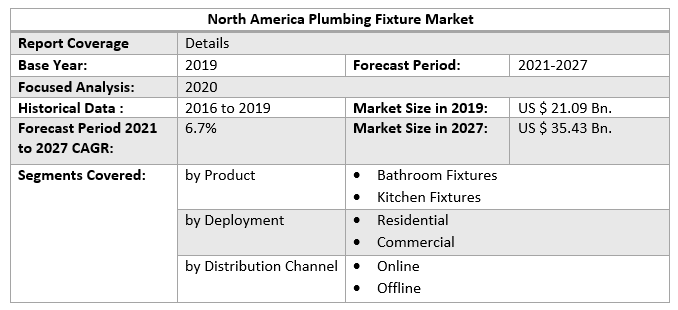

North America Plumbing Fixture Market size was valued at US$ 21.09 Bn. in 2019 and the total revenue is expected to grow at 6.7% through 2021 to 2027, reaching nearly US$ 35.43 Bn.To know about the Research Methodology :- Request Free Sample Report 2019 is considered as a base year to forecast the market from 2021 to 2027. 2020’s market size is estimated on real numbers and outputs of the key players and major players across the globe. Past five years trends are considered while forecasting the market through 2027. 2020 is a year of exception and analyzed specially with the impact of lockdown by region

North America Plumbing Fixture Market Overview:

North America plumbing fixture market is expected to grow significantly over the forecast period owing to the increasing number of construction activities in the residential sector, airports, hotels, and restaurants. Furthermore, growing urbanization and change in lifestyle are responsible for the demand for modern kitchen and bathroom accessories. The rising demand of multifunctionality plumbing material along with modern design offered by key players also boost the market growth of plumbing fixture in North America. In 2020, the market size of the plumbing fixture market in North America was US$ 22.50 Bn. and it is expected to grow at 6.7% over the forecast period 2021-2027, reaching nearly 35.43 Bn. by 2027.North America Plumbing Fixture Market Dynamics:

Growing demand for modern houses and increasing standards of life worldwide is expected to surge the plumbing fixtures market in North America. The plumbing fixture market in North America is driven by increasing consumer preference towards luxury products and demand for advanced kitchens and bathrooms among middle-class people across the globe. In addition, changing lifestyles, rising urbanization, rising disposable income, and increasing construction activities also boost the plumbing fixture market in the forecast period. The growing tourism and hospitality industry is creating a huge market for branded and stylish plumbing fixtures. Local key players make huge investments in R & D of plumbing fixtures to manufacture contactless and different varieties to cater to the market demand in the recent pandemic situations. Its usage in the hotel industry is increased due to infrastructural development and change of customer requirements which is a great opportunity for key players. High cost of technology and disruption in the supply chain due to this pandemic are the major challenges in the plumbing fixtures market in North America. Changing consumer preference due to the arrival of modern products, stringent government policies and high transportation cost is also biggest concern for market. In July 2020, Moen Inc. took a major share in smart water start-up Flo Technologies. The new ownership stake is an evolution of the two companies work together to provide a best-in-class solutions for whole-home water security and management.North America Plumbing Fixture Market Segment Analysis:

