and how a small country like Norway with a population just over five Mn leads the Electric Vehicle development. The answer is simple -encouraging environmental math, & fiscal incentives. Despite its status as a key oil industry player, nearly all of Norway’s national energy comes from hydropower. Many of the nation’s electricity is renewable, a switch to Electric Vehicles is a far greener equation than it would be for nations whose electricity comes from nonrenewable plants. To make the shift happen, the Norway government has invested greatly in economic incentives & charging infrastructure. In 1990, the government announced incentives for electric vehicle owners. Huge changes began to come with time when highway tax was dropped, values for toll highway & public ferries were removed, & free parking was opened in several municipal car parks. The nation’s wide charging set-up was kick-started by government fund, private firms are now taking over actions & there has been a lot of interest from foreign counterparts. The government reached its goal of 50,000 zero-emission vehicles on the street 3 years earlier than scheduled.Electric vehicle in Norway:

Electric cars take 44 percent market share in Norway:

In January 2019, electric cars made up 37.8 percent of sales in the state & scaled in succeeding months to a total of 42.4 percent market share for the whole year. German auto manufacturer Audi’s fully electric sports function car was Norway’s best-selling car for the 2nd time, beating a market share of 9.4 percent. Audi supplied 902 electric SUVs, ahead of Renault’s Zoe with 533 cars & Volkswagen’s Golf with 511. The objective of the report is to present a comprehensive analysis of the Norway Electric Car Market including all the stakeholders of the industry. The past and current status of the industry with forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that includes market leaders, followers, and new entrants. PORTER, SVOR, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analyzed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding Norway’s Electric Car Market dynamics, structure by analyzing the market segments and project the Norway Electric Car Market size. Clear representation of competitive analysis of key players by Application, price, financial position, Product portfolio, growth strategies, and regional presence in the Norway Electric Car Market make the report investor’s guide.Scope of Norway Electric Car Market: Inquire before buying

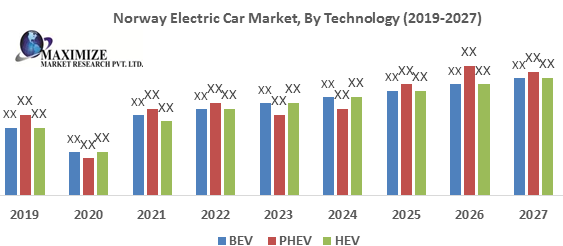

Norway Electric Car Market, By Technology

• BEV • PHEV • HEVNorway Electric Car Market, By Product

• Hatchback • Sedan • SUV • OthersNorway Electric Car Market, By Battery

• LFP • Li-NMC • OthersNorway Electric Car Market, By Battery Capacity

• >201 Ah • <201 AhNorway Electric Car Market, By End-User

• Shared mobility providers • Government organizations • Personal users • OthersNorway Electric Car Market Key Player

• BMW • Renault • Chevrolet • Tesla • Hyundai • Jaguar I-Pace • Mercedes-Benz • Audi • Kia • AB Volvo • Hyundai Motor Co. • Mitsubishi Motors Corp. • Nissan Motor Co. • Porsche Taycan