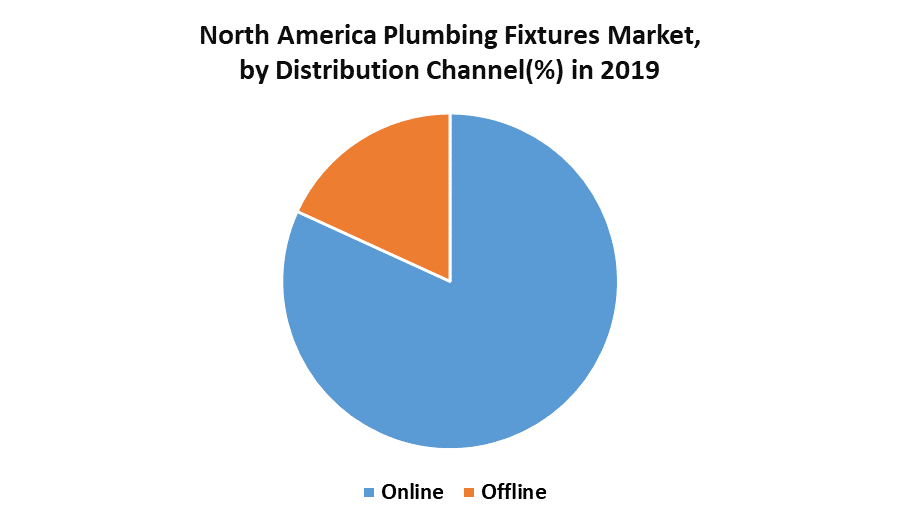

Based on the Product, the North America plumbing fixtures market is classified into bathroom fixtures and kitchen fixtures. Bathroom Fixtures dominate the plumbing fixtures market in North America. Factors attributing to the growth of bathroom fixtures in North America are the rise of tourism and the hospitality sector. In 2020, the U.S. led the North American hospitality development with 1,871 new hotels and 245,407 rooms under construction. Government policies and regulations for open defection and hygiene lead to the construction of bathrooms in North America. In 2020, bathroom fixtures segment held market share of 52%. The rise of construction activities in the residential sector and the willingness of consumers for comfortable life drive the market growth of kitchen fixtures. Furthermore, its demand is primarily driven by the growing need for stylish, multifunctional, sophisticated, and innovative products. Based on the Deployment, the North America plumbing fixtures market is divided into commercial and residential. The commercial segment dominates the plumbing fixtures market in North America owing to the wide coverage of hotels, hospitals, and other commercial buildings under it. It accounts for 57% of the market share. The residential sector also has a major market share in the North America plumbing fixtures market due to the promotion of open defection free activities from the government and increasing urbanization which lead to more demand for modern bathrooms and kitchens in this sector.Based on the Distribution Channel, the North America plumbing fixtures market is segmented into online and offline. The offline segment dominates the plumbing fixtures market in North America owing to the availability of a wide variety of modern products with different brands and convenience for consumer purchasing. Furthermore, it is the well-established route for manufacturer and customer desire to physically examine the product before actual purchase. In 2020, the offline segment held 85% of the market share in the plumbing fixtures market in North America. The online segment also capturing the attention of consumers due to the rise of online purchasing app and active logistic channels.

North America Plumbing Fixtures Market Regional Analysis:

The U.S. dominates the plumbing fixtures market in North America. Factors attributing to the growth of plumbing fixtures market in the U.S. are increasing number of commercial and residential projects in the country is expected to boost the market growth of plumbing fixtures in the U.S. In 2020, the U.S. accounting for over 70% of the market share. According to a report by the Harvard University’s Joint Center for Housing Studies, high income group as well as middle-class homeowners, today, have been significantly spending on home improvements as opposed to the scenario 25-30 years ago. The increasing rejuvenation and reconstruction activities of bathrooms and kitchens are also paving the way for plumbing fixtures products. The objective of the report is to present a comprehensive analysis of the North America plumbing fixture market to the stakeholders in the industry. The past and current status of the industry with the forecasted market size and trends are presented in the report with the analysis of complicated data in simple language. The report covers all the aspects of the industry with a dedicated study of key players that include market leaders, followers, and new entrants. PORTER, PESTEL analysis with the potential impact of micro-economic factors of the market have been presented in the report. External as well as internal factors that are supposed to affect the business positively or negatively have been analysed, which will give a clear futuristic view of the industry to the decision-makers. The report also helps in understanding the North America plumbing fixture market dynamics, structure by analyzing the market segments and project the North America plumbing fixture market size. Clear representation of competitive analysis of key players by product, price, financial position, product portfolio, growth strategies, and regional presence in the North America plumbing fixture market make the report investor’s guide.North America Plumbing Fixture Market Scope: Inquire before buying

North America Plumbing Fixture Market, by Region

• North America • Europe • Asia Pacific • Middle East and Africa • South AmericaNorth America Plumbing Fixture Market Key Players

• Delta Faucet Company • Masco Plumbing Products • Moen, Inc. • Rohl • Brizo • Kallista • Grohe • Waterworks • Lefroy Brooks • Central Arizona Company, Inc. • Park Supply Company Inc • Northeastern Supply • Moore Supply • Rampart Supply • North Shore Faucets. Inc.FAQ

1. What are the factors responsible for growth of plumbing fixtures market in North America? Ans: The factors responsible for growth of plumbing fixtures market in North America are awareness about the water conservation and growing demand of advanced kitchen and bathroom accessories 2. What are the expected growth rate and revenue of plumbing fixtures market from North America in 2021-2027? Ans: The total revenue is expected to grow at 6.7% through 2021 to 2027, reaching nearly US$ 35.43 Bn. 3. What are the major key players in the plumbing fixtures market in North America? Ans: The major key players in the plumbing fixtures market are Kallista, Grohe, Waterworks, Lefroy Brooks, Central Arizona Company, Inc., Park Supply Company Inc, Northeastern Supply, Moore Supply and Rampart Supply 4. What are the market segments of plumbing fixtures market? Ans: The plumbing fixtures market is segmented on the basis of Product, Deployment and Distribution Channel.

1. Preface 1.1. Market Definition and Key Research Objectives 1.2. Research Highlights 2. Assumptions and Research Methodology 2.1. Report Assumptions 2.2. Abbreviations 2.3. Research Methodology 2.3.1. Secondary Research 2.3.1.1. Secondary data 2.3.1.2. Secondary Sources 2.3.2. Primary Research 2.3.2.1. Data from Primary Sources 2.3.2.2. Breakdown of Primary Sources 3. Executive Summary: North America Plumbing Fixture Market Size, by Market Value (US$ Mn) 3.1. Global Market Segmentation 3.2. Global Market Segmentation Share Analysis, 2019 3.2.1. Global 3.2.2. By Region (North America, Europe, Asia Pacific, South America, Middle East Africa) 3.3. Geographical Snapshot of the North America Plumbing Fixture Market 3.4. Geographical Snapshot of the North America Plumbing Fixture Market, By Manufacturer share 4. North America Plumbing Fixture Market Overview, 2019-2027 4.1. Market Dynamics 4.1.1. Drivers 4.1.2. Restraints 4.1.3. Opportunities 4.1.4. Challenges 4.1.5. Industry Trends and Emerging Technologies 4.1.6. Porters Five Forces Analysis 4.1.6.1. Threat of New Entrants 4.1.6.2. Bargaining Power of Buyers/Consumers 4.1.6.3. Bargaining Power of Suppliers 4.1.6.4. Threat of Substitute Products 4.1.6.5. Intensity of Competitive Rivalry 4.1.7. Value Chain Analysis 4.1.8. Technological Roadmap 4.1.9. Regulatory landscape 4.1.10. Impact of the Covid-19 Pandemic on the North America Plumbing Fixture Market 5. Supply Side and Demand Side Indicators 6. North America Plumbing Fixture Market Analysis and Forecast, 2019-2027 6.1. North America Plumbing Fixture Market Size & Y-o-Y Growth Analysis. 7. North America Plumbing Fixture Market Analysis and Forecasts, 2019-2027 7.1. Market Size (Value) Estimates & Forecast By Product, 2019-2027 7.1.1. Bathroom Fixtures 7.1.2. Kitchen Fixtures 7.2. Market Size (Value) Estimates & Forecast By Deployment, 2019-2027 7.2.1. Residential 7.2.2. Commercial 7.3. Market Size (Value) Estimates & Forecast By Distribution Channel, 2019-2027 7.3.1. Online 7.3.2. Offline 8. North America Plumbing Fixture Market Analysis and Forecasts, 2019-2027 8.1. Market Size (Value) Estimates & Forecast By Product, 2019-2027 8.1.1. Bathroom Fixtures 8.1.2. Kitchen Fixtures 8.2. Market Size (Value) Estimates & Forecast By Deployment, 2019-2027 8.2.1. Residential 8.2.2. Commercial 8.3. Market Size (Value) Estimates & Forecast By Distribution Channel, 2019-2027 8.3.1. Online 8.3.2. Offline 9. North America North America Plumbing Fixture Market Analysis and Forecasts, By Country 9.1. Market Size (Value) Estimates & Forecast By Country, 2019-2027 9.1.1. US 9.1.2. Canada 9.1.3. Mexico 10. U.S. North America Plumbing Fixture Market Analysis and Forecasts, 2019-2027 10.1. Market Size (Value) Estimates & Forecast By Product, 2019-2027 10.2. Market Size (Value) Estimates & Forecast By Deployment, 2019-2027 10.3. Market Size (Value) Estimates & Forecast By Distribution Channel, 2019-2027 11. Canada North America Plumbing Fixture Market Analysis and Forecasts, 2019-2027 11.1. Market Size (Value) Estimates & Forecast By Product, 2019-2027 11.2. Market Size (Value) Estimates & Forecast By Deployment, 2019-2027 11.3. Market Size (Value) Estimates & Forecast By Distribution Channel, 2019-2027 12. Mexico North America Plumbing Fixture Market Analysis and Forecasts, 2019-2027 12.1. Market Size (Value) Estimates & Forecast By Product, 2019-2027 12.2. Market Size (Value) Estimates & Forecast By Deployment, 2019-2027 12.3. Market Size (Value) Estimates & Forecast By Distribution Channel, 2019-2027 13. Competitive Landscape 13.1. Geographic Footprint of Major Players in the Global North America Plumbing Fixture Market 13.2. Competition Matrix 13.2.1. Competitive Benchmarking of Key Players By Price, Presence, Market Share, Applications and R&D Investment 13.2.2. New Product Launches and Product Enhancements 13.2.3. Market Consolidation 13.2.3.1. M&A by Regions, Investment and Verticals 13.2.3.2. M&A, Forward Integration and Backward Integration 13.2.3.3. Partnership, Joint Ventures and Strategic Alliances/ Sales Agreements 13.3. Company Profile : Key Players 13.3.1. Cadence Design Systems, Inc. 13.3.1.1. Company Overview 13.3.1.2. Financial Overview 13.3.1.3. Geographic Footprint 13.3.1.4. Product Portfolio 13.3.1.5. Business Strategy 13.3.1.6. Recent Developments 13.3.2. Danaher Corporation 13.3.3. Becton 13.3.4. Dickinson and Company 13.3.5. Luminex Corporation 13.3.6. Agilent Technologies, Inc. 13.3.7. Bio-Rad Laboratories, Inc. 13.3.8. Miltenyi Biotec 13.3.9. Sysmex Corporation 13.3.10. Stratedigm, Inc. 13.3.11. Apogee Flow Systems Ltd. 13.3.12. Sony Biotechnology, Inc. 13.3.13. Thermo Fisher Scientific, Inc. 13.3.14. Other Key Players 14. Primary Key Insights