1. Preface 1.1. Report Scope and Market Segmentation 1.2. Research Highlights 1.3. Research Objectives 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: Norway Electric Car Market Size, by Market Value (US$ Mn) 4. Market Overview 4.1. Introduction 4.2. Market Indicator 4.2.1. Drivers 4.2.2. Restraints 4.2.3. Opportunities 4.2.4. Challenges 4.3. Porter’s Analysis 4.4. Value Chain Analysis 4.5. Market Risk Analysis 4.6. SWOT Analysis 4.7. Industry Trends and Emerging Technologies 5. Supply Side and Demand Side Indicators 6. Norway Electric Car Market Analysis and Forecast 7. Norway Electric Car Market Analysis and Forecast, by Technology 7.1. Introduction and Definition 7.2. Key Findings 7.3. Norway Electric Car Market Value Share Analysis, by Technology 7.4. Norway Electric Car Market Size (US$ Mn) Forecast, by Technology 7.5. Norway Electric Car Market Analysis, by Technology 7.6. Norway Electric Car Market Attractiveness Analysis, by Technology 8. Norway Electric Car Market Analysis and Forecast, by Product 8.1. Introduction and Definition 8.2. Key Findings 8.3. Norway Electric Car Market Value Share Analysis, by Product 8.4. Norway Electric Car Market Size (US$ Mn) Forecast, by Product 8.5. Norway Electric Car Market Analysis, by Product 8.6. Norway Electric Car Market Attractiveness Analysis, by Product 9. Norway Electric Car Market Analysis and Forecast, by Battery 9.1. Introduction and Definition 9.2. Key Findings 9.3. Norway Electric Car Market Value Share Analysis, by Battery 9.4. Norway Electric Car Market Size (US$ Mn) Forecast, by Battery 9.5. Norway Electric Car Market Analysis, by Battery 9.6. Norway Electric Car Market Attractiveness Analysis, by Battery 10. Norway Electric Car Market Analysis and Forecast, by Battery Capacity 10.1. Introduction and Definition 10.2. Key Findings 10.3. Norway Electric Car Market Value Share Analysis, by Battery Capacity 10.4. Norway Electric Car Market Size (US$ Mn) Forecast, by Battery Capacity 10.5. Norway Electric Car Market Analysis, by Battery Capacity 10.6. Norway Electric Car Market Attractiveness Analysis, by Battery Capacity 11. Norway Electric Car Market Analysis and Forecast, by End-User 11.1. Introduction and Definition 11.2. Key Findings 11.3. Norway Electric Car Market Value Share Analysis, by End-User 11.4. Norway Electric Car Market Size (US$ Mn) Forecast, by End-User 11.5. Norway Electric Car Market Analysis, by End-User 11.6. Norway Electric Car Market Attractiveness Analysis, by End-User 12. Norway Electric Car Market Analysis 12.1. Key Findings 12.2. Norway Electric Car Market Overview 12.3. Norway Electric Car Market Value Share Analysis, by Type 12.4. Norway Electric Car Market Forecast, by Technology 12.4.1. BEV 12.4.2. PHEV 12.4.3. HEV 12.5. Norway Electric Car Market Forecast, by Product 12.5.1. Hatchback 12.5.2. Sedan 12.5.3. SUV 12.5.4. Others 12.6. Norway Electric Car Market Forecast, by Battery 12.6.1. LFP 12.6.2. Li-NMC 12.6.3. Others 12.7. Norway Electric Car Market Forecast, by Battery Capacity 12.7.1. >201 Ah 12.7.2. <201 Ah 12.8. Norway Electric Car Market Forecast, by End-User 12.8.1. Shared mobility providers 12.8.2. Government organizations 12.8.3. Personal users 12.8.4. Others. 12.9. PEST Analysis 12.10. Key Trends 12.11. Key Developments 13. Company Profiles 13.1. Market Share Analysis, by Company 13.2. Competition Matrix 13.2.1. Competitive Benchmarking of key players by price, presence, market share, Vehicle Type, and R&D investment 13.2.2. New Product Launches and Product Enhancements 13.2.3. Market Consolidation 13.2.3.1. M&A by Regions, Investment and Vehicle Type 13.2.3.2. M&A Key Players, Forward Integration and Backward Integration 13.3. Company Profiles: Key Players 13.3.1. BMW 13.3.2. Renault 13.3.3. Chevrolet 13.3.4. Tesla 13.3.5. Hyundai 13.3.6. Jaguar I-Pace 13.3.7. Mercedes-Benz 13.3.8. Audi 13.3.9. Kia 13.3.10. AB Volvo 13.3.11. Hyundai Motor Co. 13.3.12. Mitsubishi Motors Corp. 13.3.13. Nissan Motor Co. 13.3.14. Porsche Taycan 14. Primary Key Insights.